I realize a lot more content has been paywalled recently. I get how that’s probably annoying for you free subscribers. So? I wanted to remove a paywall on a high-profile report from this week. Consider this a thank you for your time and an audition for your business. This is the detail you can expect from me on a consistent basis. I live for providing you as much value as I can.

Other Reviews to Read From This Season:

- Uber Earnings Review.

- AMD & Datadog Earnings Reviews (& Coupang part 1).

- Palantir & Hims Earnings Reviews.

- Alphabet Earnings Review.

- Meta, Robinhood & Starbucks Reviews.

- Apple & Duolingo Earnings Reviews (sections 2 & 3).

- Tesla Earnings Review.

- Lemonade Earnings Review.

- Amazon & Microsoft Earnings Reviews.

- PayPal Earnings Review.

- SoFi Earnings Review.

- Chipotle Earnings Review.

- ServiceNow Earnings Review.

- Netflix and Taiwan Semi Earnings Reviews.

- My portfolio & performance vs. the S&P 500 as of today.

1. Hims (HIMS) — Q1 2025 Earnings Review

a. Hims 101

Hims sells personalized men’s and women’s health products with a direct-to-consumer business model. It aims to allow users to more comfortably access sensitive prescriptions for issues like erectile dysfunction or hair loss, without going to an office or a pharmacy. Products are mailed right to a consumer’s door to provide ultimate privacy.

It offers both standard and personalized medicine and subscriptions for customer savings & Hims retention boosts. Personalization is enabled & amplified by its electronic medical record (EMR) system. From its early days, it sought to build this EMR foundation to enable scalable data ingestion, automate tedious provider work and foster rapid product expansion. That will remain absolutely vital in the firm’s future. It paved the way for MedMatch, which is the company’s tool to data mine all customer interactions and uncover valuable consumer insights. This, in turn, supports best provider practices. It also enabled Clever Routing, which contextualizes individual user needs; it also helps prioritize and match demand with proper levels of care.

“Our historical strengths include developing a trusted brand, deploying technology to remove barriers to access, and providing access to personalized solutions and services at an affordable price.”

Founder/CEO Andrew Dodum

Despite being founded just 8 years ago, Hims is already nearing a $500 million quarterly revenue run rate, with great margins. It’s founder-led and competes with smaller vendors like LifeMD, Keeps, and Amazon.

b. Key Points

- Great quarter.

- Mixed but not bad guidance.

- Great progress with shifting more subscribers to personalized solutions.

c. Demand

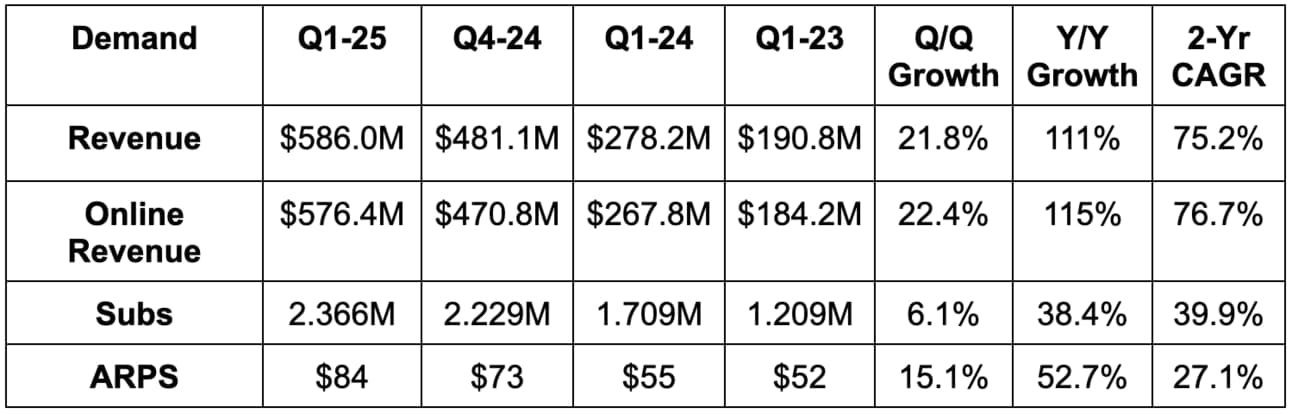

- Beat revenue estimates by 8.7% & beat guidance by 10.6%.

