Table of Contents

In case you missed it:

- The Trade Desk Earnings Review.

- Lemonade & Duolingo Earnings Reviews.

- Palantir & Hims Earnings Reviews.

- Cava Earnings Review.

- DraftKings Earnings Review.

- Uber Earnings Review.

- Shopify & Coupang Earnings Reviews.

- Meta Earnings Review.

- Alphabet Earnings Review.

- Apple, ServiceNow & Starbucks Earnings Reviews.

- Amazon & Mercado Libre Earnings Reviews.

- PayPal Earnings Review.

- Tesla Earnings Review.

- SoFi Earnings Review.

- Netflix Earnings Review.

- Taiwan Semi Earnings Review.

- Portfolio & performance updates.

a. Key Points

Sea Limited is a commerce, fintech and entertainment giant across Southeast Asia, Brazil and Argentina.

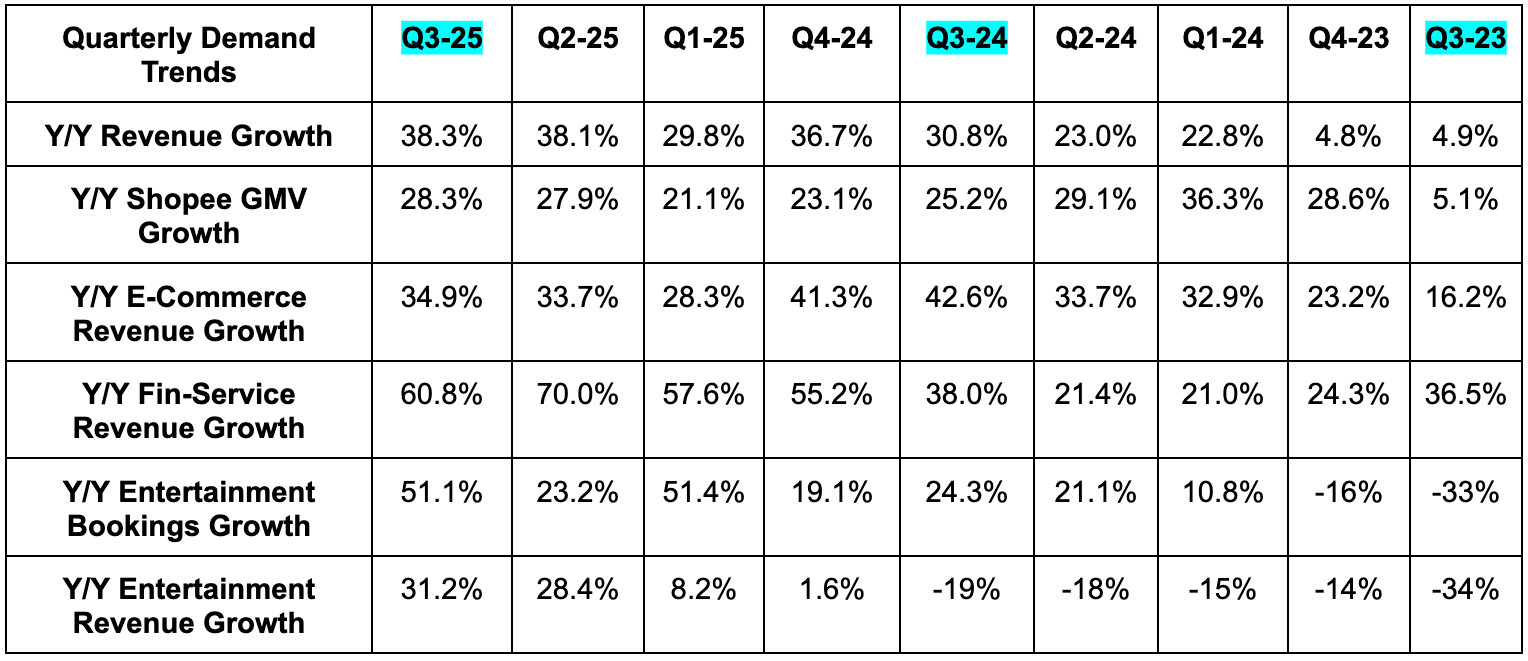

- Strong revenue performance for all 3 segments.

- Highest growth rate for the Entertainment segment in 4 years.

