Table of Contents

1. Free Cash Flow Valuation Comp Sheets

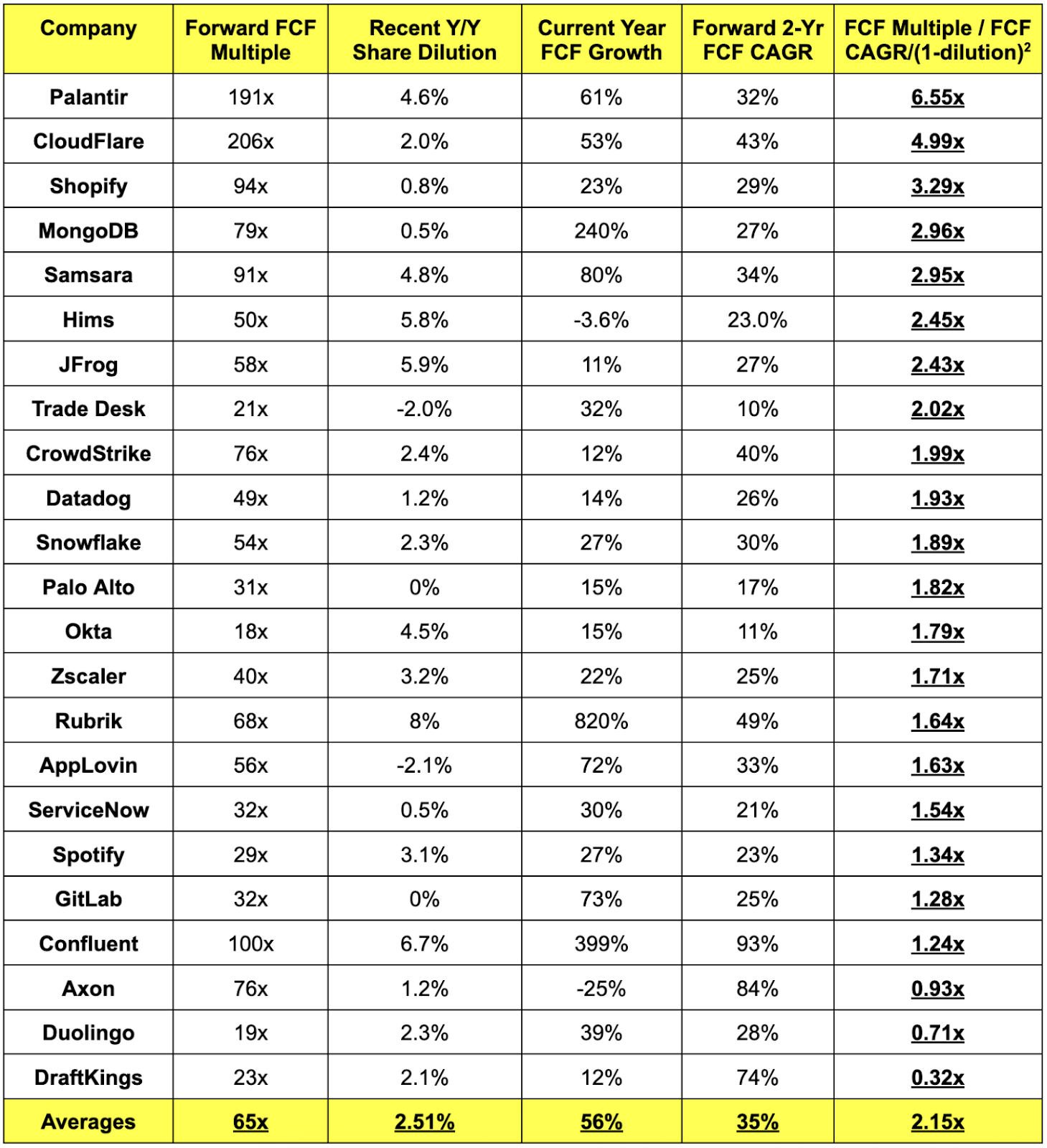

a. Fast Growth

Rubrik’s 800% Y/Y FCF growth was excluded from the 56% average to eliminate an outlier.

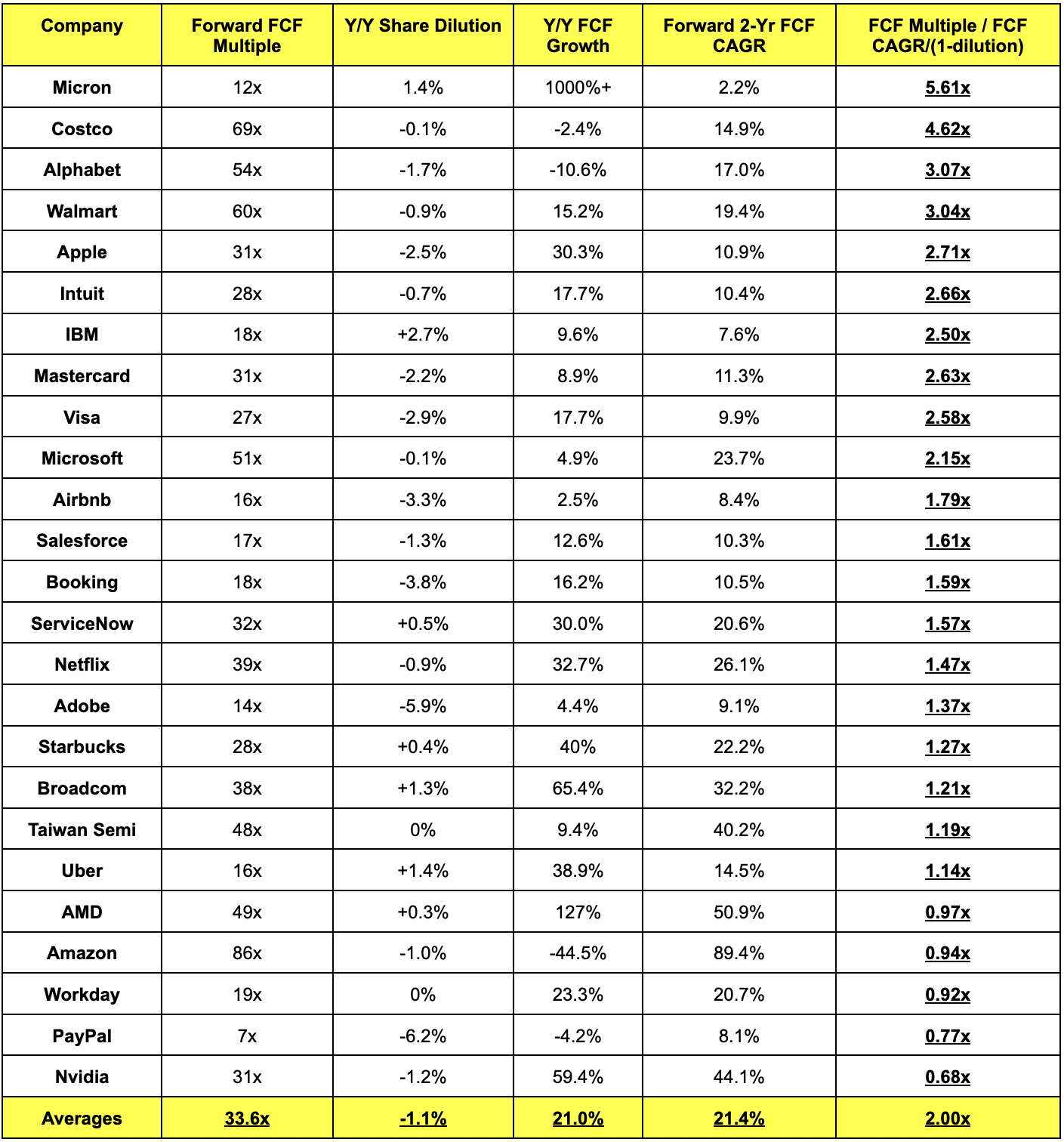

b. Maturing Growth

This is the messiest the FCF sheet has ever been for this cohort, which has everything to do with AI CapEx. I think the income statement comp sheet I publish next week will be more useful, but I still wanted to include this. Tesla was excluded because its FCF growth multiple is currently over 20x. Oracle and Meta were excluded because FCF for both is shrinking due to AI CapEx. Alphabet’s multiple zoomed past 3.0x due to its CapEx strategy as well. The income statement sheet next week will more gradually account for all of this spending via depreciation instead of a direct cash outlay.

2. Meta (META) – M&A

Manus 101:

Meta is buying a company called Manus for somewhere between $2B-$3B. The purpose of the move is clear: Use Manus to deepen Meta’s presence in agentic AI. This is Meta accelerating its push beyond chatbots and answer engines into something much more actionable and valuable.

Manus specializes in building, orchestrating and deploying agents for complex, multi-step tasks. They have a sizable scale disadvantage vs. leaders such as OpenAI and Anthropic, yet still perform extremely well in standardized agentic benchmarks and cost per token output. Despite less fixed cost leverage and inferior access to data and compute, this underdog delivers its impressive performance in a few ways. They’re model agnostic and will intelligently route customer inputs to the best and cheapest choice. Their architecture can also store old interactions and evaluate new prompts to gauge whether or not any of those previous outputs can be recycled to cut costs. And lastly, it uses a “planner-executor-verifier” system that allocates subsections of jobs to different, more specialized models best suited for that work. It’s somewhat similar to the Mixture of Experts (MoE) concept that splits simultaneous work into specific pieces of a model. Manus’s approach also splits the work, but does so across different models and in asynchronous steps that can help match the efficiency edge that MoE provides.

Here’s how the three pieces of Manus’s “planner-executor-verifier” approach:

- The “planner” model is a reasoning model that evaluates the task and selects the best way to complete it.

- The “executor” or workhorse model leverages its leaner and more purpose-built makeup to finish tasks more affordably than giant, generalist frontier models.

- The “verifier” model evaluates executor model work before it’s finalized to find issues and improve work efficacy. This lowers hallucination rates, reduces costs and builds enterprise confidence in embracing this new wave.

To conduct work, Manus will autonomously write a Python-based script for essentially every workflow (if work can’t be recycled). This improves agentic flexibility. Unlike other systems that effectively call on a preset list of actions to complete tasks, this tool calling method is far more granular. This means Manus’s work is perfectly suited for a customer’s own needs… not generally built and constantly retrofitted. And with the firm’s powerful layers of automation, this more relevant product delivery occurs without the exploding costs that generally coincide with customization.

This architecture also helps augment the strong cost dynamics that Manus enjoys at its relatively tiny scale. How? The Python-based code that it writes eliminates a lot of redundant and inefficient work that generalist agents entail. They’re written and optimized for one task. Not millions.

Consider an example where I’m looking for the best and most affordable driver for my golf bag this summer. Then consider that the preset actions of alternative systems allow me to scrape information from a website that sells drivers. I would need to call on this fixed move over and over again for every single option to finally be populated and judged. Manus, alternatively, can write a script allowing me to call on a similar tool one time with custom parameters set to ensure that a single request for information returns the aggregated data I need. And if there’s a web connection issue? The alternative system will get frustrated and give up. Manus will see that technical error playing out in its generated code and fix the problem on the fly to still arrive at a good answer.

To accomplish all of this in a valuable and seamless way, Manus will complete desired work in a separate virtual machine (VM) for a customer. This means core operations and apps aren’t impacted by these outputs in a disruptive way before the AI is ready to create real value. The work is both separated and deeply integrable, combining lower security and operational risk with interoperability.

Price Tag & Deal Terms:

Manus has quickly stormed onto the scene and matched Lovable’s record for the fastest ramp to $100M in ARR… ever. It took them just 8 months, and they’re already up to $125M as of this deal announcement. Considering this, the estimated $2B-$3B price tag for Manus actually feels refreshingly fair. 16x-24x forward ARR for an AI darling like this is a pleasant surprise to me. I would have guessed a price tag closer to 40x ARR like Anthropic’s most recent raise or what Adobe tried to pay for another AI disruptor like Figma.

I’d also like to point out that Manus got to $100M in ARR without billions in funding allowing them to freely and carelessly incinerate cash in favor of more compute. They’ve raised just $85M since inception (pre-Meta) yet have gotten very far with that comparatively small infusion. Lovable has raised $500M+. LLM builders have raised billions.

And now? Manus is joining a company determined to provide their AI researchers more compute per person than anyone on the planet. That alone should greatly amplify Manus’s ability to accelerate and expand its roadmap.

- The company plans to keep offering its existing subscriptions and services to customers (while integrating its tech across FOA).

Finally and importantly, CEO Xiao Hong (Red Xiao) will stay with Meta post deal closure, along with 100 of Manus’s researchers who will join forces with Alexandr Wang and Meta’s AI teams. I always love seeing that. When teams sell and immediately vanish, that hints at them believing value creation has been exhausted. That’s not happening here.

Geopolitics:

It is true that Manus was founded by a company called Butterfly Effect in China. On the other hand, they moved headquarters to Singapore, fired their staff in China and severed all ties to the Chinese market as part of the deal. That includes a tight Alibaba cloud relationship that no longer exists. Manus has chosen to embrace U.S. capital markets over Chinese capital markets.

Plans for these Assets:

This will greatly uplevel the AI experiences Meta provides across its core family of apps (FOA). Right now, Meta AI’s presence functions as a companion or an information retriever. That’s about it. The actionable work and purchasing that can be done through that interface are very limited, so Meta’s ability to monetize it is equally limited. It’s hard to make money on a question about Curt Cignetti and Indiana Football with an answer offering useful background information. It’s way easier to make money when that answer coincides with nudges to purchase tickets, find a hotel and book dinner reservations for their upcoming semi-final. With Meta’s world-class targeting capabilities, they should be able to do that more impactfully than most. It’s also easier to make money when customers directly ask for things if you can… well… provide what they want without shipping the traffic to another site. This allows Meta to meaningfully take part in agentic commerce and more actively fetch a piece of the overall opportunity.

The deal also gives Meta a slew of enterprise-facing tools that cultivate subscriptions and paid products like WhatsApp click-to-message. Manus will mean those interactions get far more advanced and lucrative, while plugging into the rest of Meta’s apps and creating value-rich interactions elsewhere. This should enhance lifetime value and drive more revenue from its existing base of traffic.

Meta has been arguably the best mega-cap aside from Nvidia in terms of capitalizing on the AI opportunity. They get very little credit for it, but every single quarter we hear about AI optimizations directly boosting time spent across their apps as well as price per ad impression. With Manus, Meta unlocks an entirely new frontier of possibilities to amplify its AI monetization and amplify its traction.

Take:

I’m a big fan of the purchase for all of the reasons cited. I am confident that the app layer of AI is poised to explode in the coming years, with that explosion led by agentic growth. Meta was not greatly positioned to financially enjoy that large structural tailwind. In my mind, this changes that in a big way and does so at a reasonable price.