Table of Contents

In case you missed it:

- SoFi Earnings Review.

- AMD & PayPal Earnings Reviews.

- Palantir Earnings Review.

- Microsoft Earnings Review.

- Meta & ServiceNow Earnings Reviews.

- Starbucks Earnings Review.

- Apple & Tesla Earnings Reviews.

- Netflix Earnings Review.

- Taiwan Semi Earnings Review.

- Axon Deep Dive.

- My Current Portfolio & Performance (I cut a position last week).

1. Alphabet (GOOGL) – Q4 2025 Earnings

a. Key Points

- Fantastic quarters for Search and Cloud.

- Massive 2026 CapEx guidance.

- The Gemini app has 750M monthly active users vs. 650M sequentially.

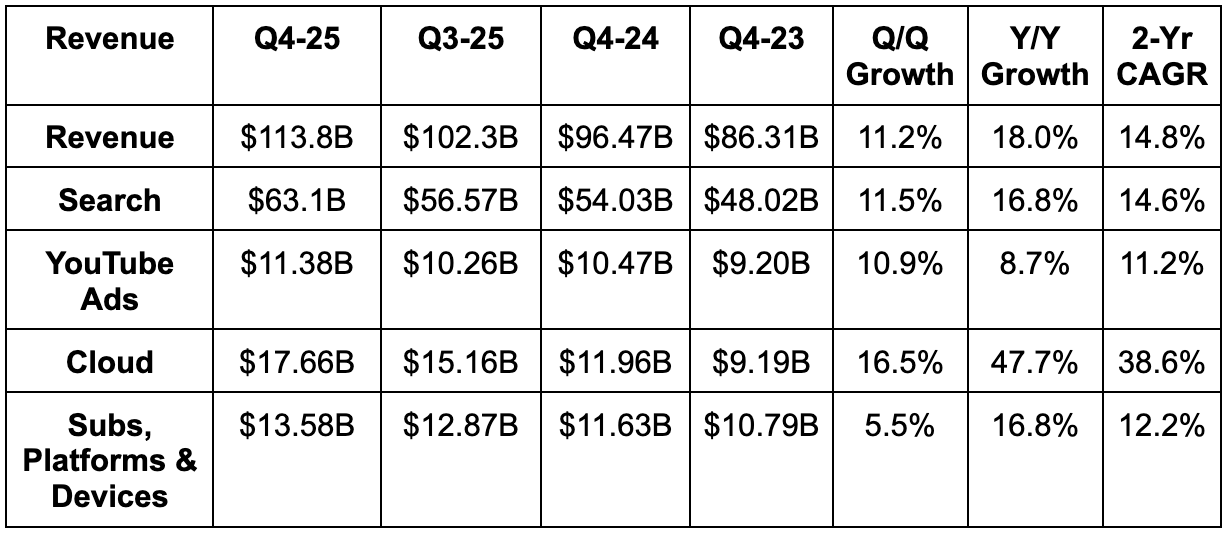

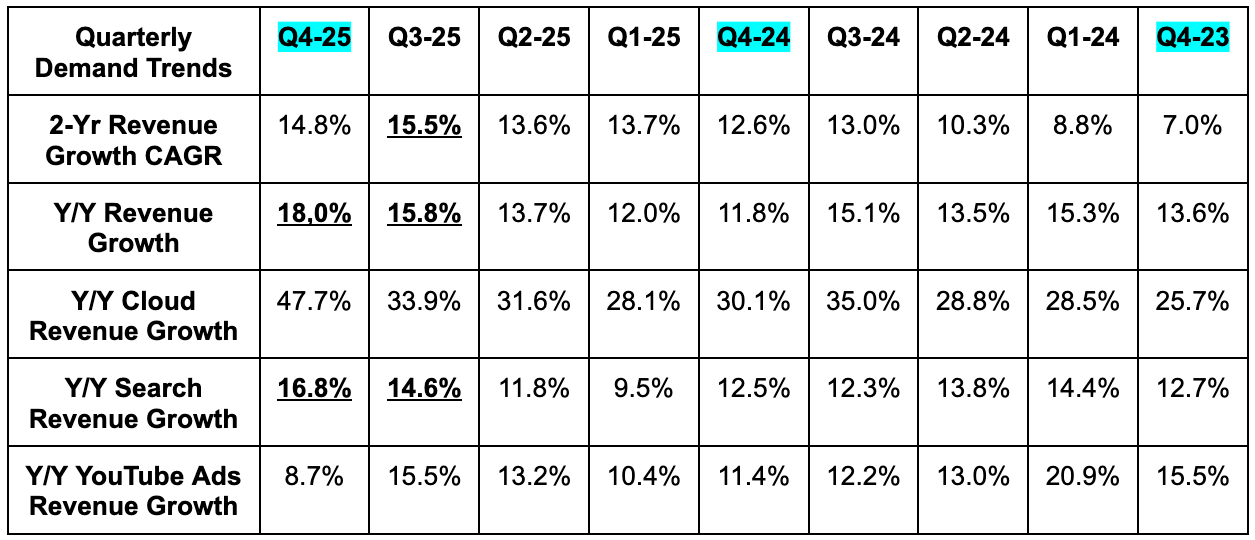

b. Demand

- Beat revenue estimates by 2.1%.

- Constant currency (CC) revenue growth was 17% Y/Y.

- It has 14 product lines over $1B in annual revenue.

- Search beat estimates by 3%.

- YouTube missed estimates by 3.7%.

- Cloud beat estimates by 9%.

- Total paid subscriptions crossed 325M vs. 300M Q/Q. Google One and YouTube Premium were the highlights (especially Music).

The cloud backlog grew by 55% Q/Q (100% Y/Y) to $240B. Importantly, contracted Anthropic compute is a big piece of the large jump, but Alphabet was careful to mention a few times that it was driven by a “wide breadth of customers.” That's nice, but Anthropic was still $50-$60B of the ~$86B increase. That’s not the same thing as getting nearly half of your entire cloud backlog from OpenAI like Microsoft does. Anthropic is relatively more fiscally responsible than its aggressive rival and not throwing out giant spend commitments left and right. Still, they are burning a lot of cash and this does create more concentration risk.

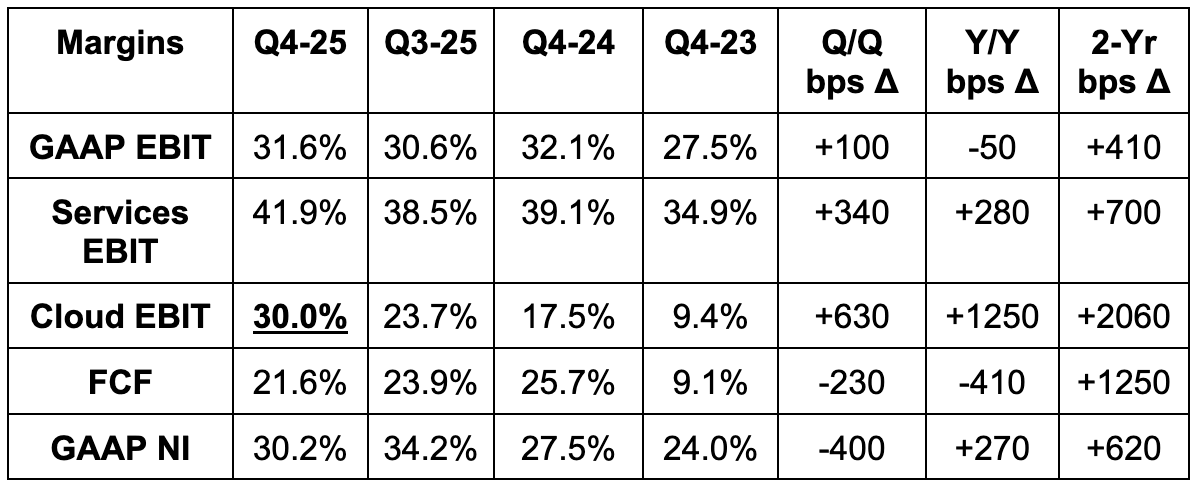

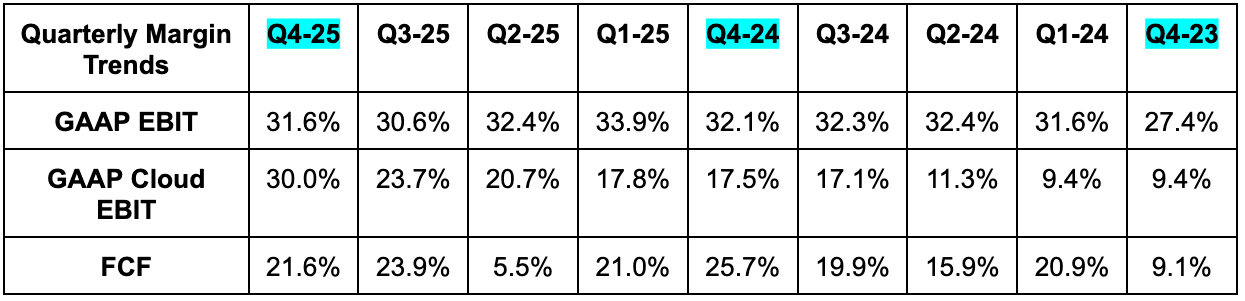

c. Margins

- EBIT missed estimates by 2.9%.

- Cloud EBIT beat estimates by 45%

- Other bets EBIT missed $1.3B estimates by $2.4B.

- EPS beat $2.64 estimates by $0.18.

- EPS rose by 31% Y/Y.

- FCF beat estimates by 57%.

- CapEx was 1.5% below expectations, so that did not help the FCF beat.

EBIT included $2.1B in compensation related to the Waymo investment round. This was part of operating expenses (OpEx). Excluding the item, EBIT beat estimates by 3%. At the same time, equity investments boosted net income by $2.3B. Excluding both of those items, EPS would have beaten estimates by $0.16 instead of $0.18. The Waymo charge led to sharp R&D growth and OpEx growth of 29% Y/Y. 21% G&A growth was also elevated, but that was due to charitable donation timing.

d. Balance Sheet

- $127B in cash & equivalents; $38B in non-marketable securities.

- $46.5B in debt. Took out $25B in unsecured notes during the quarter.

- Share count fell by 1% Y/Y.

e. Guidance & Valuation

2026 CapEx guidance at $180B was 50% ahead of $120B consensus estimates. This represents 100% Y/Y growth vs. 2025. This likely means Alphabet will generate very little 2026 FCF, considering operating cash flow estimates are $188B for the year. They’re currently expected to do $72.2B in 2026 FCF and I think those estimates are going to plummet. This is making Meta look conservative. Hard to do right now. Just like the other mega-caps, the massive spend is to support fantastic demand signals for their cloud services, address supply scarcity and alleviate future growth bottlenecks. About 60% is for servers and 40% is for data center buildings and networking equipment.

Depreciation expense for the full year will by faster than 38% Y/Y in 2025 due to hefty CapEx investments over the last few years.

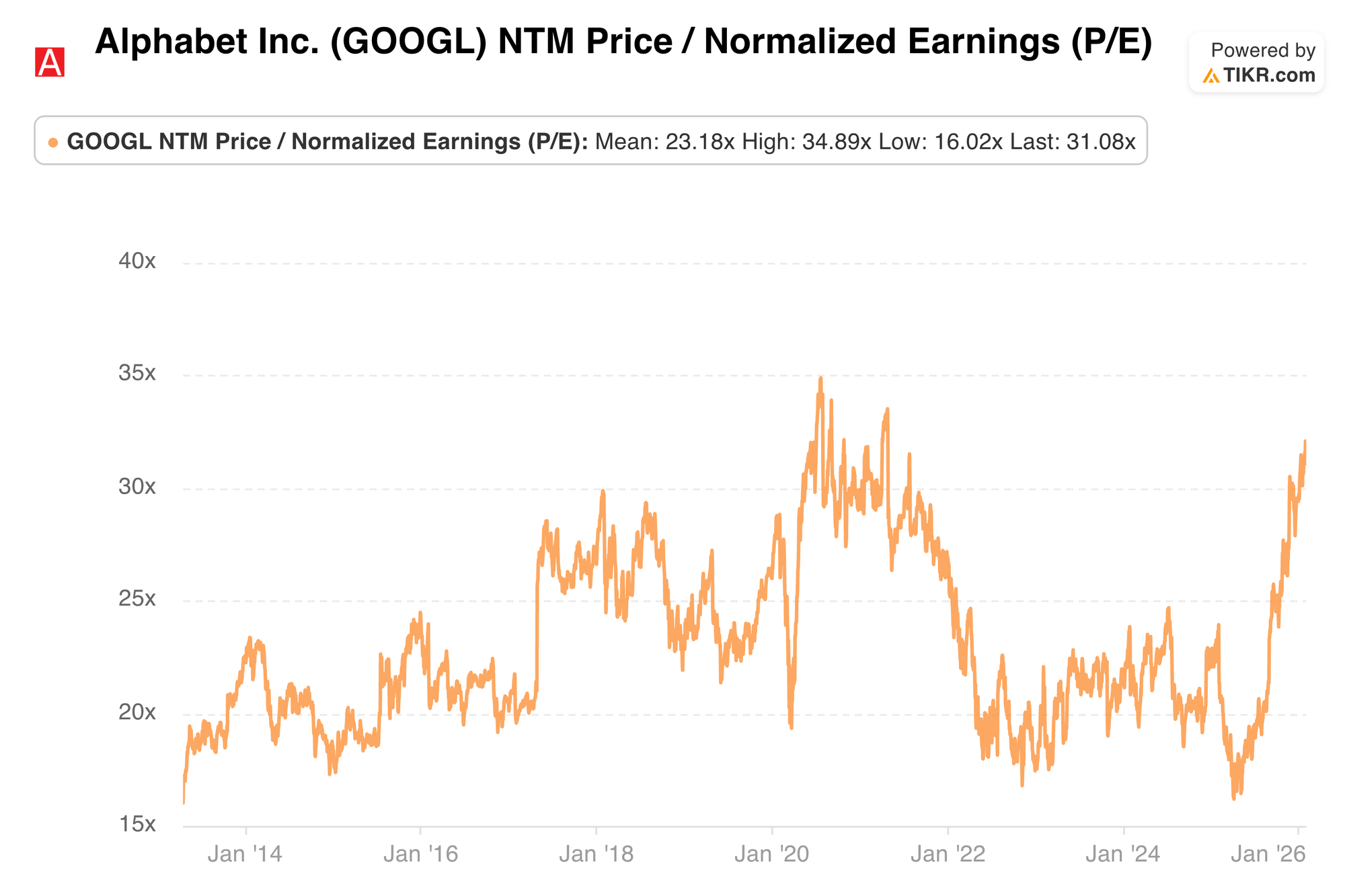

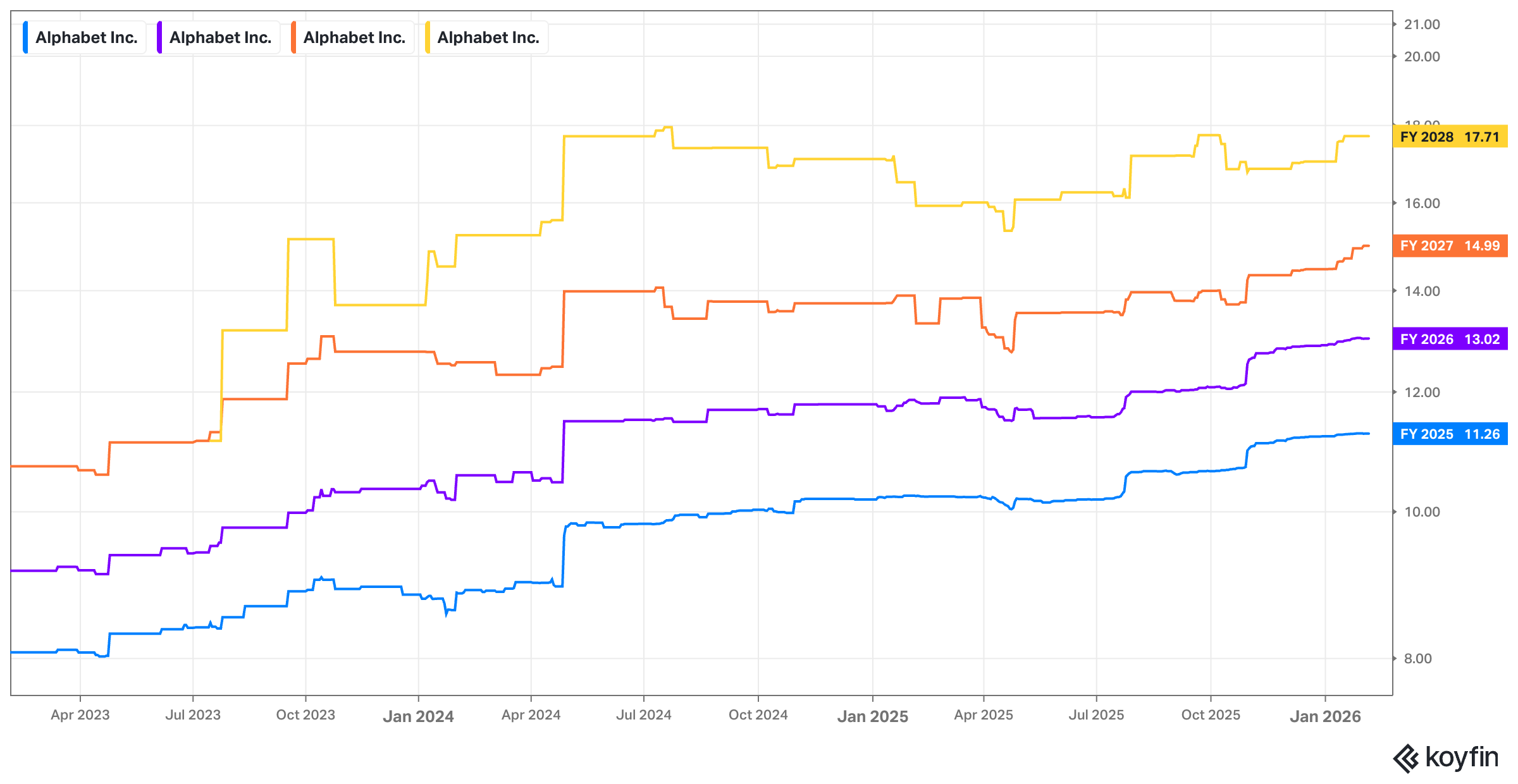

Google trades for 31x forward EPS vs. 17x last year. EPS is expected to grow by 4% this year and by 15% next year. It has quickly gotten quite expensive in the last 12 months.

f. Call

Search:

The pace of innovation for Google’s suite of search products remains excellent, as it shipped 250 products across AI Mode and AI overviews during the quarter. The updates included integrating Gemini 3 and making the transition from overviews to AI mode easier. So far, these items have fostered a doubling in AI mode queries per user, spearheaded more complex and lengthy user sessions and delivered more multimodal consumer inputs.

Cloud & AI:

Everything is going well for this segment. Their pace of contract wins exiting 2025 was double the start-of-year pace. They signed more $1B deals in 2025 than they did in all of 2022-2024 and fortified relationships with existing customers. These customers consumed 30% more than initial commitments and provided considerable revenue upside for the segment.

At the core of all this momentum is their full stack AI approach. 75% of cloud customers are using this overarching product umbrella of its infrastructure, models, tools, agents and apps. And they're not just buying products and experimenting... they're meaningfully ramping usage. It now has 350 customers processing 100B or more tokens per month on average, which is the equivalent of about 150M pages of text every 30 days. It will merely scale from there.

When looking across the 3 layers of the AI stack (infrastructure, research/models, apps) progress is uniformly encouraging. On the infrastructure side, perpetual optimization work led to 78% efficiency gains for Gemini unit costs throughout 2025. You may hear that and wonder “Ok, so what do they need $60B more in 2026 CapEx than analysts expected?” Totally fair. They’re not interested in leveraging added efficiency via keeping compute needs stable and pocketing savings. They’re happy to forgo this near-term savings to turn efficiency into an ability to add more connected compute with the same budget. They see these investments already greatly benefitting their ad core business (better targeting) and they're also proving they can create new cloud revenue streams that rapidly grow as well. Confidence in these investments coming with high returns is building thanks to this concrete evidence and demand signals. They’re adamant that having more compute than competition will be an edge and so they’re leaning in.

Gemini Enterprise now has 8M paid seats across 2,800 customers. This tier managed 5B customer interactions in Q4, which represents 65% Y/Y growth and is only the beginning. Overall, Gemini 3 Pro has enjoyed 3x the average traffic of 2.5 Pro since launch. The leading LLM family is now up to 10 billion tokens processed per minute vs. 7B Q/Q and the Gemini app reached 750M monthly users vs. 650M Q/Q and 350M 10 months ago. Good progress here.

- Project Genie is an experimental world model that allows users to generate and inhabit immersive, detailed 3D environments using text or image prompts. It’s clear how this could become increasingly valuable in sectors like gaming and film, as well as anything that can benefit from digital twin engines that can enable risk-free, high-fidelity split testing (so pretty much everyone else).

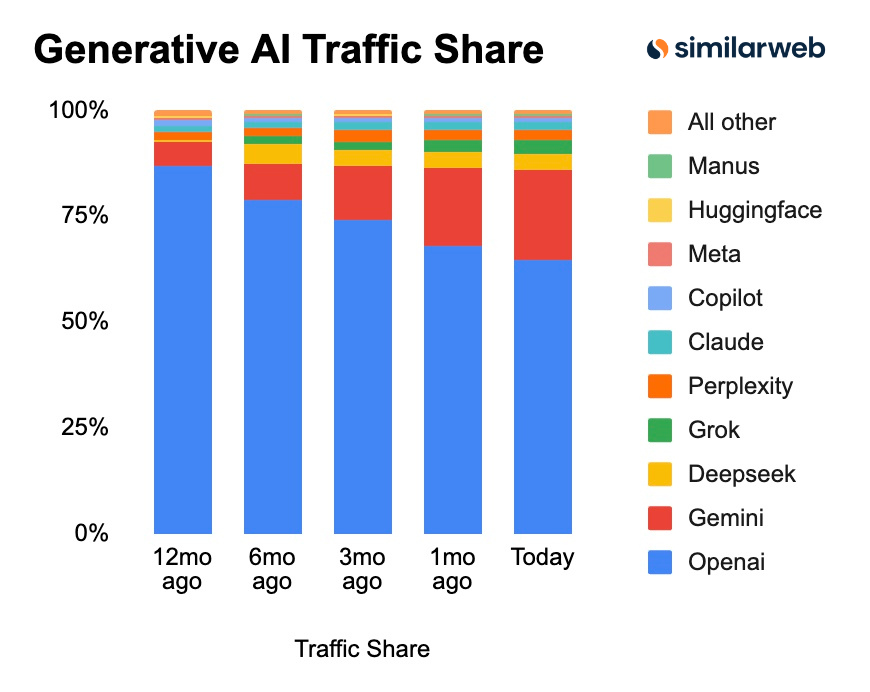

While token, seat and interaction growth sound cool, we love revenue and profit. What do token inputs represent in that arena? This cloud-based token momentum coincided with 400% Y/Y growth in Gemini-powered Google AI products, which marks a “significant acceleration from last quarter.” These numbers are still small, but that will not be true for long if this keeps up. Furthermore, products built on its platform by 3rd-parties rose by 300% Y/Y and commitments from their 15 largest software partners rose 16x Y/Y. They’re consistently taking market share in GenAI traffic (chart below) and steadily improving their ability to turn impressive AI key performance indicators into financial results.

- They expect to remain supply constrained in 2026. This was Sundar’s answer to the “what keeps you up at night” question.

- AI continues to expand the overall search pie as Google said it would (they’re also taking a bigger piece of that bigger pie)

- As an aside either all of its software customers that are adding to their commitments like crazy have no feel for their business models, competitive landscapes and positioning... or AI is accelerating demand for their apps like I’ve been arguing.

YouTube:

YouTube has been the top streamer in the USA for 3 straight years, and is finding nice activity with a cheaper sports package early on. They plan to build on this with 10 additional genre-specific packages that will be released in the coming months. Traction for its brand marketing campaign product (Demand Gen) was a notable highlight and benefited from especially good adoption from larger customers. Shoppable ads on YouTube are boosting monetization and yielded great performance throughout the holiday season. Furthermore, ongoing work to harvest more value from YouTube Shorts’ 200B daily views is bearing fruit. Alphabet is monetizing better than traditional YouTube ad formats in many markets including the USA.

- With the Creator Partnership Hub (find creators to market your products), Mattel enjoyed a 25% boost to Uno sales volume.

- While trends are healthy, lapping the U.S. election hurt the brand side of this business and slowed down growth. Strong subscription growth also held advertising growth back just a tad, as that reduces ad-based revenue but is positive for the business overall.

- Podcast engagement hours rose by 75% Y/Y.

More on Ad Tools:

On the ad quality front, Alphabet is hard at work on bolstering ad relevancy to improve targeting and returns. They’ve added Gemini 3 across all of their ad ranking algorithms and are enjoying things like lower irrelevant ad rates as a result. For advertisers, campaign building is now more conversational and guided with data-driven recommendations on how to maximize returns. Together Performance Max (optimize bottom-of-funnel conversions) and AI Max (upgraded search campaign design) are helping:

- Home Depot boost ad clicks and visits by 10%+

- Kayak boost conversion rates by 12%

- L’Oreal raise direct-to-consumer revenue by 23%.

- Aritzia enjoy an 80% conversion rate boost.

This explains is why AI Max has crossed 200,000+ customers and is its “fastest-growing AI-powered Search ads product.” Finally, on the monetization front, they’ve started testing AI mode ads and launched Direct Offers for businesses to show products to shoppers intending to buy something through AI mode. This leans heavily on the universal commerce protocol Google carefully built throughout 2025. That project laid the foundation for future agentic commerce scaling, while tools like this one will help ensure that scaling is as large as possible.

Other:

- Waymo is up to 400,000 rides per week (Uber 280M). It just launched in Miami and will launch in Japan and the UK hopefully this year.

- When asked if they’re planning on selling their Tensor Processing Units (TPUs) externally, they side-stepped the question.