Table of Contents

In Case You Missed it:

- Palantir & Hims Earnings Reviews.

- Cava Earnings Review.

- Uber Earnings Review.

- Shopify & Coupang Earnings Reviews.

- Meta Earnings Review.

- Alphabet Earnings Review.

- Apple, ServiceNow & Starbucks Earnings Reviews.

- Amazon & Mercado Libre Earnings Reviews.

- PayPal Earnings Review.

- Tesla Earnings Review.

- SoFi Earnings Review.

- Netflix Earnings Review.

- Taiwan Semi Earnings Review.

- My current portfolio & performance vs. the S&P 500.

1. Lemonade (LMND) – Detailed Earnings Review

Lemonade offers renters, home, auto, pet & life insurance in the USA and parts of Europe. The company’s tech-and-AI-native foundation cuts out hefty fixed costs associated with legacy models to lower cost of service. This enables it to routinely outcompete substitutes on price. It builds on this edge by obsessively iterating on its underwriting algorithms to ensure accurate underwriting. This has enabled accelerating top-line growth, sizable fixed cost leverage and brisk margin improvement for years.

For a detailed review of its latest investor day, where I dig a lot more into what makes Lemonade special, click here.

a. Key Points

- Sharp acceleration in car in-force premium (IFP) growth.

- Quarterly record for new customer additions.

- Accelerated overall IFP growth to 30% Y/Y ahead of schedule.

- Reiterated path to positive EBITDA.

b. Demand

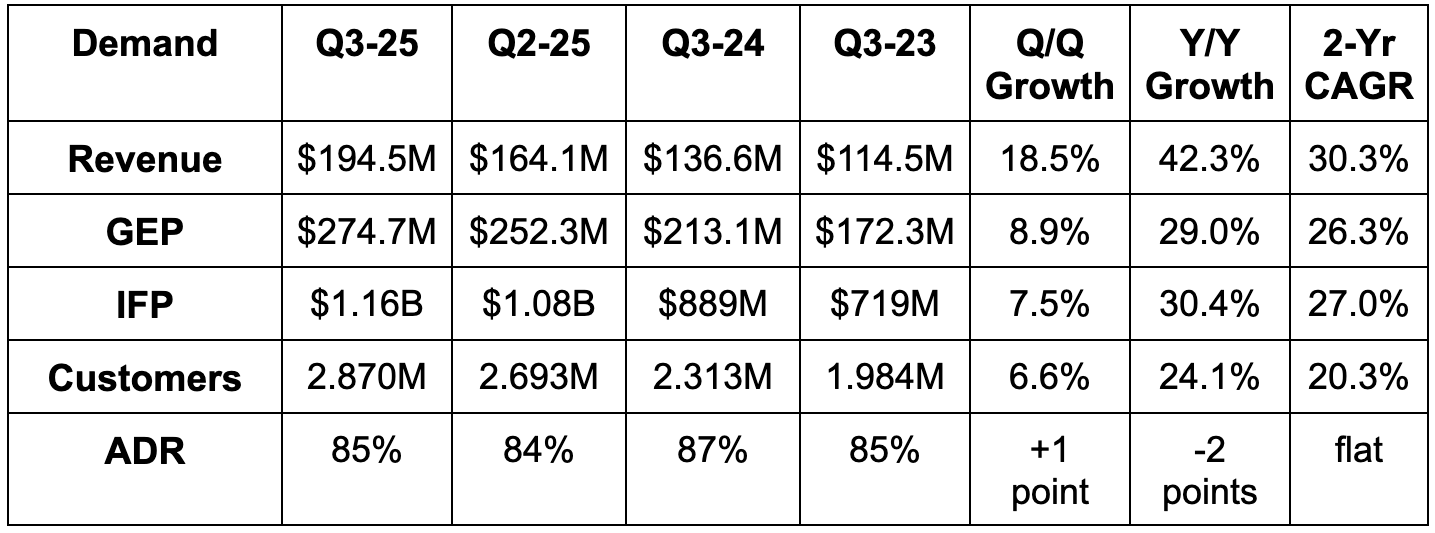

- Beat gross earned premium (GEP) estimates by 2% & beat guidance by 2.5%.

- Beat in-force premium (IFP) estimates by 1.6% & beat guidance by 1.2%.

- Beat revenue estimate by 5.1% & beat guidance by 5.4%.

