a. Taiwan Semi 101

Taiwan Semi manufactures chipsets for designers like Nvidia, Amazon, AMD, Broadcom and Qualcomm. It does so in its highly expensive and complex chip fabrication plants. These are called “fabs” for short.

Needed Definitions:

- Fab means a factory.

- Nanometer (NM) describes the chip manufacturing technology. Smaller NM is more advanced, as it uses smaller transistors. This means TSM can pack more transistors into a single chip, making those chips more energy efficient and cost-effective.

- “Advanced Technology” revenue is revenue from 3-nanometer (N3), N5 & N7 technology. Anything under N7 is “advanced.”

- These labels describe the actual manufacturing technology process.

- Wafer refers to the raw materials (usually silicon) that are used to manufacture chips. Wafers are the “substrate” that integrated circuits (ICs) are built on top of. The transistors within these ICs guide and facilitate functions. Nvidia’s Blackwell chips are considered ICs.

- While traditional foundry services entail the actual testing and creation of a chip on a silicon wafer, packaging involves storing, integrating and prepping chip components with thermal protection, connectivity equipment and encapsulation (physical damage protection).

- These categories are part of TSM’s “Foundry 2.0” – or the firm’s updated overall foundry total addressable market (TAM).

- Lithography is the process of using thin layers of glass to etch or print chip patterns onto wafers. A light-sensitive material is added to wafers and “masks” are placed on top. This closely guides how light and chemicals (used to manipulate wafers) generate desired patterns and create specific use cases. Lithography is paramount to TSM’s production.

- Chip-on-wafer-on-substrate (CoWoS) is a packaging process that combines chips into a single unit. It allows things like GPUs, high-bandwidth memory (HBM) and custom chips to be vertically stacked and connected on a single substrate. This improves the compute speed and performance generated from these chips.

- Substrates also help protect chip components and manage heat.

- Vast processing needs from GenAI and Agentic AI require the vertical stacking CoWoS facilitates to ensure needed access to scalable data.

- AI Accelerators, as the name indicates, accelerate high-performance compute (HPC) workloads in the realm of AI. GPUs are a type of AI accelerator, along with Application Specific Integrated Circuit (ASICs) (custom chips) and Google’s Tensor Processing Units (TPUs; for machine learning). TSM also includes high-bandwidth memory in this category. HBM facilitates ultra-low latency, high-bandwidth support for querying and data processing tasks as a wonderful complement to GPUs, for example.

b. Key Points

- Strong capacity utilization drove demand and margin outperformance.

- They don’t think the AI cycle is slowing down anytime soon.

- Tariffs are having no impact on financials.

- Arizona construction is progressing very well.

c. Demand

TSM beat revenue estimates by 4.7% and beat its guidance by 2.2%. Unsurprisingly, advanced technology products drove the financial momentum this quarter. And that will continue to be the case, as AI-related demand surges. Notably, non-AI revenue is enjoying a “mild recovery” but these results are a byproduct of the high-performance compute bucket.

