News of the Week (June 12 - 16)

SoFi; Revolve; Adobe; CrowdStrike; Shopify; Uber; Apple; Macro; Final Market Headlines; Portfolio

1. SoFi Technologies (SOFI) -- CFO Chris Lapointe Interview & Downgrades

a) CFO Interview

Student Loan Ramping:

In the 15 years leading up to the student loan pause, $575 billion in credit was issued at 6%-7% yields which SoFi is able to refinance at more favorable terms. Of that, $200 billion presides within the credit bands where SoFi operates. There will be two sources of refinancing demand acceleration as interest begins accruing in August and payments resume in October.

First, with the student loan repayment burden as pressing as ever, borrowers will be looking to extend the terms of their loans. Even if SoFi can’t provide a lower rate to these borrowers, Lapointe offered an example of extending a term from ten to twenty years. Even at a higher rate (7% instead of 6%) this led to monthly payments falling from $775 to $540. Many will be able to maintain or cut their rates and extend terms for larger savings. This loan demand should rapidly proliferate in today’s rate environment and doesn’t require future rate cuts for support. That said, rates will inevitably come back down.

The second source of demand would be aided by rate cuts. This will come from borrowers who SoFi can refinance at lower yields. It sees a large chunk of outstanding federal volume as presently ripe for doing so. As rates are cut some time in the next year, this source of demand will ramp further. Because refinancing costs a borrower nothing and is a quick application, Lapointe sees some borrowers refinancing multiple times as rates start to fall. Most won’t be waiting for more cuts to refinance just once at the optimal rate -- there’s no need.

The largest year of refinancing demand in the history of the market was $20 billion. That’s just 10% of the opportunity SoFi is pursuing today and offers a long potential runway of demand to enjoy. With its 60% market share of the refinancing sector (vs. 40% in 2019 as some players have vacated), the business is theirs for the taking.

To Hold or Sell Student Loans? That is the Question:

Lapointe offered some updates to the student loan business’s profit structure. As of last quarter, the segment’s weighted average coupon was 4.9%. In period refi originations this quarter have risen to a more robust 6.5% rate. Considering SoFi’s cost of capital of around 3.85% (call it 3.9% now with the APY hikes) and annual losses of 0.4%, SoFi is left with a roughly 2.4% return on asset (ROA) and a 20% return on equity (ROE) with its capital structure. A 20% ROE for low risk debt is good.

Of the student loans originated around 4.9%, most were issued when warehouse debt was cheaper, SoFi’s APY was lower and so its cost of capital was lower. Lapointe didn’t tell us what the whole book’s ROE was, but hinted at those lower coupon loans still being attractive holds. Student ROE of 20% is much lower than unsecured personal ROE over 40%, but SoFi has the leverage and capital ratios to retain all of the loans rather than sell any of them. That would juice return metrics, and that’s the plan.

Lapointe ended this segment by reminding us that 6.5% yielding debt with 40 bps of annual losses is also quite compelling for capital markets. That’s why capital market demand remains “strong” and available to SoFi if it needs to tap that liquidity (which it doesn’t). There is a lot of flexibility here and, as that remains the case, its sole objective will be to responsibly maximize shareholder returns.

Personal Loan Markings:

Like every other conference, SoFi was asked about its mark-to-market loan valuations as it doesn’t use traditional current expected credit loss (CECL) methods. Again, Lapointe told us exactly how overly conservative the assumptions baked into the markings truly are. They assume 4.6% personal loan annual loss rates while -- several quarters into putrid macro -- SoFi’s actual losses are less than half that. Its expectations are that “loss rates will continue to consistently outperform.” The marking methodology also writes down loan valuations more expediently and aggressively than alternative methods. For example, after a loan turns 30+ days delinquent, it writes down 70% of the valuation and incurs the costs on its financial statements for that quarter. It is not shady in its marking methodology… it is effectively (if not overly) prudent while even using an independent third party to value the credit.

SoFi’s macro assumptions also include 5% 2023 unemployment and a pessimistic 2.5% 2023 GDP contraction. The Federal Reserve, for context, expects unemployment of 4.1% this year and 1% GDP growth.

As another interesting note, leadership reminded us how balance sheet markings are closely tied to actual capital market demand. They assume SoFi can fetch a 4% gain on sale margin for personal loans vs. 6% apples to apples returns for holding. That 4% gain on sale is based on direct communication with loan buying customers and valuations are tightly tied to this reality. The noise surrounding SoFi’s lack of whole loan sales last quarter was unwarranted. Again, it’s all about ROE optimization thanks to its balance sheet flexibility. Today, that ROE optimization requires holding and forgoing capital market sales that are fully available to the firm. Bids on residuals are less compelling than balance sheet stashing.

