Table of Contents

In case you Missed It:

- Lemonade & Duolingo Earnings Reviews.

- Palantir & Hims Earnings Reviews.

- Cava Earnings Review.

- Uber Earnings Review.

- Shopify & Coupang Earnings Reviews.

- Meta Earnings Review.

- Alphabet Earnings Review.

- Apple, ServiceNow & Starbucks Earnings Reviews.

- Amazon & Mercado Libre Earnings Reviews.

- PayPal Earnings Review.

- Tesla Earnings Review.

- SoFi Earnings Review.

- Netflix Earnings Review.

- Taiwan Semi Earnings Review.

- My current portfolio & performance vs. the S&P 500.

a. Trade Desk 101

The Trade Desk is the leading buy-side player in open internet advertising. The firm’s two most compelling revenue segments are streaming and retail media. In these segments, it has tight relationships with most of the leading streamers and stores. Its platform allows advertisers to bid on & purchase impressions with surgical precision, scale and open reporting. Purchases are essentially made on an impression-by-impression basis, uplifting targeting efficacy and doubling ad return metrics. Needed data is infused into every purchasing decision to ensure placements provide optimal value. With this company, advertisers are freed from a need to commit millions at annual upfront events to reach audiences. They can commit to smaller purchases in real-time and with fantastic accuracy. No more guessing. No more “spray and pray.”

Kokai is the name of its data-driven, AI-copilot infused platform. It combines TTD’s leading open internet scale with its vast roster of partners to inject more data and signal into each decision. It’s what tells advertisers who they should be targeting. Kokai does so through TTD’s decade of experience that allows it to essentially find groups of high intent “copy-cat customers” with similar interests. Advertisers onboard their own data (what TTD calls “concentrated data seeds”) and The Trade Desk does the rest. Kokai allows buyers to focus on whichever variable, key performance indicator (KPI) or campaign objective they’d like to. Finally, Kokai emulates the ease of data onboarding that has made Alphabet and Meta so popular.

Unified ID 2.0 (UID2) is its open internet, omni-channel identifier. It uses hashed emails to responsibly ensure consumer and brand security. It knows exactly who is accessing what site or app. Kokai tells you who to target, while UID2 is what tells you where they are.

Other products include:

- OpenPath allows publishers on the sell-side to directly plug into TTD’s buy-side platform. It “shines a light on where advertising value is, where that value is being obscured and what signals advertisers value the most.” It does not replace sell-side programmatic players like Magnite, as it does not do things like yield management for these publishers. It’s just TTD’s way of cleaning up the supply chain and letting publishers with their own resources connect more easily. This way, publishers gain a better understanding of impression value and buyers gain a better view into what they’re buying.

- Galileo is the firm’s product for ensuring seamless, automated first-party data onboarding.

- TV Quality Index (TVQI) uncovers the incremental value of professionally produced content as compared to user-generated content.

OpenPath and UID2 are meant to support the sell-side rather than supplant it. TTD does not want to build a sell-side platform. It wants to exclusively represent the buy-side to eliminate conflict of interest. Helping sell-siders with identity and supply chain is meant to help its buyers enjoy more success.

b. Key Points

- Accelerating growth was powered by connected TV (CTV).

- Kokai is delivering strong incremental value.

- No tariff or macro-related excuses this quarter.

- They feel they now have the right team in place, following 3 C-level hires in 2025.

