Table of Contents

Earnings reviews from this season:

- Rubrik

- Oracle & Broadcom.

- Snowflake

- CrowdStrike & MongoDB

- Zscaler

- Datadog & Palo Alto

- Sea Limited

- On Holdings

- Nu Holdings

- The Trade Desk

- Lemonade & Duolingo

- Palantir & Hims

- Cava

- SentinelOne

- DraftKings

- Microsoft & Cloudflare

- Uber

- Shopify & Coupang

- Meta

- Alphabet

- Apple, ServiceNow & Starbucks

- Amazon & Mercado Libre

- PayPal

- Tesla

- SoFi

- Netflix

- Taiwan Semi

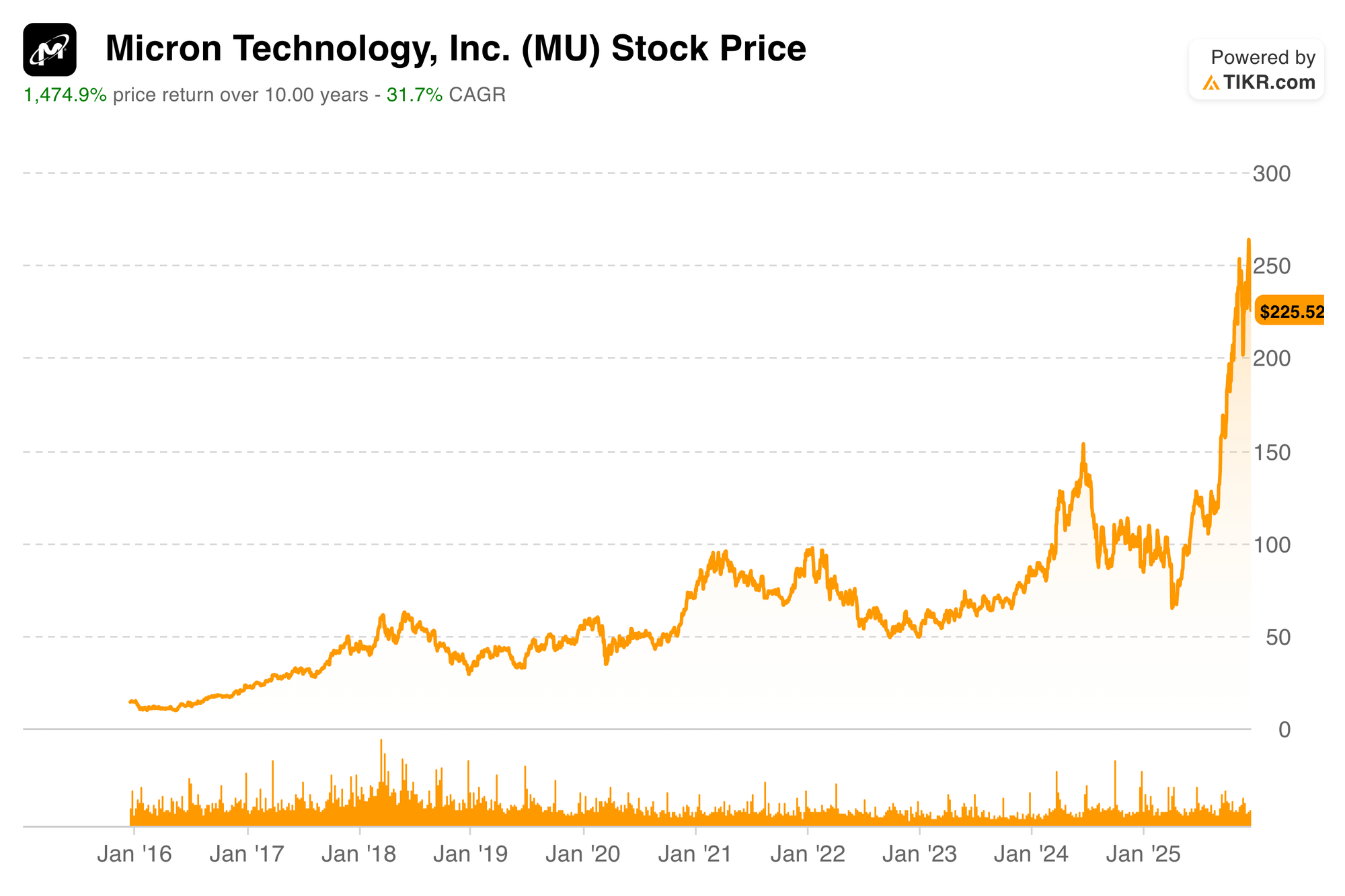

1. Micron (MU) – Earnings Review

a. Micron 101

Micron sells semiconductors for memory and storage. The firm's "NAND" chips offer non-volatile data storage, which maintains stored information when a system’s power is turned off. Separately, its Dynamic Random Access Memory (DRAM) chips offer volatile memory storage for personal computers, next-gen data centers, and more. “Volatile” means that storage isn’t maintained when a system’s power is turned off. DRAM helps processors access real-time data to alleviate processing latency, cost and other potential bottlenecks.

- DRAM is great for short-term memory storage and rapid access.

- NAND is great for longer-term memory storage and use cases that don’t need the lowest data processing latency.

