This is the new format for Max subscribers to see my real-time, contextualized transaction. This is where I will walk through how the portfolio is changing in real-time, why I’ve made those decisions and the plan for the position going forward. So let’s dive in:

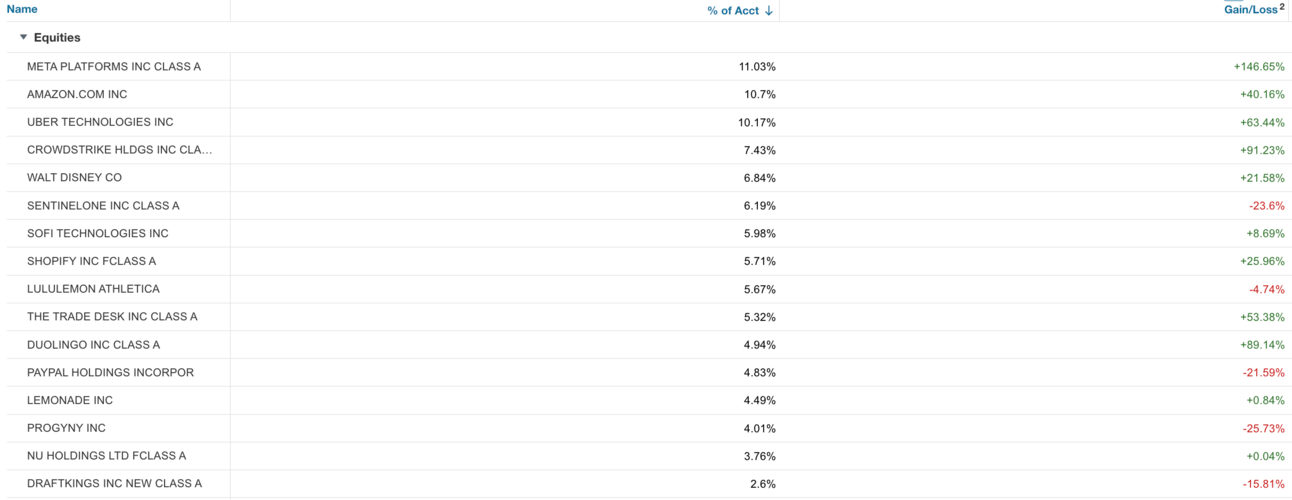

I deposited some funds into the account this morning and immediately used them to add to SentinelOne. It was about 8% of the deposit chunk I’ve been discussing in previous articles. The rest continues to sit in a money market fund.

The earnings review will get into the meat of the report, but I view this post-earnings reaction as a gross over-reaction. The top line ARR miss wasn’t ideal, but was less than 0.5% off vs. estimates. The annual revenue guidance missed sell-side consensus by 0.3%, while profit estimates were reiterated. We can’t call this strong, but it really wasn’t that bad in my view.

This is one of the fastest growth names in software, with a 30%+ Y/Y revenue growth guide in this environment. It just broke FCF positive, just posted breakeven EPS, will turn EBIT positive this year, and expects explosive operating leverage to continue in the years to come. I don’t love the dilution, but do really like the flat Y/Y stock compensation. That means dilution should slow.

It will likely earn somewhere around $0.10 this year, $0.35 next year and $0.60 the following year. This estimates are slightly ahead of sell-side, but by a smaller margin than this firm has consistently outperformed on profitability over the last couple years. At today’s prices, it’s about 18 months away from trading at 25x forward earnings, with profit growth thereafter expected to remain well in excess of 25%. That’s quite comparatively cheap vs. comparable firms.

For now, we still have to use gross profit multiples as other profit metrics are near 0. Today, SentinelOne trades for 7x this year’s gross profit vs. over 20x for CrowdStrike and about 14x for Palo Alto. As I said in the investment case, CrowdStrike is clearly the best name in the space and deserves a premium vs. everyone else. But? The premium is currently gigantic, the space is massive and I still see SentinelOne as second best. That leaves it with a lengthy runway.

I also think there’s a solid backstop here if things do turn sour. The team has already reportedly explored a private equity sale in prior years. They’re not stubborn founders determined to figure it out on their own. If they think they can’t win, they’ll sell and we’ll enjoy a premium.

If this can continue delivering the profit inflection… and there are zero signs that it can’t… I think there’s a lot to like. So I added.