Table of Contents

Earnings Reviews from this season:

- Zscaler Earnings Review.

- Datadog & Palo Alto Earnings Reviews.

- Zscaler Earnings Review.

- Sea Limited Earnings Review.

- On Holdings Earnings Review.

- Nu Holdings Earnings Review.

- The Trade Desk Earnings Review.

- Lemonade & Duolingo Earnings Reviews.

- Palantir & Hims Earnings Reviews.

- Cava Earnings Review.

- DraftKings Earnings Review.

- Microsoft & Cloudflare Earnings Reviews.

- Uber Earnings Review.

- Shopify & Coupang Earnings Reviews.

- Meta Earnings Review.

- Alphabet Earnings Review.

- Apple, ServiceNow & Starbucks Earnings Reviews.

- Amazon & Mercado Libre Earnings Reviews.

- PayPal Earnings Review.

- Tesla Earnings Review.

- SoFi Earnings Review.

- Netflix Earnings Review.

- Taiwan Semi Earnings Review.

My Current Portfolio & Performance.

Housekeeping:

I hear you. The 101 sections are important, but they're too long to include in quarterly earnings reviews. As suggested by readers, I will be making a 101 archive that I can link back to after this season. That will make it easy to access for those needing a refresher (or new readers) and easy to skip for those not needing the info.

1. MongoDB (MDB) – Earnings Review

a. MongoDB 101

MongoDB is a key player in data storage and analytics, with a document-oriented setup. This differs from legacy relational-style databases and next-gen versions like Snowflake’s. How so? Relational databases store data in rigid rows and columns linked by pre-set relationships. These databases look like giant Excel spreadsheets and use structured query language (SQL) to work. The datasets are fixed, with formatting and filtering more limited.

Per MDB leadership, relational databases cannot seamlessly handle unstructured data like MongoDB’s “not only SQL” (NoSQL) format can. MDB's document-oriented setup organizes and uses unstructured data more effectively, which is vital in the age of GenAI and agentic AI. Relational and SQL are fine for traditional machine learning, but less effective for agentic, multi-step, goal-oriented tasks. It’s worth noting that Snowflake and Databricks argue that their upgraded relational databases can handle scalable unstructured and semi-structured data ingestion. Still, MongoDB is widely believed to be a leader in the space.

- MongoDB’s NoSQL document-oriented database is called Atlas.

- The newest version of its database software that powers Atlas is called MongoDB 8.2. This offers 20% to 60% performance boosts vs. the old version and better time series (timeline-based) data services.

Atlas’s cloud-native database architecture uses a group of servers (or a cluster) to actually store data for eventual product creation within its platform. The nature of MongoDB’s Atlas product enables easy cluster additions and subtractions as needs fluctuate. That greatly helps control costs and improve performance. It also offers MongoDB Search for data querying with a highly capable Vector Search offering for AI use cases as well. Vector Search allows clients to conveniently scrape insights from data via theme-based querying rather than just word-based. MongoDB’s retrieval-augmented generation (RAG) perfectly complements these search products, as it enriches large language model (LLM) outputs with external context as needed to improve querying precision. This way, search products deliver optimally relevant and accurate responses.

More Core Atlas Products:

- MongoDB Data Lake houses unstructured data for querying and analytics.

- Atlas Stream Processing enables real-time data ingestion. That matters a lot for app developers who constantly tinker with, split-test, and render every single little detail within their apps. Real-time access to data querying helps make that process better.

- Atlas Search Nodes (nodes = servers) automate productive usage of compute capacity and separate database & search functions to enable easier, more affordable scaling. This product is key for cloud cost control.

Product Expansion & AI:

Beyond its aforementioned Vector Search offering, MongoDB excels in automating the cumbersome data modernization work for migrations. Its Relational Migrator (RM) handles and takes client headaches out of this process. Now, it’s focused on leveraging RM, allowing companies to actively re-code their legacy applications with end-to-end support. They call this the “modernization factory.” With this holistic strategy, MongoDB becomes a more prevalent and relied-upon vendor, as it directly handles data and software modernization through its singular platform.

Voyage AI (recently acquired) is a key player in AI model accuracy. While models routinely create delightful, jaw-dropping experiences, they’re also wrong a lot. Hallucination rates (wrong answer rates) can often reach 25%, making models really only useful when you know what a right answer should look like and are double-checking. That limitation puts a tight ceiling on utility and is what Voyage aims to fix.