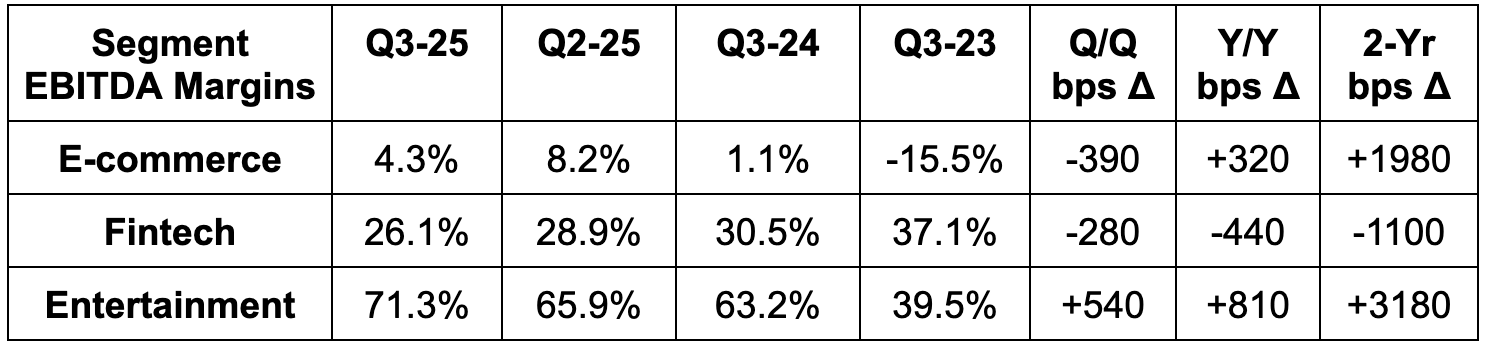

- Strong e-commerce margin expansion despite ramping competition in Brazil.

- Looking to sell more 3rd-party logistics services to merchants and add more capacity for these customers.

b. Demand

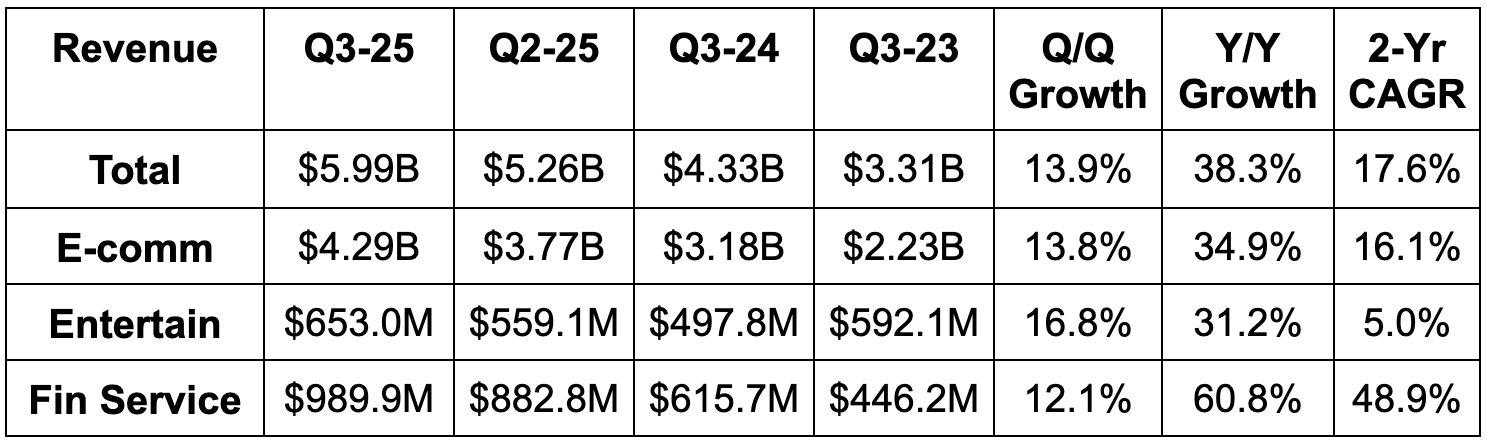

- Beat revenue estimates by 6.1%.

- E-commerce beat estimates by 5.7%. Within e-commerce, core marketplace revenue (transactions & ads) rose by 53% Y/Y. Value-added services revenue (logistics) fell 6% Y/Y.

- Entertainment beat estimates by 7%.

- Financial services beat estimates by 3.1%.

- Beat e-commerce Gross Merchandise Value (GMV) estimates by 2.3%.

