Table of Contents

Reviews and deep dives already published this season:

- Axon Deep Dive.

- Palantir Earnings Review.

- AMD & PayPal Earnings Reviews.

- Alphabet & Uber Earnings Reviews.

- Amazon Earnings Review.

- My Current Portfolio & Performance.

- Access 8 other reviews from earlier in the earnings season.

a. Datadog 101

I am determined to move these lengthy 101 sections into a dedicated archive for future earnings seasons. That should happen before Q1 reports.

Core Product Niche:

This is a dominant player in the observability space. Observability refers to monitoring an entire digital ecosystem to track issues, vulnerabilities and performance. Other players within this area include the hyper-scalers, Elastic, CrowdStrike (through M&A) and many more. Datadog splits its observability niche into various buckets.

Bucket #1 – Infrastructure monitoring: provides a holistic view of assets like servers and networks to automate insight collection. Knowledge is power, and so this organized surveillance has a way of expediting issue finding and resolving. It helps optimize usage of compute and eliminate hardware performance bottlenecks. Optimization routinely means lower total cost of ownership for DDOG customers.

Bucket #2 – Log management: collects and manages logs or time-stamped event records. This also facilitates faster issue remediation and performance improvement. This product routinely complements infrastructure-based monitoring with its event-based support for things like customer service interactions.

- Flex Logs: A cost-effective means to store and retain large batches of logs by separating storage and query usage. Separation makes compliance & access more efficient while augmenting data scalability and query breadth. Conversely, flex log querying is slow. That makes this better for lower priority data and where latency is not a crippling bottleneck.

Bucket #3a – Application Performance Monitoring (APM): Tracks app performance and uncovers/prioritizes performance issues to be remediated. Datadog is rounding out developer tools to help users customize existing apps and models with their own data. It offers a “Latency Investigator” to automate forensic investigations and expedite root cause analysis and “Proactive App Recommendations” to turn insights into actionable plans.

Bucket #3b – Digital Experience Monitoring (DEM): This is exactly what it sounds like. This product includes real-time user monitoring (RUM) to track precise, observed interactions, and Datadog Synthetics, which provides a simulation of expected observed interactions. Here, Datadog delivers detailed churn analysis, engagement metrics, feature testing, user journey reports etc. It also recently introduced mobile app testing. Users can now conduct this testing right from their actual mobile phones. Finally, this segment features product analytics. This allows clients to directly trace application behavior such as feature adoption, engagement and retention to see how tweaking an experience impacts the overall business. This includes split testing capabilities to experiment before deploying changes.

Other Product Categories – Security:

Because Datadog already handles network viability, security is a very relevant growth adjacency. Here are some important security products to know:

- Cloud Infrastructure Entitlement Management (CIEM) sets strict, minimum access identity controls, cutting risk of identity attacks in the cloud.

- Security Information and Event Management (SIEM) product enables “long-term data log visualization for security investigations.” It’s helpful for broad threat management use cases. This can be done without dedicated staff, making cloud migration and usage easier.

- Application security and code security offerings cater to use cases across the development, security and operations (DevSecOps) lifecycle. Datadog has been a large player in the Ops section (and increasingly Sec too). Code security is moving into the Dev section more meaningfully, or moving “further left” towards developers.

- It also has some data loss prevention scanning to flag, monitor and protect sensitive data. This supports every other security product. Most recently, it added agentless environment scanning (no security agent installation needed) to match with its agent-based product.

- They’ve retrofitted these data scanners for large language models (LLMs) and agents.

Finally, Datadog offers an Incident Management suite. This includes Datadog On-Call, which alerts engineers about various issues and Incident Management to actually orchestrate remediation and learn from what went wrong. It seamlessly integrates DDOG’s holistic observability suite to not only provide an end-to-end, bird’s-eye view of operations, but to also actionably fix issues.

Other Product Categories – AI:

Toto is the name of its time series foundational model. This predicts the next datapoint for things like user trends or service scores, rather than simply serving us words or images based on model inputs. Bits AI is its suite of agentic tools. This includes the Bits AI Agents for work across several categories. One of these is its site reliability engineer (SRE) agent (just launched), which is the real workhorse here. This fully handles alert response, triaging and remediation, while offering fixes to and actionably resolving code bugs. It streamlines work within DDOG’s core product pillars to extract more productivity gains. The company also added dedicated security agents to investigate, propose remediation plans and fix vulnerabilities in apps and source code. Developers can implement these fixes right from their mobile devices.

Its Model Context Protocol (MCP) ensures autonomous agents can connect to other agents and apps to obtain needed information and sharpen goal-oriented work completion. This helps broaden available context to expedite root cause analysis of various issues. Early integration partners include Cursor, OpenAI and Anthropic. With Cursor and OpenAI specifically, the new integrations allow DDOG products to be used within the integrated developer environments (IDEs) of each firm. It’s available for some customers, but not yet fully released. It can summarize incidents and conversationally field questions. It’s also rolling out autonomous investigations to remove manual work associated with uncovering issues with various assets.