It has two products. First is its set of Vector Embedding Models. As leadership puts it, these are the “bridge between models and a client's private data.” They allow for meticulous information transfer into models and significantly overlap with its RAG offering with the aim of ensuring maximum answer accuracy. Voyage's embedding models are what make data usable for RAG and their database offerings by numerically organizing standardized insights. All of this helps with machine learning accuracy rates and uncovering patterns to reduce model mistakes. Secondly, it offers reranking models. As an LLM query yields a batch of sources to begin forming a final response, these reranking models (as the name indicates) rank the available sources to curate the final answer from a better batch of information. It’s a second filter that makes sure models are using only the best, most accurate information. With Voyage, MDB gains a broader suite of GenAI services to round out a more cohesive platform.

More things to Know:

Atlas App Services is a serverless toolkit for developers to build modern apps. It provides a slew of templates, integrations and guardrails to diminish friction. MongoDB AI Applications Program (MAAP) is an AI adoption acceleration initiative. It helps customers effectively use GenAI tools (with Voyage AI giving them more confidence in doing so). It frees customers to embrace new AI-enabled technologies like Vector Search.

Enterprise Advanced (EA) refers to its on-premise (Atlas is cloud-based), database and app bundle. It allows companies to purchase licensing for subscription-based usage (rather than paying for consumption under Atlas).

Most of MongoDB’s growth is based on acquiring new customers and migrating their workloads onto the platform, as well as consumption-based revenue from customers using its data products and growing workloads.

b. Key Points

- Strong opening quarter for new CEO CJ Desai.

- Voyage AI traction is loud and clear.

- Their AI positioning is broad and compelling.

- Atlas strength continues to weigh on gross margin.

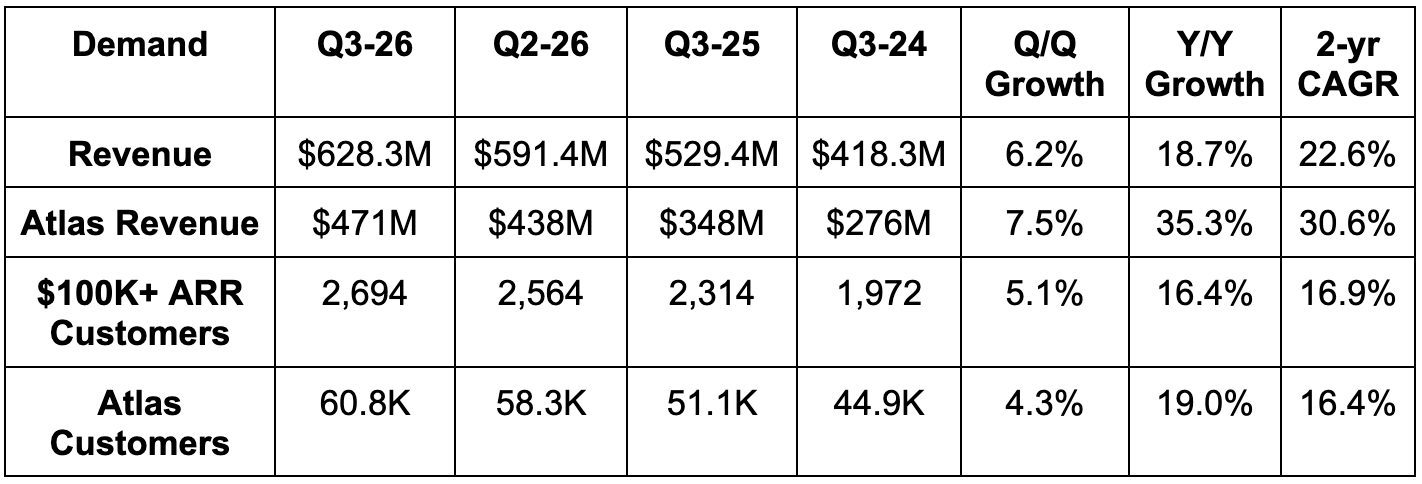

c. Demand

- Beat revenue estimate by 5.6% & beat guide by 6.6%.

- Beat Atlas revenue estimate by 3.5%.

- Beat 2,684 $100K ARR client estimate by 10 clients.

A material part of this outperformance was powered by non-Atlas, or on-premise, demand. Non-Atlas ARR rose by 8% Y/Y. This crushed -20% Y/Y growth estimates, as the company enjoyed much better than expected multi-year licensing revenue. They’re often aggressively pessimistic when it comes to forecasting for this segment, as revenue recognition is lumpy and unpredictable. There will continue to be plenty of on-premise opportunities for highly sensitive workloads, but the lion's share of the workload opportunity will be for its cloud-based Atlas offering.

