Table of Contents

80-hour work week in the books. In case you missed it, here's what was sent since Monday:

- The Trade Desk Earnings Review.

- Lemonade & Duolingo Earnings Reviews.

- Palantir & Hims Earnings Reviews.

- Cava Earnings Review.

- DraftKings Earnings Review.

- Uber Earnings Review.

- Shopify & Coupang Earnings Reviews.

- Portfolio & performance updates.

Other earnings reviews sent so far this season:

- Meta Earnings Review.

- Alphabet Earnings Review.

- Apple, ServiceNow & Starbucks Earnings Reviews.

- Amazon & Mercado Libre Earnings Reviews.

- PayPal Earnings Review.

- Tesla Earnings Review.

- SoFi Earnings Review.

- Netflix Earnings Review.

- Taiwan Semi Earnings Review.

6 more coming next week. Can't wait.

1. Brief Earnings Snapshots – Spotify, AppLovin, Datadog & Axon

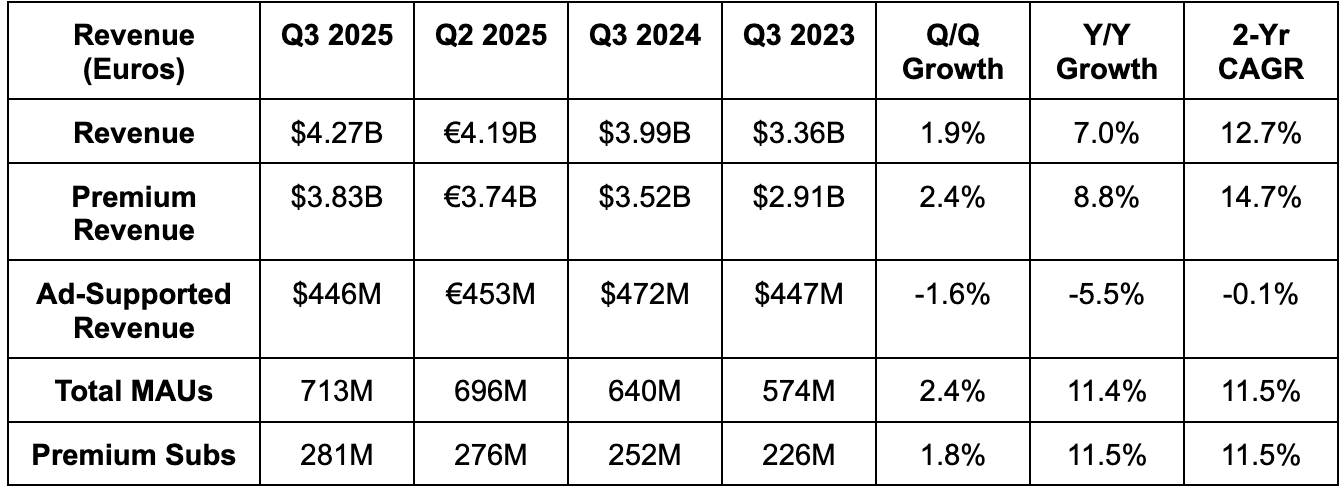

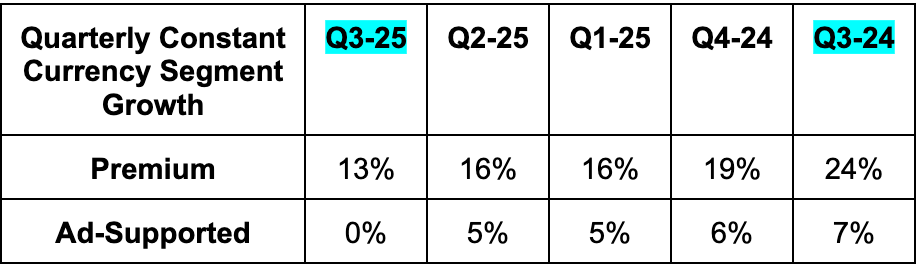

a. Spotify

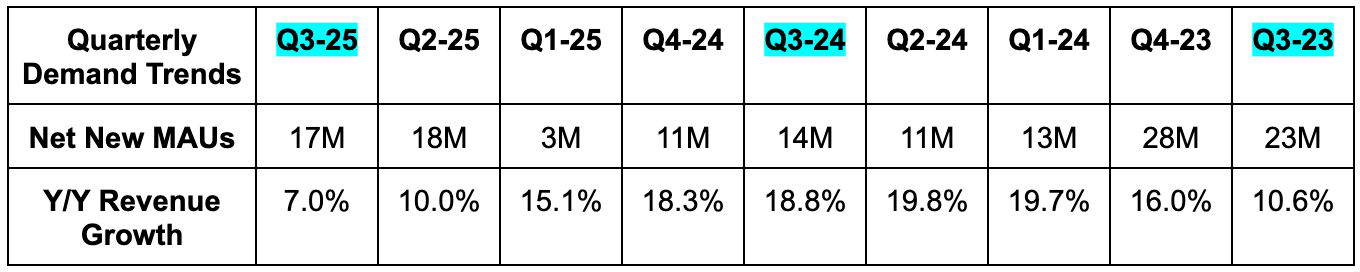

Demand:

- Revenue beat estimates by 0.9%.

- Premium revenue beat 1.6%.

- Ad revenue missed by 5.3%.

- There was a large, 5-point foreign exchange headwind this quarter.

- Beat 15M net new monthly active user (MAU) estimates by 2M.

- Met premium subscriber estimates and roughly met revenue per user estimates.

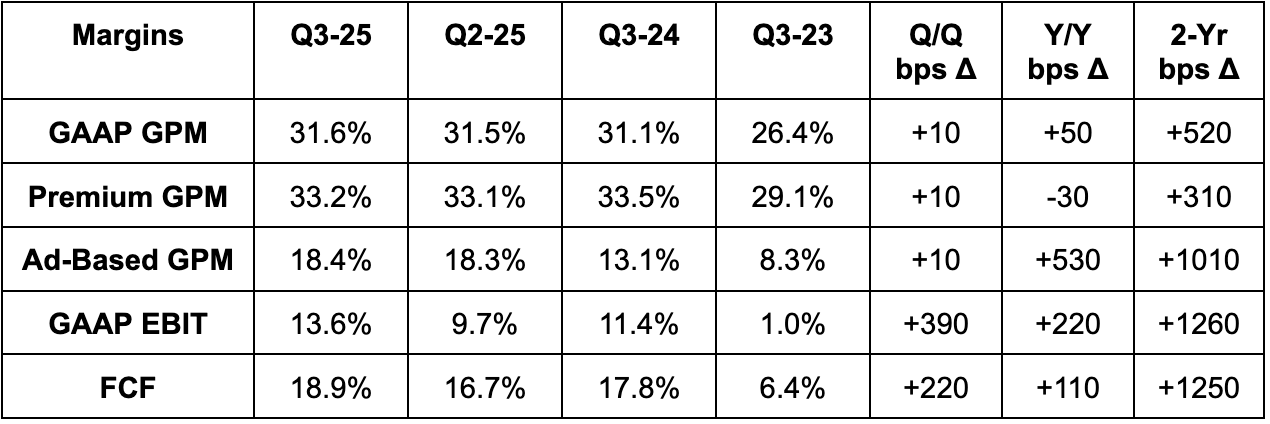

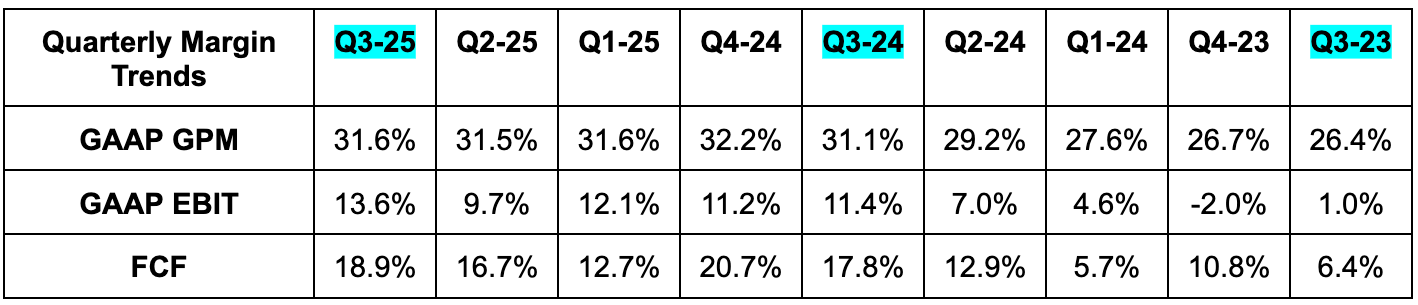

Margins:

- 31.6% Gross profit margin (GPM) beat 31.1% estimates by 50 basis points (bps; 1 basis point = 0.01%).

- Beat EBIT estimate by 17%.

- Beat Free Cash Flow (FCF) estimate by 22%.

Balance Sheet:

- €9.1 billion in cash, equivalents and short term investments.

- €1.74B in convertible senior notes.

- Diluted share count rose by 3.1% Y/Y.

Q4 Guidance & Valuation:

- Revenue guidance missed estimates by 1.6%.

- 32.9% GPM guidance beat 31% estimates by 190 bps.

- EBIT guidance beat estimates by 24%.

- Monthly active user guidance beat estimates by 4.8%.

- Premium subscriber guidance beat estimates by 2.9%.

