“These results demonstrate that Uber continues to drive profitable growth at scale. This is why we believe we’re well positioned for the journey ahead, in good or bad macro environments.” – CEO Dara Khosrowshahi

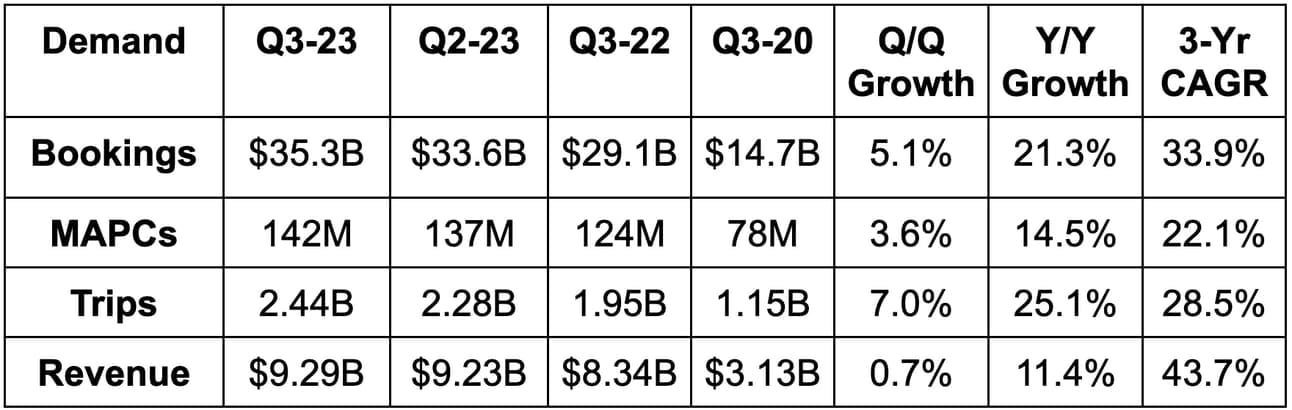

1. Demand

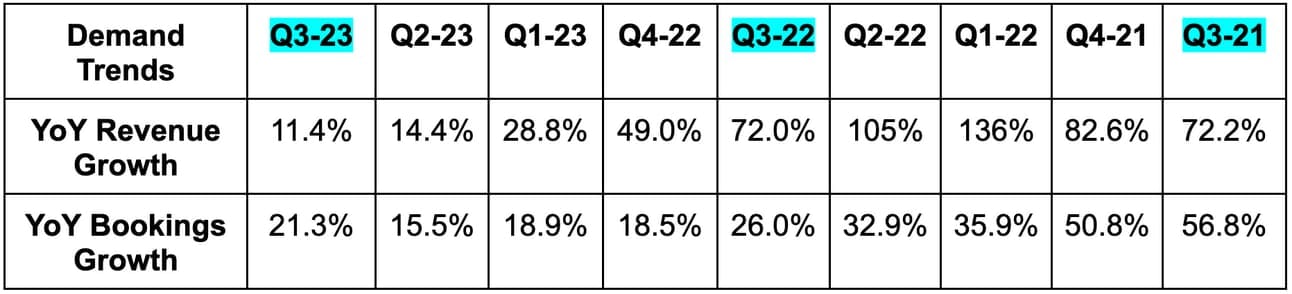

Uber beat bookings estimates by 2.3% and beat its identical bookings guidance by 2.3%. It actually missed revenue estimates by 2.5%. This was due to a $520 million hit from an accounting change. For business model compliance in nations like the U.K., it had to reclassify some sales & marketing expenses as a contra (AKA negative) revenue item. The impact was harshest in the delivery segment where promotional activity is the most intense.

- Revenue was 4% ahead of consensus and Y/Y growth was about 19.4% without this headwind. Growth comps will normalize next year.

- 25% Y/Y trip growth comfortably beat guidance of at least 20% growth.

- Monthly active platform consumers (MAPCs) reached another all time high. That’s what I expect for a growth company.

