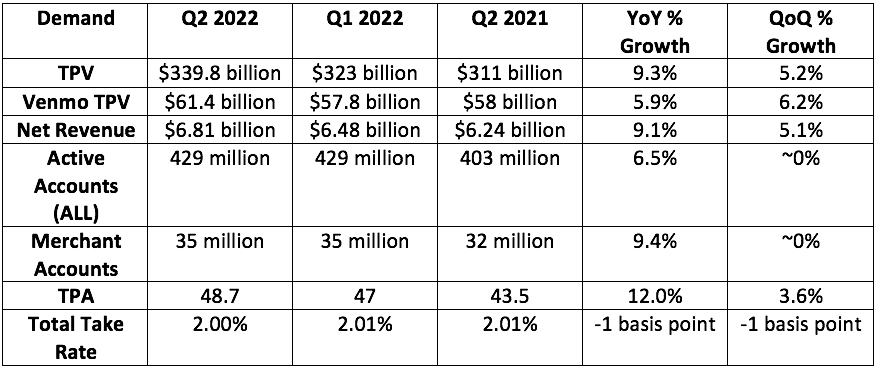

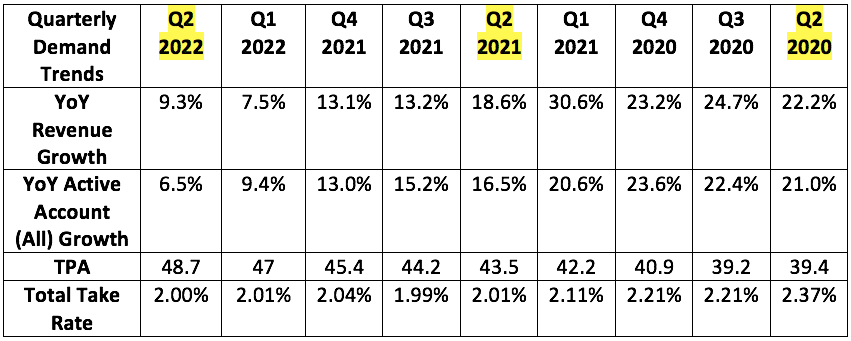

1. Demand

“We are seeing a flight to quality in our markets that we expect to continue driving market share gains like it did for us this quarter.” — CEO Dan Schulman

Analysts were looking for $6.78 billion in revenue while PayPal guided to $6.8 billion. It posted $6.81 billion in revenue, barely beating expectations.

More Context on Demand:

- This was the last quarter in which the end of the eBay operating agreement impacted growth. The headwind is officially in the rear-view. No more “ex-eBay” qualifications. Hallelujah.

- Foreign Currency (FX) headwinds and the eBay operating agreement shaved 500 basis points (bps) off of PayPal's growth. 1 basis point = 0.01%.

- PayPal added 400,000 net accounts this quarter. This was all thanks to Venmo as PayPal let many low engagement accounts roll-off. 0% YoY account growth shown above is a matter of rounding

- TPV and revenue have expanded at a CAGR of 25% and 16% (22% ex-eBay) over the last 3 years.

- Take rate stability is a great sign. I was not expecting it to remain at or above 2% for the quarter.

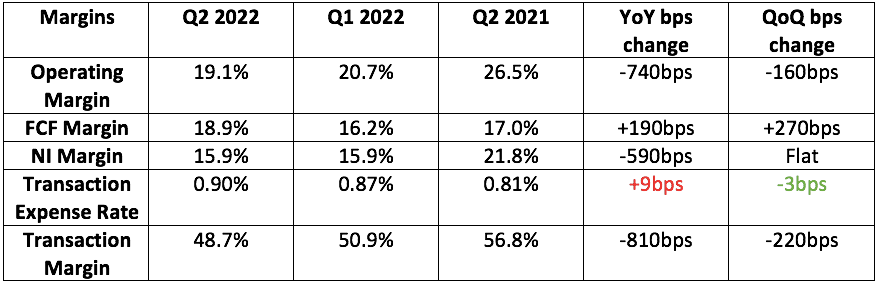

2. Profitability

Analysts were looking for $0.87 in EPS while PayPal guided to the same. It earned $0.93 per share, beating expectations by 6.5%.

PayPal also guided to an 18% operating margin. Its 19.1% margin beat expectations by 110bps. It's controlling costs.

Margin context:

- eBay and Q2 2021 credit reserve releases shaved $0.22 off of PayPal's earnings this quarter.

- Volume based expenses rose 30% YoY via a shift back to higher cost credit as the stimulus debit shock ends. Braintree growth also contributed to this.

3. Balance Sheet

PayPal has:

- $15.6 billion in cash, equivalents and investments vs. $15.1 billion sequentially.

- $10.6 billion in debt vs. $9.2 billion sequentially (new debt raise in May 2022).

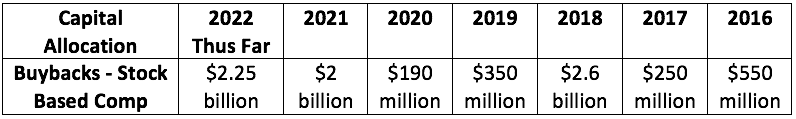

Buybacks represented 95% of PayPal’s free cash flow generation so far in 2022. It expects 2022 buybacks to reach $4 billion.

4. 2022 Guidance

- PayPal now expects 10% revenue growth vs. 12% growth as of last quarter and analyst expectations of 11% growth. The miss was via added FX headwinds.

- With no 2022 eBay headwind, growth would be roughly 14% YoY for the year.

- PayPal now expects $3.92 in EPS vs. $3.87 as of last quarter. Analysts expected $3.87 as of last quarter as well. Nice raise.

- PayPal continues to expect to add 10 million net new accounts this year.

- PayPal continues to expect over $5 billion in free cash flow.

- PayPal continues to expect over 50% Venmo revenue growth for 2022.

“The shape and dynamics of the quarter reflect the trends we anticipated in our full year guidance.” — CEO Dan Schulman