c. Demand

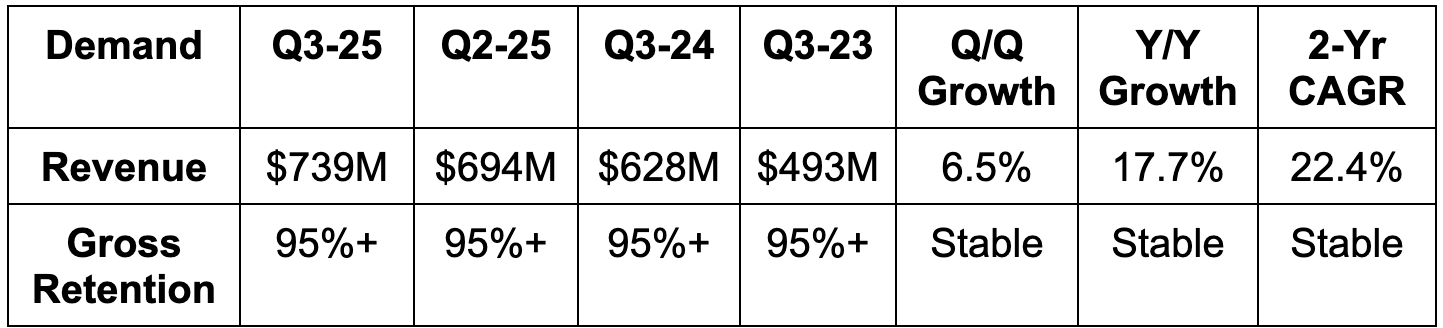

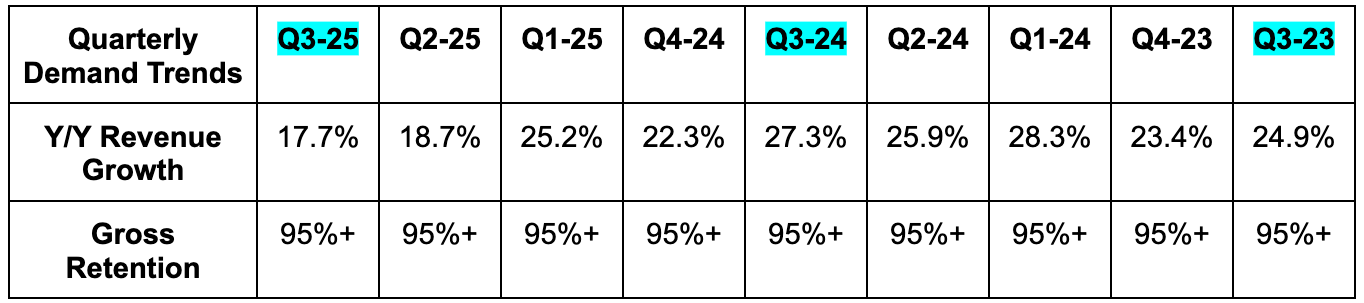

TTD beat revenue estimates by 2.8% & beat guidance by 3.1%. Its 22.4% 2-year revenue compounded annual growth rate (CAGR) compares to 18.7% last quarter and 26.6% 2 quarters ago.

