Table of Contents

Most of this week’s content has already been sent:

Other Recent Content:

- Axon Deep Dive.

- Palantir Earnings Review.

- AMD & PayPal Earnings Reviews.

- Alphabet & Uber Earnings Reviews.

- Amazon Earnings Review.

- My Current Portfolio & Performance.

- Access 8 other reviews from earlier in the earnings season.

Max readers, if you are not in the Discord, you should be. It’s included in your subscription and it’s a fantastic community for camaraderie and idea exchanging during hectic times. It’s also where I offer some portfolio management thoughts, highlights from sell-side analyst notes and field your questions. Take advantage!

1. AppLovin (APP) – Brief Earnings Snapshot

As a reminder, “brief earnings snapshots” provide a high-level view of quarterly highlights. These are not nearly as detailed as “earnings reviews,” but there’s not enough time to write reviews on every name I want to cover. This is my way of briefly keeping up with more companies to signal which are deserving of a deeper look.

a. Results

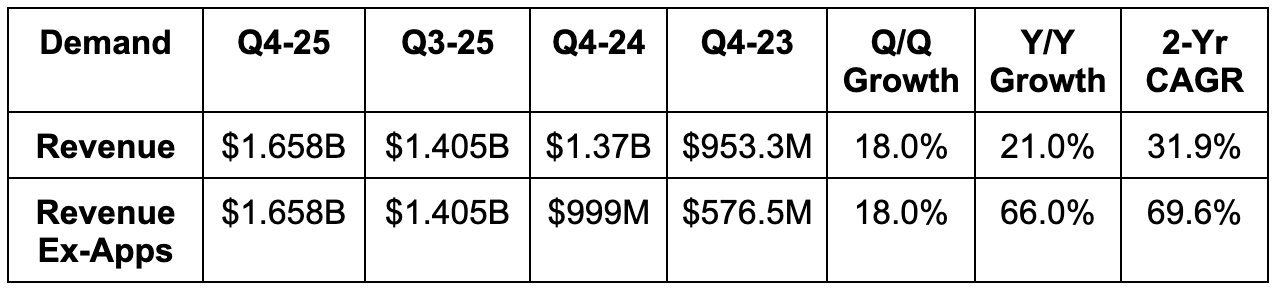

- Beat revenue estimate by 2.9% & beat guidance by 4.6%.

- Beat EBITDA estimate by 5.3% & beat guidance by 7.2%.

- Beat $2.94 GAAP EPS estimate by $0.32.

- Beat FCF estimate by 39%.

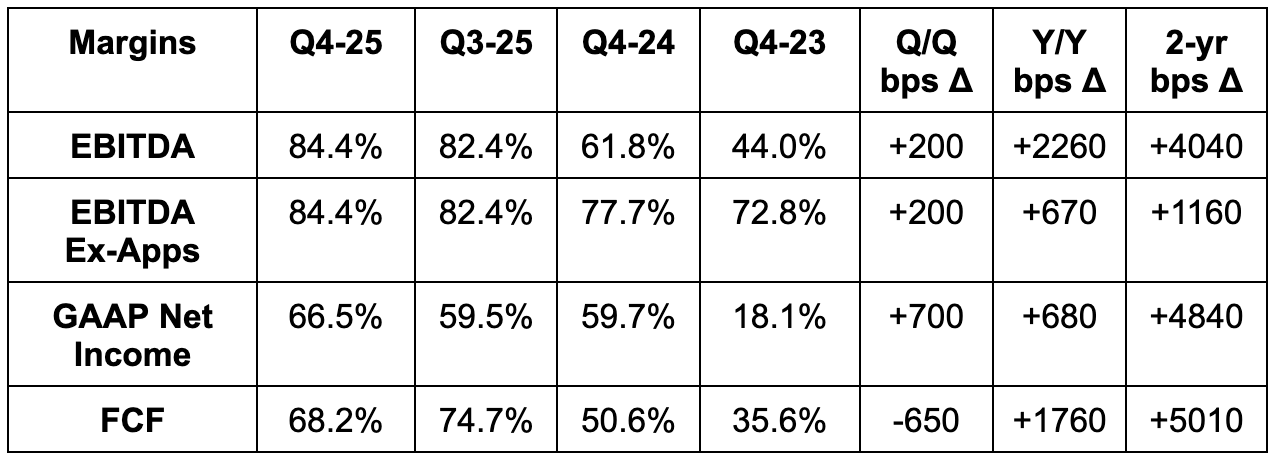

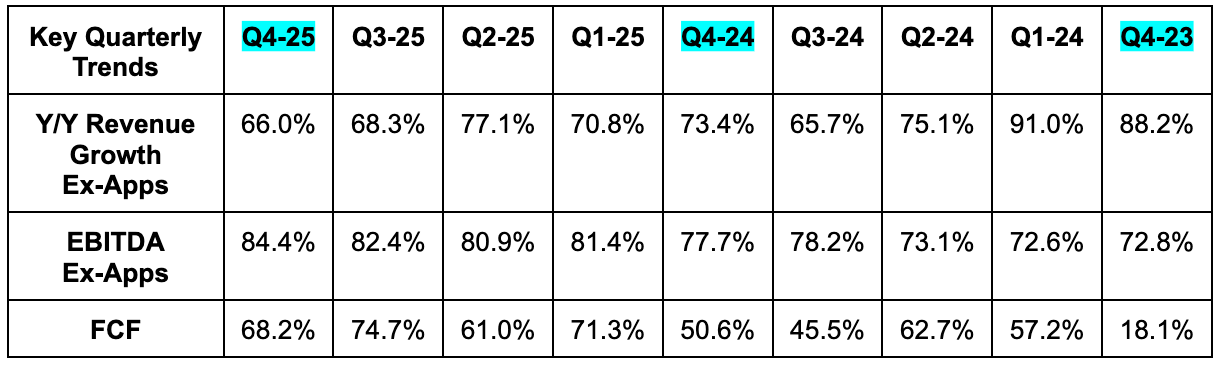

AppLovin sold its app segment last year. Comps are still normalizing, so I think it’s more valuable to focus on ex-Apps trends as the structural part of its current financials.

b. Balance Sheet

- $2.49B in cash & equivalents.

- $3.5B debt.

- -1.8% Y/Y dilution.

c. Guidance & Valuation

Q1 revenue guidance was 3.5% ahead of consensus and Q1 EBITDA guidance was 5.7% ahead. I don’t cover this name closely, but I was able to chat with a hedge fund friend with a large position. They spoke about modest disappointment surrounding the e-commerce ramp. They’re sticking with it and don’t seem to think of this as permanent or structural. Still, in this market, anything but perfection can easily be punished.

