Today’s Piece is Powered by our Friends atLong Term Mindset:

We strongly encourage you to share this article far and wide if you find it valuable and feel inspired to do so. That’s how we grow.

1. Tesla Q2 2023 Earnings Review

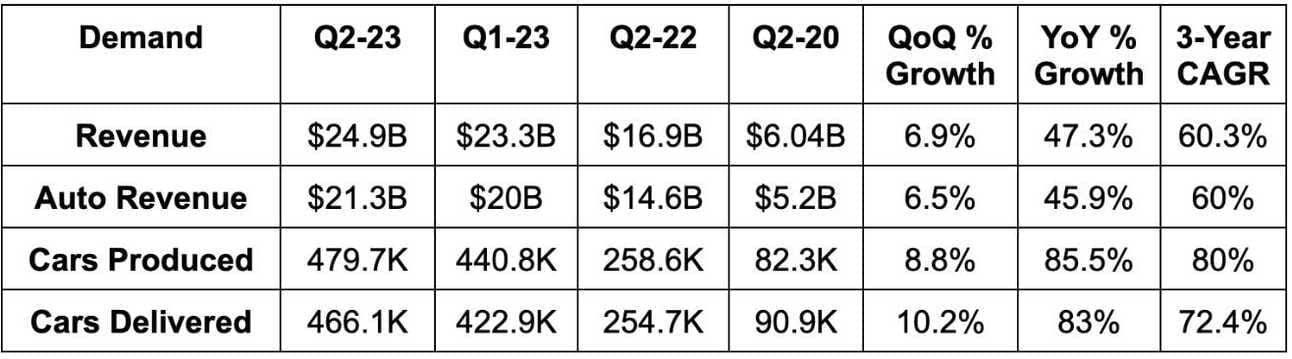

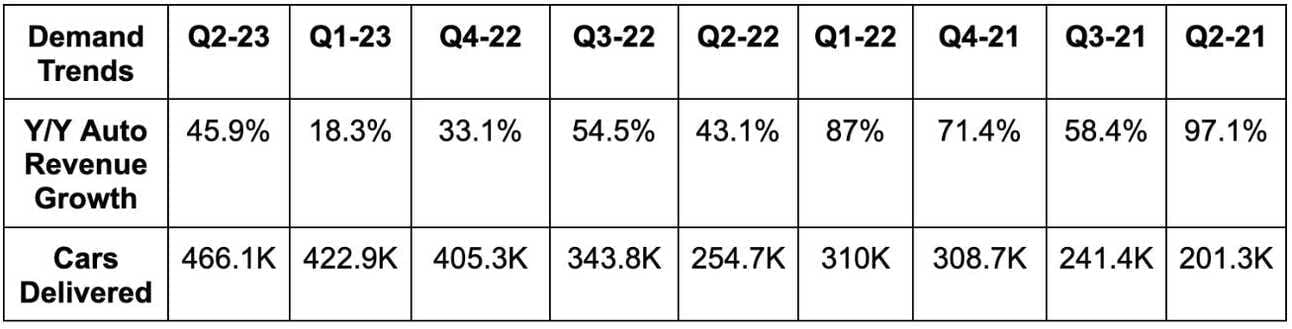

a. Demand

Tesla reports its production and delivery numbers right after the end of the calendar quarter. These results were ahead of consensus by a few percent. In terms of revenue, Tesla beat consensus sell side estimates by 0.8%.

Demand Context:

- Deliveries represented 97% of cars produced this quarter vs. 96% last quarter and 92% 2 quarters ago.

- 60.3% 3-year revenue CAGR compares to 57.2% Q/Q and 48.6% 2 quarters ago.

