Table of Contents

- Section 1 – SoFi Basics

- Section 2 – Lending

- Section 3 – (Non-Lending) Financial Services

- Section 4 – The Technology Platform

- Section 5 – Quantitative & Risks

- Concluding Thoughts:

Section 1 – SoFi Basics

1a. Company Basics

SoFi aims to be the one-stop shop for consumer financial needs, with an owned tech stack that it also sells to customers like Robinhood and H&R Block. While it started as a student loan company, it now offers a full line of core financial services and lending products. It fixates on having every single tool a customer could possibly need and delivering high-quality experiences through those tools. This, in practice, means higher lifetime value (LTV) without material incremental customer acquisition cost (CAC) when cross-selling additional items. That helps it stand out in a highly competitive sector, creates more valuable customer cohorts and justifies leaning into things like more growth marketing. It doesn’t base its offering on what carries the highest return on equity (ROE). Instead, it offers slick, useful, interoperable, digitally-native tools for everything to give consumers zero reason to ever look elsewhere. CEO Anthony Noto describes this approach as helping customers answer “what they need to do, should do and could do” in their financial journeys. SoFi has you covered for everything.

The company caters to a relatively affluent and young crowd that has been “underserved” by existing institutions. This makes other credit vendors like American Express a better read through to SoFi’s results than companies like Discover. That affluence means a higher LTV ceiling and a more resilient credit book, which we’ll explore in detail later on. The value proposition has resonated for several years now, and that’s understandable when we consider the environment. 50% of Americans use more than one bank account, with about 80% doing so because the one-stop shop they want isn’t an option. Furthermore, 50% of all bank accounts in the USA are with 10 legacy vendors not offering the end-to-end suite that many yearn for. Enter SoFi.

1b. Team Introduction

Anthony Noto has been the company’s CEO since early 2018. He’s a no-nonsense individual who will speak his mind and do so candidly. Through beating revenue & EBITDA estimates in every quarter since going public (despite student loan headwinds discussed later), as well as mid-quarter updates that always prove accurate, he’s a CEO whose words I take seriously. The fundamental execution track record is excellent, and so is his resume. Before starting with SoFi, Noto spent 4 years with Twitter as the COO and CFO. Before that, he was the Co-Head of Global Technology, Media, and Telecommunications (TMT) Investment Banking at Goldman Sachs and the CFO of the NFL.

Chris Lapointe has been with SoFi since June 2018 and has been the CFO since April 2020. Before SoFi, he was a Director and Head of Corporate Financial Planning & Analysis (FP&A) with Uber and a Vice President of TMT Investment Banking at Goldman Sachs as well. The rest of the team features several more impressive resumes:

- Arun Pinto is the Chief Risk Officer and started with SoFi this year. He came from Wells Fargo where he was the Chief Risk Officer for their Consumer and Small Business Banking. He was the Chief Risk Officer of Auto and a Managing Director at JP Morgan before that. He has also been a Senior VP at Bank of America. Great resume.

- Jeremy Rishel is the Chief Technology Officer and has been since June 2022. He was an SVP of Engineering at Splunk and the VP of Engineering at DoorDash and Twitter.

- Derek White is the CEO of Galileo. Before that role, he was the VP of Global Financial Services Cloud at Google and the Chief Digital Officer at U.S Bank.

- Lauren Stafford Webb is the Chief Marketing Officer. Before starting with SoFi in 2019, she was the VP of Marketing at Intuit and a Senior Brand Manager at Procter & Gamble.

- Stephen Simcock is the firm’s General Counsel. He recently started in this role, after spending 10 years as JP Morgan’s Consumer Banking General Counsel. Before that, he was the General Counsel for Citibank’s Consumer Banking division.

- Anna Avalos is SoFi’s Chief People Officer. She was the Senior Director of Human Resources at Stryker and a Human Resources geographic lead for Tesla too.

- Eric Schuppenhauer is SoFi’s Borrow Business Unit Leader. He comes from Citizens Financial Group where he led consumer lending. He also previously led Capital One’s mortgage business.

1c. Overall Edge

This section will sound somewhat familiar for those of you who read our Nu (NU) deep dive. Banking is a commodity, and it’s hard to differentiate given that reality. The way to drive unique value when competing products are similar is via cost advantages. In financial services, those cost advantages generally come from a few places.

With legacy incumbents, bank charters allow participants to fund loan books with lower cost deposits. Non-banks are reliant on more expensive sources of capital like warehouse debt. Higher cost of capital means more difficult net interest margin (NIM) preservation and a lower ability to get aggressive on originations, as fewer of them are adequately profitable. SoFi has a bank charter, which allows it to unleash its deposit base for funding its loan book. And since getting this charter, it has worked hard to shift its warehouse-funded credit to deposit-funded credit. This process is part of “balance sheet optimization,” which simply means making SoFi’s liabilities as cheap as they can be and its assets as yield-producing as possible. Charters significantly bolster optimization potential.

SoFi’s charter removes the innate cost advantage that incumbents have over this firm. Furthermore, it allows SoFi to act as a sponsor on some corporate banking activities, which means another high margin revenue opportunity that other next-gen players cannot match.

On the disruptor side, it offers more cost advantages. Like other disruptors, it doesn’t have a large physical branch presence. This means lower input cost intensity, which it can use to profitably offer higher savings yields to its customers or cheaper rates on loans. That’s the standard cost edge for disruptors vs. incumbents, but SoFi has another advantage. Through the acquisitions of Galileo and Technisys (much more later), the company has essentially acquired its entire tech stack and owns it internally. This greatly diminishes 3rd party vendor fees, drives superior interoperability and, all else equal, raises SoFi’s margin ceiling beyond both disruptors and incumbents. It also turns those previous vendor fees into new revenue opportunities by licensing this tech to others.

Finally, its willingness to offer every product that a customer needs rather than only the most profitable tools helps here as well. Consider the following: When SoFi sells its Money product (bank accounts) to a new customer, CAC is $40 and variable profit is $85 with a 34% margin. If it sells an individual personal loan product, CAC is $825 and variable profit is $938 with a 45% margin. Both margins are respectable. At the same time, when it cross-sells a loan product to a Money customer, there’s no added CAC, variable profit jumps to $1,763 and the variable margin soars to 86%. This concretely illustrates why SoFi’s one-stop shop concept is an edge in its own right. It creates more touchpoints for product cross-selling, which means a large spike in its potential customer margin profile.

Bank accounts with strong yields are not unique; lending products aren’t unique; its other financial services are not unique; its bank charter is not unique; its asset-light next-gen model is not unique; its technology business is not unique. What is unique? Combining all of these ingredients into a business model and an LTV/CAC dynamic that nobody can currently touch in the USA.

Section 2 – Lending

2a. Borrower Demographic

It’s important to begin this section with an overview of SoFi’s actual borrower. It tees up the explanation for how SoFi’s credit health has proved resilient and how it is different from most disruptors. While next-gen competition caters to lower credit quality, lower-income individuals, SoFI does not. As briefly mentioned, it predominantly caters to young, ultra-prime borrowers with the longest spend runways and the highest probability of repaying debt on time.