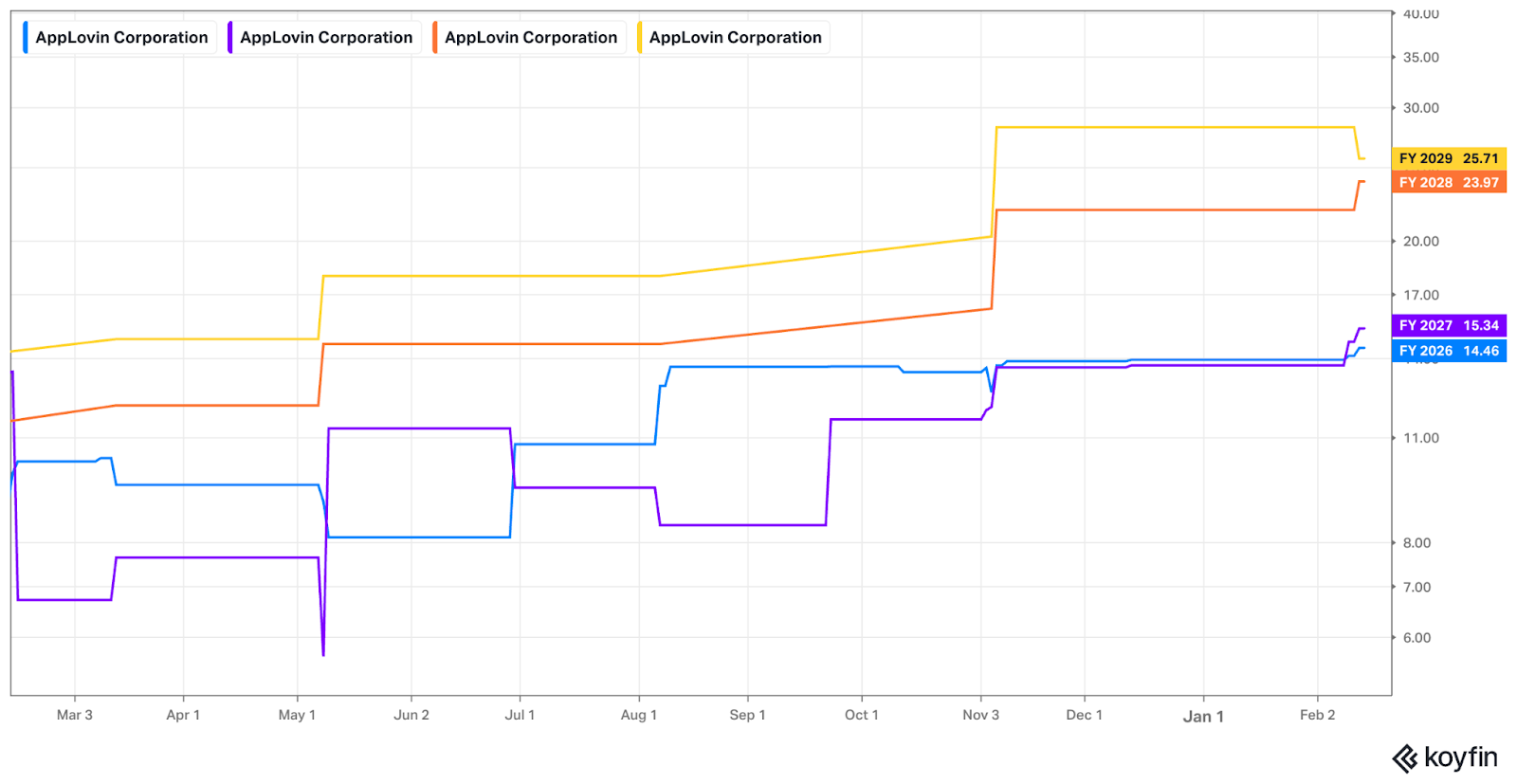

APP trades for 25x forward EPS. EPS is expected to grow by 61% this year and by 27% in 2027.

d. Quick Thoughts

I’ve been asked what I think of this name. It will be an option on the deep dive poll in the Discord after earnings season. For now, I’m not sure. If their 80%+ EBITDA margin is defensible, this looks very reasonable and likely will do well when sentiment for software turns. If Meta and CloudX and other competitors get more aggressive on pricing and pursuit of market share within their end markets? Then 20x forward sales can start to look very expensive very quickly. I don’t know enough to offer a strong opinion one way or another.