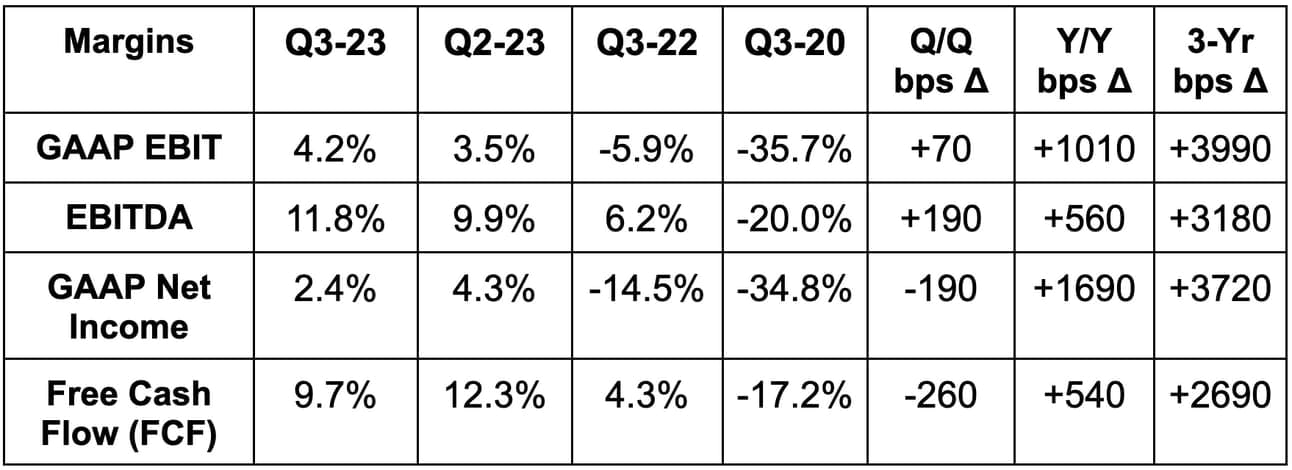

2. Profitability

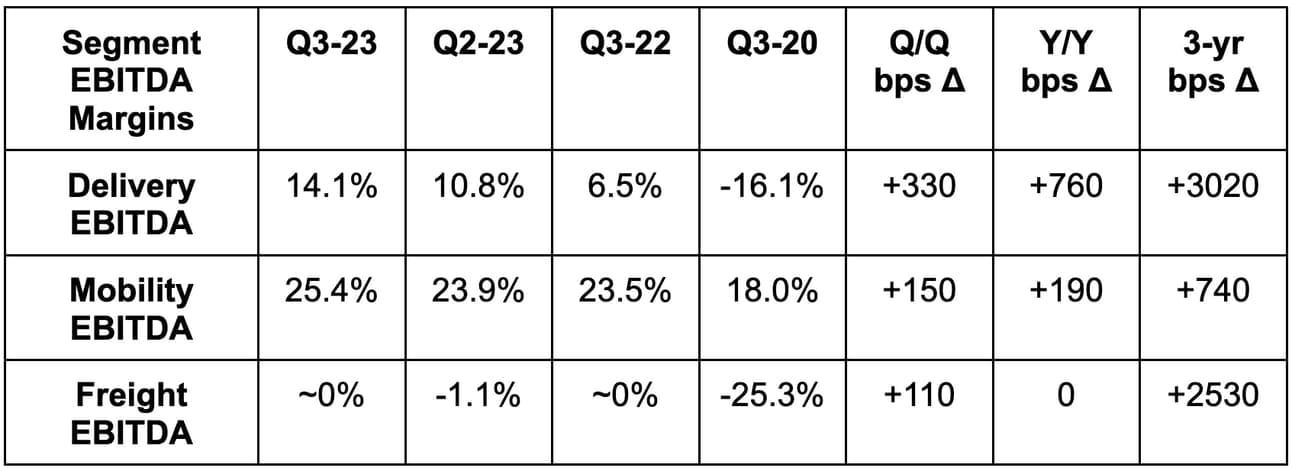

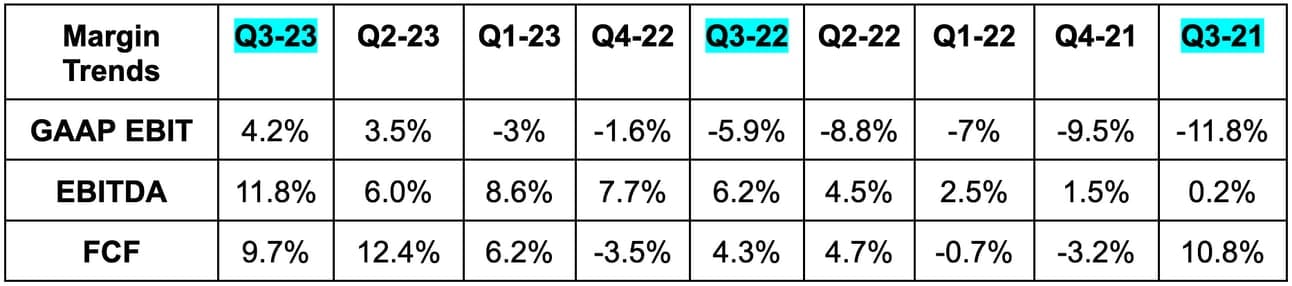

Uber beat EBITDA estimates by 6.9% and beat its EBITDA guidance by 9.0%. It beat GAAP EBIT estimates by 29.0% and missed $0.12 GAAP earnings per share (EPS) estimates by a penny.

