In case you missed it:

- SoFi Earnings Review.

- Alphabet Earnings Review.

- Tesla Earnings Review.

- PayPal Earnings Review.

- Chipotle Earnings Review.

- ServiceNow Earnings Review.

- Netflix and Taiwan Semi Earnings Reviews.

- My portfolio & performance vs. the S&P 500 as of today.

Table of Contents

- 1. Microsoft (MSFT) — Brief Earnings Snapshot

- 2. Starbucks (SBUX) — Detailed Earnings Review

- 3. Robinhood (HOOD) — Detailed Earnings Review

- 4. Meta (META) — Detailed Earnings Review

Macro Housekeeping:

Quick note on the negative GDP reading from this morning. That was entirely related to the aforementioned import front-loading we’ve extensively covered in portfolio management articles. Imports reduced the GDP reading by nearly 5 points (lots and lots of gold imports especially), with that hit a full 1.5 points larger than the help from higher inventory levels. Consumption was actually a bit better than expected, with 1.8% Y/Y annualized growth vs. a little over 1% growth expected. Real final sales to private domestic purchasers, which excludes net export and government spending noise, rose by 3% Y/Y and is stable.

1. Microsoft (MSFT) — Brief Earnings Snapshot

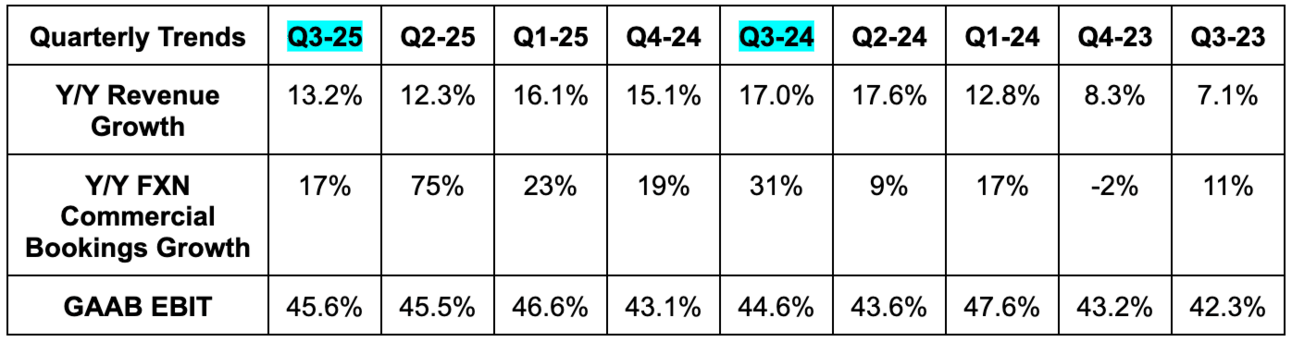

My detailed Microsoft earnings review will be published this week. For now, the brief snapshot of financials.

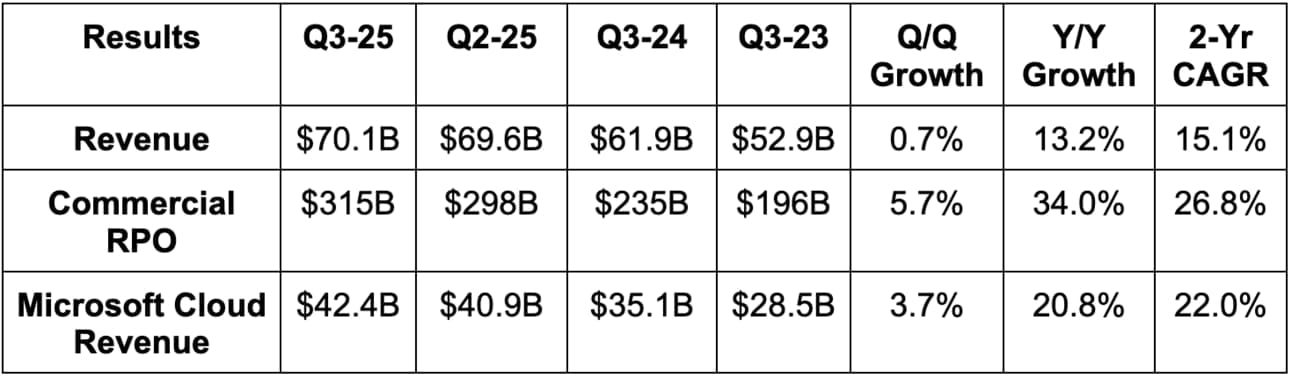

Results:

- Beat revenue estimates by 2.5% & beat guidance by 2.8%.

- Intelligent cloud revenue beat estimates by 2.6% & beat guidance by 2.9%.