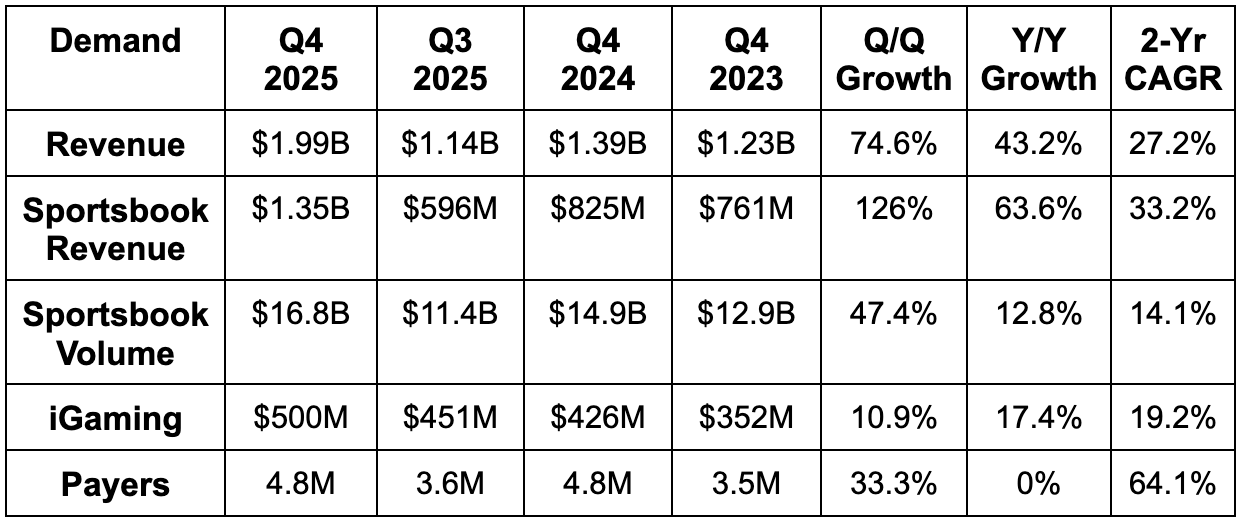

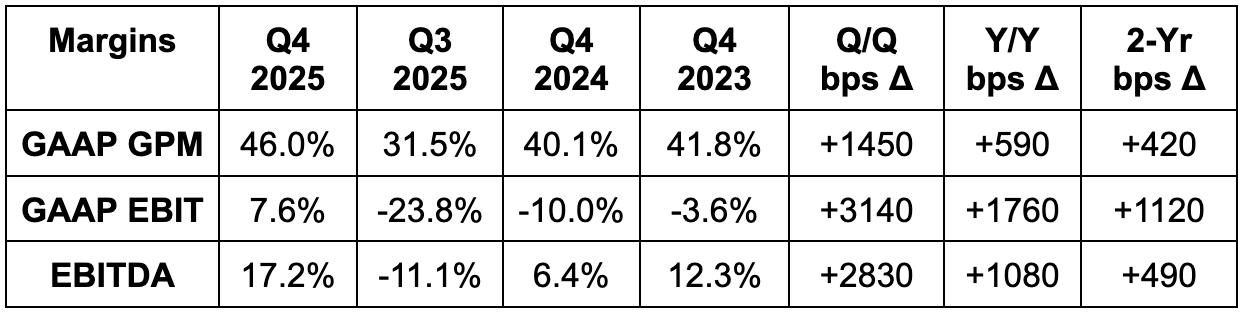

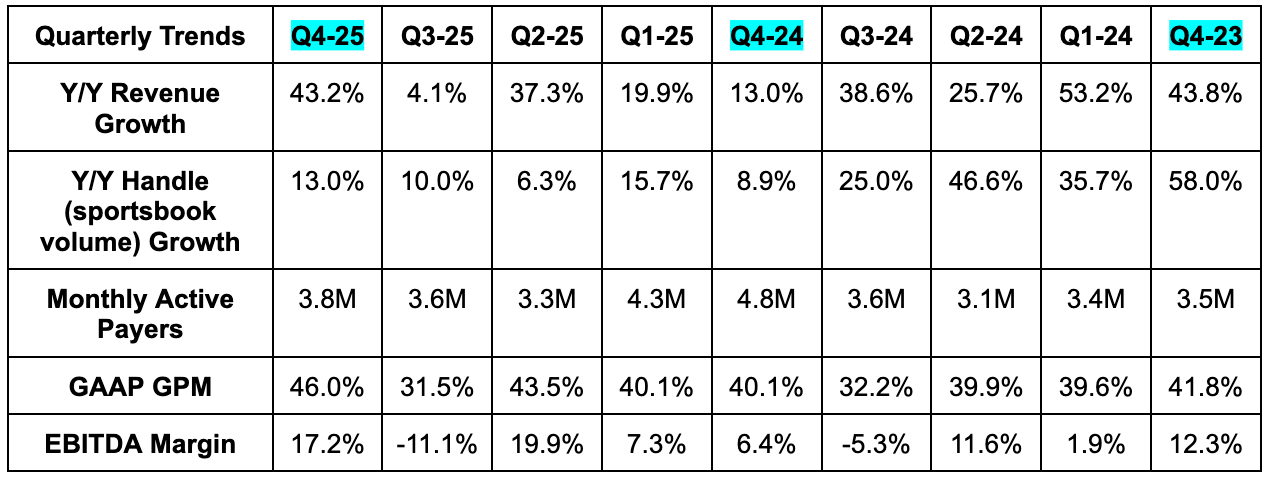

2. DraftKings (DKNG) – Earnings Snapshot

a. Results

- Met revenue estimate. Met GPM estimate.

- Beat EBITDA estimate by 27%.

- Beat GAAP EBIT estimate by 57%.

- Missed $0.41 EPS estimate by $0.05 (tax headwinds).

Just like I don’t care when bad outcome luck drives weaker revenue and profit for a quarter… I don’t care when the opposite plays out either. The beats in Q4 were driven by better-than-expected outcome luck and are not structural in my mind. What is structural is volume growth. Y/Y volume growth accelerated by just 3 points vs. last quarter despite the Y/Y growth comp getting 16 points easier.

b. Balance Sheet

- $1.13B in cash & equivalents.

- $1.26B in convertible notes.

- $576M in debt.

- 2.9% Y/Y diluted share count growth.

c. Guidance & Valuation

Annual revenue guidance missed expectations by 8.3%. That’s despite 2026 expectations falling consistently over the last year. Their revenue is 13% lighter than 2026 expectations from 12 months ago. The same is true for EBITDA. Guidance missed consensus by 18.5% and missed consensus from a year ago by 46%.

DKNG trades for 17x forward EBITDA. EBITDA is expected to grow by 25% Y/Y this year.

d. Blunt Thoughts

As Max readers know, I exited this position a couple weeks ago due to concerning weekly state volume trends that were popping up. It’s not the revenue fluctuations that made me give up on them. That’s based on outcome luck swings and is noise. Volume growth isn’t and that growth turned negative in New York over the last several weeks. That was an alarming deal breaker and this quarter doesn’t make me interested in re-entering.

The data offered to argue that DKNG is defending its market position wasn't good. They highlighted 4% volume growth in January as a positive, despite that being materially slower than what we’ve previously seen out of them. It was almost funny to me that the team thought this was worth celebrating when I saw it as a red flag getting redder. The continued slowing was partially blamed on "friendly sportsbook outcomes in November and December" lowering customer balances. I found that reasoning annoying. Why? Here's Robbins in a previous earnings call saying outcome luck shouldn't impact volume growth from quarter to quarter:

Either he was wrong then or he's wrong now.

They also blamed prediction market competition as another reason for the slowdown, which I think is the true source. That, to me, is likely why monthly active users aren’t growing despite a Missouri launch... and why February data points to more negative growth thus far. Leadership tried arguing that the impact prediction market competition is having is small and within lower-value users, but to me that's how any trend of market share degradation would start.

Simply put, if their main business is ceding market share (which looks likely), the headwind from prediction market in those states will likely be larger than help from its own prediction market launch in the other states. That's especially true considering they're still in product market fit mode. Elsewhere, HOOD is up to a $300M annualized run rate and Kalshi is already as large as DKNG in terms of market cap.