- Missed quarterly active entertainment user estimates by 1%; beat quarterly active entertainment payer estimates by 5.6%.

c. Profits & Margins

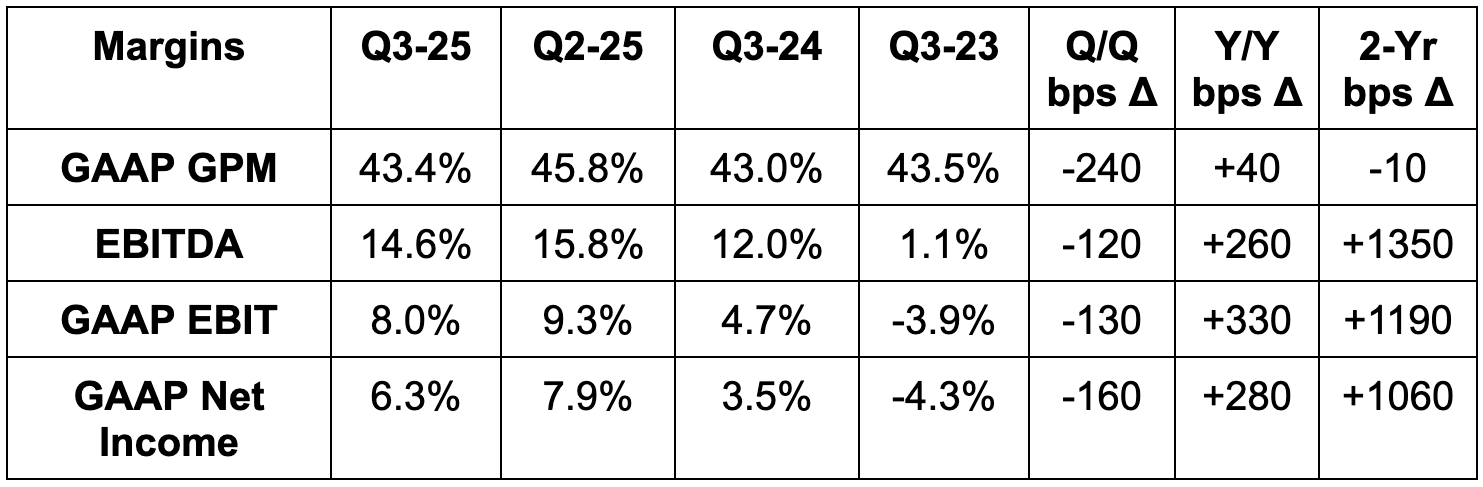

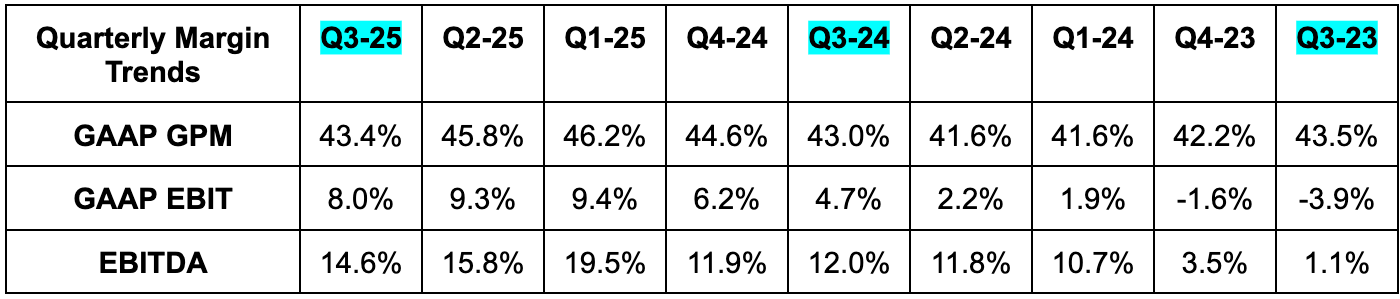

- Missed 45.7% GPM estimates by 230 basis points (bps; 1 basis point = 0.01%).

- Beat EBITDA estimates by 3.1%.

- Missed $0.88 EPS estimates by $0.08. Its tax bill rose by 74% Y/Y, which pressured EPS (but not EBITDA).

Cost of goods sold growth was mainly driven by variable cost to support outperforming demand. Furthermore, credit cost growth associated with its credit portfolio weighed on this margin. Despite that, as economies of scale continue to deepen, GPM expanded. Moving down the income statement, G&A growth was just 11% Y/Y, while R&D fell by 5% Y/Y. Both items facilitated a lot of the margin expansion you see below.

Conversely, provision for credit loss growth was 76%. That is related to the aforementioned credit portfolio expansion, but the 76% provision growth was in excess of 70% loan book growth. This could lead to a bit of anxiety for the U.S.-based investors grappling with credit trends in a less familiar region like Southeast Asia. At the same time, Forrest Li is a world-class and battle-tested founder. That means I don’t think the risk amid any kind of macro issues is SE’s balance sheet blowing up. It’s that growth would slow down… because they would do the right thing and slow it down. Right now, macro signals look good to them and rapid credit growth will likely continue. More on credit health later.

d. Balance Sheet

- $3.07B in cash & equivalents.

- $6.8B in short-term investments; $1.8B in long-term investments.