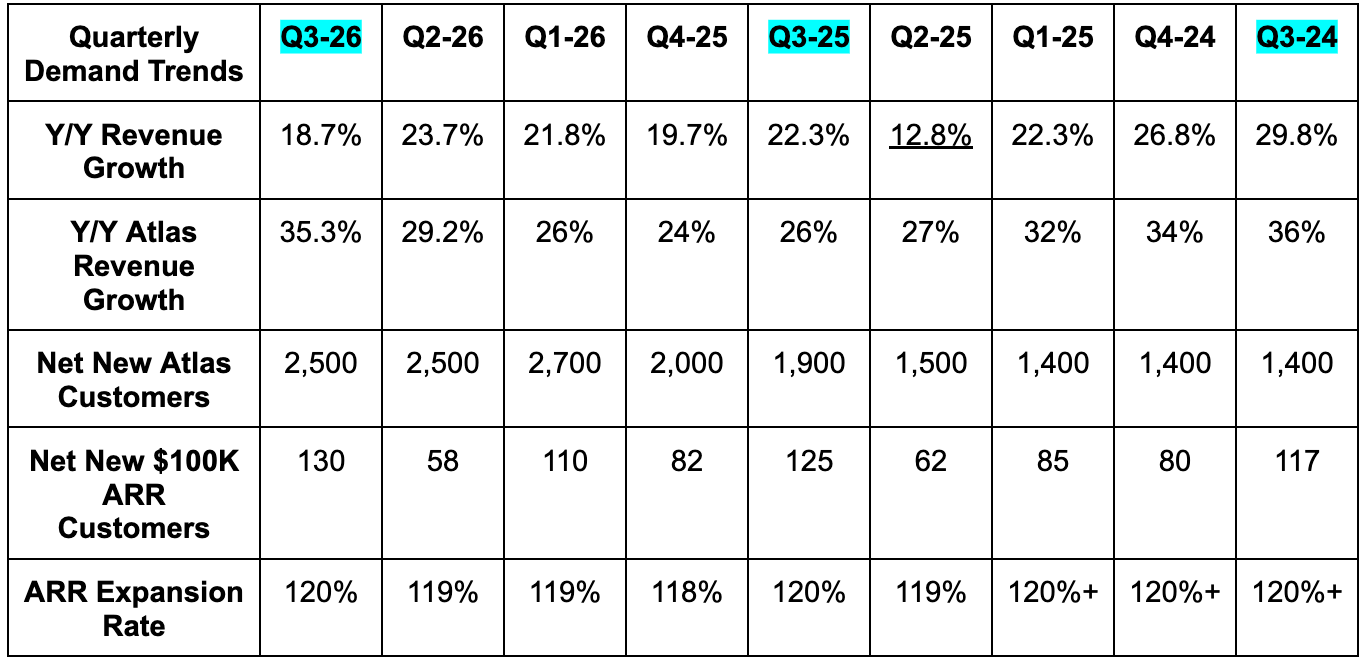

And that’s why the sizable Atlas beat is even more encouraging than the non-Atlas result. Strong demand for the segment was driven by consistent consumption growth across the globe. This momentum was felt within new customer wins and existing workload expansions. There was nothing temporary or weird about this success… just general and structural strength.

Lastly, year-to-date new customer additions have grown by 65%. That is related to its decision to allow mid-market demand to access self-service channels instead of going through formal procurement processes. This has shrunk sales cycles, removed customer friction and accelerated growth. Great decision.

