Today’s Piece is Powered by My Friends at BBAE:

1. Sea Limited (SE) – Earnings Review

a. Demand

Sea Limited beat revenue estimates by 3.1%. .

Please note that the financial services 3-yr CAGR is comping vs. a base period in which revenue was close to $0. This makes the comp overly easy and not important.

b. Margins

- Missed $180 million EBITDA estimates by $145 million.

- Missed -$55 million GAAP EBIT estimates by $72 million.

- Missed $0.00 GAAP earnings per share (EPS) estimates by $0.26.

- Missed 44.5% GAAP gross profit margin (GPM) estimates by 100 basis points (bps; 1 bps = 0.01%).

Most of the Y/Y leverage was from 30%+ declines in general/administrative and research/development costs.

c. Balance Sheet

- $6 billion in cash & equivalents. Including other investments & restricted cash, it has $7.9 billion in total liquidity.

- $800 million in debt.

- $3.3 billion in convertible notes.

- Share count rose by 1.4% Y/Y. Diluted share count rose by 7.0% Y/Y.

d. Call & Release Highlights

The Balancing Act:

Earlier in the year, Sea Limited pivoted in its operational approach. It went from a philosophy that predominantly sought more revenue to one that balanced future growth with current profit. The macro backdrop changed, and so Sea Limited changed too.

It fixated on “self-sufficiency” and funding operations without external cash raises. It strengthened its balance sheet and streamlined operations significantly. The recent explosion in margins is the result. You’ll notice, however, that the sequential margin trend turned materially negative this quarter. This is intentional. With SE now on firmer footing, it’s ready to re-accelerate growth spend. It will not return to its 2020-2021 spending philosophy, but it will lean back in a bit.

The catch 22 is that investors want profits, and massive e-commerce footprints need massive scale to generate those profits. So? It’s pushing forward with scaling its under-penetrated markets, but with more fiscal responsibility than in the past. Balance. As an aside, live streaming was called out as a significant focus area for supporting future growth.

E-Commerce:

Core marketplace revenue rose 31.7% Y/Y compared to 37.6% Y/Y growth last quarter. Value added services revenue rose by 4.2% Y/Y compared to 11.3% Y/Y growth last quarter. Interestingly, its rightsizing of logistics is negatively impacting value added service growth. Gross orders rose by 13.2% Y/Y to foster 5.1% Y/Y gross merchandise value growth. It believes that it took more market share in all of its geographies this quarter.

EBITDA margin for the segment was about -16% vs. roughly 7% Q/Q and -26% Y/Y. This is the effect of its re-accelerating growth spend. I’d love to see the coinciding margin contraction complemented by accelerating growth, but it’s likely too early to expect that.

Part of its recent shift to a profit-focused strategy is based on competition. Per the team, new entrants are intensifying that competition. It wants to support the e-commerce business with needed investments to ensure it maintains a strong category position. It seems that SE can support these investments while getting more efficient simultaneously. For evidence, cost per order fell 17% Y/Y.

Live Streaming:

Within e-commerce, it’s pushing heavily into live content streaming to juice market engagement. Shopee live, the streaming platform, is greatly expanding creator collaborations. This is already working in Indonesia where 20% of its daily platform users are watching live streaming. Overall, average daily streamers, hours streamed, and daily sessions rose by 300% from June to October.

Logistics Investments:

SE continues to build more sort centers and enhance its last-mile delivery coverage across all markets. Specifically, the firm is enjoying strong growth in Brazil with improving unit economics there as well. It continues to build out its footprint in that region and those investments continue to bear fruit.

Digital Entertainment:

- Quarterly active users and payers continued to fall Q/Q. Payer ratio also continued to fall.

- Garena bookings specifically rose Q/Q with quarterly active users and EBITDA stable Q/Q.

- Free Fire was the most downloaded game in Q3 across the globe per Sensor Tower. The firm upgraded Free Fire in an attempt to make it more social.

- EBITDA was 52.2% of bookings vs. 54% Q/Q.

Financial Services:

Its credit portfolio overall rose 5% Q/Q to $2.9 billion. This includes $500 million in loans from other financial institutions through its platform. The credit book “stayed healthy” per the team. Specifically, the rate of non-performing loans (NPL) 90+ days due improved sequentially to 1.6% of gross receivables. Rate of loans 30+ days past due also improved Q/Q. Finally, the firm is actively expanding funding supply sources to lower overall cost of capital. Its own deposits and asset backed lending deals with 3rd parties are the two main examples.

e. Take

Fine quarter. This company remains in “prove it” mode. The cost cutting to prop up margins is nice, but it will need to reignite spending (like it’s starting to do) to juice demand. That spending must result in growth rather than another instance of costs spiraling out of control. With ramping competition across all of its markets, it’s unclear how sticky its business truly is. Can they keep cutting costs while taking share, re-accelerating demand and expanding margins? I’m not sure. That’s what needs to happen for this to work.

Step one was right-sizing the cost base. To the firm’s credit, it completed this step very quickly. Now onto step 2.

2. Nubank (NU) – Earnings Review

NuBank is a large & rapidly growing digital bank in Latin America.

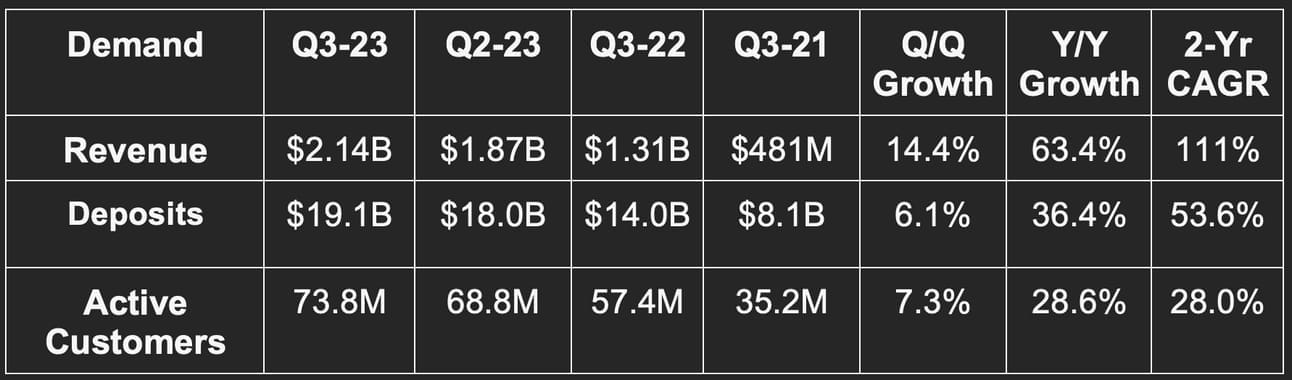

a. Demand

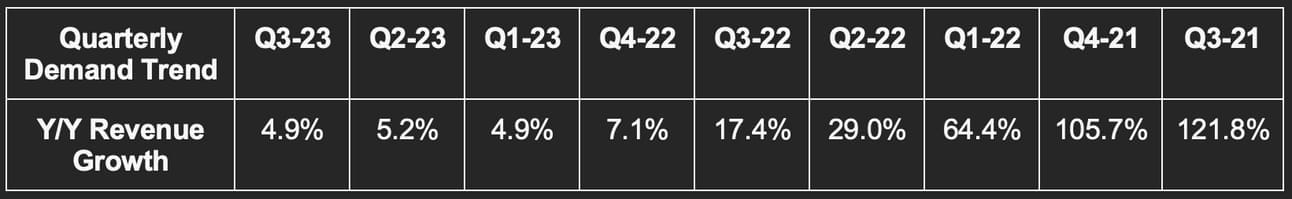

Revenue was 4.4% better than consensus. Its 111% 2-year revenue CAGR compares to 136% as of last quarter and 157% as of 2 quarters ago. Revenue rose by 53% Y/Y on a foreign exchange neutral (FXN) basis.

b. Margins

- Beat net income estimates by 18.4%.

- Beat GAAP net income estimates by 22.7%.

- Beat 40.5% GAAP GPM estimates by 230 bps.

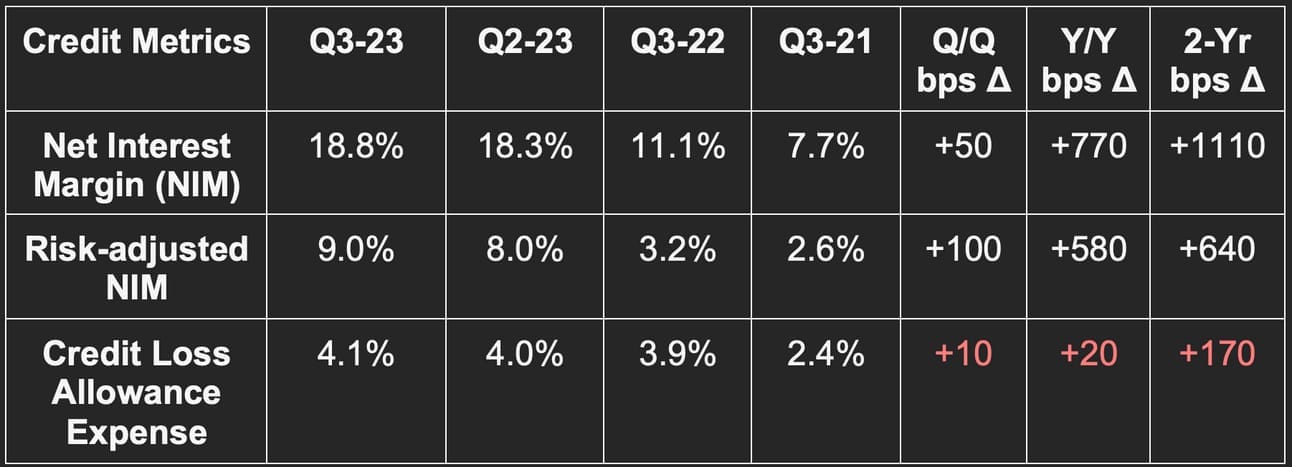

Please note that a lower credit loss allowance expense is a good thing.

“We anticipate continued gains in operating leverage as we continue to scale… we believe there is potential for increased future leverage as our Mexican and Colombian businesses, which are currently operating with losses, reach their inflection points.” – CFO Guilherme Lago

c. Balance Sheet

- $2.3 billion in excess cash.

- $1.1 billion in borrowings and financing vs. $585 million Y/Y.

- Loan to Deposit Ratio (LDR) of 35% vs. 35% Q/Q & 25% Y/Y. The team sees room for this to rise further to continue lowering the cost of funding loans.

d. Call & Release Highlights

Customer & Product Growth:

Nu is now the 5th largest financial institution in Latin America by customer count and the 4th largest in Brazil. Rapid customer growth continues to coincide with rising engagement. Its customer activity rate set a new record high at 82.8% vs. 82.2% Q/Q and 81.6% Y/Y. Customers using Nu for primary banking services rose from 58% to 59% Q/Q as well. Impressively, it has 51% of Brazil’s entire population as customers vs. 49% Q/Q. Impressive.

Revenue per active member rose to $10.00 vs. $9.30 Q/Q and $7.90 Y/Y. Products per member on average surpassed 4.0 for the first time. Per the team, cross-selling is a main driver of its “extraordinary pace of customer growth.” It continues to enjoy a modest $7 customer acquisition cost because of this cross-selling. That reality allows it to invest more heavily in customer growth. It’s a key competitive edge. Specifically, its cost to serve users is 85% lower than incumbents.

Broader product breadth also means better access to consumer data which it can use to sharpen underwriting and boost approval rates. This quarter, it added payroll lending to further fortify this equation. It will add a new savings account in Colombia this year.

“We believe $7 is one of the lowest customer acquisition costs among consumer fintechs and banks on a global scale.” – CFO Guilherme Lago

Demand Metrics:

- 23% Y/Y credit card customer growth to reach 38.9 million

- 100%+ Y/Y NuInvest customer growth to reach 12.4 million

- 32% Y/Y bank account growth to reach 64.7 million

- 52% Y/Y loan customer growth to reach 7.3 million.

- Personal loan originations rose 93% Y/Y.

- 54% Y/Y small merchant account growth to reach 2 million.

- Overall purchase volume rose by 36.8% Y/Y (28% FXN) to reach $29 billion.

- In Brazil, its growth is outpacing growth of the 5 largest banks there… combined.

Market share across Brazil, Mexico and Colombia continued to rise at a rapid clip. In Mexico specifically, its Cuenta Nu savings product was credited for re-accelerating user growth as the product gained rapid adoption. Cuenta Nu already has 2.4 million accounts and $150 million in deposits early on. Per CFO Guilherme Lago on the call, this success will lead to it “further expanding the deposit franchise model across Latin America.”

Deposits & Credit Portfolio Growth:

The rapid 36% Y/Y deposit growth was 26% Y/Y on an FXN basis. This continued momentum in building deposits is directly helping its cost of funding. This quarter, that cost sat at 80% of the Brazilian Interbank Deposit Rate (CDI) vs. 95% Y/Y. 80% is not a floor.

Its credit card and lending portfolio rose by 58.7% Y/Y (48% Y/Y FXN growth) to reach $15.4 billion. Importantly, NuBank’s shift to interest earning assets within this base continued. 21% of its total portfolio is now within the interest earning bucket vs. 10% Y/Y. This is feeding net interest income and is positively supporting its overall results. The trend is expected to continue.

NuBank’s new secured credit product is off to a good start as well. This product is secured by a customer’s federally-mandated savings account in Brazil. Thanks to the entirely digital nature of this offering, time to fund the loan and input costs are best in class.

Credit Health:

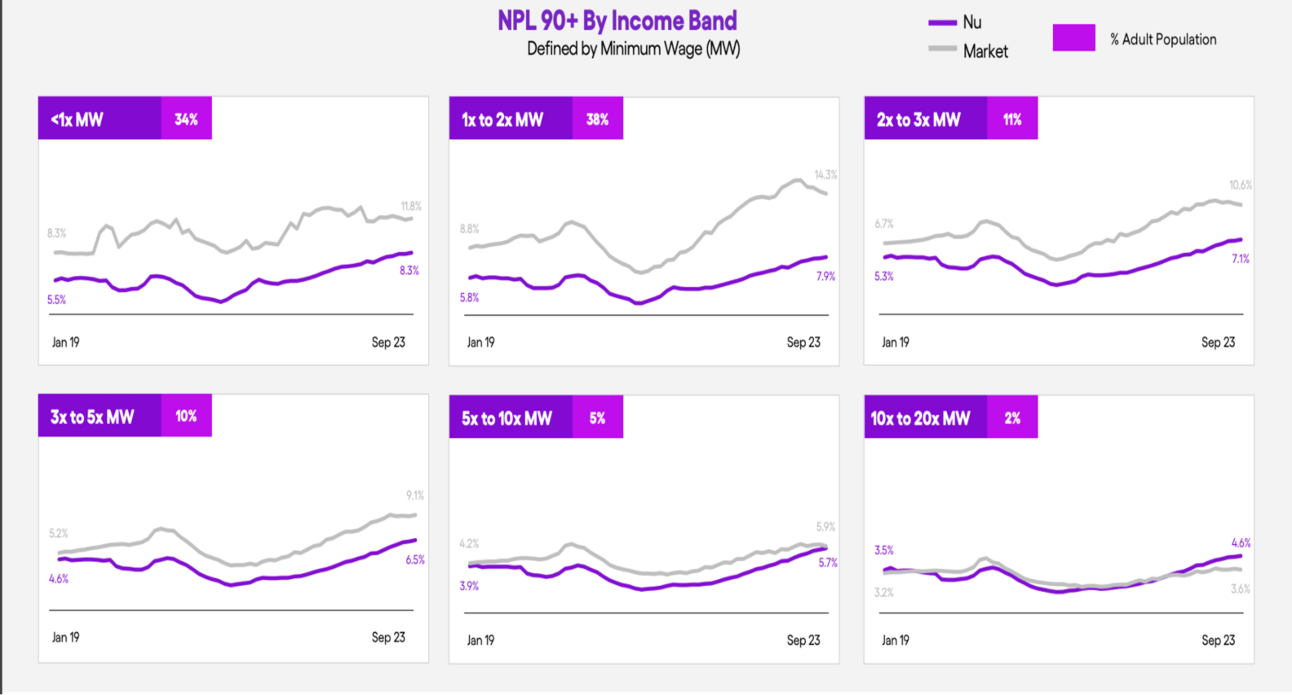

15-90 day non-performing loan (NPL) rate was stable Y/Y at 4.2%. The 4.2% result improved slightly Q/Q vs. 4.3%. This is good news considering the metric is a leading indicator of 90+ day NPL rates. Still, the 90+ day NPL rate continued to worsen. It rose from 4.7% to 6.1% Y/Y and vs. 5.9% Q/Q. NuBank blamed this on the buildup of newer originations continuing to mature. This is leading to a “stacking up” of early delinquencies. All in all, delinquency rates for the firm are about 15% lower than Brazilian benchmarks. It continues to outperform in its underwriting role. This is true across 98% of its addressable market (and the 98% that are most difficult to underwrite):

“Our personal loan cohorts continue to exhibit expected behavior. This is enabling us to continue to increase originations… we see an opportunity to expand credit with attractive returns and robust resilience going forward. This may lead to higher delinquency rates, which we expect to be more than offset by additional revenue.” – CFO Guilherme Lago

Margins & Ratios:

Cost of financial and transactional services is similar to gross margin for a non-bank. It deducts costs directly tied to the firm’s products. This margin line sharply improved from 32.7% to 42.8% Y/Y. From an operating expense (OpEx) point of view, general/administrative costs are driving the firm’s rapid leverage. This cost bucket was flat Y/Y while demand torridly grew.

Nu’s Capital Adequacy Ratio (important capital ratio in its markets) sits at 11.0% and is well above its 6.75% minimum. This gives it a lot more room to use low-cost funding sources like deposits to fund credit.

Trailing 12 month return on equity (ROE) (using adjusted net income) was 25% vs. 19% Q/Q and 8% Y/Y.

e. Take

Another impressive quarter from NuBank. The 90+ NPL rate is a bit concerning, but the cohort build-up reasoning does make sense. Aside from that, there’s absolutely nothing to pick at here. Only growth, market share gains, rapid leverage and successful product launches to praise. Its competitive advantages are clear. Its costs to acquire customers and service them are comparatively low; its 35% efficiency ratio is comparatively excellent and improving; its funding supply is healthy and cheap; its underwriting is outperforming. MercadoLibre is the highest quality Latin American firm that I cover, but Nu is quickly entering that conversation. I added NuBank to my short watchlist this week.