Table of Contents

In case you missed it:

- Meta & ServiceNow Earnings Reviews.

- Starbucks Earnings Review.

- Netflix Earnings Review.

- Taiwan Semi Earnings Review.

I sent a portfolio & performance update today. Soon after, amid the software sell-off, I decided to make another transaction. To avoid inbox clutter, I updated the article I already sent with the second transaction and current holdings.

1. Tesla (TSLA) – Earnings Review

a. Key Points

- Shifting Model S and Model X production to Optimus.

- Expects Robotaxi to be in at least dozens of cities this year.

- The energy business keeps thriving.

- Continued negative overall revenue growth and pressure on net income and FCF margins.

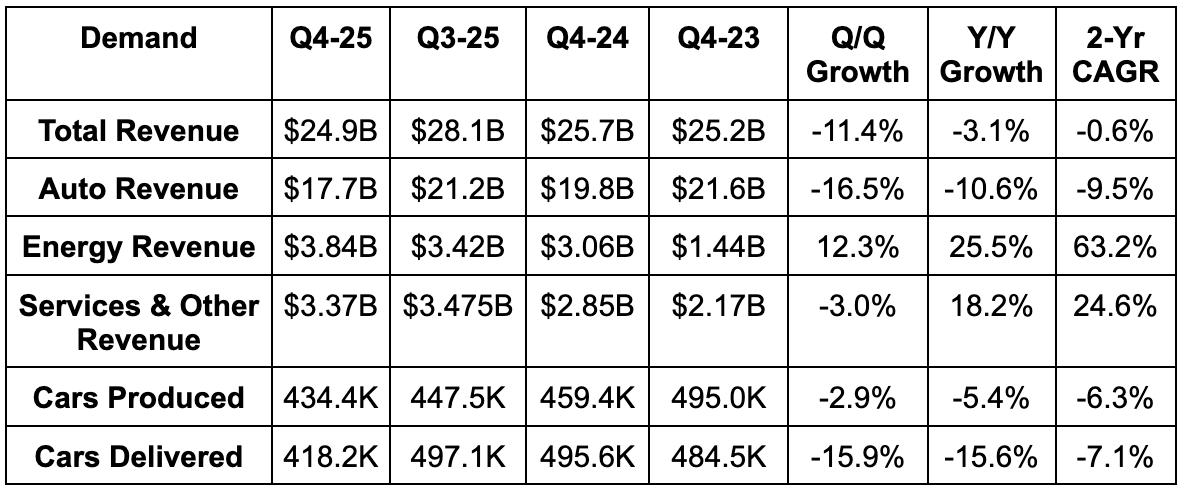

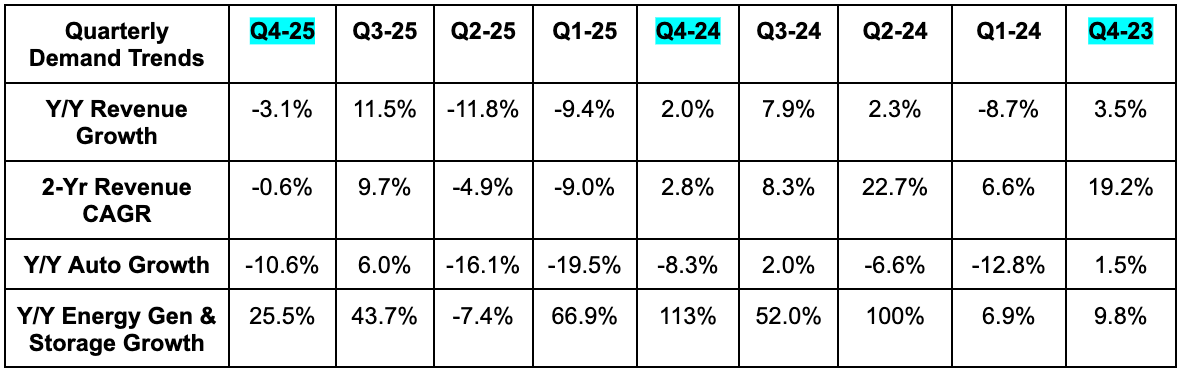

b. Demand

- Tesla missed revenue estimates by 1.2%.

