1. The Trade Desk (TTD) -- Q2 2023 Earnings Review

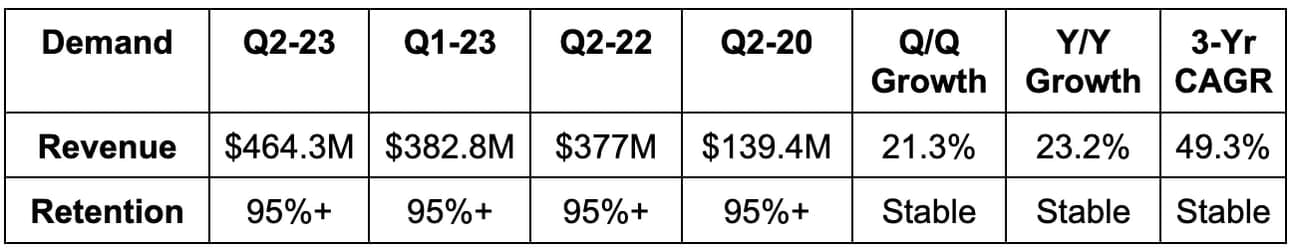

a. Demand

Beat revenue estimate by 2% & beat guide by 2.7%.

Demand Context:

- Ex-political spend, Y/Y revenue grew by 24.5%.

- Video is stable at 45% of revenue, Mobile is stable at around 35% of revenue, Display is stable in the low double digit range, and Audio is stable at 5% of total revenue.

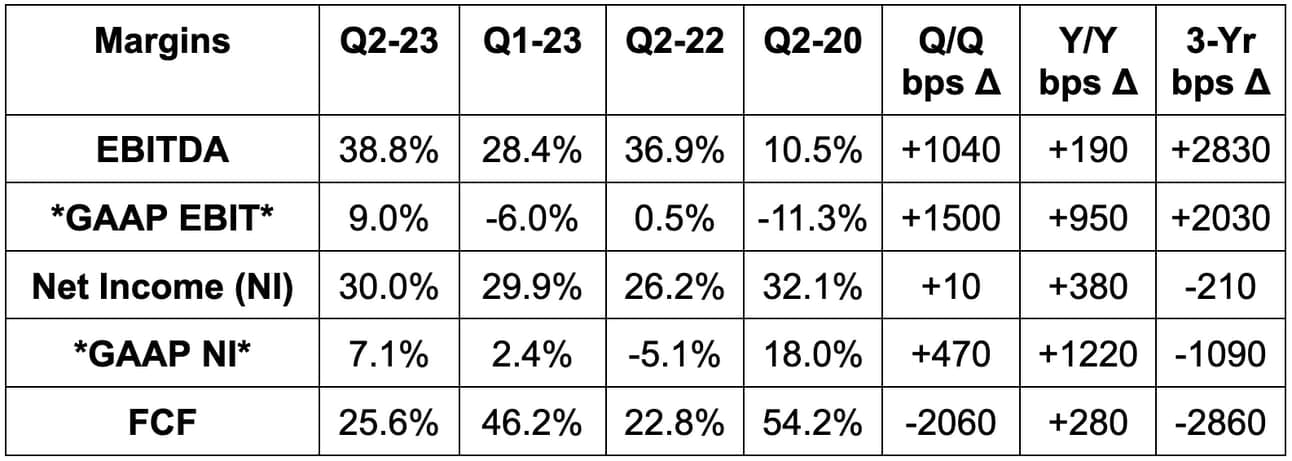

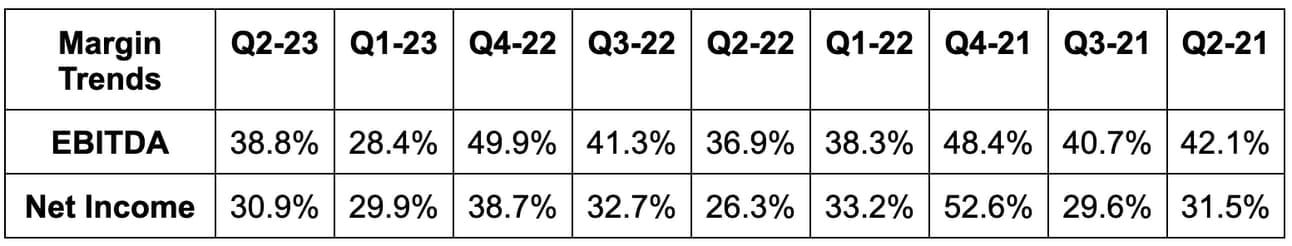

b. Profitability

- Beat EBITDA estimates by 10.6% & beat guidance by 12.5%.

- Beat GAAP EBIT estimates by 40%.

- Beat $0.25 EPS estimates by $0.03 & beat $0.05 GAAP EPS estimates by $0.02.

- Beat free cash flow (FCF) estimates by 20%.

Margins:

- Founder awards are hitting GAAP margins hard and will materially through next quarter. Things will normalize in Q4 2023.

- Without the founder package, operating expenses rose 22% Y/Y. The company sees easy operating leverage in its model but is prioritizing growth and share taking today. It thinks it can grow margin whenever it wants to. Based on its track record, that’s accurate.

c. Balance Sheet

- $1.4B in cash & equivalents.

- No debt.

- Share count up 2.2% Y/Y.

- Bought back $44M with $364M left on its buyback program.

d. Next Quarter Guidance

- Beat Q3 revenue estimates by AT LEAST 1.1%. This represents another quarter of acceleration to 23% Y/Y (25% ex-political spend).

- Beat Q3 EBITDA estimates by 0.5%.

- Will continue to hire at half the pace of 2022.

“2024 is looking like a massive wave of opportunity and a chance to grab more land.” -- Co-Founder/CEO Jeff Green

“We are well positioned for the second half of the year and highly optimistic about 2024.” -- New CFO Laura Schenkein

e. Call & Release Highlights

Unified ID 2.0 -- a brief reminder:

As a refresher to preface the rest of this section, UID2 stands for Unified ID 2.0. It’s The Trade Desk’s replacement (and upgrade) of 3rd party cookies. It doesn’t own this directly, but built it and opened it up to the entire internet.

UID2 frees organized email tracking to ensure buyers know exactly who they’re marketing to and sellers know exactly what impressions are worth. This means more valuable ad slots for publishers & higher returns for buyers thanks to the immensely better targeting. TTD threads the needle of making BOTH stakeholders more successful. Unlike cookies, this does not just work in a web browser setting… but across all channels.

All of the top streamers have integrated with UID2 “or are planning to.” Warner Brothers & Discovery (including Max) were the latest to integrate this quarter along with Peacock adding it across all content channels. As a speculative aside, the “or are planning to” tells me Netflix (the remaining holdout) will soon integrate. We’ll see.

As 3rd party cookies are deprecated by Google in 2024, the value of UID2 will merely build. Why? In the eyes of Jeff Green, all advertisers need an “identity strategy.” Cookies is obviously not a sustainable choice there. If Cookies are actually phased out next year (big if), that will pressure buyers to form that identity strategy. UID2 is the way to do it without material signal loss. Just like with Apple’s IDFA and Safari’s cookies deprecation before that, this will have 0 negative impact (maybe even slightly positive) on TTD.

How does this possibly not impact TTD negatively? Good question. Scale & efficacy leads in the open internet is the answer. TTD shops through 12 million impressions per second. If a chunk of these lose their Cookies tag, it will choose away from them with (in its view) 0 impact on ad spend return for clients. Furthermore, video is completely un-impacted by cookies deprecation and retail media is too. This really only impacts web-based publishers. The sad reality is that it will sharply hurt the journalism industry, but will make all open internet players MORE reliant on TTD’s returns. Google is pushing advertisers closer to The Trade Desk. Thank you Sundar.

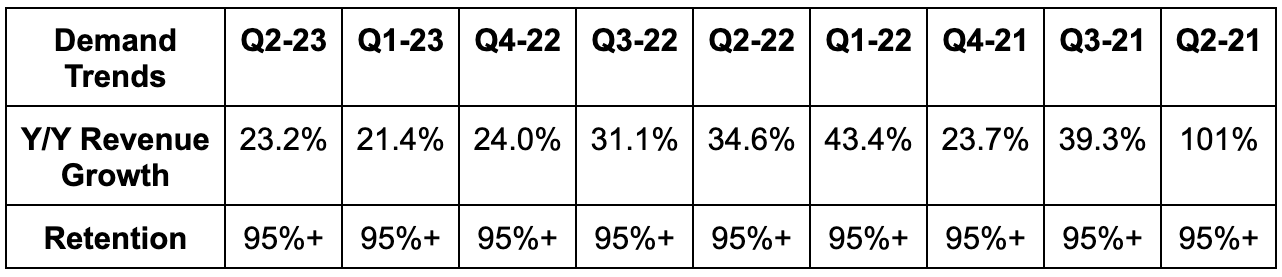

Competition & Macro:

The company continues to vastly outperform its peers and take market share. Specifically, it has taken more share this year than at any point in its history. Scale helps, but still notable. While macro remains somewhat uncertain and ad buyers remain timid, they are flocking to the highest certainty, highest return and most open reporting means of advertising. So? They’re flocking to The Trade Desk. It continues to win contracts from bellwether advertisers and agencies representing billions in future platform spend. Retention is stable, the pipeline is strong and the team is even more excited about 2024 than this year. They’re killing it… and have been for nearly 9 years as a public company.

The firm sees ad sentiment and demand visibility now improving. This led to yet another forward guide calling for accelerating growth.

Connected TV (CTV)(Streaming):

The always signed-on (so always authenticated) user reality of streaming continues to be very attractive to the ad industry. If I always know who you are (in a responsible manner), then I can more granularly market. It’s as simple as that. The result is dollars continuing to briskly migrate to this demand channel. The Trade Desk’s platform and commanding marketshare put it in an ideal spot to capitalize as streamers embrace ad-supported plans.

When pairing UID2 with CTV, The Trade Desk has changed the way video ad buying works (and really all channels of buying). Now, buyers starts with condensed “data seeds” or extensive profiles anonymously covering all relevant previous consumer touch points to build a sense of demand. Companies used to need to “hunt for opportunities to infuse their data.” Now their data (and enriching 3rd party sources) is infused across all parts of the value chain in an intuitive manner.