In case you missed it:

a. General Market Thoughts

Entering Q1 earnings, trade and tariff drama led to plummeting expectations, soaring anxiety and volatile markets. Negative guidance revisions were seen as inevitable, so anything better than that was generally rewarded. For Q2, the backdrop was starkly different. Indexes aggressively bounced-back, with individual names doubling in the span of a quarter and multiples zooming higher. That pattern has generally continued into the Q3 print. Rallies have gotten even more dramatic, and we’ve seen that led by the lowest-quality, least profitable and most speculative names that Mr. Market has to offer. Multiple expansion has continued to rage and animalistic spirits have grown more pronounced.

But there’s some encouraging nuance as we head into this season. I see this mania more confined to market pockets than it was in 2021. It’s the AI infrastructure darlings, data center energy players and quantum researchers where the froth seems the most obvious. Many of them are pre-revenue, with immensely risky investment cases and sky-high valuations that don’t account for all of that real risk.

It’s hard to find anything close to that same level of excitement elsewhere. And? I do not think that this dose of market froth is nearly as broad-based as it was during the pandemic bubble. So while I do think the high-fliers come with terrible risk/reward today… I don’t think that applies to the majority. And I don’t think it applies to enterprise software, consumer internet or consumer discretionary, which are the sectors that we mainly focus on. While those areas felt overly excited entering Q2, that’s not true for Q3.

I expect the areas that I focus on to deliver generally strong results that lead to small upward estimate revisions and brightening market sentiment. There are very strong and healthy names trading at highly compelling valuations. There is deep relative value to be found in this market and the craziness hasn’t extended to everything. At least not yet. With that in mind, the word I would use to describe market conditions today is bifurcated.

I do think there is room for positive data to be rewarded for most of the portfolio. And while that’s not crucial for the long-term investor like myself, I think it’s still relevant. It leaves me with a compelling setup for the quality firms that continue to fundamentally deliver. Either these quality names see their stocks go up and I make money. Or? The results are shrugged off, multiples contract from an already enticing starting point, I accumulate and make money later.

One more note before we begin. I am about to do a ton of prognostication. Some of that speculation, especially when it pertains to share price reaction, will inevitably turn out to be wrong. As always, I will likely use disconnects between financial strength and share price weakness to build out positions in companies. These are educated guesses based on inter-quarter data and news – with the takes on how actual data will look being more important than how Mr. Market will immediately react.

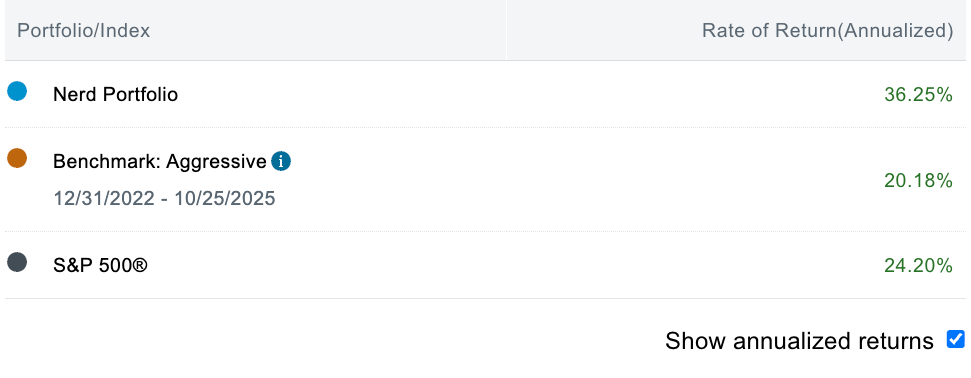

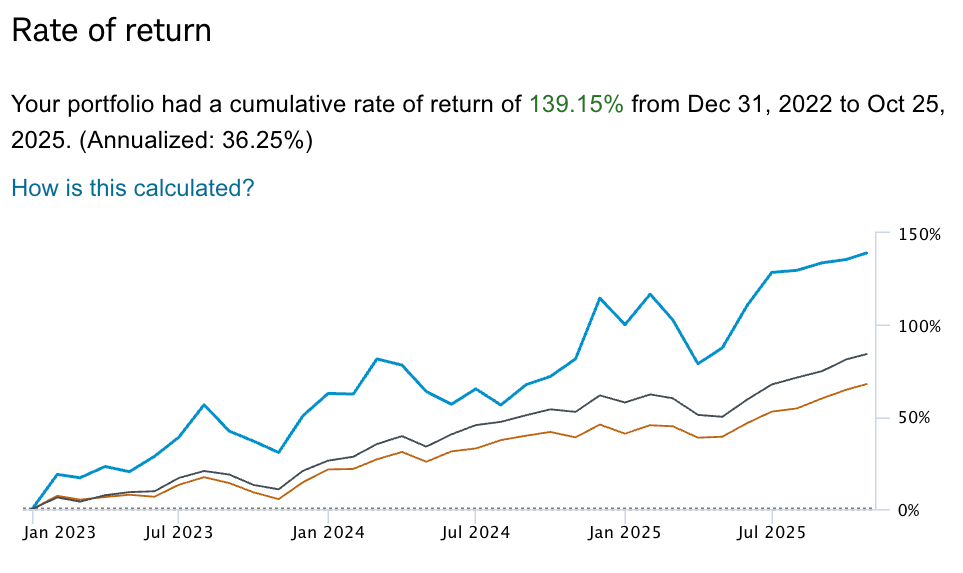

Here is how portfolio performance looks heading into the busy season: