News of the Week (April 3 - 7)

CrowdStrike; Airbnb; The Trade Desk; SoFi; Tesla; Uber; PayPal; Piper Sandler Teen Survey; Alphabet; Progyny; Palantir; Olo; Macro; My Activity

1. CrowdStrike (CRWD) -- Investor Briefing

Legacy Endpoint Security:

The first antivirus (AV) product debuted in 1987. This signature-based approach was leaned on heavily to effectively block malware. Today, 36 years later, Symantec, McAfee and Microsoft Defender all still use a modernized, signature-based approach. This works somewhat well with stopping malware, but 71% of breaches no longer use any malware. This renders the signature-based mindset antiquated and is why Microsoft breaches and vulnerabilities continue to be a source of CrowdStrike lead generation.

Conversely, CrowdStrike’s platform operates on a single, light-weight agent that has proven to be extensible to multiple other ancillary use cases and environments. All this utility is centralized in one threat graph with consolidated reporting for an overarching view of security posture. This vendor and agent consolidation inherently fosters easier use, higher efficacy, quicker onboarding with no downtime and lower cost. This combination is a winning one, facilitating CrowdStrike’s rapid market share gains.

Its North Star is to “stop breaches” from the endpoint rather than stop malware; that’s what’s required to keep customers safe in an increasingly chaotic and sophisticated threat landscape. The buzzword for this approach is endpoint detection and response (EDR) which is considered next-generation AV. The threat graph constantly hunts down deviations in typical activity to flag and prioritize vulnerabilities and breaches for quicker, cheaper remediation.

With extended detection and response (XDR) now in the fold, this EDR base can add countless 3rd party data sources like Okta, Zscaler, ServiceNow and Salesforce to augment reach beyond the endpoint to cloud workload environments and beyond. It easily allows for web hook integrations to ensure data sources and apps are working cohesively. Furthermore, CrowdStrike’s log management module affordably devours and organizes all of this disparate data to unify, leverage and permanently store.

“McAfee, Symantec and Microsoft haven’t been able to make the jump from identifying malware to stopping breaches.” -- Founder/CEO George Kurtz

While CrowdStrike is briskly entering other fields like cloud and identity security, all of these expansions are being executed from the endpoint core. That’s CrowdStrike’s bread and butter and always will be. Why does this matter? Because 80% of vulnerable data comes from the endpoint, it’s “where work happens” and where attackers focus. 90% of successful cyberattacks start at the endpoint as the “tip of the sphere” for breaches.

“Endpoint is not just about the endpoint. It is a jumping point that opens us up to all of these other adjacencies in the platform like observability, threat intelligence and more.” -- Founder/CEO George Kurtz

More on Microsoft Competition & Market Share:

80% of the time that a customer tests Microsoft Defender and CrowdStrike Falcon, they go with CrowdStrike. That’s despite the compelling product bundling opportunities for Microsoft vs. CrowdStrike’s standalone security suite. Kurtz explained this as follows:

Microsoft runs its security stack through 9 consoles and several agents vs. 1 of each for CrowdStrike. That makes Microsoft’s product work flows more fragmented and its total cost of ownership higher.

95% of compromised endpoints that CrowdStrike remediates for new customers within its incident response arm come from Microsoft. 75% of these instances are via Microsoft Defender customers.

Defender’s AV signature-based tech must be updated 6-7 times per day with the operating system and security stack fully tied together. That means these updates foster downtime and that Microsoft’s product will not even work properly unless the customer is on the latest update.

“Every CrowdStrike customer is always up to date with the latest protection thanks to the singular agent cloud architecture… we don’t blue screen endpoints with failed updates which constantly happens in the industry.” -- President Adam Sentonas

This is why CrowdStrike has overtaken Microsoft as the largest endpoint vendor since its 2018 IPO. Specifically, CrowdStrike’s share grew from 12.6% to 17.7% YoY in 2022 for its best year of market share-taking ever. Encouragingly, 47% of endpoint market share still remains with legacy vendors that are rapidly ceding share to CrowdStrike. The runway remains miles long even for its most mature endpoint offerings. In terms of the opportunity, its emerging modules are helping to expand its total addressable market (TAM) to $158 billion by calendar year 2026. It was $25 billion in 2019.

Case Studies:

Large school district switched from Microsoft Defender to Falcon:

Before CrowdStrike, it was unable to stop malware attacks despite Defender being up to date. 6,000 machines had to be whipped/reimaged due to a missed attack which halted student work.

Defender produced 10x the number of false positives vs. Falcon.

Incident response took several weeks with Defender vs. hours with CrowdStrike.

U.S. State switched from Microsoft Defender to Falcon:

With Defender, 30% of its ecosystem was not on the latest operating system and so received virtually no Defender protection. It was spending “more time figuring out licensing and system updates than protecting the organization.”

With Falcon, 100% of its ecosystem is on its latest protections with updates rendered in real-time.

The client will save $6.4 million over its first 3 years with CrowdStrike.

Global Services Firm switched from Microsoft Defender to Falcon:

With Defender, endpoint and identity alerts were siloed. This meant “no actionable insight for a managed detection and response firm to help it clean up constant vulnerabilities and breaches.” This led to false positive inundation and alert fatigue.

Falcon was deployed in 36 hours with a “unified XDR product to query data into 1 console for more rapid, unified response.”

CrowdStrike rapidly cleansed the ecosystem of adversaries that had been lurking for a full year.

On Identity Security as an Emerging Star Module:

Scaled to $100 million in 2022 ARR. Identity modules stem from the Preempt acquisition. Preempt was worth $90 million as of 2020.

This is NOT an Okta competitor. Okta is an identity broker which controls ID access and permissions. CrowdStrike identity prevents attackers who gained impermissible access to legitimate IDs from abusing those privileges. It prevents threat actors from breaching the most vulnerable piece of an enterprise’s ecosystem and then freely, horizontally moving throughout the rest of it. CrowdStrike does so by flagging deviations from typical behavior and network requests.

Agent vs. Agentless Approach:

Agent vs. agentless is a hot topic of debate in the world of endpoint efficacy. Leadership spent some time on the topic so I thought it would be valuable to explain what this actually is and the pros and cons of each approach.

Agent-based means software is directly installed on an endpoint like a car, robot, cloud workload or smart watch. The agent helps to collect and query data, ensures proper permissions and offers strong security posture to respond to breaches expeditiously. Agentless means the software is not installed on the device. It remotely protects endpoints based on desired client workflows and network scanners.

Agent-based offers more complete coverage of a client’s ecosystem and is greatly preferred for some of the more stringently regulated industries like banks. Agentless involves a more seamless onboarding process thanks to eliminating the installation need. On its own however, agentless solutions from some vendors (not CrowdStrike) have led to less than complete coverage and false positive inundation.

Agentless is usually preferred for a base of endpoints where physical installation is just not feasible. Think about massive cloud environments and data lakes. This approach generally scales more easily and is cheaper. Data collection however is more challenging and less organized while leaving environments more vulnerable to attacks stemming from the network as it innately relies more on the network. Puts and takes.

CrowdStrike offers both. Agent-based -- per CrowdStrike -- offers it full runtime protection to stop breaches while agentless “extends the agent-based approach” to automate the prevention of human error. Other vendors like SentinelOne only offer agentless as they think it offers sufficient protection.

“You have to be on the device or workload to stop a breach or you’ll detect it too slowly without an ability to remediate.” -- CrowdStrike President Adam Sentonas

Customer Accolades:

CrowdStrike is ranked first for endpoint protection and EDR among several independent customer review sites including G2, PeerSpot and Trustradius.

Incident Response Lead Generation:

CrowdStrike now enjoys $6.07 of added subscription annual recurring revenue (ARR) for every $1 its new clients spend with it on incident response and remediation. This was $5.51 2 years ago and around $3 at the time of its IPO. This continues to be an increasingly strong top of the funnel product for easy cross-selling. It’s a “small but extremely strategic portion of the business” per CFO Burt Podbere.

Long Term Demand Guidance:

CFO Burt Podbere reiterated CrowdStrike’s aim to reach or eclipse $5 billion in ARR in Calendar year 2025. This assumption includes a 10% YoY headwind to net new ARR growth in the first half of this year. Next year, it assumes macro headwinds “remain consistent” with this year when those headwinds are expected to be challenging. So? This guide doesn’t rely on any macro improvements and if they come there could be upside.

This calendar year 2025 guidance also only requires that CrowdStrike see flat net new ARR growth vs. 2022 through the entire period. It assumes its net retention rate falls more sharply than the company assumes it will. CrowdStrike expects to do much better than this and I expect it to obliterate this revenue target by a mile.

“We intend to continue to take market share across all aspects of the business and to expand wallet share with more modules as we enter new adjacencies.” -- CFO Burt Podbere

Long Term Margin Guidance:

Gross margin fluctuation has nothing to do with pricing pressures. There are no pricing pressures in the business currently. They are about infrastructure investments and M&A integration. The infrastructure investments are set to deliver 100 bps of gross margin expansion YoY next quarter as “fruits of labor pay off.” It is fully confident in its long-term margin target here of 82%.

It sees FCF margin of 30% this year, 30%-32% next year and 32%+ for calendar 2025. This represents an update to its margin model from 30%-32% previously.

It will get to its EBIT margin target of 20%-22%+ “some time in” calendar year 2024.

“We could reach these margin targets now. We don’t think this would be the best course of action given the massive market opportunity and our strategic position within the ecosystem.” -- CFO Burt Podbere

Module Adoption:

Average Module count:

8 on average for its $1 million+ ARR customers vs. 3.7 5 years ago.

6.3 on average for its $100,000-$1 million ARR customers vs. 2.9 5 years ago.

4.7 on average for its sub-$100,000 ARR clients vs. 2.6 5 years ago.

New customers are landing with 4.8 modules vs. 2.8 in calendar 2017.

4,500 customers have adopted 2+ emerging modules with emerging module ARR rising 116% YoY last quarter to $339 million. This is now very needle moving.

Identity modules are the largest emerging module ARR contributor growing 200% YoY.

The largest private global tech services provider (Cognizant or Accenture probably) has helped it close $200 million worth of deals in 18 months as it becomes a better ecosystem partner.

CrowdStrike has $9.6 billion in possible cross-selling opportunities within its current customer base vs. $7 billion YoY as it adds more use cases.

2. Airbnb (ABNB) -- Short Report Response

As an independent investment analyst, I naturally feel somewhat connected to the author of the Bear Cave and root for his success. Still, his Airbnb ~short report~ published this past week was substance-lacking. I needed to address it bluntly and why I added to my stake following it.

Professional Landlord Competition:

Here is the premise: The report argued that individual landlords are somehow going to build their own competitors. They’re going to match Airbnb’s massive network effect while relying on 3rd parties for a sub-3% Airbnb host take rate. They’re somehow going to get all of the same, complementary insurance coverage and will match all of the ancillary utility building services that Airbnb continues to add. This will somehow make hosts more profitable than they are on Airbnb. Somehow.

Superhosts with several mortgages and maintenance fees are going to forego the steady stream of demand that Airbnb provides. They’re going to maintain their entire fixed cost base, add new fixed costs and take a chance on if they’ll still be able to find demand alone. Really? This is not remotely realistic. Airbnb’s superhost model only propagated because Airbnb made it work with its massive customer cohort.

The vast majority of drivers succeed more on Uber than alone. The vast majority of businesses succeed more with Shopify than building custom solutions on their own. The vast majority of hosts do better with Airbnb than alone. There are obviously exceptions to this rule… but not many. Network effects matter a lot and this report irrationally discounted the value of that perk to 0.

Regulation:

Airbnb is in a better position to comply with regulation vs. smaller, less deep-pocketed competition. Furthermore, lawmakers are mostly focused on ID verification and tax collection -- two issues where Airbnb has proactively led in its industry. It is better equipped to handle new rules than anyone else in the space based on size, balance sheet, and global relationships that it has painstakingly built. Tighter regulation often provides relative value for the richest and biggest in the space.

I love to use New York City as a case study. This has been the strictest city in the states for shorter term rentals and has boasted a wildly fluid regulatory backdrop. Airbnb has gracefully endured all of these changes and has continued to find success in that market. Regulation will continue to change. I expect Airbnb will continue to fruitfully adapt.

Property Damage and Bad Actors:

Sometimes guests damage host properties. Sometimes guests are not happy about an aspect of their stay and take to Twitter to vent. This apparently is a key bear case. Apparently, hotels never, ever deal with anything like this as all of their guests behave perfectly 100% of the time. I’m sure you can hear the sarcasm oozing out of these words. I found this argument not only irrelevant but also ironic. If it were actually a crippling risk for the business, it would mean hosts are even more reliant on Airbnb’s cash collection and insurance coverage. So which is it? Hosts deciding to take all of the risk to compete on their own? Or bad actors making it infeasible to do so? It can’t be both… and I think it’s neither.

I saw anecdotes popping up on Twitter about hosts allowing Airbnb guests to pay them independently from Airbnb. This is not a bear case, it’s a means of tax evasion and is illegal. It also removes all protections that the company provides. This vastly amplifies risk of stolen funds or fraudulent listings by hosts and stolen or damaged property by guests.

Despite bad actors being inevitable within this space, Airbnb’s new AirCover policy has all but solved this issue for hosts. The company now has a lofty net promoter score (NPS) for claims on damaged homes as it raised coverage limits and service levels all while maintaining rapid margin expansion. This means hosts who have their properties damaged are actively promoting Airbnb in word-of-mouth fashion because the claims experience is so delightful.

Fees (Econ 101):

Airbnb charges fees based on a massive network where it must balance supply and demand. Hosts choose cleaning fees and other service fees based on this same reality. If the equilibrium moves out of whack, stakeholders must adjust pricing accordingly to maximize occupancy and optimize revenue. It’s the same as any other marketplace. Fees are not arbitrary, but a reaction to the market; they are the result of the first lesson we all learned in Econ 101. Airbnb and hosts charge what facilitates an equilibrium and removes deadweight loss. And? Hosts continue to rapidly onboard. Nights-stayed and rates remain robust into this quarter.

Valuation:

Airbnb trades for 20x 2023 FCF with a relatively modest stock comp add-back. This profit metric is growing at a compounded rate of 20%. Booking trades for 16x 2023 FCF compounding at a rate of 6%. From a GAAP net income point of view, Airbnb trades for roughly 30x 2023 earnings compounding at a rate of 20% for 1.5 forward PEG. Booking trades for 21x 2023 earnings compounding at a rate of 16% for a 1.31 forward PEG. Does this really look that egregiously priced to you? It doesn’t to me either.

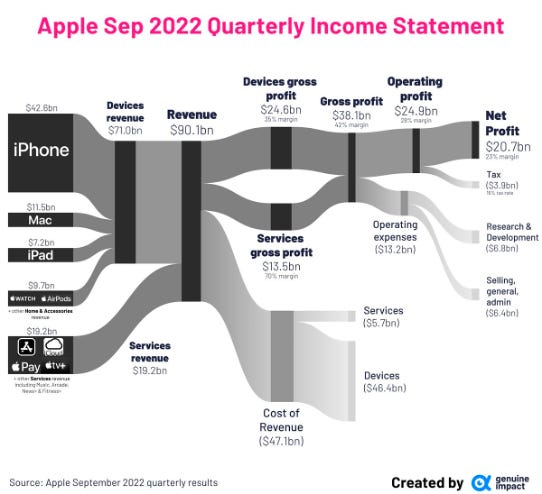

Simply put, Genuine Impact makes investing easier. It pulls and organizes complex data into simple, beautiful charts. It takes complex financial statements and depicts them in a far more aesthetically pleasing manner.

It’s one of my favorite Twitter accounts and the quickest, clearest way to learn about investing. In my constant journey to save you all time, Genuine Impact accomplishes this in a purely complementary and high-quality way.

You can follow them on Twitter here or subscribe to their wonderful newsletter here.

You’ll be happy that you did.

3. The Trade Desk (TTD) -- Inaugural Forward Event

The Trade Desk transforms ad buying from a forward process to real-time impression bidding. Forward refers to purchasing large blocks of impressions well in advance of the placements while programmatic bidding is far more flexible, data driven, real-time and so effective.

Still, the forward market garners a lot of ad dollars and attention. Knowing this, The Trade Desk has made more of a concerted effort to carve a niche within it. It’s infusing new layers of data into that process to make it less guess work. The company won’t say it, but this is obviously a move to better evolve with advertisers as they embrace programmatic -- rather than forcing an abrupt pivot. It wants to be a bigger piece of this transformation rather than waiting as it takes place.

There were a few key highlights from the firm’s inaugural forward event: Programmatic advertising is gaining steam, it delivers superior returns regardless of paying higher cost per impression and ad-based is very complementary to subscription based packages. None of this is surprising, but all is worth noting as a reiteration of how compelling TTD’s position in the industry truly is.

4. SoFi (SOFI) -- M&A

The M&A rumors that I discussed last week were spot on. SoFi is buying Wyndham Capital -- a digital mortgage originator. It looks like integration work will take SoFi up to 6 months as it expects Wyndham’s results to be “accretive to results” thereafter.

Per the press release, this acquisition will free SoFi to bolster its suite of mortgage products with better profitability thanks to Wyndham’s decades of underwriting experience and lower 3rd party fees. It gives SoFi access to the “full stack” like it has with Galileo and payment processing for example. This philosophy is set to “minimize reliance on 3rd parties” which is leadership’s way of telling us it will allow SoFi to conduct the process 100% digitally and to fund loans far faster. According to the press release, Wyndham crunches that time frame in a delightful manner with a 98% customer satisfaction rating. That is not normal for mortgage originators. The transaction is all cash with the price tag not yet disclosed.

Aside from these tidbits, last week’s blurb covered the purpose and timing of the acquisition very well (if I do say so myself). If you missed it, that can be found here.

5. Tesla (TSLA) -- Demand

Tesla slightly beat consensus delivery and production forecasts for the quarter.

All that I’ll say is a 68% 3-yr delivery CAGR stands in stark contrast to the typically no-growth nature of legacy automakers which actually saw a 2022 demand contraction. Tesla deserves a valuation premium vs. these competitors. How much of a premium? I’m not sure.

6. Uber (UBER) -- Product Expansion

a) Uber Health

Uber is expanding further into healthcare. It is debuting a product allowing prescribers to set up same day drug delivery for patients through Uber Health. It had done a bit of this through a ScriptDrop partnership, but this greatly expands the service to more drugs and shrinks the delivery window. While cost is the number 1 reason why patients don’t adhere to medications, convenience plays a material role too. This allows a “care coordinator to close the loop on behalf of their patients” (per the company) to theoretically boost adherence. Uber is rumored to be considering expanding into more medical devices in relation to this announcement.

The company will only win transportation if it can lump more utility-building services into its consumer app and subscription bundle than the competition can. Its path is quite similar to Amazon Prime’s, but with a mobility focus rather than e-commerce and logistics. It already has more value creating services than its competition and already owns the most scale. It has the recipe to boast more subscriber value and more cross-selling to facilitate unique (yet still profitable) deals and promotions. This is how it will motivate higher retention with lower marketing intensity and the way I see this becoming a profit compounder over time. The subscription is the key to its success.

This launch specifically allows me to do some fun speculating about subscription perks going forward. If Uber can prove to insurance carriers that it raises medication adherence with this product, perhaps it could negotiate some kind of premium discount for select Uber One customers? Again, I’m speculating, but this does not seem all that far-fetched.

b) LatAm

Through a partnership with Brazilian-based Tembici, Uber will offer bike sharing on its app throughout Latin America.

7. PayPal Holdings (PYPL) -- Apple Pay

PayPal’s payments solution geared to smaller businesses added Apple Pay as an option this week. This marks the deepening of a recently struck partnership which also includes things like Venmo cards being available to Apple Wallets. The press release added an interesting stat from Ponemon stating that 59% of online shoppers will abandon a cart if their favorite payment option isn’t available. So? PayPal needs to offer as many relevant options as possible. These merchants now have access to interchange plus, plus pricing as well as the typical flat rate for more flexibility. They also can enjoy “one of the market leading rates” on card fees.

PayPal also debuted an ability to vault and save card info through its platform but on external merchant sites for more native and convenient checkout.

8. Piper Sandler Teen Survey

Piper Sandler released another teen survey with 5,690 respondents around the U.S. These respondents were 16.2 years old on average. Some of the data was sliced by upper and average income. Household income for the upper portion was $103,000 with the average bucket at $54,000. Here were all of the highlights from the lengthy report:

Social:

Instagram is the favorite social platform for 23% of respondents vs. 20% in the last survey. Facebook rose from 2% to 3%. Conversely, Snapchat fell from 30% to 27% and TikTok fell from 38% to 37%.

Monthly engagement rate for Instagram was flat at 80% of respondents. Facebook rose from 27% to 28%, Pinterest rose from 34% to 35% and Twitter rose from 35% to 36%. TikTok fell sharply from 76% to 72% with Snapchat falling from 76% to 73%. Reels is taking share from other video sharing apps per the report.

Apparel & Footwear:

Lululemon “continues to gain mindshare. It’s the top female upper income brand and the #2 athletic apparel brand overall for all income cohorts.

“Leggings/Lululemon” remained the top female fashion trend for the 3rd straight year.

Lulu is now the #3 brand overall among teens vs. 5th 18 months ago. For men specifically, it rose from 9th to 5th. This brand is on fire.

Nike remains the top apparel and footwear brand among all teens. Its Converse brand is #2 in footwear.

It’s doing better with males on footwear (gained 400 bps of share) vs. females (lost 240 bps of share).

It’s gaining a lot more share in apparel overall vs. athletic apparel where it’s actually losing a bit of share to brands like Lulu and Gymshark.

For apparel specifically, Nike has a 33% favorite rate vs. 7% for second place American Eagle. Its lead is massive.

For footwear, Nike is #1 by a mile with over a 60% favorite rate.

Nike is still #1 for top brands starting to be worn with Adidas, Lululemon, Champion and New Balance rounding out the top 5.

Female fashion spend fell 3% YoY which could spell temporary challenges for brands like Revolve.

Under Armour fell entirely out of the top ten brand rankings in its core categories.

New Balance rose from 10th to 5th over the last 18 months for people starting to use the brand with North Face rising from out of the top ten to 7th during that time.

E-Commerce/Internet/Streaming:

57% of teens pick Amazon as their top e-commerce site. This leads all vendors with Nike at #2, SHEIN at #3 and Lululemon now sitting at #4.

Teens are spending 31% of daily video time on Netflix vs. 32% a few quarters ago. YouTube fell from 29% to 28% over that period. HBO Max took a bit of share.

44% of respondents don’t have Cable with another 7% looking to cancel it. This compares to 37% not having cable with 7% planning to cut it 2 years ago.

VR headset demand is slightly dwindling with most owners not really using the device.

Food:

Chick-fil-A continues to dominate as the favorite brand among all income and gender cohorts. Still, it fell from a 20% preference rate in 2021 to 14% today. Starbucks has now nearly caught the brand and is #2 while Chipotle was #3 and lost a bit of share. McDonalds and Olive Garden round out the top 5.

Among income demographics, upper income has Dunkin as #5 instead of Olive Garden with the rest of the top 5 the same.

Teens are becoming less and less interested in plant-based meat.

Nature Valley is killing it with teens for General Mills while Campbell’s continues to enjoy passionate teen love for Cheez-its and Goldfish Crackers.

Restaurant spending trends turned positive and grew wallet share vs. 2021 and 2022. Good news for Olo and others in the industry.

Payments:

Apple Pay enjoys top penetration levels for Payment Apps on a smartphone with 52%. Note that nearly all respondents had an iPhone. Cash App is second at 36% while PayPal’s Venmo is 3rd at 31%, PayPal 4th at 22% and Zelle 5th at 15%.

Cash App was the top preferred peer-to-peer money transfer app at 41% vs. 39% for Venmo.

PayPal is the top buy now, pay later option at 30% vs. 34% YoY; Afterpay is 2nd at 28% vs. 30% YoY.

Final Notes:

87% of teens own an iPhone with 88% expecting it to be their next phone.

67%+ of respondents use Spotify with Apple Music a distant 2nd.

25% of teens have used ChatGPT with about 75% of its users being male.

9. Alphabet (GOOG) -- Chips & Cost Cutting

Alphabet debuted its latest semiconductor set that it uses to train and season AI algorithms and its supercomputer. According to the company, it’s 1.7x faster than Nvidia’s comparable set and 1.9x more efficient. Nvidia’s development of its latest chip set, which is expected to be far more powerful than the current offering, is well underway. It’s a back-and-forth battle in AI semi-conductors with multiple mega cap tech names attempting to vertically integrate.

In other news, Google’s CFO reportedly told employees to expect more cost-cutting in 2023. More layoffs may be coming as the tech sector reverses its overly aggressive hiring and spending since the pandemic struck. Google is a few months behind others like Meta and Amazon in terms of rounds of layoffs and expense trimming, but it’s quickly following in their footsteps. Microsoft also ended plans to build a new office in London while Amazon is looking to cut down on more stock awards. This is not just the year of efficiency for Meta, but for the entire sector.

10. Progyny (PGNY) -- Hire

Dr. Janet Choi is Progyny’s new Chief Medical Officer. Per the presser, Choi has 20+ years of experience as a certified Gynecology and Obstetrics specialist as well as in Reproductive Endocrinology. Her mission will be to ensure Progyny’s product bundles remain as current and flexible as possible with outcome leads being maintained or grown. She has been on Progyny’s medical advisory board for 3 years and apparently liked what she saw. Before this, she was the Medical Director of CCRM’s New York fertility clinic for 7 years and an assistant professor at Columbia. She has been a New York Magazine “Super Doctor” since 2018 to name one accolade amid her long list of achievements.

“As a physician in the Progyny network, I have seen how an inclusive and comprehensive employer-sponsored benefit empowers patients and providers to make the best clinical decisions -- resulting in healthier pregnancies and babies. Growing one’s family should not be considered a luxury and I am eager to increase access to high-quality family building care.” -- Dr. Janet Choi

11. Palantir (PLTR) -- Microsoft Partnership

Palantir and Microsoft have been private sector partners for a while. Now, the two companies will expand that integration of Palantir’s software and Microsoft Azure to the public sector. This comes as Palantir secured FedRAMP Impact level 4 and 5 authorizations to support Azure workloads within the U.S. Department of Defense (DoD).

This accreditation often serves as a domino for Federal agency contract winning as the DoD’s stamp of approval means it can now serve defense-based agencies. CrowdStrike’s previous authorization here for example served as gasoline on the fire for accelerating its public sector growth. We’ll have to wait and see if Palantir enjoys a similar edge. William Blair sees this partnership as insignificant with others slightly more optimistic on the tie-up. Again, we’ll see.

12. Olo (OLO) -- Notable Cross-Sell:

Denny’s was already an Olo Ordering, Dispatch and Rails customer. Now, it's adding Olo’s Guest Data Platform and Marketing capabilities and standing up a new partnership with Olo and Sparkfly. The trio will debut new rewards and a promotional program with Olo’s customer engagement modules being rolled out to all 1,500+ locations.

“This is true personalization to help restaurants make every guest feel like a regular and is another great example of our platform-level innovation.” -- Olo Founder/CEO Noah Glass

13. Miscellaneous Market Headlines:

FedEx is consolidating ground and freight segments to trim billions in redundant costs. Finally.

Walmart reiterated its full year guidance at an investor event this past week. It wants to have 65% of store service automated in 3 years. It’s unclear how this will impact worker needs for this massive employer.

Elon Musk and Steve Wozniak signed a letter calling for a 6+ month pause on AI model development beyond GPT-4. They argue that regulators need time to catch up to this rapid innovation and contemplate which use cases are desirable and lawful. Critics like Reed Hoffman think this is them asking competition to “slow down so I can speed up.” I agree. Meta’s Chief AI Officer called this proposal “stupid.” AI competency is not a race within the U.S., it’s a race throughout the world. To be candid, I don’t see how a 6 month pause on innovation would be a good idea and instead see it as a way for Western Democracy adversaries to catch up. Why give them that chance?

RBC channel checks revealed some likely upside for advertising with Google a notable standout and Instagram taking share from TikTok. They’re quite bearish on Snap following this research as their relative ad performance vs. competitors is apparently lacking.

Italy banned ChatGPT for privacy violation concerns.

UK regulators are calling for a probe into monopolistic characteristics for AWS and Azure. The complaint should have said “duopolistic” or “oligopolistic” but I digress.

14. Macro

a) Key Data from the Week

Output data was modestly weak across the board:

The March Purchasing Managers Index (PMI) was 49.2 vs. 49.3 expected and 47.3 last month.

March Institute of Supply Management (ISM) Manufacturing PMI was 46.3 vs. 47.5 expected and 47.7 last month.

Factory orders for February fell 0.7% month over month (MoM) vs. -0.5% expected and -2.1% last month.

S&P Global Composite PMI for March was 52.3 vs. 53.3 expected and 50.1 last month.

The Services PMI for March was 52.6 vs. 53.8 expected and 50.6 last month.

ISM Non-Manufacturing PMI for March was 51.2 vs. 54.5 expected and 55.1 last month.

Employment Data (finally) showed signs of labor market tightening although with continued pockets of impressive strength:

JOLTs Job Openings for February were 9.931 million vs. 10.4 million expected and 10.56 million last month. Tightening.

ADP Nonfarm employment rose 145,000 in March vs. 200,000 expected and 261,000 last month. Tightening.

Jobless claims were 228,000 vs. 200,000 expected. Tightening.

Average hourly earnings rose 0.3% MoM in March vs. 0.3% expected and 0.2% growth last month. YoY measures were slightly below estimates.

Nonfarm Payroll for March was 236,000 vs. 239,000 expected and 326,000 last month.

Private nonfarm payroll for march was 189,000 vs. 215,000 expected and 266,000 last month. Tightening.

March ISM Manufacturing Employment was 46.9 vs. 50 expected and 49.1 last month.

Unemployment for March was 3.5% vs. 3.6% expected and 3.6% last month. Labor force participation was 62.6% vs. 62.5% expected and 62.5% last month. NOT tightening.

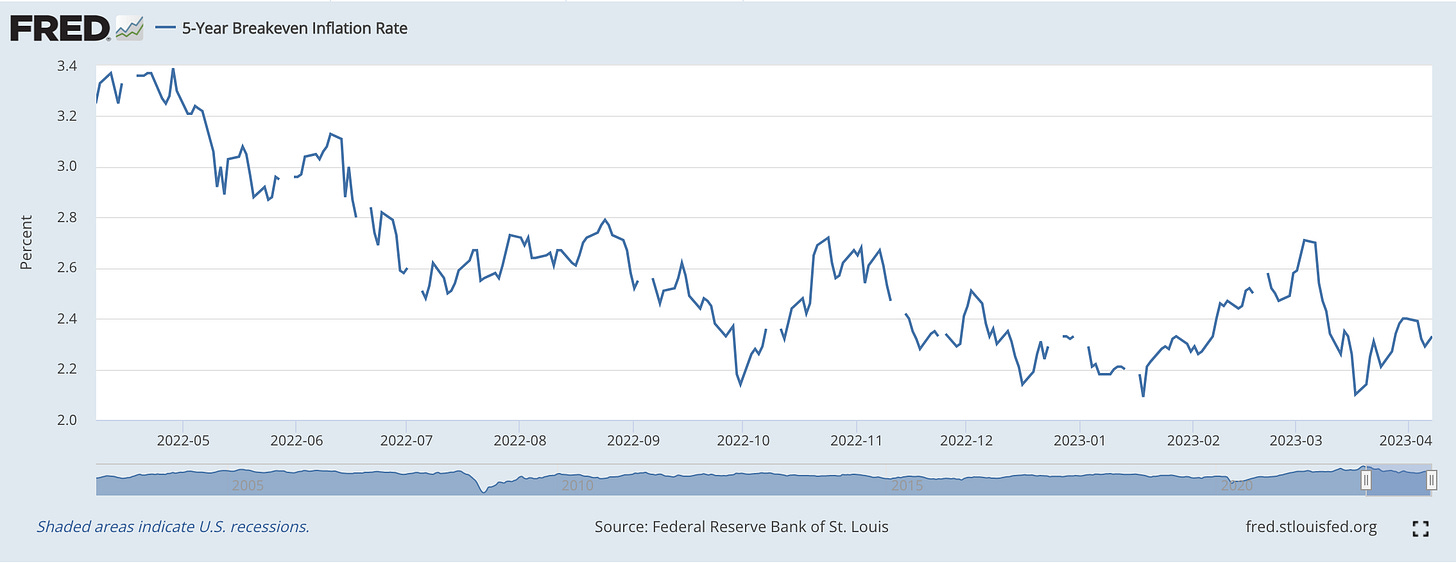

5 Year Breakeven Inflation:

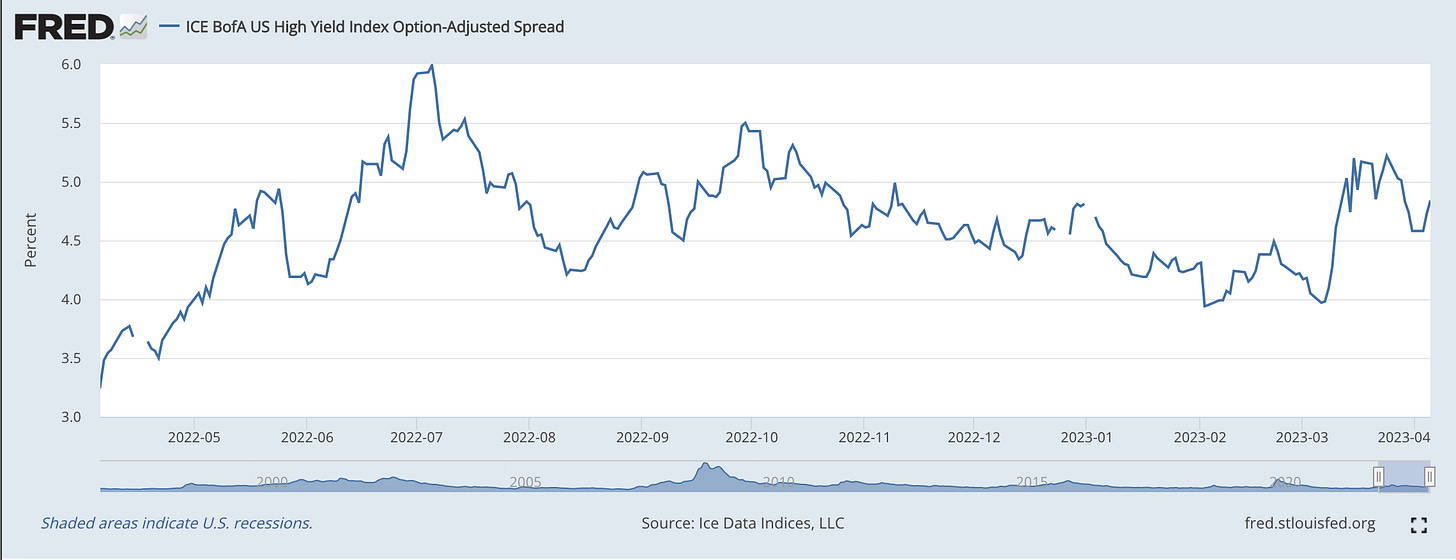

High Yield Option Adjusted Corporate Credit Spreads (Lower is Preferred):

b) Level-Setting the Data

Output data was somewhat weak along with employment metrics. Counterintuitively, I see this as an ideal setup for long duration risk assets. The Fed will surely pause rate hikes in the coming months as inflation cools, their past hikes take hold, and the economy weakens. As that happens, growth should find some stability as discount rates stop rising, exogenous macro shocks fade away and expectations of accommodative policy set in. Nothing about my outlook changed this week. I still see a modest recession as the most likely economic outcome. I am increasingly confident that we have avoided runaway inflation and the need to hike beyond that mild recession and into a deeper depression.

15. My Activity

I added to Uber and Airbnb during the week.

Have a great weekend.

Thank you. Great read

Always love your weekly updates. one of my first reads over the weekend...actually I listen to your posts using the Substack app while I am working out. Thanks!