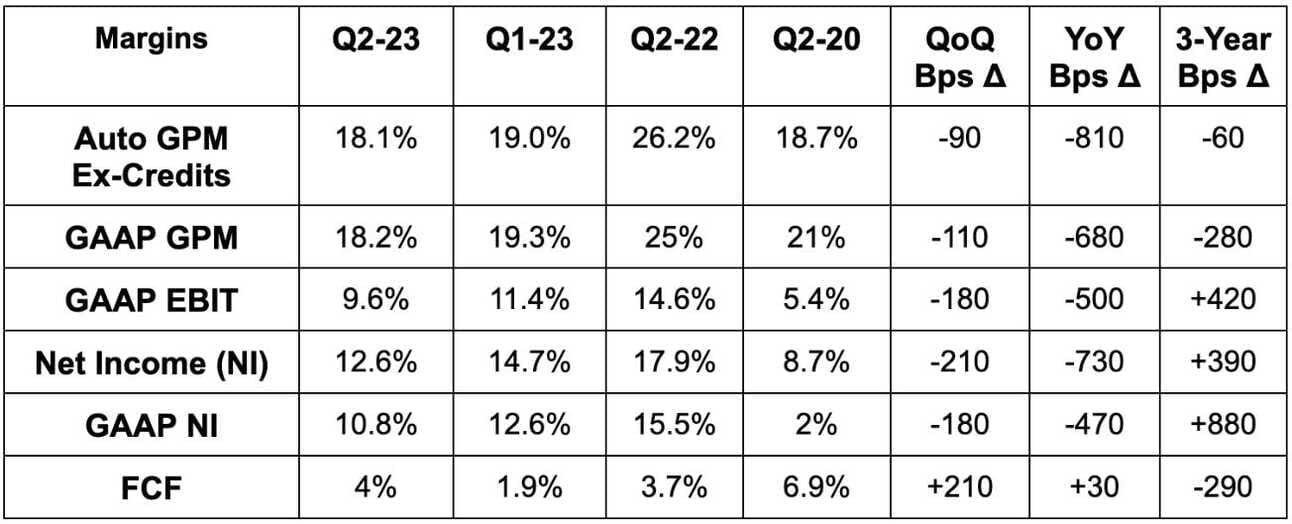

b. Margins

- Missed GAAP EBIT estimates by 13%.

- Beat $0.68 GAAP EPS estimates by $0.10.

- Missed 18.9% GAAP gross margin (GPM) estimates by 70 basis points (bps).

- Missed 18.2% auto GPM estimates ex-credits by 10 bps. Some data sources had 18% consensus estimates so we can call this wildly important metric for Tesla roughly in line with expectations.

- Sharply missed $2.8 billion free cash flow (FCF) estimates by $1.8 billion. Capital Expenditures (CapEx) rose by 19% Y/Y.

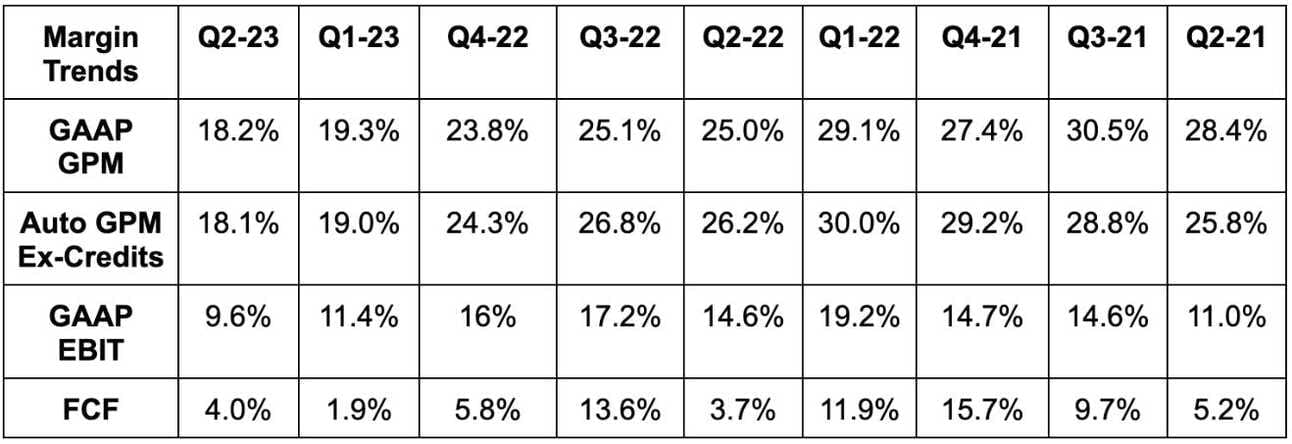

Margin Context:

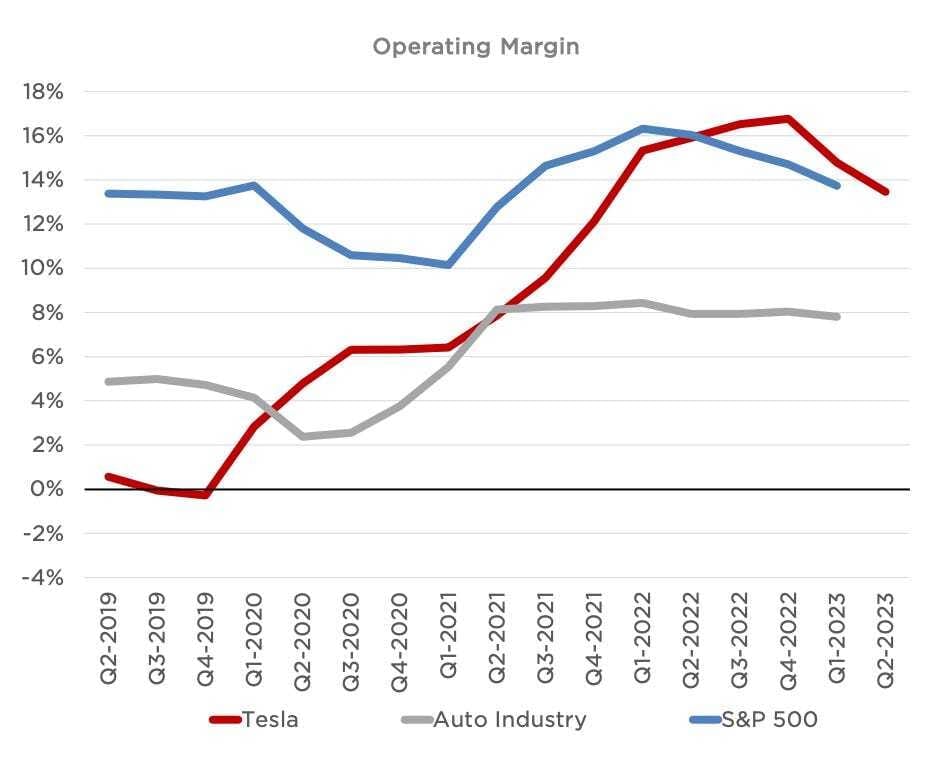

Tesla’s strategy has recently shifted to rationally maximizing production and deliveries. It wants to take advantage of its input cost leads (depicted in the graph below) over competitors to grow share as rapidly as possible. For context, most legacy automakers have EV programs running at negative gross margins (the image shows overall margins). This is the time for Tesla to distance itself from the competition and this is how it’s trying to do so. It’s willing to make sales at lower gross margins because of this and thinks it can “harvest more margin” over time with technology up-sells. The falling GPM was fully expected and makes it tougher to compete with for legacy brands. That’s the present philosophy.

For the quarter, EBIT margin headwinds included:

- Reduced selling price via mix shift and price cuts.

- Its 4680 battery cell production still ramping (which will eventually be a margin tailwind).

- More CyberTruck OpEx.

- Austin and Berlin factories still ramping production capacity.

Some disinflation for raw materials helped offset some of this contraction. It enjoyed raw material disinflation in virtually every key area including lithium, steel and aluminum.