Specifically, SoFi’s average personal loan borrower has a 747 FICO and $168,000 in annual income. These are both stable Q/Q, despite rapid 41% Y/Y member growth. This growth is not coming at the expense of customer quality. For student lending, its average borrower has a 768 FICO and $146,000 in annual income. This is how “credit performed better than expected” per the team last quarter and “continues to perform well” as of an investor conference in early September.

2b. Secured & Student Lending Products

Student loan refinancing, again, was SoFi’s original product and by far its largest revenue and profit driver as we entered the pandemic in 2020. Years of student loan relief and court battles have heavily weighed on demand for refinancing. If borrowers expected forgiveness, there would be no reason to refinance, so most didn’t. And there has been a lot of confusion here on empty promises pertaining to who actually would be eligible for relief. Those promises became even more empty a few months ago, as the Supreme Court again blocked the administration’s Saving on a Valuable Education (SAVE) plan. Many borrowers are realizing their bills will not be canceled. Whether that’s a good thing or not is not a relevant topic for this deep dive.

- This plan would have artificially lowered monthly payments (making refinancing less compelling) and forgiveness for lower-income cohorts after 10 years. There also would have been automatic enrollment for all eligible borrowers.

Since this ruling, SoFi has enjoyed a steady ramp in loan demand here as borrowers come to terms with needing to repay their debt. Despite the election, broad-scale forgiveness is unlikely at this point. And considering SoFi’s borrower is highly affluent in general, targeted relief plans likely won’t impact its customer base all that much.

On the secured home loan side of things, SoFi recently reached acceptable service levels needed to greenlight stepping on the gas pedal. This is thanks to its purchase of Wyndham Capital a couple years ago. Wyndham is a digital purchase mortgage vendor born during the Dot Com Bubble. It specializes in “augmented intelligence” or the process of using AI/ML models to support employees instead of replacing them. Every mundane, tedious task is automated by its engineers, while customer service talent ensures human touch is available when needed. This makes the “clunky, difficult process more seamless and delightful for customers.”

SoFi had been in the mortgage business for 5 years before Wyndham, but it struggled with unreliable, slow and expensive 3rd party vendors. Now, SoFi owns the backend tech stack, which helps it do things like shrink origination times from 90 days to 30 (20% faster than the industry). Wyndham does that with a 98% net promoter score (NPS) and also helped SoFi become a primary closer for home equity lines of credit (HELOCs) instead of needing a 3rd party broker. This materially raises revenue per loan, and is just one example of Wyndham cutting 3rd party vendor fees for SoFi.

The integration timing is quite compelling; the rate cut cycle has just begun and mortgage rates look as though they’ve peaked for this cycle:

Finally, SoFi very recently launched small and medium business (SMB) loans. These are offered by SoFi through its app and funded by participating partners. The company is still focused on consumer banking. But? Some of its consumers are entrepreneurs and small business owners (like your favorite nerd). This makes SMB loans a relevant expansion opportunity for the company and follows their philosophy of providing a full host of services, leaving clients no reason to go elsewhere for any financial products.

- Between this product, its technology platform (more later), and plans to be a business-to-business (B2B) sponsor bank for commercial payments, the enterprise could be a promising future opportunity. It likely won’t be a sponsor bank for consumer-facing FinTechs, as SoFi directly competes with them through its own consumer app.

2c. Personal Loans

SoFi’s personal loan business is now its largest financial driver, accounting for roughly 80% of its credit book and nearly half of its overall business. Unlike its other lending products, it has not been willing to originate as much of this credit as it can. Why? Because this type of credit is inherently riskier. It does not feature any underlying asset to guarantee repayment in the event of borrower charge-offs. For now, there is significant pent-up demand, which can be seen in rapid growth for its loan marketplace called Lantern.

SoFi has been extremely conservative here for more than a year amid chaotic rate volatility. That volatility means heightened macro uncertainty pertaining to cost of capital and liquidity for SoFi and its capital market partners. It also means more uncertainty for borrower health, as folks grapple with the state of the economy. For context, SoFi’s guidance for 2024 assumes negative GDP growth and 5% unemployment rate. Neither of those numbers will prove to be anywhere near reality. This pessimism generally leads to prudence, like it did here. Furthermore, the team’s point of view is that rate cuts in 2024 were required to avoid a severe 2025 recession. As those rate cuts only just came, it has been operating without banking on something that is firmly outside of its control.

The effect of this approach is 2024 being a “transition year” in which lending will shrink Y/Y, its other segments will keep briskly growing and so lending will become a smaller piece of overall revenue (50% exiting 2024). It’s on track to do exactly this, but the prudent approach has left many investors frustrated, wanting more growth from the lending business. I think that’s very short-sighted. It’s asking leadership to risk their balance sheet and their company to bank on timing the Fed. That’s not smart. Instead of risking existential doom for the firm, SoFi instead delayed a bit of lending revenue for a couple quarters. That is miles upon miles easier to stomach and was the prudent path.

2d. Credit Health & Capacity (As of September 2024)

While there has been incessant noise pertaining to SoFi personal loan credit risk, you wouldn’t be able to tell that from their cross-cycle durability. First, a few credit health definitions and how these important buzzwords relate to each other:

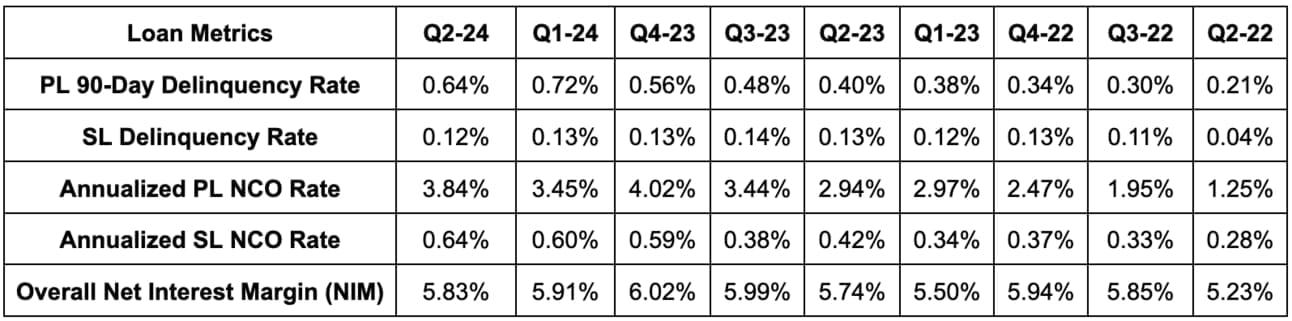

- Delinquencies are loans that are past due by a number of days. SoFi discloses 90+ day delinquency rates (delinquent loans as a % of total). Delinquency rates are the leading indicator for SoFi credit health.

- Net charge-offs are loans that a creditor decides won’t be repaid and will instead become losses. Net charge-off (NCO) rate is the percentage of loans classified as uncollectible. This is a lagging credit indicator compared to the leading delinquency indicator.

- Life of Loan Loss Rate (LoLLR) represents the total net charge-offs realized over the period of a loan. For personal loans, LoLLR = annualized charge-off rate * 1.5 (because terms are 18 months). SoFi has an LoLLR target of 7%-8%, meaning an NCO target of 4.6%-5.4%.

- Delinquencies eventually become charge-offs and charge-offs are aggregated to form LoLLR.

- Net Interest Margin (NIM) is the spread between interest earned on loans and interest paid out to fund those loans (either to depositors or creditors).