DraftKings can cite good Super Bowl downloads and retention for their prediction market product. They can charismatically mention they plan to be the leader here eventually. They can celebrate a 3-point sequential acceleration in Y/Y handle growth for Q4 despite that being due to their comp getting 16 points easier. They can talk about transaction revenue opportunities and the potential to create a sizable market maker business too. They can say guidance is finally appropriately conservative just like they did last year before sharply missing their supposedly prudent targets. They can say a lot of exciting things like they have for the last two years. I’m just too skeptical at this point to care with core business trends looking this fragile. It feels like their industry has sharply changed and their demonstrated ability to quickly evolve has been lacking. Yes, that's partially because of an unfair regulatory landscape... but that landscape is their reality. They have to win with the hand they're dealt, and I don't know if Robbins is capable of doing that.

I realize the name is very (very) cheap, but I don’t have any faith in estimates being accurate and think more negative revisions are likely. My patience comes when broken stocks coincide with healthy companies. I think this company is broken.

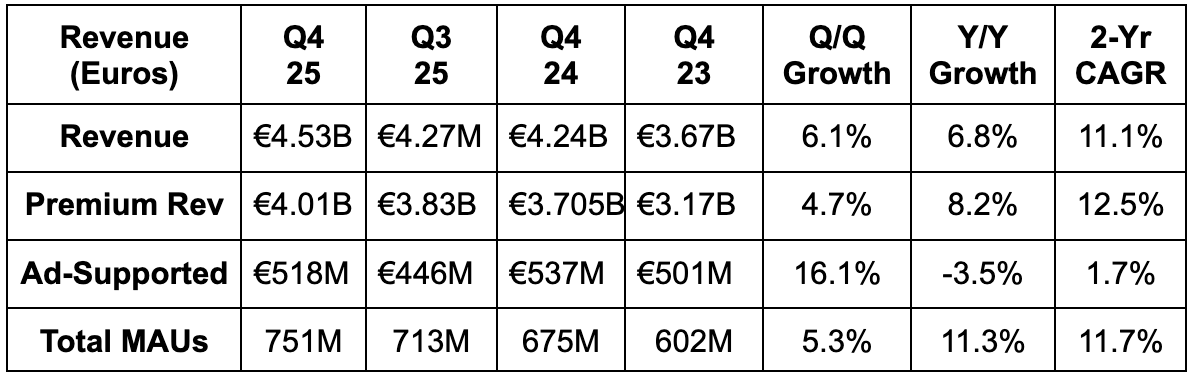

3. Spotify (SPOT) – Earnings Snapshot

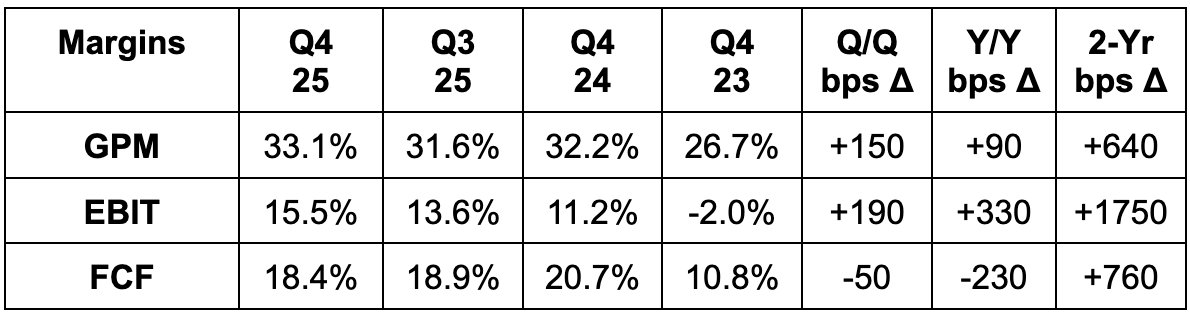

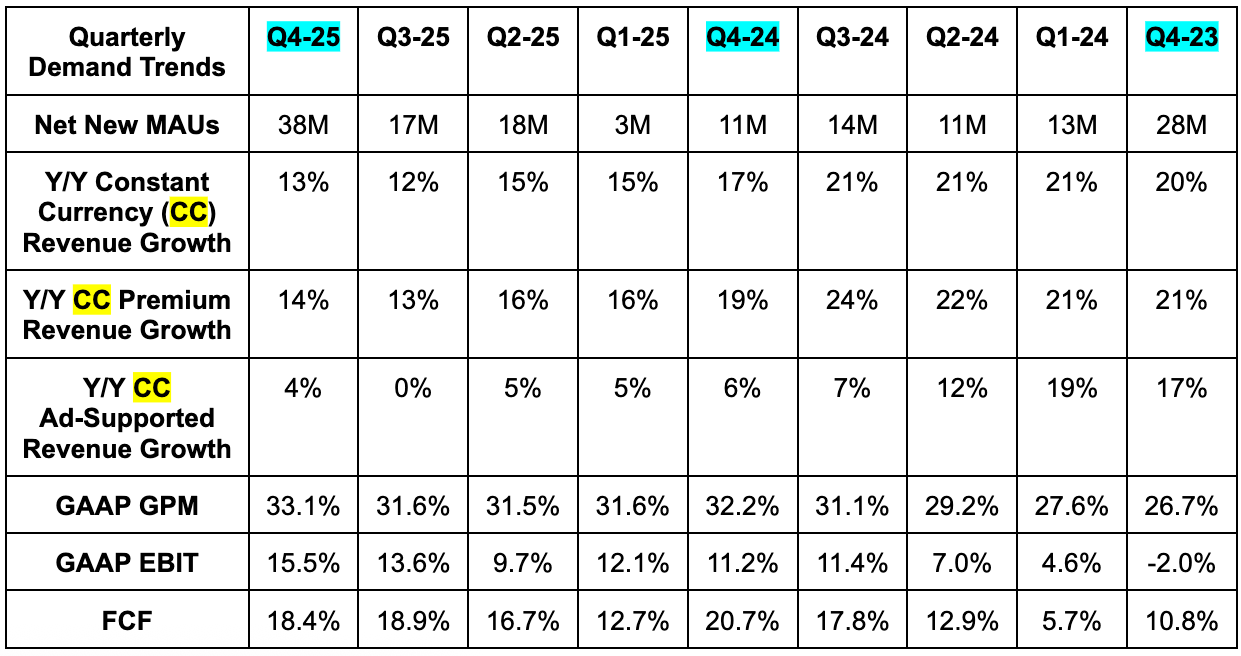

a. Results

- Slightly beat revenue estimates & beat guidance by 0.7%.