d. Profit

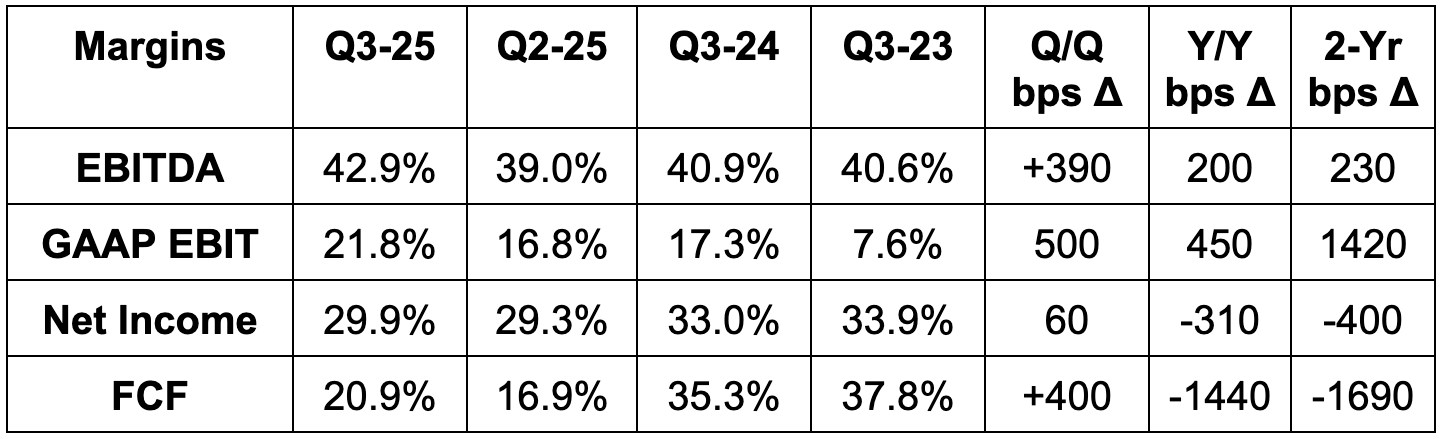

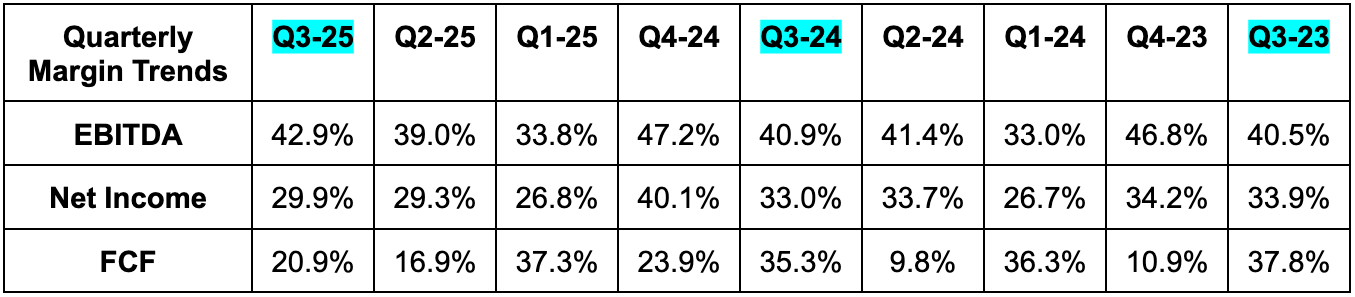

- Beat EBITDA estimates by 13.7% & beat guidance by 14.4%.

- Beat GAAP EBIT estimates by 35%.

- Beat $0.44 EPS estimate by $0.01. EPS rose by 10% Y/Y.

Founder awards are meaningfully fading and enabling strong GAAP-level operating leverage. On the other hand, GAAP EBIT growth stemming from this help meant their tax bill doubled Y/Y and was 55% of net income vs. 35% of net income last year. That's why the EPS beat is a lot smaller than the beat for the other two pre-tax profit metrics. At that same 35% rate as last year, EPS would have been $0.55 vs. $0.41 Y/Y for 34% Y/Y growth.

e. Balance Sheet

- $1.44B cash & equivalents.

- No debt.

- Share count fell by 2% Y/Y.

f. Guidance & Valuation

- Q4 revenue guide Beat estimates by at least 1.1%.

- Q4 EBITDA guide Beat estimates by 1.9%.