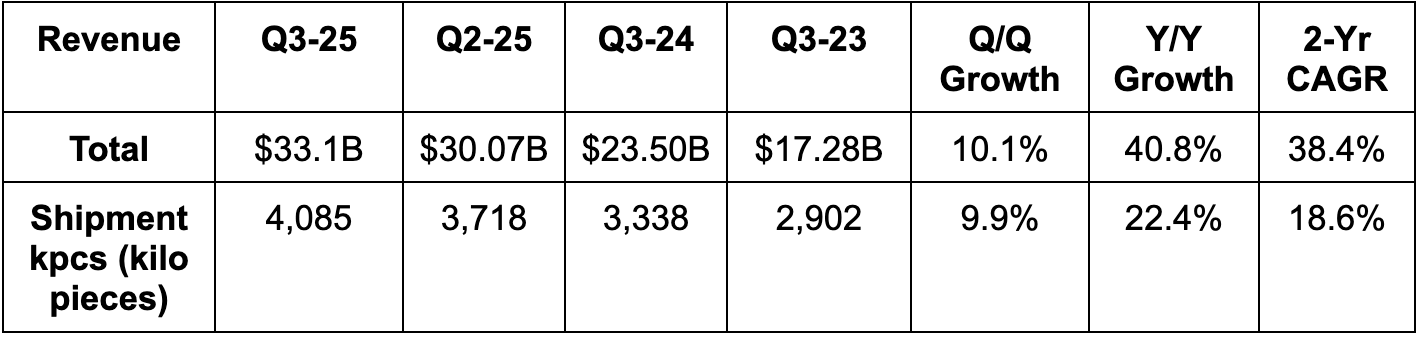

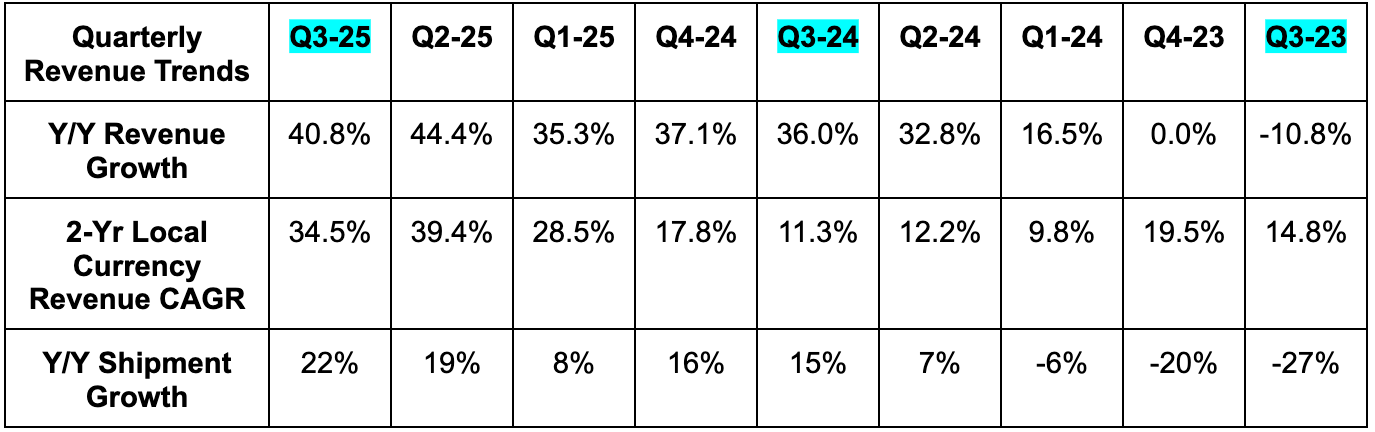

- Its 38.4% 2-year revenue compounded annual growth rate (CAGR) compares to 38.5% last quarter and 23.6% 2 quarters ago.

- This was its second-fastest rate of Y/Y growth and its second-best 2-year local currency revenue CAGR in years.

- This was also its fastest rate of shipment growth in years.

- The cycle is humming; they’re as deeply entrenched and relied upon within that cycle as anyone else.

- CoWoS (already defined) revenue is already approaching 10% of its total business.

By Technology:

- 7N was 14% of revenue vs. 17% Y/Y.

- 5N was 37% of revenue vs. 32% Y/Y.

- 3N was 23% of revenue vs. 20% Y/Y.

- Advanced technology (all 3 of the products above) was 74% of revenue vs. 69% Y/Y.

By Segment:

- Smartphone revenue rose by 19% Q/Q & was 30% of total revenue vs. 34% Y/Y.

- Internet of Things (IoT) revenue rose 20% Q/Q and was 5% of total revenue vs. 7% Y/Y.

- High-Performance Compute revenue was flat Q/Q and was 57% of total revenue vs. 51% Y/Y.