- Premium revenue was slightly ahead and ad revenue was 1% light.

- The foreign exchange (FX) headwind was roughly as expected. Revenue rose by 13% Y/Y on a constant currency (CC) basis.

- Beat 745M monthly active user (MAU) estimates & identical guidance by 6M each.

- Beat 289M premium subscriber estimate & identical guidance by 1M each.

- Beat 32.9% GPM estimates by 10 basis points (bps; 1 basis point = 0.01%) and beat guidance by 20 bps.

- Premium GPM was 34.8% vs. 33.5% expected.

- Ad-supported GPM was 19.5% vs. 21.2% expected.

- Beat EBIT estimates by 9.7% & beat guidance by 13.1%.

- Excluding help from lower-than-expected comp-related payroll taxes, EBIT beat estimates by 0.8% & beat guidance by 2.3%.

- Missed FCF estimates by 10%.

- Beat €2.69 EPS estimate by €1.16 excluding a tax benefit enjoyed during the quarter.

b. Balance Sheet

- €9.5B in cash, equivalents, restricted cash and short-term investments.

- €1.46B in convertible notes.

- No traditional debt.

- 1.7% Y/Y diluted share count growth.

c. Guidance & Valuation

- Q1 revenue guidance missed estimates by 1.5%.

- Q1 EBIT guidance beat estimates by 1%.

- Q1 32.8% GPM guidance beat estimates by 50 bps.

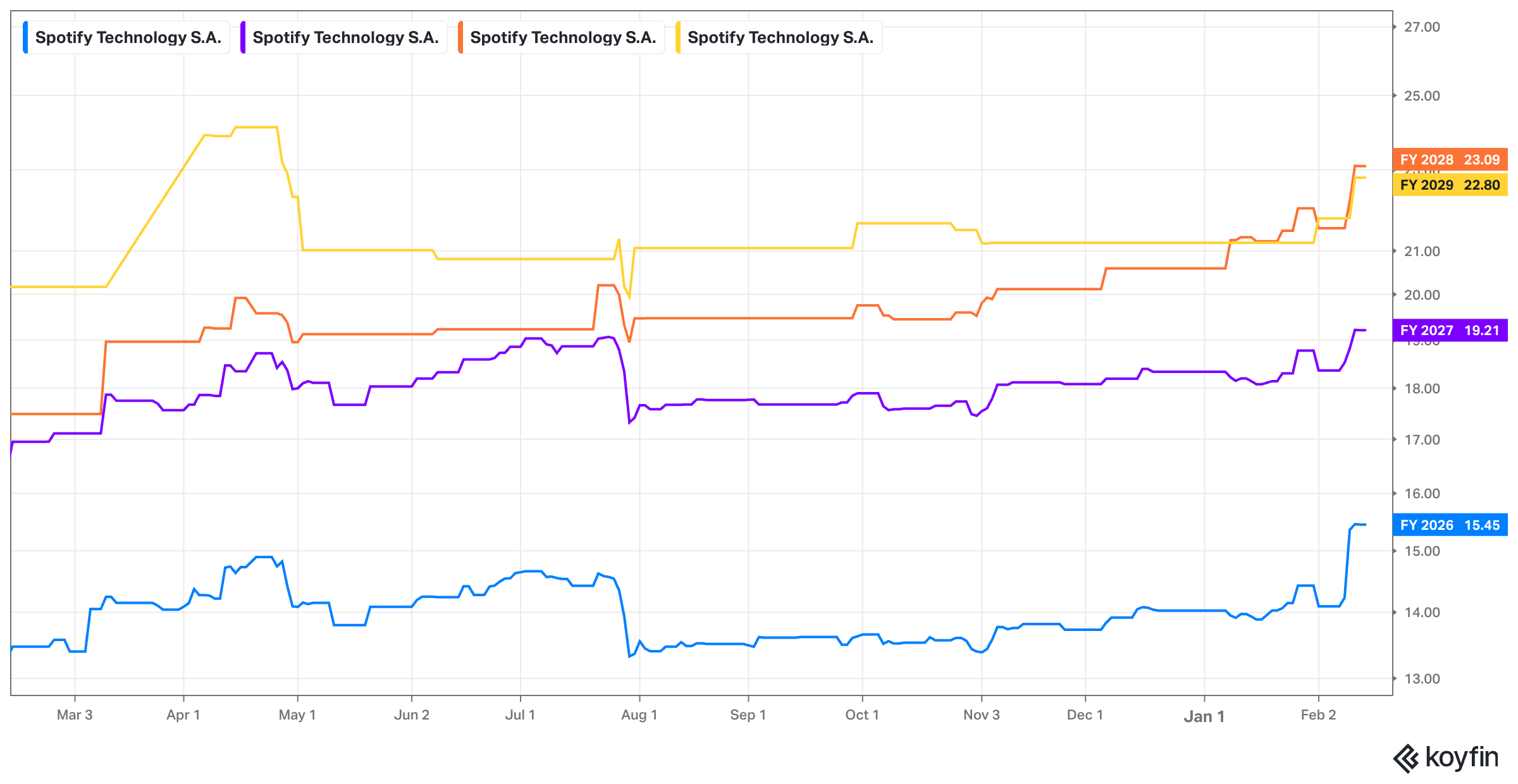

SPOT trades for 24x forward EBIT and 22x forward FCF. EBIT is expected to grow by 39% this year and by 27% next year. FCF is expected to grow by 24% this year and by 23% next year.

SPOT hasn’t been profitable for that long. I was able to include more years in the sale multiple chart below without the recently explosive profit inflection messing up the chart.

d. Quick Thoughts

Candidly, I’m hoping Max subscribers pick this name for my next deep dive. I loved Ek and think he leaves big shoes to fill, but the bench of talent is deep. The forward multiple paired with these results is compelling to me.

