Sections 3-14 are for paid subscribers. These sections include commentary on First Brands and Tricolor implications, as well as updates on PayPal, Uber, Flutter, Robinhood, SoFi, Amazon etc.

Welcome back to earnings season. Our Taiwan Semi earnings review was published during the week. Next week’s content schedule includes Tesla and Netflix reviews, as well as IBM and Intel coverage. My current portfolio & performance vs. the S&P 500 can be found here.

1. Credit Earnings – JP Morgan, Bank of America & American Express

Important Credit Lingo:

- Delinquencies are loans that are past due by a number of days. Delinquency rates are the leading indicator for credit health.

- Net charge-offs are loans that a creditor decides won’t be repaid and will instead become losses. Net charge-off (NCO) rate is the percentage of loans classified as uncollectible. This is a lagging credit indicator compared to the leading delinquency indicator.

- Reserve levels refer to the amount of funds set aside to cover potential losses for the overall portfolio. Reserves and provisions (which are also for covering potential losses for specific types of credit) are tightly positively correlated.

- Higher expected delinquencies and NCOs contribute to reserve building.

- As reserves and provisions build, allowance for credit losses grows. This is the overall balance of funds to cover losses.

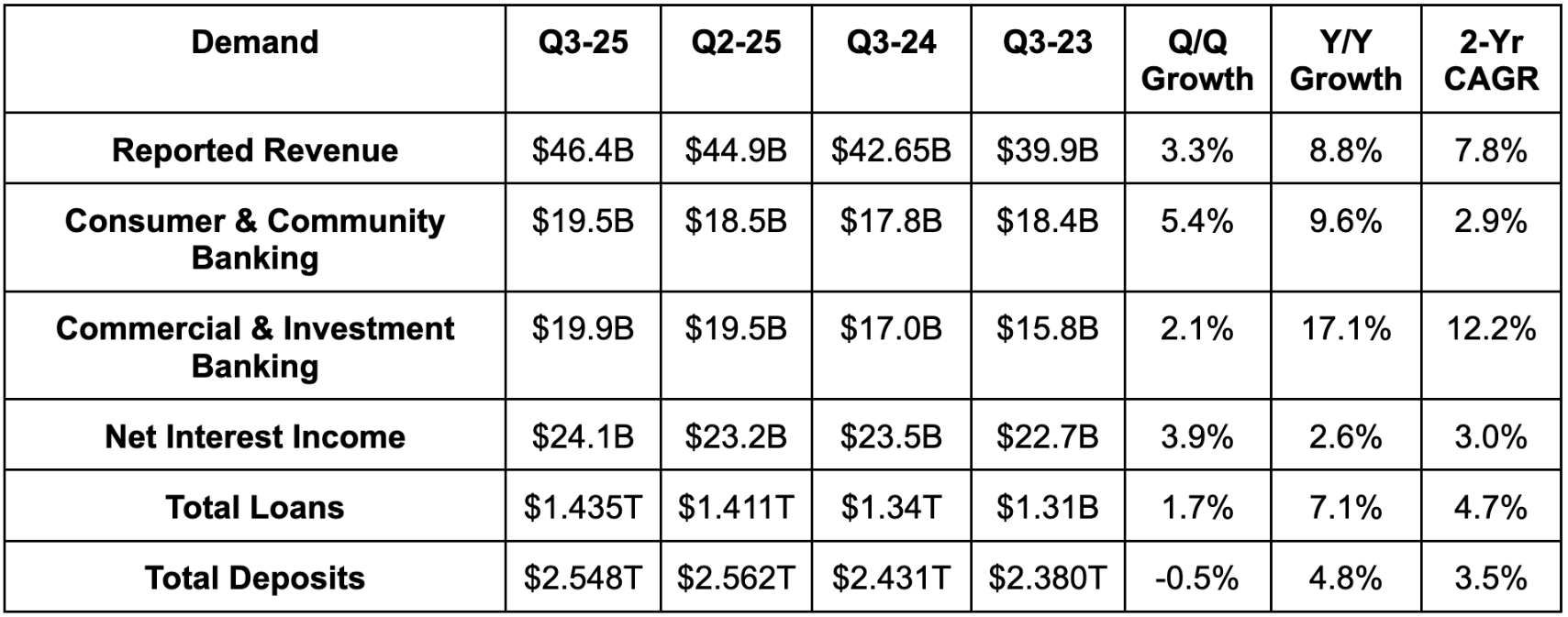

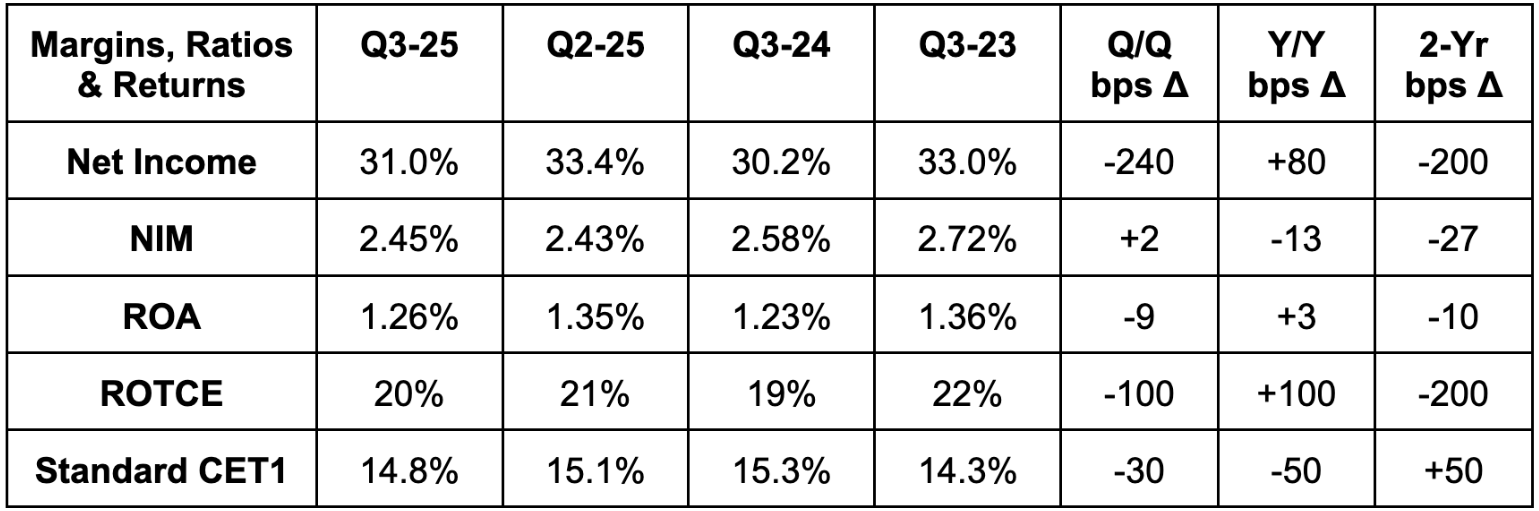

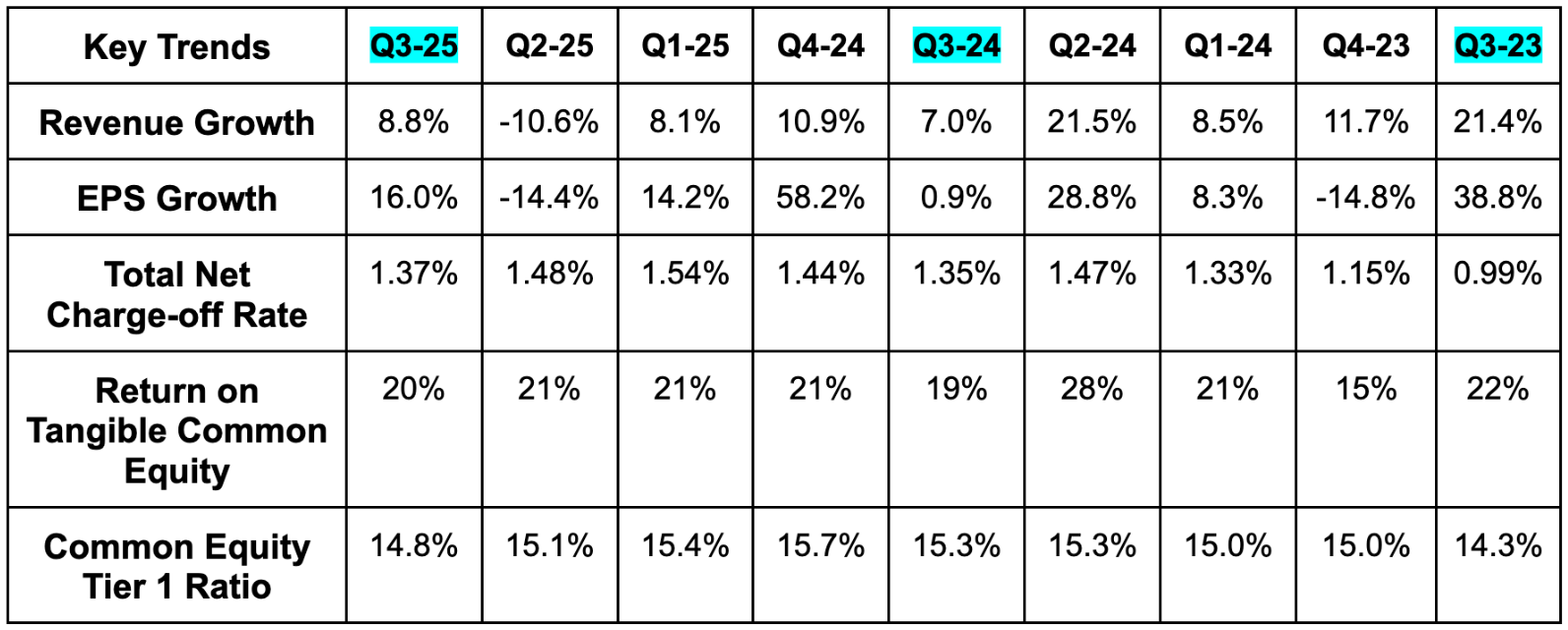

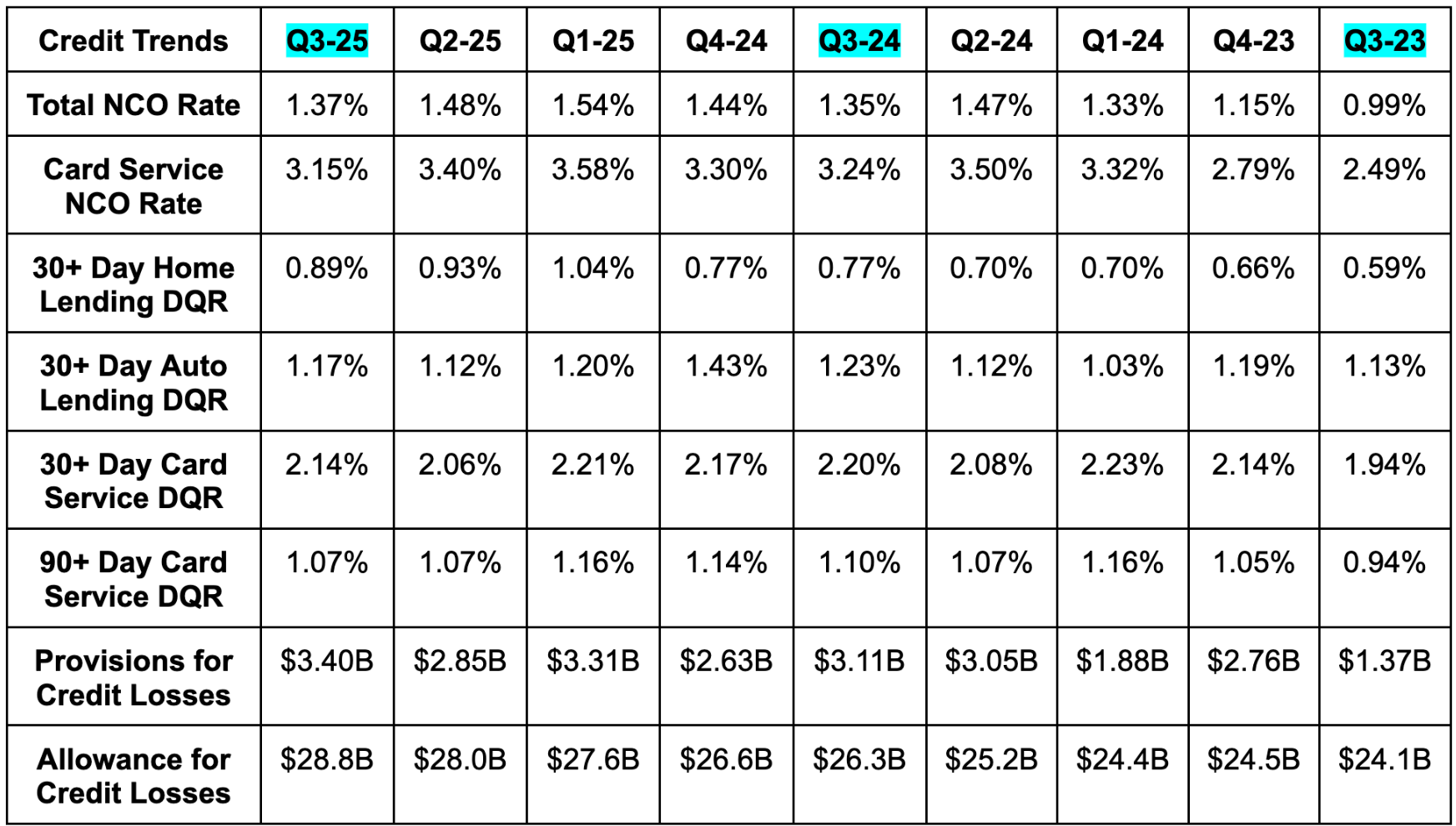

a. JP Morgan

Results:

JPM beat revenue estimates by 1.5%. Missed 2.48% net interest margin (NIM) estimates by 3 basis points (bps; 1 basis point = 0.01%). It also beat $4.81 GAAP EPS estimate by $0.26 or 5.4%.

Credit:

It’s great to see NCO meaningfully tick down on a sequential basis alongside card service NCO. Improving card service NCO guidance for the year was equally encouraging. Provisions continue to rise, which is something to keep an eye on, but generally speaking, credit metrics look at equity resilience on a Q/Q and Y/Y basis. Encouraging.

Outlook & Valuation:

