“As the operating environment adjusts to a period of tighter capital availability and higher rates, we are poised to improve our competitive position… Put simply, we remain committed to best-of-breed cash flow growth, irrespective of the demand environment. The Uber platform has never been stronger and our expectations have never been higher.” -- CEO Dara Khosrowshahi

1. Demand

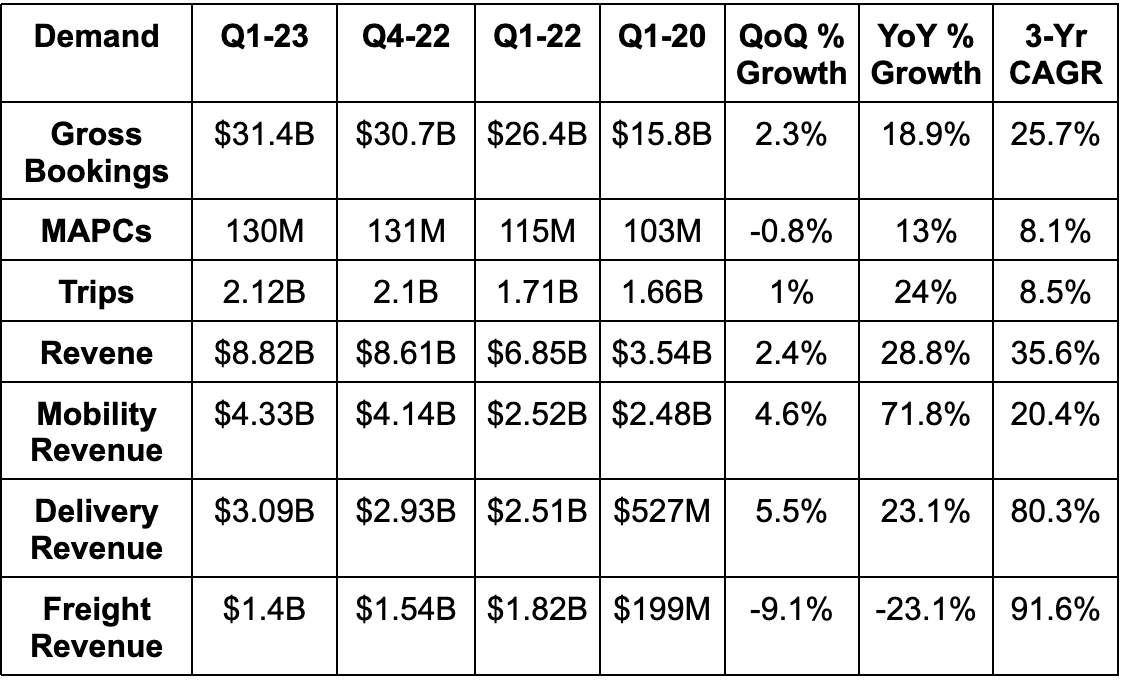

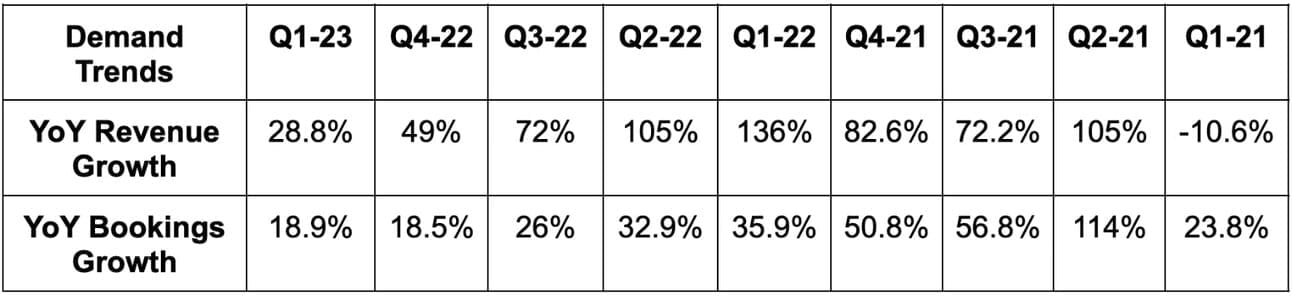

Uber beat revenue estimates by 1.3% and slightly missed the midpoint of its gross bookings guidance by 0.3%. Trips growth of 24% YoY met or beat estimates of at least 20% growth.

Demand Context:

- Trips growth accelerated from 19% last quarter to 24% this quarter.

- By region, USA + Canada (UCAN) saw 12% YoY growth, LatAm saw 31% YoY growth, EMEA enjoyed 86% YoY growth & APAC 41% YoY growth.

- Foreign Exchange (FX) hit bookings growth by 320 basis points (bps) which met expectations.

- Trips per MAPC rose 10% YoY.

- Uber continues to take share in most markets despite materially lowering driver and rider incentives from 2022. Its scale, product breadth (for more cross-selling) and operational tweaks to improve the experience for drivers and riders are working wonders. It sees this combination as the explanation for rising share, engagement and profitability.

- The newer the consumer cohort, the more frequent the engagement with Uber’s platform. This is direct evidence of new products working.

- The sequential rise in Uber’s take rate was mainly driven by typical seasonality.

Revenue growth greatly outpaced volume growth because of a revenue recognition change in the UK. That change led to Uber recognizing all fares charged for trips in that country as revenue. Uber used to function as a middle man that merely facilitated the transference of some fees without recognizing the revenue. This change boosted revenue growth, didn’t impact volume growth and hit margins due to dividing by a larger denominator. It made this model tweak to comply with new regulations… not to shadily juice revenue.