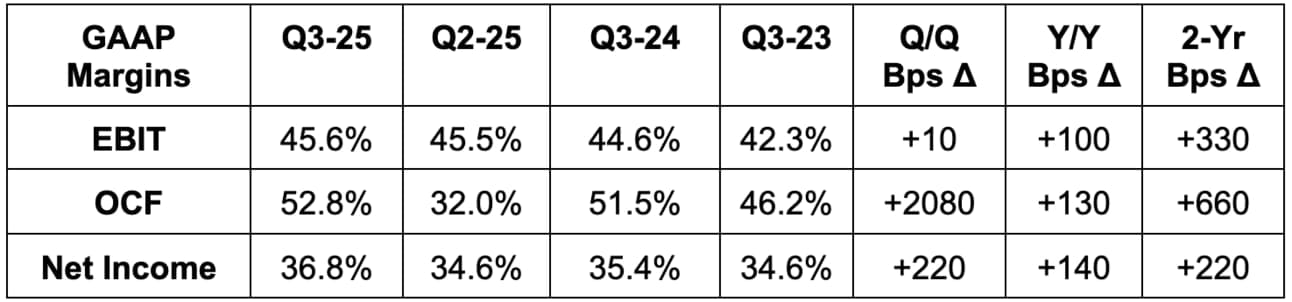

- Beat EBIT estimates by 5.5% & beat guidance by 6.8%.

- Beat $3.22 EPS estimate by $0.24; beat operating cash flow (OCF) estimates by 10%.

Guidance & Valuation:

- Next quarter revenue guidance beat by 1.8%.

- Next quarter EBIT guidance beat by 1.3%.

