Most of this week's content has already been sent:

- CrowdStrike & MongoDB Earnings Reviews.

- Snowflake Earnings Review, ServiceNow M&A & PayPal CFO Interview with UBS.

- SentinelOne Earnings Review.

- Rubrik Earnings Review.

Table of Contents

- 1. Brief Earnings Snapshots – Salesforce (CRM) and Gitlab (GTLB)

- 2. ServiceNow (NOW) – COO/President Interview with UBS

- 3. Uber (UBER) – CFO Prashanth Mahendra-Rajah Interviews with UBS

- 4. Zscaler (ZS) – Co-Founder/CEO Jay Chaudhry Interviews with UBS

- 5. Coupang (CPNG) – Data Breach

- 6. SoFi (SOFI) – Capital Raise & CFO Chris Lapointe Interviews with UBS

- 7. The Trade Desk (TTD) – More Turnover & News

- 8. DraftKings (DKNG) – Various News

- 9. Headlines & Other Brief Notes

- 10. Macro

1. Brief Earnings Snapshots – Salesforce (CRM) and Gitlab (GTLB)

a. Salesforce

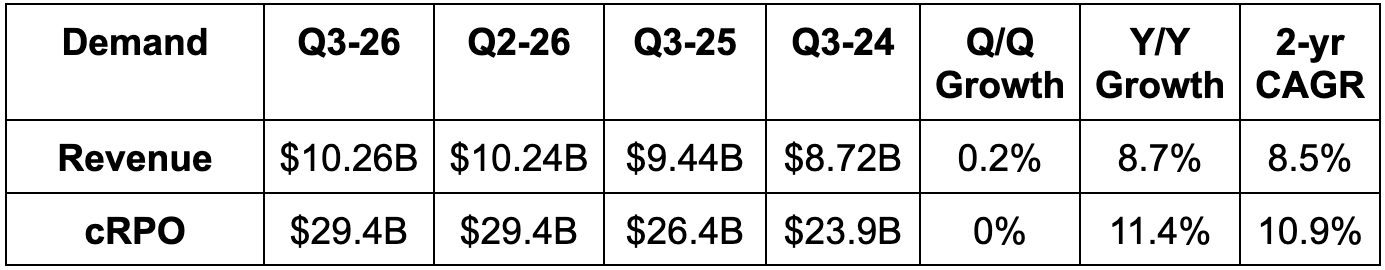

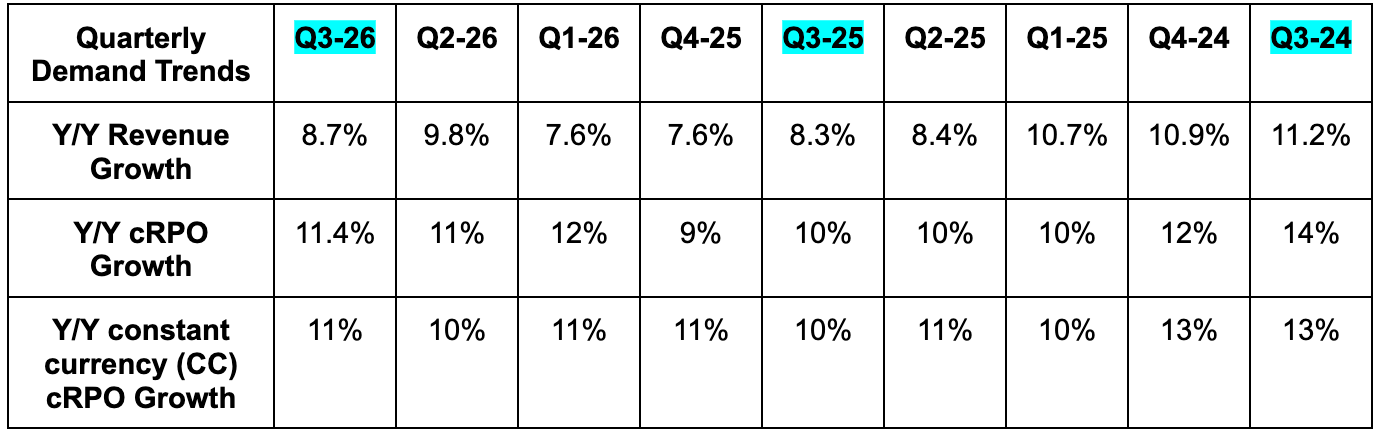

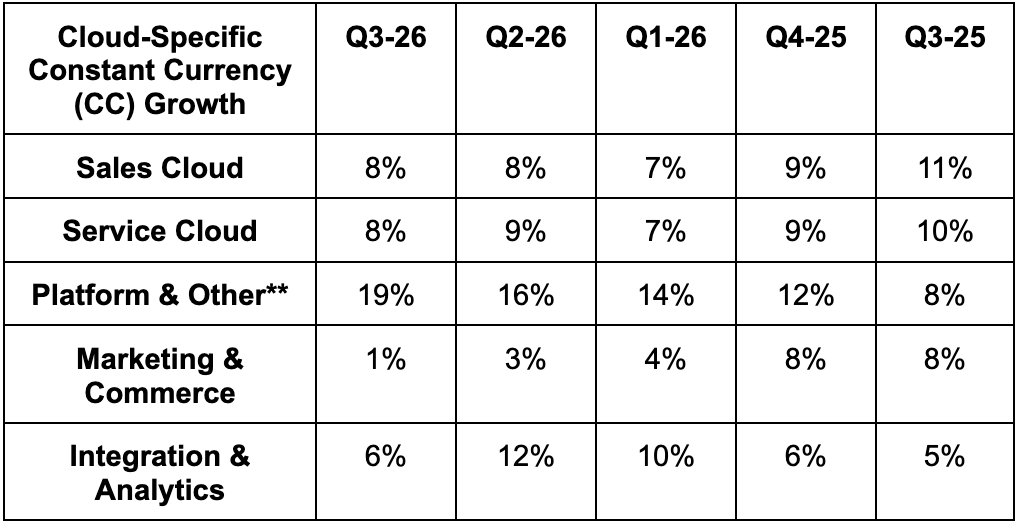

