Table of Contents

- 1. Brief Earnings Snapshots – Lululemon (LULU) & Adobe (ADBE)

- 2. Amazon (AMZN) – 2025 AWS Event Review

- 3. ServiceNow (NOW) – CFO Gina Mastantuono Interviews with Barclays

- 4. Shopify (SHOP) – CFO Jeff Hoffmeister Interviews with Barclays

- 5. Zscaler (ZS) – CFO Kevin Rubin Interviews with Barclays

- 6. Coupang (CPNG) – Breach Fallout

- 7. SoFi (SOFI) – Credit Card & Innovation

- 8. Alphabet (GOOGL) – Various News

- 9. SentinelOne (S) – CFO

- 10. PayPal (PYPL) – Downgrades

- 11. Headlines

- 12. Fed Day & More on Macro

Broadcom & Oracle earnings reviews were published during the week. Micron and Nike earnings reviews will be published next week. Here are the other reviews from this season:

- Rubrik

- Snowflake

- CrowdStrike & MongoDB

- Zscaler

- Datadog & Palo Alto

- Sea Limited

- On Holdings

- Nu Holdings

- The Trade Desk

- Lemonade & Duolingo

- Palantir & Hims

- Cava

- SentinelOne

- DraftKings

- Microsoft & Cloudflare

- Uber

- Shopify & Coupang

- Meta

- Alphabet

- Apple, ServiceNow & Starbucks

- Amazon & Mercado Libre

- PayPal

- Tesla

- SoFi

- Netflix

- Taiwan Semi

And finally, my current portfolio and performance vs. the S&P 500.

1. Brief Earnings Snapshots – Lululemon (LULU) & Adobe (ADBE)

a. Lululemon

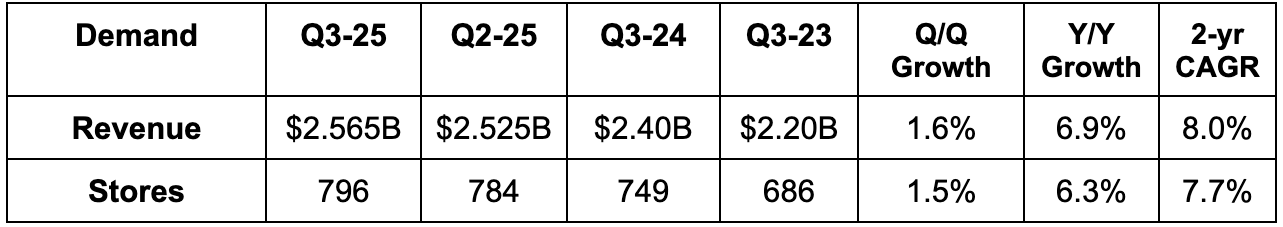

Results:

- Beat revenue estimates by 3.4% & beat guidance by 3.2%.

- Beat EBIT estimates by 18%.

- Beat 54.4% GPM estimates by 120 bps.

- Beat $2.22 EPS estimate by $0.37 & beat guidance by $0.38.

Balance Sheet:

- $1B in cash & equivalents.

- $593M in credit capacity.

- Inventory +11% Y/Y.

- Added $1B to the buyback program ($23B market cap).

Guidance & Valuation:

- Slightly lowered Q4 revenue guidance, missing estimates by 0.7%.

- Lowered Q4 EPS guidance from $4.96 to $4.71, missing estimates by $0.23.