Again, the U.S. is through a period of aggressively hawkish policy that made surpassing loan hurdle rates more difficult, while hurting borrower health and overall liquidity. Observing SoFi’s credit trends through this period is much more important than looking at it when things are fine and dandy. As you can see below for its two credit buckets that are at scale (mortgages aren’t), things have held up quite well thanks to its prudence, strong underwriting and affluent demographic. It has stayed comfortably below LoLLR targets and implied NCO rate targets too:

“The decrease in delinquency rate is evidence of surpassing a peak here… delinquencies on an absolute and percentage basis peaked in Q1 2024.”

CFO Chris Lapointe Q1 2024 Earnings

While annualized NCO rate has remained below 4.0% (for a 6% LoLLR), more context is needed. For the last two quarters, SoFi sold a chunk of late-stage delinquent loans for positive fair value realization. Without this help, NCO would have approached 5.4%, which represents an 8% LoLLR (its maximum). There’s nothing abnormal or shady about these maneuvers. This type of transaction is routine and is one of many things SoFi can do to control loss rates while bolstering balance sheet origination capacity. The firm is more of a puppet master here than I think many bears give them credit for. Whether it’s these sales, or some previous capital structure changes (discussed later) it has a lot of control here and will use it.

SoFi has reiterated its 7%-8% LoLLR target over and over…. and over again. This flexibility is partially why the wording of those statements has become progressively more confident. They’re now “exceedingly confident” vs. “confident” previously. Still, there are other, more encouraging reasons for credit health optimism. SoFi leadership offered new loan vintage analysis last quarter that clearly depicts why they’re so optimistic. It gave us a history lesson dating back to 2017, as that was the last time LoLLR approached 8%. 2020 through Q1 2024 vintages at the same amortization rate carry significantly better loss rates than the 2017 cohort. This is increasingly true for its newest vintages.

2020-2024 vintages overall are now 56% through repayment. Average loss rates here are 3%. To breach its 8% risk tolerance target, the remaining 44% of principal would need to carry loss rates of 11%. SoFi has never come remotely close to that level, including in Q4 2022, as it was tightening credit parameters and needing to pull back from riskier borrowers than it wanted. The 5.02% charge off rate in Q4 2022 is 17% lower than in 2017. Structural, compelling, data-driven evidence.

Finally, it has consistently guided to maintaining a 5%+ NIM through this cycle. That’s only possible if it continues to properly price risk.

Staying within its tolerable range of losses partially relies on the U.S. economy avoiding a severe recession or depression like for every other lender. In that outcome, structural share gains and underwriting quality will not be enough to offset exogenous headwinds. The company wouldn’t die, but it would enter survival mode and results would temporarily suffer. This is one of the reasons why it’s so important that our economy gets the monetary accommodation that it’s now receiving. More reasons later.

2e. Balance Sheet Control

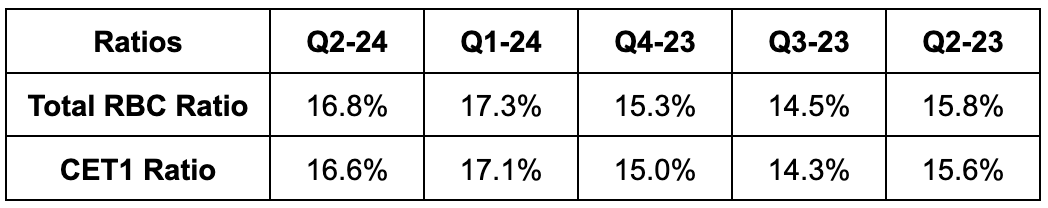

Banks (which SoFi is) are highly regulated with capital ratio requirements. There are two that we are going to focus on here: Total Risk-Based Capital (RBC) Ratio and Common Equity Tier 1 (CET1) ratio. Here are the definitions:

- Total RBC Ratio: Divides a bank's total capital by its total risk-weighted assets. Assets considered “total capital” include common equity, preferred stock, retained earnings and even subordinated debt. The legal minimum for SoFi is 10.5%.

- CET1: Divides only common equity tier 1 capital (not total capital) by risk-weighted assets. Common equity tier 1 includes common stock and retained earnings. The legal minimum for SoFi is 7.0%.

As you can see, SoFi’s capital ratios remain well in excess of regulatory minimums. This means it can comfortably accelerate originations beyond current levels at its discretion. This is a direct result of the extreme conservatism of SoFi’s personal loan underwriting – and one other item. In March 2024, as part of a series of capital market maneuvers, SoFi exchanged $600 million in senior notes for common stock at a 10% discount to par value. This boosted its total RBC ratio by a full 200 basis points (bps; 1 basis point = 0.01%), adding more balance sheet flexibility for whenever it’s ready to lean back in. Full details on these capital market maneuvers here would take several pages and would get way too in the weeds. For those interested in my detailed explanation, you can find it in section 3 of this article.

SoFi’s balance sheet leaves it with significant power and control to tailor origination aggression to macro trends. When things brighten, it will safely and responsibly rev the personal loan origination engine once more.

2f. Loan Macro, Monetary Policy & NIM

What would give it the confidence needed to accelerate personal loan originations? Time and time again, leadership has told us rate cuts, and specifically two of them, would go a long way here. It would convey to SoFi that the Fed backstop is in place and would create more policy certainty going forward. These cuts would also lower capital market investor hurdle rates and improve liquidity to make them less picky. Again, better capital market demand means SoFi can originate more loans beyond its own balance sheet’s capacity. These buyers are taking the risk while SoFi takes a fee.

What did we get last month? Two rate cuts. Coincidentally (or not coincidentally), my SoFi app has gotten a lot more crowded with personal loan offers over the last few weeks. Very anecdotal, but still. Capital ratio cushion… and improving credit metrics… and rate cuts… and little evidence of a severe recession coming. It’s a good setup. It’s worth noting that rate cuts diminish variable-to-fixed rate refinancing demand. If rates are falling, there’s little reason to try to fix your interest payments. And while that’s certainly a consideration, the team is adamant that all of the pent-up demand will offset that obstacle by a wide margin.

On the secured side of things, rate cuts are also positive for SoFi’s business. Starting with student loans, SoFi has no application fees and no limits to the number of applications. So? Customers can keep applying for lower interest payments as rates fall, which eliminates the incentive to wait and see if rates are going to fall more. Consider this: A student loan customer paying an 8% interest rate can, in some cases, save over $1,000/year by refinancing to a 6% rate. These are the kinds of offers SoFi can unlock with rate cuts. Macro and the continued blocking of wide-scaled forgiveness by the Supreme Court bode well for this business. SL volume was already up 86% Y/Y last quarter due to court action; monetary accommodation should merely fuel this wildfire.

For mortgages, rate cuts lower the interest fees associated with purchasing a home. Cuts also motivate more mortgage refinancing and also HELOCs by allowing it to offer cheaper interest rates to those borrowing against their homes.

It was already slowly ramping volume here, with 100% Y/Y growth last quarter, but this remains just 0.3% of its overall loan book. To really grow that, it has told us that it needs… you guessed it… rate cuts. Consider that on August 5th during the Japan carry trade drama, the 25 bps hit to mortgage rates led to HELOC demand doubling for the brief period of time before that dip reverted. This demonstrates how much demand is waiting to be serviced. In the words of CEO Anthony Noto, this business is “geared up and ready to go.”