Demand:

- Slightly missed revenue estimate & slightly missed guide.

- 8% Y/Y constant currency (CC) revenue growth met its guidance.

- Beat cRPO estimate by 1.0%.

- 11% CC cRPO growth beat 9% growth guidance.

- Beat billings estimates by 2.3%.

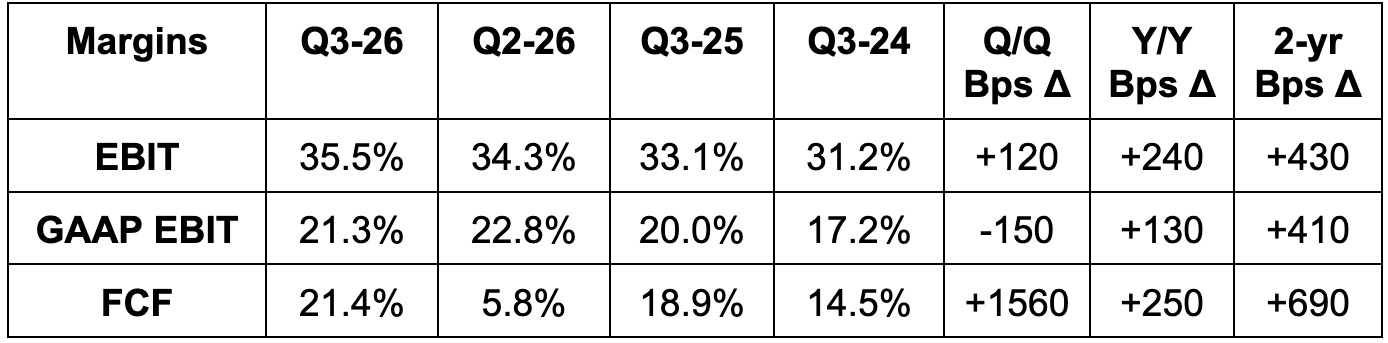

Profits:

- Beat EBIT estimates by 3.7%.

- Beat $2.85 EPS estimates by $0.39 & beat guidance by $0.40.

- Missed operating cash flow estimates by 5%.

Guidance & Valuation:

- Raised Q4 revenue guidance by 2.8%, beating estimates by 2.6% (M&A helping).

- Slightly raised $3.02 Q4 EPS guidance by a penny, meeting estimates.

- Beat Q4 9% CC cRPO growth estimates with 13% growth (4 point M&A boost).

- For the year, demand growth guidance was raised with the help of M&A. EBIT margin guidance was maintained. EPS guidance was raised by the size of the Q3 beat.

CRM trades for 21x forward EPS. EPS is expected to grow by 15.4% this year and by 10.5% next year.