“What’s embedded in the marks is what a buyer is willing to pay and you can assume they are baking in a level of conservatism accounting for a recession or harder times.” -- CFO Chris Lapointe

Annual Percent Yield (APY) Flexibility:

The benefit SoFi enjoys from the charter (allowing it to use deposits for funding) rose again last quarter. It sits at 210 basis points vs. around 150-190 in 2022. This gives it the flexibility to continue raising its APY which bolsters deposit growth and so loan liquidity. It thinks that its flexibility is unparalleled vs. non-banks and will let it maintain its APY at higher levels as rates are eventually cut to distance itself from alternatives.

Technology Segment:

Lapointe reiterated that tech segment margins are set to bottom from here while growth accelerates to 15%-20% by Q4 and speeds up more in 2024. It is “well on its way” in late stage conversations with a “dozen large financial institutions” which would all be very needle moving to revenue over time. We’ve heard this for a while but these “conversations” now seem to be wrapping up. The recent proof-of-concept with a top ten financial institution has been a “large win” for the firm and an accelerant to this potential demand.

Final Notes:

Reiterated plans to add over $2 billion in deposits this quarter.

Reiterated plans to be GAAP net income positive by Q4.

Customer acquisition cost in its lending business fell 19% Y/Y last quarter thanks to financial service cross selling.

Wyndham integration is going “well.” Home loan volumes are still expected to ramp in the second half of the year.

Reiterated that stock compensation will fall below 10% of revenue by Q4. That’s a big piece of turning GAAP net income profitable.

b) Downgrades

This week, three different firms downgraded SoFi. The core theme of the decisions was valuation due to its recent near doubling in price (with upbeat views of the company’s longer term prospects). Concurrent with the downgrades, the price targets were actually raised. This is valid: There has been a great deal of multiple expansion in just 30 days with the stock racing aggressively higher.

We saw claims of “market manipulation” and “shady dealings” from some across the web and we wanted to address these claims and why they’re erroneous. As a reminder, SoFi is a top three holding in my portfolio, and I see no merit in an argument that analysts were doing anything but acting rationally. This is normal. This is healthy. This is entirely fine.

Companies do not go up in a straight line and multiples cannot just endlessly expand. Especially without negative real interest rates, fundamentals and valuation will always matter. Long term alpha is driven by rate of profit compounding; profit cannot explosively compound overnight and so share price cannot permanently soar higher while the business stays the same. So? It was clearly time for this stock to take a breather and to digest some of the explosive gains we’ve seen.

From an analyst perspective, this also makes perfect sense. Piper Sandler for example had a $6.5 price target as of last week with an outperform rating on the firm. It either needed to figure out a way to argue the firm was somehow 50% more valuable than it recently thought it was or more gradually tweak the target and downgrade the stock. Analysts are simply playing catch up. They need new data and a new reason to raise targets beyond where SoFi sits today. Considering the consistent commentary we’ve gotten on how well Q2 is going for the firm, that reason could come when it reports earnings later in the summer. We’ll see.

2. Revolve Group (RVLV) -- Plans

I don’t talk about Revolve much vs. other, more popular holdings. I’m prepping to meaningfully add to my stake in the coming quarters and I wanted to explain the timing and why Revolve.

A Weird Time Period:

Revolve caters to a young, “aspirational” consumer shopping for expensive clothing and accessories from established and up and coming brands. Furthermore, it drives a great deal of traffic, buzz and revenue from live events that it hosts all year along. These events coincide with things like Cochella and New York Fashion week. Finally, it’s clothing is worn to “look and feel your best” meaning it’s mainly for going out use cases. When you combine these things together we are left with the following trends:

2020 and early 2021 was a very challenging period for the firm as socializing ground to a halt, its live events paused, and the drive to “look and feel your best” greatly diminished. Growth mightily slowed.

In late 2021 and the first half of 2022, comps got extremely easy while cash sloshed around in pockets, socializing and live events resumed and Revolve continued consistently taking market share. This resulted in the 20% annual growth company expanding revenues by well over 50% for most of this period.

In late 2022 and the first half of 2023, comps became abnormally difficult via rapid growth the year before. Beyond that, macro turned sour, liquidity dried up, consumer confidence eroded and economic growth slowed. The world shifted from buying goods to services and also traded down across categories to preserve more finite budgets. Revolve, like everyone else, was also caught with excess inventory when demand trends abruptly shifted. As a result of this all, Revolve’s growth ground to a halt and income statement margins contracted. Its cash flows have been exceedingly strong recently, but that’s mainly the result of inventory liquidation from the prior glut.