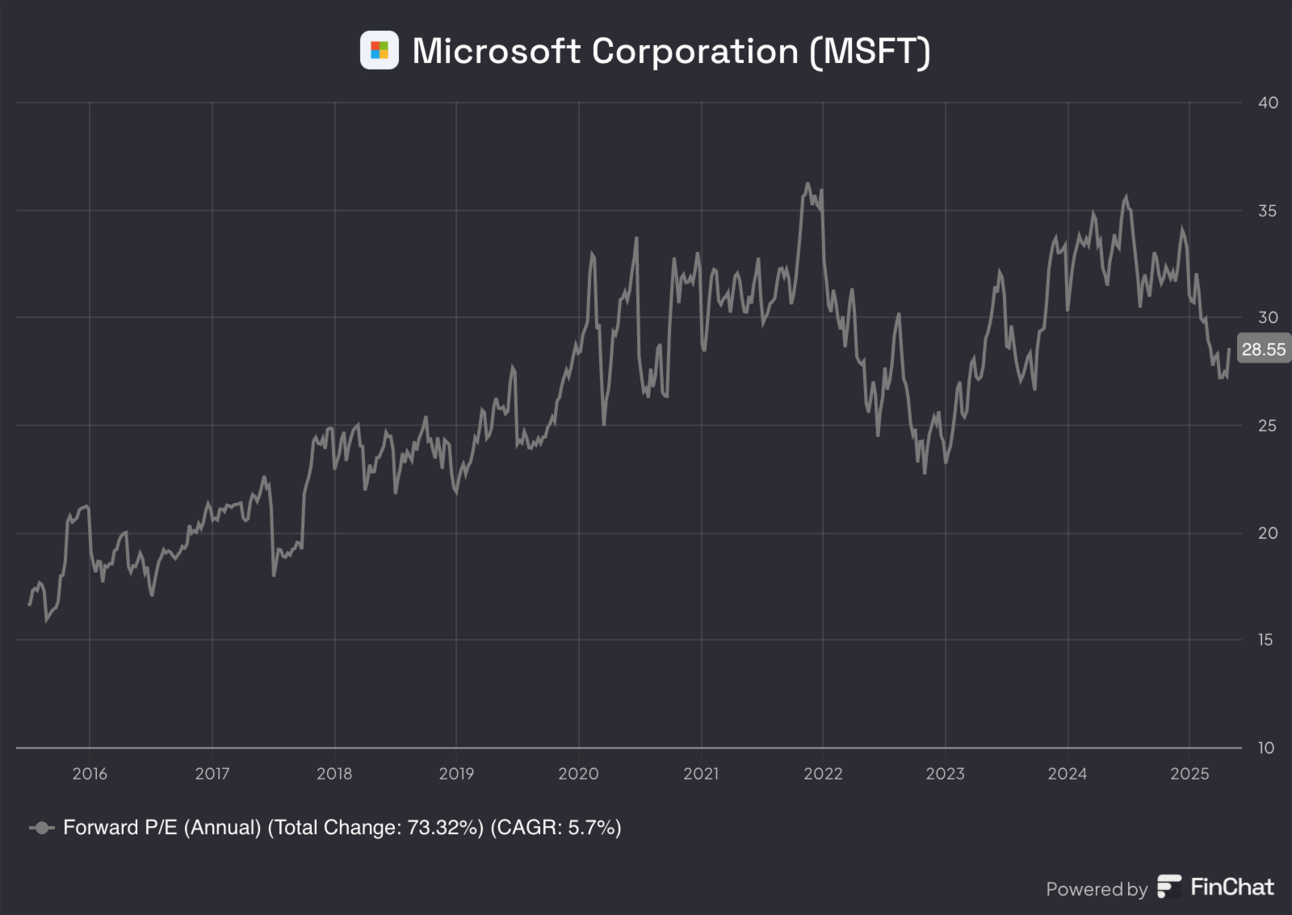

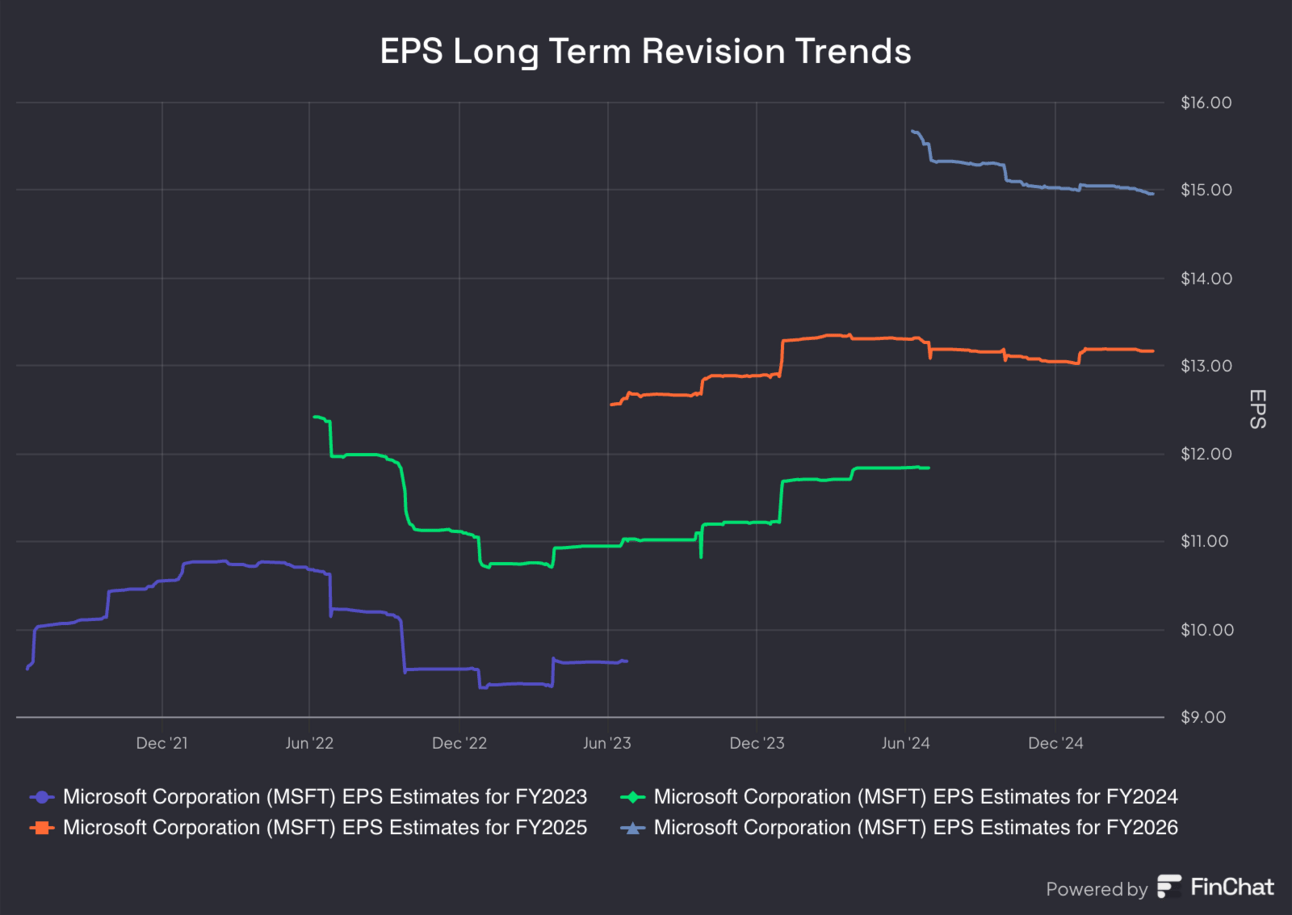

MSFT trades for 28x EPS. EPS is expected to compound at a 12% clip for the next two years.

Balance Sheet:

- Nearly $80B in cash & equivalents.

- $40B in debt.

- Slight Y/Y share count reduction.

- Dividends rose 10.7% Y/Y.