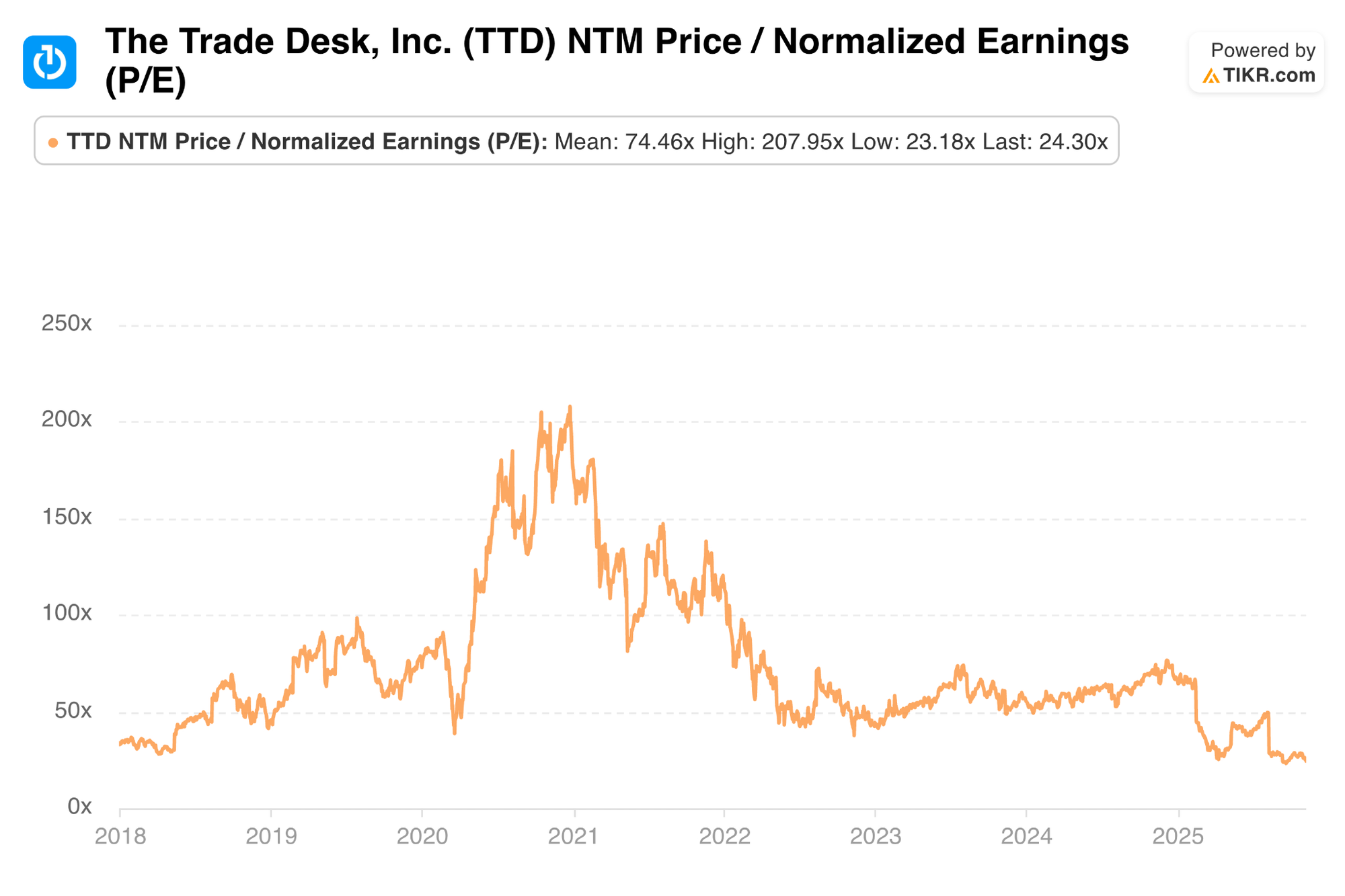

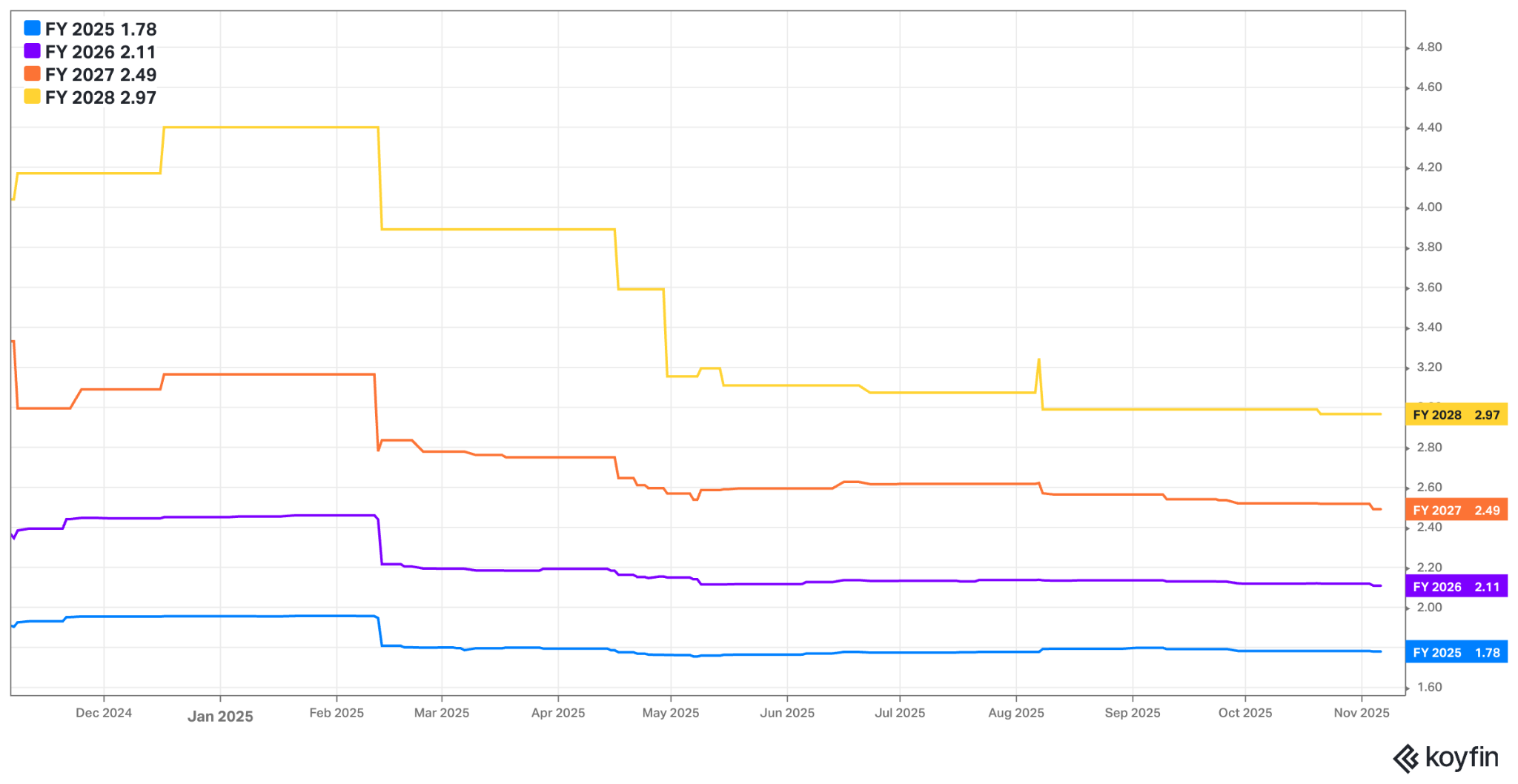

TTD will likely trade for a little over 20x forward EPS following this report. EPS is expected to grow by 7% this year before compounding at an 18% 2-year CAGR in 2026-2027. This report should stabilize declining forward EPS estimates.

g. Call & Release

Open Internet Momentum:

Green Walked Investors through all of the momentum its Open Internet (OI) ad segment is enjoying. The supply/demand imbalance is only deepening and creating an even more compelling buyer’s market. That’s great for this buy-side king. OI continues to win the first dollar of large budgets more frequently and win larger share of those budgets as well. The time spent advantage is already there. It has been. As leadership pointed out, ⅔ of online consumer engagement happens in some part of the open internet. Still, more than 50% of campaign dollars have been going to Google, Meta and TikTok. That’s because walled gardens have a much easier time controlling their ad supply chains, considering they own every part of the process. TTD doesn’t. It does not represent the sell-side or practice key sell-side features like yield management. It solely represents the buy-side. That makes the OI supply chain more fragmented and has allowed bad actors and parasites to proliferate. These bad actors for years have eroded what should be superior campaign value and clouded the true appeal of premium, addressable, biddable open internet inventory. That’s finally changing with product development we’ll dig into later. These changes are why OI is beginning to make more progress vs. walled gardens on campaign dollar market share.

