a. Taiwan Semi 101

Taiwan Semi manufactures chipsets for designers like Nvidia, Amazon, AMD, Broadcom and Qualcomm. It does so in its highly expensive and complex chip fabrication plants. These are called “fabs” for short.

Needed Definitions:

- Fab means a factory.

- Nanometer (NM) describes the chip manufacturing technology. Smaller NM is more advanced, as it uses smaller transistors. This means TSM can pack more transistors into a single chip, making those chips more energy efficient and cost-effective.

- “Advanced Technology” revenue is revenue from 3-nanometer (N3), N5 & N7 technology. Anything under N7 is “advanced.”

- These labels describe the actual manufacturing technology process.

- Wafer refers to the raw materials (usually silicon) that are used to manufacture chips. Wafers are the “substrate” that integrated circuits (ICs) are built on top of. The transistors within these ICs guide and facilitate functions. Nvidia’s Blackwell chips are considered ICs.

- Lithography is the process of using photomasks (chip blueprints) and light to print chip patterns onto wafers. A light-sensitive material is added to wafers, with light pushed through the masks to guide the chip's design. This closely guides how light and chemicals generate desired patterns and create specific use cases. Lithography is paramount to TSM’s production."

- While traditional foundry services entail the actual testing and creation of a chip on a silicon wafer, packaging involves storing, integrating and prepping chip components with thermal protection, connectivity equipment and encapsulation (physical damage protection).

- These categories (packaging, testing and mask-making) are part of TSM’s “Foundry 2.0” – or the firm’s updated overall foundry total addressable market (TAM).

- Chip-on-wafer-on-substrate (CoWoS) is a packaging process that combines chips into a single unit. It allows things like GPUs, high-bandwidth memory (HBM) and custom chips to be vertically stacked and connected on a single substrate. This improves the compute speed and performance generated from these chips. TSM is a key partner for all HBM manufacturers. It doesn't actually build the memory layer of these memory chips, but does provide the infrastructure to layer on and package other needed components.

- Substrates also help protect chip components and manage heat.

- Vast processing needs from GenAI and Agentic AI require the vertical stacking CoWoS facilitates to ensure needed access to scalable data.

- AI Accelerators, as the name indicates, accelerate high-performance compute (HPC) workloads in the realm of AI. GPUs are a type of AI accelerator, along with Application Specific Integrated Circuit (ASICs) (custom chips) and Google’s Tensor Processing Units (TPUs; for machine learning). TSM also includes high-bandwidth memory in this category. HBM facilitates ultra-low latency, high-bandwidth support for querying and data processing tasks as a wonderful complement to GPUs, for example.

b. Key Points

- Raised AI revenue forecast.

- Sees supply constraints lasting into 2027.

- Memory inflation is not hurting smartphone demand.

- Accelerating Arizona construction schedules.

c. Demand

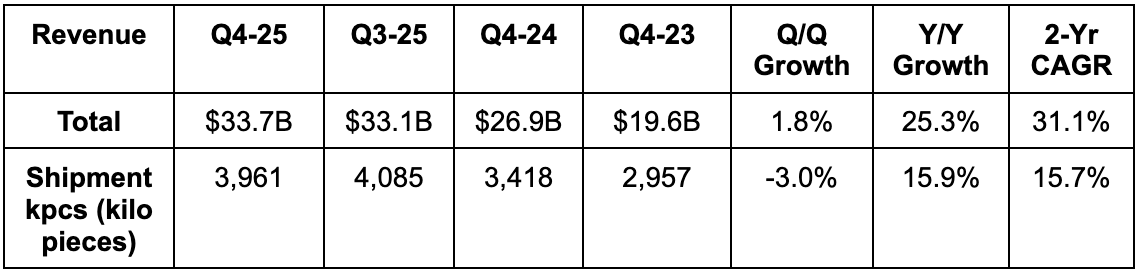

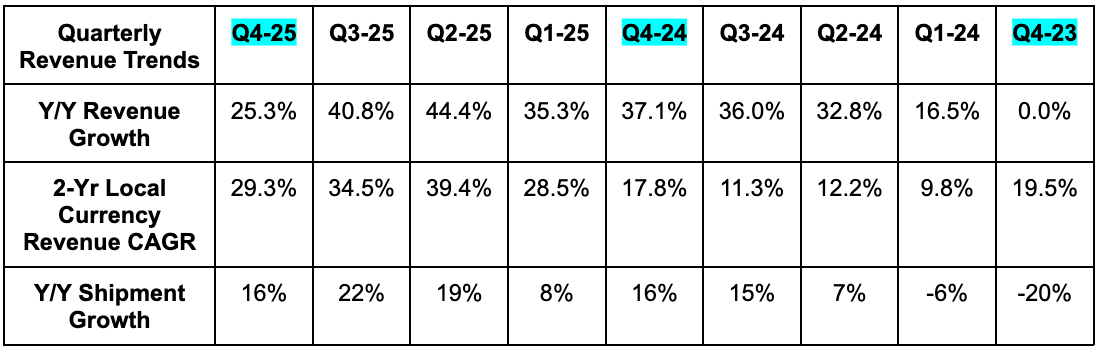

TSM beat revenue estimates by 2.7% & beat guidance by 3%. Its 31.1% 2-year revenue compounded annual growth rate (CAGR) compares to 38.4% last quarter and 38.5% 2 quarters ago.

By Technology:

- N7 was 14% of revenue vs. 14% Q/Q & 14% Y/Y.

- N5 was 35% of revenue vs. 37% Q/Q & 34% Y/Y.

- N3 was 28% of revenue vs. 23% Q/Q & 26% Y/Y.

- Advanced Technology was 77% of revenue vs. 74% Q/Q & 74% Y/Y.

By Segment:

- Smartphone revenue rose by 11% Q/Q vs. 19% Q/Q growth last quarter and 16% Q/Q growth the quarter before that. It was 32% of total revenue vs. 30% Q/Q & 35% Y/Y.

- Internet of Things (IoT) revenue rose 3% Q/Q vs. 20% Q/Q growth last quarter and 35% Q/Q growth the quarter before that. It was 5% of total revenue vs. 5% Q/Q & 5% Y/Y.

- High-performance compute (HPC) revenue rose 4% Q/Q vs. 0% Q/Q growth last quarter and 11% Q/Q growth the quarter before that. It was 55% of total revenue vs. 57% Q/Q & 53% Y/Y.

- Auto revenue fell by 1% Q/Q vs. 18% Q/Q growth last quarter and 6% Q/Q growth the quarter before that. It was 5% of total revenue vs. 5% Q/Q & 4% Y/Y.

d. Profits & Margins

- Beat 60% GPM estimates by 230 basis points (bps; 1 basis point = 0.01%) & beat guidance by 160 bps.

- Beat 51% EBIT margin estimates by 300 bps & beat guidance by 400 bps.

- OpEx as a percentage of revenue fell 50 bps Y/Y.

- Beat $0.58 EPS estimates by $0.05. EPS rose by 35% Y/Y.

- Beat 35.6% return on equity (ROE) estimates by 320 bps.

- The excess Y/Y free cash flow (FCF) margin leverage was due to CapEx actually falling a bit Y/Y.

GPM improvements were related to a few structural tailwinds...