Most of this week’s content has already been sent. In case you missed it:

- Snowflake & Duolingo Earnings Reviews

- Nvidia & Cava Earnings Reviews

- Lemonade Earnings Review

- Coupang Earnings Review

- PayPal Investor Day Review

- Hims Earnings Review

- My Updated Portfolio & Performance

Table of Contents

- Most of this week’s content has already been sent. …

- 1. Earnings snapshots – Salesforce, Axon, Workday …

- 2. Amazon (AMZN) – Various News

- 3. Portfolio Update Coming Monday

- 4. Market Headlines

- 5. Macro

1. Earnings snapshots – Salesforce, Axon, Workday & Dell

a. Salesforce (CRM)

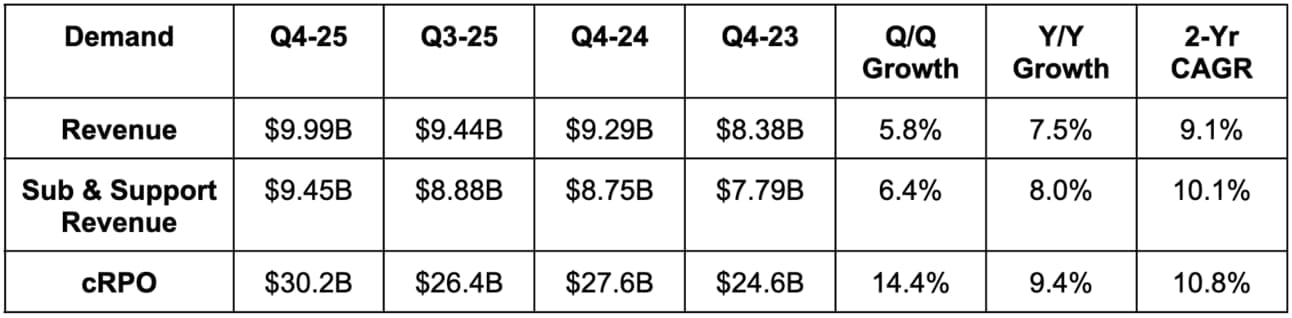

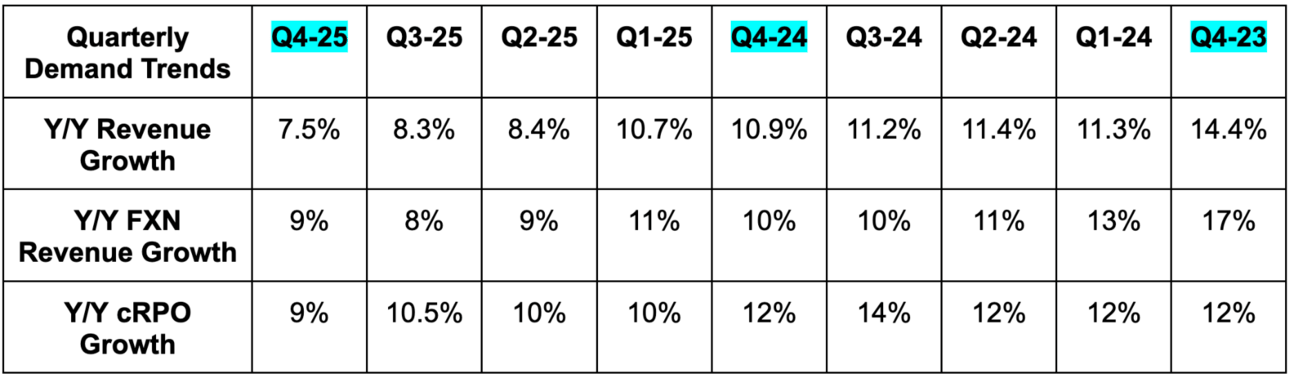

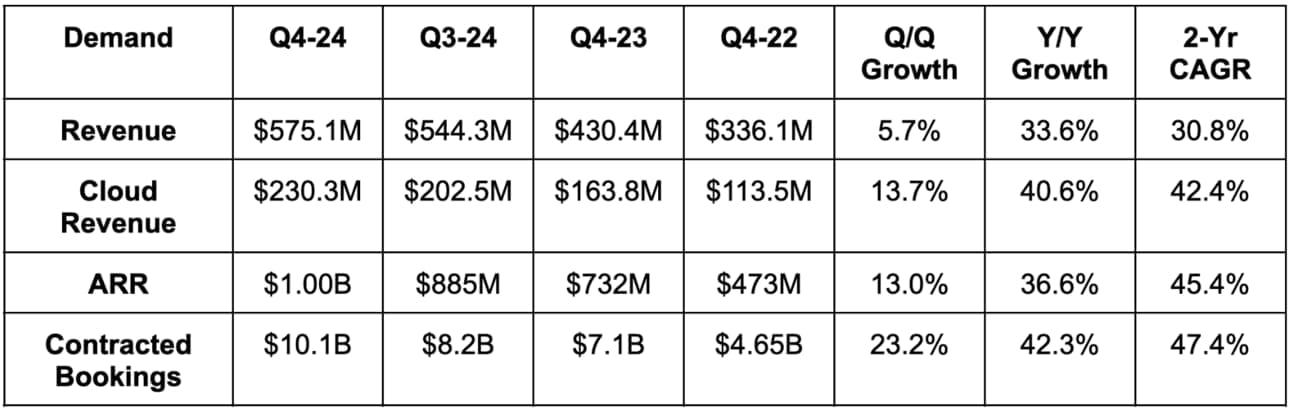

Demand:

- Missed revenue estimates by 0.5%.

