News of the Week (December 19-23)

SoFi; Airbnb; CrowdStrike; Duolingo; Meta; Olo; Cannabis; Macro; My Activity

Today’s Piece is Powered by Savvy Trader -- the only place you can find my portfolio:

Welcome to the 342 new readers who have joined us this week. We’re delighted to have you all as subscribers and permanently determined to provide as much value & objectivity as possible.

1. SoFi Technologies (SOFI) -- More Buying & Student Loans

a) More Buying

Following the $8.8 million in stock that CEO Anthony Noto has purchased in recent months, he purchased $2.5 million more via yet another open market purchase.

While some like to point out Asana’s CEO as the reason why this doesn’t matter, I wholeheartedly disagree. Why? 2 main reasons:

The evidence is entirely anecdotal and there are many more instances indicating that it is a bullish signal for shareholders.

Noto is not worth billions of dollars like Asana’s founder is. He’s worth around $100 million… meaning he placed over 10% of his total net worth into SoFi shares with these purchases ALONE. Not to mention that his liquid net worth is much less than $100 million and a large chunk of his wealth is already invested in SoFi.

b) Student Loans

The Supreme court will field arguments pertaining to Biden’s pandemic-era loan forgiveness policy in February. I’m not here to tell you what I think about the politics behind this move. I know you don’t care about reading that. I’m here to tell you what this could potentially mean for SoFi. Regardless of what happens here, any kind of final resolution will almost definitely be a large positive for business. Why? The proposed forgiveness equates to just 14% of outstanding Federal loan balances for SoFi’s target demographic. The moratorium ending either means 100% of that target volume will become more motivated to refinance with SoFi, or 86% of it will.

Regardless, that outcome would be far better than what we have today with loan customers having virtually zero incentive to seek refinancing and no clarity on when that incentive will return. Dragging out the moratorium is what will delay SoFi’s full fundamental recovery -- not if a small chunk of the debt ends up being forgiven. Hopefully these hearings will resolve this annoying issue once and for all. But we shall see. And regardless, forgiveness expiration is not in the company’s forecasts and Sofi still expects 35%+ revenue growth and more margin expansion for 2023.

2. Airbnb (ABNB) -- Regulation

a) Puerto Rico

New data from Puerto Rico revealed that a 10% rise in short term rentals inflates average home prices by about 7%. With the proliferation of Airbnb’s in the territory, it could consider (I’m speculating) a special tax on properties to remedy this issue which would hurt the company’s unit economics to a certain extent (taxes always push us away from equilibrium and create deadweight loss). A more restrictive ban seems very unlikely considering how important this market has been to that economy’s post pandemic recovery. Banning Airbnb’s would be cutting off the nose to spite the face.

b) EU

In the last month, the EU has been moving towards expanding the Digital Services Act to require more data-sharing from rental companies like Airbnb, Booking.com and Expedia. The added data sharing obligations would include things like host identity, stricter tax disclosures and safety measures among other things. It would also create stricter host registration requirements to monitor properties and platforms -- something that has been tough to do in the past due to properties routinely being listed in multiple locations. This would create requirements at the platform level for Airbnb to disclose needed information to the EU on a monthly basis.

The main worry here is that this will embolden cities to act like Barcelona (banned rentals of a month or less) and restrict short term rental availability in certain areas. For now, the legislation does not seem to call for that and even seems to make it less likely. Why? This pushes more of the regulation from the city level to the continent level which could make cities less motivated to create their own restrictive legislation to diminish economic activity. More organization, more clarity and more data-sharing should, I think, assuage some local concern -- all else equal.

Airbnb supposedly “welcomes the regulation” and plans to continue working closely with European governments to find a solution. In a company statement, Airbnb also called the proposal a “major step forward to harmonize rules and unlock benefits of hosting for European families while allowing the Government to clamp down on speculators.” It sees this as potentially RESOLVING strict rules in places like Paris and Barcelona by creating a more open and centralized framework. It has to say this… but still good to hear.

Savvy Trader is the only place where readers can view my current, complete holdings. It allows me to seamlessly re-create my portfolio, alert subscribers of transactions with real-time SMS and email notifications, include context-rich comments explaining why each transaction took place AND track my performance vs. benchmarks. Simply put: It elevates my transparency in a way that’s wildly convenient for me and you. What’s not to like?

Interested in building your own portfolio? You can do so for free here. Creators can charge a fee for subscriber access or offer it for free like I do. This is objectively a value-creating product, and I’m sure you’ll agree.

There’s a reason why my up-to-date portfolio is only visible through this link.

3. CrowdStrike (CRWD) -- Accolade

Frost & Sullivan crowned CrowdStrike as its top Cyber Threat Intelligence vendor for 2022. It took first place in both growth and innovation. The research organization estimated its market share to be over 15% and called its growth “remarkable.” I agree. It sees CrowdStrike quickly pushing towards a one-stop shop for stopping breaches.

“Unlike most other vendors on the Frost Radar, CrowdStrike can leverage client threat telemetry from deployments of its endpoint solution. CrowdStrike’s strategy addresses the needs of the most basic customers that are implementing threat intelligence for the first time, and the more strategic requirements of advanced organizations and government entities. -- Frost & Sullivan Global Research Director Jared Carleton

4. Duolingo (DUOL) -- Insider Buying & Fundamental Strength

Durable Capital Partners -- a 10%+ owner of Duolingo -- added roughly 300,000 ($21 million) more shares to their sizable Duolingo stake via 3 separate open market purchases this week. This equates to about a 9% boost to its position and follows a string of consistent purchases since the company has gone public.

While weakness has been felt broadly across the app economy, Duolingo (at least thus far) has been largely immune to the pain. Why? I see a few reasons:

The company fixates on product enhancement & data-driven split testing to optimize the feel of the UI at every turn. It creates a gamified, competitive feel to learning that keeps people coming back. It’s almost more like a video game than an educational tool. It prioritizes customer delight and intrigue over promotional spend.

The result is a robust and efficient top of the funnel for customer acquisition. This serves as a lucrative channel of highly relevant customers to convert to paid. And furthermore, 90%+ of this top of funnel is enjoyed via ORGANIC word of mouth growth, not external marketing. So? While Duolingo has cut back on some marketing spend this year like everyone else, that hasn’t slowed its growth.

But regardless of that gamified niche and mission, it still has a key presence in roughly half of all K-12 classrooms in the United States. That type of business is about as recession-proof as things get for an app.

Finally, the vast majority of its revenue comes from subscriptions and not à la carte purchases. A large chunk of app economy weakness (Match, Bumble, Candy Crush etc.) has been felt within à la carte style purchasing.

5. Meta Platforms (META) -- Miscellaneous

a) WhatsApp

Zuckerberg told the public that WhatsApp reached 25 million messages per second during the World Cup final. I continue to wholeheartedly believe this app is an absolute monster with more low hanging monetization fruit to devour than anything else in existence… by a mile. Pilot programs with Uber, MercadoLibre and countless others along with rapid click to messaging growth already underway (with scale) both point to that being the case.

b) CTO Memo

CTO Andrew Bosworth (Bos) sent out a company-wide memo this week reflecting on 2022 and the Metaverse project as a whole. The tone of the memo was one of re-affirming the company’s dedication to building out the metaverse while acknowledging this year has been tougher than leadership expected. The combination of economic weakness, Reels maturation and Apple-based targeting challenges were all blamed as a concoction of simultaneous factors that contributed to what he called “skepticism about our investments” -- as I’ve said constantly in the past.

He balanced the metaverse dedication rhetoric with a reminder of how Meta has made “tough calls to stop some work and focus on what’s most important.”

Complacency and “sticking with what’s safest and most profitable” when poor conditions emerge is the easy decision. But it fosters detrimental complacency that has destroyed countless titans of the past. Meta refuses to accept that fate -- hence the historically aggressive R&D we’ve recently seen. And its confidence in this kind of spend isn’t based on hoping or wishing, but strength within its core business where engagement trends remain very healthy. It’s also based on the majority of VR use cases coming from social motivations -- meshing quite perfectly into Meta’s core business.

Aside from this, Bos went into some tech advances Meta has made this year like adding Spatial Anchors to enable virtual items to be transfixed in physical worlds and the eye/face tracking upgrades we saw with Quest Pro. There were a couple of cool videos showing some of these technological advancements in the blog post which can be found here.

c) More News

John Cormack resigned from his Oculus role out of frustration over not feeling listened to by Zuckerberg.

The EU levied new antitrust charges against Meta pertaining to its Marketplace practices. The complaints are based on Meta tying its Marketplace into its social network to juice usage. I really don’t see this as malicious and find the news to be silly. But it’s not up to me, it’s up to EU regulators looking for every reason (valid or not) to clamp down on mega-cap tech.

The public sector TikTok ban was ultimately included in the new spending bill. Forbes dropped a new article outlining how TikTok has been tracking their writers who have criticized the firm.

Meta delayed its closing of “Within Unlimited” by a month to make it after courts rule on FTC inquiries.

The Matt Allen Letter is a weekly newsletter that focuses on investing, finance, and money. It takes complex ideas and breaks them down in a simple, insightful way. Typically, it's a 5-minute read & free! What a no-brainer. Subscribe here.

6. Olo (OLO) -- Encouraging Data

a) Slim Chickens

Olo published new data involving Slim Chickens -- a client with over 140 locations. The chain is gearing up for more rapid location expansion and recently purchased Olo’s Sync module to better track this progress, monitor efficiency of operations and ensure accurate, real-time menus across the entire footprint. It was already an Olo Ordering, Dispatch, Rails and Switchboard customer. With the help of Sync joining all these products, Slim Chickens enjoyed the following benefits:

Removes need to tediously update hours, menus and order links on a by location basis. All of this can be automated on the Olo Dashboard.

Also enjoys menus now being present on Google, Facebook and “50+ other sites” with better search rankings due to more accurate menus.

Restaurant specific links displayed on these sites lowers clicks to checkout and raises conversion.

Sync tracking allows for complete data on how Google/Facebook and other partner listings are performing in terms of ROI. This frees more data driven, informed and accurate marketing.

+6.2% rise in direct order volume.

11.3% click through rate (CTR) of direct links on Google.

b) Olo Pay

Olo Pay -- the company’s newest module that quadruples its revenue collected per order -- is off to a good start. With Panda Express, Friday’s and Wetzel’s Pretzels among the first brands to use the offering, Olo is already seeing some impressive results:

0.06% Olo pay fraud rate vs. 0.4% for the industry average.

0.08% Olo pay chargeback rate vs. .5%-1% for the industry average.

Average on-boarding time of 1 day with a 20x YoY adoption rate & 100% uptime thus far.

7% boost to basket conversion.

2.5X increase in payment and customer data access vs. other methods.

98% authorization rate (above industry averages).

I’m adding to Olo more confidently than any other holding of mine currently setting 52 week lows. The divergence of company quality and stock performance here is exciting to me. And I could always be wrong to think that.

7. Cannabis

A few weeks ago, when excitement was yet again building for cannabis banking reform, I expressed caution and a desire to take a wait and see approach to reform being passed. As this round of negotiations turned out to be more insufferable political theater, that approach (I think) is the right one for any future developments.

Banking reform will happen. Taxation, cost of capital, listing and business insurance relief will come. But when will that all come? I honestly have no clue. This is why it’s important to focus on the firms in the space with the strongest balance sheets and cheapest access to capital. The longer the handcuffs remain on these firms, the more of the weaker, less liquid competitors will fail.

Cannabis is still an early innings growth story with overwhelming bipartisan support. States are still quickly rolling out their own programs with New York recreational sales set to go live this month and more programs on the way. While this month has been discouraging and wildly annoying, there will be brighter days ahead for the space. Anyone who tells you when those brighter days will come is guessing.

I continue to hold my Cresco Labs stake. I will not add to it here. I will not trim it here.

8. Macro:

a) Data from the week:

November Personal Consumption Expenditures (PCE) Data came in as expected:

YoY Core PCE (strips out food & energy) was 4.7% vs. 4.7% expected & 5% last month.

Month over month (MoM) Core PCE was 0.2% vs. 0.2% expected & 0.3% last month.

YoY PCE was 5.5% vs. 5.5% expected & 6.1% last month.

MoM PCE was 0.1% vs. 0.1% expected & 0.4% last month.

More Inflation Data:

Michigan 1 year inflation expectations fell from 4.9% to 4.4% MoM vs. 4.6% expected.

Michigan 5 year inflation expectations fell from 3% to 2.9% MoM.

The GDP price index fell from 9% to 4.4% QoQ.

Consumer Health:

Conference Board (CB) Consumer Confidence was 108.3 vs. 101.4 expected.

Michigan Consumer Sentiment was 59.7 vs. 59.1 expected & 59.1 last month.

Michigan Consumer Expectations came in at 59.9 vs. 58.5 expected & 58.4 last month.

Michigan Current Conditions came in at 59.4 vs. 60.3 expected.

Existing home sales and building permits both missed expectations.

Jobless claims came in at 216,000 vs. 222,000 expected.

MoM personal spending growth for November was 0.1% vs. 0.2% expected.

Economic Data:

Q3 GDP came in at 3.2% vs. 2.9% expected & -0.6% last quarter.

MoM Core Durable Goods order growth came in at 0.2% vs. 0.1% expected.

MoM Durable Goods order growth came in at -2.1% vs. -0.6% expected.

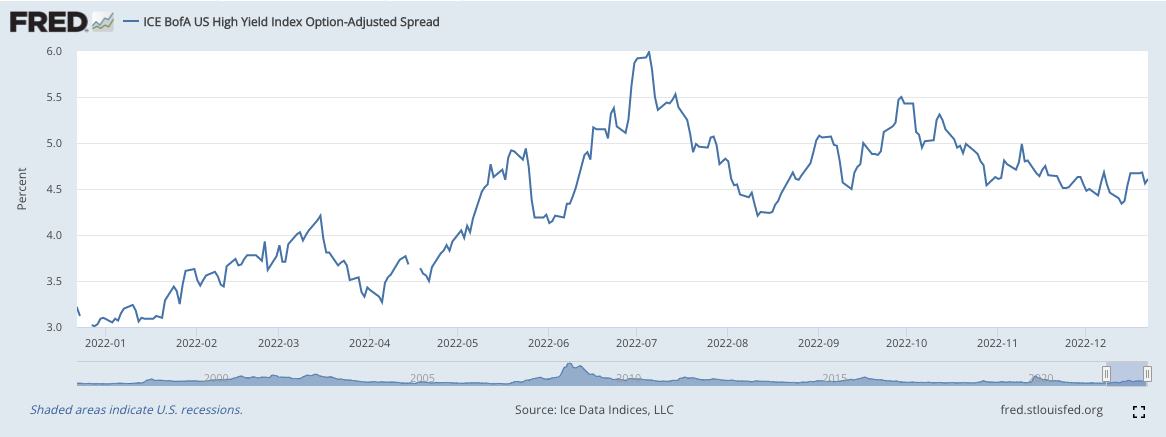

High Yield Option Adjusted Corporate Credit Spreads (lower is better):

5 Year Breakeven Inflation Rate (lower is better):

2 Year Treasury Yield (today, lower is better for equities):

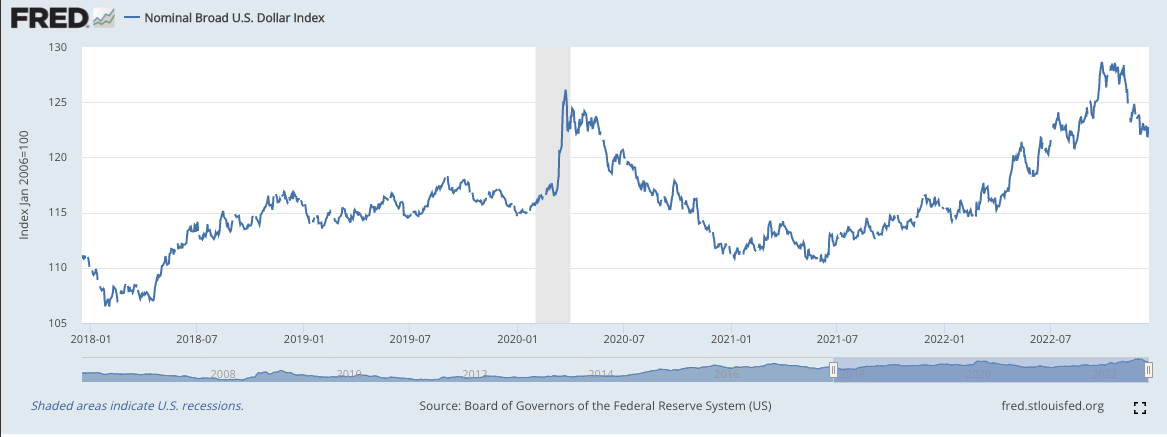

U.S. Dollar (weakness here would mean a revenue growth tailwind for internationally oriented firms like Match Group):

b) Level-Setting the Data

Backward looking economic indicators remain strong while more real-time metrics point to continued economic weakness. While this happens, inflation continues to convincingly fall from the peak with forward looking measures all encouraging.

But still, inflation must come down more, and unfortunately, the job market must show deeper cracks before we get a hawkish pause from the Fed. They don’t care about stock prices, they care about economic sustainability and see inflicting more pain as a necessary evil for securing that sustainability.

So? Nothing has changed for me. I still see employment becoming the more fragile Fed mandate in the first half of next year. And I also think that will become much more obvious to the herd as we get more data from now to the next Fed meeting in February.

If you’re wondering why my cash position hasn’t fallen much following accumulating post-positive inflation data, that is because of my liquidation of PENN and Bitcoin to create more ammo for high conviction accumulation.

9. My Activity:

I liquidated my bitcoin stake this week to focus on higher conviction holdings. I added to CrowdStrike, Airbnb and Olo during the week. My cash position is 14.1% of holdings.

What are your thoughts on Toast vs Olo

Some of the best info out there