- Auto revenue rose by 18% Q/Q & was 5% of total revenue vs. 5% Y/Y.

d. Profits & Margins

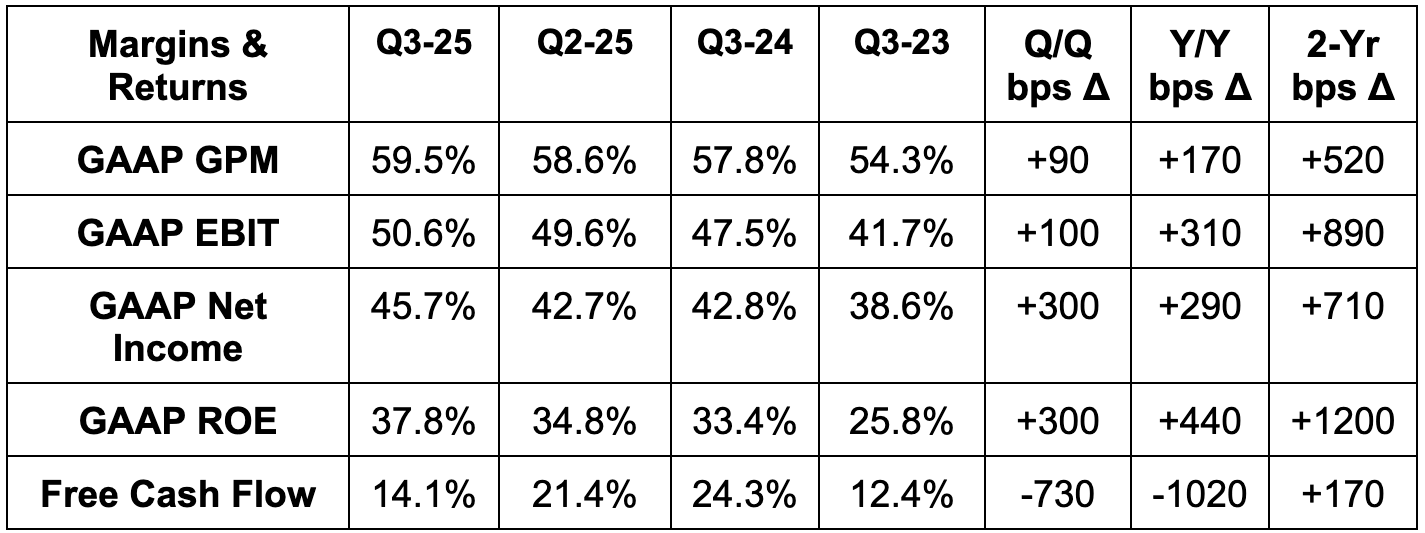

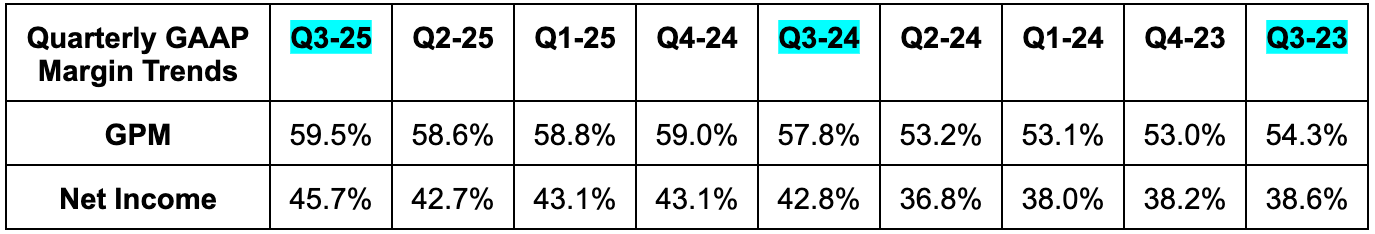

- Beat 56.5% gross profit margin (GPM) estimates by 300 basis points (bps; 1 basis point = 0.01%) & beat guidance by 220 bps. A lot more on this later.

