In case you missed it:

- Palantir & Hims Earnings Reviews.

- Meta Earnings Review.

- Alphabet Earnings Review.

- Apple, ServiceNow & Starbucks Earnings Reviews.

- Amazon & Mercado Libre Earnings Reviews.

- PayPal Earnings Review.

- Tesla Earnings Review.

- SoFi Earnings Review.

- Netflix Earnings Review.

- Taiwan Semi Earnings Review.

- My current portfolio & performance vs. the S&P 500.

Coupang & Cava reviews are coming tonight. Robinhood, Duolingo, The Trade Desk and a few other reviews will come later in the week.

Table of Contents

a. Key Points

- Investing in a few growth areas with early success.

- Uber One growth remains strong.

- Uber’s mobility markets with the most autonomous vehicles are growing the fastest.

- Affordability is driving accelerating engagement.

- A link to Uber’s recent "GoGet" product event can be found here (section 7).

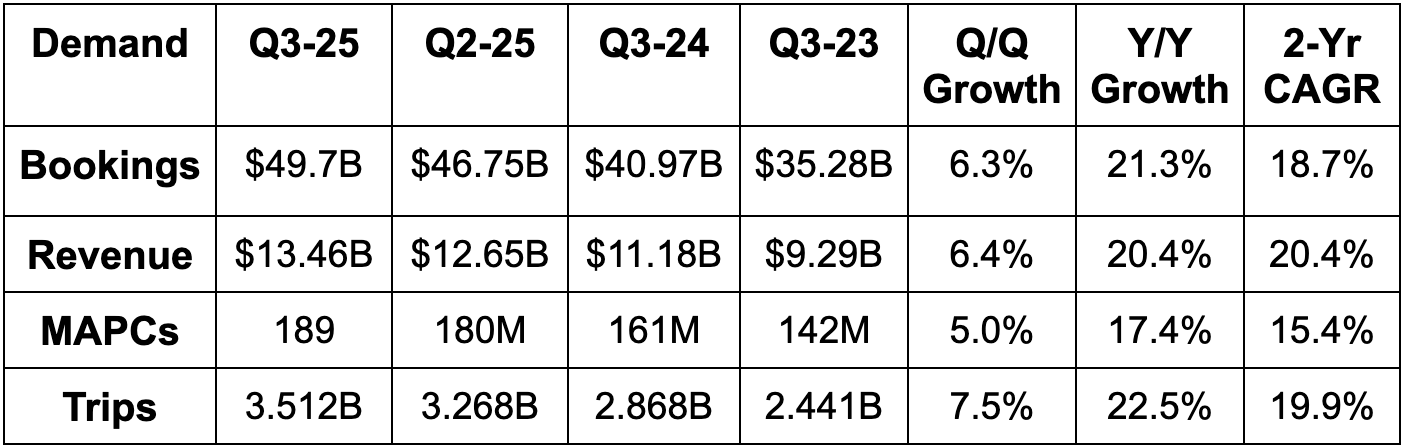

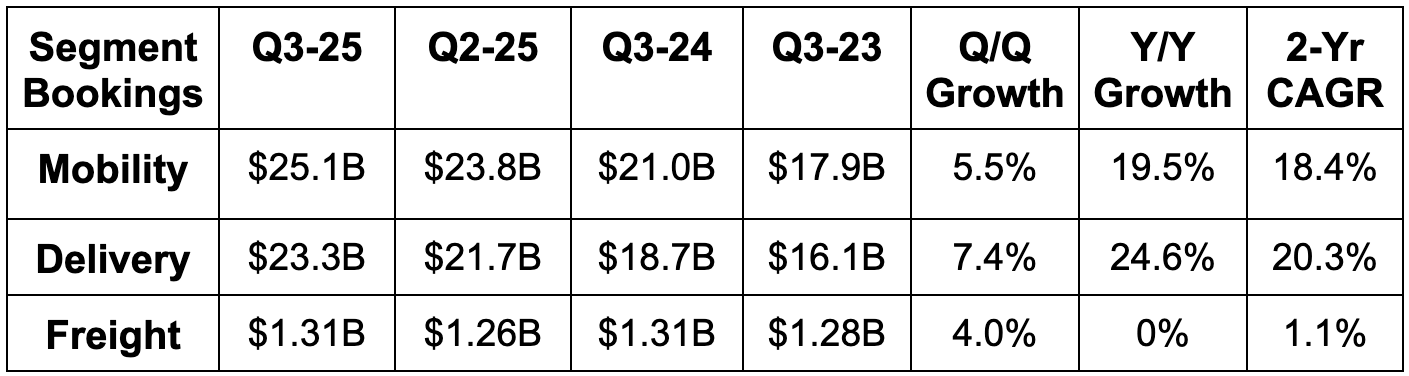

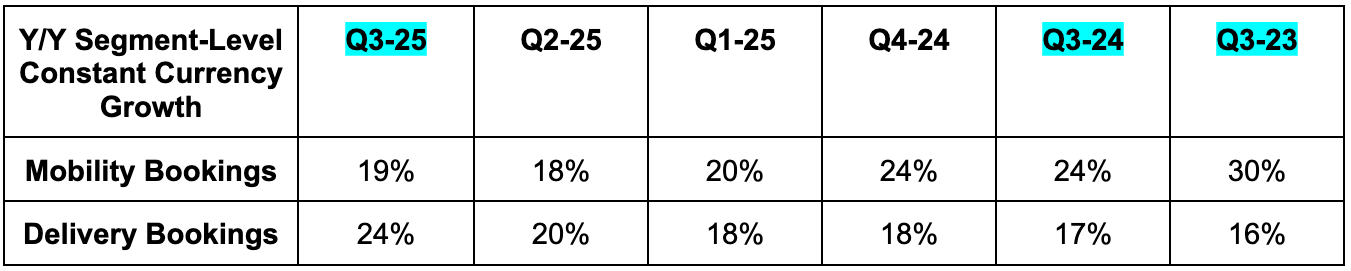

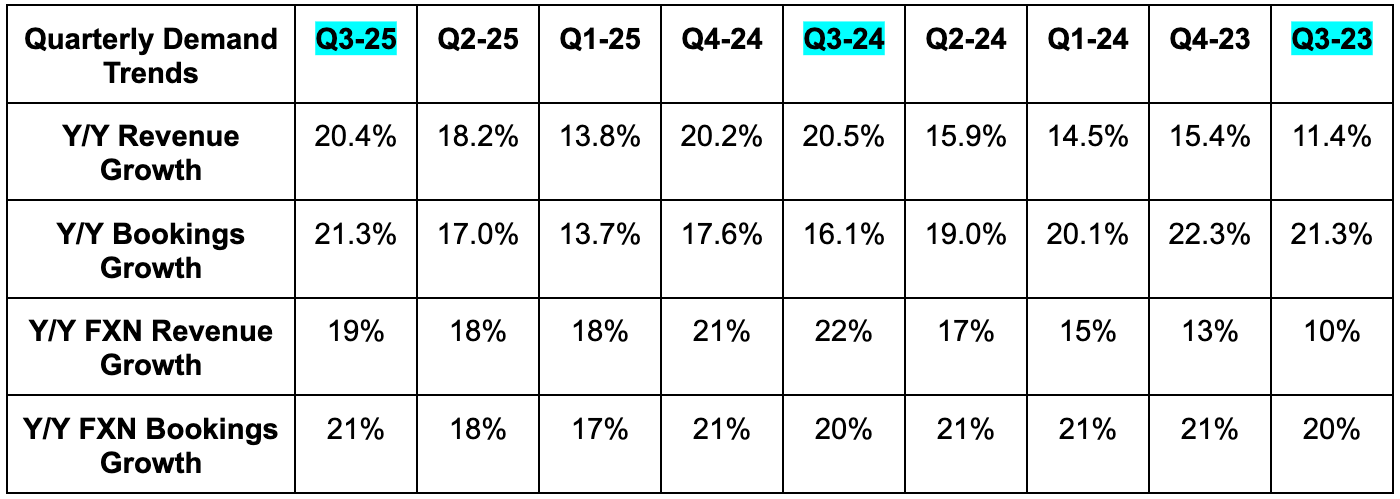

b. Demand

- Beat bookings estimates by 1.4% & beat guidance by 1.4%.

- Beat revenue estimates by 1.5%

- Beat Monthly Active Platform Consumer (MAPC) estimates by 2.6%.