- Online revenue beat by 10%; wholesale revenue, which is a much smaller and lower-quality revenue bucket, missed by 15%.

- 98% of Hims revenue is from the online bucket, rather than wholesale.

- Missed subscriber estimates by 1.5%.

- Beat average revenue per subscriber (ARPS) by 11%.

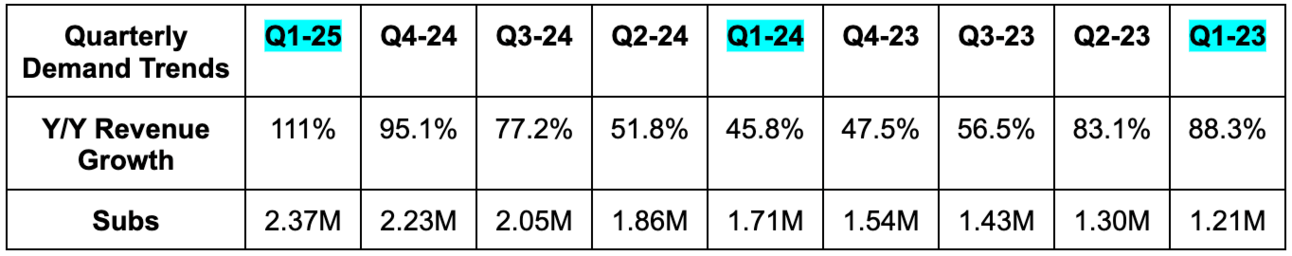

Hims did not disclose average order value (AOV) for the first time since going public this quarter. Impactfully efficient marketing drove great top-line outperformance, as it has in recent quarters. The ARPS growth was again driven by weight loss GLP-1 drugs, which will moderate as it moves people off commercially available Semaglutide (popular GLP-1; more later) options. Note that Y/Y growth comps still are measuring quarterly revenue vs. a period before it launched GLP drugs at scale. Comps normalize during Q3 of this year.

