Sections e, f & g are for paid subscribers. They include detailed data and commentary on guidance, valuation, the shareholder letter and the conference call, as well as my take on the quarter.

If you'd like to read those sections and full reviews on 40+ companies this season (and so much more), you can access 25% annual discounts and upgrade below.

In case you missed it:

a. Key Points

- Optimus 3 is still on track for an early 2026 debut.

- The Model Y iteration that launched in China looks to be performing well.

- The energy business keeps delivering explosive, margin-accretive growth.

- The safety driver in Austin robotaxis will hopefully be gone by the end of the year.

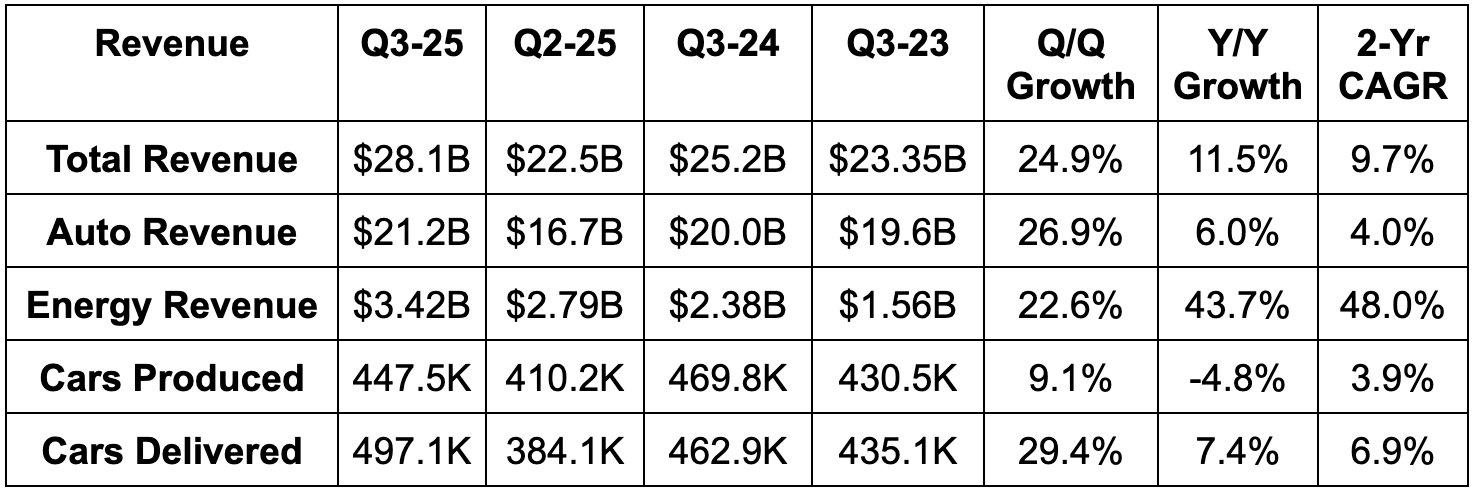

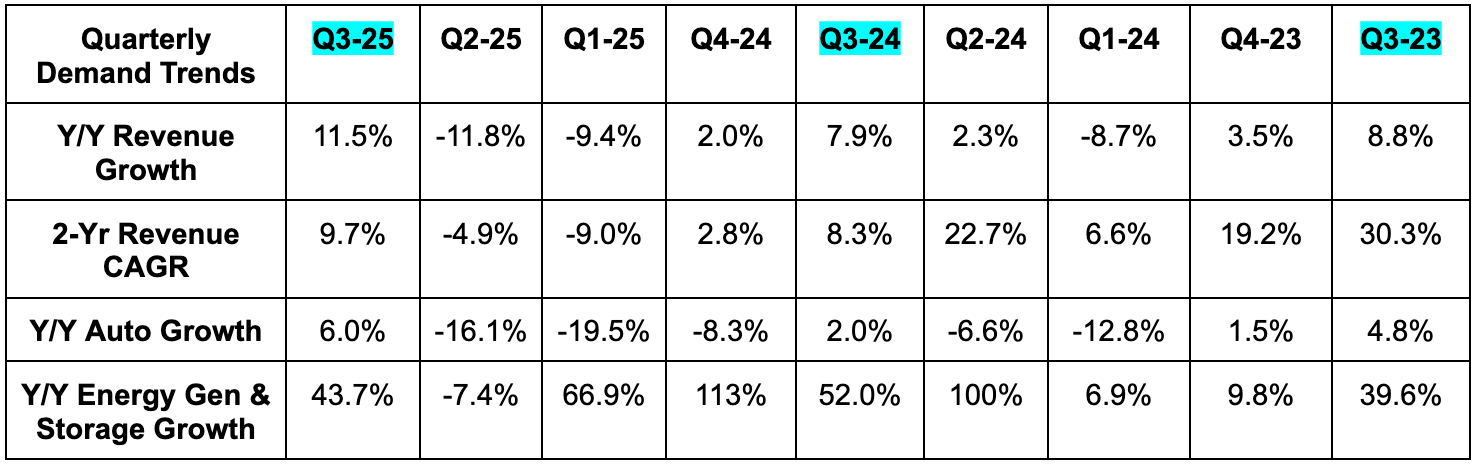

b. Demand

- Beat total revenue estimates by 10%.

- Some sources had this as a 5.2% beat, but I only have energy & auto estimates from the source that says it’s a 10% beat.

- Beat auto revenue estimates by 12%. Regulatory credits were 4% larger than expected.

- Beat energy generation and storage revenue (energy revenue) estimates by 8%.

- Beat services and other revenue estimates by 8%.

South Korean growth remains robust, as that market is now bigger than every other country besides the USA and China. Deliveries in that nation, Taiwan, Japan and Singapore set new records. Across Europe, Model Y has been the top-ranked vehicle in Norway, Switzerland and Iceland so far in 2025. And momentum appears to be healthy, as this car became the top seller in Finland this quarter and the top seller in the Netherlands and Denmark last month.

Lower regulatory credits Y/Y and lapping higher full self-driving (FSD) revenue recognition were both revenue headwinds. The FSD factor is related to last year’s Cybertruck FSD release and popular feature debuts like “Actually Smart Summon.” As Tesla reaches product milestones, it recognizes deferred revenue from previous FSD payments as revenue. It reached an abnormal number of milestones last year, leading to the tough comp.