We’ve spoken a lot about how rate cuts will help this business well in excess of variable-to-fixed refi headwinds, but it’s a bank. Aren’t banks supposed to like loftier rates? After all, that means more Net Interest Income (NII) for institutions that don’t really give consumers more savings yield amid higher rates… and so higher NIM all else equal. But? Not all else is ever equal. Rate cuts surely diminish the NII SoFi can collect on loans. At the same time, the firm has several other offsetting cost of capital reduction factors at play.

What reduction factors am I talking about? First is the aforementioned ability to use deposits to fund credit rather than more expensive debt (part of balance sheet optimization). This process is still ongoing. For example, it pockets 200 bps in added profit spread by shifting from warehouse debt to deposits – even with a 4.5% savings account yield paid to customers. Secondly, as part of the briefly mentioned capital market deals from early this year, SoFi pocketed about $46 million in interest expense by swapping in cheaper debt instruments in its capital structure. That still hasn’t made its way through Y/Y comps. It also continues to find cheaper access to brokered CDs to further offset the rate cut NII headwind.

Beyond cost of capital, SoFi doesn’t really take advantage of higher rates in the same way that JP Morgan or Bank of America readily will. When rate changes alter SoFi’s NII per loan, it lets rates paid to depositors essentially float these changes. It doesn't let rate hikes directly prop up NIM like legacy banks do, so hikes don’t really help it like you’d expect. And? Cuts won’t hurt NIM in the same way as others either. This reality, paired with the cost of capital reduction levers, is why the company remains so confident in a 5%+ NIM through this cycle.

- Remember this positive outlook assumes our economy avoids a 2008-like recession or a 1929-like depression. If those outcomes were to happen, SoFi’s results would greatly suffer just like everyone else’s.

2g. Fair Value Accounting Practices & Commentary

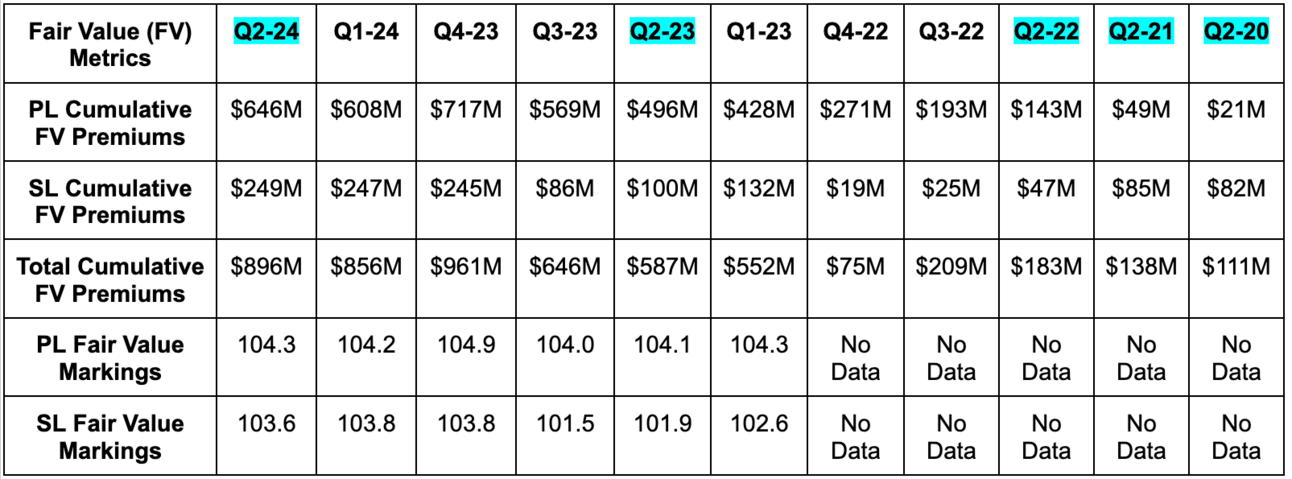

One of the biggest sources of contention from bears is SoFi’s use of fair value accounting vs. current expected credit loss (CECL) (or at cost) accounting used by pretty much everyone else. Skeptics will say that this form of accounting allows them to unfairly establish “fair value premium” increases, which benefit earnings. On the other hand, the unwinding of this fair value premium would be an earnings drag. I would just point out that SoFi ran off $105 million in cumulative fair value premium from Q4 2023 to Q1 2024 (3rd chart below) while handsomely beating earnings estimates.

Before we dig into this method of accounting, it’s important to understand all of the inputs and lingo that it entails.