Looking Ahead:

So what do we expect the rest of 2023 and beyond to look like for Revolve? The second quarter will likely be ugly again when it reports in July. That could set the stage for a great purchase opportunity. We’ve already gotten April and May sales data showing Y/Y declines in the “mid-single digit percent range.” June is when comps start to get much easier, but macro headwinds should continue to dampen growth this month as well. For this reason, I’m not racing to add the shares that I want to add this year. I did add a bit recently, but I’m leaving a great deal of room and flexibility to keep accumulating as we approach that report.

Looking at Q3 and beyond, things will likely start to look much healthier and more normal. The inventory re-balancing it’s conducting will be finished this month and gross margins should briskly expand as a result. We’ll start to see that play out in Q3. The team has consistently reiterated that margins are set to bottom and is fully confident in growth re-ramping back towards 20% as Y/Y comps ease and macro headwinds begin to fade.

There could be more margin upside ahead as well. The global company is finally ready to expand its fulfillment footprint. While it was using a single West Coast facility, it has since added a distribution center on the East Coast and is prepping to add international capacity as well. This will cut down miles to fulfill which is especially important for Revolve. Why? Its goal is to “turn your home into a dressing room” to emulate the strengths of department store shopping. This entails free, seamless returns and rapid shipment windows. Returns are a big part of its model and that won’t change. If Revolve can store returned inventory in the U.K. for example to re-fulfill there vs. shipping it back to California and then again to the U.K., processes become more efficient and costs fall. This will raise the long-term margin ceiling of the firm. It’s also investing in sharpening its existing AI models to enhance product matching and ideally lower return rates.

Once inventory is re-balanced, Revolve will lean back into owned-brand sales and growth. It has shied away from doing so as offering owned brands comes with less ordering and inventory flexibility than 3rd party. Owned-brands inherently come with better margins vs. its 3rd party business. Another margin tailwind to look forward to.

Growth drivers for this firm remain abundant. It’s still tiny compared to the legacy department stores that it disrupts and displaces. It has recently expanded into the beauty category along with other apparel segments to expand wallet share and is finding early success. Its Men’s category is still close to 0% of sales, but it just hired new talent to grow that important opportunity as well. With the loyalty it has built with young women and the reality that they do a lot of the shopping for men, this could find rapid traction. It also continues to see its other website (FWRD.com) thrive with brisk multi-year compounding. The team is now ramping cross-marketing efforts on the two sites and combining loyalty programs as well to drive growth. Just a mid-single digit % of Revolve customers shop on FWRD. That proportion rises every quarter with a long way to go. Hiring Kendall Jenner as FWRD’s creative director turbo-charged that site’s awareness and remains an exciting development. Finally, partnerships in India and Mexico are fostering rapid growth in those newer markets. While North America remains untapped, potential abroad is even less mature.

The Team, The Team, The Team:

One of the best parts of this investment is the rock-solid leadership team. The co-founders built the firm from the ground up with very little capital. They did so with a tech background enabling them to build their own vertical tech stack and save on 3rd party fees. The co-founders own nearly 50% of the company and pay out well under 1% of revenues in stock-based compensation. They deeply respect the value of the equity because that value is what powers their own net worth. Management and shareholder interests are fully aligned.

That alignment is likely why Revolve has been profitable throughout its decades of existence -- which is quite the rarity in its e-commerce fashion niche. Its balance sheet is pristine with no debt and its cash pile sits at a robust $280 million or 23% of its total market capitalization. That allows it to continue playing offense and to increase its market share across this entire cycle. Those share gains should become more noticeable as e-commerce growth recovers in the second half of 2023.

Valuation:

The aforementioned headwinds to current results will lead to flat revenue growth in 2023 and about a 25% decline in EBITDA and net income. Free cash flow will spike higher, but that’s again due to inventory reductions. This is why I’m not in a hurry to add today.

Looking ahead to profit growth in 2024 and beyond is where things get very compelling. From 2023-2025, EBIT is set to compound at 51% with GAAP net income compounding at a rate of 46%. These profit estimates rely on 16% revenue growth compounding over that period. I view that as overly conservative based on historical compounded growth and leadership commentary (which has always been candid). Faster revenue growth would mean faster profit growth, but that upside is not necessary for this to work thanks to the currently modest valuation. The firm trades for 25x 2023 earnings which, based on rate of profit compounding, leaves it at a forward PEG ratio (using 2-year net income CAGR) near 0.5. Yes please.

As the 2nd quarter draws to a close and we enter the second half of the year, I expect to accumulate more shares here.

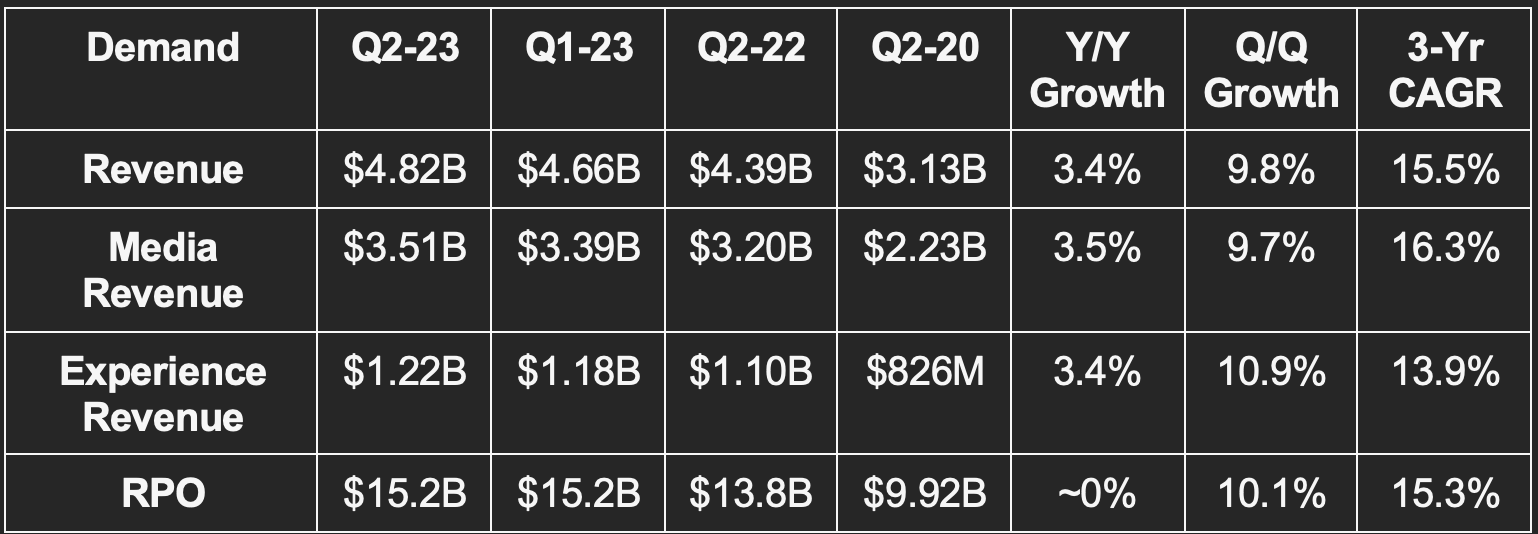

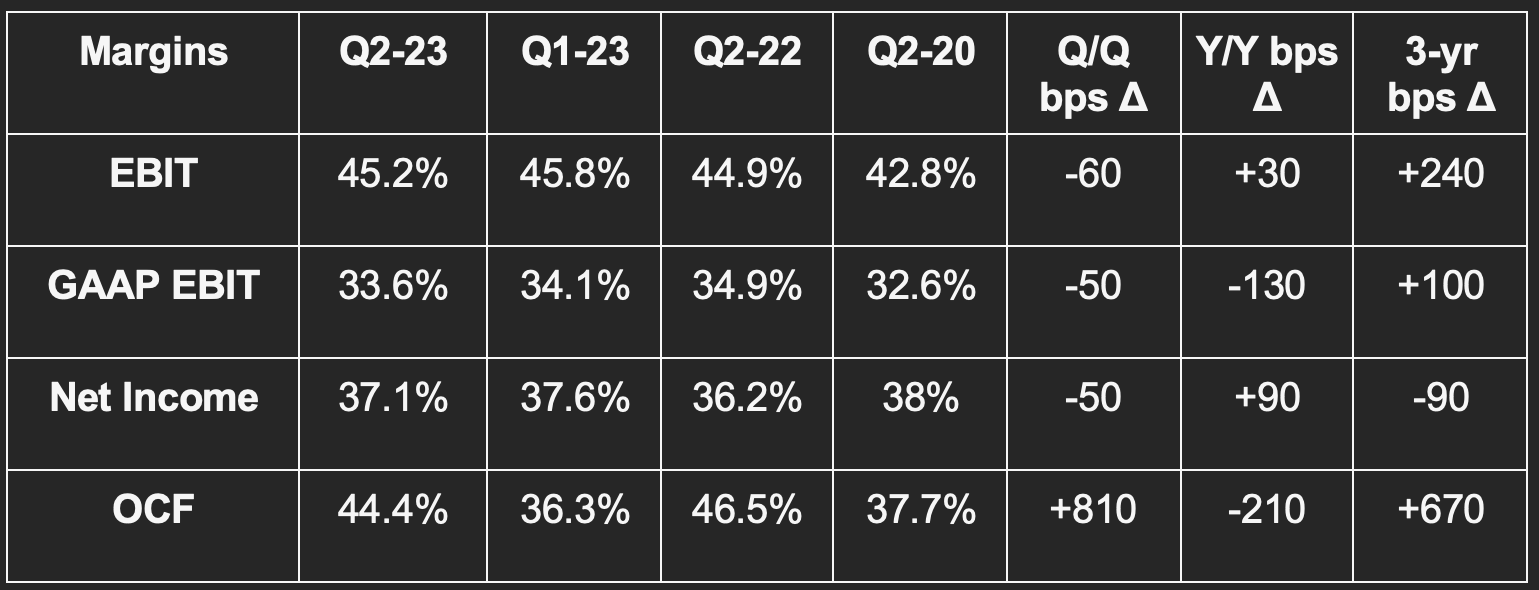

3. Adobe (ADBE) -- Earnings Review

a) Results

Beat revenue estimate by 1.1% & beat guide by 1.1%.

Digital experience revenue was in line with guidance.

Digital media revenue beat guidance by 1.4%.

Beat EBIT estimate by 2.3%.

Beat operating cash flow (OCF) estimate by 6%.

Beat $2.72 GAAP EPS estimate by $0.10 & beat guide by $0.14.

Beat $3.79 EPS estimate by $0.12 & beat guide by $0.13.

Beat digital media net new ARR guidance by 11.9%.

b) Guidance

Raised $11 GAAP EPS guide by $0.20 & beat estimate by $0.06.

Raised $15.45 EPS guide by $0.25 & beat estimate by $0.21.

Raised digital media net new ARR guide by 3%.

$19.3B revenue guide met estimate. This was the first time it offered annual revenue guidance for this year

Next quarter guidance was roughly in line on revenue & slightly ahead on EPS.

c) Balance Sheet

$6.6 billion in cash and equivalents.

$3.6 billion in debt.

Repurchased $1 billion in stock and share count fell 3% Y/Y. It has $4.15 billion left on its $15 billion buyback program.

d) Event Highlights

The Creative Cloud:

The creative cloud segment (9% Y/Y revenue growth) released “Firefly.” This is its group of generative AI models to be infused across apps like Photoshop to enhance productivity and ease of use. Firefly comes with a bevy of use cases including adding neural filters into photoshop for more intuitive and powerful editing. Adobe sees its core competency in AI as two-fold. First, it sees a clear path to building its own compelling models to augment app functionality. Secondly, it sees the decades of data it has collected within digital media and the experience segment as providing it with a unique ability to season models more effectively than the competition. The more algo data seasoning, the better. We hear similar sentiment from other leaders in various pieces of tech. This superior seasoning should theoretically lead to more value within endpoint use cases. That’s its hypothesis within generative (gen) AI. Since launching 3 months ago, Firefly has now crossed 500 million content generations.

Creative Cloud won EY, the Government of the Philippines and Nvidia as new clients this quarter. It is also collaborating with Google’s Bard and with Apple on its VisionPro headset.

Plans for its Firefly gen AI model include:

Offering it as an independent freemium offering.

Using its “co-pilot” functionality to drive higher creator and developer productivity.

New subscription credit packs for customers needing this use case to drive up-selling.

Open sourcing Firefly to certain developer communities to allow them to build new use cases on top of it.

The Document Cloud:

Won Boston Consulting Group, Novartis and T-Mobile as new users.

Adobe still expects its acquisition of Figma to close by the end of this year.

The Experience Cloud:

Added new gen AI tools like real time content performance data and insights within its customer data platform (CDP).

Won Dicks Sporting Goods, the MLB and ServiceNow as new CDP customers.

Its native apps within the segment crossed $500 million in bookings.

Its creation collaboration tool (Frame.io) grew recurring revenue by 50% Y/Y.

4. CrowdStrike (CRWD) -- Tide Lifting all Boats & CrowdStrike’s Big Boat

a) Tide Lifting all Boats

Whether it’s CrowdStrike’s annual threat report or similar research from its partners and competitors, the theme is clear: Cyberattacks are becoming more and more frequent. Generative AI could add further to that unfortunate momentum as it vastly lowers the talent barrier to conducting sophisticated hacks.

This week, a group of U.S. government agencies were all hit by an attack stemming from an overlooked software vulnerability driving poor hygiene. Between Log4J, the Solar Winds incident, Colonial Pipeline or countless headlines similar to this one, it’s obvious how pressing of an issue this is. It’s equally obvious how non-discretionary proper cybersecurity spend and protection continues to be.

b) CrowdStrike’s Boat

While this will be a tide that lifts all boats, players like CrowdStrike and Zscaler may benefit even more. Why? They’re among the small group that has secured Impact level 5 (IL5) authorization from the Department of Defense. This stamp of approval has served as a domino for both winning more public sector business. That winning should continue with the motivation to spend on this type of technology merely growing.

Mizuho came out with a bullish CrowdStrike note after hosting leadership for a chat this week. The team talked up the impressive resilience of its pipeline and current demand. It also sees new products like Charlotte AI driving a considerable demand uplift going forward. Thank you to @fundam_inv on Twitter for sharing this note with me.

5. Shopify (SHOP) -- Expensive

Shopify trades for 12x 2023 sales, roughly 24x 2023 gross profit and 200x earnings. No matter which valuation denominator you use, estimates make it look expensive. That premium, however, is in our view overstated which is why we maintain a core position.

Since CFO Jeff Hoffmeister took over, layoffs, broad cost rationalization and a renewed focus on free cash flow (rather than investing all profits into more growth) took hold. These changes have resulted in analyst profit estimates moving higher for 2023 and beyond, but I think there’s a lot more room for upward revisions.

Why? The most compelling part of business rationalization comes from Shopify finally parting ways with its struggling fulfillment business in a sale to Flexport. Incredibly, Shopify was losing several dollars per order solely in input costs to scale this business (not to mention OpEx and CapEx). Simply put, it was a massive drag on gross margin. This drag is gone and so margins should spike higher starting in Q3. That tailwind combined with more focus on profits, cost cuts and accelerating revenue growth should all feed continued margin expansion and should easily result in a 3-yr forward earnings CAGR well over 50%. That level of consistent profit growth deserves the premium valuation Shopify carries and is required for this investment to work from here.

6. Uber Technologies (UBER) -- Ads

Uber is adding long form video ads to its Eats, Rides and Drizzly products. This will start in the USA and expand globally thereafter. Why does this matter? Advertising revenue is higher margin business vs. its core operations. Because Uber has built a massive network, because it has become a verb and because it has established loyalty through savings and product bundling within Uber One, it’s now able to leverage its user base and fatten up margins with things like this. Uber offers more products vs. competition to juice cross-selling and retention and it boasts better wait times vs. competition due to its leading supply scale. These key advantages drive return business. Amazon is in a similar spot within a different industry.

Through cost cutting, product rationalization and improved market share dynamics (as it takes better care of drivers and riders), Uber has seen its margin profile rapidly improve in recent quarters. It is making the tough decisions needed to drive sustainable and profitable growth. This week for example, it shuttered business in Israel and Italy amid underwhelming traction and cash burn.

What was once thought of as a “never can be profitable” firm is now morphing into a free cash flow machine before our eyes. Incremental EBITDA margin a full 1060 bps ahead of its current margin line points to much more leverage in the model with new ad products supporting that momentum further.

7. Apple (AAPL) -- China

Apple continues to intentionally diminish reliance on Chinese suppliers as geopolitical tensions stay elevated. It’s moving a large chunk of iPhone 15 production to Vietnam and just announced plans to move some MacBook production from China to Thailand.

It also continues to embrace India as an increasingly important supply geography and source of demand. This year, smartphones became a top 5 export in India with that export value skyrocketing from $5.4 billion to $10.9 billion Y/Y. Its government put in place robust programs to incentivize building and assembling in the quickly growing nation. This helped India rise from 1% of iPhone production in 2020 to 5% now while Samsung also utilizes the nation more for its own production. Simply put, these programs are working and were timed perfectly as China pandemic policy and potential military action in Taiwan both build concern.

In addition to India being leaned on more for a source of supply, Apple has also opened its first stores in the nation. The population is massive, the government is business friendly and the population’s tech evolution is behind the U.S. and Western Europe. Translation? The low hanging business fruit is ripe and ready to devour. Apple is taking advantage like many other mega cap tech names now are.

8. Macro

a) Fed Rate Decision and Chair Powell press Conference

On Monetary Policy & Projections:

Fed maintains Fed Funds rate at 5%-5.25%.

“Prudent to pause” via lags in monetary policy impact, credit tightening, banking turmoil and how far the rate has come over the last 12 months.

Fed to continue quantitative tightening.

Summary of Economic Projections (SEP) now sees the Fed Funds rate at 5.6% by year end (vs. 5.1% as of last quarter), 4.6% for end of 2024 and 3.4% for end of 2025. Most (not all) members view it as likely that 2 more hikes will happen this year.

Fed swaps no longer priced in probable rate cuts in 2023 following this event.

On Inflation:

Inflation is moderating with more work to do. Interest rate sensitive sectors like housing and fixed business investment both remain weak.

Target of 2% inflation remains unchanged. The goal post was not moved.

Mean PCE projection of 3.2% this year, 2.5% next year and 2.1% in 2025.

Supply chains continue to improve and help goods inflation. A bit more work to do here.

Housing services inflation showing progress with new lease disinflation acknowledged by Powell. He expects this source of disinflation to continue at a moderate pace.

Non-housing services showing “earliest signs of disinflation” within wages. Need more labor market loosening.

Long term inflation expectations remain well anchored.

“Conditions needed to get inflation down towards the target are coming into place. The process will take some time.” -- Powell

Growth & Employment:

Now sees real GDP growth of 1% this year and 1.1% next year. Controlling inflation will likely require a period of below trend growth.

Now sees 4.1% unemployment this year and 4.5% unemployment next year.

Better labor supply and demand balance with more work to do.

b) Translating Fed Talk

Two things were clear from this meeting. First, the Fed saw enough data lag uncertainty, banking fragility and disinflationary progress to warrant a pause. Secondly, it was dead set on convincing investors that more rate hikes were on the table. It will continue to take a data driven approach to future policy and expects two more rate hikes to be appropriate for this year. We’d argue that if they’re truly data dependent then they have no clue what they’re going to do for the rest of the year. Those actions will depend on incoming data that continues to look promising.

All major inflation metrics continue to meaningfully tick down, real time rent shows much more disinflation which should erase a portion of the more stubborn inflation we’ve had. Truflation’s reading is now pushing 2%, egg inflation turned negative and wage inflation is now easing as labor supply starts to normalize.

All of this is to say that I don’t believe the Fed will raise 2 more times. I think they’re done with 1 more hike a possibility and 2 more hikes not at all likely. You cannot continue hiking in a World where you expect unemployment to meaningfully rise to 4.5%. It was time to pause but was not time to convey to the public that the Fed was done with hawkish policy. They threaded the needle and effectively jawboned to turn what was likely a dovish pause into a “hawkish skip.” Considering how important controlling inflation is for the economy and especially those most vulnerable, this was a necessary line to tow. It couldn’t keep raising rates… and it didn’t. It couldn’t declare victory with more progress still needed… and it didn’t. With all of this said, the terminal rate debate for this cycle is somewhat irrelevant to me at this point. It was important when we argued over 5 rate hikes or 30. It’s less important when the debate is 0-2 more.

c) More Economic Data from the Week

Consumer Price Index (CPI):

CPI for May rose 4% Y/Y vs. 4.1% expected and 4.9% last month.

Core CPI for May rose 5.3% Y/Y vs. 5.3% expected and 5.5% last month.

CPI for May rose 0.1% M/M vs. 0.2% expected and 0.4% last month.

Core CPI for May rose 0.4% M/M vs. 0.4% expected and 0.4% last month.

Producer Price Index (PPI) (note that producer prices lead consumer prices as consumer prices are partially a function of those producer prices):

PPI for May rose 1.1% Y/Y vs. 1.5% expected and 2.3% last month.

Core PPI for May rose 2.8% Y/Y vs. 2.9% expected and 3.1% last month.

PPI for May rose -0.3% M/M vs. -0.1% expected and 0.2% last month.

Core PPI for May rose 0.2% M/M vs. 0.2% expected and 0.2% last month.

Consumer Data:

Core Retail Sales for May rose 0.1% M/M vs. 0.1% expected and 0.4% last month.

Retail sales for May rose 0.3% M/M vs. -0.1% expected and 0.4% last month.

Initial Jobless Claims were 262,000 vs. 250,000 expected and 262,000 last reading.

Output Data:

NY Empire State Manufacturing Index for June was 6.6 vs. -16 expected and -31.8 last month.

Philly Fed Manufacturing Index for June was -13.7 vs. -13.5 expected and -10.4 last month.

Industrial Production for May rose -0.2% M/M vs. 0.1% expected and 0.5% last month.

8. Final Market Headlines:

Amazon (AMZN):

Multiple more analyst notes came out this week all agreeing on one thing: AWS growth will bottom this quarter.

Amazon is looking to expand its struggling digital wallet product in India with a renewed focus on QR code usability.

AWS won Banco Bilbao Vizcaya’s business in Argentina.

Its acquisition of iRobot was cleared in the UK.

Meta Platforms (META):

Meta debuted a “human-like AI model” which projects the outside world to emulate the processing of a human brain. It debuted another AI model called Voicebox for speech generation using text. It continues to rapidly roll out generative AI models with many of them being open sourced for developers to build on top of. This is Meta’s strategic gen AI path: To commoditize models as quickly as possible and win the commoditized share so it can monetize that traffic via more product updates (thanks to developers building through Meta), ads and new apps. It’s a very similar playbook to its AR/VR headset approach.

Broadcast channels on Instagram are now live to allow users to add users into private groups for text and content sharing.

Airbnb (ABNB):

In an Airbnb regulatory win, New York is delaying a law forcing short term rental firms to secure a specific operating license to September. Airbnb filed a lawsuit about this item recently and it seems to be working so far.

The Trade Desk (TTD):

Citi came out with a glowing note on The Trade Desk this week on its Kokai launch driving further competitive differentiation the new tools making its platform more accessible for smaller agencies and advertisers.

Lemonade (LMND):

Lemonade broke a world record by using AI to settle a claim in 2 seconds.

China:

Reopening and dovish monetary policy in China is expected to accelerate its growth. That could be great news for firms like PayPal and Lululemon which both lean on it as a key international growth market.

Upstart (UPST):

Upstart added another small credit union to its funding supply roster. Not needle moving in isolation but these partners in aggregate should become more & more needle moving to combine with its newly secured committed capital.

PayPal (PYPL):

PayPal entered into a $5 billion revolving credit facility with JP Morgan for its foreign entities this week.

9. Portfolio

a) Goodbye Olo for Now

I sold the rest of my Olo stake this week. To be candid, this was the toughest sell decision I’ve had to date. There are no glaring red flags, there are no shady dealings here, the core of the team is rock solid and I wouldn’t blame anyone (in the least) for wanting to continue holding this. Why did I sell? A few reasons:

The first is based on gross margin. Over the last 2 years, this margin line contracted from 83% to 71%. This is due to a few things. First, its acquisitions of Omnivore and Wisely and related product suite investments have weighed on margins. The second concern is coming from the success of its newer Olo Pay module. This is a next-gen payment processor where gross margins are much lower than its other product buckets. It’s not all that clear when these headwinds will abate and when the gross margin line will bottom.

The firm has pulled back on costs in recent quarters to drive profits. but we really haven’t seen that translate into all that much operating leverage (especially GAAP margins). This is all while revenue growth has continued slowing to an average of 4% sequentially over the last two years.

While comps have been tough for most technology names, we were hoping Olo’s growth would be a bit more resilient. Restaurant spend has been surprisingly durable and that’s especially the case within cheaper, fast casual models where Olo dominates. The retention and location growth isn’t concerning as that’s related to Subway leaving the platform. Will more large clients leave? I don’t think so but am less confident than I’ve been since starting the position.

Future growth will come from its newer product suites. The Engage suite (customer data platform) is unproven and comes with a decent amount of uncertainty tied to how meaningful of a growth driver it can be. It had a nice win with Denny’s, but not many noticeable brands aside from that. The Pay product, again, is killing it for the company. HOWEVER… I did not buy this company as a payment processor which is a wildly competitive and low margin space. I bought it for its higher margin revenue buckets which are maturing faster than I wanted them to and will provide less of its incremental revenue going forward. Its decision to initiate a buyback with its sizable yet finite cash pile hints at that maturation coming faster than I wanted it to as well. Ideally, they’d have more opportunities to invest that money into high return, high probability growth vectors.

Furthermore, pieces of the go-to-market have been reshuffled now twice in the last year with two hires (in what I view as somewhat similar roles) which merely adds a new layer of uncertainty and execution risk. They are both talented individuals with great track records, but it was a bit concerning that go-to-market needed to be changed for a company of this size and longevity.

All of this is to say that there’s far more uncertainty coming with this investment than when I bought in -- even at the now lower multiple. I want to see gross margin bottom, I want to see EBIT margins more consistently expand, I want to see revenue growth creep back over 6% sequentially and I want to see the Engage suite win several more large customers. I’d also love to see the Order suite win more bellwether brands to ease my concern of premature slowing. This was the first name I’ve ever sold and immediately added to my watch list. A tough decision but a necessary move for now.

b) Activity

I added to Amazon this week.

Hi there Brad, i have always found your content very helpful and intuitive. Im new to substack not sure how i can make the comment private as well.

I am not sure if you’d like to add two more considerations with regards to rvlv. I share your thoughts on this one.

Personally my strike price previously was anywhere below 17 dollars. But now I feel our expectations may be a little too optimistic, given the bad rep with fast fashion recently and also, very strong online competition from shein.

I fear that for clothing/fashion there is hardly any moat as you can easily replicate some of the designs.

Having spent a huge amount on marketing through influential socialites, I fear shoppers may turn to other online retailers that offer a cheaper price to just “get the look”. Resulting in lower margins.

🙏🏻