1. My Holdings -- July 2022

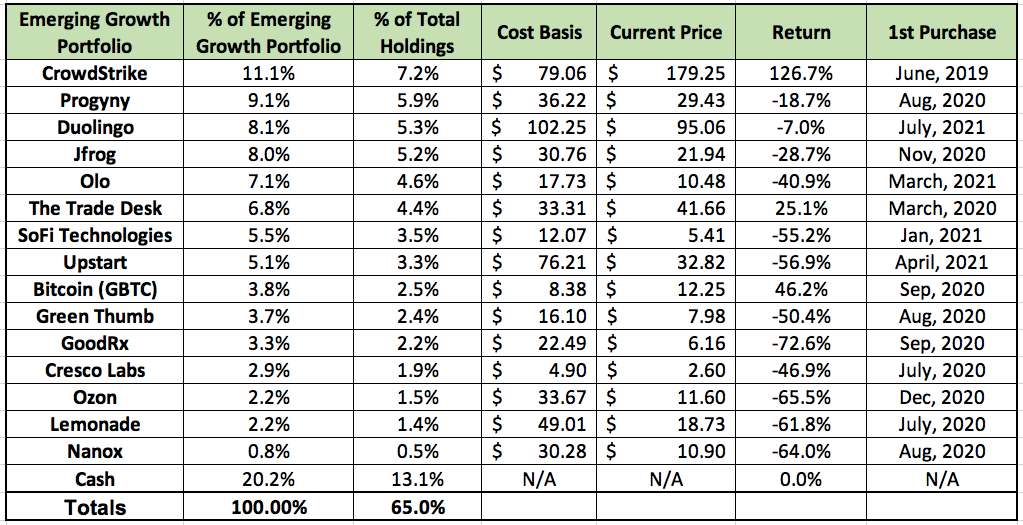

Please note that I treat my cash position as one total position. I split it among my two portfolios based on the proportional size of each. Also note that my portfolio update does not include exited positions like FedEx and Viacom which represent two of my best investments to date.

a) Emerging Growth Portfolio

Notable Changes during the quarter:

- Exited Teladoc Health.

- Most aggressive adding with Progyny, JFrog, Olo and SoFI.

- Most aggressive trimming with Upstart Holdings (still trimmed well under 20% of the total position).

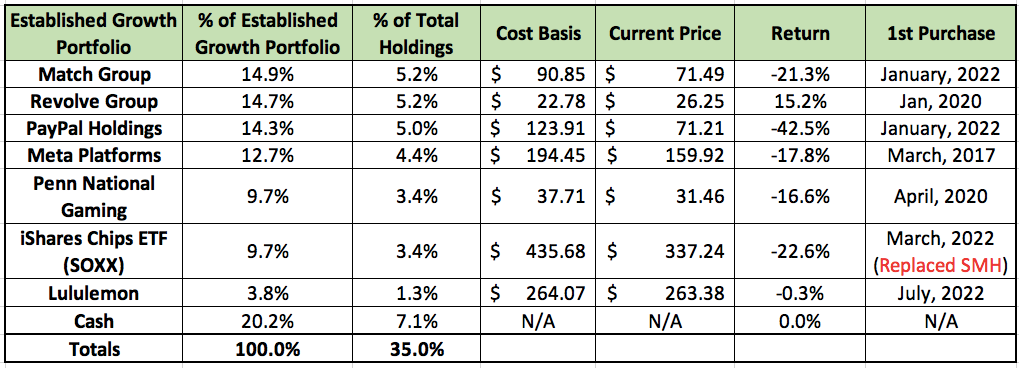

b) Established Growth Portfolio

Notable changes during the quarter:

- Exited Boeing.

- Started Lululemon

- Added most aggressively to Match Group and Revolve Group.

- I did zero trimming in this portfolio.

Watch List:

- Shopify

- Chipotle

2. Summing Up Another Earnings Season

a) The Stand-Outs

Duolingo (DUOL):

While Duolingo was lumped into the bucket of pandemic beneficiaries that would flame out as the world normalized, that has simply not happened. Don't let the cuddly, lovable owl mascot fool you -- this team means business and business is booming.

The Duolingo team comfortably surpassed revenue expectations while posting its fastest sequential user and subscriber growth since the pandemic struck. And it significantly raised 2022 demand expectations as well. It continued to grow its percentage of users that subscribe and easily soared past its previous pandemic pull-forward engagement records. Note that this growth outperformance forecast does not include any contribution from its new Duolingo Math product in beta testing -- it was solely a matter of core strength. It also broke out its budding Duolingo English Test (DET) revenue which is rapidly displacing legacy proficiency exams and growing at a casual 62% YoY clip.

“We believe that the future of standardized assessment is online, and our ongoing DET innovation continues to make us a pioneer in the field.” — Co-Founder/CEO Luis von Ahn

But it's not just demand that is impressive. The company continues to see its gross margin expand (with a little help from diminished Google Play fees) and even generated positive EBITDA despite expectations of a loss. That growth continues via word-of-mouth, which is incredibly cost-efficient. As a result, Duolingo saw its marketing as a percent of revenue cut in half from 36% to 18% despite thriving demand. Ideal.

Looking ahead, Duolingo’s strong results led to analysts dramatically improving 2022 profit estimates from a loss of over $1.00/share to a profit of $.04. That's is not normal.

“We have no reason to believe there’s going to be a slowdown. Our user growth numbers are accelerating. We are not a pandemic story like other digital educational services. Furthermore, we are product driven. A lot of these other companies spend a lot of their resources on marketing. We spend on making excellent products that work and grow via word of mouth.” — Founder/CEO Luis von Ahn

Revolve Group (RVLV):

Revolve is quickly becoming a quarterly member of this Stand-Outs section. Revenue beat expectations by 10.4% while the firm enjoyed its fastest customer growth since 2019. It has now set sequential customer add records in 3 straight quarters and offered upbeat early commentary on this current quarter with growth well above its long term target. Its profit metrics beat expectations across the board despite normalizing tax rates with a record Q1 gross margin of 54.5%. Revolve’s main marketing channel of live events and festivals is now coming back in full swing, and management is fully taking advantage. With a $270 million cash cushion and no debt, Revolve has the firepower, the clout and the leadership to continue the current trajectory. Its niche of catering to affluent, macro-economically resistant customers helps a lot as well.

“As founders, we’ve been focused on profitable growth from day one. This quarter was no exception to continuing our long track record of delivering a unique combination of growth and profitability… Our results for the past several quarters demonstrate that we are gaining meaningful market share.” — Co-Founder/Co-CEO Mike Karanikolas

b) The Good

The following companies materially exceeded expectations while offering up-beat guidance:

- CrowdStrike

- The Trade Desk (honorable mention for a stand-out quarter)

- Lululemon

- SoFi Technologies

- Penn National Gaming

- JFrog

- Lemonade

- Olo

- Ozon -- The company is actually thriving while Russian stock trading remains halted.

I will continue to slowly add to all of these names besides Ozon.

c) The “Meh”

The following companies reported roughly in-line results and guidance with perhaps a bit of downside amid chaotic macro:

- Match Group

- Nano-X Imaging

- Progyny

- Meta Platforms

- Green Thumb (no material forward guidance as per usual)

- Cresco Labs (no material forward guidance as per usual)

I will continue to slowly add to all of these names besides Nanox.