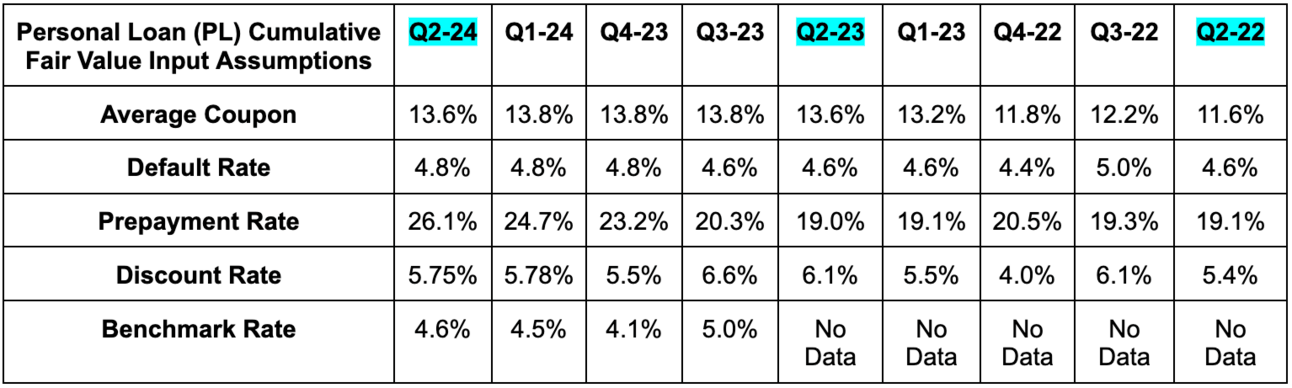

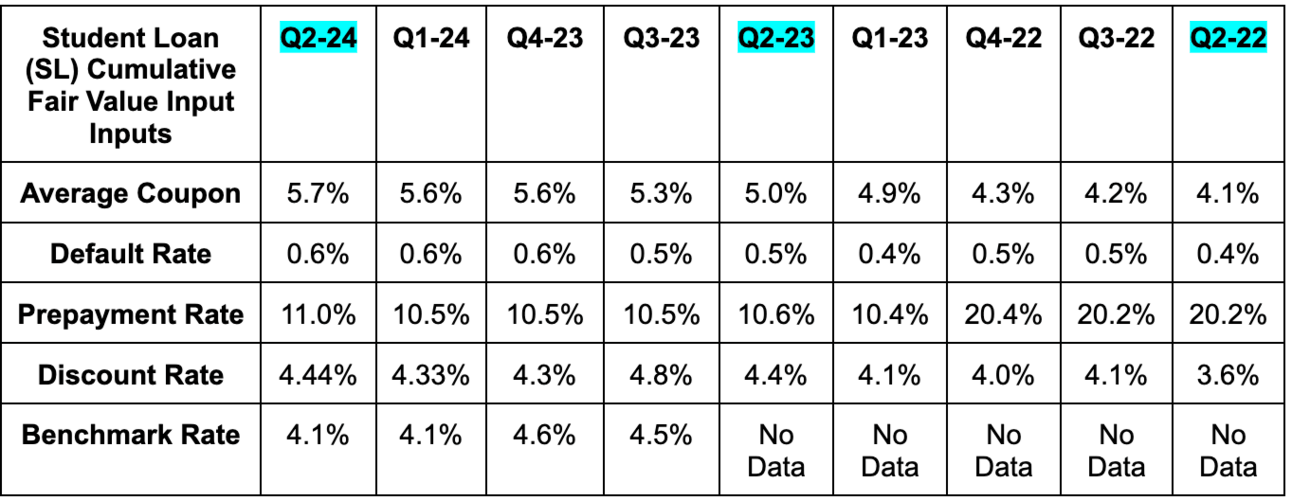

Fair value accounting attempts to estimate the market price tag on a certain pool of loans. It does so through a series of observed and assumed inputs. The inputs and their relationship with fair value calculation (all else equal) are as follows:

- Weighted average coupon rate or interest earned per average loan. As this rises, fair value rises.

- Default rate. As this rises, fair value falls.

- Loan prepayment rate. As this rises, fair value falls. This variable has the smallest impact on overall fair value out of the group.

- Blended benchmark rates. As these rise, less risky assets pay more interest and SoFi’s loan fair value falls.

- SoFi’s own discount rate (based on benchmark rates). As this rises, future loan repayments are discounted more heavily (higher time value of money and higher opportunity cost) and fair value falls.

- Also note that overall loan growth adds cumulative fair value premium if new loans carry premiums. SoFI’s loan book has grown mightily since Q2 2022.

In addition to these factors based on observed market conditions, SoFi’s also has its own conservative U.S. GDP and unemployment rate assumptions. These influence overall fair value as well. All of these inputs make up the cumulative fair value premiums and fair value markings in the 3rd chart. It’s all closely related. If the loans are trading at a premium to par value (original value), the marking will be over 100.0 and vice versa.

With this needed context, we’re now ready to dig into SoFi’s own assumptions baked into fair value. We’ll also unpack if SoFi does this all on its own and if there’s any compelling evidence supporting the accuracy of these markings.

SoFi’s internal marking assumptions are overly prudent, if anything. First of all, its delinquent loan valuation write-down methodology is strict. It cuts valuation by a full 70% after just 30 days. Next, as a reminder, for the last year it has been working under the assumption that 2024 GDP would contract and the unemployment rate would rise to 5%. Well… GDP continues to grow and unemployment rates just fell from 4.2% to 4.1%. Again, its aggressively pessimistic macro directly influences these premiums and markings in a solidly negative manner. And furthermore, for another layer of checks and balances, SoFi uses a 3rd party, independent auditor to ensure all calculations are done responsibly.

Beyond this, the other inputs baked into fair value (the leftmost columns in the first two charts), are based on observed market conditions, not random ideology. For example, in Q4 2023, falling benchmark rates like the 2-year treasury swap drove down the discount rate and credit spreads tightened as markets looked ahead to easier Fed policy. Rising default rates (which it internally observed) partially offset these tailwinds, but not entirely. So? Cumulative fair value rose and markings did too. The opposite was true from Q4 2023 to Q1 2024, so cumulative fair value fell. SoFi told us last quarter that fair value peaked for the cycle, so there will not be any noise surrounding rising premiums propping up earnings for the next several quarters.

“Notably, the benchmark rate change and the spread change are empirical as their actual market observed inputs, not assumptions.”

CFO Chris Lapointe

This is all nice, but we love concrete evidence. The best form of that comes from capital market loan buyers. If these loan buyers are paying more in premium to SoFi than par value and markings would suggest, that means those markings are adequate or overly safe. “Gain on sale margin” is the buzz phrase you will hear to describe the premium paid over par value.

Well? Capital market buyers have uniformly paid higher gain on sale Margin to SoFi than its fair value markings would indicate. It placed over $1 billion in loan sales at gain on sale margins in excess of markings in Q3 2022; in Q2 2023, it sold a personal loan pool at a gain on sale margin of 104.5 vs. markings of 104.1; in Q3 2023, it sold a personal loan pool at a gain on sale margin of 105.1 vs. fair value markings of 104.0. This is the norm. Over the last three quarters overall, it has placed nearly $5 billion in total principal, all at gain on sale in excess of markings.

- Note that SoFi’s decision to hold or sell loans is based on two things: capital ratio flexibility and which decision would maximize its lending business’s lifetime value. Whatever it can do to responsibly juice revenue and margin.

These are sophisticated capital market buyers, with superior access to data that are directly voting with their wallets on SoFi’s accounting practices being too conservative if anything. Bears can scream all they want to… bears can think they know better than these institutions. They don’t.

“We're seeing continued strong demand from credit buyers.”

CEO Anthony Noto Q2 2024

There’s one caveat here. A lot of the premium SoFi collects from capital market buyers is on the servicing part of the loans, while there’s also a small loss sharing agreement that SoFi accepts for executing the deals. This is an industry norm. It’s routine. It’s also a byproduct of how confident SoFi is in its loan pools. It’s willing to accept a very small loss sharing agreement and willing to spread out premium realization because it knows these are high quality assets. It’s not originating subprime loans like all other fintech lenders are. SoFi gets more premium and more lifetime value by structuring the deals in this way. And if it’s adamant that these loans performing as expected, there’s no reason not to do this.

I’d like to cap this section off with my thoughts on why I think fair value accounting is actually superior to, and more transparent than, CECL. Under fair value accounting, firms must mark-to-market loan valuations on held-for-investment loans. These changes flow through the income statement and balance sheet every single quarter. For held-for-sale loans, we get the consistent capital market signals offering ample confidence in their valuation methodology. For CECL, you front-load losses and periodically adjust them over time. Bank’s don’t need to mark on a quarterly basis (as SoFi does) and don’t realize those changes on financial statements each quarter. This can lead to pent-up unrealized losses, which is what led to Silicon Valley Bank’s downfall and the regional banking turmoil.

“Every factor that could change its value we have to recognize in real-time. These flow through our income statement and our balance sheet… for at cost (CECL-based) accounting, companies can report an equity balance of positive $18 billion on a Monday and, a week later, be taken into a receivership because they don’t record unrealized losses on their financial statements.”