As a reminder, GAAP EPS is heavily influenced by mark to market equity valuation swings. If Uber owns a stake in a company that saw its stock fall during the quarter, Uber’s net income suffers and vice versa. That’s not at all related to the unit economics of this business and is why I prefer GAAP EBIT. It’s less noisy.

Uber continues to tightly control costs. GAAP operating expenses as a percent of volume fell for all buckets Y/Y. The same is true for non-GAAP cost buckets as well. Headcount fell 1% Y/Y and the firm doesn’t expect much headcount growth in the near future.

Finally, it paid $622 million in non-recurring taxes to the U.K.’s tax authority (their IRS) during the quarter.

3. Guidance

Next quarter guidance was ahead on bookings by 1.6% and ahead on EBITDA by 5.2%. Demand on its platform “remains healthy” into November as it just wrapped up a new monthly record for volume in October. It also guided to flat freight volumes Q/Q. This puts the company on track to exceed $4 billion in 2023 EBITDA. At the start of the year, analysts were expecting $3.25 billion in 2023 EBITDA.

Outgoing CFO Nelson Chai told us the capital return update we’ve been expecting will come next quarter. It sounds like the firm is gearing up to add a new buyback. Its superior margins, scale and liquidity give it a clear path to the lowest cost of capital in the space. It sees this serving as a growingly “significant competitive edge” as it often does. I’d argue that edge here is even more significant than it usually is given the low margin nature of this sector.

4. Balance Sheet

- $5.2 billion in cash & equivalents.

- $5.1 billion in investments.

- $9.3 billion in debt with a $2.5 billion credit revolver.

- Share count rose by 3.3% Y/Y. This needs to slow and should with the lack of headcount growth. Stock compensation dollars also started an encouraging negative growth trend this quarter.

5. Call & Release Highlights

Demand:

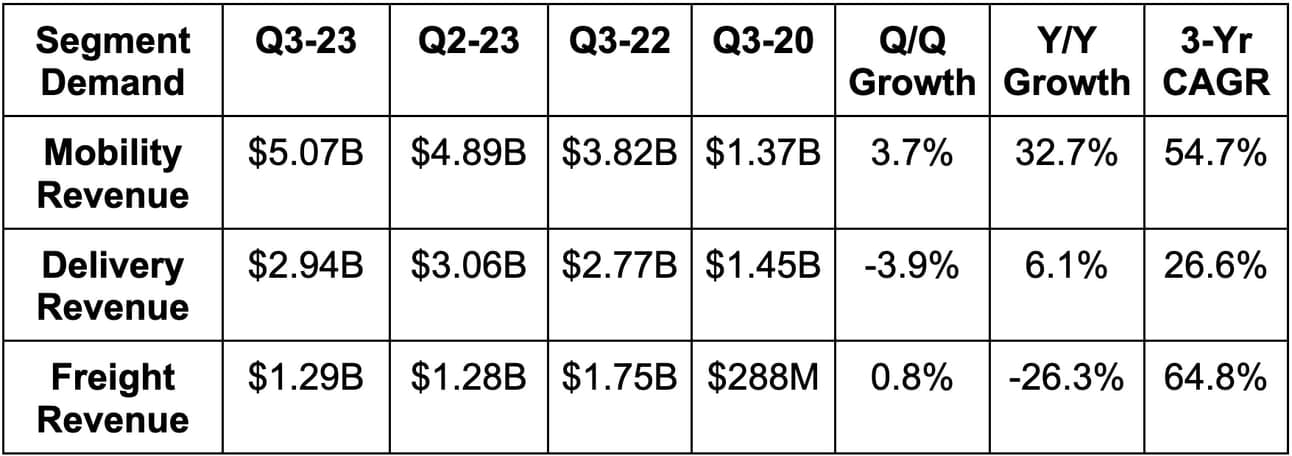

Demand and engagement remain rock solid. Y/Y trip growth accelerated to 25% vs. 22% last quarter and trips per monthly active matched an all time high. Overall, volume growth for mobility and delivery was strong at 31% Y/Y and 18% Y/Y respectively. Importantly, this “robust activity” has continued quarter-to-date -- hence the strong guide.

Mobility:

Strength across products and geographies was consistently broad. Still, there were some standouts. Asia Pacific and Latin America boasted the strongest quarterly accelerations for Uber.