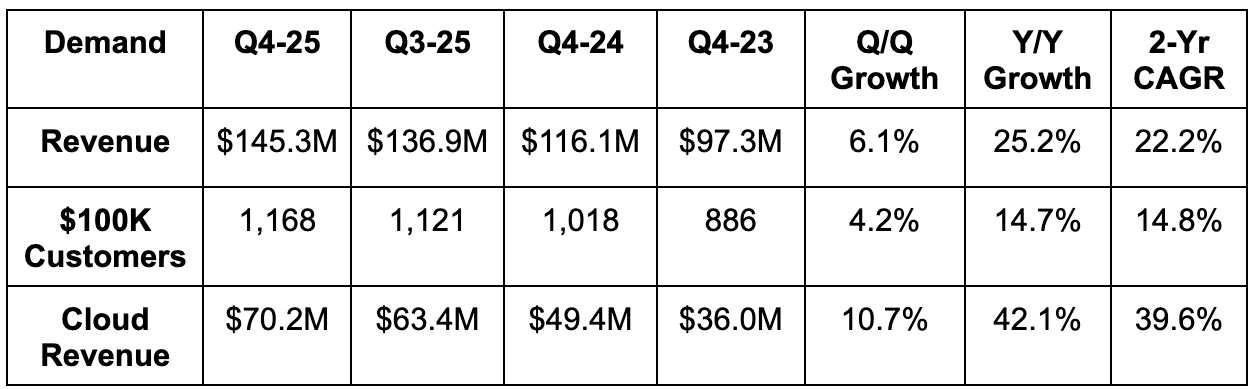

4. JFrog (FROG) – Earnings Snapshot

a. Results

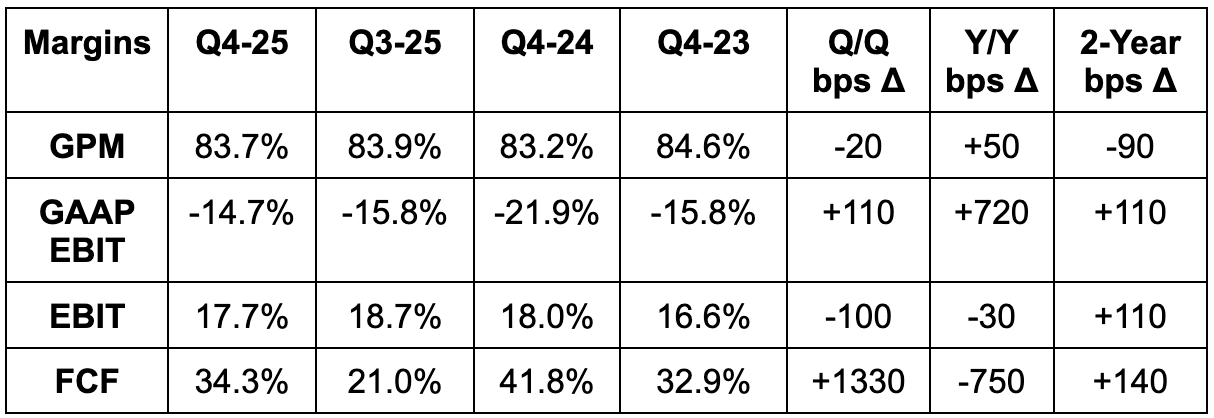

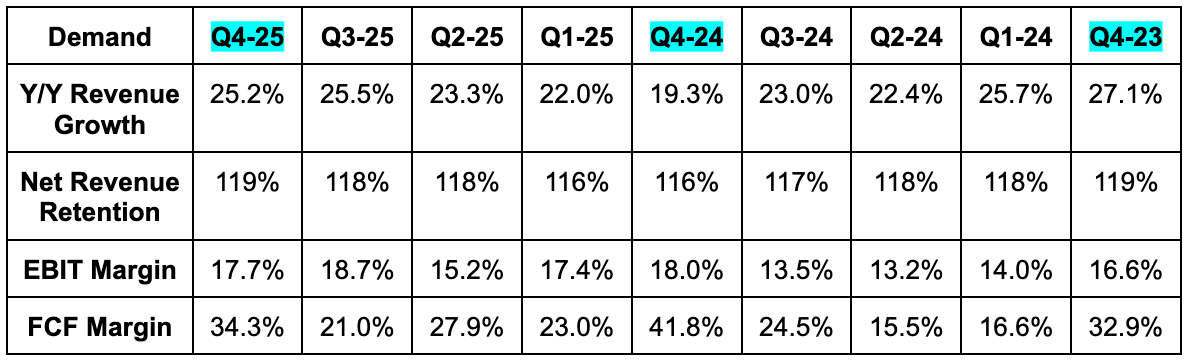

- Beat revenue estimates by 5.3% & beat guidance by 5.7%.

- Beat 83.2% GPM estimates by 50 bps.

- Beat FCF estimates by 56%.

- Beat EBIT estimates by 17.9% & beat guidance by 19.5%.

- Beat $0.19 EPS estimates & beat identical guidance by $0.03 each.

b. Balance Sheet

- $700M in cash & equivalents.

- No debt.

- 8% Y/Y diluted share growth; 6.1% Y/Y basic share growth.

c. Guidance & Valuation

- Annual revenue guide beat by 2.2%.

- Annual EBIT guide missed by 1%.

- Annual $0.90 EPS guide beat by $0.02.

- Q1 guidance was ahead on revenue, EBIT & EPS.