These chips provide the foundation for its solid-state drives (SSDs), which are used in computer data storage and things like USB flash drives. Micron sells standalone NAND/DRAM chips and also SSDs with their chips in them. SSDs replace hard disk drives (HDDs), as they’re more power efficient, durable and resilient. It provides basic memory cards for things like gaming devices and cameras as well.

Perhaps most interestingly, Micron offers a type of DRAM called high-bandwidth memory (HBM). This helps fulfill massive AI data processing needs. It sharply improves data processing capabilities and facilitates improved data sharing between CPUs & GPUs. Nvidia is a big customer, using Micron’s HBM in its Blackwell and future Rubin systems. Google and Amazon are big clients too. It also offers high-capacity SSDs to help with LLM storage.

As we work through this piece, keep in mind that Micron is a hyper-cyclical business. Demand fluctuates violently with changes in the macro environment. Margins do too, as pricing & utilization rates can experience hefty swings. Right now, the memory cycle is rocking in harmony with the overarching AI infrastructure cycle. Micron is a key enabler of this technological revolution.

b. Key Points

- Demand levels remain wildly strong.

- Guidance resembled an Nvidia 2023-like beat.

- Supply tightness is expected to last at least for another 3 quarters and likely longer.

- They see the HBM market reaching $100B in size by 2028 (previously by 2030).

c. Demand

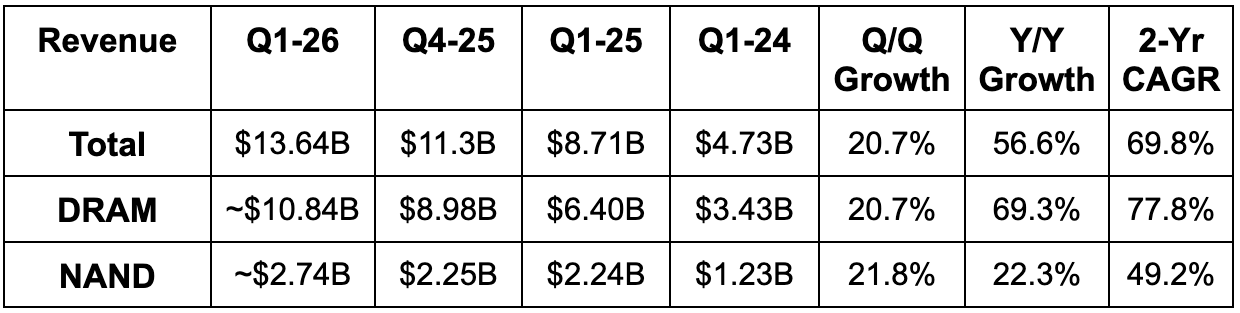

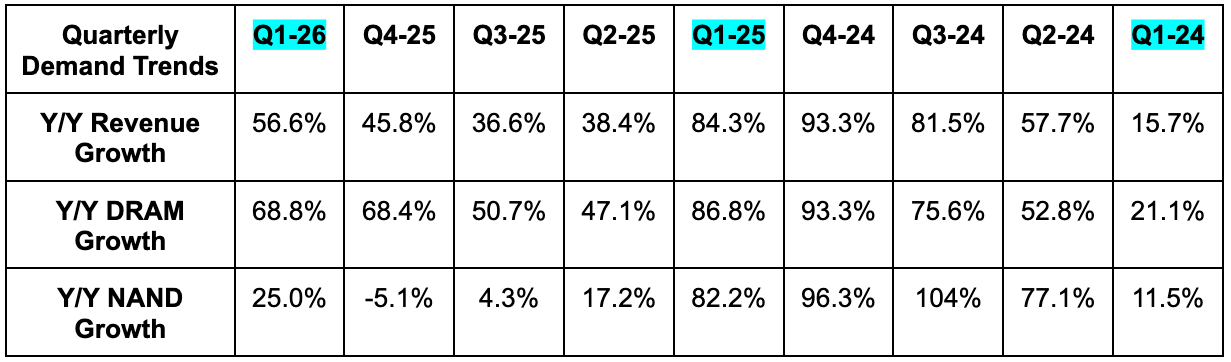

Micron beat revenue estimates by 5.9% & beat guidance by 7%.