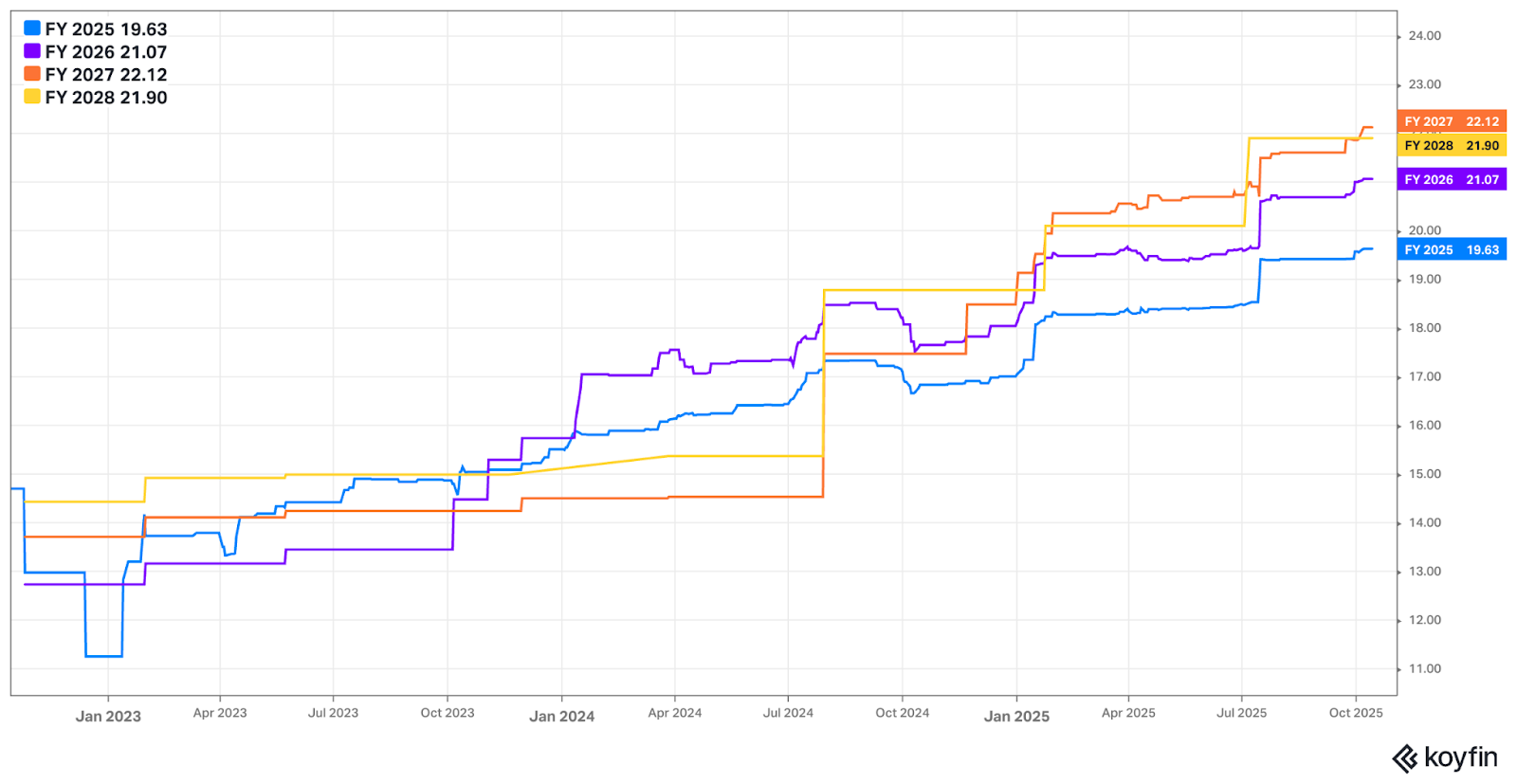

The firm slightly raised annual net interest income and net interest income ex-markets guidance for the year. Improved card service net charge-off rate expectations from 3.6% to 3.3% for the year. JPM trades for 15x forward EPS. EPS is expected to slightly fall this year, and compound at a 6% clip over the following two years.

b. Bank of America (BAC)