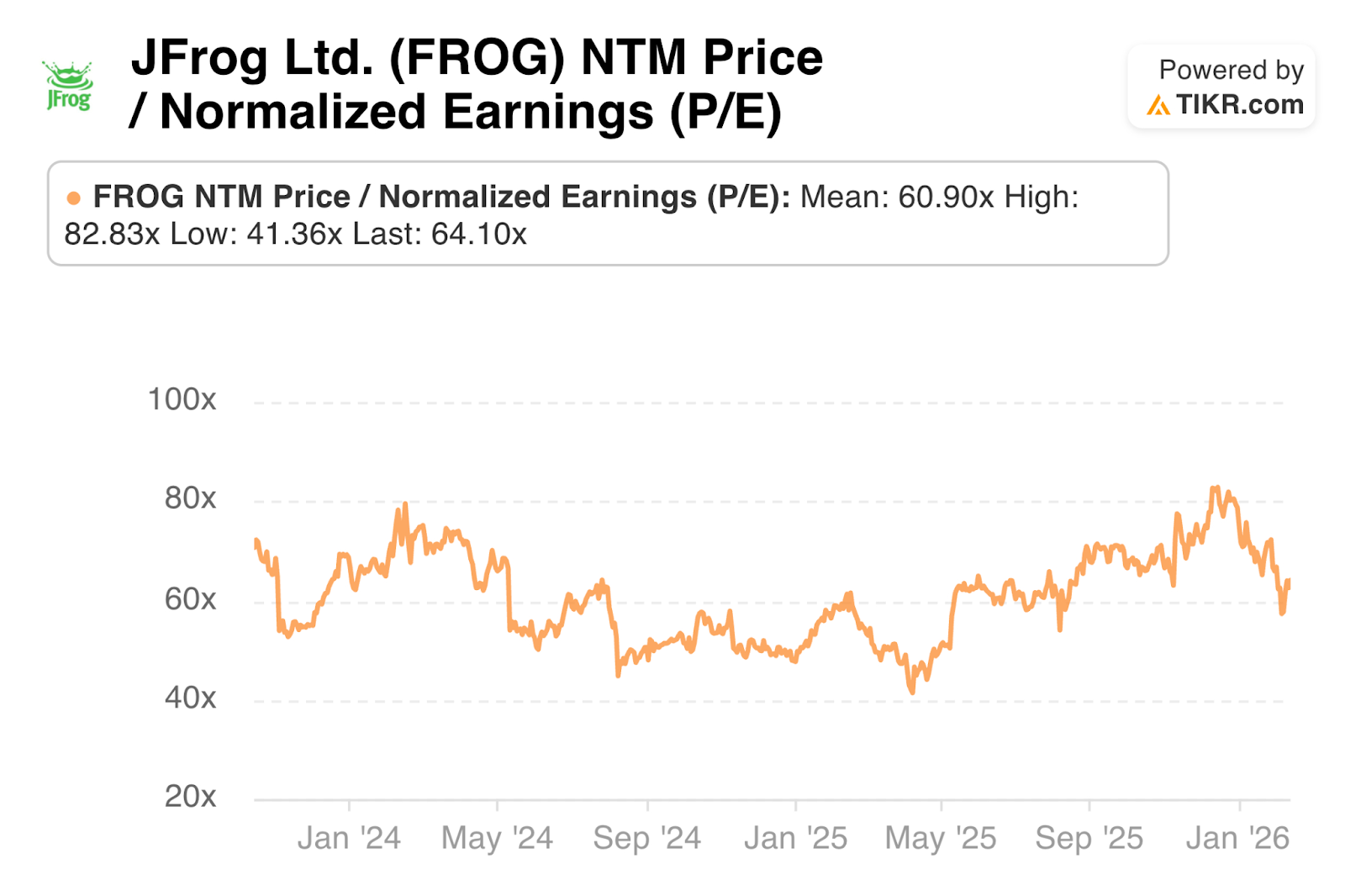

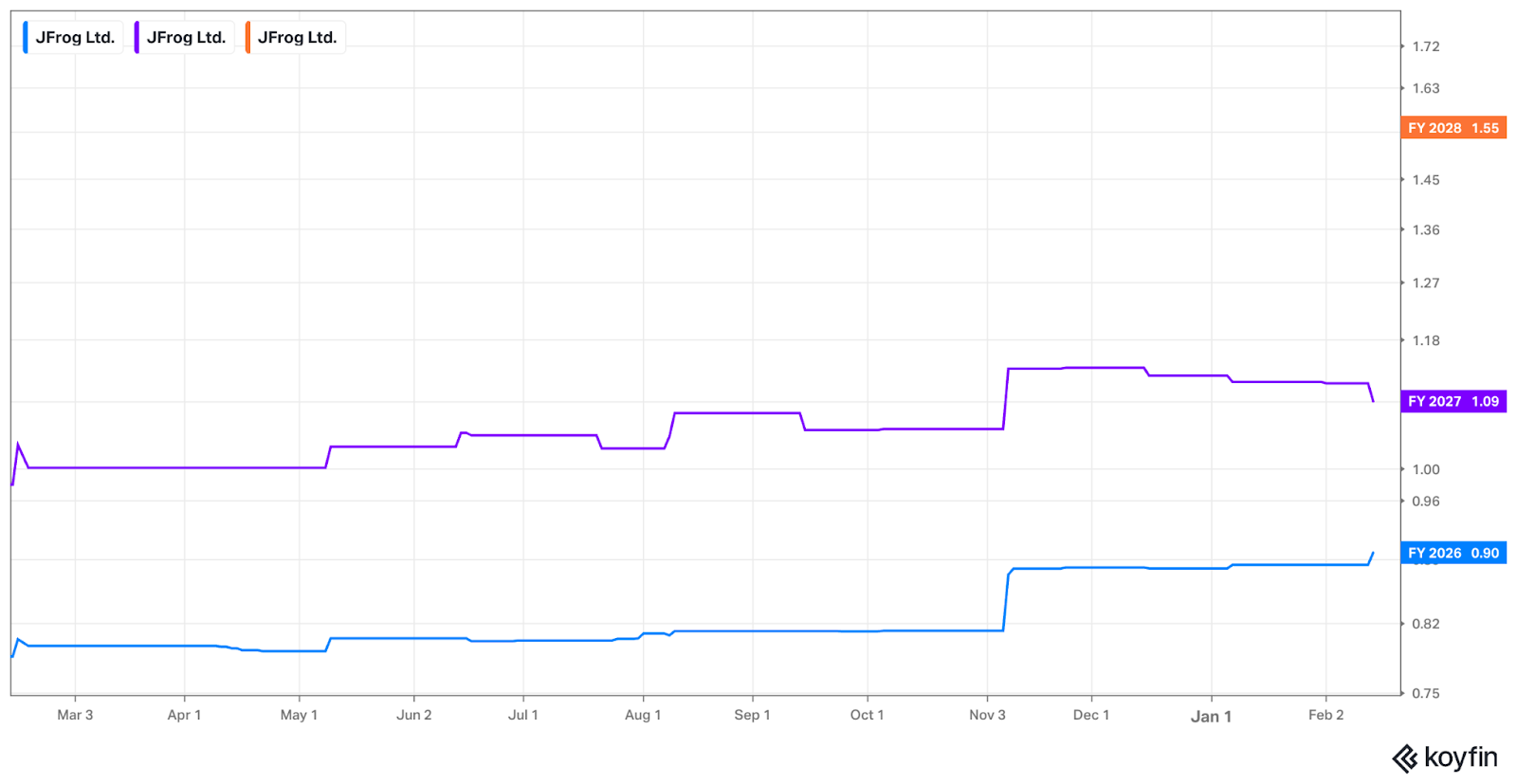

FROG trades for about 58x 2026 EPS once estimates update. EPS is expected to grow by 10% this year and by 21% next year. It also trades for 45x FCF. FCF is expected to be roughly flat this year and grow by 30% in 2027.

5. Starbucks (SBUX) – Investor Day

The theme of the SBUX Investor Day was moving to offense. While there’s still work to be done in their “Back to Starbucks” turnaround, they’re ahead of schedule and exceedingly confident in their approach. This is the time to keep leaning in, and so they are.