- The Cloud Memory Business Unit delivered nearly 100% Y/Y revenue growth.

- The Core Data Center Business Unit grew by 3.8% Y/Y.

- The Mobile & Client Business Unit grew by 63% Y/Y.

- The Auto and Embedded Business Unit expanded by 48.5% Y/Y.

Micron significantly raised bit (unit of data storage) pricing for both DRAM and NAND. This powered Q/Q revenue growth. Bit shipments for DRAM rose “slightly” Q/Q while average selling price rose by 20% Q/Q. For NAND, bit shipments rose by around 7% Q/Q, with average selling price up around 15% Q/Q. They are flexing their pricing power muscles as the supply/demand backdrop remains convincingly favorable for the company.

d. Profits & Margins

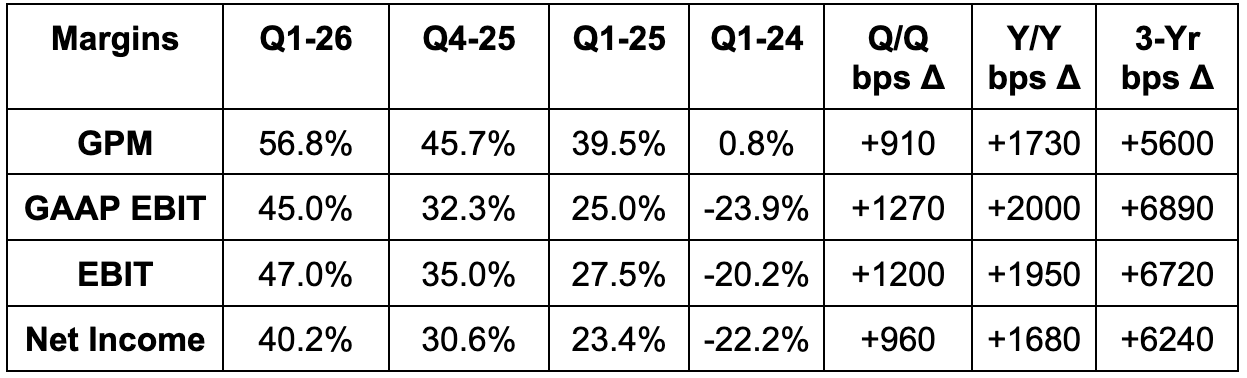

- Beat 51.8% GPM estimates by 500 basis points (bps; 1 basis point = 0.01%) & beat guidance by 630 bps.

- Cloud memory GPM was 66% vs. 59% Q/Q & 51% Y/Y.

- Core data center GPM (mainly on-premise deployments) was 51% vs. 41% Q/Q & 50% Y/Y.

- Mobile & Client GPM was 54% vs. 36% Q/Q & 27% Y/Y.

- Auto and Embedded GPM was 45% vs. 31% Q/Q & 20% Y/Y.

- Beat EBIT estimates by 20%.

- Cloud memory EBIT was 55% vs. 48% Q/Q & 40% Y/Y.

- Core data center EBIT was 37% vs. 25% Q/Q & 38% Y/Y.

- Mobile & Client EBIT was 47% vs. 29% Q/Q & 15% Y/Y.

- Auto and Embedded EBIT was 36% vs. 20% Q/Q & 7% Y/Y.

- Overall EBIT rose by 168% Y/Y.

- Beat $1.9B FCF estimates by $2B. This metric is lumpy on a quarterly basis, but it's still an impressive result.

- Beat $3.75 EPS estimates by $1.03 & beat guidance by $1.22.

- EPS rose by 167% Y/Y.

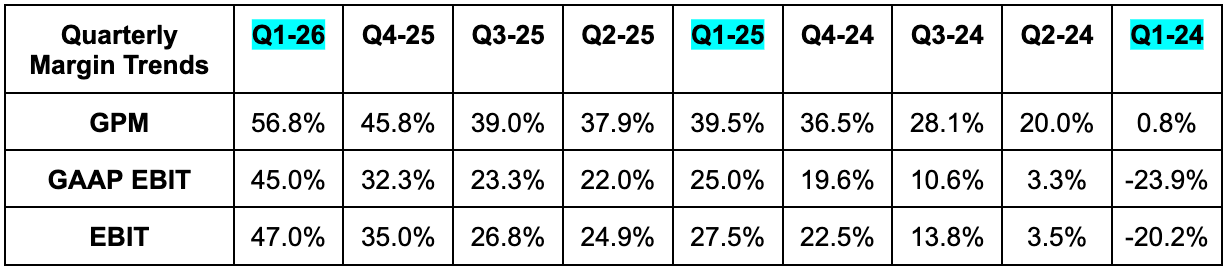

Strong GPM expansion was helped by added fixed cost leverage from soaring demand levels and also disciplined cost growth. Additionally, price hikes helped GPM a lot.

OpEx rose by 27% Y/Y, which was much slower than revenue growth and amplified Y/Y EBIT gains.

e. Balance Sheet

- $10.3B in cash & equivalents.

- $1.7B in long-term investments.

- $3.5B in untapped credit revolver capacity.

- Inventory fell 6% Y/Y.

- $11.8B in debt. The company paid down $1B in term loans and $1.7B in convertible senior notes during the quarter.

- 1.4% diluted share count growth Y/Y.

f. Guidance & Valuation

- Crushed revenue estimates by 31%.

- Crushed 54% GPM estimates by 14 points. 14!

- When demand is spiking, fixed cost leverage in this business model mounts quickly and margins explode higher (and again price hikes).

- Crushed $4.49 EPS estimates by $3.93.

- They expect FCF to “strengthen in Q2” and showcase Y/Y growth. Their operating cash flow (OCF) guidance represents 47% Y/Y growth. FCF growth may trail that a bit as they accelerate CapEx.

For the full year, Micron now expects $20B in CapEx vs. last quarter’s $18B guide. The raise is to support strong demand signals as it struggles to keep up with customer needs. At the same time, management said their CapEx intensity (CapEx / revenue) is “dropping.” If they’re raising CapEx guidance by 11% and saying this? To me that means internal revenue expectations rose by more than 11% for the year. The 7% Q1 beat & 31% Q2 raise vs. analyst estimates bode well for that being the case.

They see results improving throughout fiscal year 2026, with strong demand and tight supply conditions lasting for at least another 3 quarters. The company is hard at work on securing additional (and large) multi-year contracts to keep this momentum humming. The team was noticeably excited about these prospects and about incremental customer interest in contracts that last longer than a year. If that momentum is strong enough, it could improve growth visibility for this cyclical business model. For now, conditions in 2026 should support strong growth at lofty margins. For calendar year 2025 (which has just 12 days remaining), Micron raised its DRAM bit (unit of data storage) growth estimate from ~18% to ~22%. It also raised its NAND bit demand forecast from ~15% to ~18%. For calendar year 2026, they expect bit shipment growth for both NAND and DRAM to be around 20% Y/Y (again with very tight supply conditions).

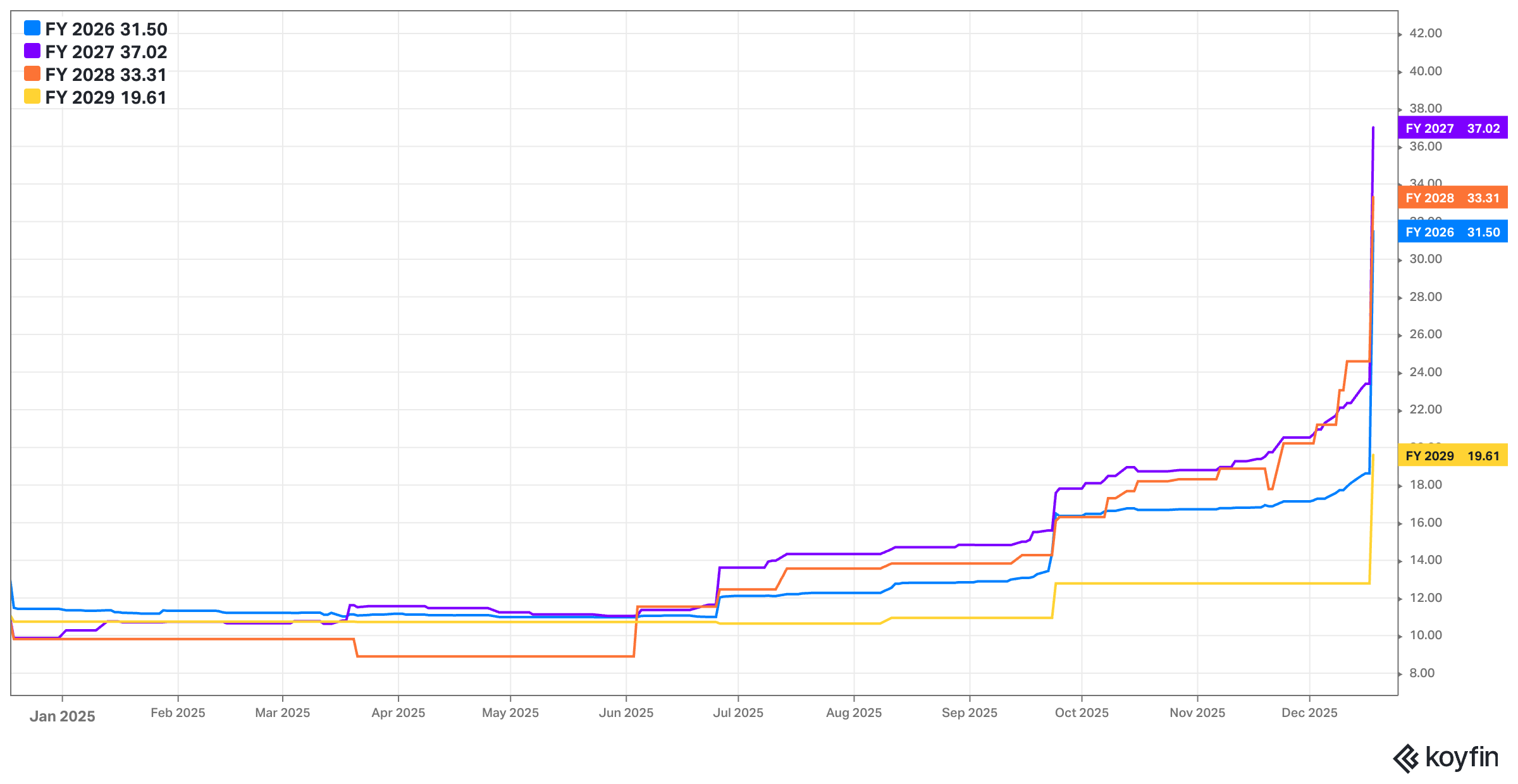

As its new DRAM and NAND nodes (manufacturing processes) ramp over the course of FY 2026, they expect a GPM tailwind to emerge. Leadership doesn’t expect the rapid pace of Q/Q GPM gains to be maintained (nor does anyone else), but does think GPM expansion can likely continue throughout the year. The large Q1 GPM and revenue beats, the larger Q2 beats and the consistent commentary on pace of GPM expansion helped profit estimates for the year spike higher.

