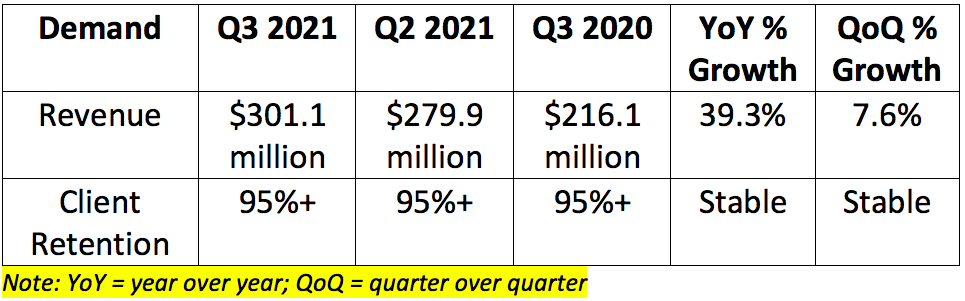

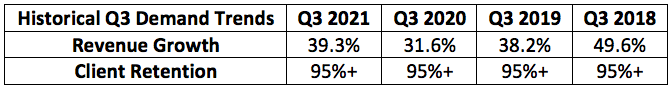

1. Demand

The company guided to “at least” $282 million in sales with mean estimates calling for $283.9 million in sales. The Trade Desk posted $301.1 million which beat expectations by 6.1%.

Note that revenue growth when excluding the political election impact from 2020 was 47%.

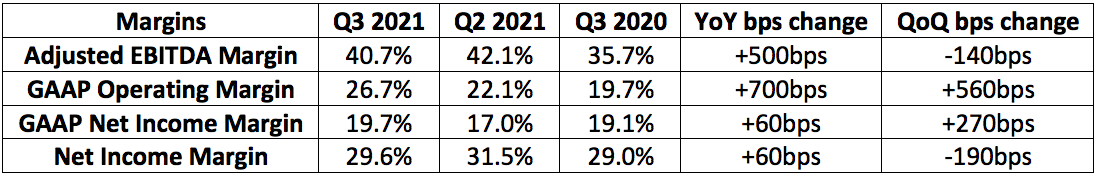

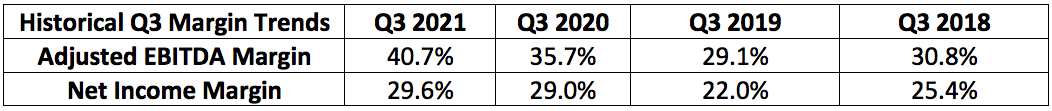

2. Profitability

The company guided to “at least” $100 million in Adjusted EBITDA with mean estimates of $101.8 million in Adjusted EBITDA. The Trade Desk posted $122.7 million which beat expectations by 20.5%.

Forecasts were for The Trade Desk to earn $0.15 per share during the quarter. The Trade Desk earned $0.18 which beat expectations by $0.03.

3. The Guide

Analysts were expecting $390 million in sales for the 4th quarter. The Trade Desk guided to “at least” $388 million for 21% growth at a minimum or 33% excluding political spend.

Analysts were expecting $165.9 million in Adjusted EBITDA for the 4th quarter. The Trade Desk guided to “at least” $175 million.

4. Co-Founder/CEO Jeff Green Conference Call Notes

“We are building a far better internet than what has been built by walled gardens holding the internet hostage.”

On supply chains:

“We see no material impact on our business from supply chains”

This is wildly encouraging considering some other players in the industry blamed supply chain obstacles for poor results.

On Walmart:

The Walmart DSP is live. Pepsi & several other behemoth brands are already active on it.