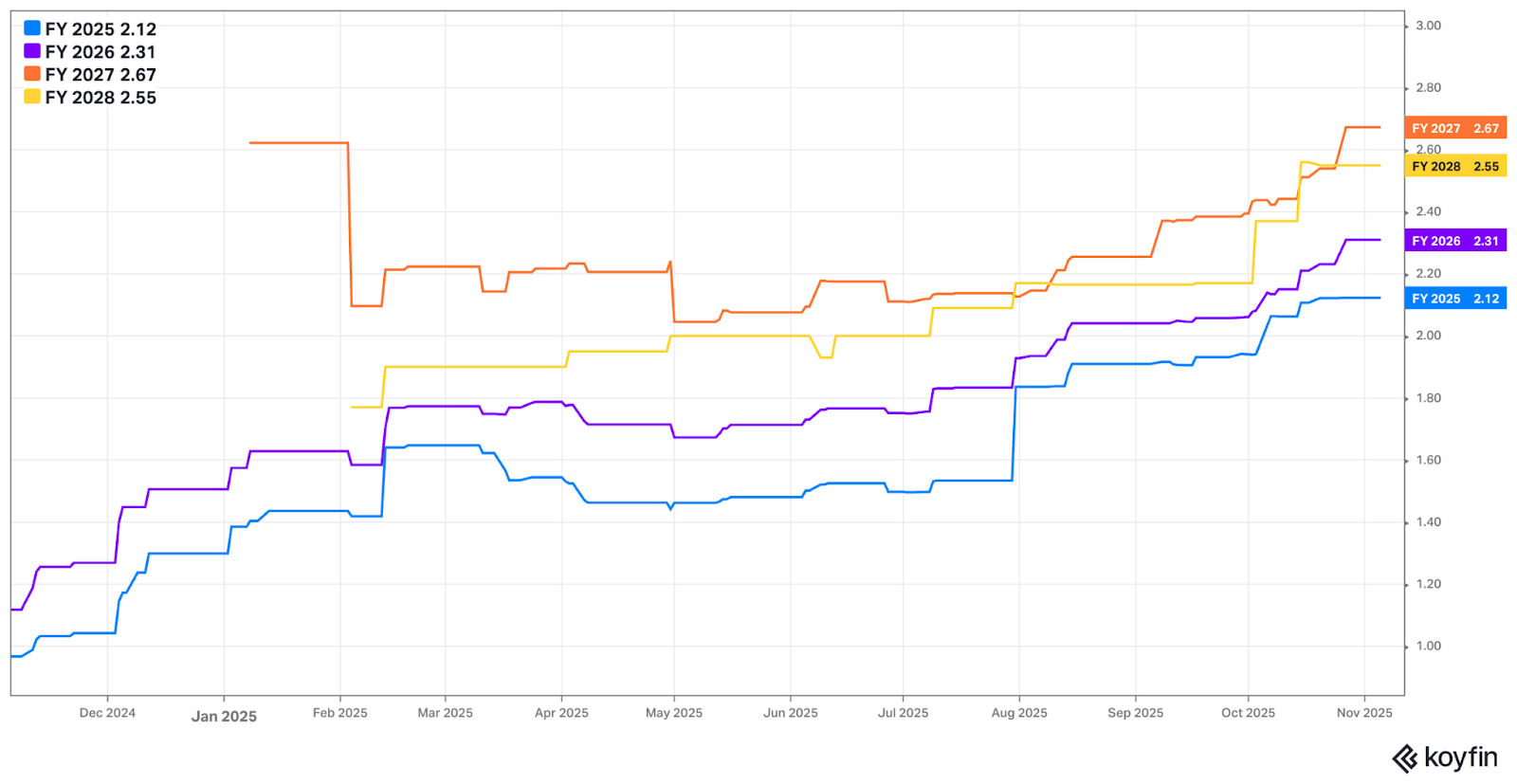

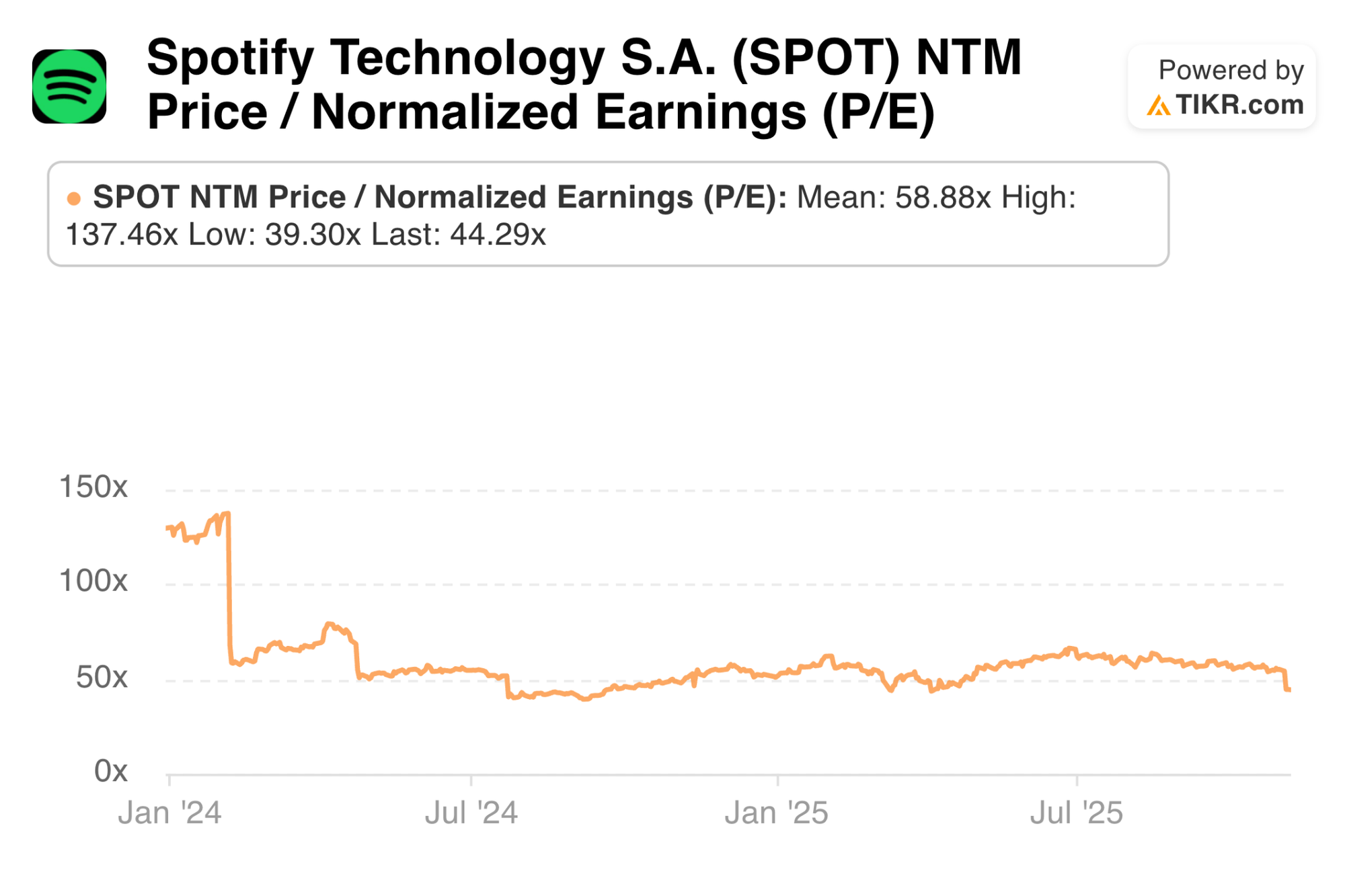

SPOT trades for 44x forward EPS. EPS is expected to grow by 37% this year, 64% next year and 27% the year after that.

b. App Lovin

Demand:

AppLovin beat revenue estimate by 4.8% & guidance by 5.6%.

Profits:

- Beat EBITDA estimates by 6.3% & beat guidance by 7.2%.

- Beat FCF estimates by 2.4%.

Balance Sheet:

- $1.67B in cash & equivalents.

- $3.51B in long-term debt.

- Diluted share count fell by 2.1% Y/Y.

Guidance & Valuation:

- Beat Q4 revenue estimates by 3.2%.

- Beat Q4 EBITDA estimates by 3.0%.

App trades for 47x forward EPS. EPS is expected to grow by 50% next year and by 32% the following year.