d. Profits

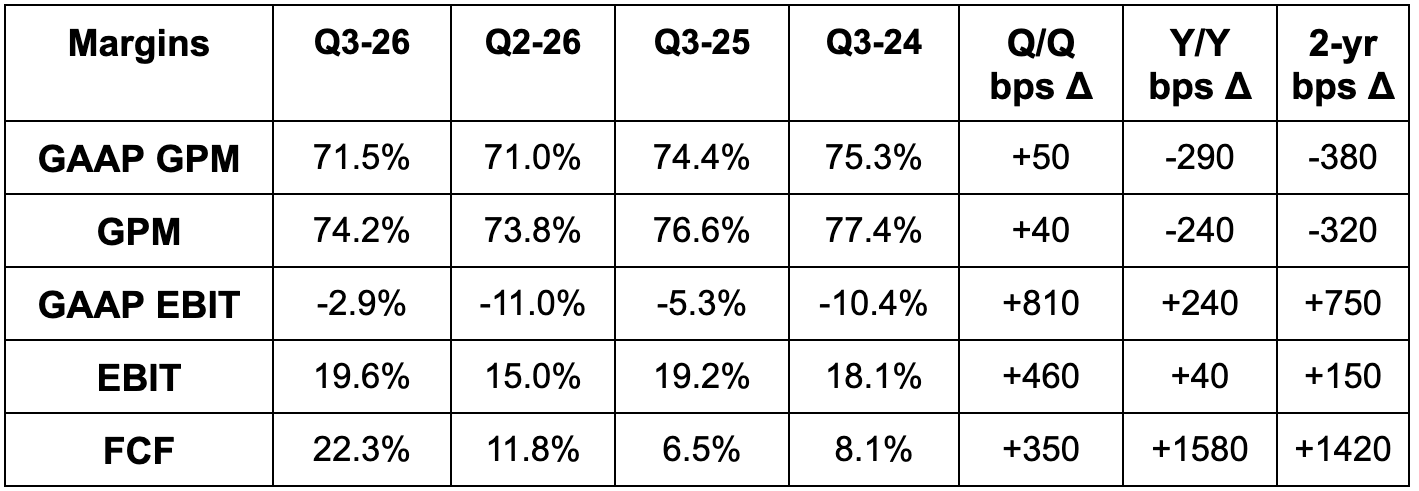

- Missed 74.4% GPM estimate by 20 basis points (bps; 1 basis point = 0.01%).

- Crushed EBIT estimate by 71% & crushed guidance by 81%. When revenue outperforms, that outperformance leads to more fixed cost leverage and large profit beats.

- Crushed $0.80 EPS estimate by $0.52 & crushed $0.77 guidance by $0.55. EPS rose 14% Y/Y.

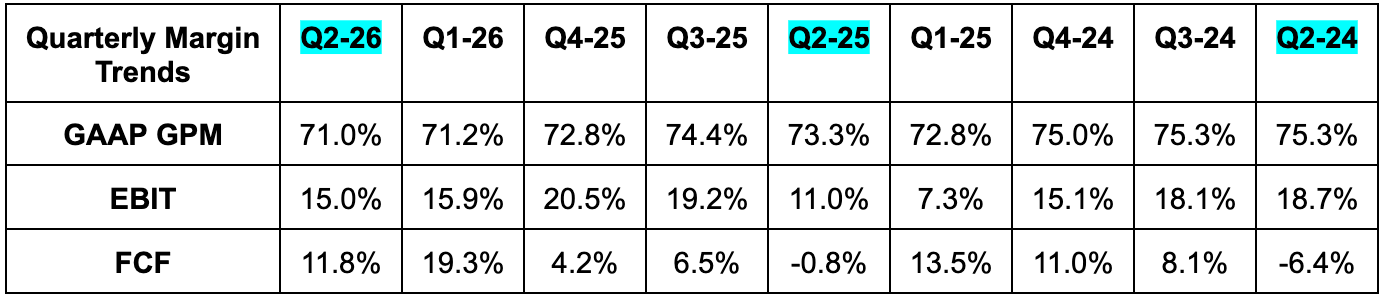

GPM pressure is related to Atlas growing as a percentage of the overall business. Atlas GPM specifically improved Y/Y, but it’s still a large drag and one that they’re happy to accept. Cloud-based demand has a far more compelling runway than on-premise.

Operating expense growth was held back by some delayed investments. Those investments will now be partially pushed to next quarter and FY 2027.

Cash flow was helped by income statement profit beats and some cash collection favorability. While that second item is not typically structural, they think improving cash flow conversion should be a durable theme as they can make working capital improvements sustainable.

e. Balance Sheet

- $2.3B in cash & equivalents.

- No debt.

- 10% Y/Y share dilution (partially M&A).

The company has begun settling restricted stock unit (RSU)-related taxes via cash instead of new shares. That should help slow down the pace of dilution, along with its ongoing buyback program.

f. Guidance & Valuation

- Raised Q4 revenue guidance by 7.4%, beating estimates by 6.8%.

- For the year, revenue growth is now expected to be 21.5% Y/Y.

- Raised Q4 EBIT guidance by 64%, beating estimates by 63%.

- Raised Q4 $0.91 EPS guidance by $0.55, beating $0.93 estimates by $0.53.

- Reiterated 100%+ FCF conversion for FY 2026.

Guidance now includes 27% Y/Y revenue growth for Atlas vs. about 25% previously expected. It also includes 7%-9% non-Atlas growth, implying non-Atlas will do much better than its previous annual segment guidance calling for a roughly 5% Y/Y decline. As this is a consumption-based business model, they remain highly prudent in forecasting assumptions.

MDB also offered preliminary thoughts on FY 2027 results. Despite the aforementioned note on some investment delays, they still expect to expand the EBIT margin by 1-2 points Y/Y and generate a roughly 90% FCF conversion rate. They reiterated all targets outlined in the September Investor Day, which was awesome to hear amid the CEO change. Leverage next year is expected to come from strong revenue growth, as OpEx is expected to grow in line with revenue.