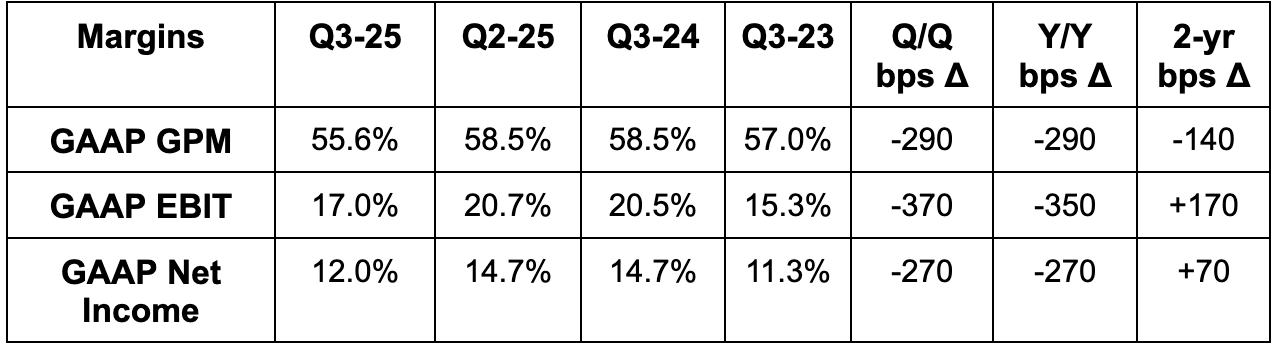

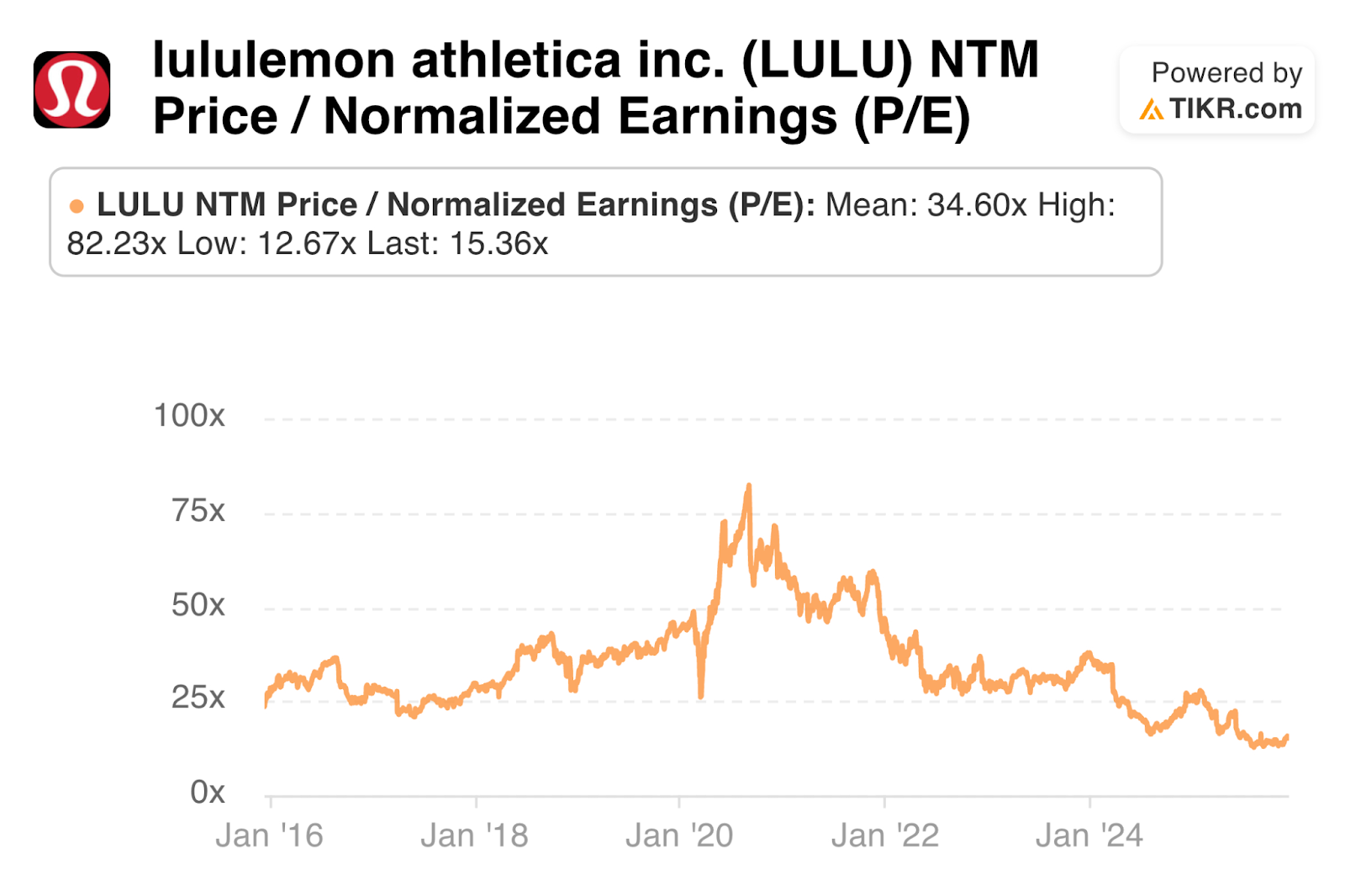

LULU trades for 15x forward EPS. EPS is expected to grow by -11% this year, -0.5% next year and 5.7% the year after.

CEO Change:

CEO Calvin McDonald is out at Lululemon. Following years of struggling to deliver relevant assortment or keep up with evolving tastes, LULU is finally looking for fresh leadership. They started blaming macro long before blaming bad macro was actually an issue, and they’ve been ceding market share and mindshare to others like Alo and On Running for quite some time. Results look horrible right now, but I still think this is a great brand. I’m interested to see how they bring in and what the plan of action entails.

