Table of Contents

Coverage of catch-up earnings summaries, more conferences (Cloudflare, Snowflake. Datadog etc.), CrowdStrike Fal.con, Amazon Buy with Prime news and so much more is coming Saturday. Can’t wait to share.

1. Powell Presser Highlights

Policy – Cut rates by 50 basis points:

- Dual mandate risks are now balanced (vs. almost in balance last meeting) between inflation and employment. Risks are no longer skewed towards inflation.

- “Growing confidence” that policy “recalibration" can thread the needle of continued disinflation, resilient growth, & resilient labor markets.

- Continues to reduce the size of balance sheet. This won’t stop just because of interest rate cuts.

- The average Fed member expects about 2 more cuts this year & 4 in 2025 to get to a 3.4% rate. Lower estimate than in June.

- The long-term neutral rate estimate moved from 2.8% to 2.9%.

“We don’t think we’re behind on policy. We think this is timely. You can take this as our commitment to not fall behind.” – Powell

Output:

- Sees 2% GDP growth in the coming years.

- Continued improvements in supply chain dynamics are supporting durable economic growth. Cuts allowed supply chain bottlenecks to ease as intended.

- Economic growth was called solid. Sees stable 2nd half growth for 2024 as roughly stable vs. the 1st half’s 2.2% mark.

- Equipment and intangibles investments picking back up from an “anemic pace.”

Employment & Consumer:

- Consumer spending was called “resilient.” Still close to “maximum employment.”

- The labor market is “cooling but reasonably strong.” Nominal wage growth is easing.

- The labor market is now “a little less tight” than pre-2019. The labor market is no longer a primary source of inflation.

- Sees the unemployment rate rising from 4.2% to 4.4% by end of year vs. 4.0% as of the June meeting. Watching for signs of sharp weakening. Not seeing them today.

- Immigration contributing to better labor supply & upward pressure on unemployment.

“The labor market is in solid condition. The intention of our policy move today is to keep it there. That’s what we’re doing.” – Powell

Inflation:

- No change to 2% target. They have higher confidence in reaching this goal without sharp economic weakening.

- Market rents point to more housing disinflation. Slower than expected; direction is clear. Spoke on rate cuts potentially improving housing supply.

- Long term inflation expectations remain well-anchored.

- The Fed now sees a 2.3% PCE by end of 2024 and 2.1% by end of next year. Both lower than during the June meeting. Sees getting to 2% in 2026.

2. Rate Cut Thoughts

So… what benefits from rate cuts? There are a few general themes to focus on, with some impacts being more immediate and same taking longer to flow through the economy.

Main Near Term Themes:

In the near term, rate cuts are great for capital markets. They briskly lower the cost of funding, ease the required hurdle rates for these participants by lowering the cost of borrowing and improve liquidity overall. Lenders that use capital markets fund and sell-off loan pools benefit and insurers reliant on reinsurance markets benefit.

Beyond that, any firm focused on consumer loan refinancing benefits. Falling rates directly help their ability to profitably offer lower interest rates. Lower interest rates for consumers are always popular. Unsecured lending products (personal loans) don’t benefit quite as much, considering variable-to-fixed refinancing is a big part of that market. Finally, cuts make financing homes or cars cheaper, which fuels demand there. For example, on August 5th when mortgage rates briefly tanked, originators like SoFi immediately enjoyed an influx of demand. That quickly vanished as the rate reverted back higher. That is crystal clear evidence of a near-term impact as the cost of borrowing to buy a home.

Main Mid-Term Themes:

While cuts do bolster velocity of money and help nearly every consumer-facing brand, that benefit takes time. Consumers are not going to go to Lulu tomorrow to buy another shirt because of what Powell just said. The vast majority aren’t paying attention.

The presumed rate cut benefits of better overall liquidity, higher consumer confidence and more liberal spending don’t come overnight. These benefits come as accommodative policy props up growth and employment markets. That tends to take 12-18 months.

More Benefits:

- Rate cuts lower the intensity of future profit discounting. The value of free cash flow 5 years from now is worth more today now that rates are lower. This props up equity valuations — all else equal. Still, I don’t expect coinciding multiple expansion to happen overnight and I don’t want to rely on that for capital returns. The more exciting benefit is how the accommodative policy flip can spur growth and consumer spend to boost corporate profits.

