Today’s Piece is Powered by SavvyTrader:

1. Demand

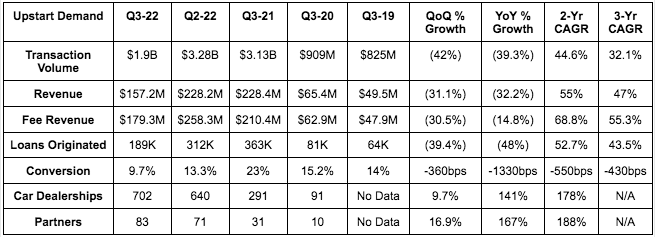

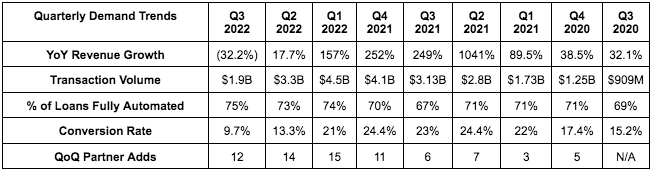

Upstart missed its revenue guide by 7.5% and analyst estimates by 7.3%.

More Context on Demand:

- The proportion of loan volume retained by partners so far in 2022 is 27.2% vs. 24% YoY. This source of funding is far more durable than institutional investor funding.

- Falling conversion rate is via 2 headwinds:

- Upstart loans are 800bps more expensive for borrowers than the same loans YoY. Especially for its less affluent demographic, this is a massive incremental cost burden.

- Funding supply from investors remains severely challenged. While Upstart continues to lean on capital markets for funding, it is intimately connected to these volatile sources of funding. The fast money hedge funds that were scooping up all of its volume in 2021 have since abruptly vanished. That’s why shifting to longer term funding supply and more partner retention is so vital. It hasn’t made enough progress yet to weather this large headwind.

- Upstart added more new lenders to the platform this quarter than in all of 2021.

- New Products:

- Small dollar loans sourced quadrupled QoQ to 9,000. All of these borrowers would have been previously rejected without the product.

- Borrowers now save $5,800 per Upstart Auto Refi vs. $4,800 QoQ.

- Upstart has sourced $10M in small business loans vs. $1M QoQ.

- Upstart Auto Retail added 3 more dealer groups this quarter to reach 22.

- ⅓ of Upstart Auto Retail applicants are now automatically verified vs. ⅙ QoQ.

- The negative fair value adjustments to the loans on its balance sheet amid rising rates as well as some loan sale losses led to fee revenue being greater than total revenue. At some point, this headwind will swing back to a tailwind and prop up growth in the future.

2. Profitability

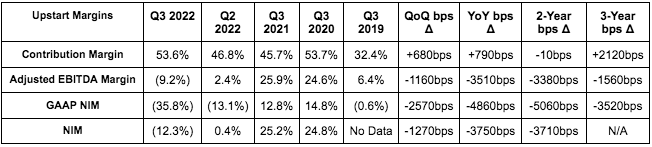

- Upstart missed its EPS guide of -$0.10 by $0.14 & analyst estimates of -$0.08 by $0.16.

- Upstart missed its GAAP EPS estimates of -$0.48 by $0.21.

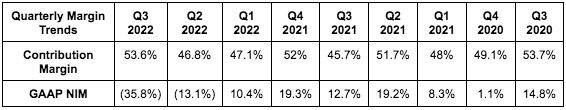

- Upstart missed its 59% contribution margin guide by 540bps.

- Upstart missed its breakeven EBITDA guide (analysts expected the same) by $14.4M.

More Context on Margins:

- Upstart has been cutting marketing (by 46% QoQ) & headcount costs to stay profitable through all of the turmoil.

- Upstart’s pricing power has allowed it to continue increasing its take rate which is why contribution margin expanded QoQ and YoY.

3. Balance Sheet

- Upstart has $830M in cash on the balance sheet. Its worst case scenario quarterly burn rate at this point is $30M. Insolvency is NOT a concern here. This is not Carvana or Opendoor.

- Upstart greatly slowed the pace of its buyback from $125M last quarter to $25M this quarter. I don’t think it should be buying back any shares right now.

- Still, shares outstanding grew by 2.9% YoY as the buyback was outpaced by stock comp expenses realized.

- Upstart has $700M in loans on the balance sheet vs. $624M QoQ & $252M YoY as it plugs funding supply gaps with its own cash.

- 64.3% of that $700M is for R&D purposes vs. 77.5% QoQ.

- It expects to add another $70-$80 million in loans to the balance sheet this quarter.