Sections e, f & g are for paid subscribers. They walk through guidance, the conference call, the investor presentation and my take on the quarter. Upgrade below to read that and 40+ more reviews this season. Meta, Google, Amazon, Starbucks, Mercado Libre and ServiceNow earnings reviews are coming this week.

In case you Missed it:

- Tesla Earnings Review.

- SoFi Earnings Review.

- Netflix Earnings Review.

- Taiwan Semi Earnings Review.

- My current portfolio & performance vs. the S&P 500.

PayPal provides branded omni-channel checkout and financial services to a massive base of consumers and merchants. It also provides non-branded payment processing through Braintree, payouts-as-a-service through Hyperwallet, identifiable guest checkout through Fastlane and it owns Venmo. For a full review of their recent investor day, click here.

a. Key Points

- Another great Venmo quarter.

- Braintree is back to growth as expected.

- Mixed commentary for branded checkout overall.

- Initiated a dividend.

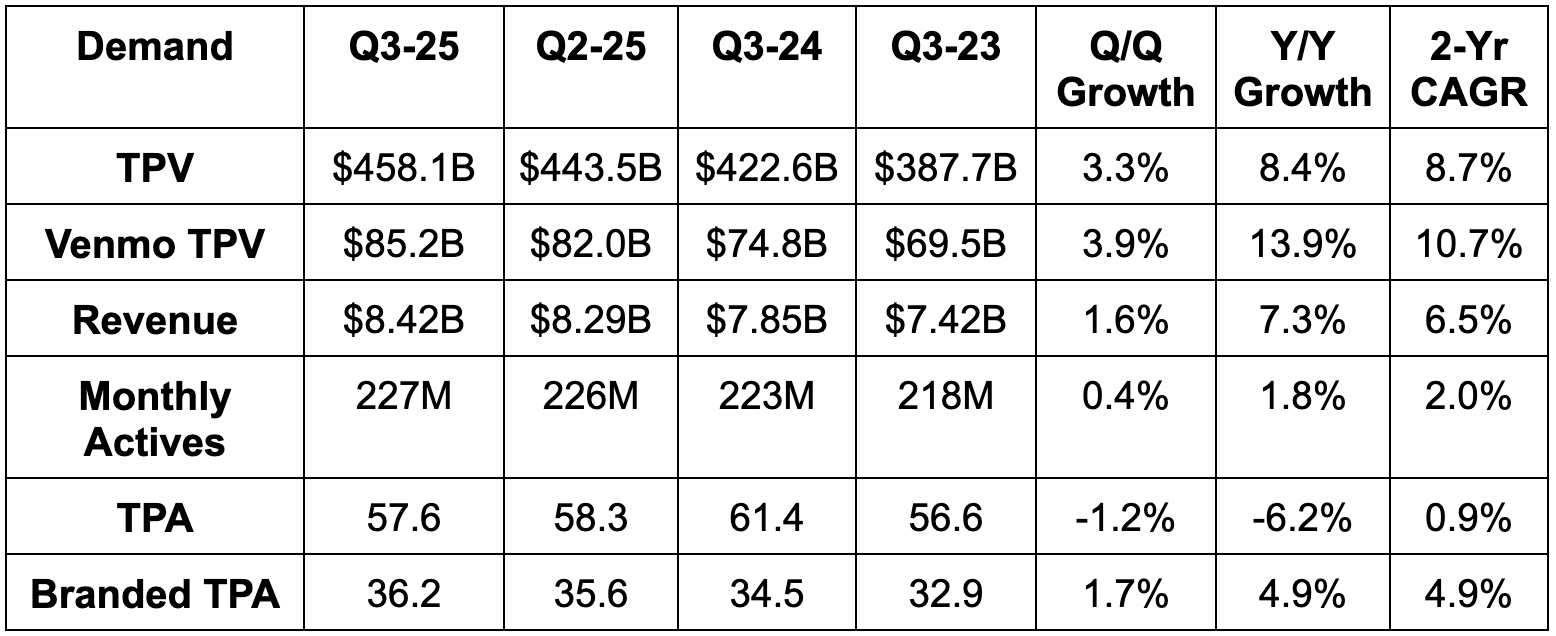

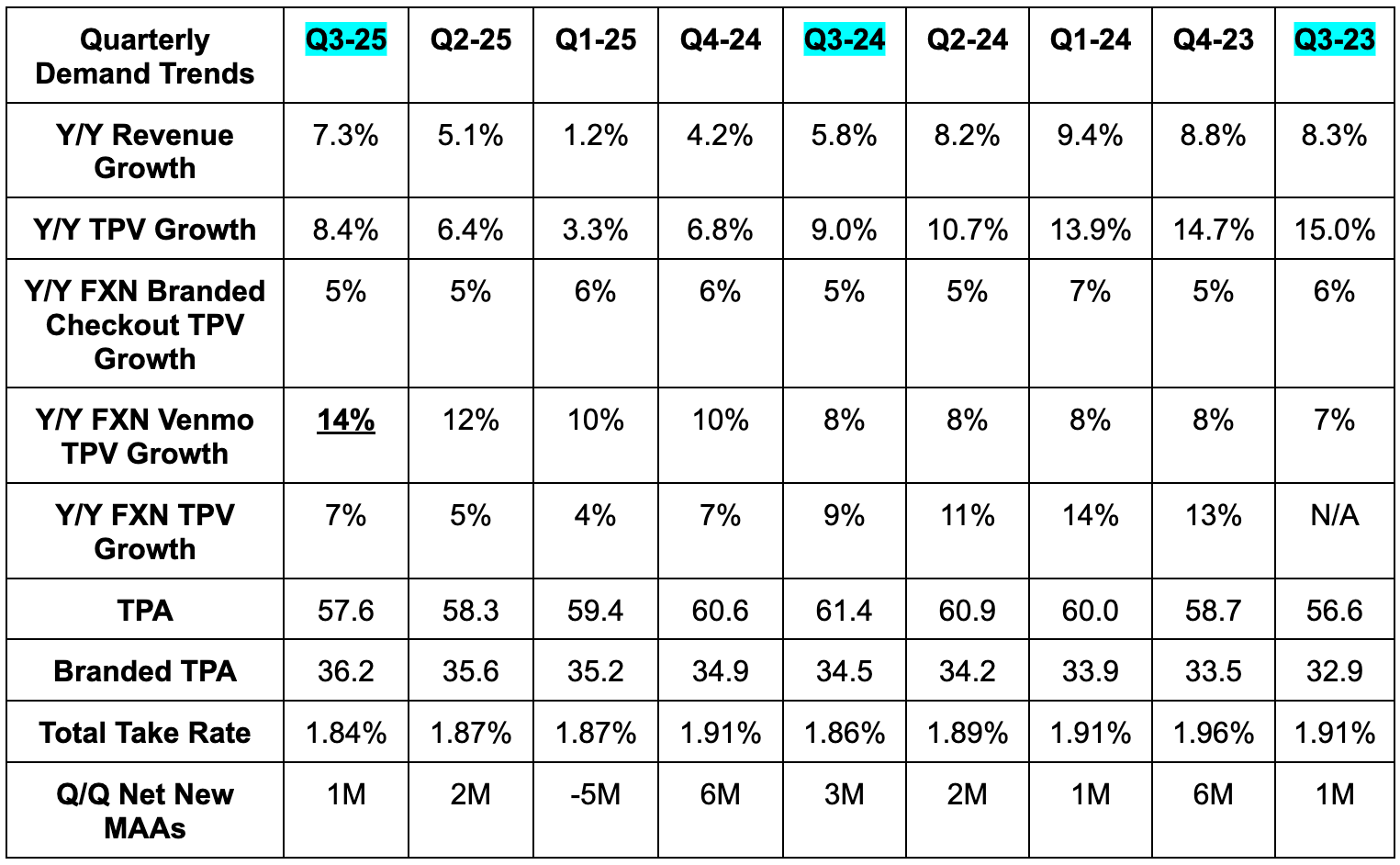

b. Demand

- Beat transaction margin dollar (TM$) estimates by 2.3% & beat guidance by 2.1%.

- Beat 4% foreign exchange neutral (FXN) TM$ growth guidance with 6% growth.

- Beat 6% FXN TM$ growth ex-customer balances guidance with 7% growth.

- Beat Total Payment Volume (TPV) estimates by 1.7%.

- Beat Venmo TPV estimates by 4%.

- Beat revenue estimates by 2.2%.

- 6% Y/Y FXN revenue growth beat 5% growth estimates.

- Met 1.84% total take rate estimates.

- Branded online checkout take rate was flat Y/Y.

The German outage during the quarter led to a 150 bps TM$ growth headwind. This was due to higher transaction loss provisions. They also got a little less than 100 bps of help from selling some receivables to Blue Owl. The overall impact was about 50 bps in unexpected net TM$ growth headwinds, and it beat its guidance regardless.

Transactions fell by 5% Y/Y, but that was related to Braintree contract negotiations as they slash cash-burning contracts and prioritize profitable growth. Excluding this ongoing initiative, transactions rose by 7% Y/Y. This is also why transactions per active (TPA) growth is negative in the chart below. Branded TPA excludes this.

Other value-added services (OVAS) revenue rose by 15% Y/Y. This continues to be driven by strong merchant and consumer credit originations, as they briskly grow the portfolio following last year’s pullback. They’re “pleased with the quality, diversification and performance” of their credit book. Furthermore, customer balance growth (and so interest income) was called “encouraging.” This is related to budding Venmo initiatives and products that we’ll work through later in the piece.