d. Profits & Margins

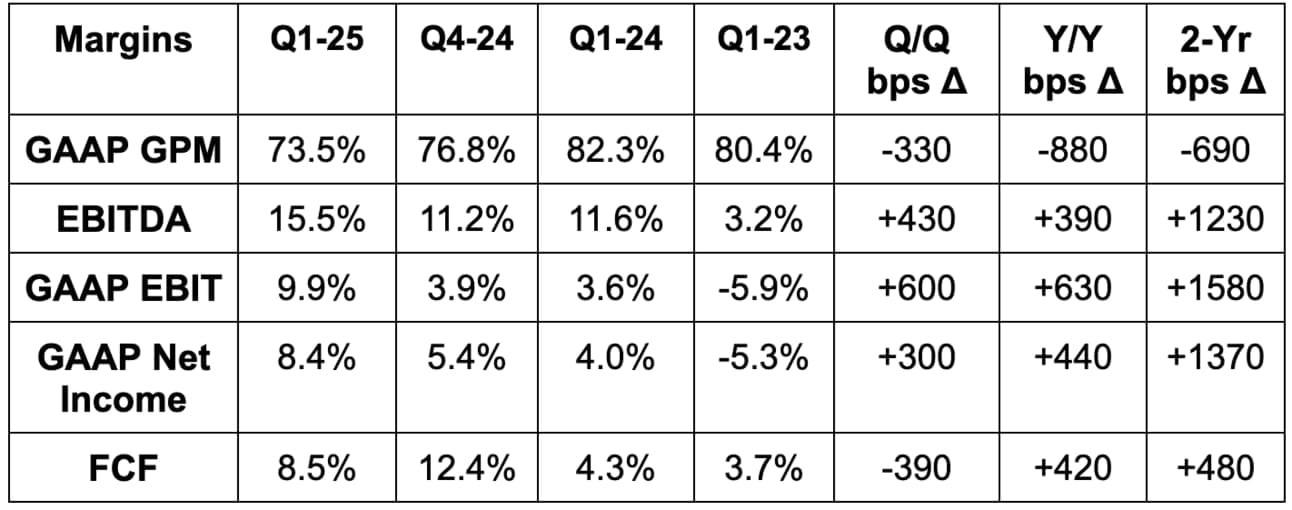

- Beat EBITDA estimate by 47% & beat guidance by 52%.

- G&A was 6% of revenue vs. 8% Y/Y.

- R&D was 4% of revenue vs. 5% Y/Y.

- Operations and support was 10% of revenue vs. 13% Y/Y.

- Marketing was 39% of revenue vs. 46% Y/Y.

- Doubled $29M GAAP EBIT estimates.

- Beat $0.12 GAAP EPS estimates by $0.08.

- Missed 77.5% GAAP GPM estimate by 4 points. That’s a sizable miss for that margin line. Gross profit dollars still modestly beat estimates thanks to the large revenue outperformance.

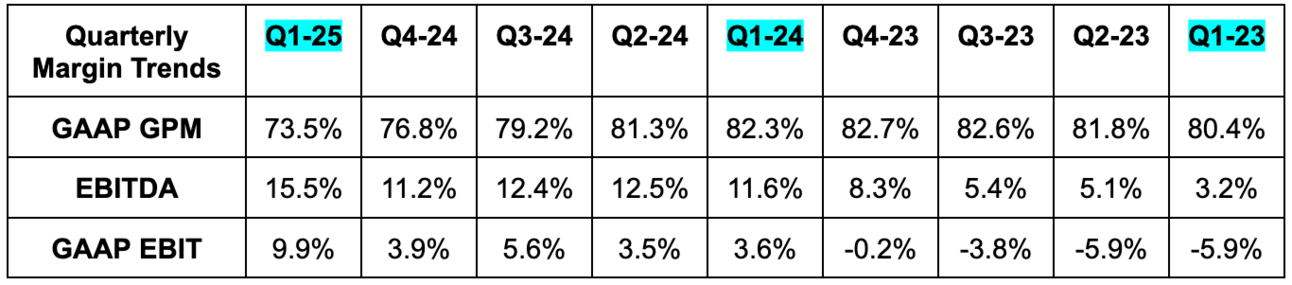

Hefty gross margin contraction is worse than analysts expected, but HIMS has been open about material GPM contraction coming this year. It’s mainly in relation to GLP-1 growth. This was offset by rising economies of scale across its entire value chain.

On marketing efficiency gains, there’s a lot to unpack. The marketing payback period remains below 12 months. Increasingly impressive as it scales. It’s also good to note that the quarter included its first Super Bowl ad. The leverage was despite this (revenue outperformance helped a ton). Things like improving retention, higher brand awareness and heightened spend pickiness in some areas also helped. Finally, it shifted dollars to weight-loss marketing during the Super Bowl. Per the team, this created some disruption as they shifted dollars back to other areas following the event. Rather than expect lower returns, they just temporarily spent less. That helped profit outperformance a bit… clearly without impacting their ability to beat on revenue.

$59M in CapEx went to expanding its manufacturing and testing footprint, as well as some manufacturing automation projects.

e. Balance Sheet

- $325M in cash & equivalents.

- $76M in inventory vs. $29.8M Y/Y. Large jump. Wasn’t asked about on the call. Assuming GLP-1-related.

- 7.2% Y/Y dilution.

f. Guidance & Valuation

- Q2 revenue guidance missed by 4.4%. That will be the last quarter of shifting subscribers off of compounded commercially available doses of Semaglutide (as the shortage is now over).

