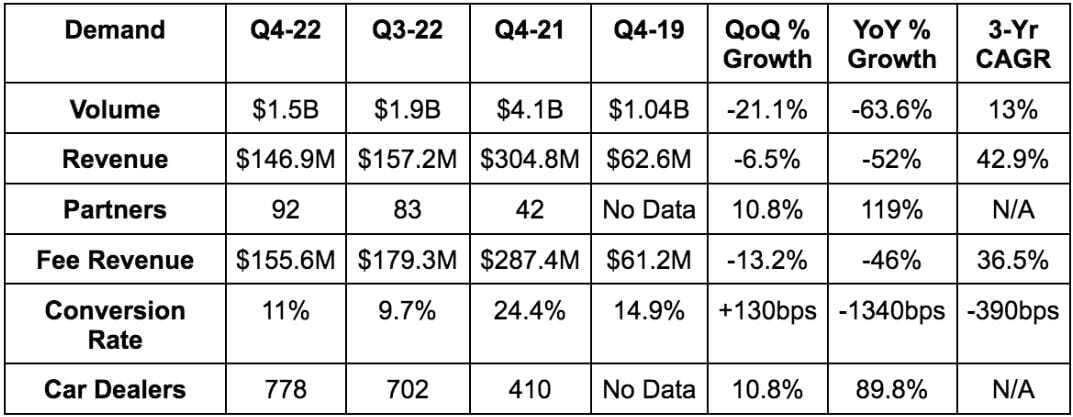

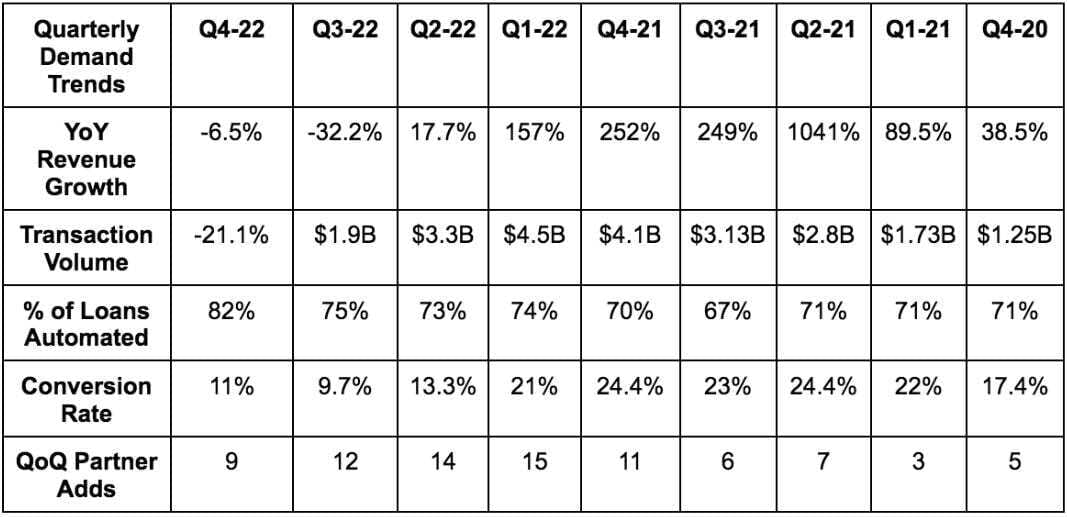

1. Demand

- Beat revenue estimates by 10.7% & beat its guide by 8.8%.

More Demand Context:

- Upstart’s demand was roughly in line with estimates. The beat was via holding more loans on the balance sheet than expected due to no suitors to sell the loans to. So it collected more interest income.

- Revenue fell 1% in 2022 as a whole vs. 2021.

- 82% of Upstart’s loans were fully automated vs. 75% YoY.

- Upstart continues to routinely turn down borrowers due to lack of supply. This is why conversion rate is plummeting.

