“Upstart has an opportunity to become one of the largest and most impactful fintech companies in the years to come. You will see us move beyond auto and consumer loans but we are so excited about the opportunities within these two categories that our near term focus is there.” — Co-Founder & CEO Dave Girouard

a. Demand

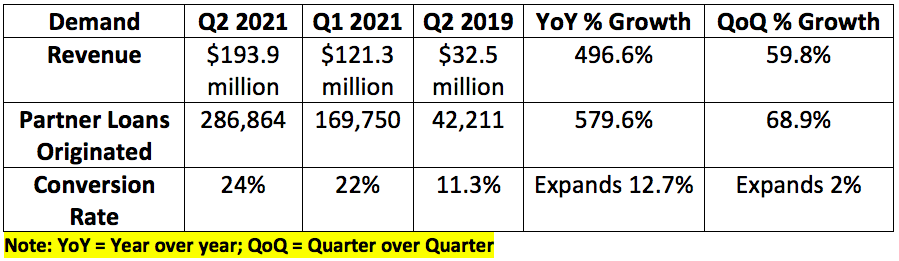

Upstart guided to $150 - $160 million in revenue for the quarter. Analysts were expecting $157.7 million in revenue. The company posted $193.9 million in revenue thus beating the high end of its internal guide by 21.8% and analyst estimates by 22.9%.

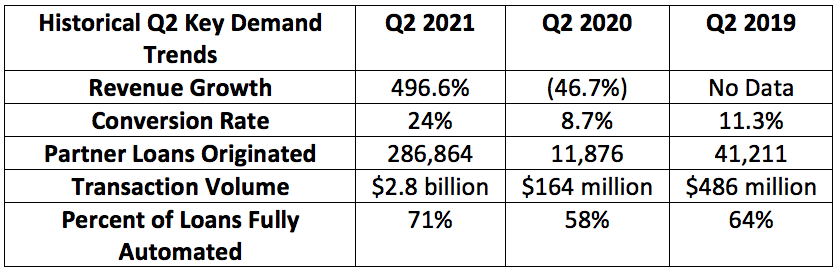

Note that demand for loans collapsed in Q2 2020 as a result of the pandemic halting economic activity. This made the year over year revenue comparison uniquely easy for Upstart. Because of this, I compared Q2 2021 results to Q2 2019 instead. The growth was still remarkable.

b. Profitability

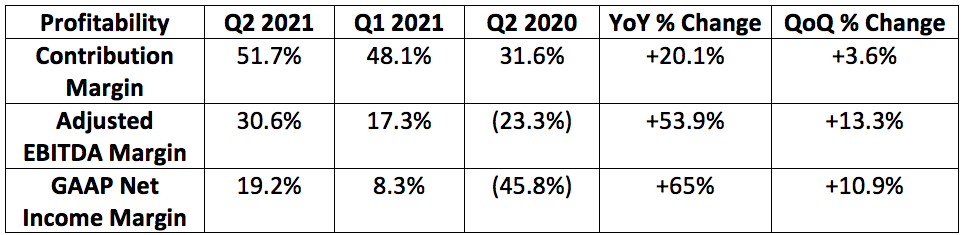

Upstart guided to a 44% contribution margin. It posted a 51.7% contribution margin thus posting results 7.7% above consensus.

Upstart guided to $21 to $25 million in net income. It posted $58.5 million thus beating the high point of expectations by 134%.

Upstart guided to $23 to $27 million in adjusted EBITDA. It posted $59.5 million thus beating the high point of expectations by 120.4%

Analysts expected Upstart to earn $0.25 per share. It earned $0.62 thus beating expectations by 148%.

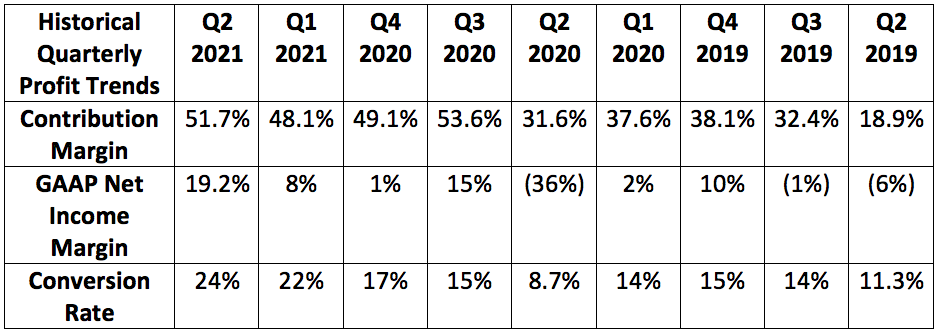

Upstart expects its 51.7% contribution margin to fall slightly in the coming quarters as it continues to accelerate spend. Still, CFO Sanjay Datta explicitly told investors during the call that elevated margins are a more durable trend than the company originally thought.

R&d remains the spend priority here, rising 66% year over year.

Last quarter, Sanjay Datta told investors a 22% conversion rate was higher than the company wanted it to be. He said he was taking this as a clear sign for Upstart to lean even more aggressively into growth and marketing. It can afford to see conversion rates well below 22% in exchange for even more growth. The conversion rate rising further to 24% this quarter means Upstart has more productive dollars to spend on growth — even after a 50% sequential boost to marketing spend.

It’s exciting to think where this company can be as it rightfully spends more and more on market share.