CEO Anthony Noto

Section 3 – (Non-Lending) Financial Services

3a. Core Product Suite

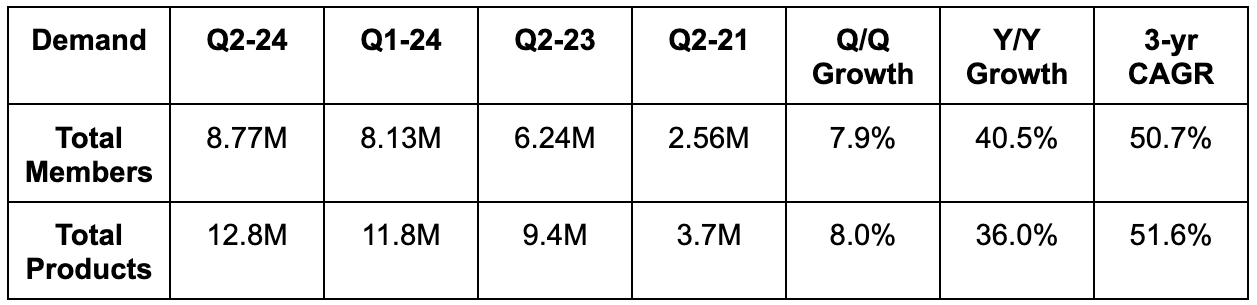

The (non-lending) financial services segment has been the best growth driver for the last several quarters. SoFi offers a slew of tools here, which augment its lending business. SoFi Money encompasses its checking and high yield savings accounts. This is its best tool for cross-selling, as 40% of all new products added last quarter were from existing users of this product. 30% of all new SoFi members (many come in through SoFi Money) are also adding a second product within 30 days.

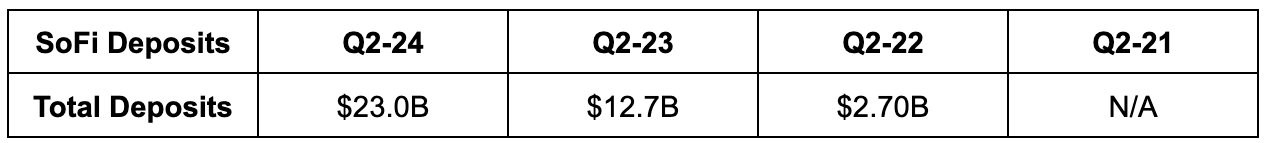

SoFi Money growth correlates closely with direct deposit growth. As you can see below, deposit growth is rapid, with an average customer FICO of 744. That has remained relatively unchanged throughout all of this momentum.

Inspiring sticky direct deposits, through things like its 4.3% savings APY and up to $2 million in FDIC insurance, spins the entire positive feedback loop for LTV creation. It provides low-cost liquidity for lending and facilitates rapid 67% Y/Y growth in debit interchange volume (which crossed $10 billion annually). Generally speaking, it makes usage of its other products more compelling. If I’m already using SoFi for direct deposit, why not also use SoFi Invest as my broker or one of SoFi’s credit cards too? If I’m doing that, why not put my credit rewards in my savings account to earn more yield? It’s quite convenient having everything in one place, with easier movement of funds and a comprehensive view of financial health.

SoFi Relay is what unlocks this overarching view of finances. It brings the convenience and value stemming from app consolidation to life. Relay offers a full snapshot of net worth, spending habits, investments and credit score. It allows customers to set financial goals, create “vaults” or buckets within bank accounts (for taxes etc.) and even allows for the linkage of external accounts to broaden the lens. It's a financial wellness consultant and an example of a unique product that SoFi can offer because it offers everything else. Anyone can make recommendations; few can connect those recommendations to a full suite of valuable tools and actionable, expeditious outcomes.

SoFi Money is also another way in which the input cost edges detailed in section 1 manifest and unlock unique value. The efficient business model, combining the strengths of disruptors and incumbents and fixating on cross-selling, is what allows SoFi to profitably offer the 4.3% savings yield. That’s 9x the national average. While that’s nice, many other companies offer a compelling savings yield too… but most of those alternatives have no banking charter. With it, SoFi doesn’t answer to any sponsor bank when setting its APY. It has the full freedom to set the rate, the cost advantages to rationally offer more yield, the LTV edge from offering more products and the philosophical mindset to pass on savings to customers. All of this is to say that SoFi fully expects its APY lead to grow through the rate cut cycle as disruptors feel the pressure to lower theirs more quickly. And for some early signs, Apple (which is a disruptor here specifically) cut their own APY from 4.5% to 4.1%, while SoFi’s is 4.3%. There's also emerging evidence indicating that SoFi’s customer stickiness extends well beyond APY. The small reductions SoFi recently made to its savings APY resulted in no impact on retention; customers clearly aren’t there solely for a slightly higher account yield. We still have to see how the most recent cut to 4.3% fares, but I suspect it will have no material effect on churn.

3b. More Products & New Products Coming

As briefly mentioned, “Lantern by SoFi” is the company’s marketplace for loans. SoFi spends money on loan marketing and not all applicants meet their high standards. Rather than discard those customers, it turned them into a referral revenue stream. Sofi actively nudges these rejected applicants to explore Lantern’s offers. This way, it still gets fees for loans that it has no interest in underwriting, while partners such as Pagaya are happy to take this risk. The ability to service more customers also means a wider top-of-funnel, beyond its borrower demographic, for the overall ecosystem. That, in turn, leads to more data for SoFi and more cross-selling. They’re still happy to take deposits and service brokerage accounts for people they wouldn’t underwrite. And some of these Lantern customers will eventually level-up their finances and become prime borrower candidates. It makes sense to help them in any way SoFi can for its business today and tomorrow.

Most recently, SoFi began inviting partners, like in Lantern, to originate loans through its own app for borrowers that are within its credit band. Why would it offer this? Because SoFi has much more unsecured personal loan demand than it can service. It’s quite suboptimal to reject eligible borrowers because of its own balance sheet bottlenecks. This way, SoFi will again get all of the data from this interaction, all of the brand awareness, referral fees and no balance sheet risk. It’s a great tool to add as capital ratios likely become more stretched with easier macro. This new business is already doing $90 million per quarter in high margin fees. That’s split between financial services and lending revenue.

Moving on, “SoFi at Work” is an employee benefits platform that educates workforces on financial wellness. This allows SoFi to gain brand awareness and market its offerings to large employee bases in large chunks. The program is specifically designed to let participants such as Tesla and Microsoft better cater to their people. Finally, “SoFi Protect” is its security tool with identity theft protection and partner-sourced tools like term life insurance.

SoFi Invest and SoFi’s credit card business are its two newest segments that should turn into core revenue drivers over time. Both are more than three years old, but neither were primary focus points for SoFi until more recently. I think if you use the Invest product, that’s very clear. It’s still incomplete to the point of Anthony Noto calling it 50% monetized. Frustrating, yet exciting… much more to do with futures, options, margin, etc. It’s all coming.

For the credit card business, they’ve gone intentionally slowly here, which is the correct approach. Underwriting a credit card is very different from any of its other loan products. This form of credit skews small-dollar, with other confounding variables like consumer rewards to contemplate. While SoFi does have extensive customer data profiles, this is still a different segment with different risks, metrics and considerations. It’s not only wise to go slowly here, it’s imperative in my mind. Losses can mount in a hurry and balance sheets can turn fragile if underwriting models are rushed into commercial usage.

This past week (October, 2024) SoFi announced a broader rollout of two new credit cards that had been in testing mode since July. The news follows “extensive feedback from SoFi members & others” (and the highly conservative approach to seasoning its underwriting models). The SoFi Everyday Cash Rewards Credit Card offers unlimited 3% cashback for restaurants and major food delivery vendors, 2% for grocery & convenience store purchases and 1% for everything else. The SoFi Essential Credit Card is for consumers looking to brighten their credit profiles. It has no surprise, annual, over-limit or foreign transaction fees. These join an existing cashback card that it really hasn’t done much with. It also continues to test a 10% cashback boost for SoFi Plus members with a credit card. Early results have been called “positive.”

