Table of Contents

In case you missed it:

- SoFi Earnings Review.

- Palantir Earnings Review.

- Microsoft Earnings Review.

- Meta & ServiceNow Earnings Reviews.

- Starbucks Earnings Review.

- Apple & Tesla Earnings Reviews.

- Netflix Earnings Review.

- Taiwan Semi Earnings Review.

- Axon Deep Dive.

- My Current Portfolio & Performance (I cut a position last week).

1. PayPal (PYPL) – Earnings Review

PayPal provides branded omni-channel checkout and financial services to a massive base of consumers and merchants. It also provides non-branded payment processing through Braintree, payouts-as-a-service through Hyperwallet, identifiable guest checkout through Fastlane and it owns Venmo.

The deep dive is old and my opinion on the company has materially changed since posting it. For an accurate overview of PayPal’s financial and product trends, the last few earnings reviews and their investor day coverage are great places to go. Just type “PYPL” into the website search bar for a chronological feed.

a. Key Points

- Bad branded checkout trends.

- Pulled Investor Day targets

- Strong Venmo growth.

- Accelerating Braintree growth.

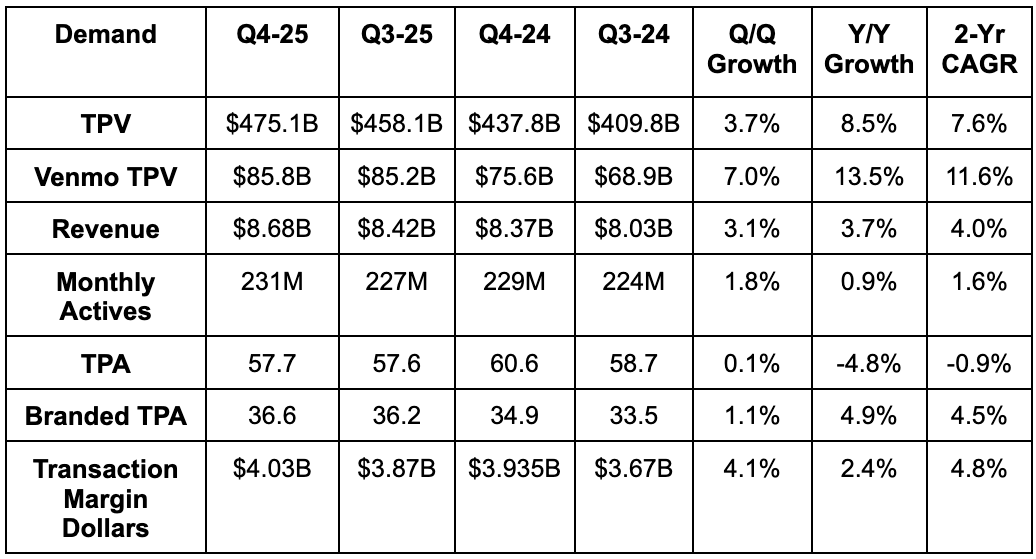

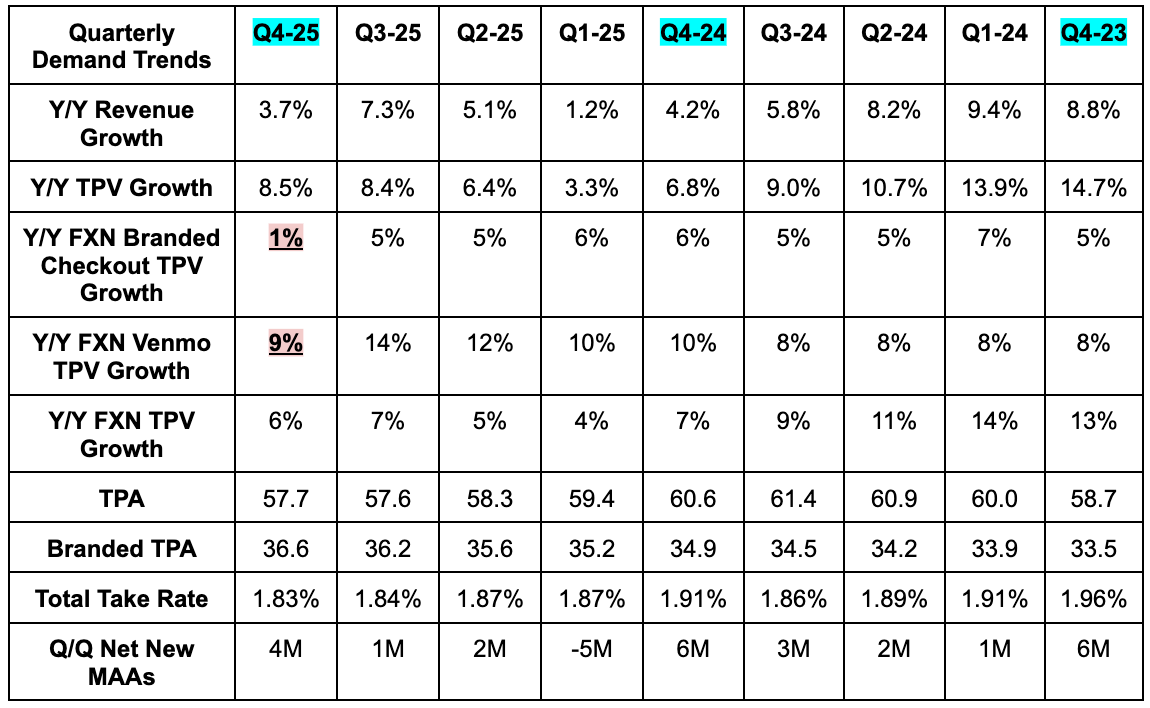

b. Demand

- Missed transaction margin dollar (TM$) estimate by 1%. 3.5% Y/Y TM$ growth also missed its 2.5% Y/Y growth guidance.

- Missed revenue estimate by 1.3%.

- 3% foreign exchange neutral (FXN) growth missed 4.5% FXN growth estimates.

- Beat TPV by 0.8%.

- TPV growth enjoyed a 3-point FX tailwind.

- Met account estimates.

- Missed transactions per active (TPA) estimates by 1%.

- More stats:

- Other value-added services revenue rose by 10% Y/Y. This was driven by merchant credit growth rather than software traction.

- Transactions per active rose 5% Y/Y excluding Braintree contract renegotiations. Branded transactions per active exclude this noise.

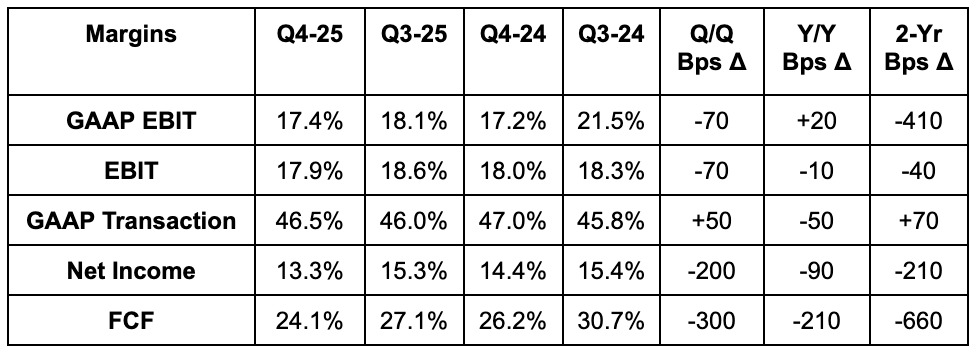

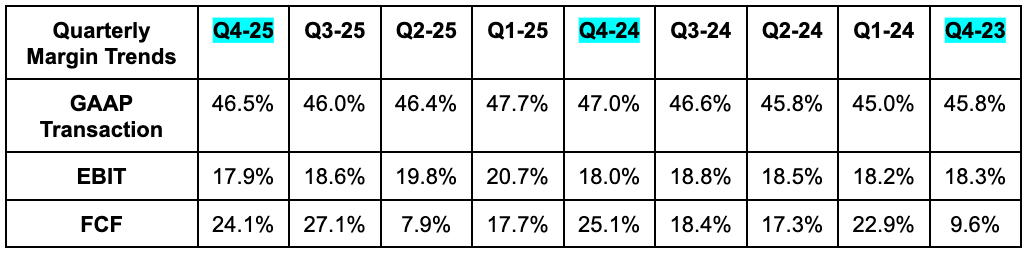

c. Profits & Margins

- Met 46.5% transaction margin dollar estimates.

- Missed $1.29 EPS estimate by $0.06 & missed guidance by $0.06.

- Missed EBIT estimates by 2%.

- Missed FCF estimates by 10% & missed guidance by 20%.

Profit growth was held back by a higher-than-expected tax rate and lower operating income.

d. Balance Sheet

- $10.4B in cash & equivalents.

- $4.3B in LT investments.

- $10B debt.

- Share count fell by 7.5% Y/Y.

e. Guidance & Valuation

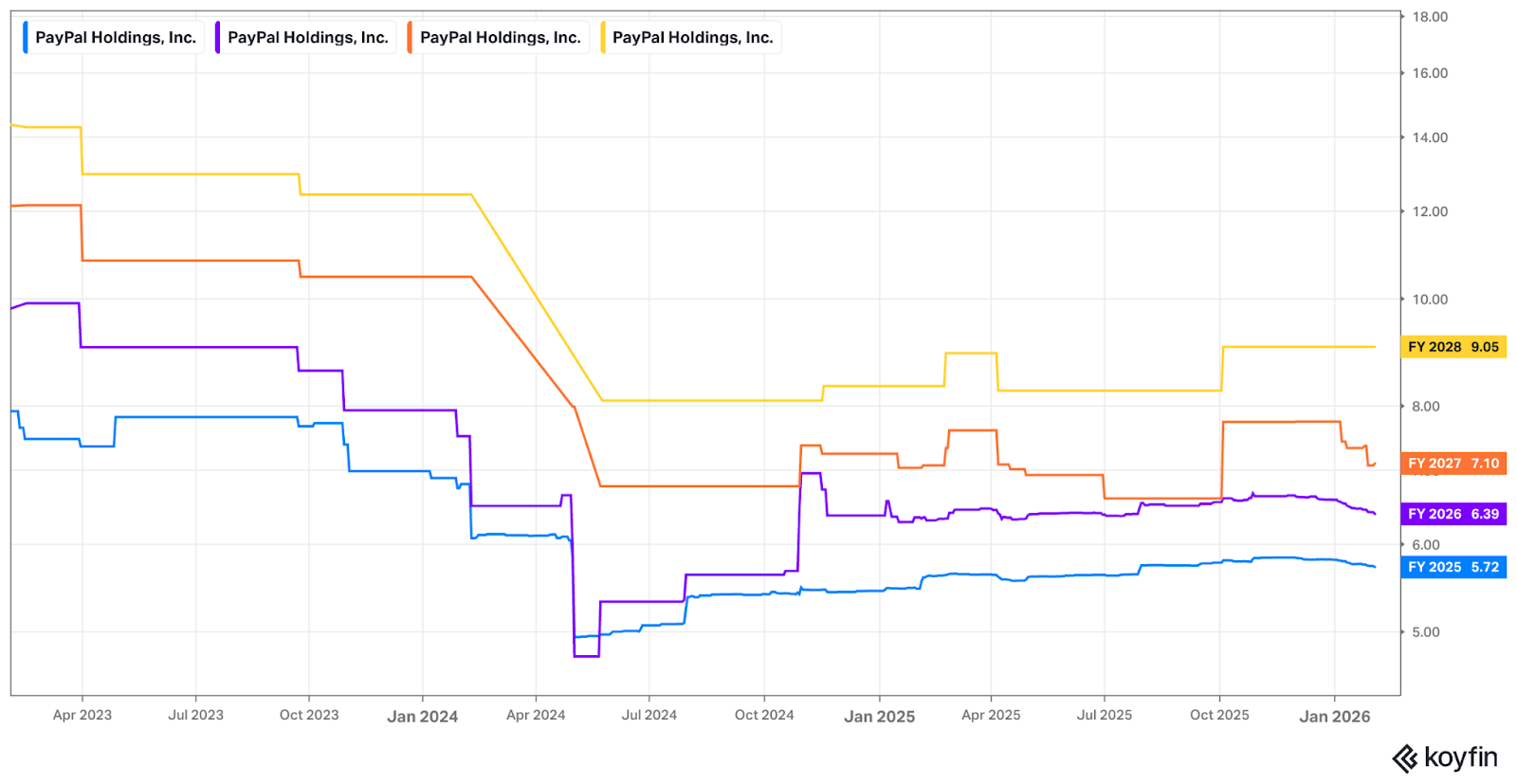

Annual guidance was a stinker. They set ~0% Y/Y EPS growth guidance vs. 7% growth estimates. This includes $6B in buyback, which means operating profit will fall by a mid-single-digit percent rate Y/Y.

PayPal expects a slight decline in transaction margin dollars for 2026 as a whole, which already missed 3% growth estimates. The weakness stems from expectations that branded checkout will not materially grow in 2026. More market share losses, which is obviously bad. As I’ve talked about during the quarter, leadership warned us that bigger investments were coming many times. They pointed to those investments coming because customers weren’t reacting to new products as expected. And when the investments come alongside bad demand trends, transaction margin and other profit metrics look this bad. 2026 is therefore going to be their third “transition year” in a row. That’s a lot of transitioning, with 3% Y/Y OpEx growth paired with negative demand trends being the result. The investments needed to try more repairs will lower TM$ growth by 3 points for 2026. Finally for 2026, it sees $6B+ in FCF, which missed $6.5B estimates by 8% at most.

Like I inferred from the investor conferences during the quarter, PayPal backed away from Investor Day targets set less than a year ago. So much for “getting points on the board” and “earning back investor trust.” Woof.

- Q1 was similarly weak across the board.

- They offered more granular color on 2025 guidance items, but when the overall picture looks this bad, we don’t really need to waste our time on it. Demand looks bad. They need to spend more. Margins look bad.

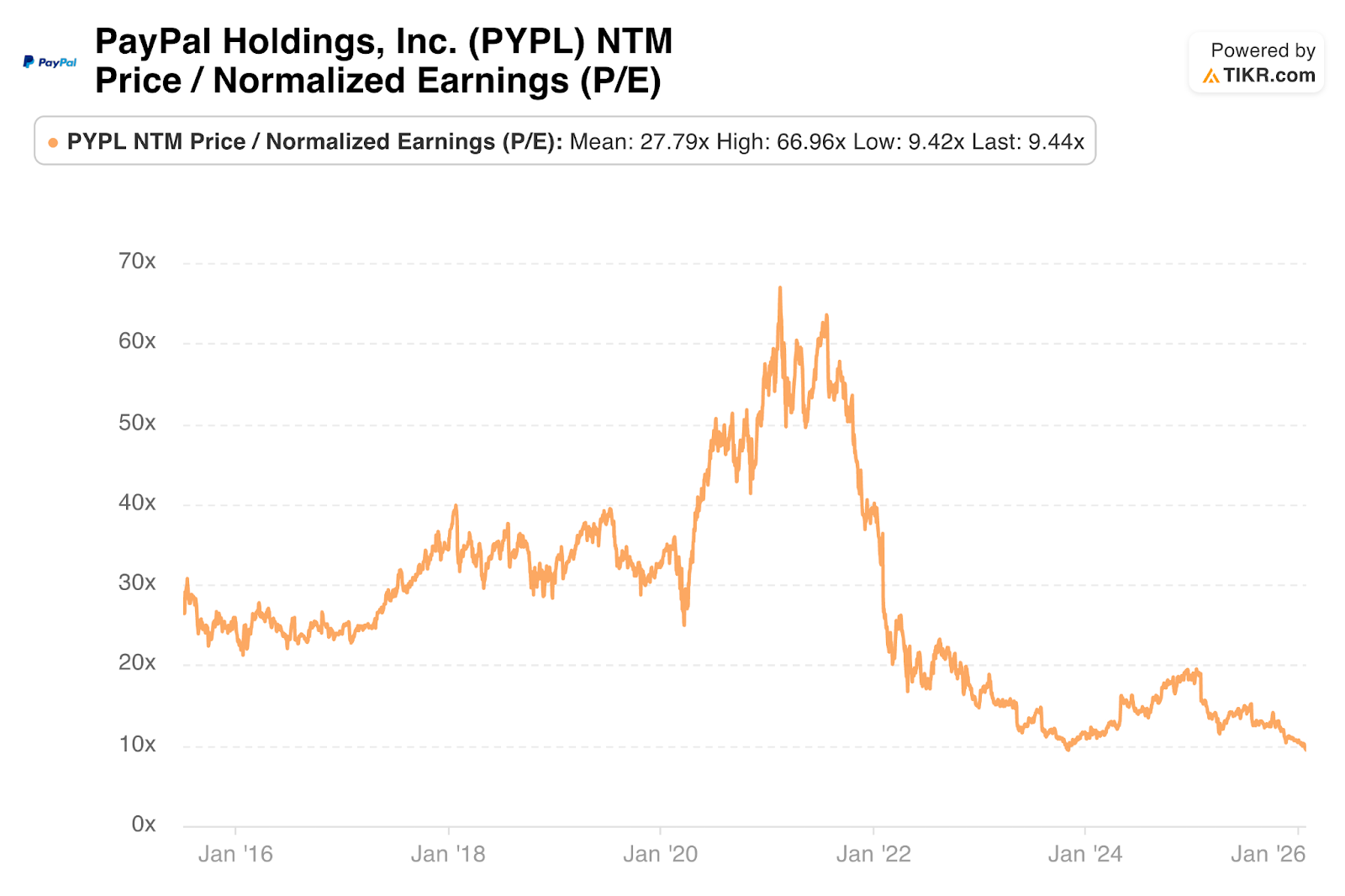

PayPal traded for 9x forward EPS heading into today’s report. It’s cheap for good reason. Forward estimates haven’t been updated yet and will fall significantly. That’s how you earn a dirt-cheap multiple.

f. Call & Release

Alex Chriss Out:

After two years and a lot of unwarranted excitement, Alex Chriss has been removed as PayPal’s CEO. HP’s President and CEO Enrique Lores will take over. He was previously PayPal Board Chair, and will now give that title to David Dorman. Lores will take over in a few weeks, with CFO Jamie Miller stepping into the interim CEO role until then. That was certainly a lot to take in, but isn’t terribly surprising following the last several months of disappointment from this company and the stalled turnaround. According to Miller, the PayPal strategy is good, but execution currently is not. Miller spoke about understanding frustration pertaining to how slowly PayPal’s checkout modernization was going, which echoed my criticism that partially caused my exit. Just like in previous quarters, the theme was "merchants with our best product are growing nicely but we’re not capable of getting enough merchants on this product for it to matter.” I’m bluntly paraphrasing, but you get the point.

Same Strategy?

Leadership spoke about the strategy remaining similar across PayPal’s operations and, again, with execution being the weak link. The one place where the approach will change is under branded checkout. The changes, to me, make no sense. The issue here is that the conversion-enhancing modern checkout page and biometrics tech isn’t rolling out quickly enough. So their fix? More direct and hands-on support for each and every merchant so they can have an easier time onboarding this new product. It sounds great in theory, but also sounds like a nightmare in practice. Their solution to moving faster isn’t accepting the disruption associated with ripping and replacing the archaic integrations holding them back. It isn’t carefully rebuilding these systems from the ground up and standardizing APIs and integrations. It isn’t doing so in a way that means future checkout updates will be seamlessly pushed to merchants like Affirm and Shopify.

PayPal’s solution is more manual work and more customization. Good luck with that. In my mind, they’re even telling us that it won’t work when laying out pace of future rollouts. The company is now at 36% of its merchants capable of using its best checkout product. Not 36% using; 36% capable of using. Their “massive leap” for 2026 entails getting that 36% to 51%, meaning 49% of their merchant customers will still feel archaic to users all year long. Their big fix is counterintuitive and misguided, and those embracing automation and agentic workflows beyond press releases and catalog integrations will pull further ahead.