- Beat EBIT estimates by 10.6% & beat guidance by 11.3%.

- Beat $2.92 earnings per ADR estimates by $0.29 (+39% Y/Y).

e. Balance Sheet

- $90B cash & equivalents.

- Inventory -1.4% Y/Y.

- $4.9B LT investments.

- $31.3B in bonds payable.

- Diluted shares up slightly Y/Y.

- Days of inventory on hand fell from 76 to 74.

f. Q4 Guidance & Valuation

- Q4 revenue guidance beat estimates by 6%.

- Q4 GPM guidance beat 57.3% estimates by 270 bps.

- Q4 EBIT guidance beat estimates by 12%.

For the full year, they raised annual revenue growth targets from 30% to 35% and boosted CapEx guidance from $40B to $41B. More on the importance of that datapoint later.

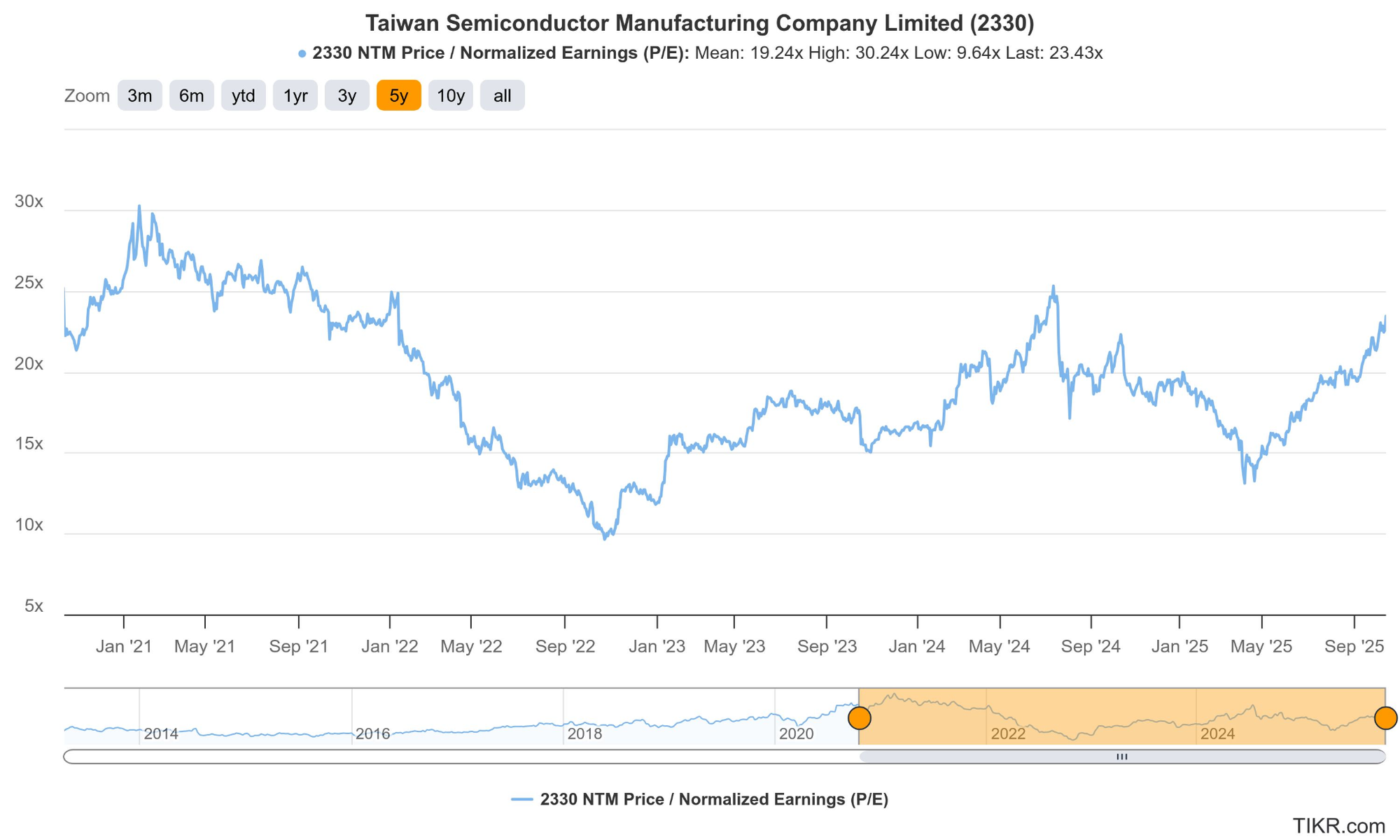

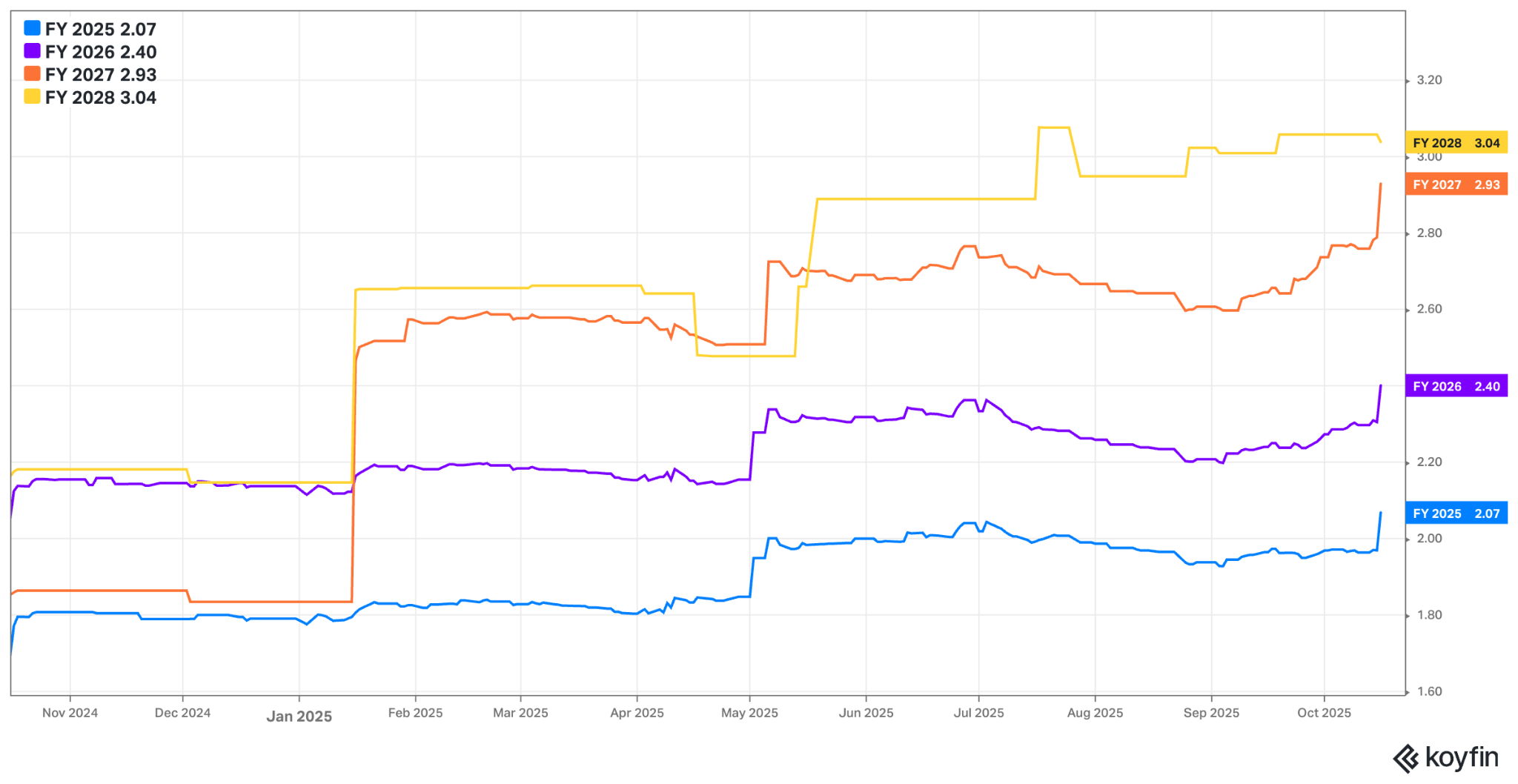

TSM trades for 22 forward earnings and 46x forward FCF. Earnings per ADR is expected to compound at a 19% clip during 2026 & 2027 following 40% growth in 2025. FCF is expected to compound at a 40% clip during 2026 & 2027 following 10% growth in 2025.

g. Call & Release

AI Super-cycle Runway:

The things to focus on when gauging forward-looking, multi-year demand will continue to be cycle longevity and how sharp the rest of the growth curve is. If insatiable AI infrastructure demand continues, there is no other company on the planet with a better chance of strongly capitalizing on that tailwind. As the manufacturer for essentially every single high-performance chip designer, they don’t care who wins market share. They don’t care if