- SoFi Plus is a subscription product (currently) only for its direct deposit customers. It’s free to use for those people. It offers exclusive perks like travel booking discounts, mortgage discounts, financial planners, estate planning discounts and more.

Up until this point, approval criteria for the two new cards were limited and only for existing customers. Through things like delinquency rates improving by 20% in 2024 vs. 2023, the team has gained the confidence needed to ramp issuance. Today, the overall segment is tiny for SoFi and the opportunity just within its existing base of members is large. It has 16x more SoFi Money products in circulation than credit cards, and many of these members (like me) are simply waiting to be eligible. If it is ready to execute here, the segment is a perfect cross-selling tool and should find success.

Going forward, a lot of the new product launches will aim to pull from the full suite of existing tools to create unique value. For example, SoFi is testing “Cash Coach,” which is a product that organizes consumer funds across accounts to guide best practices. If you can save money by paying off a late credit card bill or make more money by moving funds in your checking account to savings, it will tell you through its chatbot called Konecta (more later). It’s one thing to say “you should do this.” It’s another thing to say “you should do this based on your entire financial profile and here’s a button to click for us to do it for you.” Again, the power of the full suite.

Later this year, SoFi will open up SoFi Plus to non-direct deposit customers for a monthly fee (like Robinhood Gold). This will come with more card rewards, loan discounts, extended early IPO access and incremental alternative asset investments. It will also allow non-direct deposit customers to pay for access for its highest savings yield.

3c. Growth Philosophy & An Important Inflection

SoFi has a concrete approach regarding investments in new products to drive growth. It strives for two milestones that serve as greenlights for leaning into expansion. The first is when revenue covers all variable costs (turns a contribution profit); the second is when revenue covers all variable and fixed costs (turns a net profit). It aims to always have products at different phases of their growth curves to deliver consistent, 20%+ revenue compounding in the years ahead. SoFi Money, the debit business, Lantern and non-home lending products are the most mature and powerful net profit drivers today.

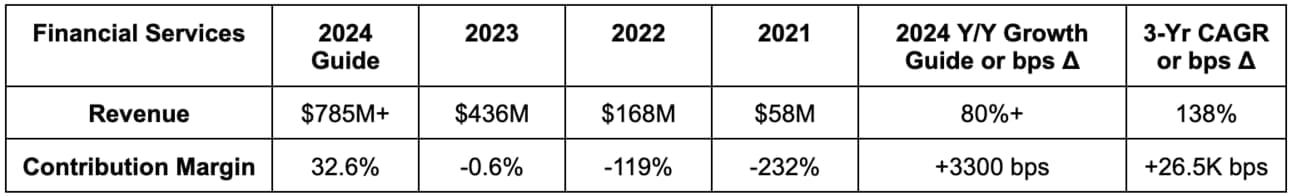

For the financial service segment overall, SoFi convincingly inflected to a positive contribution profit in Q3 2023 and now carries a robust 31% contribution margin. This is important, as many thought the segment could never be a meaningful profit driver. Not so fast; that’s the cross-selling engine and coinciding LTV/CAC dynamics in action. There’s clear reason to think of 31% as a positive initial step, rather than a final destination. As briefly mentioned, SoFi credit cards and SoFi Invest are still in their testing, iterating, and investment modes. Specifically, the two products carry an annualized loss of $100 million as the firm perfects product-market fit and ensures both are ready for primetime. It could cut these products, erase these losses and deliver a margin today in the mid-40% range, that’s just not in the best interest of maximizing long term returns. So it won’t.

Additionally, Invest just flipped to positive contribution profit and a sub-24 month payback period, despite being 50% under-monetized. And? Per the team, both SoFi Invest and SoFi Credit Card closely resemble the deeply profitable SoFi Money tool early on in that growth curve. They’re both well on their way, which would be deeply positive for financials. For an idea of how positive, leadership sees the overall brokerage and credit card opportunities as larger than its entire existing business.

3d. Growth Engine Context

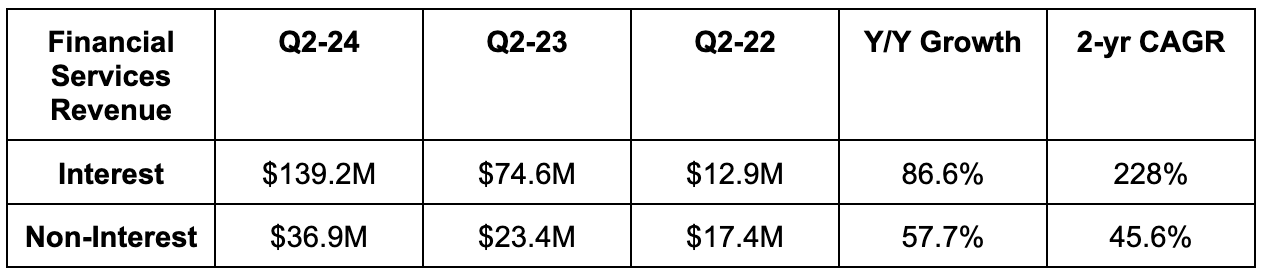

As you can see in the table below, financial services has been among the numerous bright spots for SoFi, with that expected to continue in 2024 and beyond. This is undeniably impressive, but needs some context.

There are two pieces of financial service revenue, just like for lending: interest income and non-interest income. The former has a more transitory growth engine than the latter. Interest income directly benefits from the same balance sheet optimization process that aids lending revenue opportunities and profit spreads. Not all of SoFi’s deposits and liquidity are being used for lending. Anything unused is a prime candidate for shifting into higher yielding assets, while it pays a lower rate on those assets to depositors vs. warehouse creditors. The effect is financial services revenue growth greatly leading product and member growth for the last couple of years.

That will not last forever. SoFi balance sheet optimization is wrapping up, with 80% of its credit book is now deposit-funded vs. an 80%-90% optimal target range. This should mean a normalization in net interest income growth that more closely matches member and product growth. Considering the chart below, and guidance of 30%+ Y/Y member growth for 2024, that’s just fine.

SoFi sees financial services growth remaining over 50% on an annual basis through 2026. That’s beyond current member and product growth, which will continue to slow with larger scale. To accomplish this lofty 50% goal, non-interest income will need to pick up the revenue generation slack. Whether that’s from its invest product, credit cards, debit interchange, or something else, fee-based revenue generation will become increasingly important.

This was a focus point during the most recent quarterly report, with several compelling updates. The aforementioned introduction of partner-funded SoFi loans on its app (that’s now doing $90 million/quarter) is partially accounted for in financial services. SoFi Invest enjoyed 58% growth in assets under management (AUM) Y/Y via strong new inflows (not just stocks rising in value). It named alternative asset investing (with single-click asset transfers) as a key source of this success. SoFi offers a wide range of assets including private credit, early IPO access and a world-class robo-investing business, which allows customers to go on autopilot. Its extended travel and overall rewards program crossed 3 million members, as its debut of redeeming rewards for brokerage funds resonated. SoFi Plus also crossed 1 million members and, as mentioned, debit interchange revenue is rapidly growing too.