Balance Sheet:

- $11.3B cash & equivalents; $6.4B investments.

- Diluted share count fell by 1.5% Y/Y.

- 3.4% Y/Y dividend growth.

b. Gitlab (GTLB)

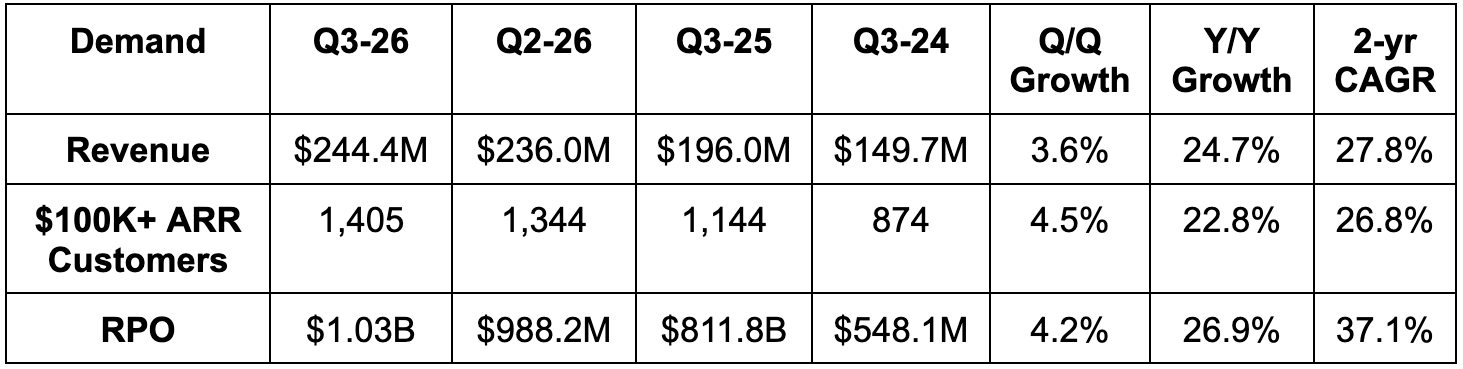

Demand:

- Beat revenue estimates by 1.8% & beat guidance by 2.5%.

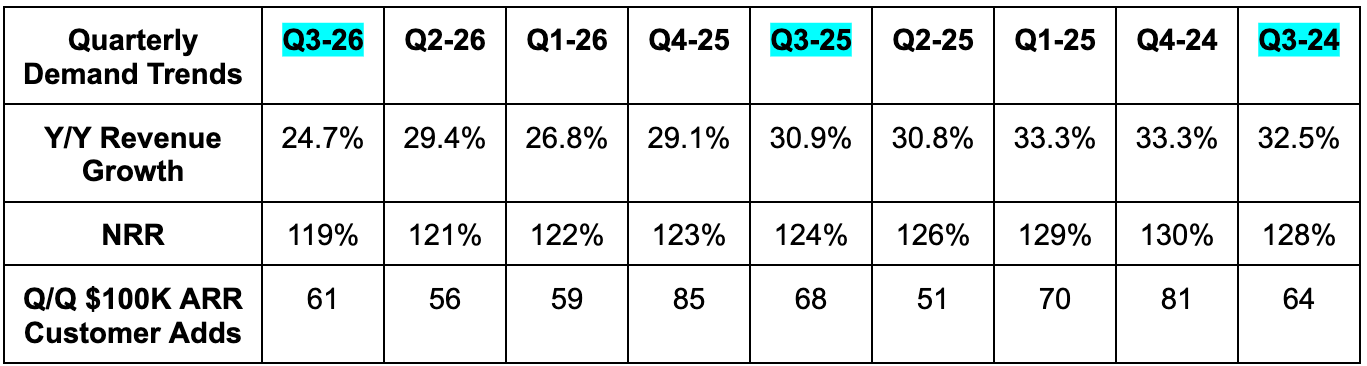

- 27.8% 2-yr revenue compounded annual growth rate (CAGR) vs. 30% Q/Q & 30% 2 quarters ago.

- Missed 120% net retention rate (NRR) with 119% NRR.

- Missed billings estimates by 3.8%. Roughly met RPO estimates.

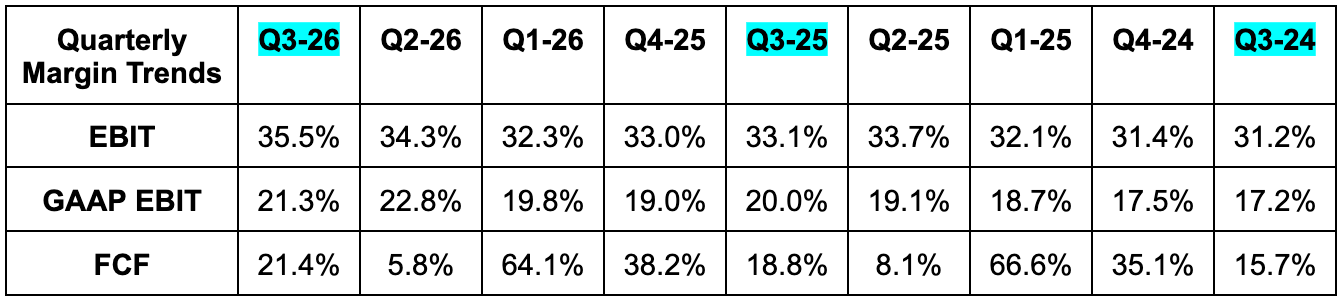

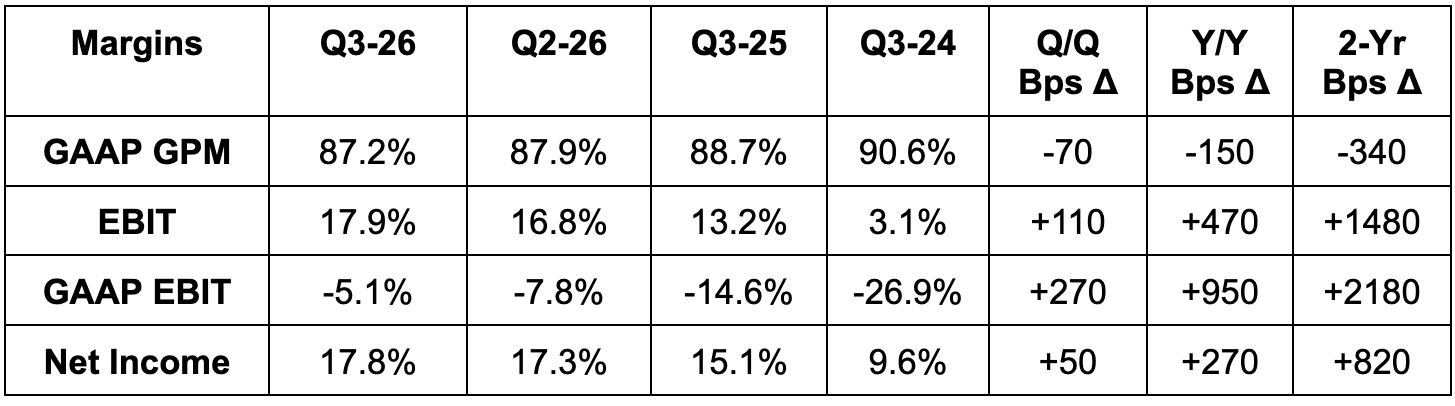

Profits:

- Missed 89.9% GPM estimates by 130 bps.

- Beat $32M EBIT estimates by $12M & beat guidance by $12.5M.

- Beat $0.20 EPS estimates by $0.05 & beat $0.195 guidance by $0.055.

Guidance & Valuation:

- Raised Q4 revenue guidance by 0.8%, meeting estimates.

- Raised Q4 EBIT guidance by 4.5%, meeting estimates.

- Raised Q4 EPS guidance from $0.22 to $0.23, meeting estimates.

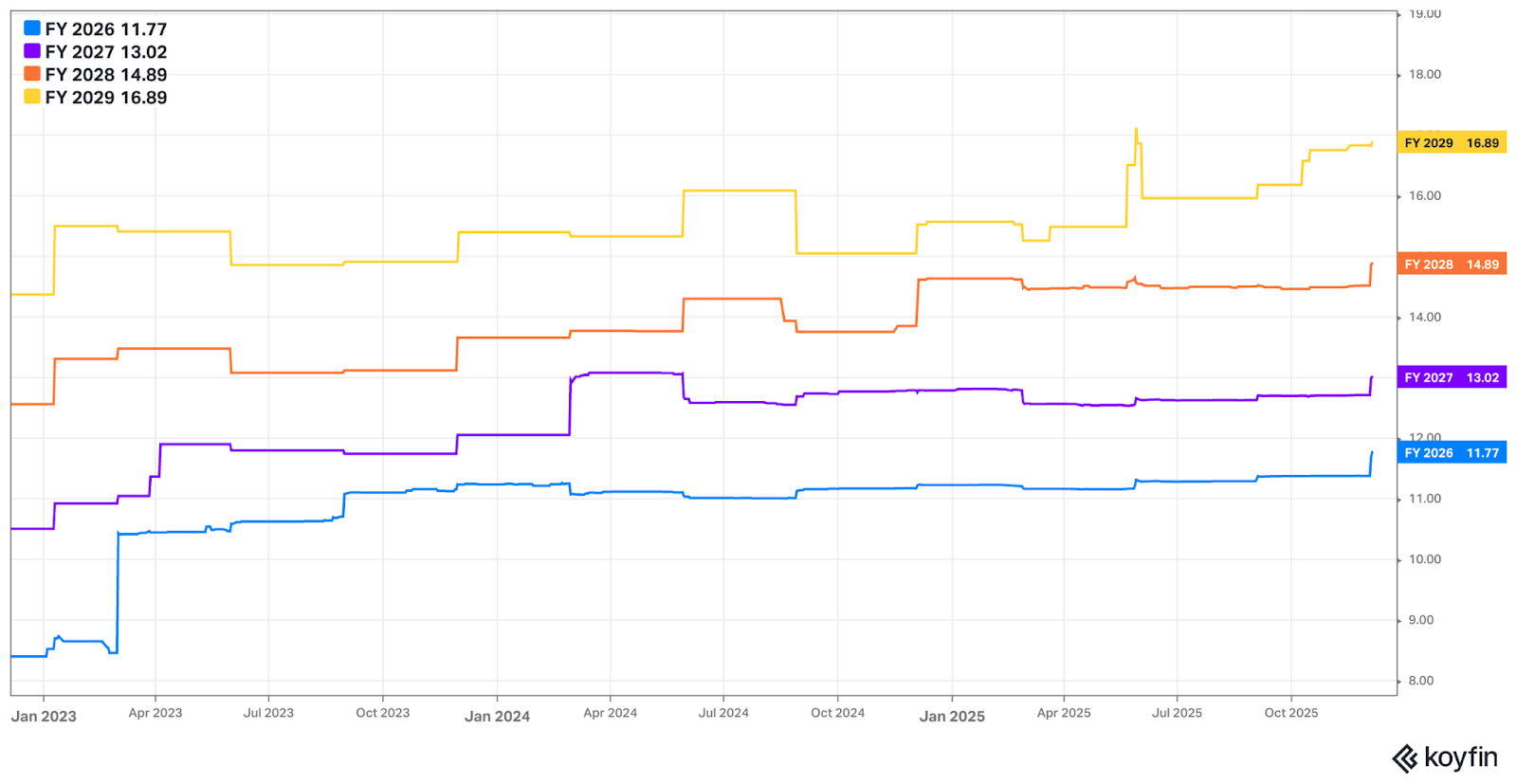

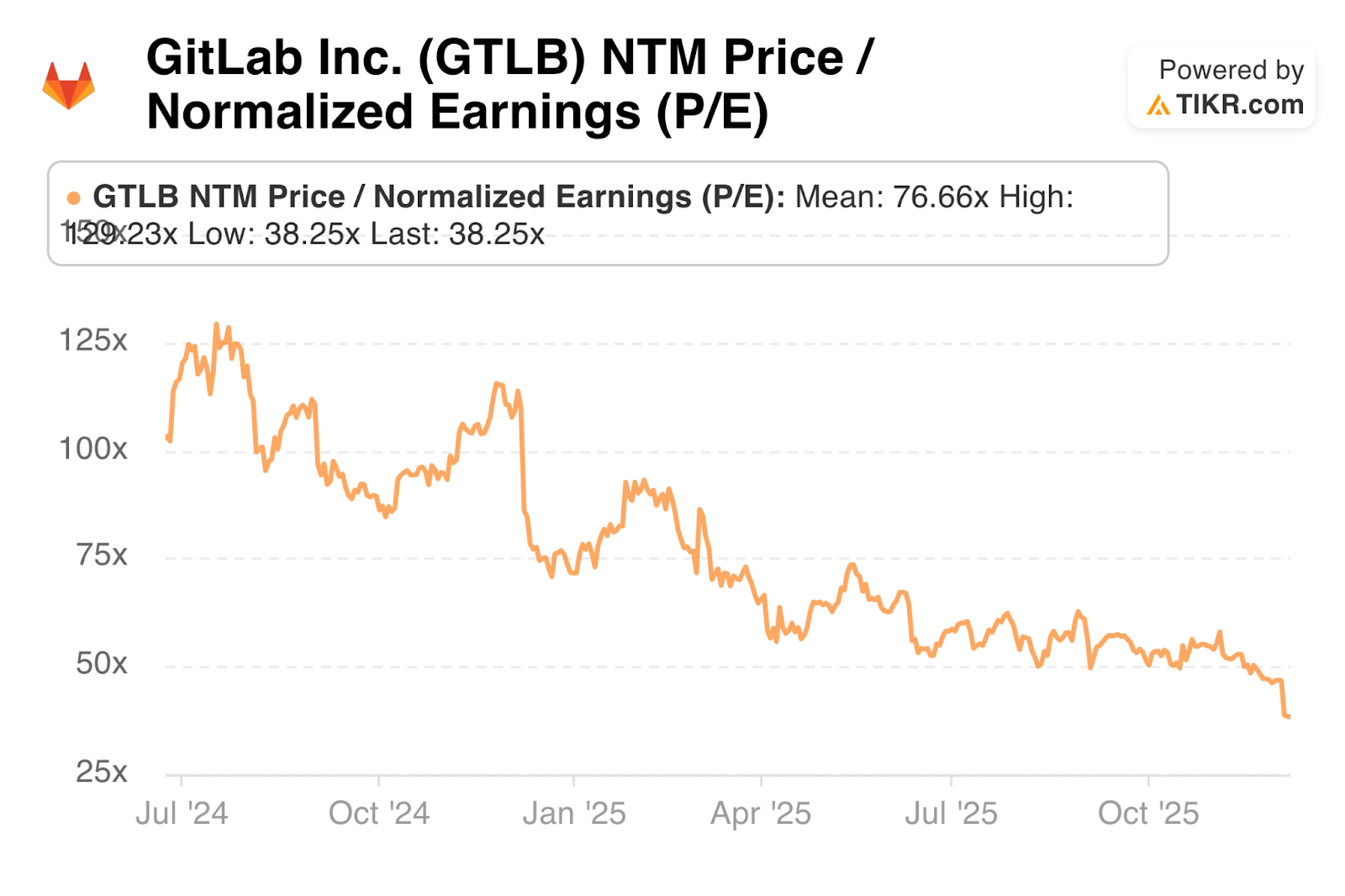

Gitlab trades for 38x forward EPS. EPS is expected to grow by 21% this year, 16% next year and 23% the year after.

Balance Sheet:

- $1.2B in cash & equivalents.

- No debt.

- Stable diluted share count.

- Basic share count rose by 3.8% Y/Y.

2. ServiceNow (NOW) – COO/President Interview with UBS

NOW’s President and COO (Amit Zavery) also gave a brief interview with UBS during the week. In it, the main theme was ServiceNow’s superior ability to offer more value-enriching products within a single unified platform. Their interoperability, powerful workflow automation apps, AI Watch Tower and complete access to data represent a breadth of utility that virtually no other enterprise software firm matches. The scale of information and insight that passes through the NOW platform is why their autonomous agents, which can tap into all of this value, have proven so popular early on. And that’s why they’re nearing $500M in AI business before most peers. And now? They’re diving more deeply into AI asset security to extend the growth runway with yet another massive adjacent growth opportunity

There has been some concern that large AI partners will try to compete with ServiceNow in workflow automation and other enterprise agents to generate the ROI from massive CapEx spend. While that will inevitably happen, NOW feels very well entrenched in its space and like innovation and platform health are in great shape. They expect partnerships with key players like Anthropic, OpenAI and Google to keep moving from strength to strength.

Next, Zavery was asked about AI’s threat to seat-based growth for software platforms like ServiceNow. While that may present a headcount headwind down the road, NOW hasn’t seen this materially show up in its business. And at the same time, agents represent an entirely new asset class to build, govern, monitor, optimize and protect. This is an asset class that can inherently do a lot more work than a person or manually-controlled machine can. That’s the main point of AI spending… productivity gains. They feel as though the model is perfectly positioned to effectively monetize rising AI usage going forward, and view this tech boom as a convincing tailwind.

And finally, there don’t seem to be any concerns about the federal business. Zavery was given the opportunity to chat about any weakness, but instead told us they were prudent with this sector in the guide and that they really haven’t seen anything concerning play out.