Table of Contents

Reviews already sent this season:

- Meta & ServiceNow Earnings Reviews.

- Starbucks Earnings Review.

- Apple & Tesla Earnings Reviews.

- Netflix Earnings Review.

- Taiwan Semi Earnings Review.

- My current portfolio & performance vs. the S&P 500.

SoFi is a one-stop shop for financial services. It aims to provide consumers with excellent products for all major needs and events. It pushes to delight them to the point of never going anywhere else. That creates key cross-selling and acquisition cost benefits. It has a large lending business with an increasingly diverse array of funding options, as well as bank accounts, brokerage services, 3rd-party insurance options, credit cards and so much more. It also owns its tech stack, has no branches and possesses a bank charter, which all give it the rare ability to combine the cost edges that incumbents and fintechs each enjoy. It also sells its tech stack to customers like H&R Block. My SoFi deep dive can be found here. This gets into intricate detail on SoFi’s unique value proposition within banking, and everything else you need to know about the firm.

a. Key Points

- Rising cross-selling traction.

- Another great quarter for the Loan Platform Business (LPB).

- Healthy credit trends.

- New 2028 financial targets.

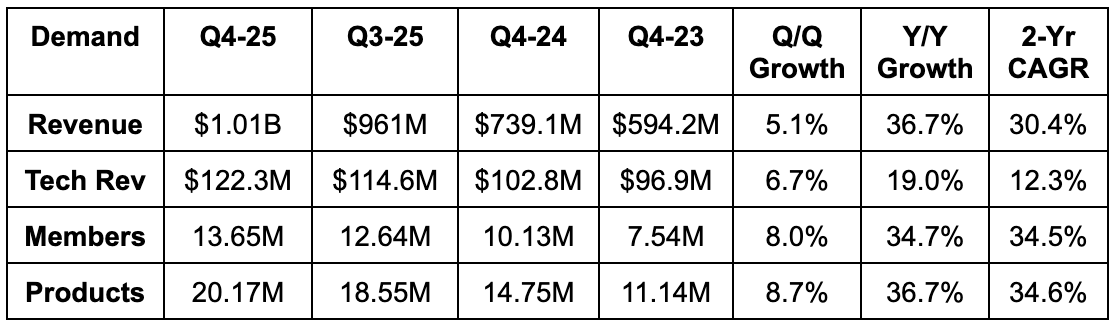

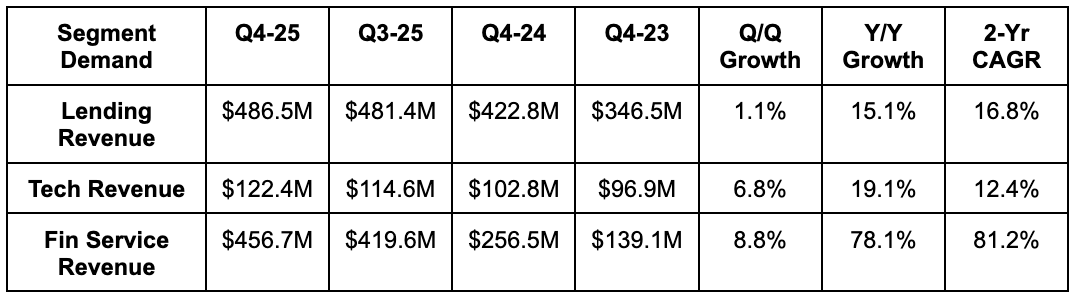

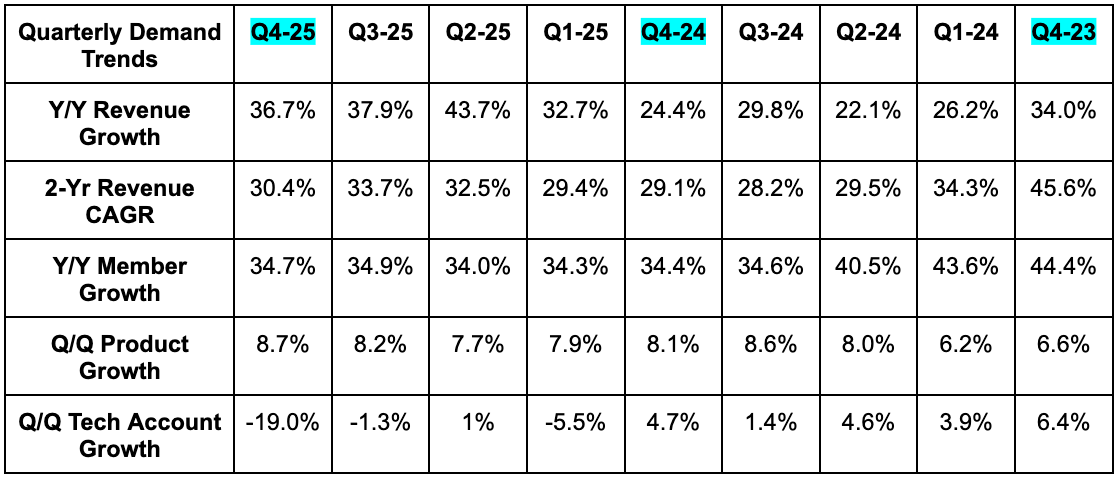

b. Demand

- Beat revenue estimates by 2.9% & beat guidance by 5%.

- Net interest income rose by 31% Y/Y and beat estimates by 2%.