Other tailwinds for this business include a new Zelle integration, which improves overall industry interoperability for SoFi and makes banking with it easier. All of these ingredients helped non-interest income for the segment grow by 57.7% Y/Y and reach $150 million in annualized revenue. These are the trends that can power SoFi’s financial services growth for decades beyond optimizing its balance sheet.

Section 4 – The Technology Platform

4a. Core Product Suite

SoFi’s independent technology company was formed through the two large acquisitions of Galileo and Technisys; it’s all called Galileo now. Independence is an important point. Because SoFi competes with many of Galileo’s customers, it must be careful to keep enough distance between itself and this owned division. It does a reasonably good job threading that needle. Through these acquisitions, SoFi gained complete control of its tech stack, with the talent needed to vastly accelerate product introduction and iteration. It also turned significant 3rd party vendor fees into significant incremental company revenue opportunities. No longer does it pay for access to these products… but instead it sells access to them to large competitors like Robinhood and Chime.

Galileo splits its product offering into four groups: Payments and Card Issuing, the Cyberbank Core, Cyberbank Digital and Cyberbank Konecta. The first was acquired through the Galileo acquisition, with the rest of the four acquired or bolstered through Technisys.

Payments & Card Issuing:.

Starting with Payments and Card Issuing, Galileo offers a cloud-native platform for enterprises to seamlessly jumpstart credit, secured credit, debit and virtual card programs. It also helps with management of accounts receivable and payable, business-to-business (B2B) transfers, wire transfers and so much more. On the processing side of things, the platform frees enterprises like Lyft and Uber to accept a broad series of payment methods. This includes direct support for Apple and Google Wallets and an ability to scale with giant customers. Galileo has a pristine track record of launching successful card programs for clients and also giving them elite conversion, authorization and uptime rates as they process payments. That’s probably why 90%+ of all neobanks use Galileo in some capacity. I haven’t been able to confirm that 90%+ metric with enough reputable sources, but it’s impressive even if it’s just sort of close to 90%.

Just like for consumer banking, card issuing and payment processing are highly competitive fields that are hard to differentiate within. This is where the Galileo Payments Risk Platform (GRPR), which binds closely with the Payments & Card Issuing arm, comes into play. This platform offers several tools.

First is the full support for real-time identity verification and fraud controls amid transaction authorization. This pulls from Galileo’s “Transaction Decision Rules Engine,” which taps into machine learning models, client rules and any other relevant context to enable real-time transaction risk-scoring and coinciding loss prevention. Galileo does this with better efficacy and lower false positives than others (per the company). Models can be tweaked on a by-customer basis, catering to a wide array of regulatory needs and preferences across industries. This product extends to card-present and card-not-present transactions, and meticulously uses strict, independent 3rd party audits to put it to the test. GRPR also includes dispute tracking, with notifications on when merchant responses are needed, as well as a full suite of compliance tools to ensure regulations such as “Know Your Customer” are taken care of for its clients.

Galileo Instant Verification Engine (GIVE) is another new company product that closely integrates with GPRP. This verifies external bank account existence, status, risk signals (red flags) and ownership in real-time, which ensures better customer service, without added merchant risk. Account ownership is confirmed by matching personal info (social security etc.) against provided customer data. GIVE generates more risk scores to rank the likelihood of issues like fraud, insufficient funds and overall account reliability. GIVE works behind the scenes, without requiring added manual data entry from customers. This means account verification and linkage can be cut from hours or days to seconds – thus greatly improving conversion rates. Specifically, per Galileo, this lowers customer abandonment rates from 50% to 1% compared to legacy micro-deposit authorization (MDA) methods.

Cyberbank Core:

Next, through its second acquisition of Technisys in Latin America, SoFi offers a holistic banking operating system and architecture. While Galileo offers compelling products, SoFi wanted to be the “only end-to-end vertically integrated banking tech stack” and accomplished this through Technisys. This provided Galileo with a foot in the door for several large bank bidding processes. The operating system is called the “Cyberbank Core” and functions as a single back-end platform to power multi-product financial service programs. The suite of APIs, or microservices, that make up the core help banks modernize front and back ends and unleash the power of their data.

Whether it’s APIs for lending, savings account servicing, wire transfers, early paycheck access, direct deposits, dedicated mobile banking apps like H&R Block’s, brokerage accounts or anything else you can think of, Technisys gracefully ties together a customer’s single, holistic user interface. Galileo provides most of these tools on its own, but it does partner in some places.

For example, Galileo and Mastercard work closely together to provide virtual, single-use card issuance, processing and risk management for enterprise clients wanting to offer buy now, pay later (BNPL). Mastercard provides the network, a massive supply of data and its brand. Galileo provides the issuing know-how. The BNPL tool includes integrations with traditional bank accounts, allowing customers to offer post-purchase BNPL financing options, as well as a product for lenders to provide to their own small and medium business customers.

Overall, the single-core architecture ensures every single tool offered on an app has the same look and feel, with seamless interoperability to carry that utility further. Here’s how SoFi puts it:

“Cyberbank Core is an API-centric platform enabling customers to power everything from account opening to anything else. It’s a one-of-a-kind digital backbone to augment and replace old core banking systems and create tailored financial products based on individual needs.”

Investor Materials

Today, nearly all incumbent banks operate with “cobbled” cores made of stitched together point solutions that frequently break and fail to properly communicate. The segment is ripe for disruption as companies like Galileo drive better results and reduce costs for clients. It’s the same idea as the other software platforms that we cover.

As incumbents and disruptors step into the future and embrace operating systems like these, they also unlock a more accurate sense of their overall operations. For example, Technisys also enables real-time ledgers. This means a quantum improvement in real-time asset and liability management. That is even more important in a post-regional banking crisis world where everyone is fixated on, and terrified of, pent-up unrealized losses. Galileo can help

Not only does Galileo provide the Cyberbank Core to fellow banking disruptors, it also offers them to non-bank companies. This is called “embedded finance.” Some firms, like T. Rowe Price and Wisdom Tree, want to offer more financial services to their employees without building them from scratch. Enter Cyberbank Core.

Cyberbank Digital & Cyberbank Konecta:

Cyberbank Digital, which was re-released two years ago, is essentially an experience manager for the Cyberbank Core. It powers the front-end, and facilitates seamless interaction between customers and the digital banking interface. The product organizes, manages and provides personal recommendations based on best actions or tools to be used. These recommendations aren’t one-size-fits-all, but constructed from a single customer’s history.

It accelerates adoption of full product suites through driving awareness and offering useful ideas on leveraging available tools. Cyberbank Core means clients have all the tools they need; Cyberbank Digital ensures the construction and delivery of these building blocks is as effective as possible. And when Cyberbank Digital conducts software or product updates, those can be pushed to a client’s runtime environment with no disruption to operations.

It also features conversational AI for those wanting to tap into that technology to automate things like customer service. These multimodal AI models can “recognize voice and text, understand intent and know when to offer human support.” It also offers another conversational GenAI assistant called Cyberbank Konecta. This goes deeper into individual customer data profiles and is what allows SoFi to nudge users with granular best practices and courses of action. Konecta also automates the consumer onboarding engine to drive traffic, features 24/7 customer support and has an ability to field 80%+ of all inquiries without manual intervention. It can be deployed in hours and has already improved SoFi’s own customer service by 7%.

It’s these four offerings that come together to form what SoFi views as unmatched product breadth and an ability to drive core consolidation for its commercial clients.