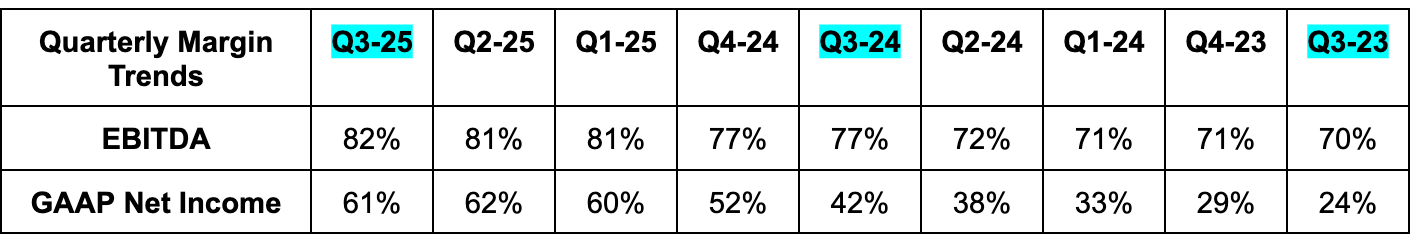

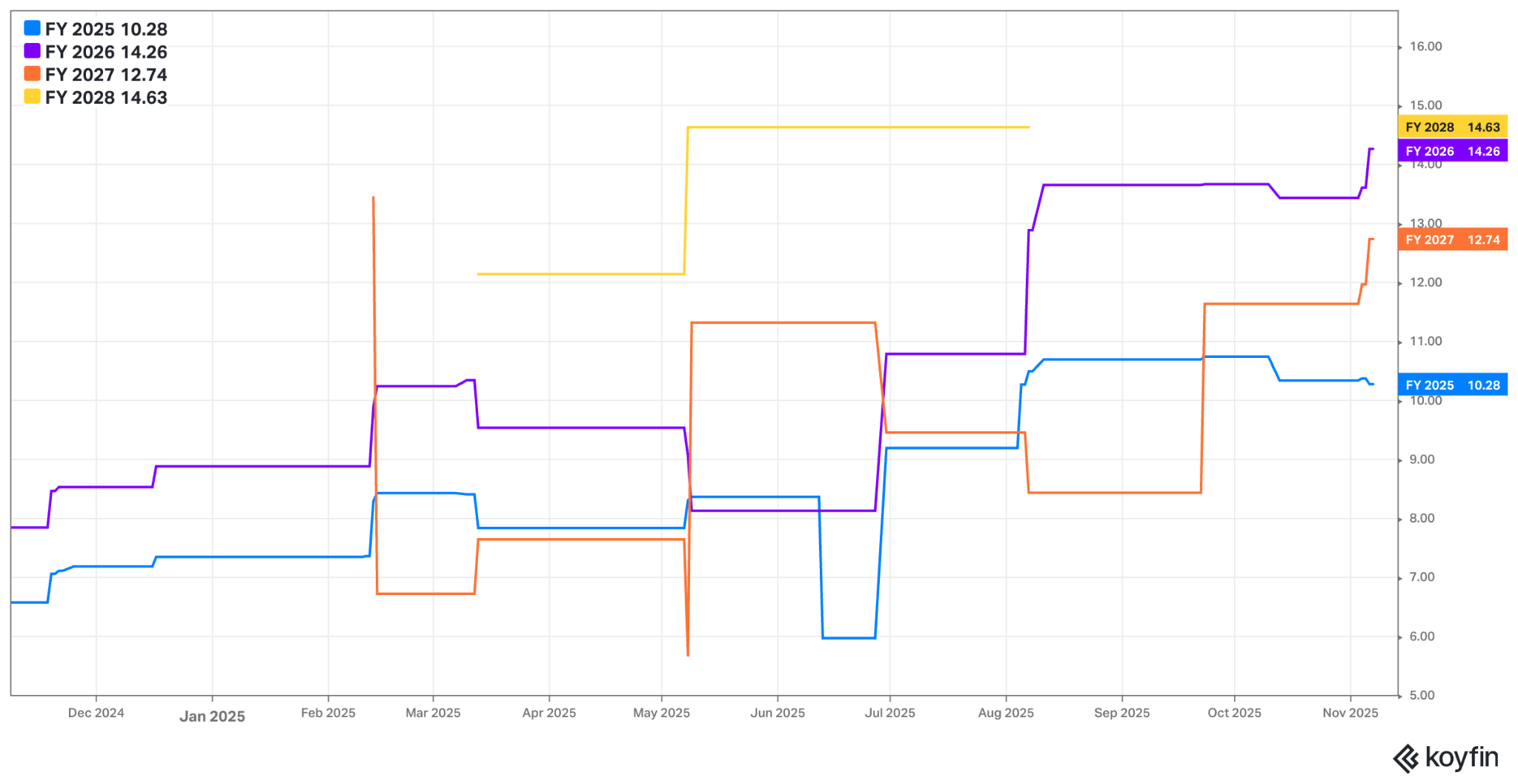

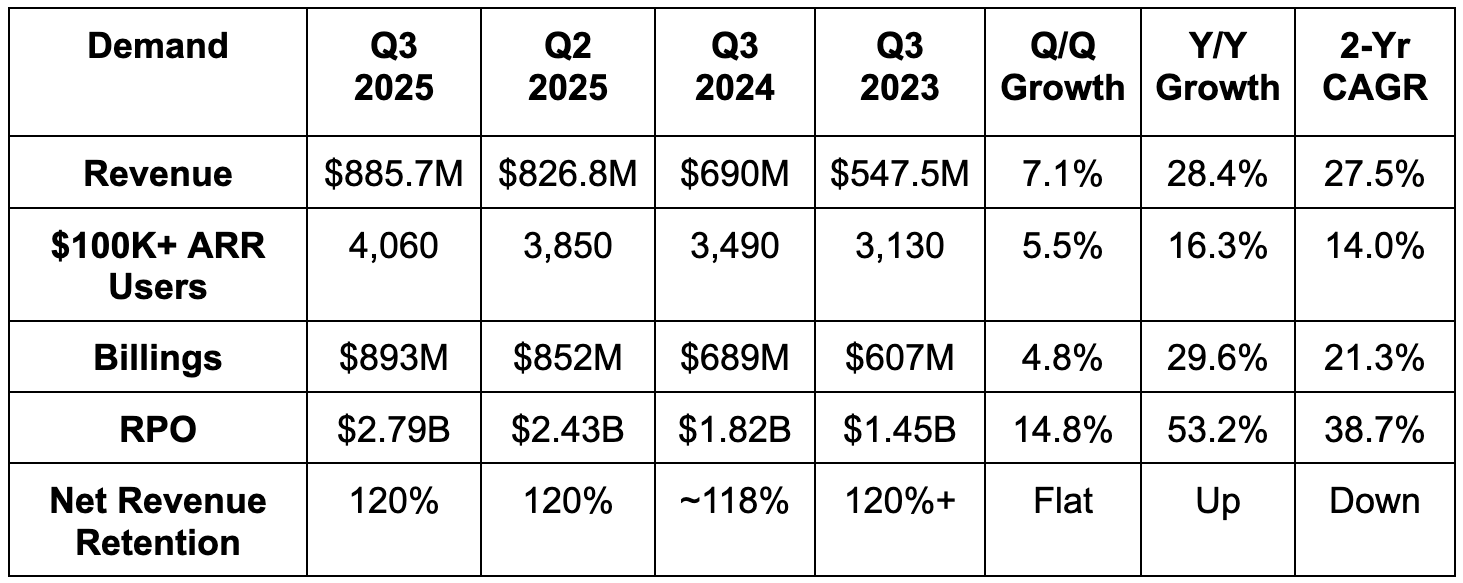

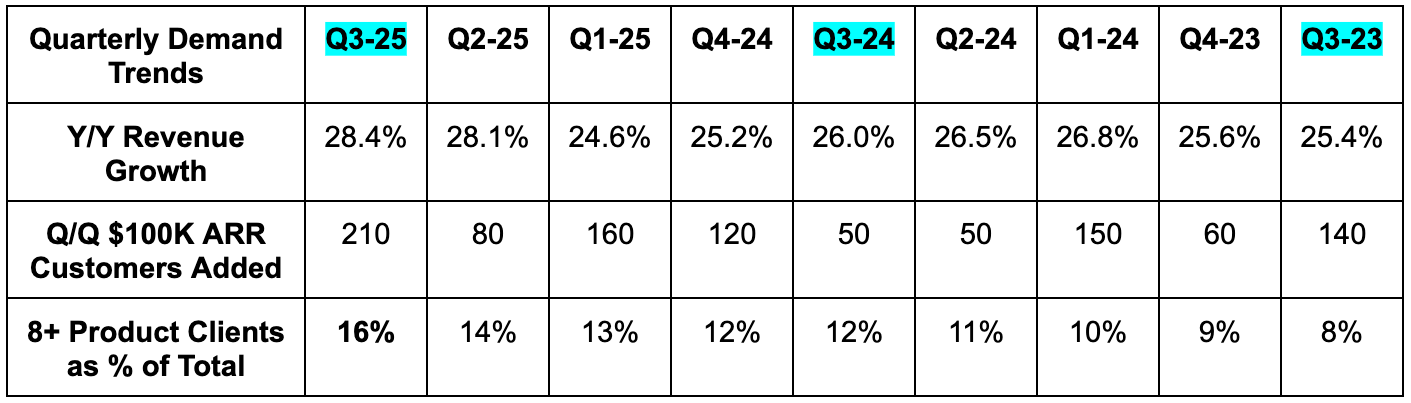

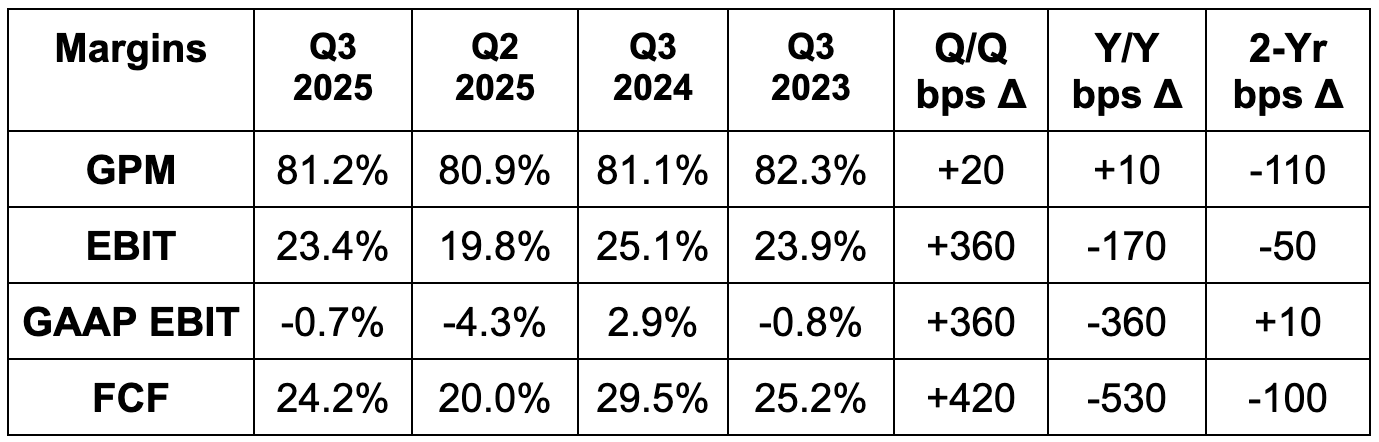

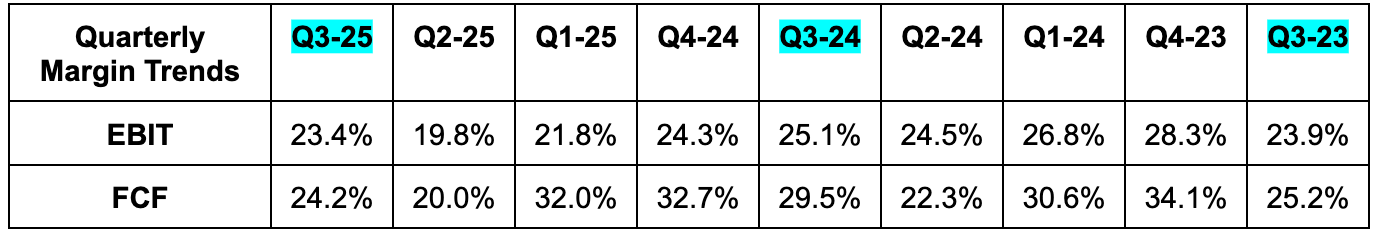

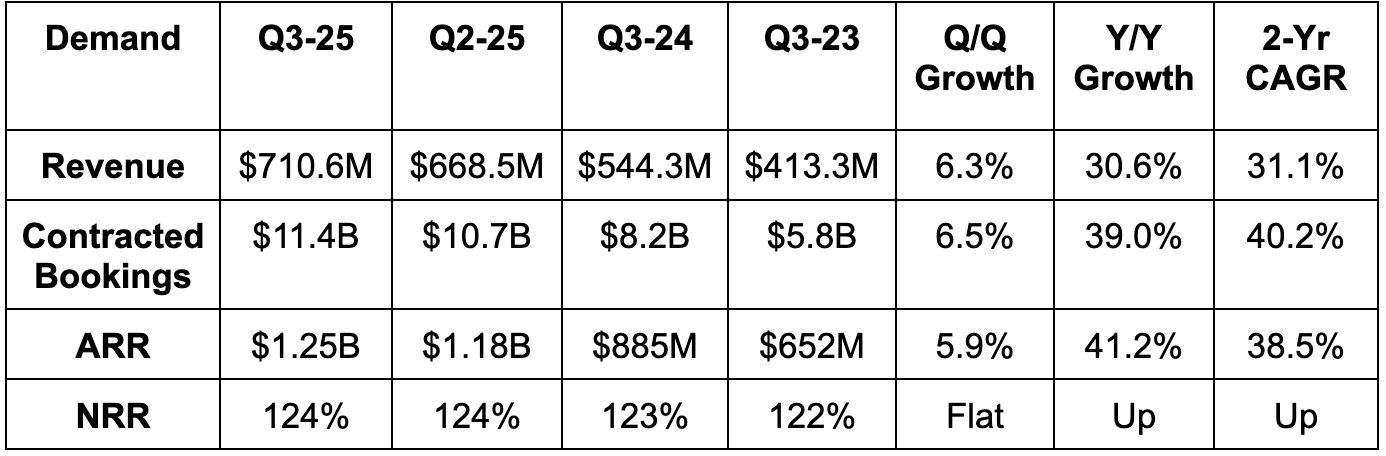

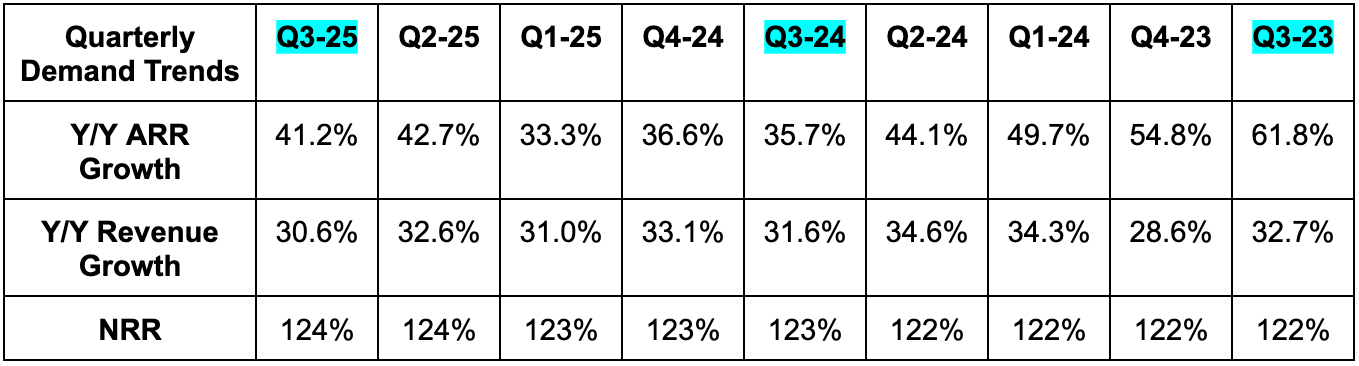

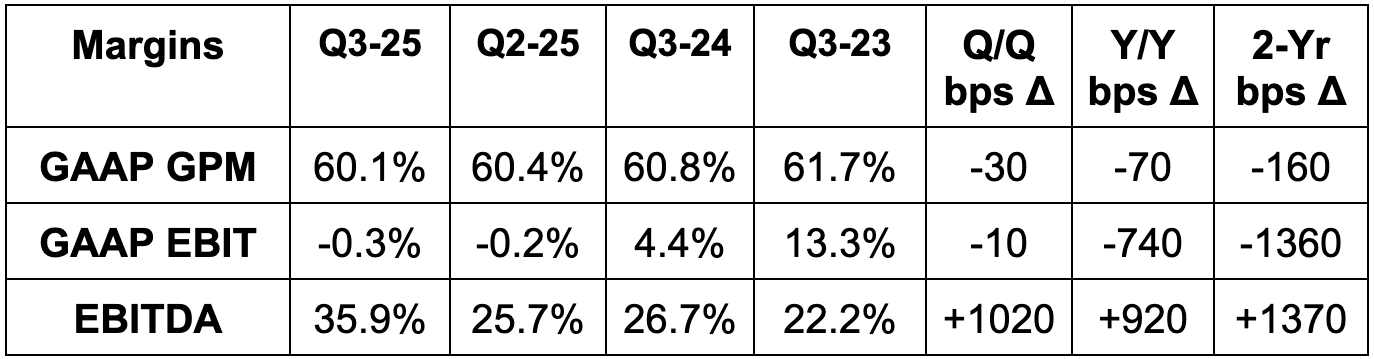

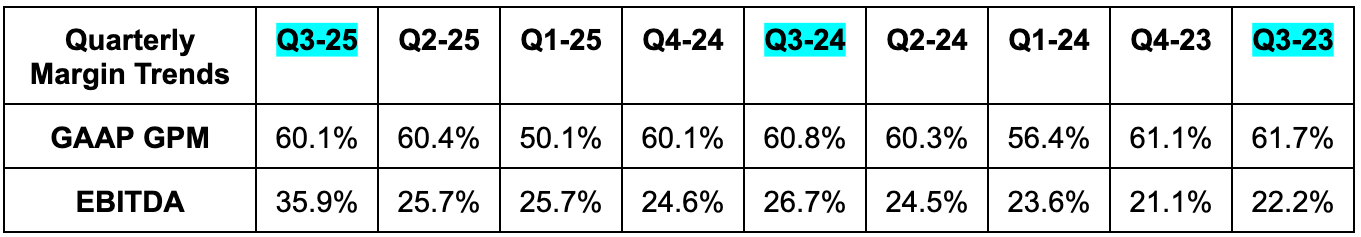

c. Datadog

Demand:

- Datadog revenue beat estimates by 3.9% & beat guidance by 4.1%.

- Beat billings estimates by 2.2%

- It was nice to see a 2 point Q/Q rise in the % of clients using 8+ products. That hasn’t happened in over 2 years.

- Beat remaining performance obligation (RPO) estimates by 9%.

Profits:

DDOG beat EBIT estimates by 15.6% and beat guidance by 16.3%. It also beat $0.46 EPS estimates by $0.09 and beat guidance by $0.010.

Balance Sheet:

- $4.1B in cash & equivalents.

- $982M in convertible senior notes.

- No traditional debt

- 1.2% Y/Y diluted share count growth.

Guidance & Valuation:

- Raised Q4 revenue guidance by 4.1%, which beat estimates by 3.1%.

- Raised Q4 EBIT guidance by 21%, which beat estimates by 19%.

- Raised Q4 EPS guidance by $0.105, which beat estimates by $0.10.

These Q4 raises are especially notable considering DataDog generally bakes in an extra degree of prudence into its forward guidance.

