“We continue to innovate more quickly & effectively than our competition. We have very strong momentum & expect the winds to stay at our backs going forward.” — CEO and Co-Founder Jeff Green

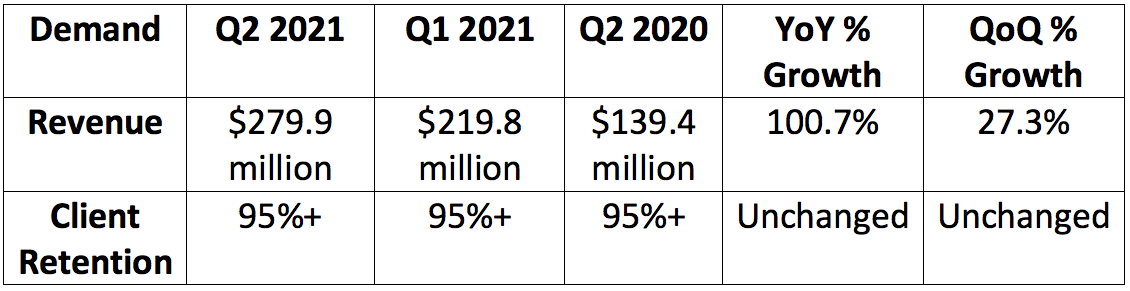

1. Demand

The Trade Desk’s internal guide called for $259 to $262 million in quarterly revenue. Analyst expectations were for $258 million in quarterly revenue.

It posted $279.9 million in sales beating the high point of its internal guide by 6.8% and analyst expectations by 8.5%.

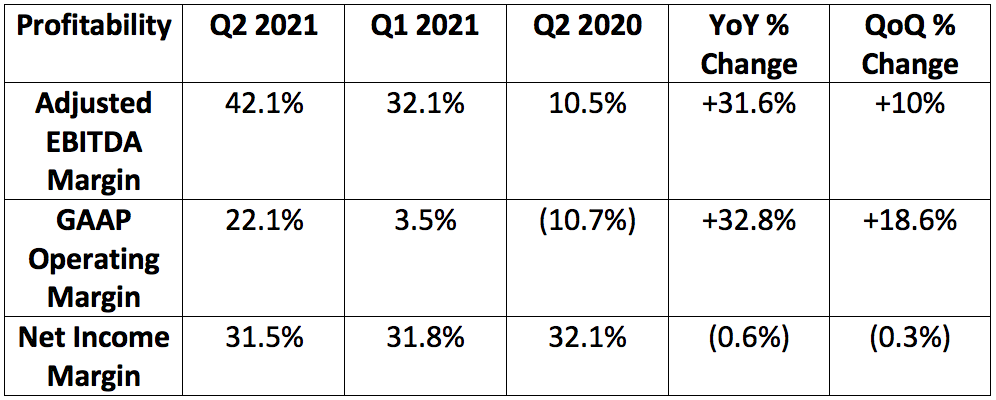

2. Profitability

The Trade Desk’s internal guide called for at least $84 million in adjusted EBITDA. It posted $117.9 million, surpassing that minimum by 40.4%.

Analysts expected The Trade Desk to earn $0.13 per share for the quarter. It earned $0.18 per share thus beating expectations by 38.4%.

The quarterly EBITDA margin was boosted by temporarily lower operating costs due to virtual living (The Trade Desk avoided travel and live event costs).

3. Next Quarter Guidance

The Trade Desk guided to at least $282 million in sales. At a minimum, this would beat analyst expectations by 2.5%. The Trade Desk has a strong history of comfortably surpassing the at least estimates it provides. This rate represents 30.5% year over year growth or 38% when excluding the impact of political spend in 2020.

The company also guided to $100 million in Adjusted EBITDA.

4. Management Commentary

a. Jeff Green

“CTV as a percent of our business continues to grow very rapidly and is by far our fastest growing channel. CTV growth significantly outpaced our total growth in the quarter.” — Green

Walmart will launch its new demand-side platform (DSP) using The Trade Desk’s Solimar in the 2nd half of the year; it will be fully integrated by Q4. The Trade Desk will collect its standard 15% platform fee within this partnership.

“We’ve gotten unanimously positive feedback on Solimar. — Green

“UID2 adoption momentum has accelerated since Google announced its 2 year delay of the phasing out of 3rd party cookies.” — Green