- Firms reliant on consumer debt also benefit, as they can more cheaply fund operations. This tends to be a near term event.

- Business-to-business software tends to get a boost thanks to cheaper cost of capital for potential clients.

- Companies that realize meaningful revenue in non-dollar currencies tend to benefit from cuts weighing on the dollar’s strength. This benefit tends to be a near term event.

- Commodities tend to benefit from stronger demand and easier pricing amid rate cuts.

Large Caveat:

All of these benefits rely on the economy not entering a severe recession. As Powell said today and as I consistently see in the data, there are no signs of that severe recession coming. If that did happen, the negative impact on consumers and enterprises would surely outweigh the benefits of lower rates for a period of time. Not likely, but always possible.

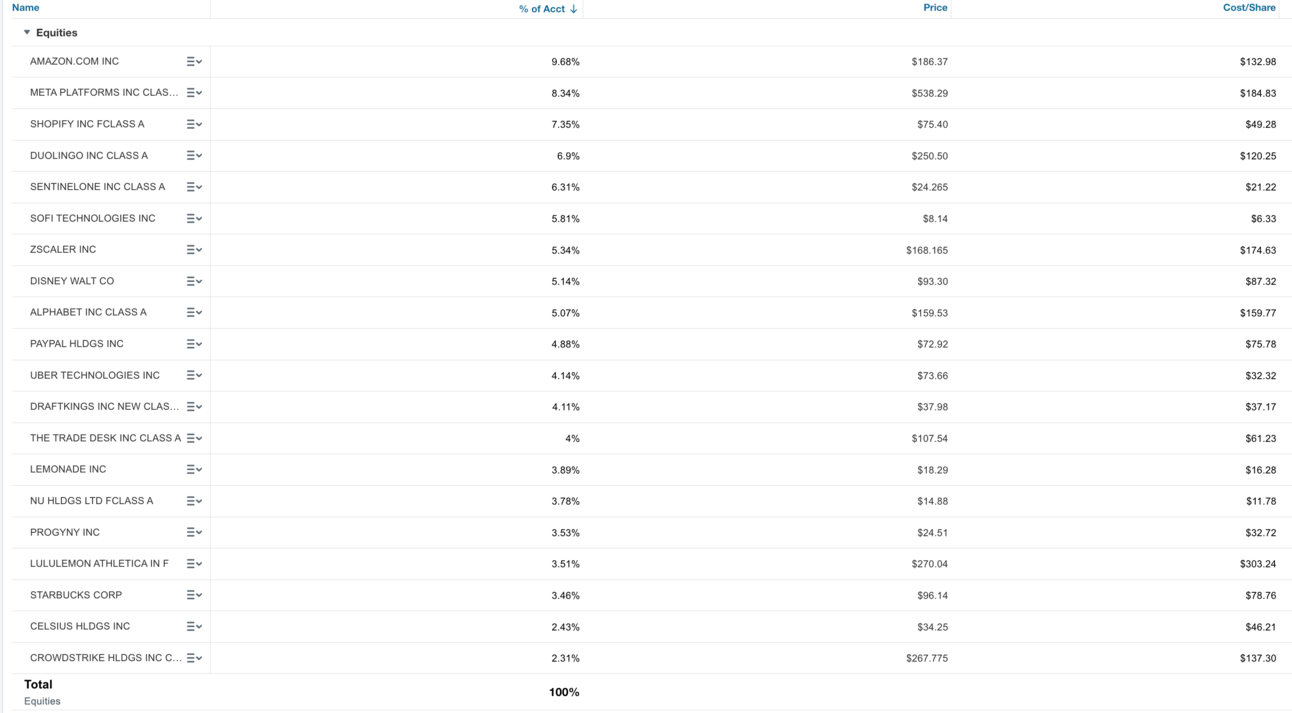

3. Coinciding Portfolio Update

I added my remaining cash to SoFi today for an 8% boost to the stake. This raised my cost base, which I’m entirely fine with. Every aspect of its business stands to benefit from these cuts. This is even true for personal lending where pent-up demand and stronger capital market access will outweigh variable-to-fixed refi headwinds. SoFi has been in survival mode for nearly 3 years. It has continued to admirably compound top line, inflect margins and fortify its balance sheet throughout all of this. And now? With its large capital ratio cushion, it’s time to switch from survival mode to attack mode.