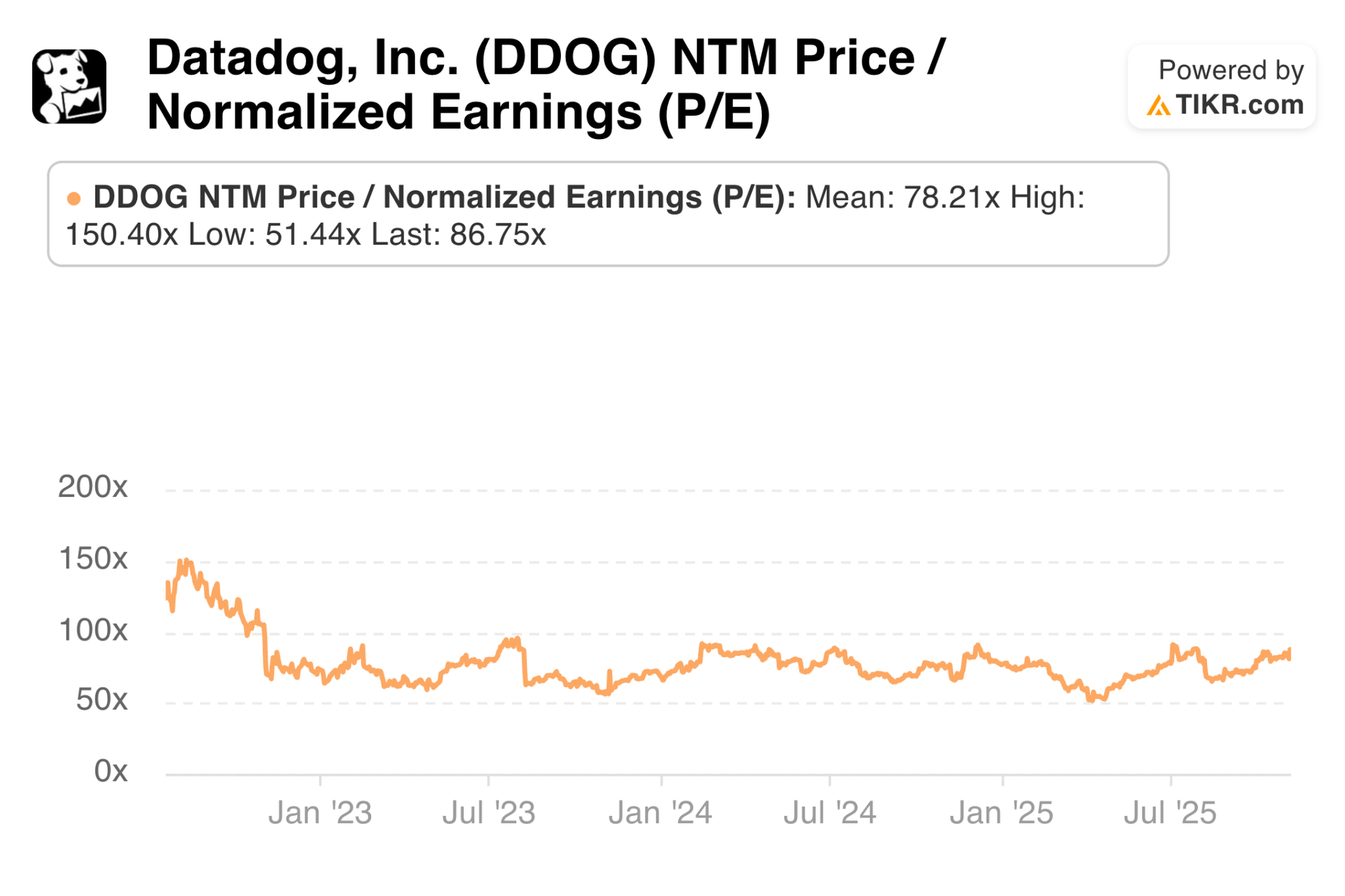

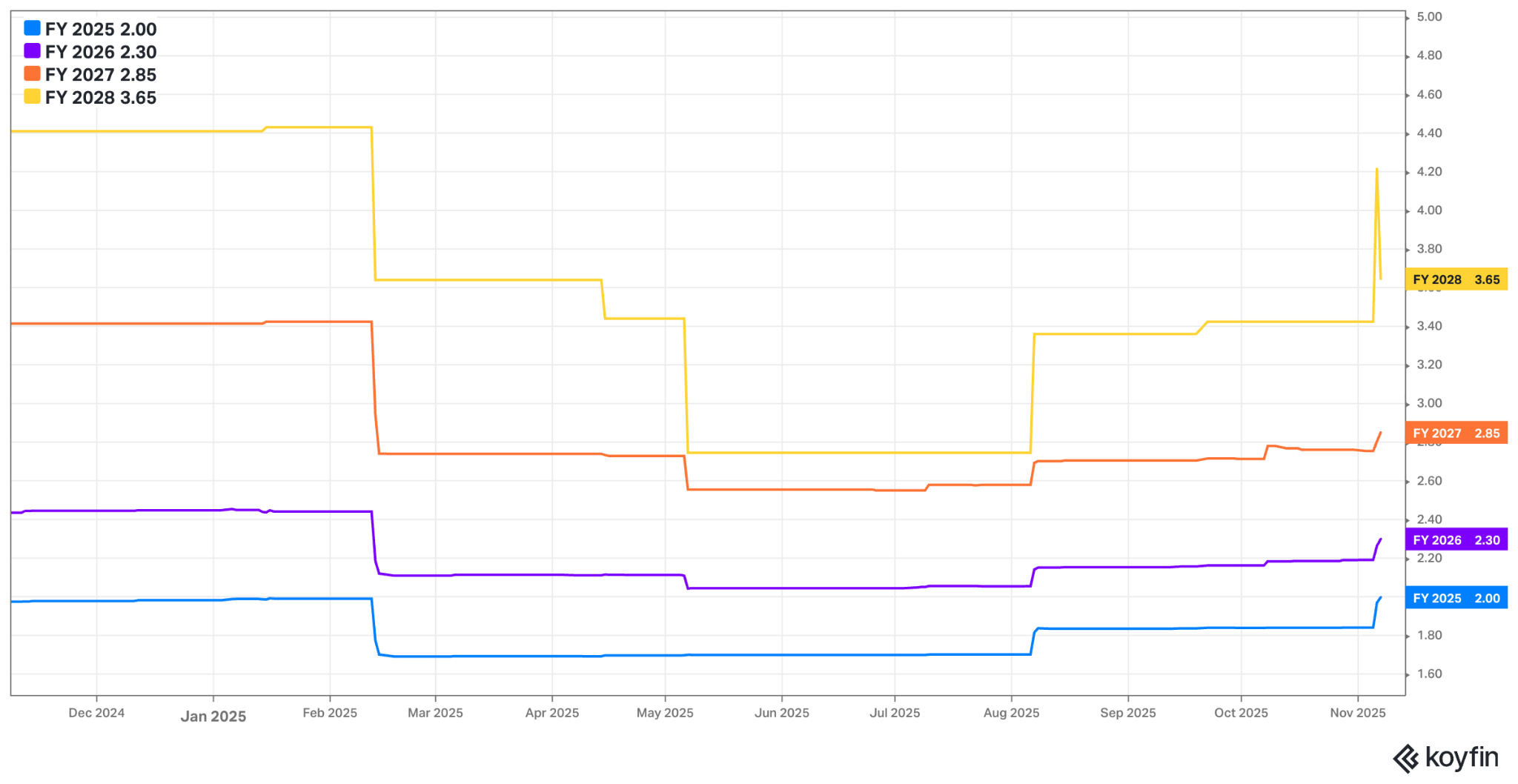

DDOG trades for 86x forward EPS. EPS is expected to grow by 10% this year, 15% next year and 24% the following year.

d. Axon (AXON)

Demand:

Axon beat revenue estimates by 0.8%. Its x% 2-year revenue CAGR compares to 33.6% Q/Q and 32.7% 2 quarters ago.

Profits:

- Beat EBITDA estimates by 2.3%.

- Missed $1.54 EPS estimate by $0.37.

- GAAP EBIT missed $40M estimates by about $40M.

OpEx rose by 40% Y/Y due to accelerated R&D investments and some cost pressures from tariffs. That was materially larger cost growth than expected. They don’t see tariff headwinds getting worse from here.

Balance Sheet:

- $2.4B in cash & equivalents.

- $2B in convertible notes.

- 6.4% Y/Y diluted share count growth. Stock comp dollars rose 43% Y/Y.

Guidance & Valuation:

- Axon raised annual revenue guidance by 1.9%, which slightly beat estimates by 0.2%.

- Axon raised annual EBITDA guidance by 1.4%, which slightly missed estimates. This is related to tariffs and decisions to accelerate R&D spend.

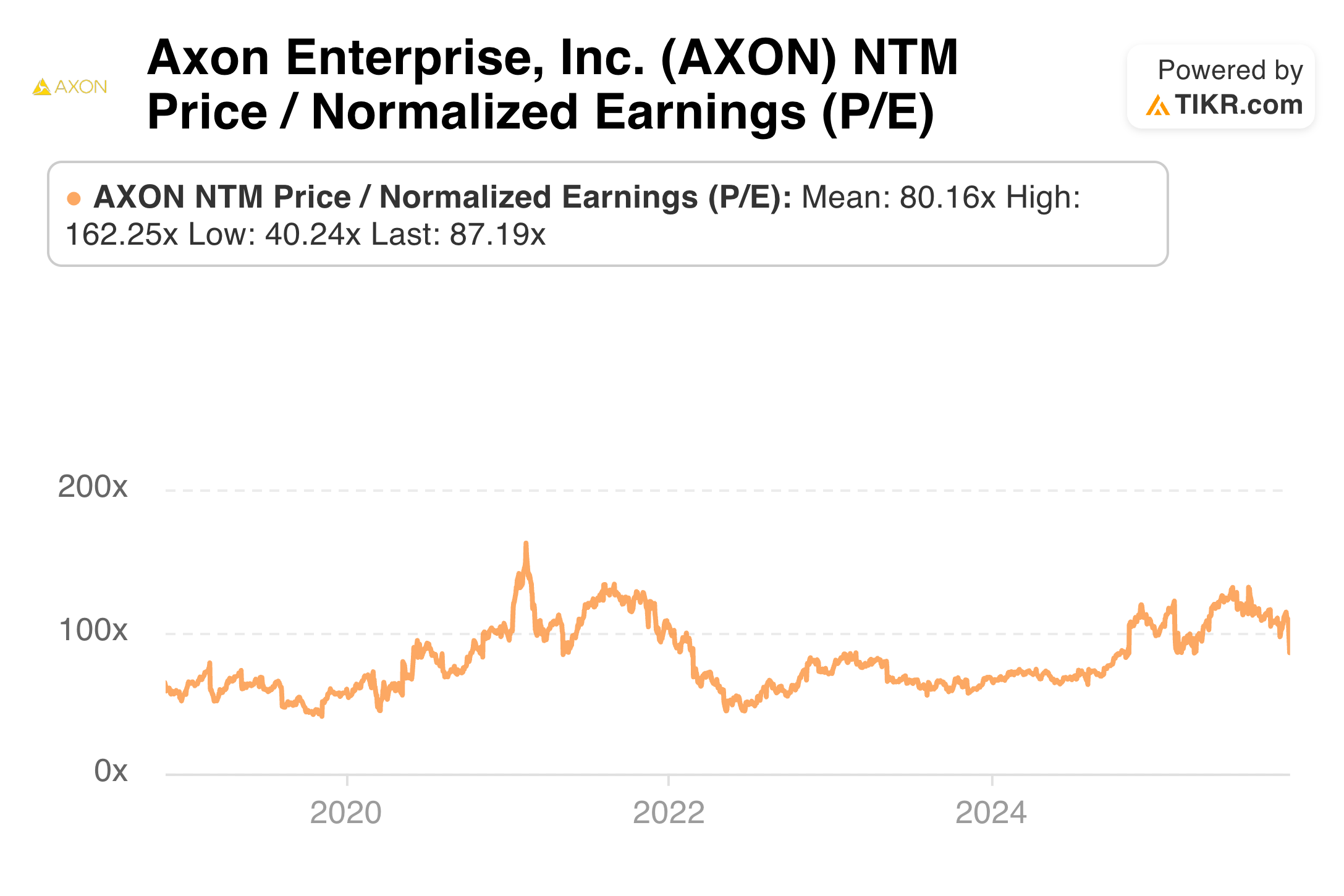

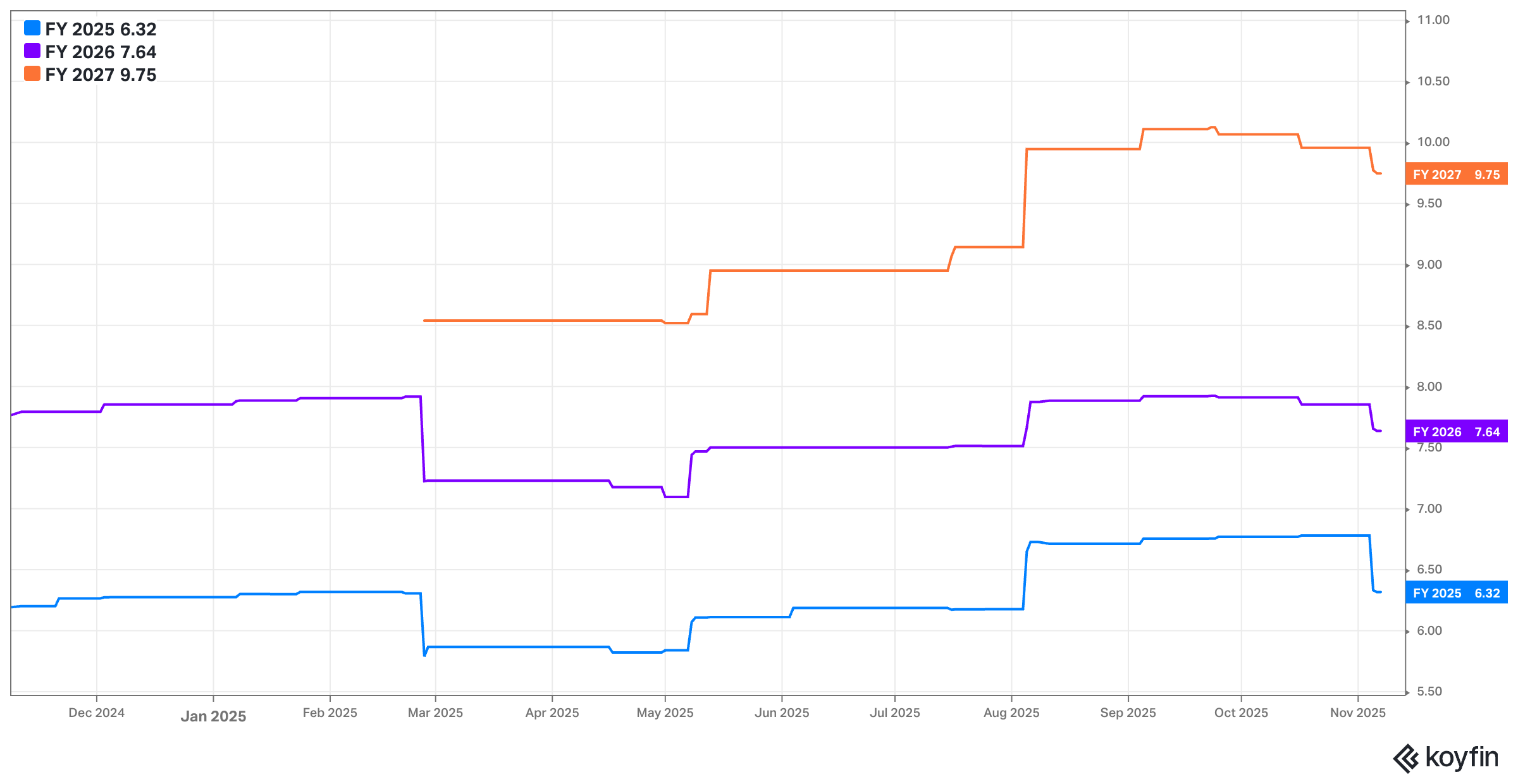

AXON trades for 87x forward EPS. EPS is expected to grow by 6% this year, 21% next year and 28% the year after that.