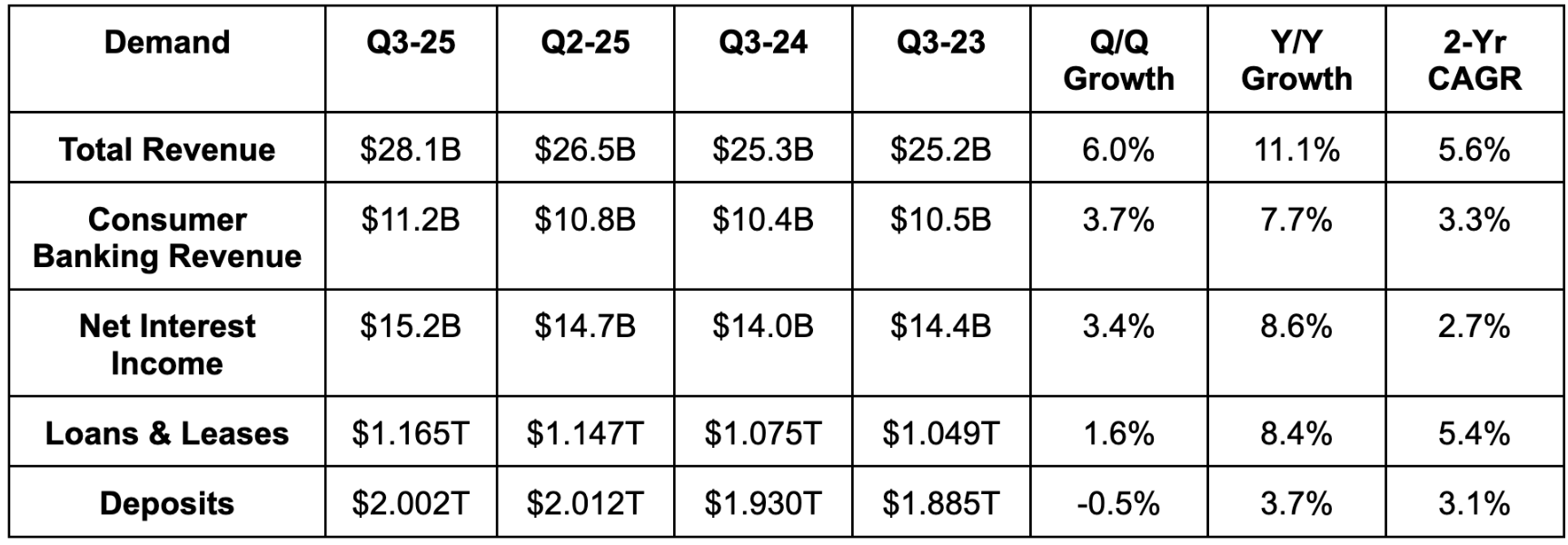

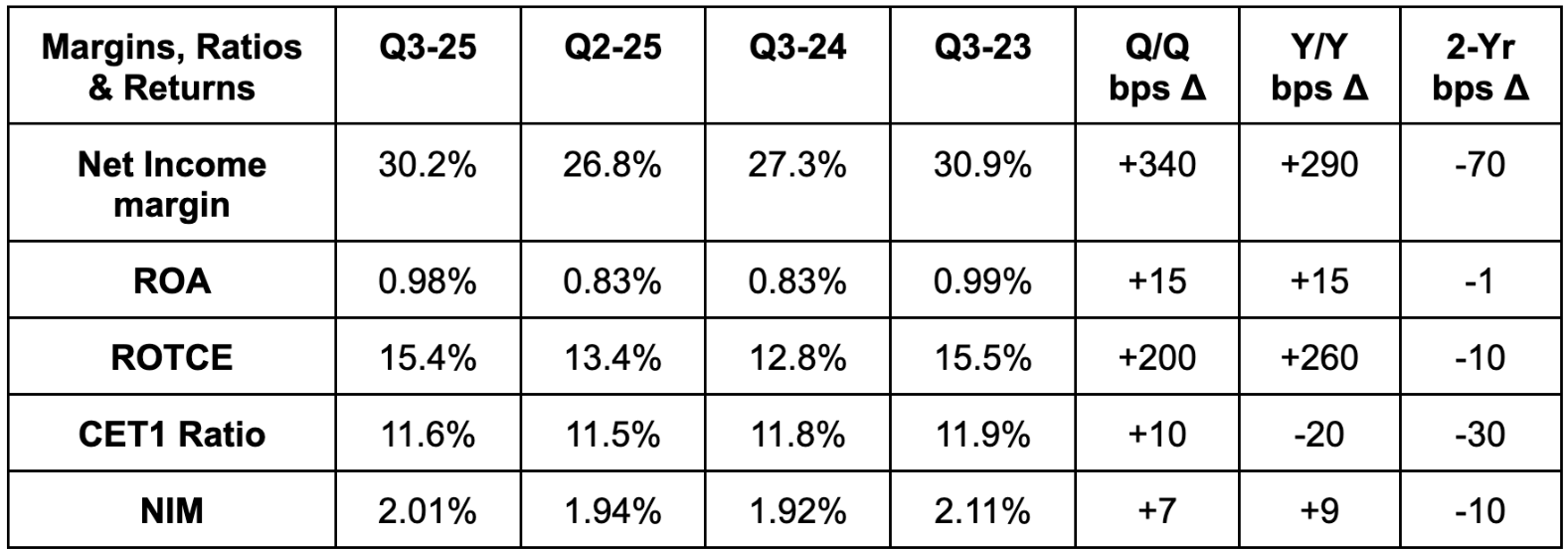

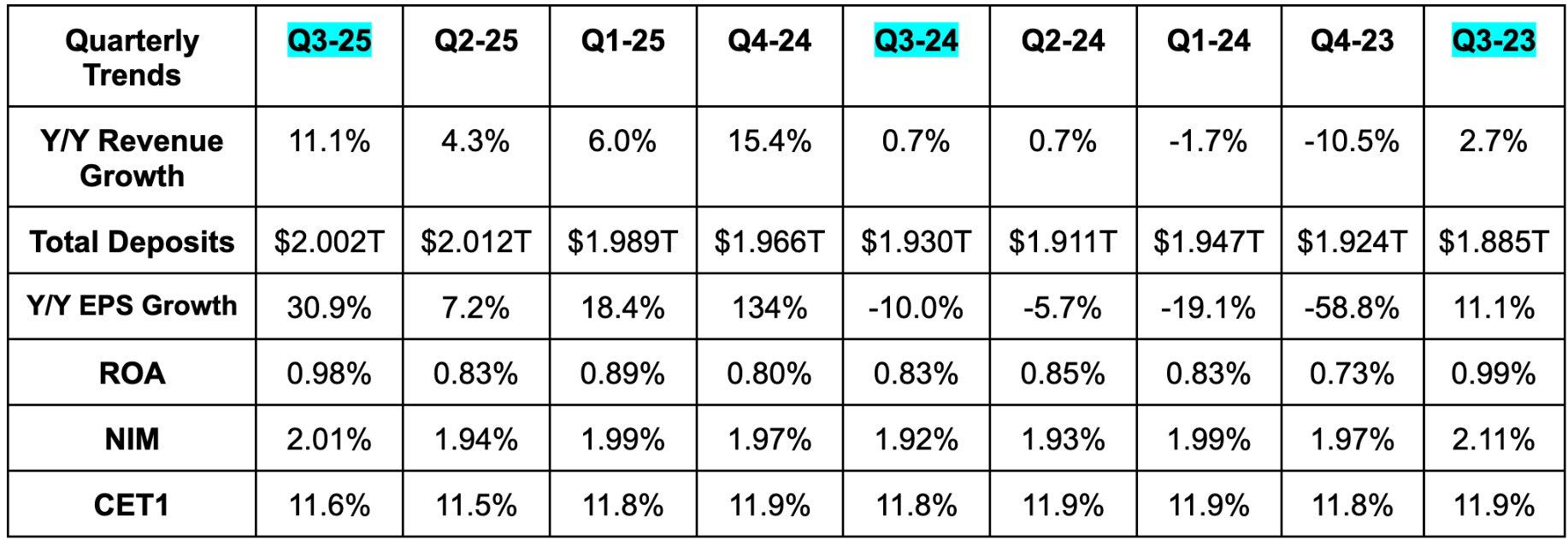

Bank of America beat revenue estimates by 2.3%. It also beat $0.95 GAAP EPS estimates by $0.11 and beat 1.98% net interest margin (NIM) estimates by 3 basis points (bps; 1 basis point = 0.01%).

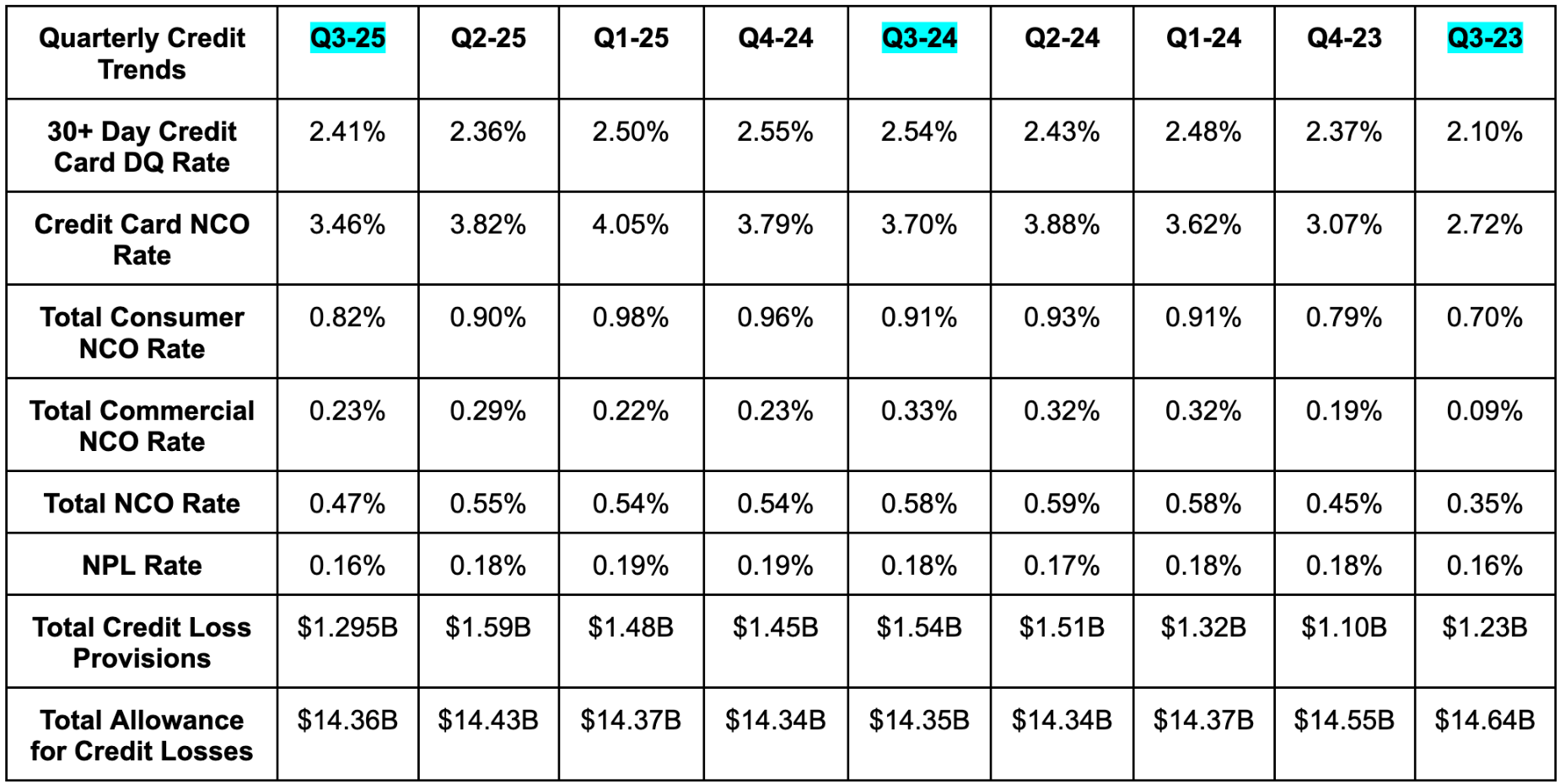

Credit:

The data below looks good. 30+ day card delinquency rates and non-performing loan (NPL) rates both improved meaningfully on a Y/Y basis, while NPL matched its best result in 2 years. Credit card NCO reached its best level in over a year. Both consumer and commercial NCO data looks resilient and improving, while overall provisions are falling, which points to reasonably strong expectations for future repayment. For a giant consumer bank, this bodes quite well for durable consumer credit health.