“Even with price reductions in Q1 and Q2, EBIT remained healthy reflecting cost reduction efforts, the Berlin and Texas ramps and strong performance of our Energy, Services and other businesses.” -- Shareholder Deck

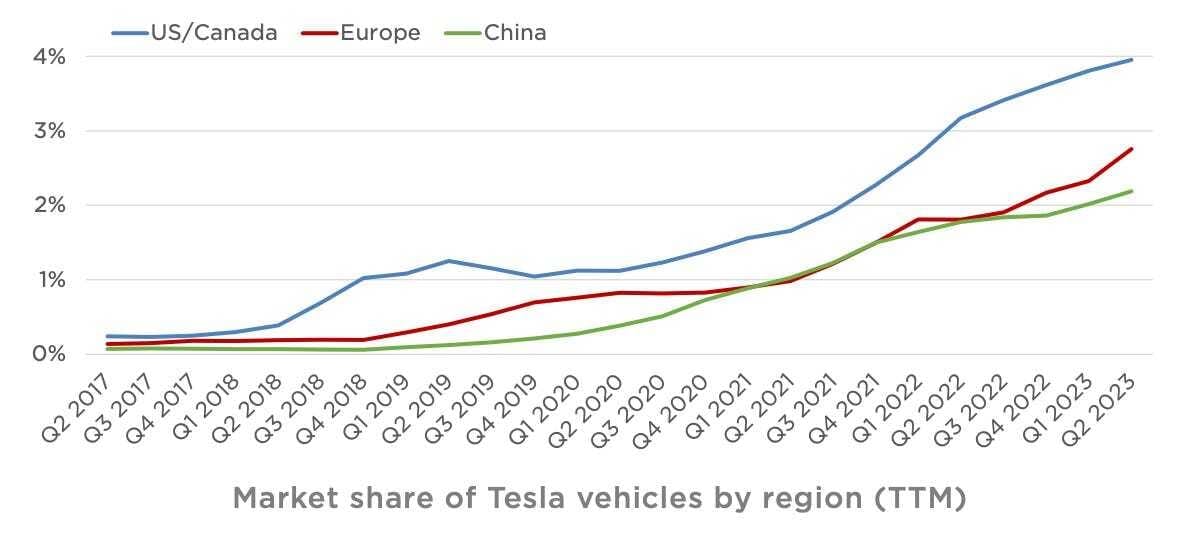

With its first goal today being marketshare growth, this graph below offers evidence of its aim working:

c. Guidance

Tesla reiterated its general long term guidance. It expects a long term 50% volume CAGR which is incredible at this scale. It also has the cash on hand needed to fund investments while it re-committed to Cyber Truck deliveries in 2023. Finally, it expects software-powered margin expansion to kick in over time.

Elon told investors he thought “Full Self Driving (FSD) would be as good as a human driver” but the end of the year. He said he could be wrong and that regulatory clearance will take time too.

The team did not update its annual auto gross margin ex-credits floor this quarter. That implies it should be just below 20% as CFO Zach Kirkhorn told us last report that the floor slightly fell from 20% with price cuts.

Finally, Tesla continues to target 1.8 million 2023 deliveries. Q3 production will be down Q/Q a bit due to factory upgrades and will normalize thereafter.

d. Balance Sheet

- Inventory levels are roughly flat Q/Q and rose 77% Y/Y.

- $23 billion in cash & equivalents.

- $2.3 billion in total debt with about 70% of it being current (due in next 12 months).

- Share count rose very modestly at well under 1% Y/Y.

e. Shareholder Deck & Call Notes

Dojo:

Tesla development of the Dojo super computer is now underway. This is not another language learning model, but takes more of a video training approach to help Tesla pursue FSD. Dojo should “satisfy immense neural net training needs” to vertically integrate a large chunk of that technology for Tesla. The vertical integration simply cannot be matched by legacy auto makers and could form another edge. Importantly, it will use Dojo AND Nvidia for graphics processing unit (GPU) needs. To train AI algorithms and create utility-building use cases, companies need access to giant supplies of relevant data. Tesla leads peers here with its 300 million FSD test miles now driven.