- Its 3-year revenue compounded annual growth rate (CAGR) was 0.8% for the quarter.

Auto revenue missed by 8%, while the rest of its smaller segments sharply beat expectations to offset that weakness. Last quarter, Tesla discussed that the end of EV incentives created a rush to purchase Tesla vehicles, which accelerated demand for the period. That led to tougher growth comps, but the Y/Y growth comp overall got 6 points easier and they still slowed by another 5 points. In terms of stronger pockets of demand, deliveries set new highs in smaller emerging markets like Saudi Arabia, Taiwan and Poland. Musk said Asia-Pacific (APAC) and EU demand was strong, but it is worth noting that Tesla did not include the market share chart it usually does in its earnings presentation.

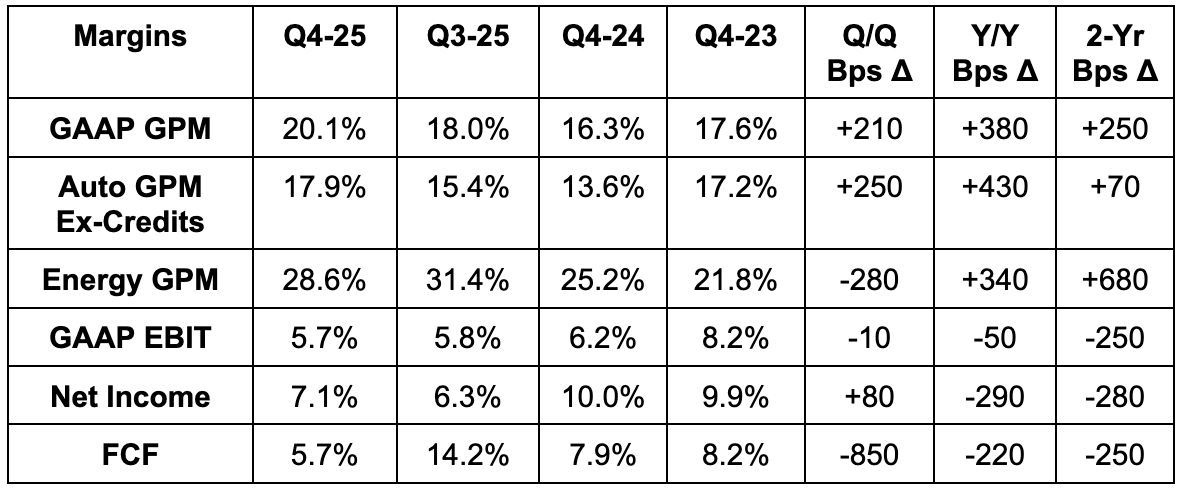

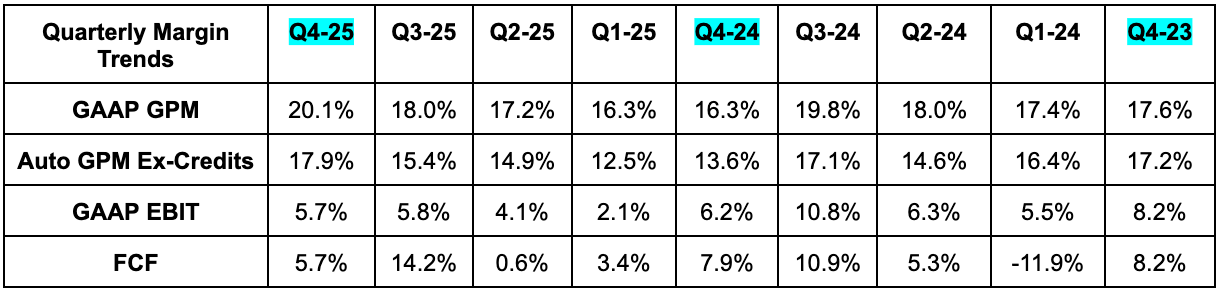

c. Profits & Margins

- Beat 17% GPM estimates by 3 points and beat 14% auto GPM ex-credits margin estimates by 4 points.