- Non-interest income (fee-based and more asset-light) beat estimates by 9%.

- Lending revenue beat estimates by 2%.

- Financial services revenue beat estimates by 10%.

- Beat tech revenue estimates by 4%.

- The sharp Q/Q decline in tech accounts is due to Chime migrating off its platform last year and was already known.

- The revenue contribution from Chime was similar to the Y/Y period. This did not prop up growth during Q4.

- Beat member estimates by 1%.

- Net new products and members both set quarterly records.

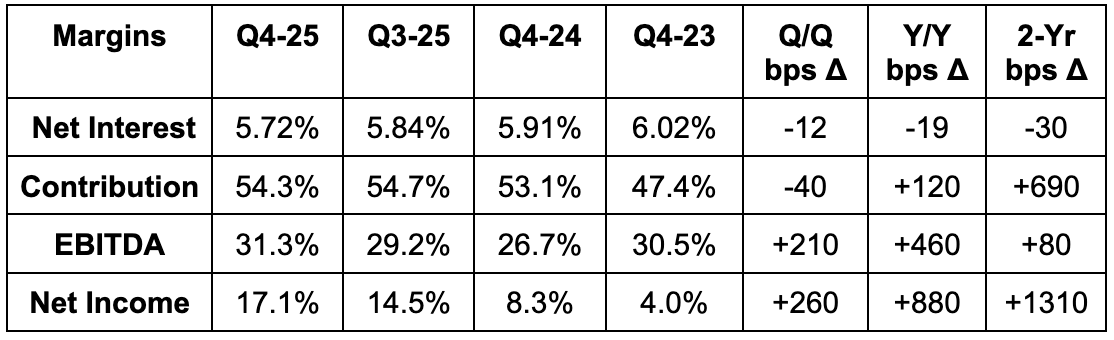

c. Profits, Book Value & Margins

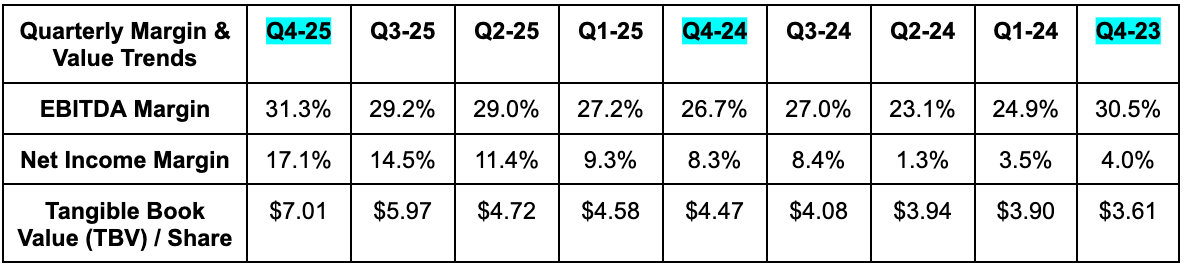

- Beat EBITDA estimate by 4.5% & beat guidance by 6.5%.

- EBITDA +60% Y/Y.

- 44% incremental EBITDA margin.

- Beat $0.13 EPS estimate by $0.02 & beat guidance by $0.02 (18% beat).

- $0.13 in EPS vs. $0.05 Y/Y.

- $7.01 in tangible book value (TBV) per share beat $6.66 estimates.

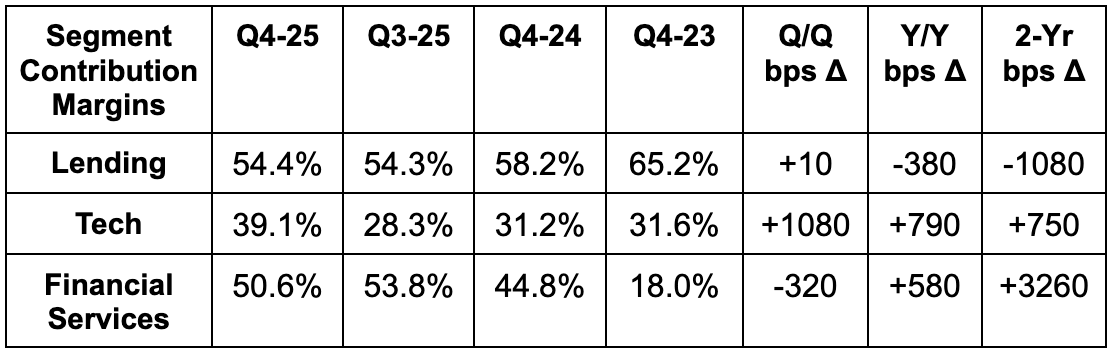

- Contribution margin slightly missed estimates due to lending and financial services. Tech segment contribution margin sharply beat estimates.

- While Chime didn’t boost revenue, the type of revenue SoFi got (termination fees) was higher margin than the typical business it was doing with them. This contributed to sharp Y/Y tech platform margin expansion.

- SoFi is pocketing 181 basis points (bps; 1 basis point = 0.01%) in cost of funds savings ($680M/year) from less warehouse debt reliance thanks to the bank charter. This compares to 190 bps last quarter and gives SoFi a durable advantage vs. non-banks.

- Net interest margin (NIM) fell due to a 74 bps decline in yields more than offsetting a 50 bps decline in cost of funds. They remain very confident in keeping NIM over 5%.

- Rapid tangible book value (TBV) growth was greatly helped by 2025 capital raises.