a. Zscaler 101

I will be turning these 101s into an archive category and linking to them starting next earnings season. Thank you to @JBL on Discord for the great recommendation.

Zscaler is a large player in network security. It competes with Palo Alto’s next-gen suite, Cloudflare and many others. Zscaler’s Zero Trust Exchange (ZTE) is its overarching, cloud-native security platform. It blazes a trail between users, apps and devices across eligible networks. Zero Trust is exactly what it sounds like: never trusting anything. The exchange vets and verifies all traffic as it moves within a company’s perimeter. It doesn’t allow bad actors to breach infrastructure weak spots and gain free access to everything else thereafter. That’s called “lateral threat movement.” It never trusts (as the name indicates) and constantly verifies. Zscaler uses risk scores to assess needed levels of security for requests. That makes sure it’s only creating user friction when there’s actual security concern. This Zero Trust approach routinely cuts infrastructure costs for customers by shrinking the attack surface down to grant more granular permission.

ZTE replaces an antiquated firewall and virtual private network (VPN) setup in which fixed rules determine entry into the firewall-protected environment. Once that entry is granted, every device & user within a perimeter gets perpetual and unconditional access. I think it’s clear to see how that could be more problematic than ZTE’s approach.

Product & Growth Pillar #1 – Zero Trust Everywhere

Zero Trust Everywhere (can’t call it ZTE because that’s the name of Zero Trust Exchange) is made up of its core network security products, branch-level security, and Zero Trust Cloud.

Core Network Security Products:

- Zscaler Internet Access (ZIA) protects internet connections. It’s the middleman between a user and a network that ensures proper authorization & access.

- Zscaler Private Access (ZPA) offers remote access to internal apps. This upgrades VPN utility by “connecting directly to required resources without public exposure,” per Zscaler filings.

- Zscaler Digital Experience (ZDX) ensures high quality and always-on performance of cloud apps. It sifts through networks to identify sources holding back productivity to be fixed.

- This includes application performance monitoring, some endpoint monitoring tools and more.

- Zscaler for Users is the firm’s bundle that combines ZIA, ZPA and ZDX.

Branch-Level Security:

For newer, ZPA-related products, Zero Trust Segmentation localizes and separates networks. Branch security treats every single company location as its own island or network to shrink the attack surface. These “islands” connect to single apps or network subsections only when needed. That’s called micro-segmentation. This lowers the risk of lateral threat movement and is offered through a unified appliance. This means there’s one console for campuses, factories, retail shops etc., thus reducing complexity and friction.

Zero Trust Cloud:

Zero Trust Cloud is Zscaler’s name for cloud app and workload use cases within its core network security products. Zscaler also offers configuration analysis and cloud workload protection products.

Product & Growth Pillar #2 – Data Security Everywhere:

Zscaler Data Fabric is the term it uses for openly integrating with a long list of needed data sources. It handles ingestion, organization, “harmonization” and the unleashing of this lucrative context. Zscaler offers data security across endpoints, email, web, GenAI apps, legacy software etc. If it’s already protecting so much of the world’s network traffic… and if it already leverages all of this data (structured and unstructured) … that gives it a head start on using this insight to offer more products.

- Data security posture management (DSPM) granularly tags, organizes and protects cloud-native data.

- Data Loss Prevention (DLP) guards clients against data leakage or theft. This works for email, cloud, web, endpoints and more.

- Data Fabric for security is how Zscaler collects and combines needed context from 1st-and 3rd-party sources. This improves overarching security visibility to ensure proper hygiene, strong risk management and timely remediation.

- Data Security Everywhere is the name of the unified suite.

Product & Growth Pillar #3 – “Agentic Operations:”

This includes security operations (SecOps), IT Operations (ITOps) and all other AI product innovation. ITOps includes products like its AI Copilot for ZDX (GenAI assistant) and ZDX Network Intelligence. This tracks internet service provider (ISP) performance. It readily uses outage data to refine Zscaler’s zero trust exchange efficacy. This helps performance and up-time.

Within SecOps:

- Unified Vulnerability Management (UVM). This offers a bird's-eye view to tag, assess and remediate vulnerabilities across all cloud environments and assets. It ranks all issues, prioritizes pressing items and offers the best course of action for remediation.

- Risk360 flags vulnerabilities and offers end-to-end risk quantification with intuitive next steps for remediation.

- Business Insights: Broad visibility into app usage, costs, needs and engagement. This helps minimize unneeded apps and licenses.

Other AI Product innovation to know:

- AI Data Security Classification adds what it calls “human-like intuition” to identifying sensitive data across 200 types of information. This accelerates the process of uncovering “unexpected sensitive data” and vulnerabilities. Rather than static if/then statements across a few categories determining if data posture is healthy, this makes that process far more dense and nuanced, without adding hefty cost of complexity.

b. Key Points

- Go-to-market fixes are working.

- Forward-looking demand signals are strong.

- Product expansion is gaining momentum.

c. Demand

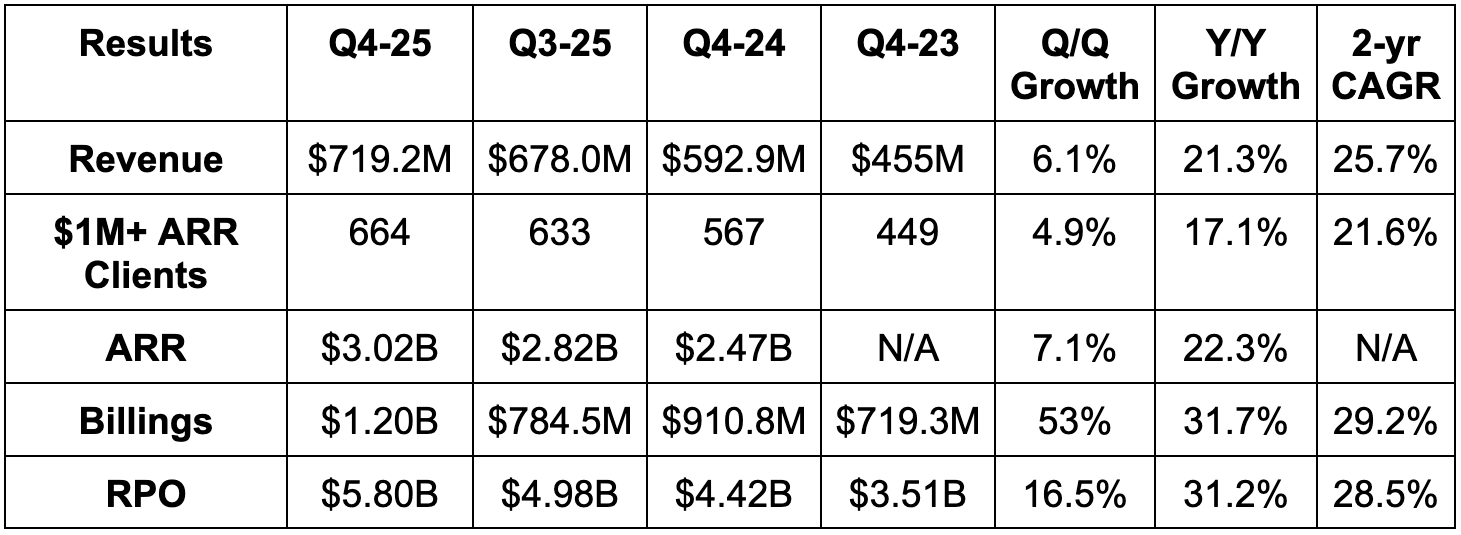

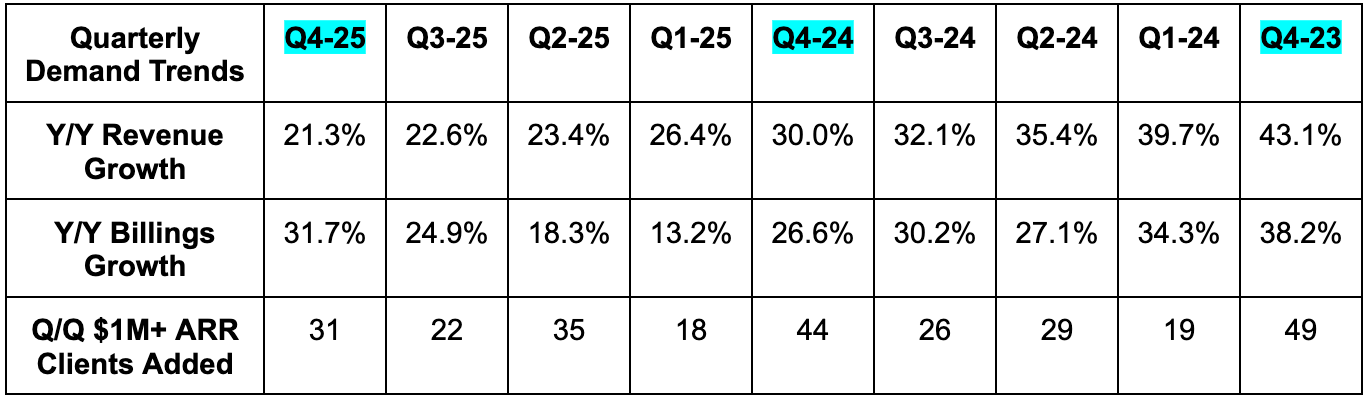

- Beat revenue estimates by 1.7% & beat guidance by 1.9%.

- Its 25.7% 2-year revenue compounded annual growth rate (CAGR) compares to 27.2% last quarter and 29.3% 2 quarters ago.

- Beat billings estimates by 5.3% & beat guidance by 5.3%.

As a reminder, annual recurring revenue (ARR) is a new company disclosure. It’s moving focus away from billings and towards that, which is something I support. Better metric from this type of business. $1M+ ARR customers rose 18% Y/Y.

d. Profits & Margins

Upgrade below to read the rest of this article (profits, balance sheet, guidance, detailed conference call notes and my take), dozens more reviews from this quarter and consistently thorough news & analysis. There's a reason why several Fortune 500 executives are consistent readers.