- Slightly beat Current Remaining Performance Obligation (cRPO) estimates by 0.2%.

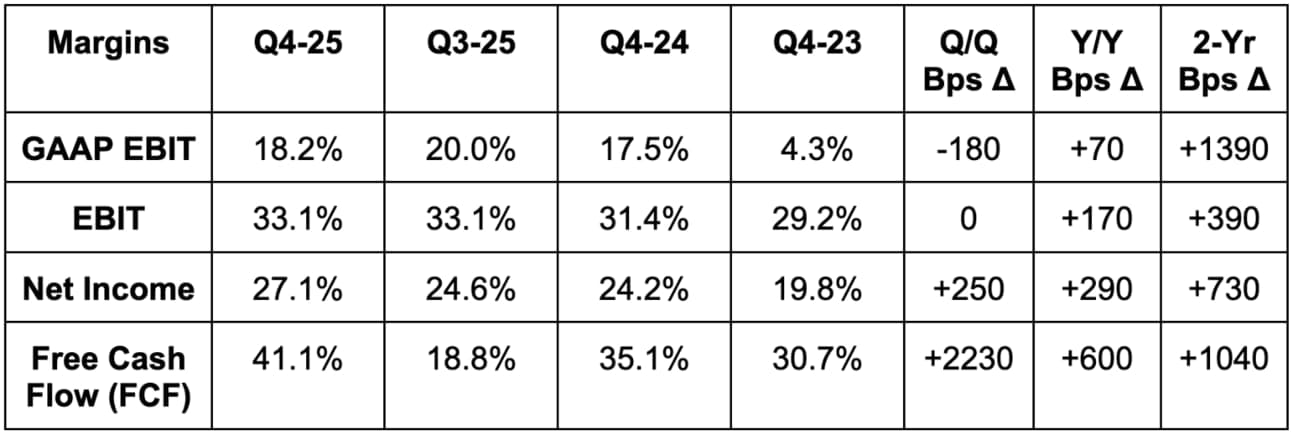

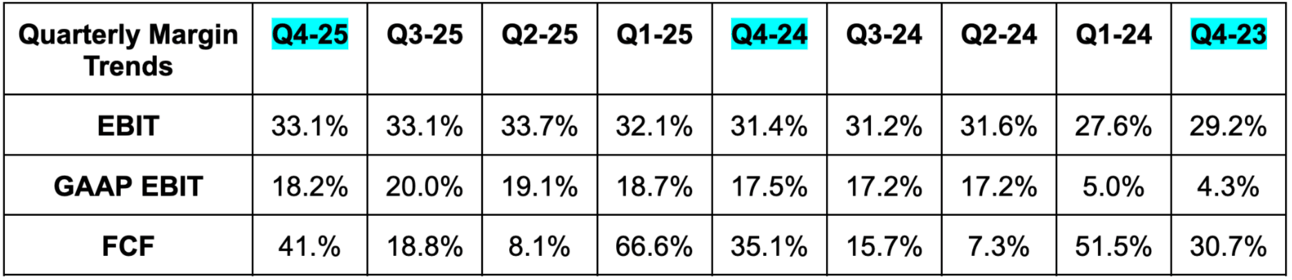

Profits & Margins:

- Slightly beat EBIT estimates.

- Beat FCF estimates by 9%.

- Beat $1.61 GAAP EPS estimates by $0.14.

- Beat $2.61 EPS estimates by $0.17.

Balance Sheet:

- $14B in cash & equivalents.

- $4.85B in strategic investments

- $8.43B in debt.

- Diluted share count fell by 1% Y/Y.

- Paid out $1.54B in dividends for the year vs. $0 Y/Y.

Guidance & Valuation:

- Annual revenue guidance missed by 1.6%.

- Annual EBIT guidance missed by 1.4%.

- Annual EPS guidance of $11.13 missed by $0.08.

- Annual 10.5% operating cash flow guidance beat 9.5% growth estimates.

- Q1 guidance was similarly light across the board for revenue, EBIT and EPS.

