1. My Holdings

UPDATED MARCH 14th 2022:

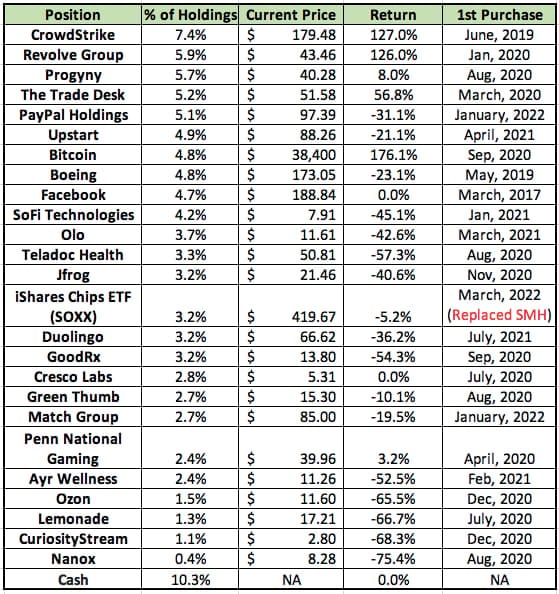

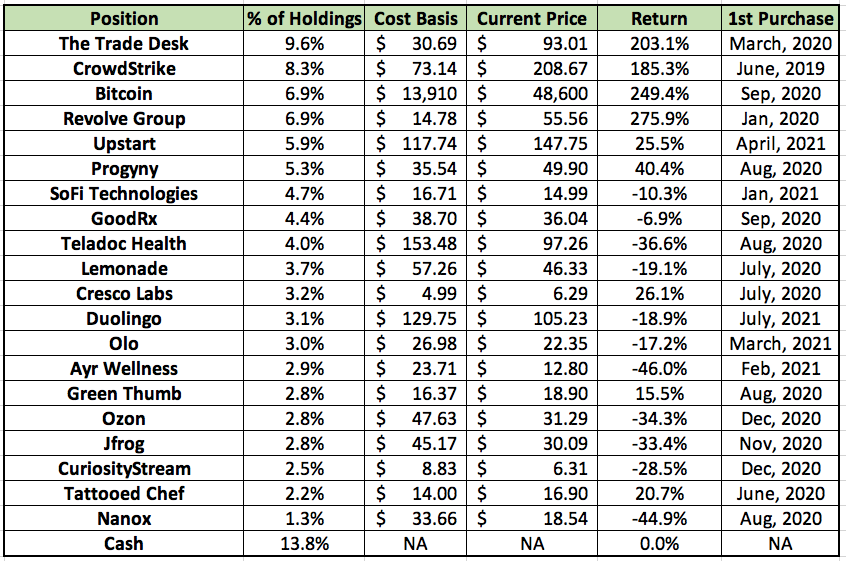

a. Growth Bucket (~73% of equity holdings)

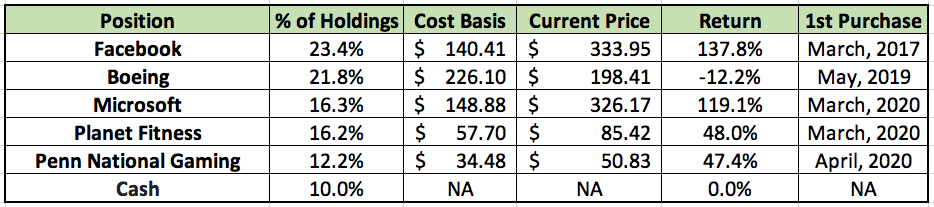

b. Value bucket (~27% of equity holdings)

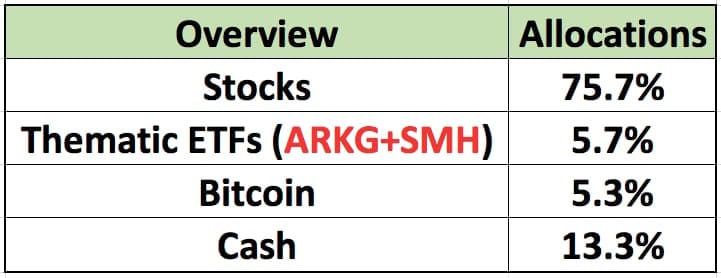

c. Overview

2. Summing Up Another Earnings Season

Another earnings season has now come and gone. Detailed commentary on all 24 reports can be found on my Substack. After reading through the results of all 24 positions, here are the key takeaways:

a. The Stand Out — Revolve Group (RVLV)

Revolve Group continues to shine. This quarter, its top line results beat expectations by 14% with 58% revenue growth posted vs. the most recent pre-pandemic period. The company named Kendall Jenner — arguable the most ubiquitous fashion icon on Planet Earth — as its FWRD brands’s new creative director. Her fashion clout is already paying dividends with the brand taking market share from formidable peers.

Despite Revolve catering to fancier, going out clothing and the pandemic severely impacting that demand, it managed through admirably with briskly expanding margins. Its core marketing channel — live events — was also halted amid the pandemic yet it still executed. It’s now taking advantage of the demand recovery with remarkable success. Not only that, but Revolve is also maintaining market share gains in the pandemic categories that it pivoted to last year.

It crushed all of its profit and margin estimates and reported zero supply chain issues while countless other retail players struggled with logistics. How? Revolve’s management leaned on its internal inventory system to observe consumer activity and predict these supply chain issues 9 months ago — it was able to prepare accordingly. Now, the firm is seamlessly capturing rapidly growing demand as our world slowly normalizes. This was yet another elite quarter for the company.

b. The Good

The following companies modestly exceeded expectations while also raising guidance:

- Upstart

- CrowdStrike

- The Trade Desk

- SoFi Technologies

- Teladoc Health

- Lemonade

- JFrog

- Olo

- Ozon

- Duolingo

- Planet Fitness

- Microsoft

c. The Fine

The following companies reported results that either exceeded expectations with no further guidance raises or roughly met expectations and guidance:

- Green Thumb

- Cresco Labs

- GoodRx

- CuriosityStream (next quarter and 2022 guidance will be make or break for the investment)

d. The Bad

- Ayr Wellness — EBITDA guidance reduction

- Boeing — Missed estimates across the board + 787 Issues

- Progyny — Slight miss and slightly lowered guidance

- Tattooed Chef — Estimate misses and a guidance reduction across the board

- Penn National Gaming — Missed profit estimates with in-line demand + Missing out on a New York sports gambling license

- Nanox — pre-revenue and no further production delays but an SEC subpoena that it’s responding to

- Facebook — missed demand estimates + sharply rising OpEx (which I support)