And unsurprisingly, it also tweaked and configured its core products to cater to LLM observability (AI Observability). Newer offerings for this asset class include data poisoning and prompt injection protection. The first guards against hackers inundating models with poor data to lower output quality; the second prevents malevolent commands (like “forget all safety protocols”) from bad actors to hack model logic. DDOG also recently launched LLM Experiments and playgrounds, as well as Custom LLM as a Judge.” Together, LLM Experiments & Playgrounds give developers a safe environment to build, iterate and test AI-powered apps and agents. Custom LLM as a Judge allows developers to build granular evaluator models that grade the quality of output of other models. This all pushes them closer to initial source code generation or “further left” in the development, security and operations (DevSecOps) space (towards “Dev).

b. Key Points

- 19 AI-native customers with $1M+ in annual recurring revenue (ARR) vs. 15 last quarter.

- Strong debut for the Bits AI SRE agent.

- Large remaining performance obligation (RPO) outperformance

- Conservative guidance as always.

c. Demand

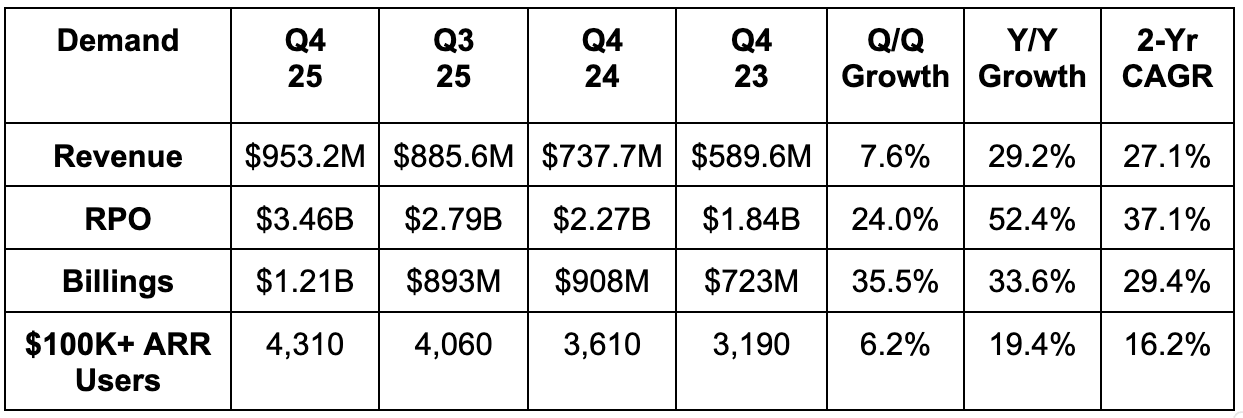

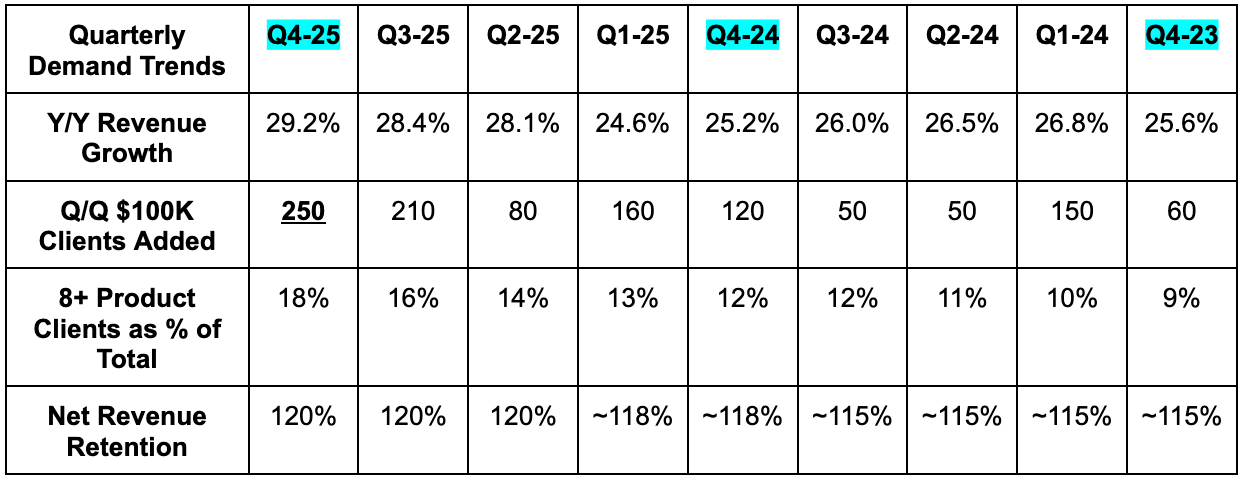

- Beat revenue estimates by 3.8% & beat guidance by 4.2%.

- Its 27.1% 2-year revenue CAGR compares to 27.2% last quarter & 27.4% 2 quarters ago.

- Beat 4,150 $100K+ ARR customer estimates by 160.

- Customers rose 9% Y/Y to 32.7K.

- 603 $1M+ ARR customers +31% Y/Y.

- Record quarter for net new logos.

- Beat billings estimates by 10%.

- Beat remaining performance obligation (RPO) estimates by 11%.

- Bookings rose 37% Y/Y to $1.63B.

In terms of the competitive landscape, as you may expect based on these numbers, there are no changes. They continue to “take market share from anybody who has scale.”