Competition:

For review, TTD’s lack of supply ownership eliminates a conflict of interest. Unlike walled gardens, it isn’t inherently motivated to place demand with its own impressions for more revenue vs. a 3rd party impression. It doesn’t have those impressions to offer, and that’s highly intentional. It isn’t placing the vast majority of traffic with its own marketplace and streaming listings like Amazon is. It hasn’t grown its network business over the last 6 years solely by routing more inventory to YouTube and Search like Google has. It isn’t tempted to use customer data for anything besides better campaign optimization, while the mega-caps certainly are. This isn’t to say that Amazon and Google won’t continue to do extremely well in advertising. I think it’s clear that both will. This is just saying most mega-cap growth will keep coming from advancing monetization of their own inventory. When Green says “Amazon doesn’t compete with us,” he doesn’t mean Amazon doesn’t have a capable DSP. Green simply means 99% of the commerce giant's focus is on using their ad products (including that DSP) for their own supply. TTD is in the business of helping everyone else. They buy the whole internet, and are confident that they can do so with superior client returns vs. the field.

Trade Desk has one goal and one goal only… maximize customer ROAS. Their focus (and their great products) is their superpower. That’s how they can price to value and consistently fetch a 20% take rate. That’s how they won against Alphabet for years while that competitor’s network priced campaigns at zero. And as Google pulls back, that’s how they’ll win in the years to come against Amazon as that budding demand side platform (DSP) makes the same pricing moves. When TTD has a chance to demonstrate an apples-to-apples value comparison vs. any of these competitors, they win every time. And encouragingly, advertisers are getting smarter about asking the right questions and demanding these fair comparisons.

So while Ad Week can keep posting articles about some random advertiser moving some campaign dollars, TTD is adamant that they will keep outgrowing the market for a very long time. Whether its sub-scale demand side platform (DSP) competition or conflicted mega-cap behemoths, The Trade Desk feels extremely well positioned to win.

- Along a related yet different line, Green thinks the $0 fee promotions Amazon is offering will end up working the same way Alphabet’s did. They will push advertisers to wonder “how are you making money off of me.” They’ll be forced to confront the fact that this answer often involves Amazon directly competing with their businesses elsewhere. For example, consider a toothbrush company that buys an ad through TTD. They don't have to worry about that ad showing up on a marketplace that's actively trying to sell the same customer their own cheaper toothbrush instead.

Operational Updates:

Since the end of last year, TTD has been hard at work on overhauling a lot of the ways it does things. This quarter, we got more detail on what that work entails with some progress reports.

First, its aim to deepen direct brand relationships is bearing fruit. They’re getting closer to C-level decision makers, with new Chief Revenue Officer Anders Mortensen opening up many more relationships to pursue from his days leading parts of Alphabet’s ad business. Joint Business Plans (JBPs) are outgrowing the overall business as a result, with 180 of these live and 80 more in the pipeline.

New COO Vivek Kundra is already making an impact. He’s bringing a heightened sense of operational rigor to many aspects of TTD’s business, cutting redundant, inefficient work and allowing the team to more effectively scale with fewer resources. They’ve operationalized new account planning review processes to augment large campaign management across multiple agencies. They’ve also established several new quantifiable ways to measure employee success and revamped incentives. They’re finally thinking about their internal operations in the same data-driven and thoughtful ways that they think about innovation and growth. All of these changes are why it thinks it won a $20M Q4 revenue contract from Amazon despite that DSP offering zero campaign fees. I bet you Ad Week won’t write an article about that (ok sorry I’m done). TTD charges higher fees, yet more than makes up for them in terms of incremental revenue. Clients would rather generate $20 for $2 than $5 for $1.

The new CFO’s priority is pretty simple: keep profitably scaling at a pace above the overall market. He may tweak some go-to-market initiatives and other processes, but these will be minor in nature. Nothing like the operational overhaul TTD conducted during Q4 2024. All of the C-level newness is meant to fortify TTD’s business and set it up for another phase of strong, margin-accretive growth.

Platform Work – Kokai:

TTD is confident that Kokai is delivering the strongest platform performance gains out of any launch in its history. It’s making what was already the highest-performing DSP on the open internet even better. Specifically, clients are enjoying a 26% better cost per acquisition, with that benefit rising from around 20% last quarter. Click through rate (CTR) is 94% better than Solimar (the old platform) and cost per reach is 58% better too. Its ability to partition foundational models for specialized use cases while neatly integrating all of these tools has proven effective, as 86% of its customers now use Kokai as the default (with better outcomes). This release got off to a rough start, but it has fully recovered. TTD’s decision to move away from “watershed” platform launches to smaller, more constant updates should ensure these rough starts don’t happen again.