2. Detailed Robinhood (HOOD) – Q3 2025 Earnings Review

For a full overview of all the product news announced at the March 2025 Robinhood Gold event, click here.

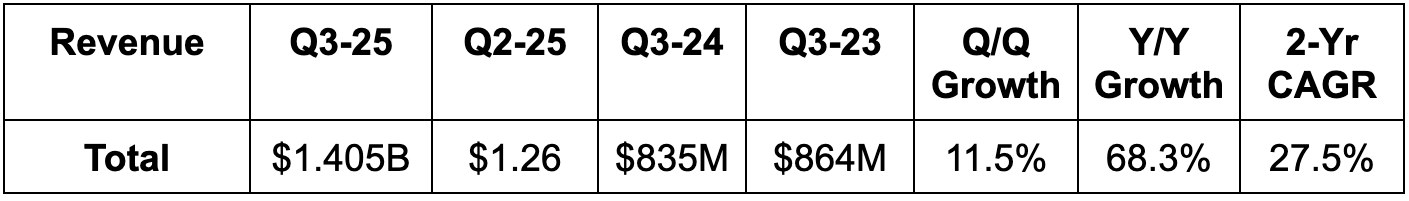

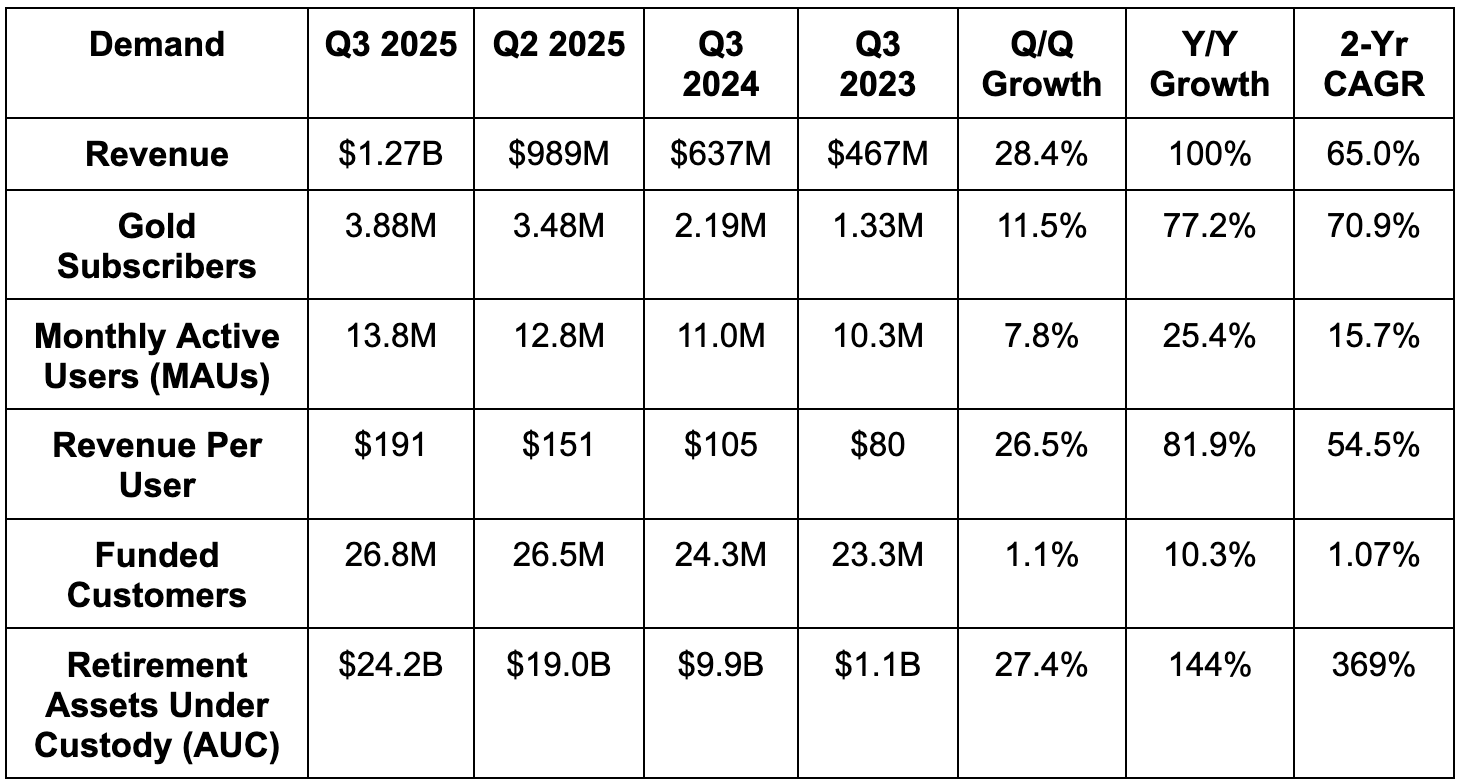

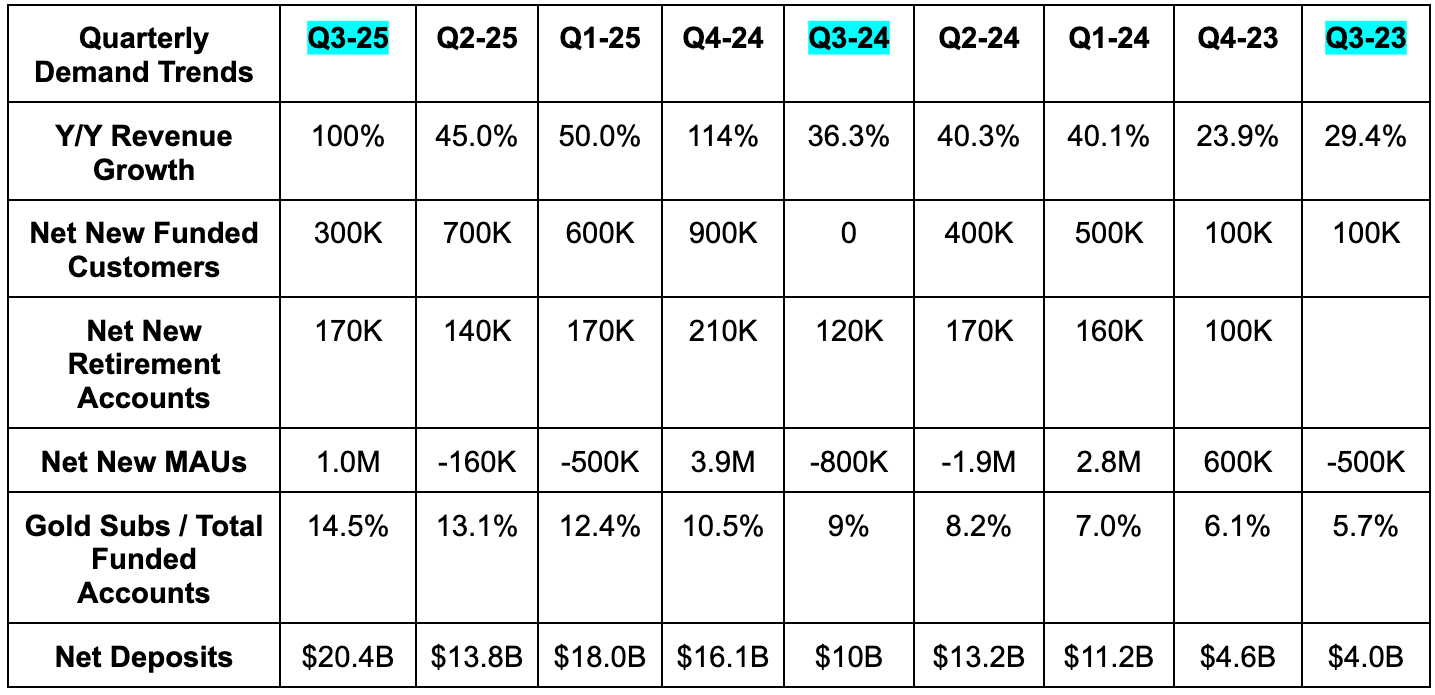

a. Demand

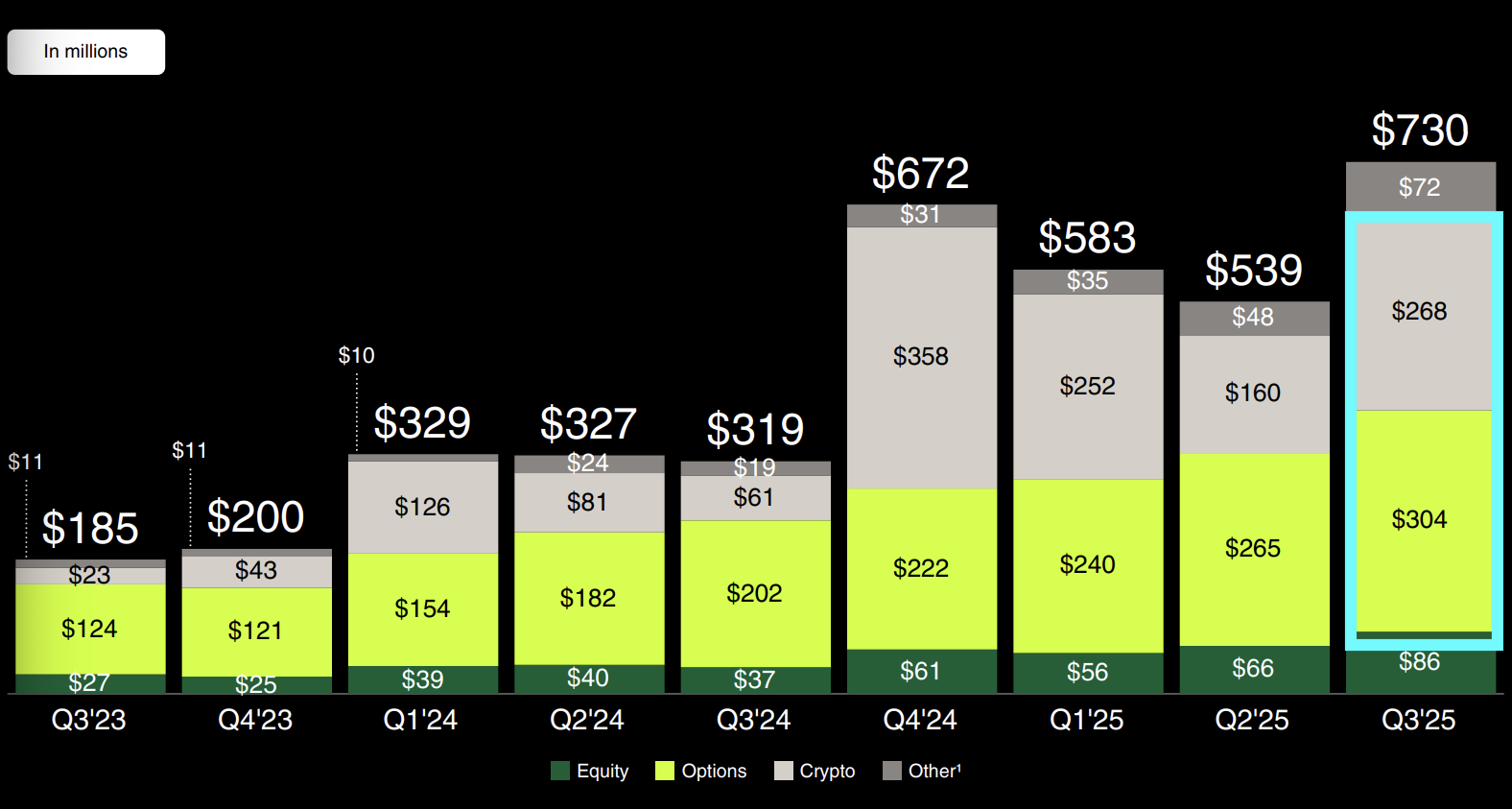

- Beat revenue estimate by 5.0%.