- Beat customer estimates by 1%. This was a record quarter for sequential additions.

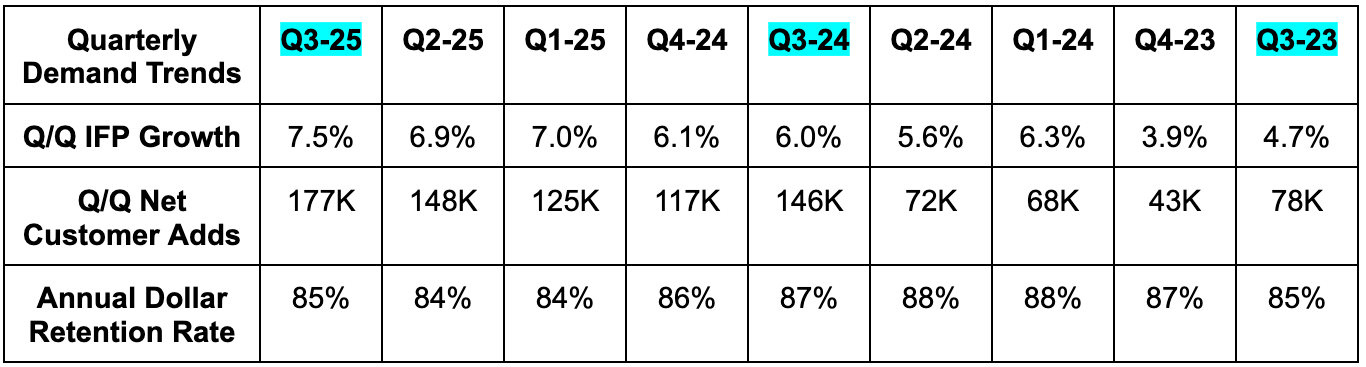

Note that a lower rate of ceded premiums to reinsurers is currently propping up revenue growth. Lemonade’s rising confidence in their underwriting, profitability and liquidity all gave it the confidence to keep a larger portion of their overall demand. This means more revenue on the same base of premiums and, if pricing risk is well executed, should be a profit dollar accelerant as well. IFP and GEP growth both were strong and offer a better sense of demand right now, as both exclude that noise. This is the 8th consecutive quarter of accelerating IFP growth and marks Lemonade reaching its 30% Y/Y growth acceleration target a full two quarters early.

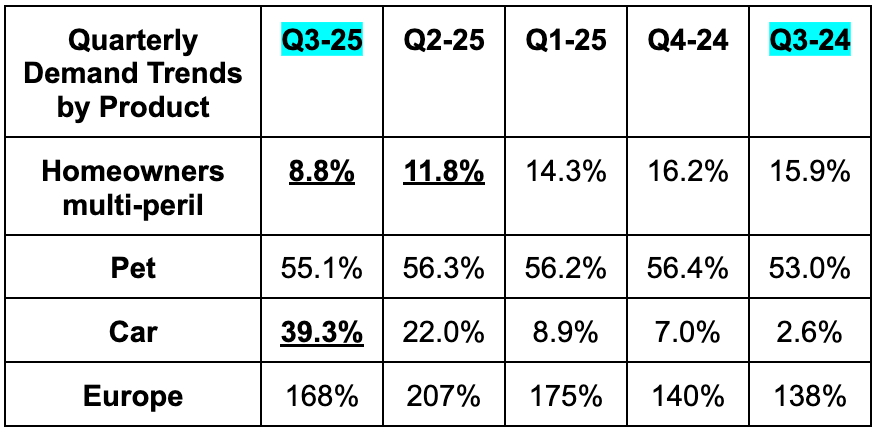

I’d like to highlight the third demand chart for a moment. You’ll notice that the large headwind from Lemonade cutting negative profit home plans in California continues to greatly weigh on that product’s expansion. The headwind actually got worse this quarter vs. Q1 or Q2, yet they meaningfully accelerated premiums growth. It’s exciting to think that this product will again be unleashed at some point and the growth engine already looks this good before that even happens. One more note – car insurance has fully arrived. 40% Y/Y growth for that product marks a sharp acceleration.

c. Profits

The rest of this full review & the Duolingo review are for paid readers. They include overviews of financials, guidance, valuation, conference calls, other investor materials and my overall takes. It's detailed yet condensed work to save you time. Subscribe below to read that and 40+ earnings reviews every season.