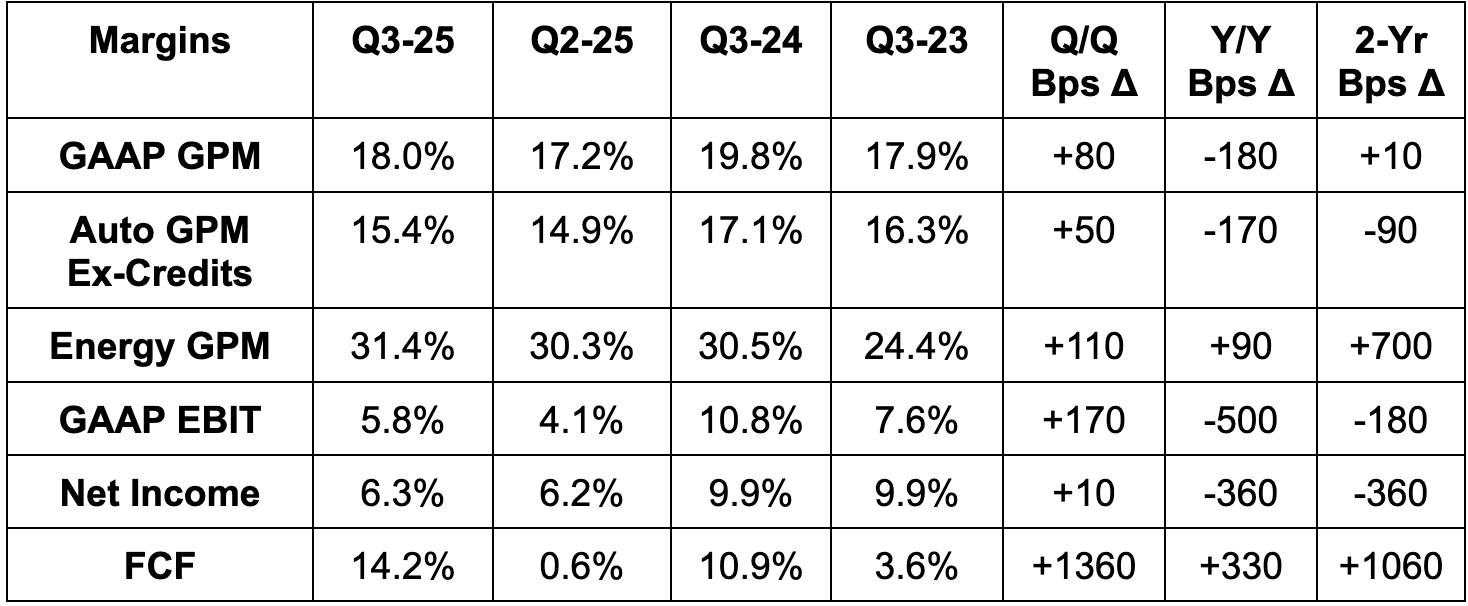

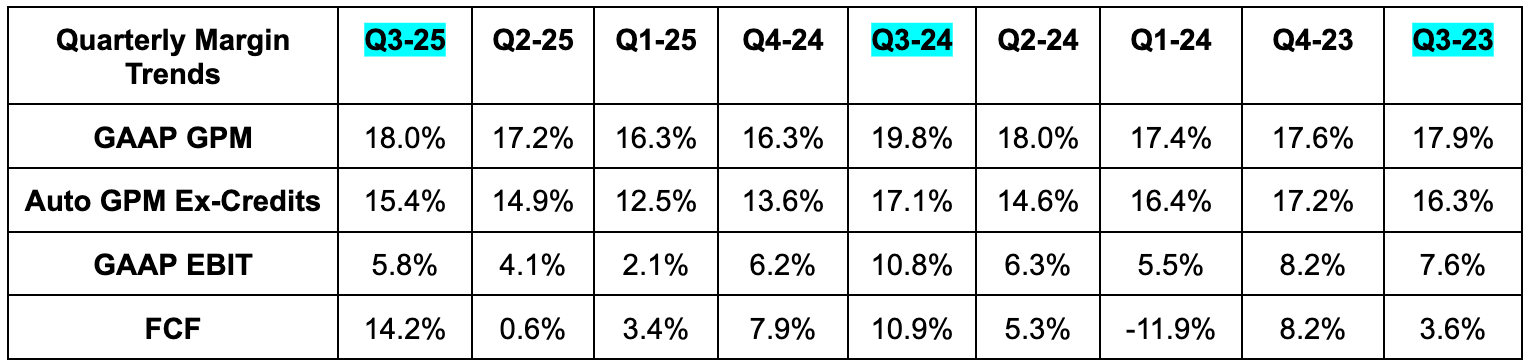

c. Profits & Margins

- Beat 17% GPM estimates by 100 basis points (bps; 1 basis point = 0.01%).

- Average cost per vehicle rose Y/Y due to “fixed cost absorption on some models” and also tariffs. Raw material costs helped offset some of this.

- Met 15.4% auto GPM ex-regulatory credits estimates.

- The Y/Y decline was related to the same notes above, while the Q/Q improvement was thanks to fixed cost absorption headwinds improving.

- Missed EBIT estimates by 1.8%.

- Missed $0.50 EPS estimates by $0.06.

- Some sources had this as a $0.01 miss.

- Beat FCF estimates by 200%+. This metric is very lumpy on a quarterly basis. During Q3, they delivered a lot more cars than they produced, with inventory reductions directly helping this metric. Inventory fell by 15.5% Y/Y.

- Tariffs amounted to $400M in incremental costs this quarter. This was split evenly between auto and energy.

The EBIT and EPS misses were related to operating expenses (OpEx) coming in 17% higher than Bloomberg consensus estimates. R&D and SG&A were 6% and 13% higher than anticipated, respectively. That was heavily tied to AI, while legal fees added to the SG&A number. There was also $238M in restructuring and other expenses (within the chip design team), which was larger than a few of the buyside analyst estimates I have access to. Without that item, EPS would have been closer to in line with expectations and the EBIT miss would have been below 1%.

d. Balance Sheet

- $41.6B cash, equivalents & investments.

- $7.5B debt.

- Share count +0.8% Y/Y.