- This was its first 20+ GPM in 2 years and was despite $500M in tariff-related costs.

- Services & other GPM fell from 10.5% to 8.8% Y/Y due to costs to support Robotaxi’s launch.

- Beat EBIT estimates by 27%.

- OpEx growth was due to more compensation from Musk’s new CEO package, more AI spending and R&D to support product roadmaps.

- Beat FCF estimates by 42%.

- This is despite Capex being a bit below their guidance.

- Beat $0.44 EPS estimates by $0.06.

d. Balance Sheet

- $8.3B in debt.

- $44B in cash, equivalents & investments.

- Slight Y/Y share count growth.

- Tesla invested $2B in xAI and will deepen product ties with the Musk-led company.

CapEx is expected to double from $8.53B to $20B next year, implying meaningful cash burn for 2026. In terms of financing this spend, they have plenty of cash on hand. Additionally, Tesla CFO Vaibhav Taneja offered another idea I found a little odd. It sounds like they’re planning on using robotaxi cashflows as collateral to underwrite financing for this year, but they haven’t meaningfully scaled that business and they’re still only in two cities with 500 cars. That seems aggressive to me, but if banks are willing to issue that debt, then that’s their prerogative. Furthermore, it sounds like CapEx will stay elevated for the next couple of years, as Tesla has several big investment priorities that we’ll discuss in a moment.

e. Guidance & Valuation

Tesla doesn’t provide formal financial guidance. It trades for 180x forward EPS. EPS is expected to compound at a 47% clip over the next two years. I do not think they will generate positive FCF next year based on their CapEx guidance being $5.5B larger than consensus operating cash flow guidance.

f. Call & Release

Heading into 2026:

In 2026, Tesla’s roadmap is ambitious. Many of its planned investments are continuations of existing programs and based on its new mission to provide “amazing abundance.”

It will launch and deploy the 5th and 6th generations of its AI inference chips and prep for more iterations thereafter to support autonomous fleet plans and Optimus. Generally speaking, it will be adding a lot more AI compute capacity to support future scale, including building its Cortex 2 Gigafactory in Texas to 2x onsite compute at that campus. From there it will expand capacity for its vertically-integrated battery supply chain, including payments tied to the new domestic lithium refinery capacity creation (now in pilot production).

The mega-cap will prep capacity in Austin for Cybercab production with its next-gen, fully-autonomous “unboxed” assembly technology that they expect to cut costs by 50%. Unboxed simply means built in subsections and only assembled at the end.

Tesla plans to start building units (without pedals or steering wheels) this spring. The ultimate goal is for Tesla to make “far more” of these than any other model to support transportation demand. Furthermore, costs for its new Tesla Semi (truck) facility in Nevada come due and it will spend on shifting some manufacturing capacity to gear it up for Optimus production (goal is 1M/year by 2027). That reshuffling includes sunsetting Model S and X programs in Fremont in favor of the humanoid robot. This change will allow the space to eventually support 1M units produced per year, according to leadership. From here on out, Tesla will focus on “autonomous vehicles,” or those with unsupervised FSD. Autonomous cars sold on the consumer side going forward will be Model 3, Y and Cybertruck. Speaking of which, Cybertruck manufacturing lines will upgrade to Tesla’s new manufacturing tech this year.

- They believe that the Cybertruck has use cases for cargo deliveries.

- The one non-autonomous car for Tesla going forward will be the highly anticipated new Tesla Roadster.

Interestingly, Musk is adamant that Tesla “needs to build” a Terafab (big chip manufacturing facility) to supplement Taiwan Semi, Micron and Samsung. There could be an announcement coming soon. They aren’t confident they’ll be able to get needed supply from these key partners three years from now, which is fair. Over the next “roughly 3 years,” they do feel confident in chip availability. After that, things naturally get less certain. Musk talked about the world discounting very real geopolitical risks stemming from hefty reliance on Taiwan Semi, and he does not want to be vulnerable if those concerns lead to shortages in the coming years. They know how important AI compute power is for Optimus and Robotaxi success and they’re determined to more tightly control their future in this area – like they’ve done in other departments like lithium refining. Tesla rightfully loves end-to-end control of supply chains, and will push aggressively forward on plans to make sure it has the needed raw materials processing, battery formation and futuristic car assembly know-how to control its destiny.

Separately, there’s a good chance they add a solar cell factory to the roadmap this year. Neither this nor the Terafab is part of their $20B 2026 CapEx guide and, if they go forward with potential plans, would raise the forecast.

Energy Generation and Storage:

Megapack 3 (commercial battery storage system) and Megablock (connects four Megapacks and a transformer) production will begin in Texas this year. They expect growth rates for this segment to remain elevated for the foreseeable future with a strong backlog informing their optimism. At the same time, margins will likely be pressured in 2026 due to price competition from competitors and tariffs. Nonetheless, Tesla is confidently working towards their goal of 100 gigawatts in annual solar-powered energy (again while owning most of the supply chain).

More on Optimus:

The 3rd generation of their Optimus concept will debut this quarter, with a much better hand design and an eye towards “mass production.” They called it the first design meant for this rapid scaling, but said the same thing about the 2nd generation in previous earnings calls. It’s very hard to build an entire supply chain from scratch and create a brand-new product line. It’s even harder to time the delivery of that product. So, while it’s fair to criticize Tesla for often being tardy on schedules (which Musk openly admits), we also have to acknowledge that they’re doing very hard things. This means the ramp will take longer, as there aren’t prebuilt systems, templates or vendors it thinks it can use to help bring this creation to life.

Tesla thinks the toughest competitors for this emerging segment will be from China. Musk also believes that generation 3 is better than anything over there, with the gap vs. domestic competition even larger. Musk thinks that nobody touches the mixture of hand dexterity, physical AI and manufacturing muscle of Tesla.

More on Robotaxi Scaling:

In addition to building out a lot more compute, Tesla also knows it will need to set up charging, storage, maintenance and cleaning systems that seamlessly scale without headache. I’d just like to point out that they can do all of these things with Uber and focus on building their disruptive hardware, but Musk isn’t interested at this stage. Tesla wants to do it all themselves, which is yet another source of CapEx growth for 2026, as these fleets will need infrastructure to support their success.

Robotaxi continues to operate in Austin and San Francisco, with Austin now offering some of their rides without a safety driver or a second car following closely behind. This year, Tesla expects to be in “dozens of cities,” or up to 25% of the USA if regulations allow this to happen. I just have to say it. They’ve been talking about this business scaling across the USA for a long time and have pushed the goalpost back several times. It’s time for them to prove it, especially as several other competitors quickly approach their commercial debuts.

- Musk has a goal of eventually allowing customers to add their autonomous cars to Tesla fleets and collect more money than they pay via monthly lease. That would make partial access to a car profitable for customers and would be a game-changer.

- Robotaxi added new updates like high-occupancy vehicle awareness so their units can use these lanes when allowed.

FSD:

- As previously reported, Tesla will no longer offer Supervised FSD via upfront payment and will fully embrace monthly subscriptions. While this will create more visible revenue, it will also weigh on auto GPM a bit until comps are lapped.

- Supervised FSD is now live in South Korea and it’s working hard on approvals in China and Europe.

- Tesla briefly mentioned the 50% insurance premium discount Lemonade is offering to FSD customers in Arizona. For customers, this effectively serves as a cost subsidy for the subscription, as Tesla can show them how much they save on their insurance plans if they buy this technology.

- FSD now has nearly 1.1M paid users vs. 500,000 in 2022 (22% 4-year CAGR).

More:

They’re now making Model Y units built with their 4680 battery cells. Considering batteries are their #1 global constraint, that’s a big positive for supply availability.