2. Margins

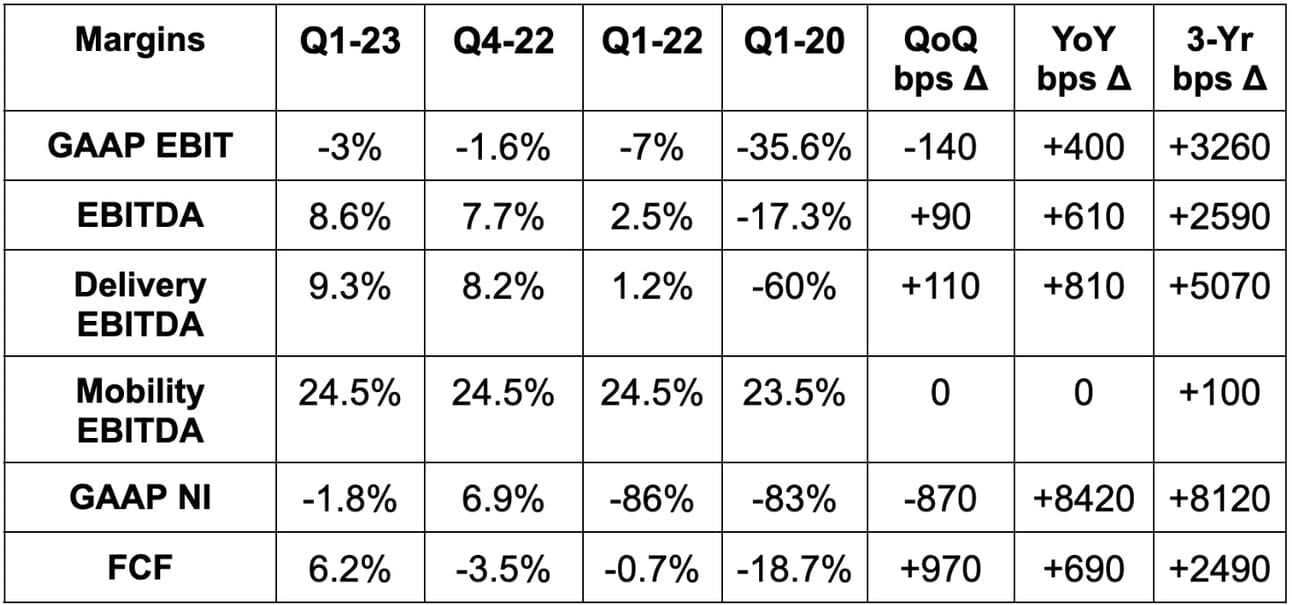

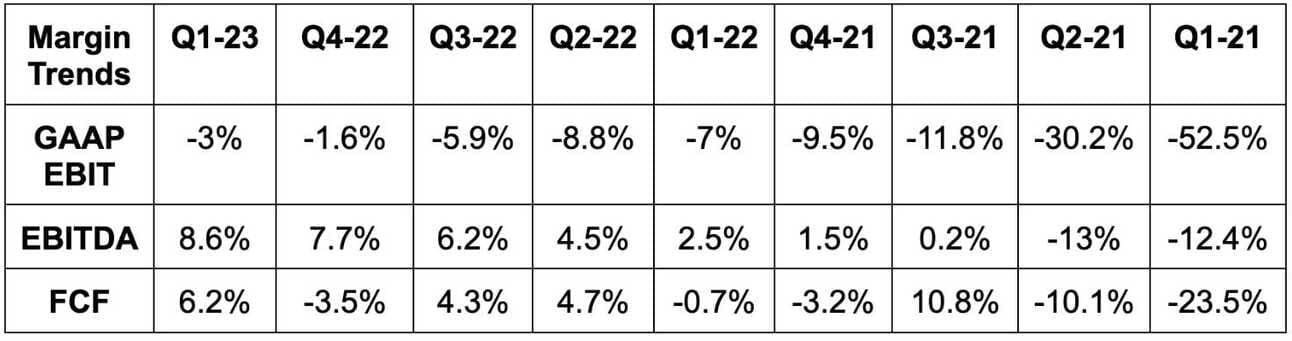

Uber beat EBITDA estimates by 12.5% and beat its EBITDA guidance by 11.9%. It also barely beat estimates of -$0.09 in earnings per share by a penny.

Margin Context:

- Uber saw modest operating leverage in every single cost bucket besides R&D which was stable at 1.5% of bookings YoY.

- Leadership thinks “free cash flow will ramp in the coming quarters.”

- Its incremental EBITDA margin was 12% of gross bookings vs. its operational goal of 7%.

3. Balance Sheet

- $4.05 billion in cash and equivalents. It sold about $1.1 billion worth of equity investment stakes after the Q1 period ended. This cash will be added to the balance sheet next quarter.

- $9.27 billion in debt.

- Uber refinanced its 2025 and 2027 term loans to 2030 maturities. The new terms come with credit spreads that are 75 bps more favorable than previously thanks to improving balance sheet health.

- Headcount fell QoQ after it reallocated some talent away from lower priority projects. This will drive more fixed cost operating leverage in the coming quarters.

- Uber’s credit rating was upgraded by S&P and Moody’s this quarter with both giving it a positive credit outlook. It’s committed to getting to investment grade debt.