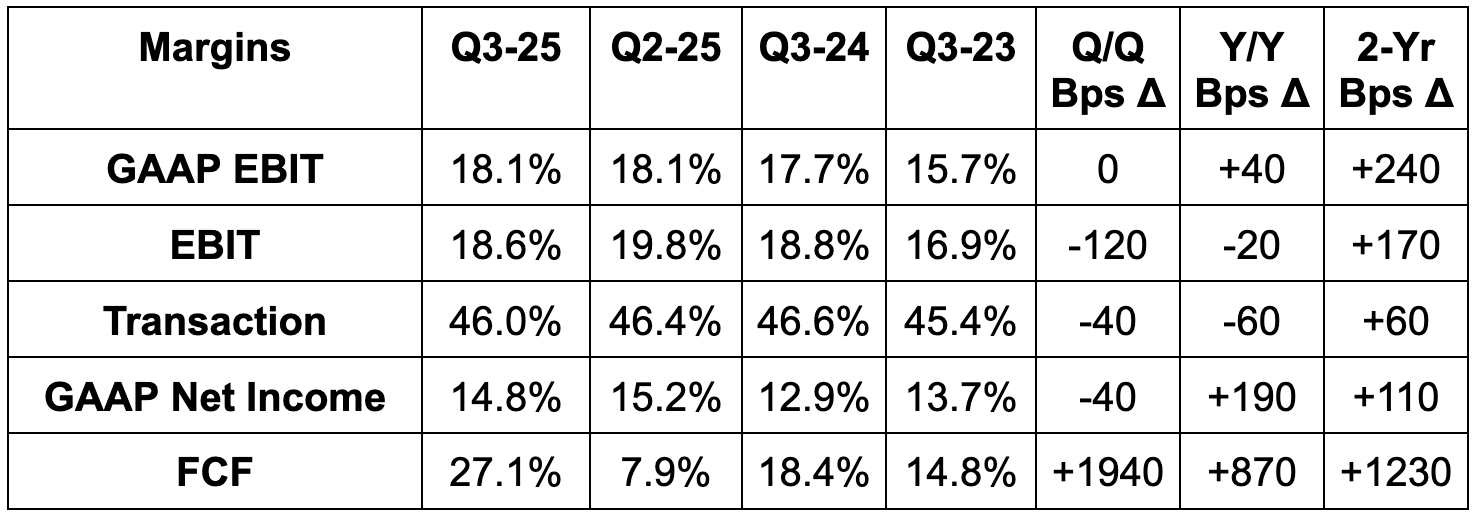

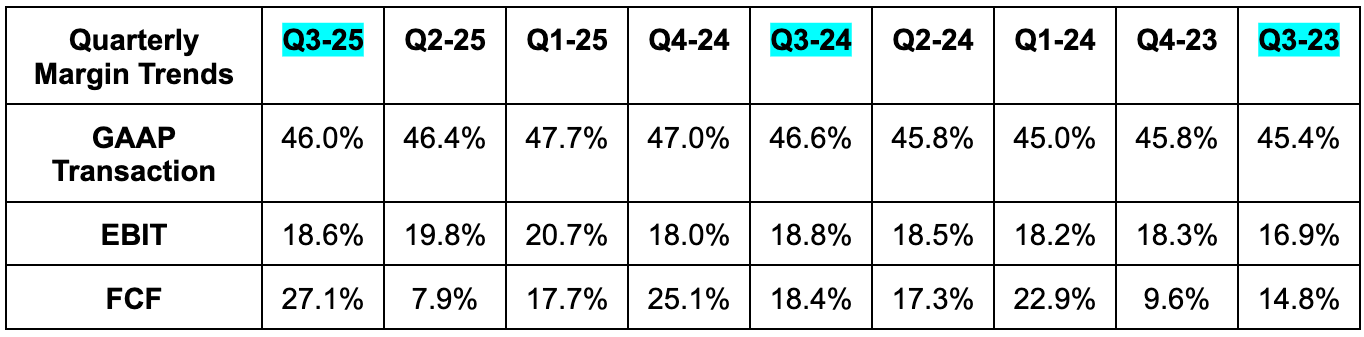

c. Profits & Margins

- Beat EBIT estimates by 9%.

- Non-transaction operating expenses (OpEx) rose by 6% Y/Y.

- Beat $1.20 EPS estimates by $0.14.

- EPS rose by 12% Y/Y. This compares to just 5% Y/Y net income growth, showing how large of an impact its current buyback program is having.

- Beat $1.16 GAAP EPS estimates by $0.14.

- GAAP EPS rose by 32% Y/Y.

- Met 46% transaction margin estimates.

- Beat FCF estimates by 7.5%.

d. Balance Sheet

- $10.8B in cash & equivalents.

- $3.6B in long-term investments.

- $11.3B in debt.

- Diluted share count fell by 6.3% Y/Y.

- PayPal also added a new $0.14 per share dividend.