- Options revenue beat estimates by 1%.

- Equities revenue beat estimates by 5.2%.

- Crypto revenue missed estimates by 6.7%.

- Net interest income revenue missed estimates by 7.3%.

- Beat monthly active user (MAU) estimates by 3.7%.

- Total platform assets rose 119% Y/Y and 19.3% Q/Q to $333B.

More growth metrics:

- Assets under custody (AUC) per retirement account was $14.8K vs. $2.8K just 2 years ago. Asset valuations are helping but so is simply attracting more inflows.

- Investment accounts rose 11% Y/Y.

- Bitstamp volumes rose 60% Q/Q as the team has done a “nice job of integrating.”

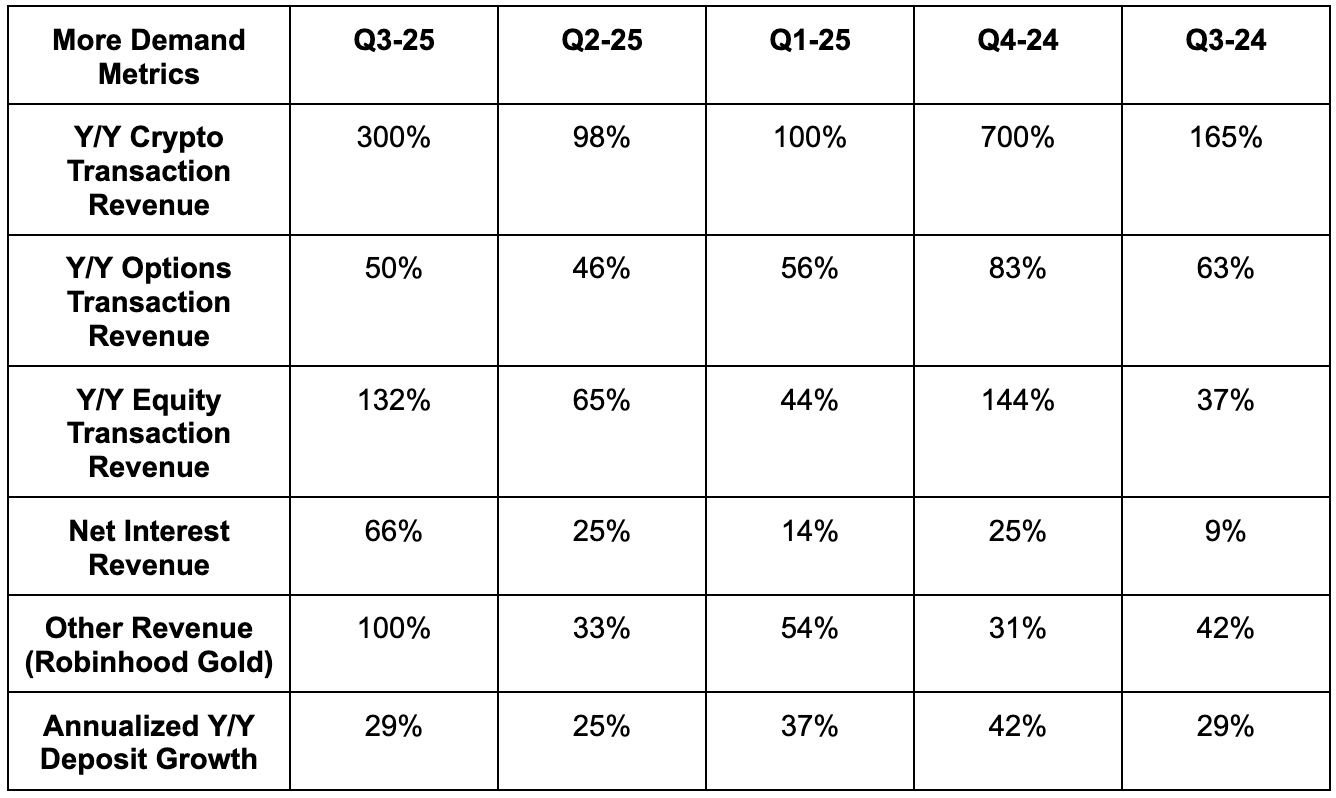

- Note that 300% Y/Y crypto notional trading volume is helped by Bitstamp (crypto exchange it bought) M&A. Organic growth was still a whopping 176% Y/Y as the cycle remained red hot.

- Equity volumes rose 126% Y/Y; margin volumes rose 153% Y/Y; cash sweet volumes rose 44% Y/Y.

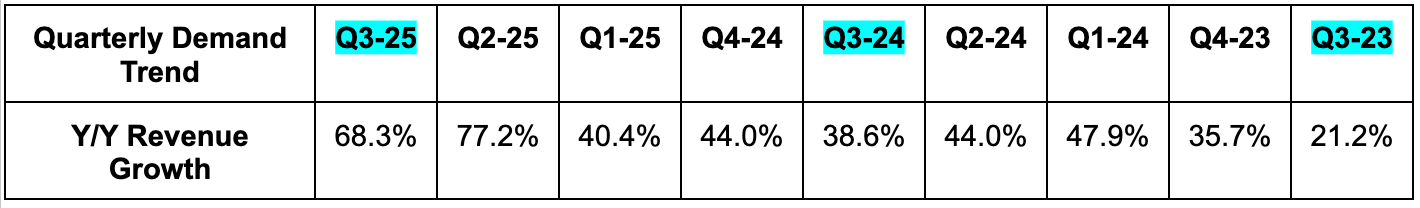

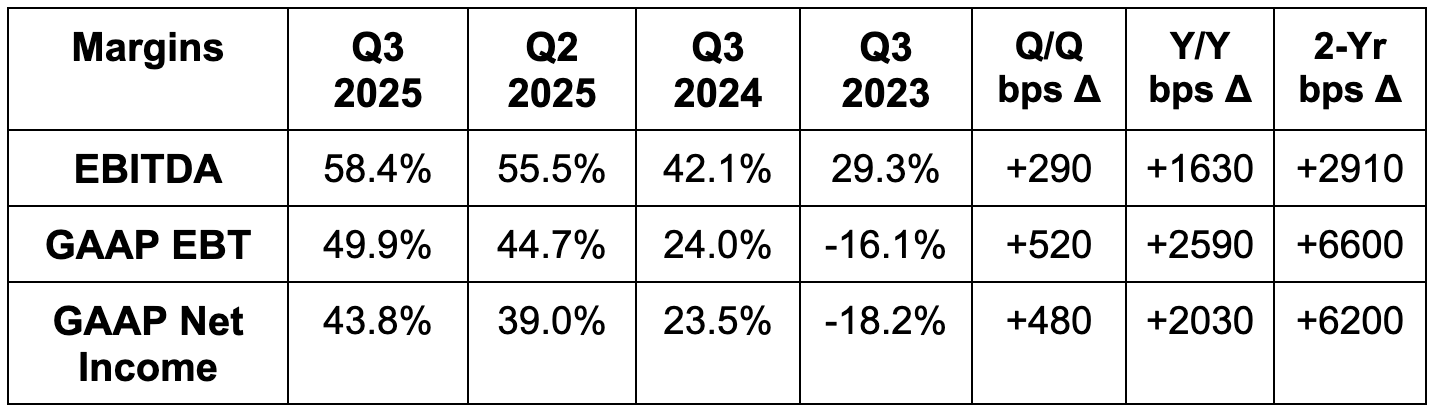

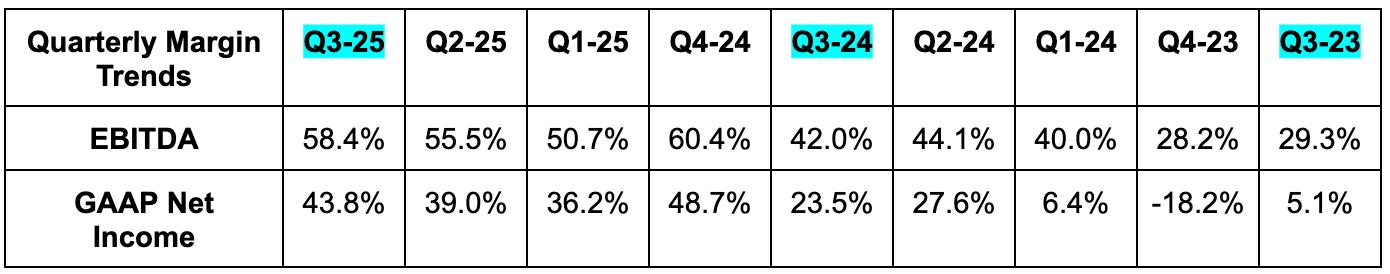

b. Profits & Margins

- Beat EBITDA estimates by 2%.

- Total operating expenses rose by 35% Y/Y and at a 2-year CAGR of 23%.

- EBITDA rose by 177% Y/Y thanks to fantastic trading volume levels as their end markets stayed strong.

- Beat $0.52 GAAP EPS estimates by $0.09.

- EPS rose by 259% Y/Y.

c. Balance Sheet

- $4.3B in cash & equivalents.

- No debt.

- 0.4% Y/Y diluted share count growth. Stock comp dollars fell slightly Y/Y. Love that.

d. Guidance & Valuation

Robinhood increased its annual OpEx guide by 2%. Meeting performance targets and higher payroll taxes from the soaring share price led to this raise. Prediction market and Robinhood Ventures investments added a bit to cost growth as well.