Finally, for FY 2027, they believe non-Atlas revenue won't be an especially large headwind or tailwind for the overall business. That was a pleasant surprise that led to 2027 revenue estimates rising by 4%. Their FY 2027 starts after next quarter.

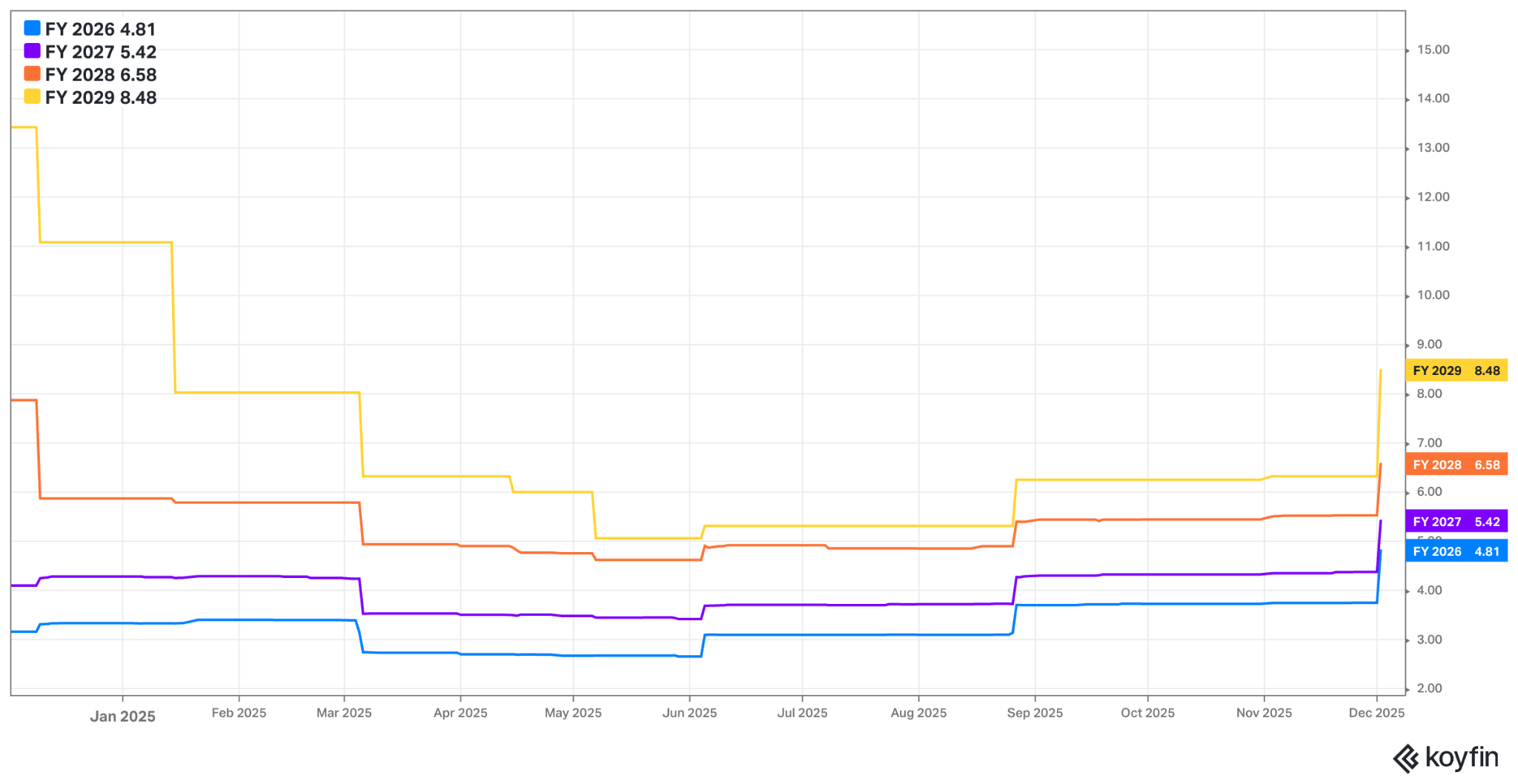

MDB trades for 81x forward EPS. EPS is expected to grow by 32% this year (we’re now in their Q4 for FY 2026), 13% next year and 21% the year after. It also trades for 100x forward FCF. FCF is expected to more than triple this year to $377M. Growth is expected to be 19% next year and 36% the year after.

g. Call

Introducing New CEO CJ Desai: