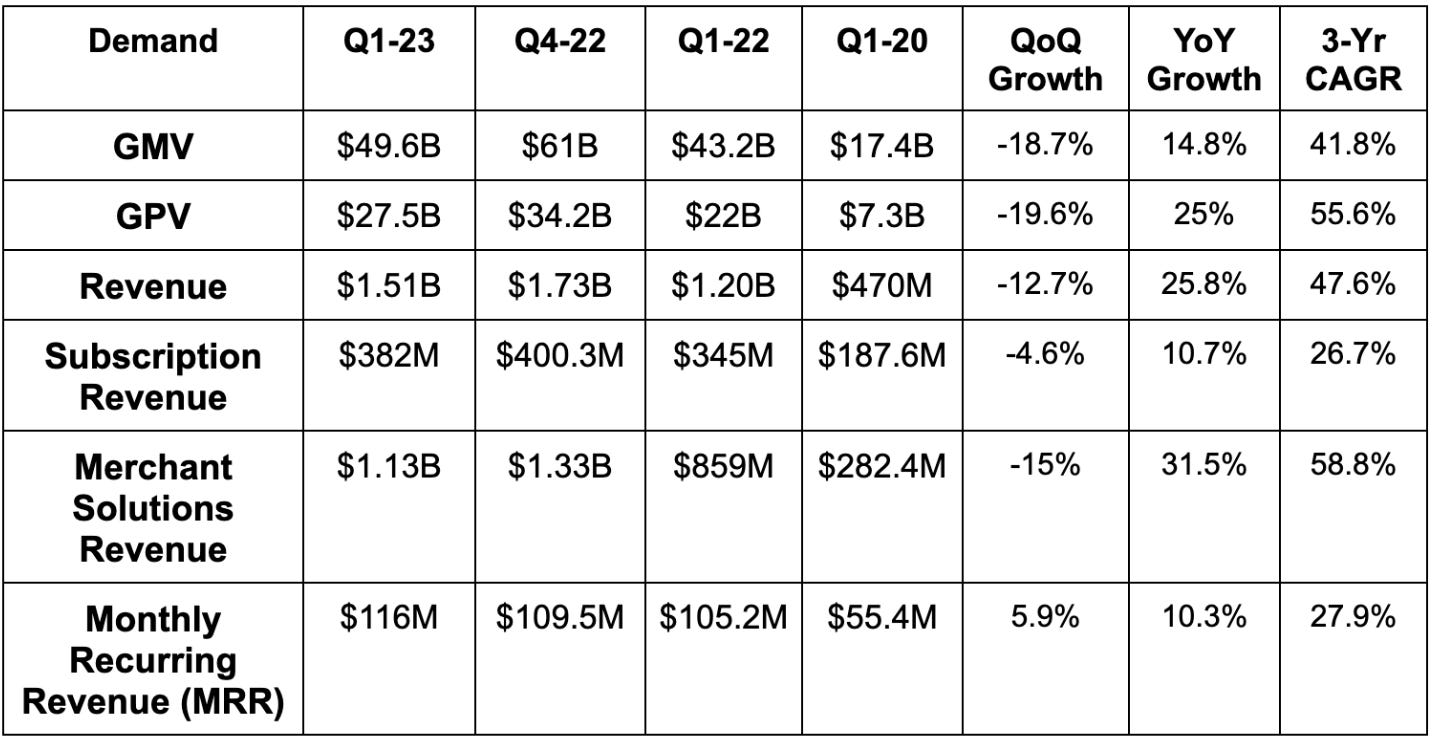

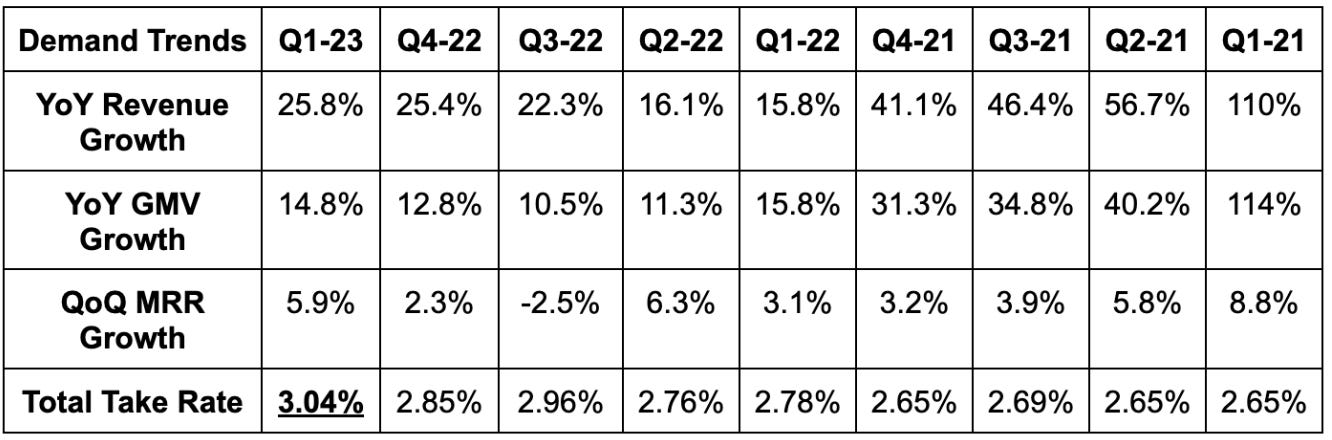

1. Demand

Shopify beat revenue estimates and its similar guide by 5.2%.

More Demand Context:

Large outperformance was via better than feared consumer spend (especially in Europe) with a bit of help from easing FX headwinds. This makes the macro headwinds some other tech firms have blamed for poor results less believable. The cream is rising to the top. The strongest are overcoming a tough backdrop.

Q4 is seasonally strong for demand.

GMV rose 18% YoY FX neutral (FXN); Revenue rose 27% YoY FXN.

GPV = 56% of GMV vs. 56% QoQ and 51% YoY.

Plus revenue is now 34% of MRR vs. 30% YoY.

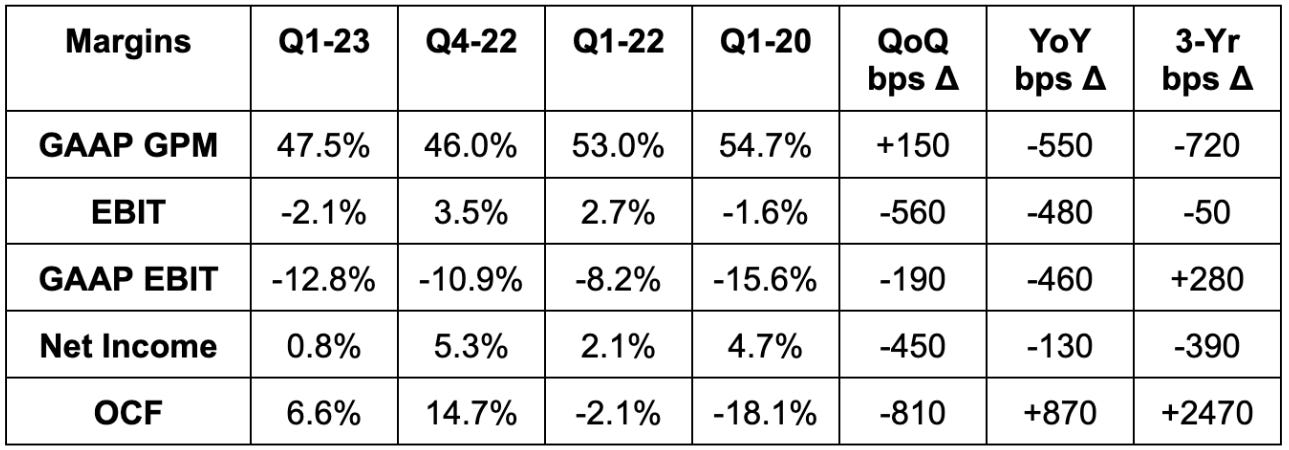

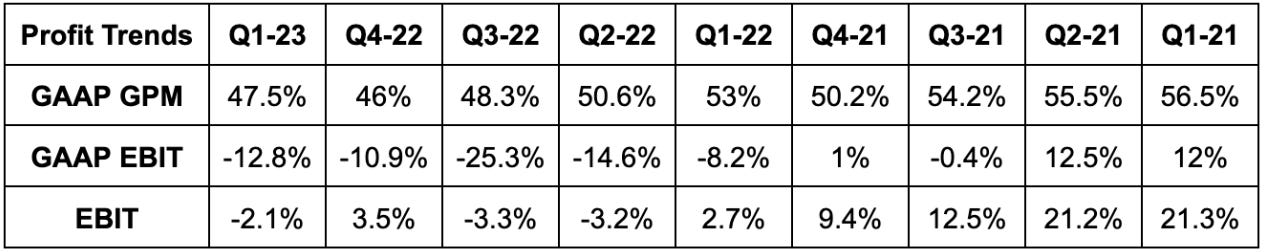

2. Profitability

Shopify slightly beat non-GAAP gross margin estimates, beat EBIT loss projections by over 50% and beat -$134 million free cash flow estimates by a whopping $222 million.

Margin context:

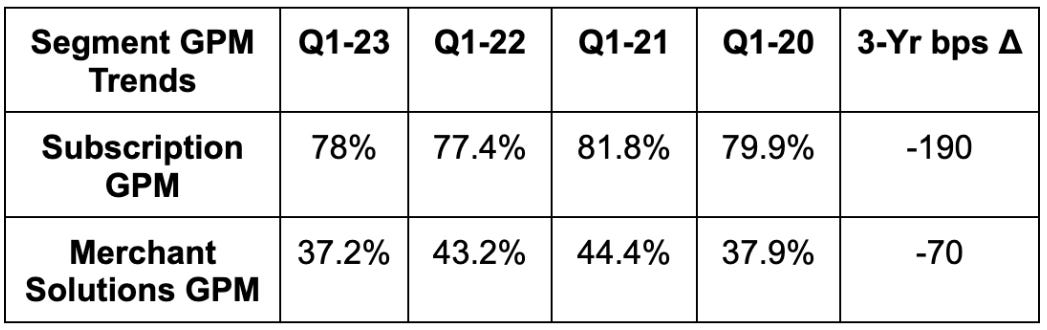

GPM contraction is being driven mainly by its fulfillment business which will be sold this year to Flexport. More later. Other GPM headwinds are from rapid payments proliferation and a shift back from debit-funded transactions to credit-funded transactions for that business as the stimulus boosts fades.

Importantly, Payments carries a similar EBIT profile to its subscription business due to lower operating expense (OpEx) needs.

OpEx rose 1% QoQ via Deliverr and will decline by single digit percentages YoY starting next quarter.

Sales and Marketing declined YoY and QoQ due to shifting external marketing strategies that led to a 50% boost in payback for Shopify.

“You will hear us talk more frequently going forward about free cash flow.” – CFO Jeff Hoffmeister

3. Guidance

Shopify guided to roughly 26% YoY revenue growth. This beat estimates by 4%.

It expects gross margin to be stable QoQ which is slightly ahead of consensus.

It will take a $1.25 billion impairment and $145 million severance charge via asset sales and layoffs discussed below.

Guidance still assumes poor macro and cautious spending all year despite signs of improvement this quarter. Under promise, over deliver.

It expects free cash flow in every quarter this year. It was supposed to POST NEGATIVE $275 million. That is not a typo. SFN CapEx is gone; FCF will inflect. Boom.

4. Balance Sheet

$4.9 billion in cash & equivalents.

$914 million in convertible notes.

Stock comp was 8.9% of sales vs. 9.8% of total 2022 sales.

Basic share count grew by 1.3% YoY and diluted share count grew by about 2.3%.

Shopify Capital has $629 million in cash advances and loans outstanding.

5. Call & Release Highlights

Selling Shopify Fulfillment Network (SFN):

Founder/CEO Tobi Lutke released a letter in tandem with the report. In it, a decision was announced to sell the majority of its logistics business to Flexport. As part of the deal, Flexport will become the preferred logistics partner for Shopify and will run its fulfillment app. Shopify will get incremental 13% ownership of the firm to bring its stake close to 20%. It also gets a board seat.

In the letter, Tobi spoke on main quests vs. side quests. Its main quest is to make commerce easy, powerful and accessible for all merchants through a singular dashboard. Logistics was a side quest to ease the vendor siloes its merchants endured to ship from port to porch. Tobi thought incubating this capability in Shopify was the right move, but now sees focus on core objectives as more important than running this. It wants to focus on what it does best and sees Flexport’s capabilities as beyond its own in the space. That’s when it decides to partner like it did with Affirm on BNPL. It sees Flexport as the ideal partner to take its fulfillment foundation to the next level. Shopify will benefit via its direct stake.

To us, this was admitting that entering fulfillment maybe wasn’t the best idea and shows a willingness to right wrongs.

This transaction is expected to close towards the end of Q2 with cost savings and margin tailwinds building throughout the year. SFN was a massive drag on gross margins and profitability. That will no longer be the case.

Finally, this decision should make an Amazon Buy with Prime integration much more doable. Harley told us to “stay tuned” with “all things moving in the right direction.” Wink, wink.

Layoffs & AI:

The other piece of Tobi’s letter was a 20% layoff announcement. This is its second round of layoffs in the last year. First and foremost, this sucks for those impacted. It was, however, a necessary evil to right-size the overly aggressive hiring conducted since 2021. Layoffs were across all departments and all geographies. Shopify will further reduce headcount through the SFN sale to Flexport. It sees its balance of “crafters” and “managers” as out of whack and this is its way to address the issue.

Shopify told us that AI-fostered pace of innovation is leading to it condensing its focus to high priority areas that it believes will deliver sustainably brisk growth.

“To adapt and stay at the forefront of commerce, Shopify must operate with greater speed & efficiency. We are refocusing on priorities that we believe will get Shopify to the size and the shape necessary to unlock the next era of growth and innovation” – President Harley Finkelstein

Large Merchant Traction:

Commerce Components by Shopify (CCS), its point of sale (POS) suite and Shopify Plus enjoyed large merchant wins this quarter. Keen, Herschel, Yogibo (largest Japan outbound deal ever), Lulu Studio (formerly Mirror) and Tim Hortons were among the highlights. It also won Gap’s Banana Republic as a new POS client.

“CCS is kicking down the door to conversations with retailers previously not aware of the power of Shopify… there’s a large enterprise perception shift happening.” – President Harley Finkelstein

Impressively, Shopify signed a new POS partnership with Intuit. Intuit sunsetted its QuickBooks product and went with Shopify’s as the preferred solution for POS migration. This already resulted in some big wins. It also signed new system integrator (SI) deals with IBM and Cognizant to help with CCS traction. These bellwethers join Accenture, Deloitte and EY as program partners.

Subscriptions:

There are no signs of merchant pushback related to the recent subscription price hikes. This was implemented last week so the benefit to revenue will be seen starting in Q2. Management sees this tailwind being roughly offset by the SFN sale and less logistics revenue.

It greatly outpaced e-commerce growth to take more market share.

The end of some extended free trials led to robust free to paid conversion which helped GMV growth. These cohorts are showing promising revenue trends.

Merchant Solutions:

15% of Q1 GMV was via cross border sales which are higher margin for Shopify. Markets and Markets Pro are enhancing international conversion.

Offline GMV grew by 31% YoY.

Shopify Audiences algorithm upgrades have doubled the return metrics for advertisers since launch. At launch, it was already delivering consistent 2x-8x return on ad spend (ROAS) boosts. It expects this lead to keep growing.

This is unlocking platform level innovation by letting all merchants plug into more relevant 3rd party merchant data sources than they can on their own. This is an inherent advantage over smaller ecosystems that cannot be matched without massive scale.

This product is still only monetized through Shopify Payments, but the firm will look to monetize it much more going forward.

6. Our Take

What a gratifying quarter this was. In our recently published deep dive, we argued that SFN would become more asset light and Shopify’s shift in philosophy (with new CFO Jess Hoffmeister) would foster more margin expansion than anyone was modeling. We said that needed to happen for this investment to work at the current valuation.

Well? Signs of that efficiency popped up this quarter while revenue growth far exceeded expectations and it took more commerce share. Cash flow unexpectedly turned positive and that ramp will merely continue without SFN CapEx weighing it down. Hoffmeister is turning out to be as great of a hire as we thought he was. We expect margins to explode higher through 2024 while it keeps compounding. We were tempted to trim following the report but refrained from doing so for now.

Have a great night.