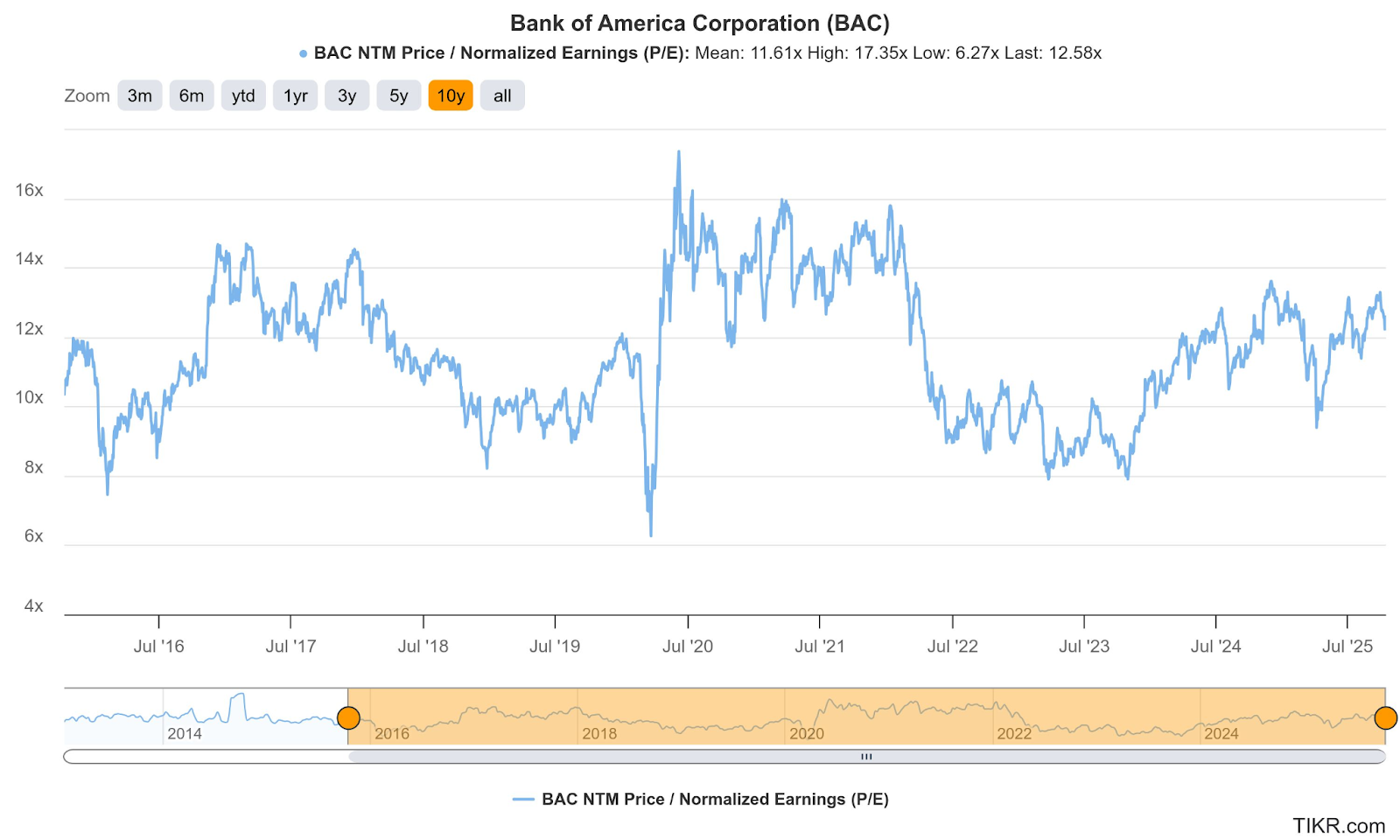

Guidance & Valuation:

Bank of America raised its Q4 net interest income guidance from $15.6B to closer to $15.7B. This would represent about 8% Y/Y growth for Q4. For 2026, they expect to replace about $10B-$15B in assets with higher-yielding products, which should allow them to maintain 2026 growth that’s similar to 2025. Specifically, they guided to roughly 5%-7% growth for next year. BAC trades for 12x forward EPS.

c. American Express (AXP)

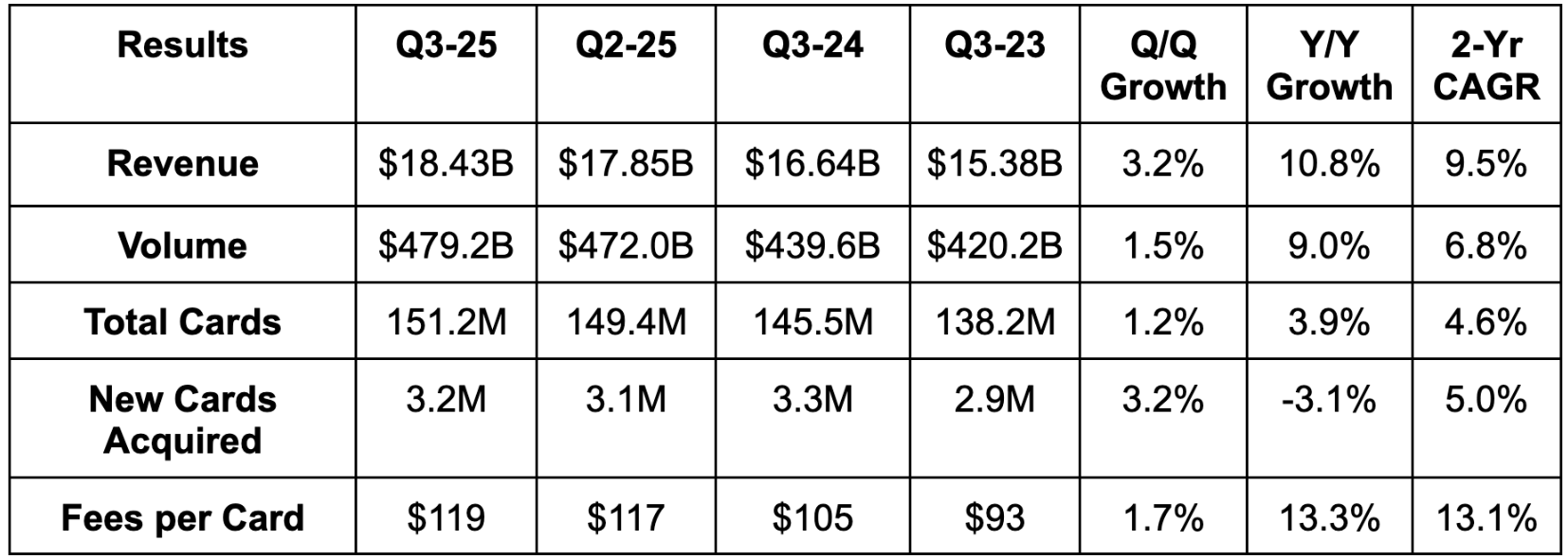

Results:

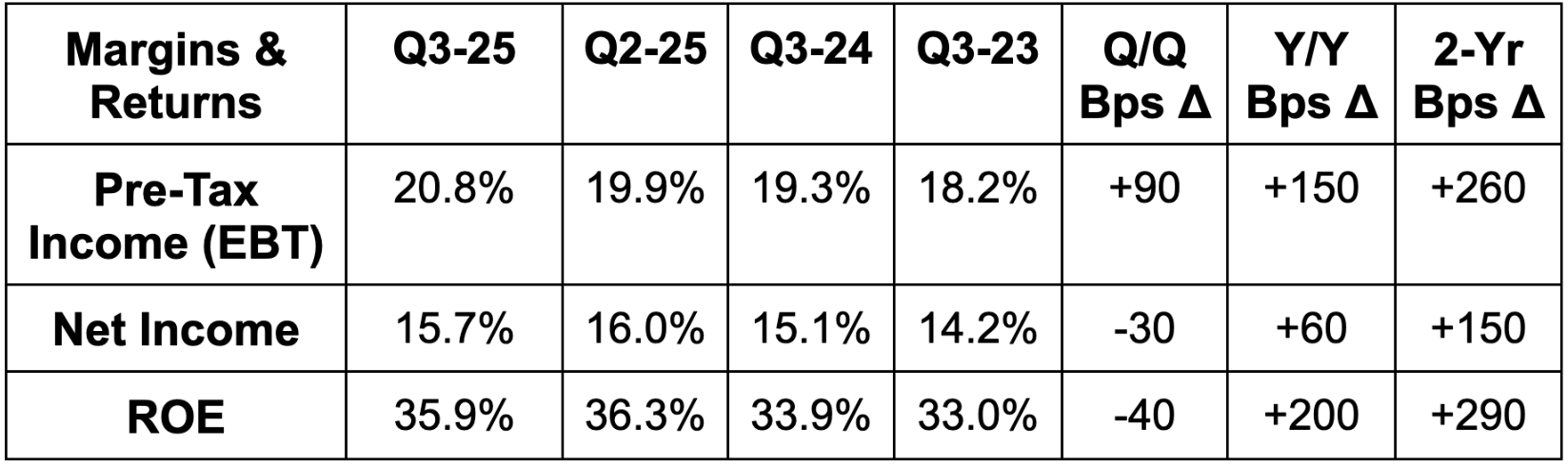

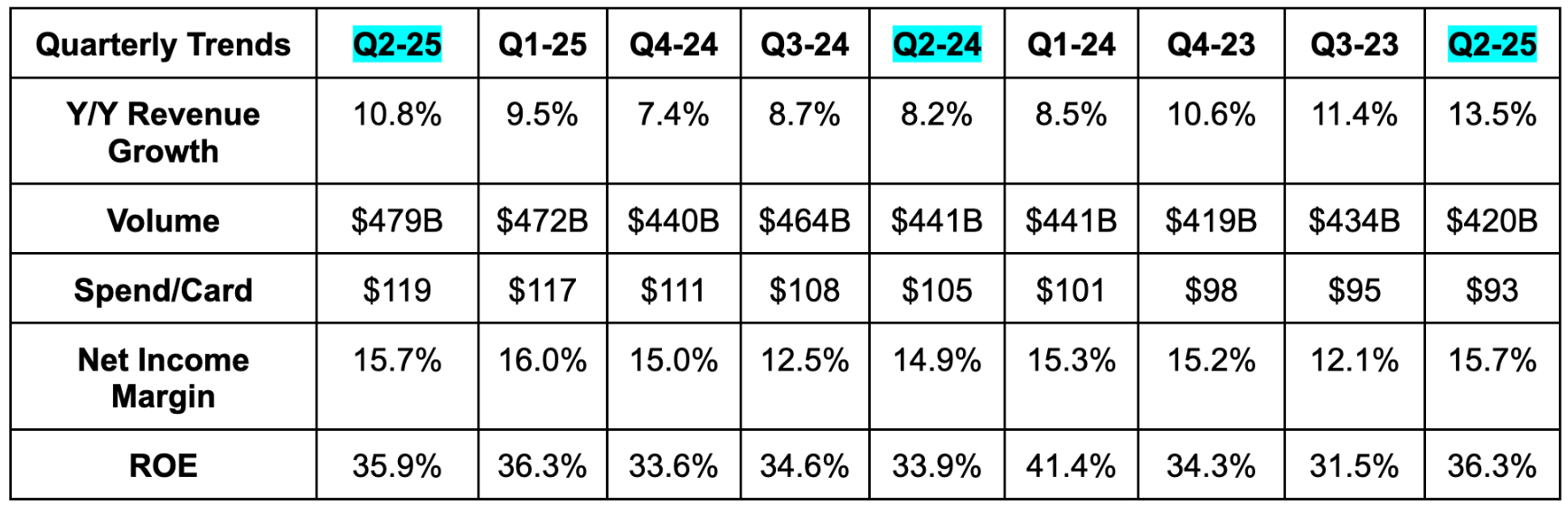

American Express beat revenue estimates by 2.1%. This was its fastest rate of revenue growth in 7 quarters, with the acceleration being in excess of easier Y/Y comp help. Pre-tax income beat estimates by 6.3%, its 35.9% return on equity (ROE) beat 35.5% estimates by 40 bps (basis points; 1 basis point = 0.01%). Finally, it beat $4 GAAP EPS estimates by $0.12. Strong showing.

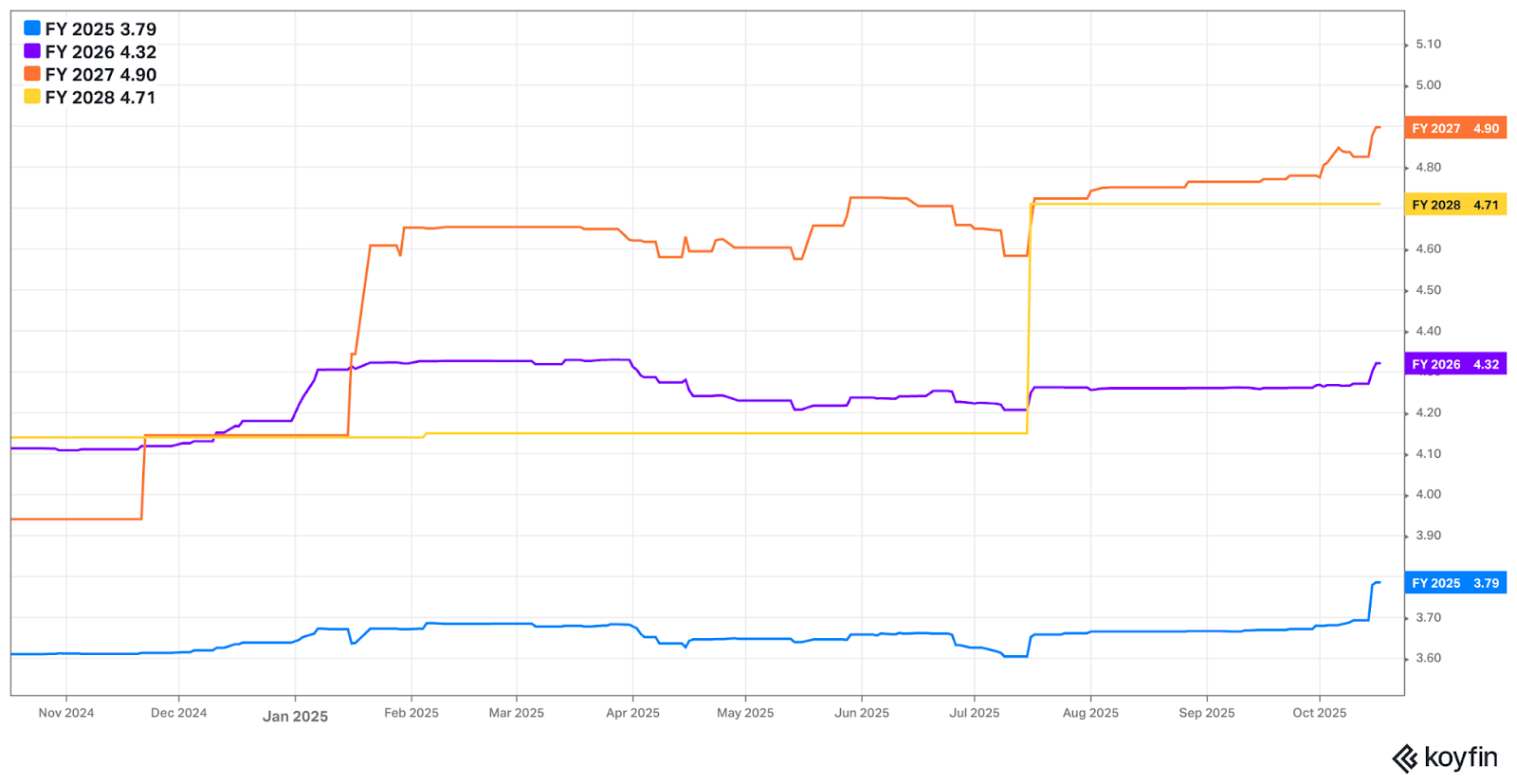

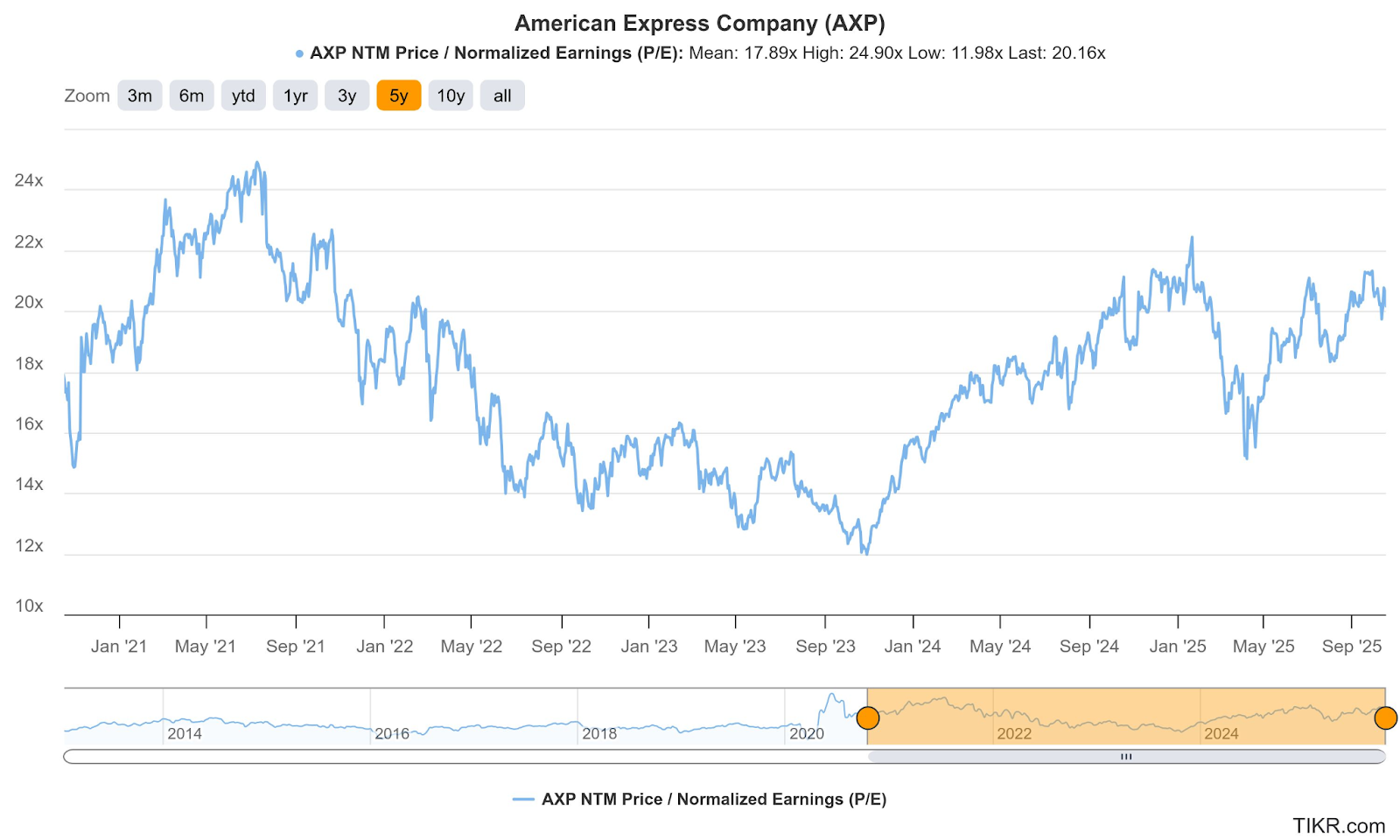

Guidance & Valuation:

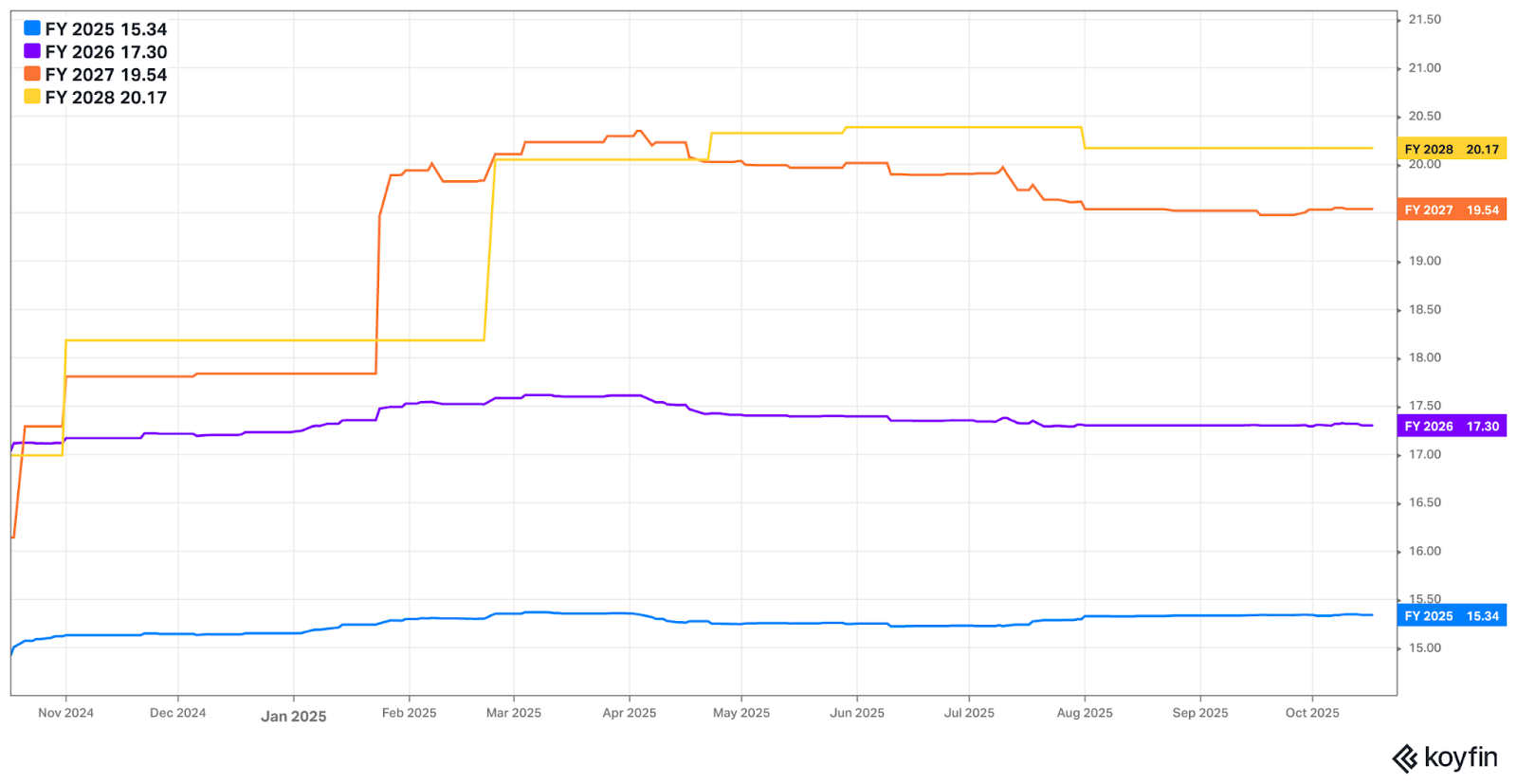

Thanks to the strong Q3 performance, it raised annual revenue growth guidance from 9% Y/Y to 9.5% Y/Y. That compares favorably to 8.5% Y/Y growth estimates. It also raised $15.25 EPS guidance to $15.35 (about 15% Y/Y growth), which met estimates. Estimates for both 2025 and 2026 are up modestly year-to-date

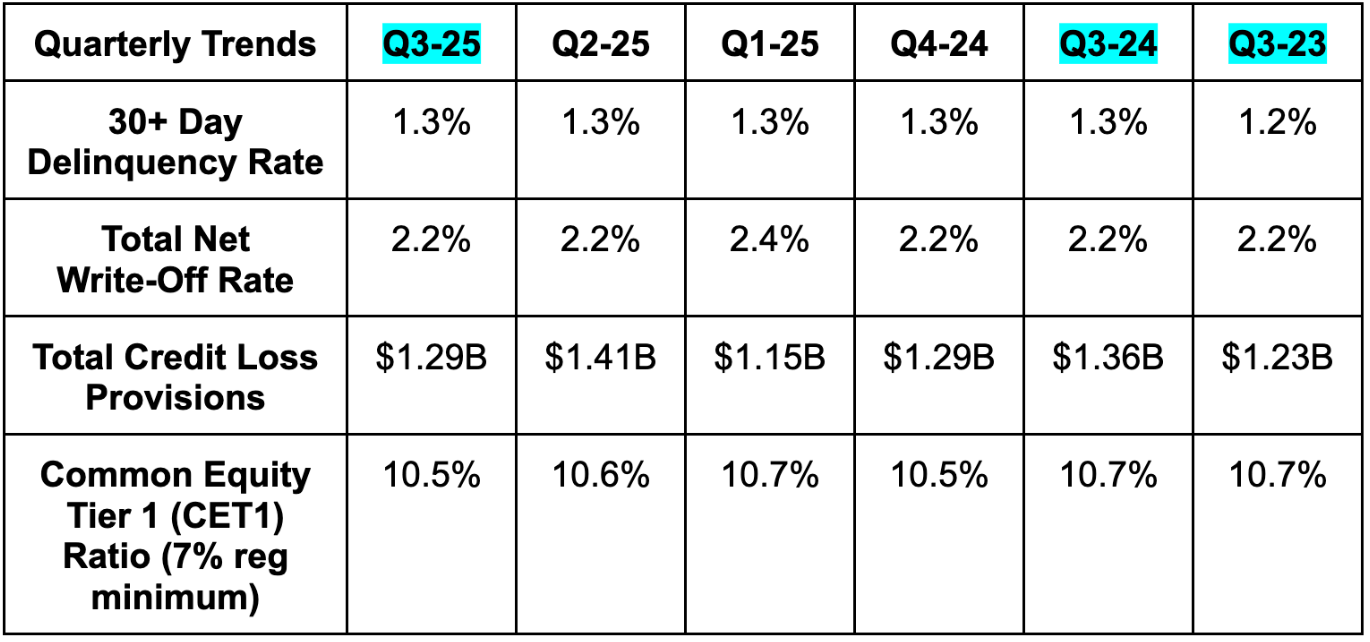

Credit Data & Commentary:

Credit metrics look as robust, healthy and stable as you’d expect from an ultra-prime originator like this.

More Big Bank Commentary from the Week:

2. Lemonade (LMND) – Tesla & Board of Directors

a. Tesla

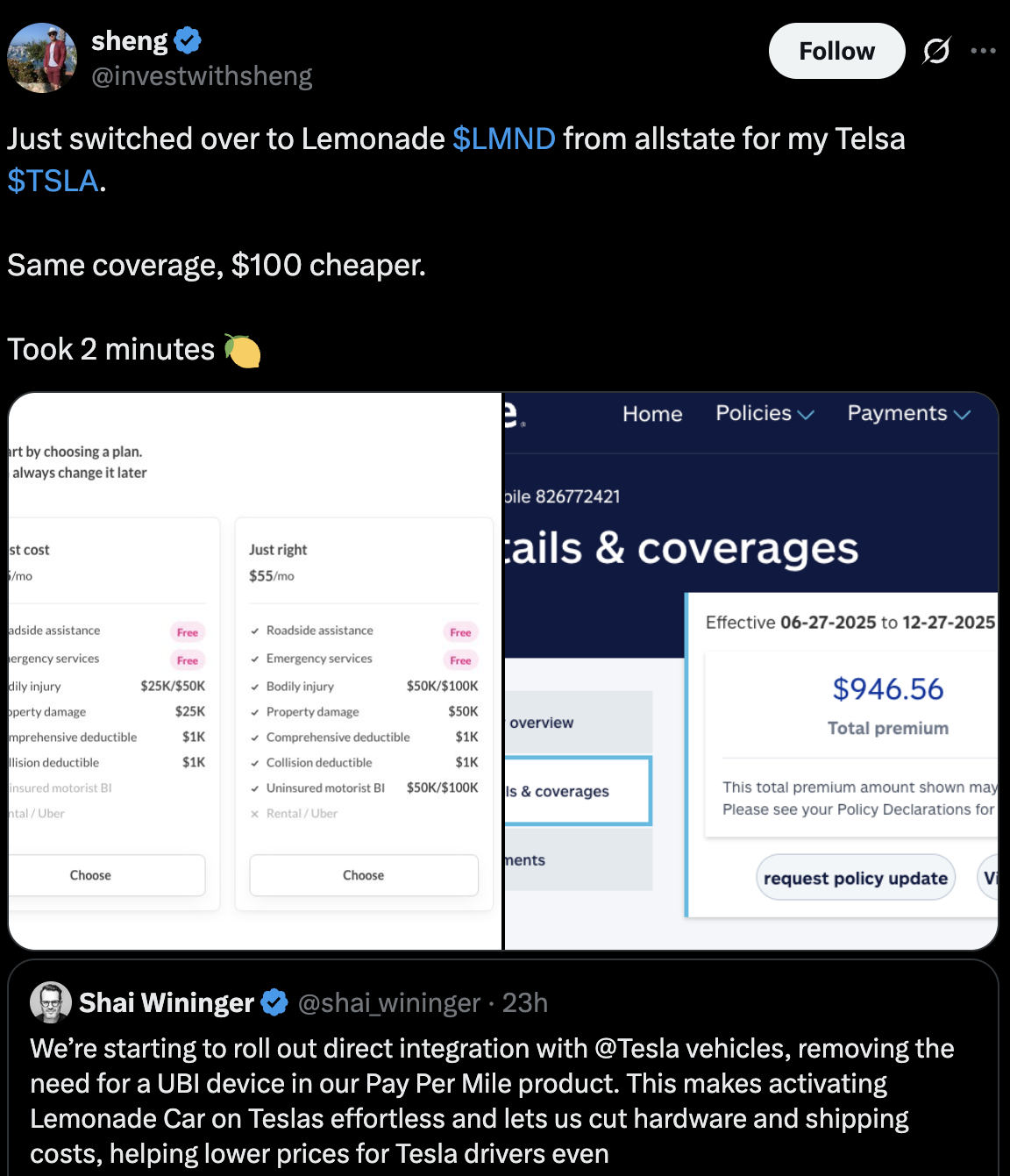

Quite the interesting integration announcement this week for Lemonade’s auto business. Going forward, it will be much easier for Tesla owners to use Lemonade’s pay-per-mile, telematics-based car insurance offering. No longer will they need to install a dedicated piece of hardware to gather data. Now, through a tight integration with Tesla’s API, that data will effortlessly stream behind the scenes right to Lemonade's real-time risk measurement.

Legacy players like State Farm and Allstate also have integrations with this API, but their auto products require a separate hardware installation. They both also have a much harder time perpetually and cohesively using this context-rich information. Progressive’s integration requires no dedicated hardware and they do have continuous monitoring/data collection like Lemonade. That’s the closest alternative, but Lemonade is confident in having superior data depth and breadth vs. the field. They say it all the time in earnings calls.

How can one expect a company to know a driver as well as Lemonade if they’re not collecting as much data and not as capable when it comes to making sense of it? They can’t. That’s why it’s able to uncover who is overpaying for their plans due to improper incumbent understanding of risk and a need for these people to subsidize those underpaying for plans. That’s why Lemonade takes granularity to another level. And that’s why Lemonade’s underwriting trends remain so promising despite its overall access to data being tiny compared to the big boys. A superior ability to leverage all of this valuable insight is the key.

And that key didn’t manifest by accident. It’s in their DNA. Lemonade Car was built with scalable data ingestion and telematics at the center. Their data pipeline orchestrates and delivers all needed driver context to associated teams through cohesive, interoperable, light-weight APIs. Unstructured driver data needs tagging and organizing to be used in the right ways, with Lemonade’s plumbing making that wonderfully automated and speedy. Simply put, this tech stack wasn’t built over decades of stitching together disparate systems that struggle to communicate or leverage each other. The tech and AI-native model was purpose-built for wonderful malleability, seamlessly constant software updates, bottleneck-free data consumption and integrations like this one. That means Lemonade Car can almost effortlessly integrate with a wide array of different sensors without nearly as much heavy lifting. They just move faster and more precisely.

This also means Lemonade will be positioned to holistically use the highly valuable data Tesla collects on these drivers to offer (it thinks) even steeper discounts vs. the field.

Others are allowed to build what Lemonade just built using the same Tesla API. The integration certainly isn’t only available to this specific company. That’s not why this is exciting. It’s exciting because it’s another signal of Lemonade’s ability to build slick integrations like this while others haven’t done nearly as good of a job. Incumbents can’t easily bend their applications to connect to other modern systems like Tesla’s. They can, and do, get part of the way there… but not all the way. Nobody else matches the onboarding ease, lower hardware needs, extensive data collection and lower Lemonade pricing. Others can match some of that equation… but not every piece. That should be a compelling offering for Tesla owners.

A few other notes:

- This should serve as a roadmap for other Lemonade OEM integrations. No other automaker will be as easy as Tesla because their software and data collection processes are the best. But eliminating dedicated hardware needs elsewhere will go a long way in driving adoption.

- There are several giant Tesla influencers on X currently giving Shai’s announcement a lot of love and encouraging a Lemonade auto and Tesla FSD partnership. It’s all speculation at this point.

- Thank you to Daniel Korn (Senior VP of Engineering) for the great thread he posted on this.

- Lemonade’s agentic coding capabilities made this integration buildable in a “very short period of time.”

b. Board of Directors

The company continues to beef up its board. They added Meta’s VP of AI products today. Added PayPal’s Chief Marketing Officer earlier in the month.