Table of Contents

In case you missed it:

- SoFi Earnings Review.

- Uber & Alphabet Earnings Reviews.

- AMD & PayPal Earnings Reviews.

- Palantir Earnings Review.

- Microsoft Earnings Review.

- Meta & ServiceNow Earnings Reviews.

- Starbucks Earnings Review.

- Apple & Tesla Earnings Reviews.

- Netflix Earnings Review.

- Taiwan Semi Earnings Review.

- Axon Deep Dive.

- My Current Portfolio & Performance (I cut a position last week).

a. Key Points

- 40% Y/Y AWS backlog growth.

- Leo is poised for 2026 commercialization.

- The chips business crossed $10B/year.

- 9th straight year of best-in-class marketplace prices.

b. Demand

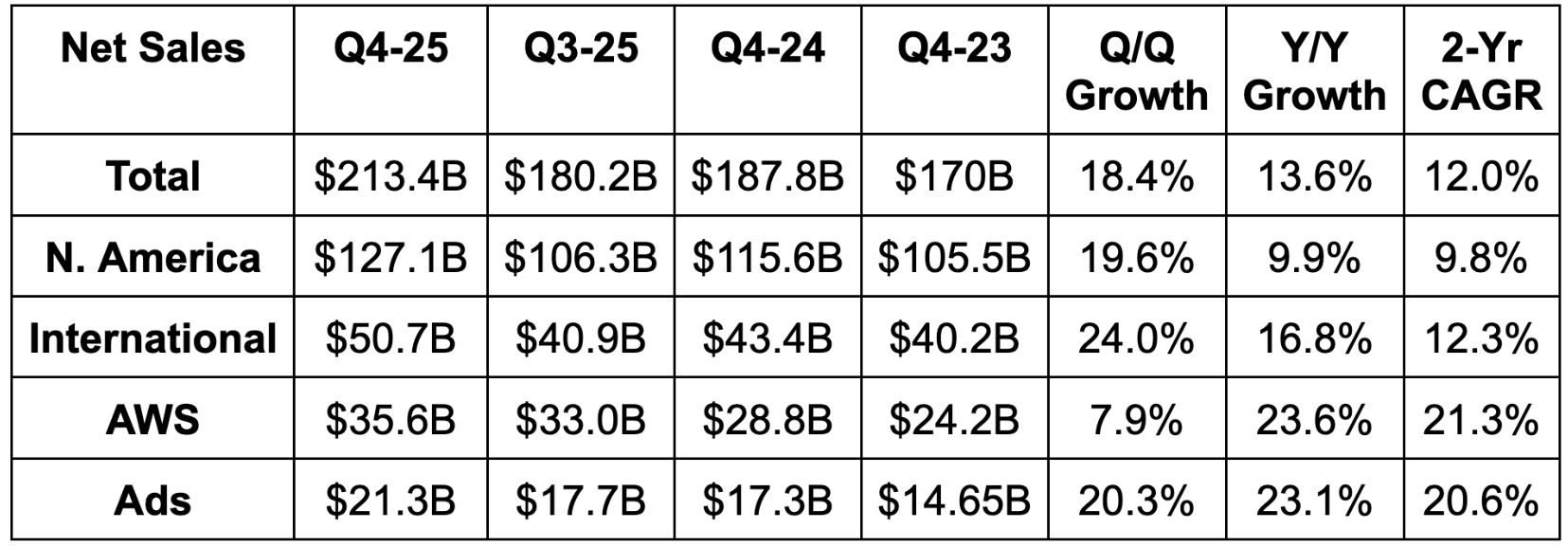

- Beat revenue estimates by 0.9% & beat guidance by 1.9%.

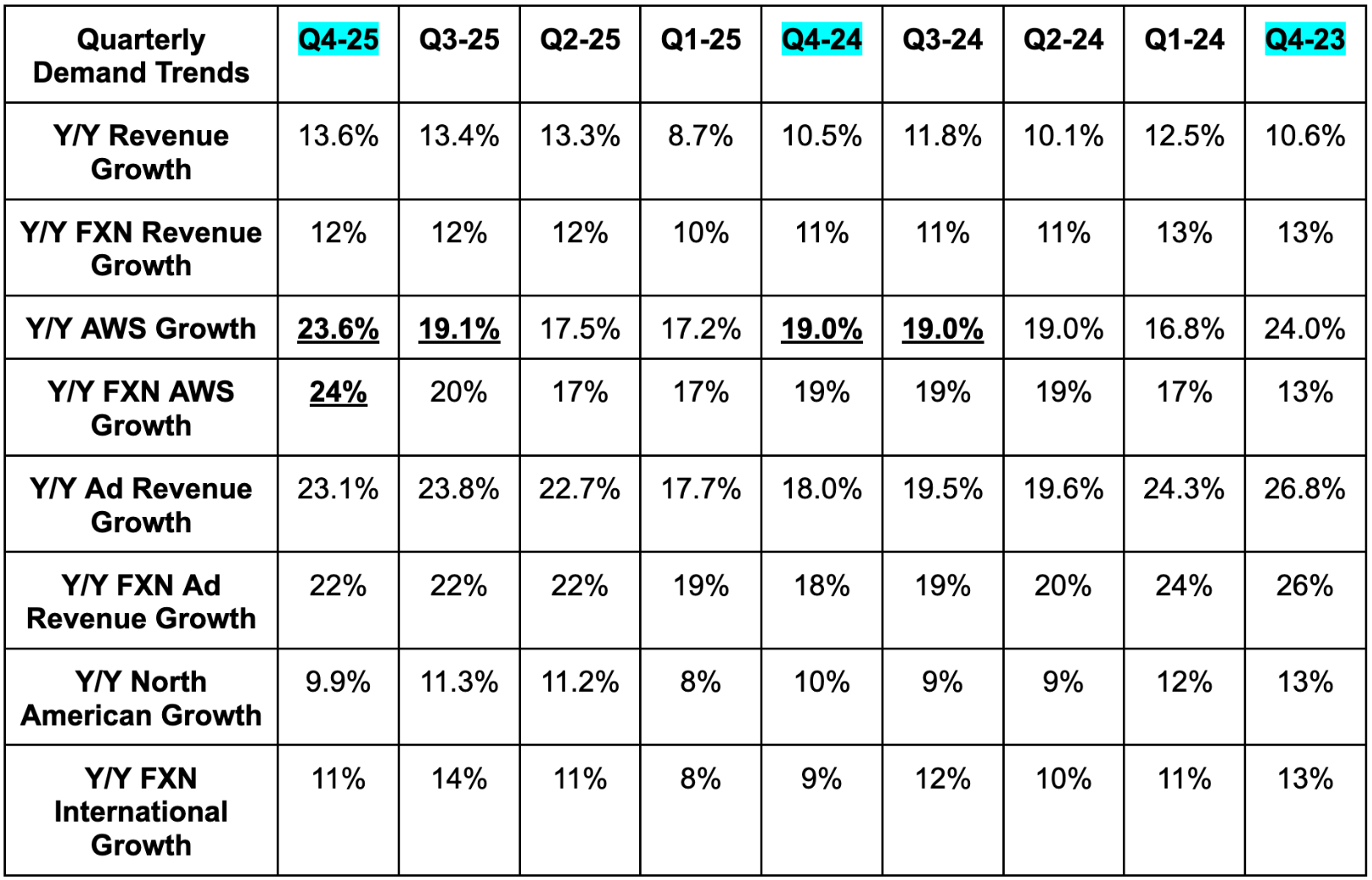

- The foreign exchange (FX) growth tailwind was 150 basis points (bps; 1 basis point = 0.01%) vs. 190 bps expected.

- Slightly missed North America revenue estimates by 0.1%.

- Beat AWS revenue estimates by 2%.

- This was the fastest rate of AWS growth since Q3 2022. Strength was broad-based and acceleration was not aided by abnormally easy comps. At the same time, the Anthropic ramp and a half quarter of OpenAI ramping both helped a lot.

- The AWS backlog grew by 40% Y/Y and 22% Q/Q to $244B. This represents $44B in added Q/Q backlog vs. $5B last quarter and $6B the quarter before. Again, Anthropic and OpenAI helped a ton.

- Beat International revenue estimates by 2%.

- Slightly beat ad revenue estimates.

- Beat online store revenue estimates by 0.9%.

c. Profits

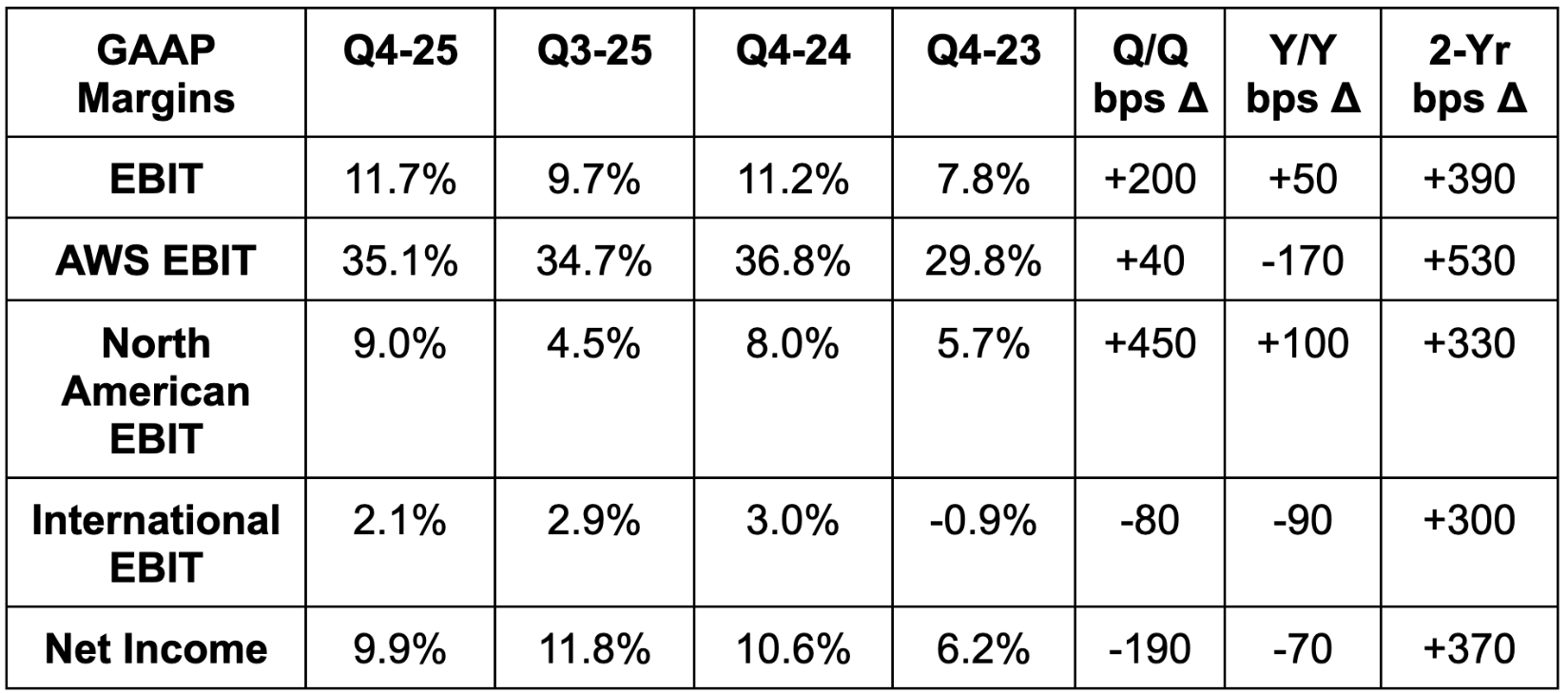

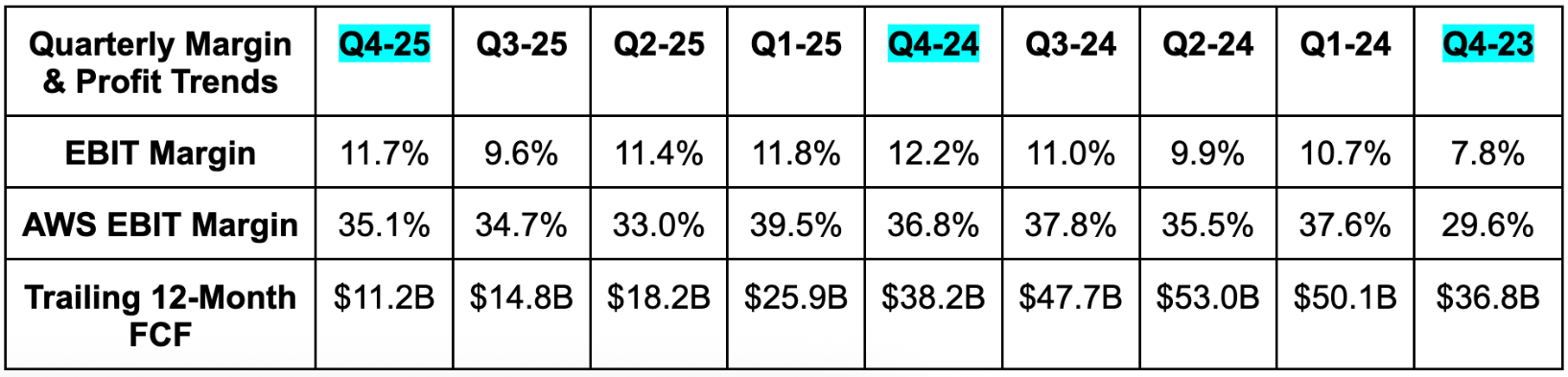

- Beat EBIT estimate by 1.6% & beat guidance by 6.4%

- Ex-special charges, Q4 2025 EBIT margin would have been 12.8% & Q3 2025 EBIT margin would have been 12%. The other periods were not impacted.

- This quarter, special charges included $1.1B to resolve an Italian tax dispute (hit international EBIT), $730M in severance (hit all 3 segments) and $610M in physical store asset impairment (hit North America segment) tied to its grocery business model change covered during the quarter.

- Missed $1.96 EPS estimate by $0.01.

- CapEx was 13% higher than expected.

d. Balance Sheet

- $123B in cash & equivalents.

- 12% Y/Y inventory growth.

- $65.6B debt.

- 0.8% Y/Y share count growth.