- Q2 EBITDA guidance roughly met.

- Guided to Q/Q GPM expansion. This technically meets expectations for modest Q/Q expansion. But analysts expected a 77.5% margin to expand to 77.8%. It’s easier to deliver sequential leverage when you’re comping over a 73.5% GPM.

- It plans to deliver Q/Q GPM expansion despite a small tariff impact.

- Reiterated annual revenue guidance, which beat estimates by 1.3%.

- Raised annual EBITDA guidance by 6.8%, which beat estimates by 6.5%.

Hims also provided 2030 revenue and EBITDA targets of $6.5B+ and $1.3B+, respectively. That’s at least 8.3% ahead on revenue and at least 18% on EBITDA. Multi-year targets are always inherently uncertain; these are unquestionably upbeat.

Hims trades for 38x forward EPS. EPS is expected to rise by 14% this year and by 24% next year. Estimates will likely rise a bit following this report and the annual EBITDA raise.

The EBITDA chart is the best chart for this name, considering it hasn’t been GAAP net income positive for all that long.

g. Call & Release

Partnerships & GLP-1:

The big news during the quarter was the recently announced Novo Nordisk and Hims GLP partnership. Hims subscribers can now access Wegovy (Semaglutide-based GLP-1) right on the website. They can take advantage of the same adherence-boosting 24/7 care and clinical support that the Hims platform offers, while being able to directly purchase a commercial-dose version of its popular drug. As a reminder, Semaglutide was removed from the FDA shortage list earlier in the year. That now blocks Hims from selling commercially-available, non-personalized doses of Semaglutide, which it had been selling on its site. It can still sell personalized Semaglutide (custom dosages, excluded ingredients, added vitamins etc.) for those with side effects to the commercially-available options.

This gives them much more clarity and certainty pertaining to carrying options for this go-to chemical. And it also sounds like Hims and NVO are aligned in terms of what Hims can consider for a patient needing a personalized option.

This is a large net positive in my mind, but there are pros and cons to consider. On the bright side, this should be positive for overall revenue generation and diminishes someone pressing legal risk with Novo-Nordisk. They (and Eli Lilly) have complained about how liberal Hims has gotten with who requires personalization. It’s a legal gray area, which is why stated alignment between HIMS and NVO on personalization is so vital.

Large biotech companies have every reason to defend the massive R&D dollars that went into designing this drug. After all, they are supposed to get lengthy exclusivity windows and this personalization loophole was seen as a threat. This language makes it modestly less risky. While they still need to play nice with Eli Lilly, this signals an improving relationship — at least with NVO.

“With regard to Lilly, we would love to continue to broaden the partnership opportunities on the platform. Currently, we go through the supply chain, not through a direct integration with Lilly. We continue to have conversations with the leadership of that organization. At this point, we've not been able to bring those offerings onto the platform, and we hope that we can.”

Founder/CEO Andrew Dodum

On the other hand, Wegovy sales are less differentiated vs. the personalized Semaglutide options it has, as NVO has already signed multiple similar deals with other platforms. They simply want to expand reach. Furthermore, the cost is about $599 per month, vs. $165 per month for the custom solutions Hims was offering. That means more buyer friction, while NVO also gets a large cut of the revenue. In turn, this business will be lower margin than its sales during the shortage, and personalized injectables today. While that’s all true, I again think it’s a convincingly net positive — especially given guidance calling for great future leverage despite this.

Hims expects to finish transitioning subscribers from the compounded (normal dose) Semaglutide to personalized Semaglutide, the branded Wegovy option, oral options or new Liraglutide (different, less popular compound) by the end of Q2-2025. Considering that, I think the Q2 guide is actually not that bad. Especially paired with the annual guidance reiteration. That’s a byproduct of Hims effectively communicating and shifting subscribers to all of these other options. Good execution. They did not reiterate the $725M annual weight loss revenue guidance, but when asked about it they didn’t talk about any assumption changes either.