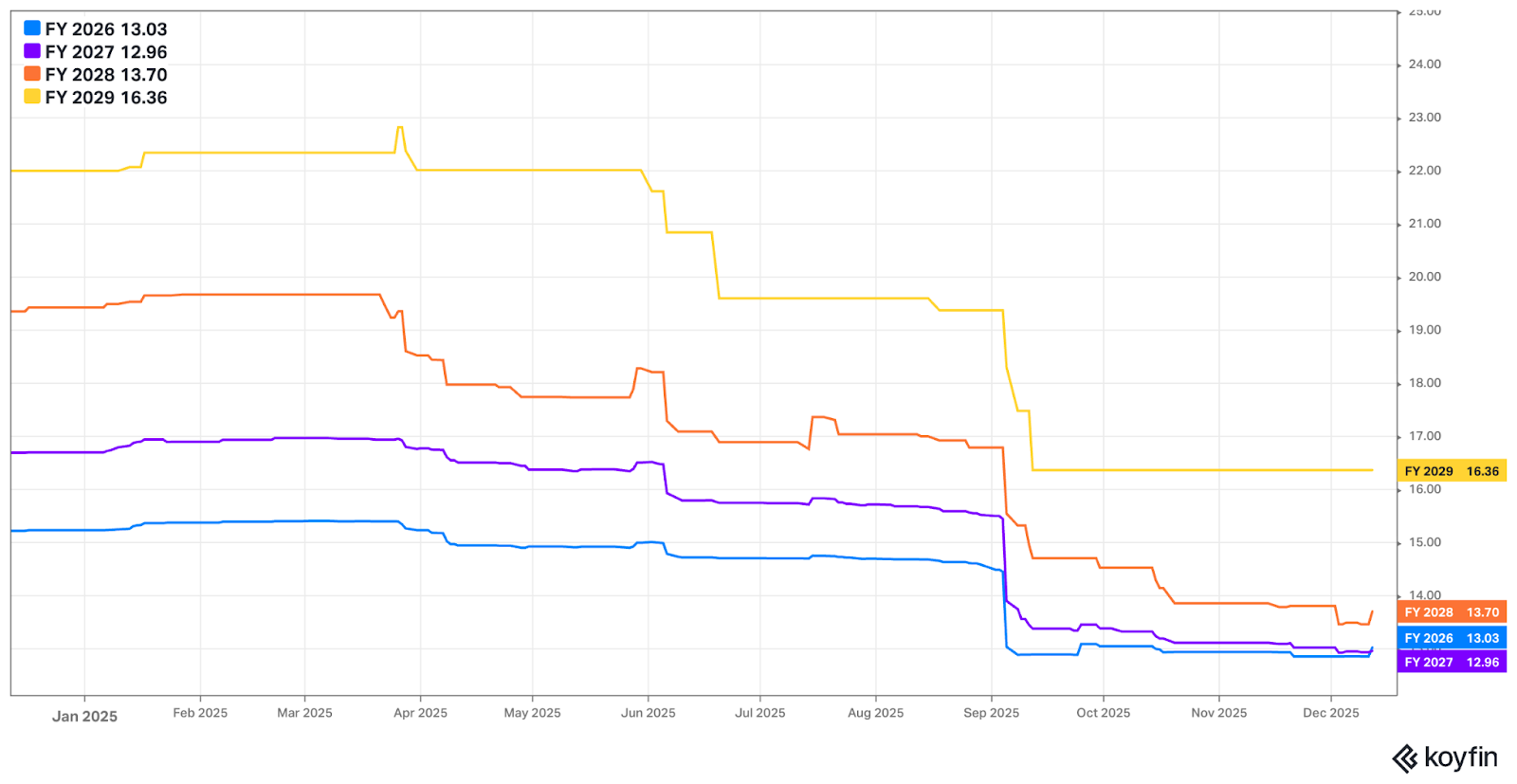

b. Adobe (ADBE)

Results:

- Beat revenue estimates by 1.3% & beat guidance by 1.5%.

- Beat digital media ARR estimates by $5M or 0.3%. Beat RPO estimates by 0.9%.

- Beat digital media revenue estimates by 1.5% & beat guidance by 1.7%.

- Beat digital experience revenue estimates by 0.7% & beat guidance by 1%.

- 11% constant currency (CC) digital media growth beat 10% growth estimates.

- 8% CC digital experiences growth met growth estimates.