Other areas of focus for 2026 beyond branded checkout preservation include a rewards program that I actually think is a good idea. It’s called PayPal+ and works to tie together perks for power users. If they can convince enough merchants in their large network to partner and cooperate on benefits, they could build a compelling offering and create more user stickiness. That remains to be seen, but early traction in the U.K. was called “encouraging” before any marketing spend. They’re going to build yet another app where this program resides.

They don’t seem interested in asset sales. I think that’s a mistake.

So What’s Going Well?

Have to give them credit where credit is due. While their main profit driver is dumpster fire, they are killing it elsewhere. Venmo grew revenue by 20% in 2025 and delivered 5 straight quarters of TPV growth. This was driven by a healthy blend of double-digit revenue per user growth and solid 7% Y/Y monthly active user (MAU) growth despite its large base of 67M. “Pay with Venmo” volume rose by 30%+ once more and engagement trends remained strong.

Braintree is back to double-digit TPV growth, following a successful pricing reset and a renewed focus on monetizing software add-ons. They’re enjoying some success with value-add services like FX as a service, and added new tools like FlexFactor (helps with sharper authorization) to keep bolstering the overall value proposition. Their first merchant went live with the new omni-channel processing product in partnership with Verifone. The pipeline for this offering was called “healthy.” Together Venmo and Braintree contributed 50% of total transaction margin dollar growth for PayPal this year. That’s partially due to easy Braintree comps (from lapping the reset) and weak branded checkout, but still good progress.

PayPal also continued to talk up strong 20% Y/Y Buy Now, Pay Later (BNPL) growth, although it really seems like that’s cannibalistic to checkout volume, based on the bad overall trends. Finally, the debit card accelerated volume growth and enjoyed 35% Y/Y customer growth.

But Branded Checkout Matters More:

So what’s weak within this bucket? In a word, everything. U.S. retail trends were called weak for a blend of macro and micro pressures. I tend to think Shopify and Affirm and others will show us how most of the pain is micro-related. Merchants are just not really jumping at the new checkout flow PayPal has to offer. Not only does it need to work more efficiently to implement this product, but it also needs to work harder to convince merchants that they want it. It’s the same story as we’ve been hearing for years. Merchants with the newest offering are growing nicely. They’re moving so slowly that once they’re finally done onboarding, that process will have become antiquated and they’ll need to do the same thing again. Broken business model… I think beyond repair.

Outside of the USA, their dominance in Germany is now eroding. They’re seeing a growth slowdown because of “normalization of our long-standing market leadership position” as well as new competitive entrants. That’s a very fancy way of saying they’re losing market share in the country where their positioning was strongest. Next, the new growth verticals that were helping overall expansion materially slowed during the quarter. So… to summarize… their most important core markets are struggling and their sources of growth are struggling. Not great, Bob.

And finally, Miller talked about the execution and operational issues that added to the headache. I question what will really change as you bring in your existing board chair to try to turn the ship around again, but I guess we’ll see. Going forward, they’ll focus on experience, presentment and selection (them and everyone else). They’ll work harder to win better button placement (like we’ve been hearing for several years) and get more aggressive on incentivizing merchants to use them. Those investments are a big part of the aforementioned 3-point transaction margin drag. Again, where the fixes have been deployed, trends look modestly better (not good, but better). They’re just struggling so much to implement updates faster than a snail’s pace. I’m not confident these investments will bring this business back to life, as PayPal has fallen too far behind a long list of better alternatives for too long.

Agentic Commerce:

PayPal Store Sync (integrate merchant catalogs with consumer chat bots) is now live with Perplexity and Microsoft Copilot, with more partnerships to come. So far, retailers including Abercrombie, Wayfair and Fabletics are early users. As a reminder, PayPal decided to buy Cymbio, which is the company it was using for this capability. For comparison, Shopify easily and rapidly built this tool on their own without M&A or partners.

Agentic will not be a material revenue driver in 2026.