CRM trades for 26x forward EPS. EPS is expected to grow by 10% this year and by 13% next year.

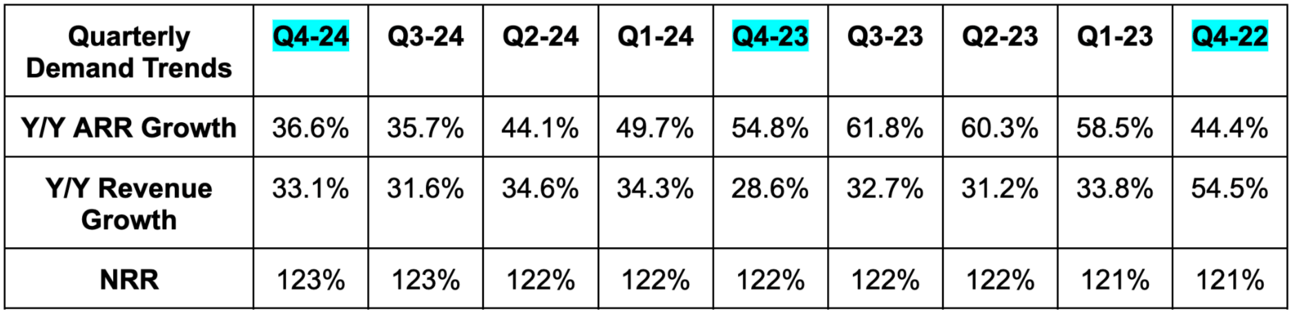

b. Axon (AXON)

Demand:

- Revenue beat by 1.5%

- Taser revenue beat by 4%.

- Cloud & services revenue beat by 3%.

- Sensors & other revenue missed by 6.5%.

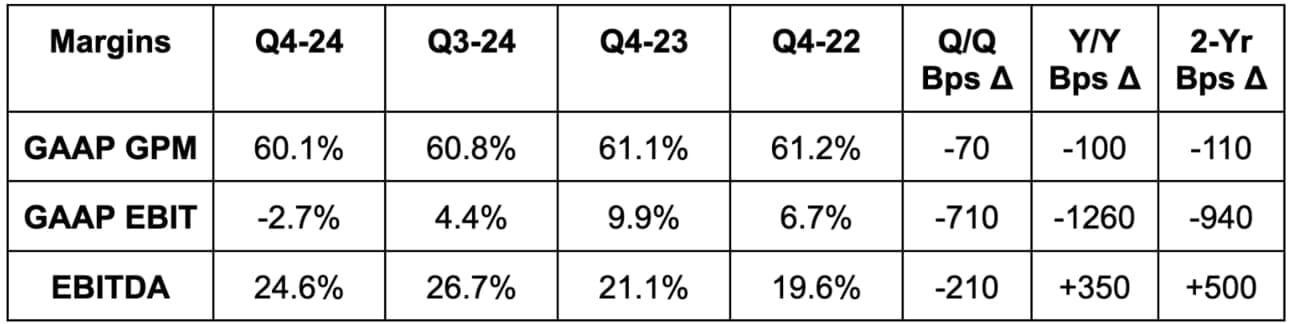

Profits & Margins:

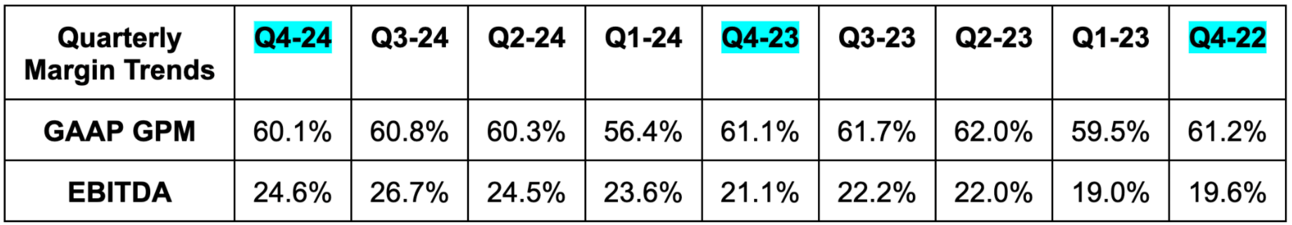

- Beat 72% GPM estimates by 120 bps (chart below is GAAP GPM).

- Beat EBITDA estimates by 6%.

- Beat $1.40 EPS estimates by $0.68.

- Beat FCF estimates by 85%.

Balance Sheet:

- Nearly $1B in cash, equivalents & investments.

- $680M in convertible notes.

- No traditional debt.

Guidance & Valuation:

- Annual revenue guidance beat by 1.8%.

- Annual EBITDA guidance beat by 3.6%.

Axon trades for 60x 2025 EBITDA. EBITDA is expected to compound at a 26% clip for the next two years.