Broadcom ASICs win more deals… or if AMD GPUs gain more momentum… or if Google’s TPUs start taking external market share… or if Nvidia keeps dominating. All of these companies will be using TSM’s capacity to fulfill these deals. And? Its margin profile, per the team this quarter, does not depend on which company performs the best. Moats do not get much deeper than this one is. And while I cannot stand that grossly overused term, it is undeniably fitting in this specific case.

So what was the takeaway from runway-related commentary and signals? In a word… positive. Again, TSM raised their annual CapEx guidance from $40B to $41B, with CapEx being the most reliable indicator of leadership’s forward-looking demand view. They only spend on capacity when they see high-probability revenue opportunities connected to that incremental capacity. Most of those opportunities right now are in the realm of AI, so raising this is a positive read-through for cycle duration. Simply put, they remain overwhelmingly bullish on AI demand and that has only become more true in the last 3 months.

Pertaining to multi-year visibility specifically, increasingly complex chip designs are leading to extended lead times with customers (in some cases 3 years). That allows Taiwan Semi to deliver higher degrees of certainty, as heavy TSM lifting requires customer volume commitments down the road. That means they have an enviable degree of certainty when planning for the long-term.

- As an aside, by engaging so early on in the design process, TSM also minimizes the risk of spending too much time or energy on concepts that won’t survive. Certainly a nice spot to be in.

But wait, there’s more. AI token (unit of model output) volume is at a 3-month doubling cadence, with larger reasoning models and apps requiring exponentially more token throughput vs. predecessors. That growth is positively correlated with demand for TSM’s chip manufacturing. Revenue growth for the firm won’t match 100% Q/Q token growth, as chips are getting more efficient. But? That’s entirely fine. Nobody expects anywhere near 100% Q/Q revenue growth to be a durable or even one-off outcome for TSM. Delivering more strong quarters like this one will work just fine. And it sounds like that’s the plan for 2026:

Finally, the company is working hard to improve capacity constraints, but things remain “very tight” across the board. Whether it’s advanced technology or CoWoS… it’s all tight. This was still a robust quarter despite TSM being unable to keep up with demand growth. That’s an encouraging sign when it comes to cycle length… as it will take more time to service customer needs. Whether it’s signals from customer outlooks, the eagerness of enterprises to use all of this compute, sovereign AI tailwinds, massive deals being struck left and right or anything else… demand still looks great for this super-cycle. All of this is leading to management hinting at raising its 45% 2024-2029 AI revenue CAGR next year.