More on the NVO Partnership:

Hims sees NVO as a domino of sorts. Hims believes that NVO will serve as a template for many other partnerships with industry players. That will deepen the breadth of its offerings and help Hims become a more powerful cross-seller with even higher retention.

“Beyond this initial launch, we are developing a broader roadmap together with Novo Nordisk, as well as a blueprint for future partnerships, to deliver access to quality care at scale, improve long-term outcomes for people living with chronic disease, and make care more affordable.”

Founder/CEO Andrew Dodum

Personalization – The Key Ingredient in Any Bull Case:

Hims continued to add personalized subscribers at a rapid clip. It reached 1.4M personalized plans and maintained its 200,000 net new additions per quarter pace for the 3rd straight quarter, after adding 100,000 net new in each of the three quarters before that. All in all, personalized subscriptions are now 60% of total vs. 35% Y/Y, and that should continue to climb with 70%+ of new subscribers on personalized solutions.

“[Personalization] results like this give us strong conviction that we are not simply gaining market share through consumer rotation… Our strengths are allowing us to expand the overall market by democratizing access to higher-quality treatment across the country.”

CFO Yemi Okupe

Why does this matter? Any Hims bull case hinges on using proprietary data from a growing base of subscribers to drive personalization. That is what can potentially create enough differentiation to durably stand out from the pack.

- As an aside – I know for a fact that there are many subscribers reading this and thinking to themselves “Well Teladoc basically said the same thing for years with a much larger base of members and data. And they were dead wrong about having a durable moat. You may also be thinking that TDOC tried to defend that moat with wearables like Hims is now talking about doing. I get it. It’s somewhat fair. At the same time, Hims is building its wearables initiative. Teladoc vastly overspent on M&A for theirs. Furthermore, this is a better team than Teladoc has ever had. I think that’s now clear based on the elite financials and margins that TDOC has never enjoyed. So yes some similarities… but there are winners and losers in every industry. Hims has far surpassed the amount of financial success Teladoc ever realized. I am a skeptic on this business model, but I do think it’s a much higher quality organization than TDOC.

Selling the exact same things as a dozen other direct-to-consumer medicine companies invites price competition, margin degradation, higher churn and customer acquisition costs and, generally speaking, eroding fundamental health. When you have a company like Amazon meaningfully entering this space, Hims has to do something to separate itself from the others. Amazon can easily use generic and branded medications as loss leaders to undercut Hims and everyone else, take their market share, and harvest margin with one of the other dozens of product categories it sells. Hims doesn’t have the Amazon luxury. Its money-making needs to come from this core business.

Personalization helps a lot here, which can be seen in a full 20-point lift to member retention rates on personalized vs. non-personalized solutions. We can have our opinions on how impactful this positioning truly is, but that evidence is quite positive and speaks volumes. I go back and forth on how durable this kind of differentiation can be over the coming years. But? The current trends indicate that, for the time being, it’s working with compelling margins. These are long sentences. What does personalization mean here?

Things like removing ingredients to eliminate side effects, combining prescriptions into one pill, adding vitamins and supplements to a drug, various form factors and diverse dosages. They’re not the only ones who can do this (other pharmacy compounders offer it), but they are one of the only doing it at scale. They also have lower headline consumer costs and an ever-expanding custom pharmacy manufacturing footprint. That footprint isn’t free to build; these capabilities aren’t free to build. I can keep saying “Well everyone else will just do this too.” But? The longer that takes, the more entrenched Hims becomes, the more known its brand becomes and the harder to displace it becomes. They’re ahead in this regard and that lead is not irrelevant.

