- Links to 40 detailed earnings reviews from this season

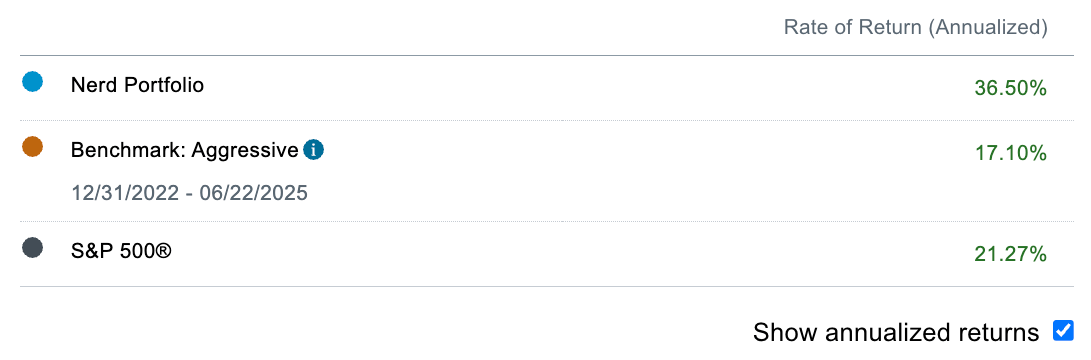

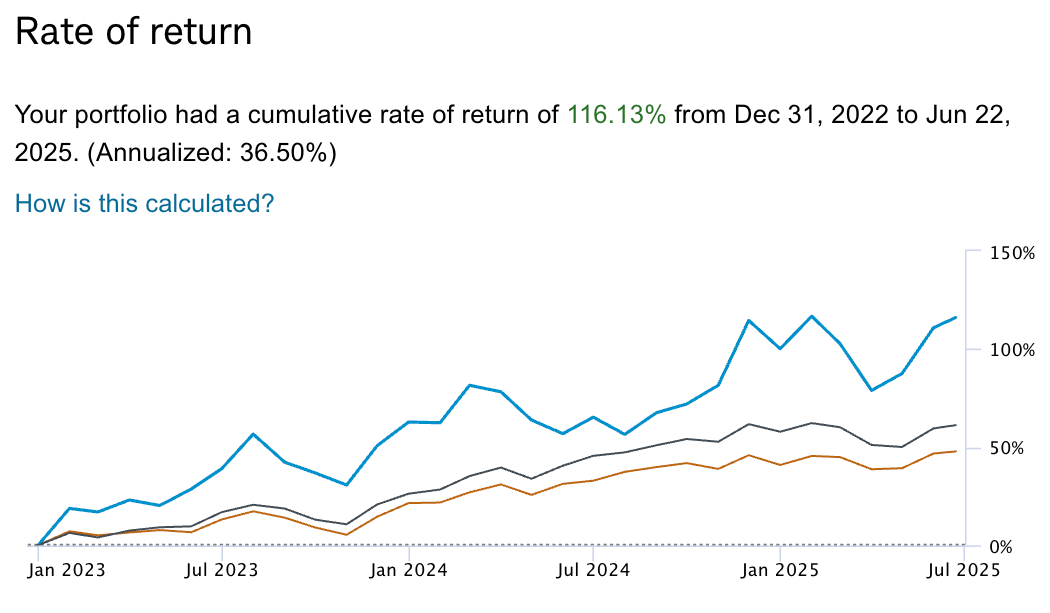

- Link to my current portfolio & performance vs. the S&P 500

a. Some General Thoughts on Markets

My oh my, how things have changed in a hurry. We’re roughly two months removed from when markets were in panic mode, I was buying up shares of holdings hand over fist and dipping into my emergency reserves cushion to help fund. Max readers, you received all of those updates in real-time. Fast forward to today, and benchmarks have rallied by more than 20%, with some holdings spiking 50% in that span.

So where are we in market cycles right now? We have IPOs doubling and tripling after a few days on public markets. We have pure-play quantum computing names fetching triple-digit sales multiples despite no near-term path to economic viability. We have Chamath Palihapitiya taunting retail investors on social media as he gears up to launch more SPACs. None of that screams “fear” in my mind. If anything, it screams “froth” and resembles the kind of animalistic spirits we witnessed in 2020 and 2021.

But there’s a large, large difference between then and now. The age-old saying is “don’t fight the Fed.” As we moved through 2021, that meant don’t get aggressive with risk assets like stocks. Powell was gearing up for an eventual 5 points of rate hikes and a multi-trillion dollar reduction in the Fed’s balance sheet. And today? The next few moves from the Federal Reserve will almost surely be rate cuts as quantitative tightening winds down, unemployment rates remain strong, inflation eases and economic output remains resilient. Today, “don’t fight the Fed” means stay aggressive with risk assets like stocks. I am carefully balancing the yellow flags of greed I’m seeing with this juxtaposing idea. As Max readers have seen, I have taken some profits on names with the most dramatic multiple expansion. I have let the cash position rise a bit in recent weeks. And yet, I remain mostly invested. That’s my plan. Trim into the severe pockets of froth yet keep those trims modest as macro tailwinds strengthen and the companies I hold continue to execute.

b. Current Performance vs. the S&P 500

c. Current Holdings

For a current view of my portfolio, click here.