Gross Margin Puts & Takes:

Outperforming capacity utilization and internal cost controls helped drive the upside vs. GPM guidance and consensus estimates. It also sounds like the GPM dilution from global footprint expansion was smaller than expected for the quarter. That headwind is expected to lower GPM by about 150 bps this year vs. 250 bps previously guided to. That’s encouraging, but they still expect the 2026 margin drag to be 250 bps and slowly ramp to 350 bps – both of which are unchanged. This makes me think favorability here was either related to spend timing or they’re simply continuing to sandbag.

Taiwan Semi doesn’t enjoy the supply chain maturity, economies of scale or facility proximity advantages that it has built over the decades in Taiwan. This means USA, Japan and Germany expansion will lower gross margin, and they’re more than happy to accept this concession. Customers love the geographic diversification, as it helps with omnipresent geopolitical risk stemming from Taiwan. Furthermore, TSM expects to be the GPM leader in every single market they enter. So the relative advantage vs. its “peers” will remain intact. And finally, we’re just a few months removed from leadership telling us to focus on the “or higher” part of its long-term “53% GPM or higher” target. That already fully bakes in the global expansion headwind and is excellent regardless of it.

All of these tailwinds were strong enough to more than offset unfavorable foreign exchange movements.

Manufacturing Footprint:

Not many changes to footprint build-out plans. In the USA, they’re accelerating Arizona expansion plans, while preparing to add some CoWoS-related capacity. To bridge the gap between now and eventually meeting all of their USA CoWoS demand, they’ll continue to work with Amkor to fulfill customer needs. TSM is also nearing closure on another large parcel of land close to the Arizona facility, which would add even more capacity. While this certainly won’t match all of the margin advantages its Taiwan campus enjoys, it should help in closing that gap by creating a more efficient U.S-based system.

- In Japan, their Kumamoto facility is at “very good production yield” and it remains full speed ahead with building another plant.

- In Germany, they’re “progressing smoothly with plans” while.

- In Taiwan, they’re gearing up for more capacity expansion.

- One more note here. TSM continues to shift some N5 capacity to N3. This capability could allow it to meet more N3 demand without requiring brand new manufacturing facilities for all of that interest.

Tariffs & Trade:

Tariffs have had zero impact on the company’s demand. They also have high confidence in AI growth remaining rapid even if China slows due to any trade drama. Despite this financial obstacle not manifesting, they continue to be conservative in forward guidance, which could set them up for another easy quarter of beating and raising.

Advanced Technology Roadmap:

N2 is “well on track for volume production later this quarter.” They expect the ramp to be strong this year and even faster next year, as both AI-related and smartphone momentum builds. From there, N2P (upgraded iteration within the N2 family) will begin scaled production during the second half of next year. N2 tape-outs (chip designs) are expected to surpass N3 and N5, while delivering a 15% density and 25% speed enhancement from the most advanced N3-based product. A16 (1.6 millimeters) is coming around the same time as N2’s debut. It will build on TSM’s consistent progress with an 8.5% density and 17.5% power boost vs. N2P. No changes to report here… meaning no delays standing in the way of this roadmap.

h. Take

What else is there to say besides great quarter? Some wanted an even larger beat for Q4 guidance, but I think that’s being overly picky. The profitable growth engine is humming at a massive scale. And again… as chip designers race to grab market share, TSM (the manufacturer) does not care who wins. Their growth is not reliant on that technological race. They’ll win regardless. This company will keep rocking and rolling as long as the super-cycle lasts, and all signs point to the AI party raging on into 2026. Bulls will need to keep living with lingering China geopolitical risk, and this excellent quarter will surely make investors more comfortable in doing so. This is my favorite name in the broader semiconductor universe.