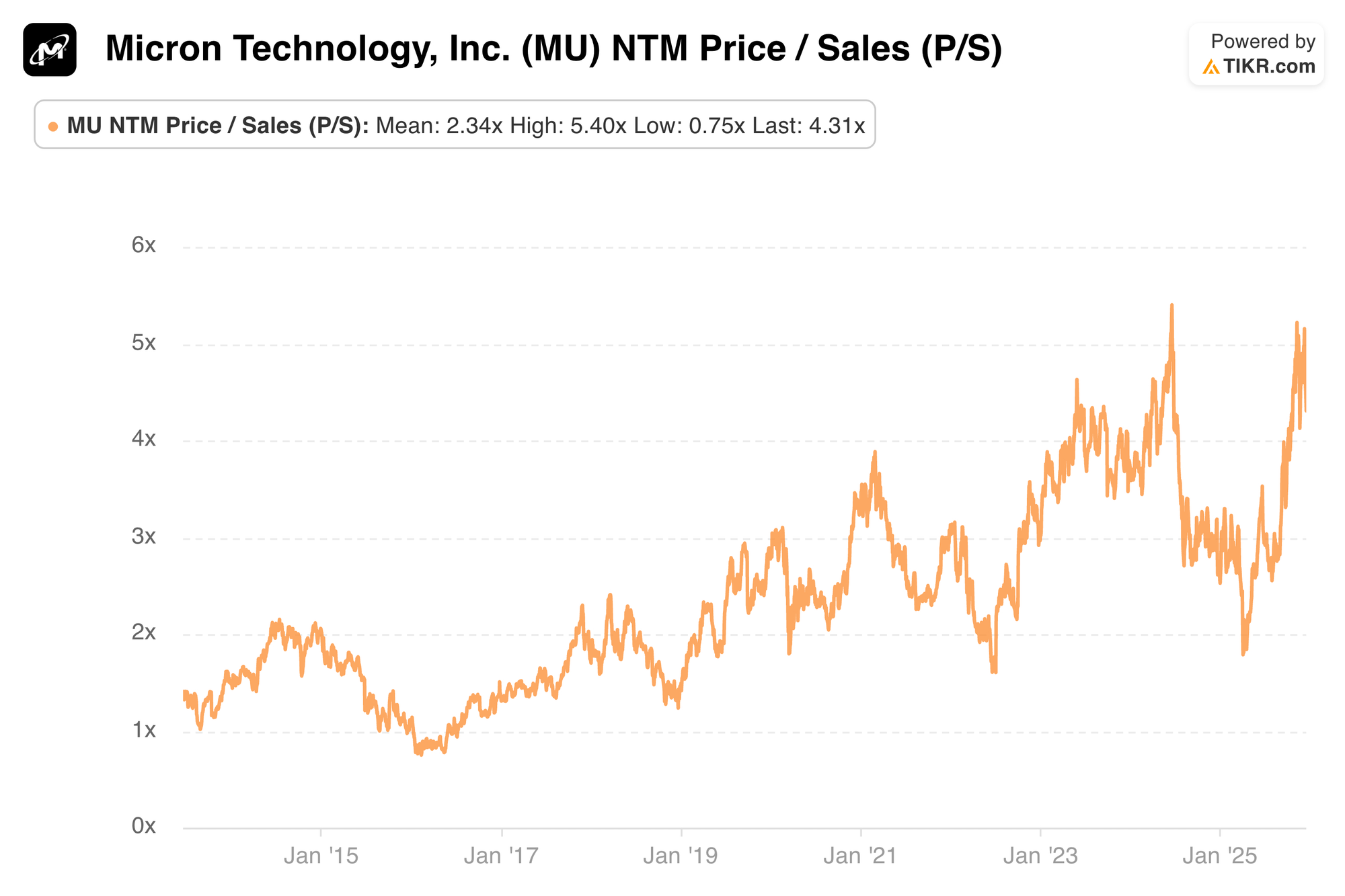

Micron trades for 12x forward EPS. EPS is expected to grow by 280% this year, 18% next year and then fall by 10% the following year.

g. Call & Release

AI in Data Centers – A Massive Tailwind:

Micron sees its memory niche evolving from “system component to a strategic asset that dictates product performance.” As we talk about constantly, AI agents and models consume and process massive amounts of data. That requires a ton of memory to store data and make it cheaply available for usage. In turn, the evolving needs mean a lot more demand for things like Micron’s high bandwidth memory (HBM) offering and high capacity SSDs.

This leaves us with a compelling growth tailwind. Modern data centers need a lot more HBM to enable valuable, AI-powered work... and demand for these data centers is exploding higher. For evidence, server unit demand for calendar year 2025 should rise by nearly 20% compared to previous 10% growth expectations. For more evidence, the HBM market is expected to compound at a 40% clip through calendar year 2028 and reach $100B in total size two years sooner than Micron’s previous 2030 timeline. Truly amazing momentum right now for Micron as the memory cycle zooms.

The incredible momentum is why they’re so fixated on driving product leadership in this specific field. And while competitors would disagree, Micron feels like their DRAM and NAND offerings are both best-in-class in terms of cost per performance.

Supply & Footprint:

As briefly mentioned, Micron now expects supply tightness for both DRAM and NAND to continue through calendar year 2026. DRAM is purely a byproduct of fantastic demand. The NAND tightness is via a combination of switching some capacity to fulfill more DRAM orders and also strengthening NAND demand.

The tightness will support a strong pricing environment for Micron for at least another 3 quarters as they struggle to keep up with customer interest. For context, HBM uses 3x the manufacturing capacity compared to its other DRAM-based offerings. That 3x will rise with future HBM generations, adding to capacity needs and overall demand levels.