- $2.24B in convertible notes.

- $225M in borrowings.

- 6% Y/Y share dilution.

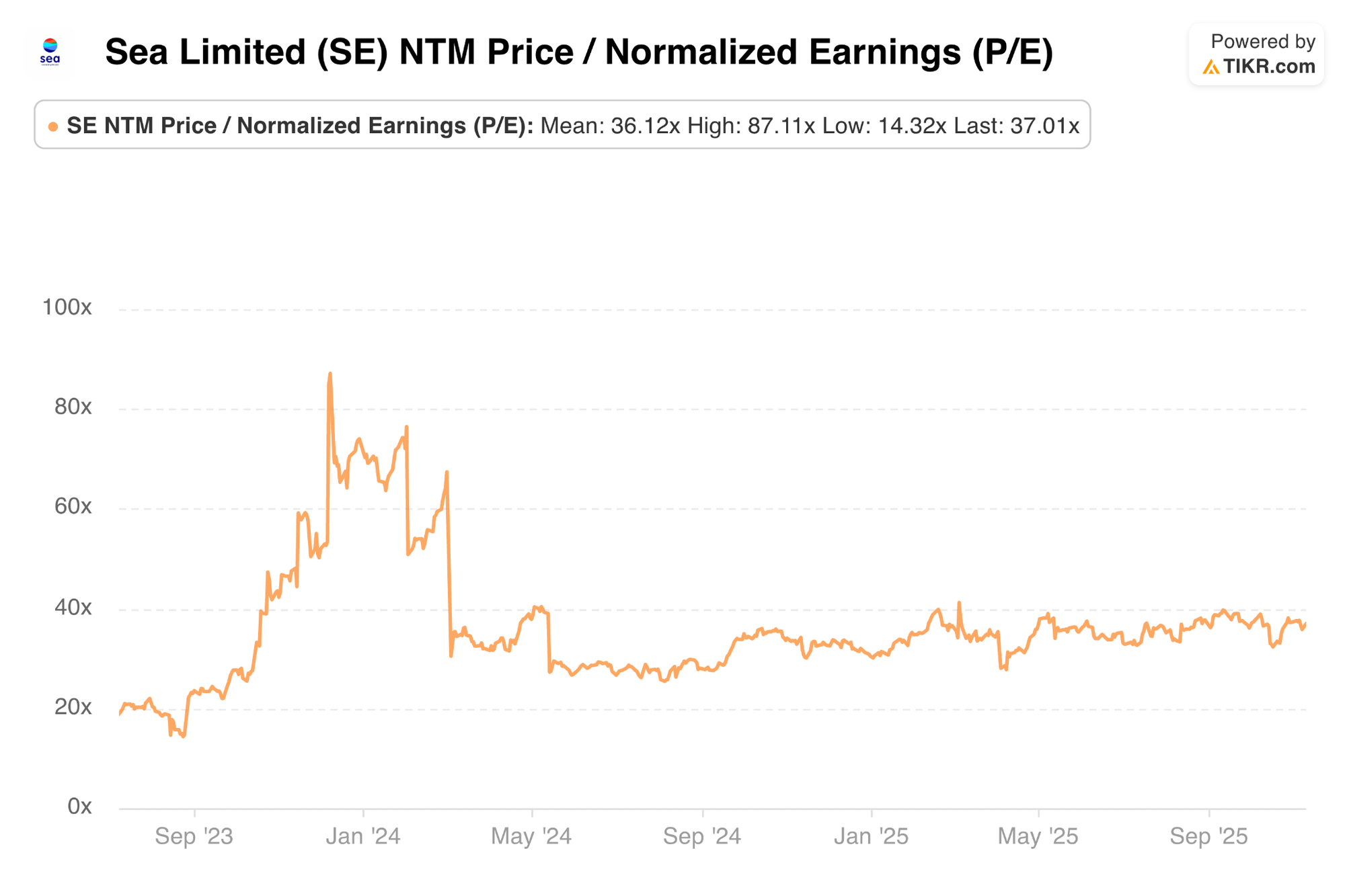

e. Guidance & Valuation

SE still expects e-commerce GMV growth to surpass 25% Y/Y this year. It also reiterated 30%+ entertainment bookings growth for 2025. They remain confident in Y/Y EBITDA margin expansion, which was great to hear amid intensifying Brazil competition as MELI lowers free shipping minimums and SE pushes its own customer service forward. Notably, these investments from SE will be a much less severe margin headwind than previous CapEx cycles.

SE trades for 37x forward EPS. EPS is expected to grow by 160% Y/Y this year, by 44% Y/Y next year and by 38% Y/Y the year after. Those growth estimates may fall a bit following this report, but I don’t expect anything too drastic.