So far in October, annualized net deposit growth rate is 20% vs. 29% this past quarter. Its margin book growth only slowed modestly from 153% to a still great 150% in October. Equity volumes accelerated from 126% Y/Y this quarter to 150% in October. Options contract growth acceleration from 38% to 60% Y/Y. Crypto growth moved from 300% Y/Y to 176% Y/Y as Bitstamp M&A keeps helping and underlying trends remain solid. All of this leads to consensus revenue estimates calling for 32% Y/Y growth.

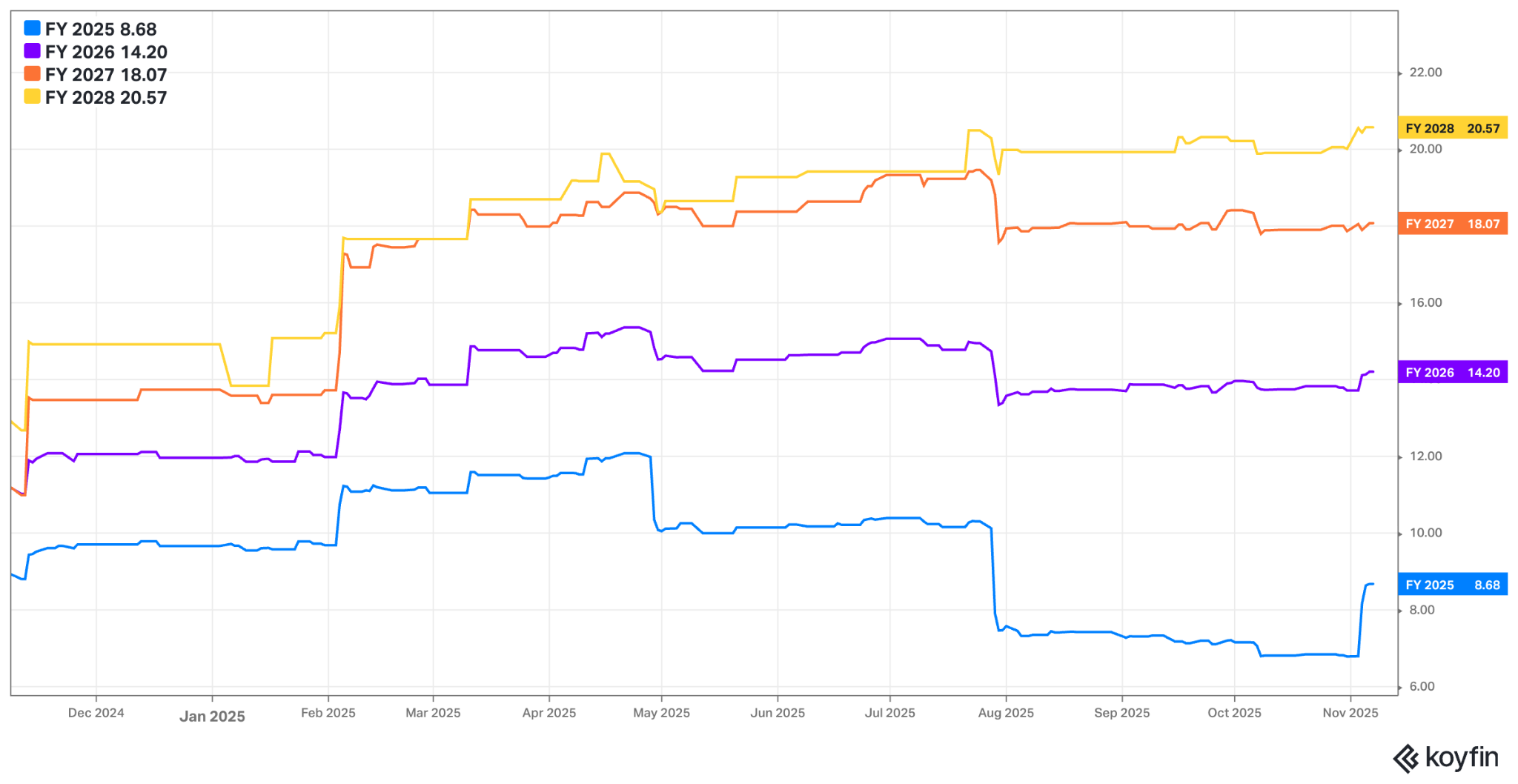

HOOD trades for 50x forward EPS. EPS is set to grow by 25% this year and by 8% in 2026 and 2027. The reason for that sharp assumed slowdown is an expectation that comps get a lot harder and tailwinds supporting its large retail crypto and options businesses don’t remain quite so strong. This is the kind of business where modeling profit estimates two years from now is especially difficult as nobody today can predict how cyclical factors will play out in 2027. They do buffer their inherent cyclicality with strong market share gains and some level of product diversification, but still, 45% of their total revenue is from options and crypto. That is the risk here, with the hope being that other products proliferate and make them less reliant on these buckets. Here’s the big HOOD risk summed up in one chart:

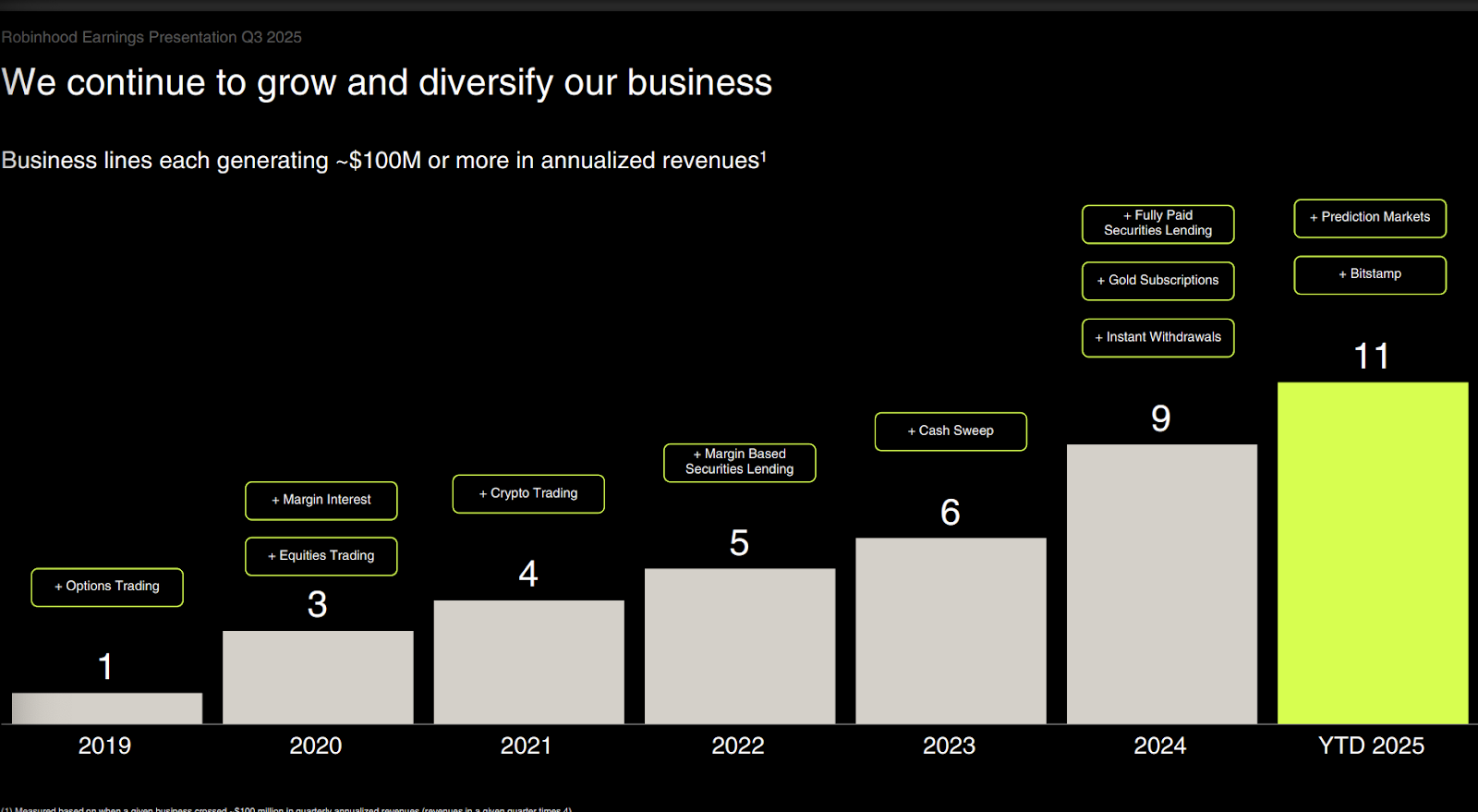

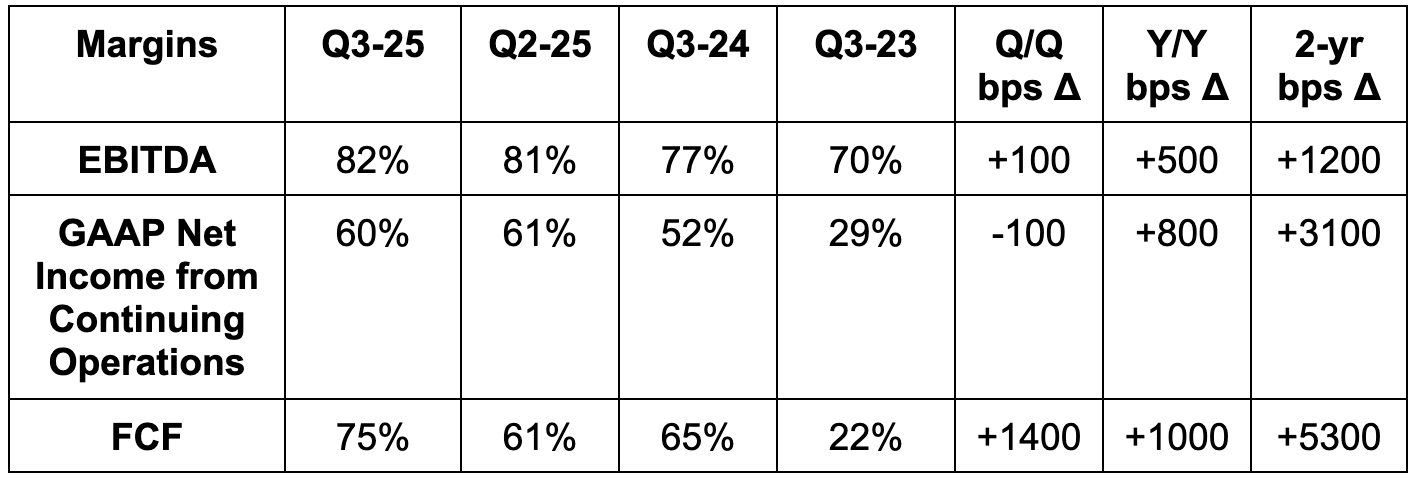

Some of these new products below are still entirely tied to crypto and options, but things like futures and gold subscriptions aren’t. This is the bull case – product diversification: