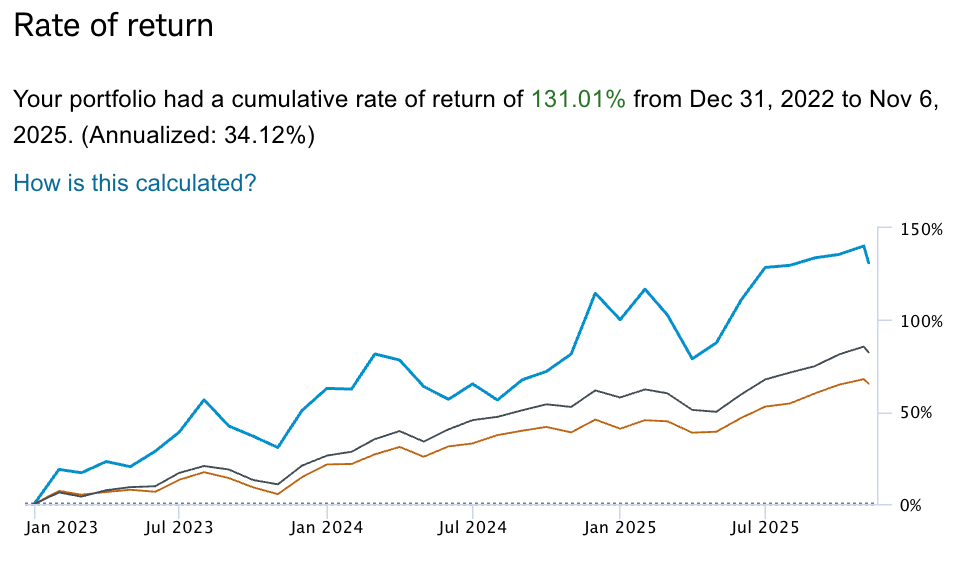

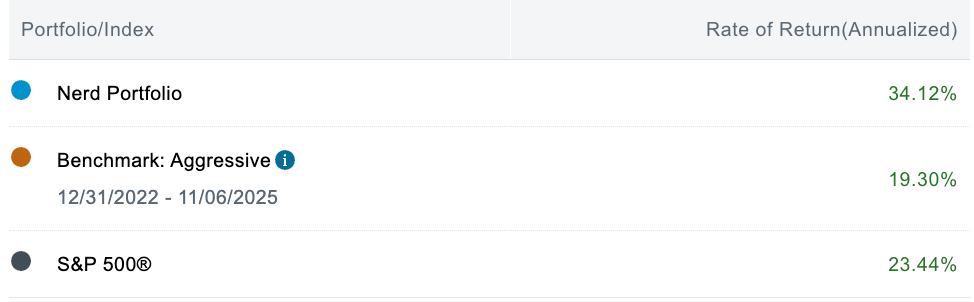

a. Updated Performance vs. the S&P 500

Not a fun week. I am now performing neck and neck with the S&P 500 for 2025, as I've given back all of the 3% lead over the last 5 sessions. The compounded annual lead also fell by about a point (as you can see above), but remains well ahead of my decades-long goal. I do not expect to beat the S&P by 10%+ on an annual basis like I currently am. My goal is simply to materially outperform over the long haul. This is all part of things.

Index-level volatility still looks very mild, but when digging into various pockets of markets, fear has seemed to fully kick in. While things could easily get more hectic in the near-term, I'd like to use this chaos to slowly lean in. More rate cuts are coming; quantitative tightening is ending; government stimulus will ramp in 2026; 1.4M Americans will again get paychecks whenever the shutdown ends; valuations of the firms I'm looking at are compelling.

Important for me to fixate on data, ride the volatility waves and make sure I'm owning good companies at good prices. Along those lines, I did some shopping.