Personalization Going Forward:

Hims has its eyes on several more specialties to drive even deeper personalization and broaden its value proposition. In dermatology, this has already led to 80% of total subscriptions being personalized. It has helped hair loss subscriptions (one of its most mature products) maintain 45% and 170% Y/Y growth for men’s and women’s, respectively. In weight loss, they think this is a key contributor to 300% Y/Y oral subscription growth. Going forward, it will focus on sexual health treatment customization.

Most of its business up until now has been all on-demand; they want that to change (with the help of personalization options like vitamin inclusion). Hims leadership is shifting go-to-market towards daily solutions for heart, hair loss, low testosterone and vitamin personalizations. Sexual health subscribers using a daily solution rose from around 10% to nearly 40% since 2023. This has helped lift retention for sexual health subscribers by a full 10 points Y/Y. In the near-term, re-educating customers on this less-known option is slowing growth a bit. But they’re focused on optimizing long-term value creation and are adamant this is a temporary concession they should make to get there.

Deepen Subscriber Value:

Hims has a few plans for augmenting subscriber value this year. Its new at-home lab testing capabilities (that were acquired) are unlocking significant blood testing potential, with a “lower fear factor compared to traditional needles.” Consumers can access these tests from home. Hims thinks these capabilities will allow it to add heart, hormone, liver, thyroid and prostate use cases down the road. Pairing this capability with lab testing expansion is paving the way for a presence in low testosterone and menopause services.

“These tools will support our current specialties and unlock entirely new ones.” –

Founder/CEO Andrew Dodum

Non-Weight Loss Business:

Ex-GLP-1 growth was still nearly 30% Y/Y. That’s meaningfully slowing but still quite rapid. And the still-brisk growth is despite shifting marketing dollars to its weight loss solutions during the quarter and the aforementioned change in sexual health go-to-market.

Unchanged Long-Term Priorities:

- Deepen breadth of personalization with its EMR foundation and ability to use structured data to build better customer need profiles.

“Our vision involves expanding from hundreds of personalized treatments today to potentially thousands.”

Founder/CEO Andrew Dodum

- More specialities like sleep and longevity/peptides. Peptides specifically are exploding in popularity, come with broad-based use cases and are too expensive for most people. That is a perfect recipe for Hims to try and take advantage of.

- Improve MedMatch and other AI analytics tools to get better at recommending courses of treatment, driving higher adherence and delivering better outcomes overall.

- Be a “best-in-class curator of healthcare services” through partnerships like with NVO.

“Over time, we expect wider collaboration across the industry from pharmaceutical players, innovative leaders in diagnostic and preventative testing, to world class providers.”

Founder/CEO Andrew Dodum

- Go global. Early traction in the U.K. is adding to the team’s conviction that this being a global opportunity over the next 5 years. They may do some M&A to expedite that schedule.

Leadership:

Hims named Nadir Khabani as its new COO. He was an SVP at Symbiotic most recently. He has also been an EVP at Flexport (large private logistics company) and was the VP of Operations for PillPack and Amazon Pharmacy for three years as well. He has a great resume and relevant, hands-on experience with a direct competitor.

h. Take

Another strong quarter from Hims. While the Q2 revenue weakness isn’t ideal, the reiterated annual revenue guidance, despite sexual health headwinds, is encouraging. It shows that the team deeply understands the regulatory climate, its industry and how evolving rules directly impact its financials. I loved seeing them not add incremental headwinds from the Semaglutide change this quarter.

It’s obvious that this leadership group is highly capable and masterfully executing every quarter. I just still do not love the business model. I don’t think direct-to-consumer healthcare provides an opportunity for durable differentiation. I don't want to deal with the regulatory headaches and worry that Amazon will use competing products as a loss leader to grow its own pharmacy business at cheaper prices. I admire how this company has overcome what I view as a risky business model with superb operations and surgical maintenance of its growth drivers. I just would rather focus my attention on other names where I view the risk/reward as better and existential risks as less likely.

Congratulations to shareholders on another wonderful performance. I will continue to root for you bulls from the sidelines. The luxury of being a long-only investor. I’d rather see every company do well.