Notes from Chief Brand Officer Tressie Liberman:

Starbucks is revamping the afternoon menu to drive more ritual-based behavior like it enjoys in the morning. The idea is that more frequency will follow. They’re adding ube and coconut flavors to the menu, a new highly personalizable chai concept and more matcha-based options. They’re also sharpening culinary efforts for the bake case, with a planned strawberry matcha loaf and other options. These additions follow some significant menu clutter simplification where it cut low performing items. As I’ve spoken about in the past, the old leadership team abandoned stage-gate processes for rolling out new menu items. They guessed and hoped. Shockingly, that didn’t work. All of this should work alongside an expanded Energy Refreshers push and a continued focus on protein add-ons. The protein line-up rapidly crossed $1B in annualized sales and that looks to be just the beginning.

With Niccol at the helm, we don’t have to worry about exciting releases frequently swinging and missing. Once something is rolled out, the decision is already based on a large base of user feedback and data. And if something fails? Their innovation pipeline has been restocked and their ability to generate shots on goal will greatly increase going forward.

In other news, SBUX is updating its loyalty program structure to include Green, Gold and Reserve tiers. This will debut on March 10th and will feature various perks depending on degree of customer loyalty. They also deepened their tight Delta partnership so customers can earn Delta loyalty points with SBUX purchases.

- For the morning day-part, they’re introducing the “Better Morning” guarantee. This will replace incorrect beverages with a “no questions asked policy.”

- SBUX will add some of the popular features like its micro-lot cold brew from its Reserve store concepts to the rest of its stores. It’s also adding the specialized bean flights in some of its highest-volume urban stores.

Notes from COO Mike Grams:

Grams focused on all the ways SBUX can continue to improve encouraging store throughput trends. This is such an important metric for comp store sales. When folks are on their way to work, speed, reliability and precision are everything. If you’re late on their cup… they’re late and annoyed too. And they’ll go somewhere else.

This team has made great strides to ensure that doesn’t happen. They’re rolling out a tweaked Siren Craft System with enhanced order fulfillment workflows. This will build on the success of its upgraded mobile order sequencing algorithms and a new ability to pause mobile order intake if stores are overwhelmed. This version of Siren Craft eliminates the expensive, disruptive equipment installation the old team had planned and pursues better throughput via work quality and labor coverage instead. In other throughput news, they plan to introduce the Mastrena III that cuts espresso shot creation in half.

For its workers, SBUX is introducing a new point-of-sale system that cuts new employee training time from 90 days to 7 and a new AI app allowing these workers to ask questions about policies or menu items if they need help. To improve menu availability rates and cut waste, they introduced a computer vision tool to automate inventory management – similar to what Cava has effectively deployed.

Finally, new SBUX stores will introduce what they’re calling sound shields to buffer loud blender and other equipment noise. This is one of the most common complaints for people who consider working in one of their locations.

Notes from Starbucks International CEO Brady Brewer:

- The change in the China model will mean about 90% of international SBUX locations are licensed.

- They plan to accelerate India store growth and double total locations there to reach 1,000 by 2028.

- They have a clear line of sight to productively doubling international store count over the long-term. Plenty of growth left.

- SBUX is opening an R&D hub in Milan to develop menu concepts more relevant for other markets.

In exciting channel development news, they unveiled the “Starbucks Anywhere Concept.” This will let them add smaller locations in just 30 days using a standardized lego-like design. They plan to add these to cruise ships, trains etc.

Reminder of the Financial Targets they Set:

For review, SBUX guided to 3%+ U.S. and global comp store sales growth in each of the next three years. While store growth will remain muted near-term, they see revenue growth reaching at least 5% Y/Y by fiscal year 2028, with a 14.25% EBIT margin and $3.67 in EPS ($3.52 post China deal closure). This has driven 6% boosts to EBIT and EPS estimates for 2028 since the event. To get there, SBUX plans to ramp new store growth to 2,000/year (400/year in the USA) by 2028 and stay there for a while. It also plans to pull $3B in costs out of the supply chain and other parts of the business to find investments while driving expected operating leverage. They also maintained a 50% shareholder payout ratio target via a blend of dividends and eventually buybacks.

Quick Thoughts:

No change to my point of view here. SBUX is back to executing at a strong clip and Niccol is the perfect CEO to usher in its next generation of success. I see real upside potential to the targets they just set and remain a confident shareholder.

6. SoFi (SOFI) – Quick Notes

SoFi’s IR team offered a new note saying the recent volatility in equity and other financial markets hasn’t impacted its financials. That was likely in response to the Robinhood earnings report raising investor concerns and just goes to show SoFi’s lack of reliance on immensely volatile crypto markets. That end market will never be nearly as important of a growth driver here as it is for Coinbase or Robinhood.

Furthermore, there was new repayment data showing delinquencies are at their highest levels in 9 years for U.S. households. This is for Americans earning about 50% of SoFi’s average borrower, and we continue to hear about how strong credit trends are from the company as of last week. With unemployment again ticking down, I remain pretty confident in the health of their credit book.

7. Headlines & Macro

Company Headlines:

- Uber acquired Getir’s delivery assets in Turkey to add more coverage across restaurants, grocery, retail and water delivery services too. They also announced robotaxi deployment plans with WeRide in Abu Dhabi and with Baidu in Dubai (both as part of ongoing and deepening partnerships).

Inflation Data:

- The January Consumer Price Index (CPI) rose by 0.3% as expected and compared to 0.2% in December.

- M/M growth was 0.2% vs. 0.3% expected and 0.3% in December.

- The January Core CPI rose by 0.3% M/M as expected and compared to 0.2% in December.

Output Data:

- December Core Retail Sales M/M rose by 0% vs. 0.3% expected and 0.4% last month.

- December Retail Sales M/M rose by 0% vs. 0.4% expected and 0.6% last month.

Employment & Consumer Data:

- January Nonfarm Payrolls rose by 130K vs. 66K expected and 48K last month (revised lower).

- January Private Nonfarm Payrolls rose by 172K vs. 70K expected and 64K last month (revised higher).

- Initial Jobless Claims were 227K vs. 222K expected and 232K last week.

The unemployment rate fell from 4.4% to 4.3% in January. This is better than 4.4% expectations. Average hourly earnings for January also rose 0.4% M/M vs. 0.3% expected. More people employed than expected… earning more than expected… while overall inflation metrics come in as expected or a bit better than expected. This is good news.