Trade Desk is also adding new Trading Modes for Kokai. This gives customers more flexibility over what campaign work they allow the platform to automate and what they want to do themselves. TTD will still provide the recommendations that inform their AI-powered work for those wanting more control. They’ll just leave the final decision to the customer. Modes will all be equipped with copilots to drive agentic value creation.

Platform Work – Supply Chain:

This is where we’ll get into all the ways TTD is fixing the OI supply chain. OpenPath is effectively connecting TTD’s customers to inventory and auctions with a secure environment that only invites “trusted supply chain” partners to participate. It has grown by “many hundreds of percentage points this year,” while giving the entire ecosystem a better understanding of true ad value and menu. More transparency means a better supply chain and more dollars flocking to the open internet. That’s great for TTD.

Competitive auctions are paramount for strong supply chain health. And just like in other parts of the supply chain, bad actors routinely ruin the quality of these processes. Some auction service providers sell the same impressions multiple times (duplication) and lie about the reach associated with these purchases. That’s what happens when workflows are disparate, unorganized and chaotic. Some dishonest companies will try to make money on this confusion. Some publishers like Disney do a great job running their own auctions the right way, but most rely on other vendors that take more than they give. This is why TTD unveiled Open Ads. This is an open source auction platform that TTD hosts for some publishers that need more help. It fixates on offering an unbiased, complete picture of supply availability and value, so that buyers can be more confident in auctioning for impressions. That should bolster overall demand and cost per impression levels, with 20 large publishers already integrating.

- To level set, with OpenPath, the demand side can plug more cleanly into the supply side. With OpenAds, the supply side has an easier time providing auctions that the demand side wants to plug into.

DealDesk is also enjoying strong traction. As a reminder, DealDesk offers conflict of interest-free “deal quality scores” for both parties to know exactly how campaigns are performing. This comes with an easy ability to rapidly tweak inventory tied to a specific channel if performance isn’t good. This works across a massive array of KPIs. The product makes it simple and rewarding for early adopters like Disney to carefully showcase their inventory, with data-rich explanations of audiences for buyers. Interest in this product was called “strong,” with a new Pubmatic integration and 35% deal performance gains by using this tool.

They also spoke a bit about Audience Unlimited. Not much new there, and our review of that launch can be found in section 3b of this article.

More Notes:

- They didn’t talk about macro or tariffs much at all unlike last quarter. There are “some softer pockets” but overall trends remain “exciting.” Weak companies love to blame exogenous factors for their own disappointment. I’m glad that didn’t happen again here for what I consider a very strong company.

- Agentic Search could change how impressions are allocated across channels. With how oversupplied TTD’s ad engine is, they don’t think this will impact their ability to target or deliver great returns in the slightest.

h. Take

Good quarter. All of the operational changes are beginning to work while they keep taking more market share and briskly growing the JBP pipeline. While sentiment is absolutely terrible for this name right now, the financial trends look more than good enough to make me optimistic about that changing eventually. Profitable growth will be rewarded at some point. Multiple contraction will stop eventually for firms consistently compounding like TTD is.

They offer a high level of uniquely bias-free value in the hectic world of digital advertising. They should effectively compete in this massive space in the years to come, with this quarter giving me incrementally more confidence in that opinion. Alphabet’s ad network aggressively competing with Trade Desk’s for years did not hold this company back. I do not think Amazon will either. Comps will get very easy for a year (poor Q4 2024, slower 2025 growth and no election headwind) starting next quarter. That happens as TTD’s operational makeover puts them on much more solid footing entering this new year than last new year. If Mr. Market wants to keep sending this lower, I’ll likely keep slowly accumulating more shares.

I’m happy to pay an earnings multiple just over 20x for what I still view as the leading structural compounder in open internet advertising. I think TTD is rediscovering its groove, with an upgraded team that should keep the momentum going.