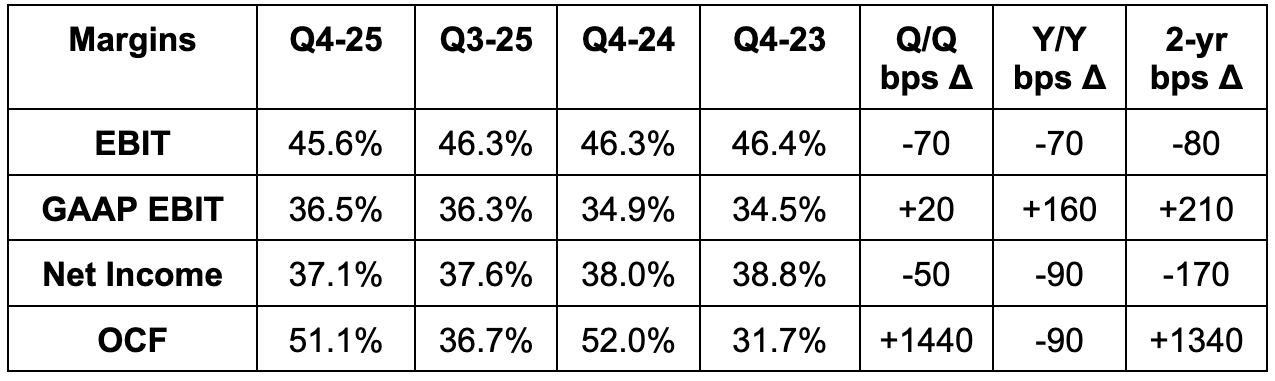

- Beat EBIT estimates by 1.4%. Beat operating cash flow estimates by 16.6%.

- Beat $5.39 EPS estimates by $0.11 & beat guidance by $0.125.

Balance Sheet:

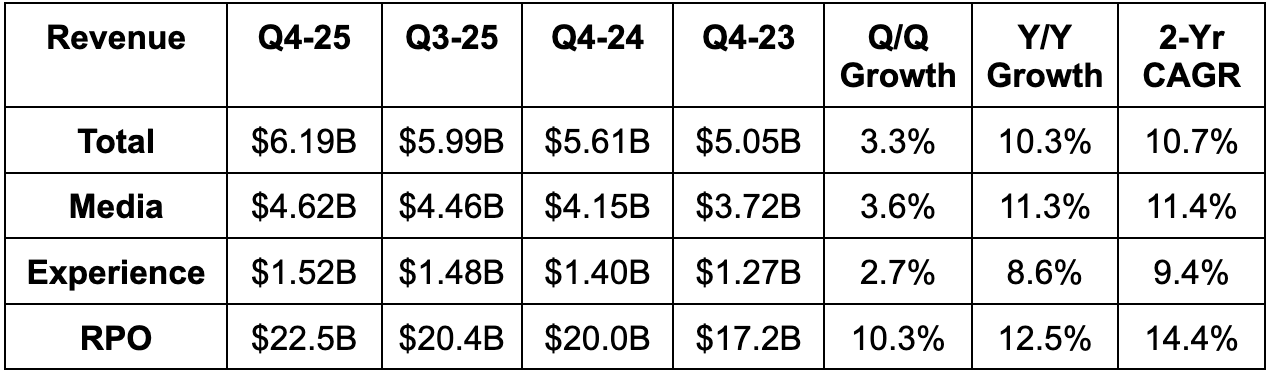

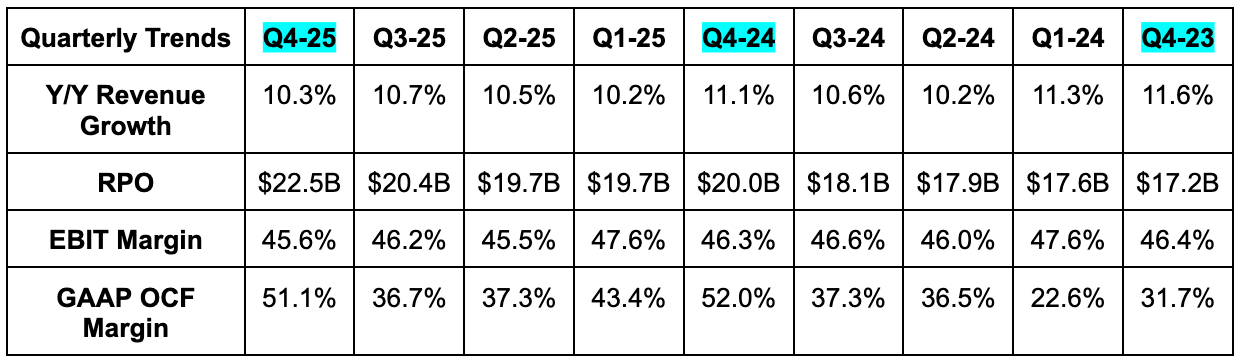

- 10.7% 2-yr revenue CAGR vs. 10.7% Q/Q & 10.4% 2 Qs ago.

- $6.7B in cash & equivalents; $6.2B in debt.

- Diluted share count fell by nearly 6% Y/Y.

Guidance & Valuation:

- Set annual revenue guidance at $26B, beating estimates by 0.4%.

- Set annual EPS guidance at $23.40, beating estimates by $0.10.