And while this dynamic is great for forward-looking margins, they’d rather have all the capacity they need to fulfill all of the demand (hence the CapEx raise). They’re obtaining equipment, leases and power as quickly as they can to meet this moment, with encouraging progress including moving its Idaho fab completion schedule from 2H of 2027 to mid-2027. The second Idaho fab is still on track for 2028 production and its New York construction should begin early next year to support demand starting in 2030. They’re adding needed cleanroom space in Japan, HBM packaging capacity in Singapore for calendar year 2027 and a testing facility in India, which should be ready to roll next year. There are many projects being simultaneously executed, while the company continues to advance on schedule and as promised (if not better).

- Micron said in some cases, they’re only fulfilling 50%-67% of customer demand due to ongoing supply shortages. They were asked why they’re not boosting CapEx even more to address this, and it’s because the issue isn’t based on budget. It’s based on procuring the equipment in a timely fashion.

HBM subsection of DRAM:

Micron has locked in commitments and pricing for all HBM supply through 2026. This includes HBM4, which is on track for scaled deliveries next quarter. The “and pricing” part of that isn’t shocking, but still encouraging following considerable price hikes. By controlling the building materials and vertically integrating the wiring processes and the movement of data (via its own DRAM logic dies). HBM3 relied on Taiwan Semi for logic die, but Micron manufactured it on its own for HBM4. This has helped unlock what they view as industry-leading performance and a larger chunk of the margin for them to fetch for themselves.

Leadership was asked about Samsung’s recently invigorated push into HBM. They’re not seeing this impact demand at all, which makes sense considering they can’t make enough to meet customer orders.

Low Power DRAM (LP DRAM):

While LP DRAM has been mainly for mobile use cases in the past, Micron is bringing this to the data center thanks to lower power and cooling needs. This isn’t as fast as HBM, but it’s still great for some inference workloads where customers are more sensitive to cost than overall performance. And it’s also still very fast in terms of data fetching, just not quite as fast as HBM4. They’re working on a new LP DRAM iteration (called LP SOCAMM2 but not important), which promises to deliver 50% higher capacity per unit, boosting efficiency and performance for this cheaper memory product even more.

DRAM & NAND Product Roadmap Schedules:

Going back to Micron’s obsessive mission to drive tech progress and leadership, its new 1-gamma node (node = manufacturing process) is on schedule. Mehrotra thinks this will likely be the 5th consecutive technology node in DRAM that “leads the industry.” Again… SK Hynix would disagree, but the progress Micron is making in this space is undeniably awesome and that couldn’t happen if their tech was inadequate. 1-delta and 1-epsilon nodes will come after 1-gamma.

On the NAND side, its new “G9” node and quad-level cell (QLC) NAND product set new revenue records this quarter. Mainstream storage (for broad-based use cases) and capacity storage (for packing as much data storage as possible for the lowest possible price) also both enjoyed strong quarters as Micron continues to advance both of those product roadmaps as well.

Using AI Internally:

Micron is voraciously consuming AI to improve internal operations as well. 80% of its workforce is using GenAI tools (+10X Y/Y). They’re cutting root cause analysis for manufacturing performance bottlenecks, boosting coding productivity by 30%, cutting design cycle times and more. They’ll keep leaning into this technological revolution for themselves, in addition to providing foundational hardware to fortify it.

More on NAND:

Debuted the 6th generation of its Peripheral Component Interconnect Express (PCIe) SSDs. These can move 28 gigabytes (GB) of data per second vs. 14 GB for the 5th generation. Demand for this has been strong, while data center NAND revenue for the quarter crossed $1B and Micron rose to the 3rd-ranked SSD vendor by market share.

Non-Data Center Demand:

For the Personal Computer (PC) segment, Windows 10 end of life is driving strong PC-related demand. The AI-PC refresh cycle has been strong. They now see calendar year 2025 growth for this segment coming in above the ~5% expectation they laid out last quarter. They see strong 2026 demand, but cautioned everyone about expected supply-related issues for “some PC unit shipments.”

In mobile, just like on the PC side, AI is driving rising memory needs. Phones with 12GB of DRAM rose by 59% Y/Y this quarter, which compares to roughly 30% Y/Y growth for these types of models last year. AI is having the same impact on memory demand from the automotive segment, and is unlocking a larger robotics segment for Micron to pursue as well.