- Foreign exchange (FX) was as expected. It did not help the revenue or bookings beats.

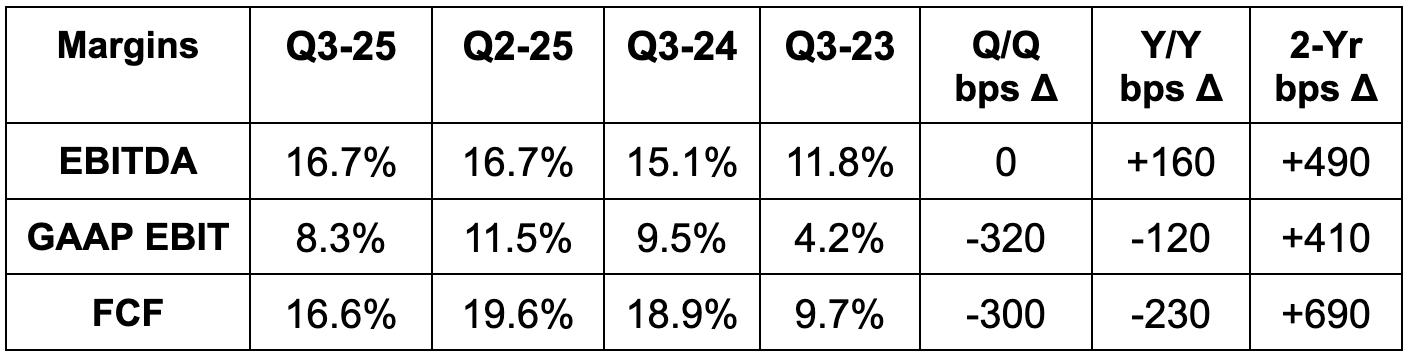

c. Profits & Margins

- Missed EBITDA estimates by 0.5% & slightly beat guidance by 0.4%.

- Beat FCF estimates by 5.6%.

- The large GAAP EPS beat was driven by equity investments. Not important.

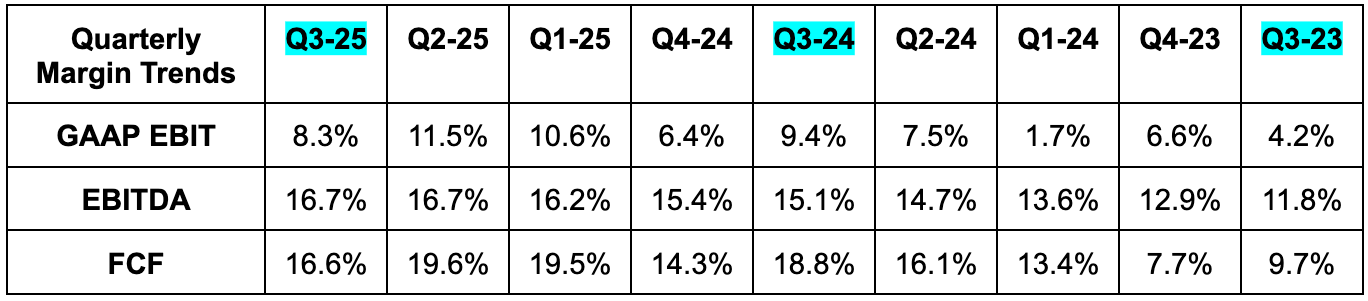

The GAAP EBIT margin contraction isn’t concerning. It’s related to a telegraphed acceleration in targeted investments (more later) and a $479M legal charge. Ex-legal, EBIT margin would have been 11.8% for a new company record.

d. Balance Sheet

- $9.1B in cash & equivalents.

- $10.3B in equity investments. They have sold $1.4B in investments so far this year and plan to keep selling over time to fund investments and shareholder returns.

- $10.6B in debt. They issued $2.3B in senior notes to retire notes with shorter maturities.

- Share count fell by 1.4% Y/Y.

e. Guidance & Valuation

The rest of this article is for paid readers. It includes guidance & valuation commentary, a detailed overview of the conference call & my take on the quarter and stock. Upgrade below to keep reading this, my current portfolio, 40+ earnings reviews every single season and consistently thorough equity research.