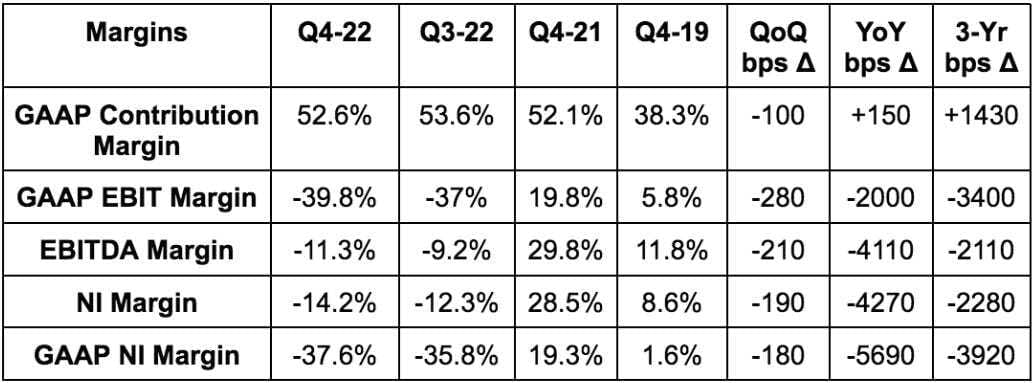

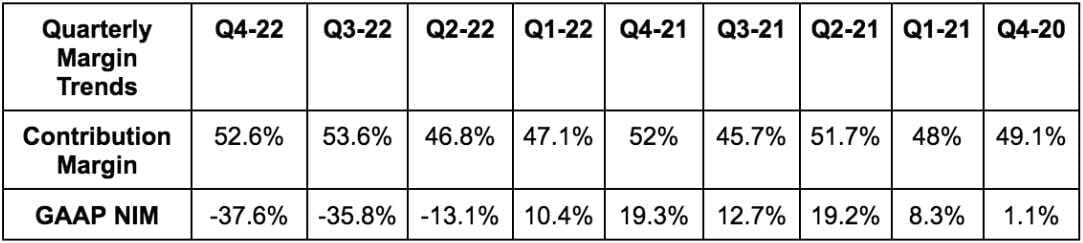

2. Profitability

- Beat EBITDA estimates by 54% & beat its guide by 53%.

- Beat GAAP EBIT estimates by 30.8%.

- Beat -$0.97 GAAP EPS estimates by $0.30 & beat -$0.45 EPS estimates by $0.20.

- Missed its contribution margin guide of 54% by 160 basis points (bps; 1 bp = 0.01%)

More Margin Context:

- Contribution margin expansion is via higher take rates and more efficient marketing spend.

- Sales & marketing fell 56% YoY.

- EBIT fell from $141 million in 2021 to -$113.9M in 2022.

3. Balance Sheet

Upstart added $310 million in loans to its balance sheet. This was more than 4X the number it guided to. Yuck.

Most of this $310 million was core personal loans that it could not match with affordable external funding supply. As of now, its has $492 million in testing loans on the balance sheet for R&D purposes and $518 million in core personal loans. This company should be in survival mode right now and should not be adding loans for R&D purposes in my view.

On the bright side, operating cash burn of $674 million for 2022 was a matter of adding these loans to its balance sheet. So? it can revert the cash burn by not continuing to add loans like it hinted at being the plan in 2023. Some argue that the loans are valuable assets that can be liquidated if need be. They argue this makes the balance sheet fragility less concerning. It’s a fair point, but at the same time, its cash position falling from $986 million to $422 million YoY significantly crunches the timeframe of that outcome needed to come to fruition. It has about a 4-5 quarter runway of GAAP cash burn (ex-restructuring charges) which is far from comfortable despite cost control efforts.

It no longer has the luxury of time on its side. It needs credit markets to ease in a timely manner to stay solvent. If pundits like Michael Burry are correct, a resurgence of inflation and credit markets becoming even more conservative could force this company into an expensive capital raise to stay afloat.

- It has $986 million in borrowings vs. $695 million YoY.

- Partners retained about 30% of Upstart’s loans in 2022 vs. 26.3% in 2021. This is encouraging progress and must continue. Partner retention is inherently more durable and less sensitive to credit market cycles than capital market participants. A higher % here means a higher quality book of business.

- It bought back another $28 million in shares which slightly accelerated QoQ. This is silly to me and borders on irresponsible. Capital preservation at the moment is far more pressing than buybacks. Preserve the dollars. Stop buying back shares. I’d prefer dilution today over being forced into a debt or equity raise with likely poor terms tomorrow.

- Stock comp was 23% of revenue vs. 9% YoY. Stock comp dollars fell YoY, but revenue fell more sharply.

4. First Quarter 2023 Guidance

Upstart’s revenue guidance of $100 million missed estimates by a whopping 36%. The guide includes $110 million in fee revenue and a net interest loss of $10 million due to fair value adjustments on its loans. This is largely a factor of Upstart not being willing to use its balance sheet to fund more loans until it can find suitable partners to sell existing balance sheet loans. There aren’t any right now. And there’s also very little capital market and partner funding appetite. So? The large revenue miss is a matter of supply drying up. To a lesser extent, rising borrower interest rates are diminishing demand a tad, but this is almost entirely a supply-based issue. Demand remains “strong.”