Today's Piece is powered by Quartr:

“We’re not happy with our results, but we are doing the right things to make the company as strong and powerful as it can be in the future. We are as committed as ever to this mission and we are taking steps to make this company better and stronger. We will be back on our growth track." — Upstart Co-Founder/CEO Dave Girouard

1. Upstart Demand

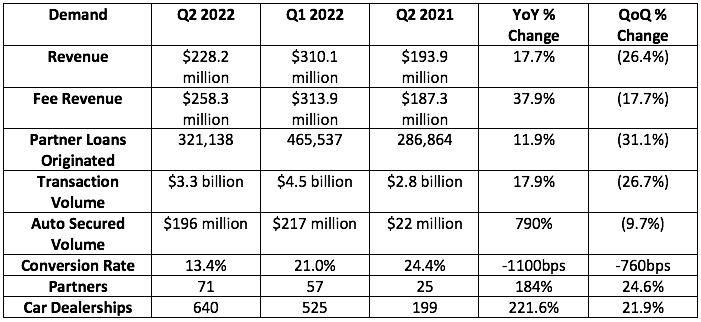

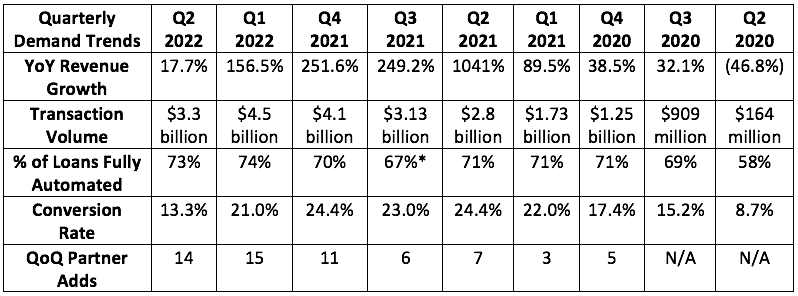

Upstart revised its Q2 2022 guidance lower from $300 million to $228 million on July 7th. Analysts were looking for $235.3 million in Q2 sales. It posted $228.2 million in sales, slightly ahead of its lowered guide but 3.1% below consensus analyst estimates.

Partners originated $914 million in the quarter vs. $1.77 billion originated by institutional investors. This partner origination made up 35% of its funding, representing the highest mark to date. That rise needs to continue. It was a little above 20% during parts of 2020 and 2021 for context. Volume retained by partners is more durable, profitable and visible for Upstart across credit cycles vs. relying on often fickle capital markers to fund. That relative durability showed up this quarter as partner volume fell 15% sequentially while institutional volume fell by over 40%.

More Context on Demand:

- Falling conversion rate is via supply constraints forcing Upstart to turn down some borrowers. Frustrating, I know. Borrower demand remains robust -- funding is the current bottleneck. Much more on this later.

- While Upstart continues to lean on capital markets for funding, it is intimately connected to these relatively volatile sources of funding. This explains the violent shifts in YoY growth rates across quarters. Upstart is not a lender -- but its business is still quite correlated to credit cycles.

- Q3 2021 was when Upstart had to address a fraud incident with manual controls. This weighted on % of loans fully automated.

- Upstart Auto Retail crossed $10 million in originated volume. It's still very small.

- The small business loan product is now live ahead of schedule. This didn't have a material impact on results.

2. Upstart Profitability

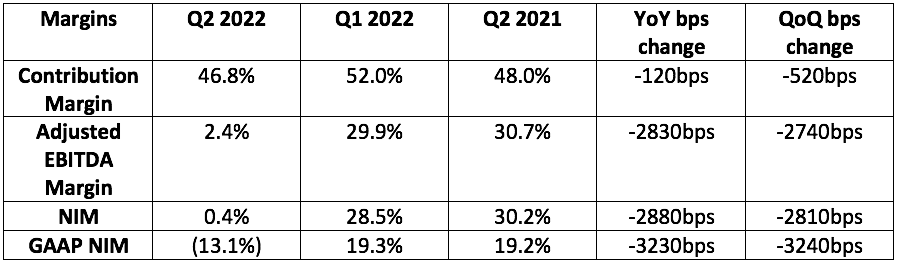

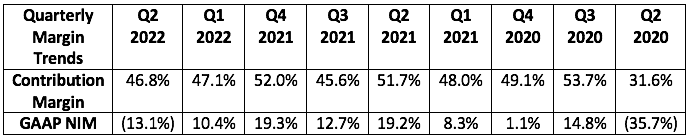

As part of the disappointing July pre-announcement, Upstart actually raised its contribution margin guidance from 45% to 47% as its take rate rises to combat volume declines. This was a small, positive sign of continued pricing power.

Conversely, it lowered its GAAP net income guide to a loss of $29 million. It lost $29.9 million, missing expectations by around 4%.

More Context on Margins:

- Personal lending contribution margin was 51%. Compression here is via the new auto business.

- Sales and marketing spend fell 21% YoY as it pulls back on promotional activity while funding remains timid.

- It has also reduced hiring to critical areas... so it's still hiring.

Thanks to Quartr’s app, earnings season is simplified, and the busiest periods of my year are far more manageable. It’s as simple as that. Whether it’s speeding through conference calls at various paces, or instant access to searchable transcripts, this service has got every Stock Market Nerd covered. And now, with its cutting-edge search tool, I can even see which bank partner just talked about Upstart, or which bellwether mentioned pricing power amid worsening macro. Talk about useful.

There's a very good reason as to why I'm an active Quartr user.

Must cost a fortune, right? Wrong. It’s a free-to-use force multiplier for research efficiency. Simply go to your app store of choice and try it today. There’s no other free tool like Quartr out there -- and I’m confident that you’ll all agree. Check it out here.